Medicare Plan G Coverage

| Medicare Part B excess charges |

| Foreign travel emergency |

Medicare Plan G will not cover your original Medicare Part B deductible, which is $233 in 2022. You would pay for medical services such as outpatient care, preventative care and ambulance services until you have reached the deductible amount. Then Medicare would cover your health care costs.

Does Medicare Supplement Plan G Cover Silversneakers

The SilverSneakers program encourages older adults to participate in physical activities that promote a healthier lifestyle. Your insurer pays for a basic membership at any gym in the SilverSneakers network. Plan G typically covers the SilverSneakers program, but it may depend on where you purchased Plan G and where you live. You can check whether you’re eligible for a SilverSneakers policy at its website.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Switching From Medicare Advantage

If you currently have a Medicare Advantage plan and want to go with a Medigap policy, when can you switch to Plan G? You can switch to Original Medicare during the Annual Election Period from October 15 to December 7, or the Medicare Advantage OEP from January 1 to March 31. Then you can apply for a Medicare Supplement plan.

In most states you will not have guaranteed-issue rights when you switch, meaning you might face medical underwriting and higher premiums. Some states do allow it. To see what the Medigap rules are where you live, check with your state insurance department.

You May Like: Will Medicare Pay For Alcohol Rehab

What Medicare Supplement Plan G Does Not Cover

The only Medicare Supplement benefit that Plan G does not cover is the Medicare Part B deductible.

Only two plans, Plan C and Plan F, provide coverage of the Part B deductible. And, only beneficiaries who became eligible for Medicare before Jan. 1, 2020 are eligible to enroll in either of those plans.

How Is Medsup Plan G Different From Other Medsup Plans

Medicare Supplement Plan G and Plan F are very similar. The main difference between them is Plan F covers your Medicare Part B deductible while Plan G doesnt.

Some of the other Medicare Supplement plans available today are only slightly different from F and G while a few are quite different. For example:

- MedSup Plan C is like Plan F but doesnt pay your Medicare Part B excess charges.

- Plan N, on the other hand, doesnt pay your Part B deductible or excess charges.

Other MedSup plans pay just a portion of costs, like your Part A deductible or your Part B copay or coinsurance fees. Some come with yearly out-of-pocket limits, too.

Also Check: Is Medicare Part D Necessary

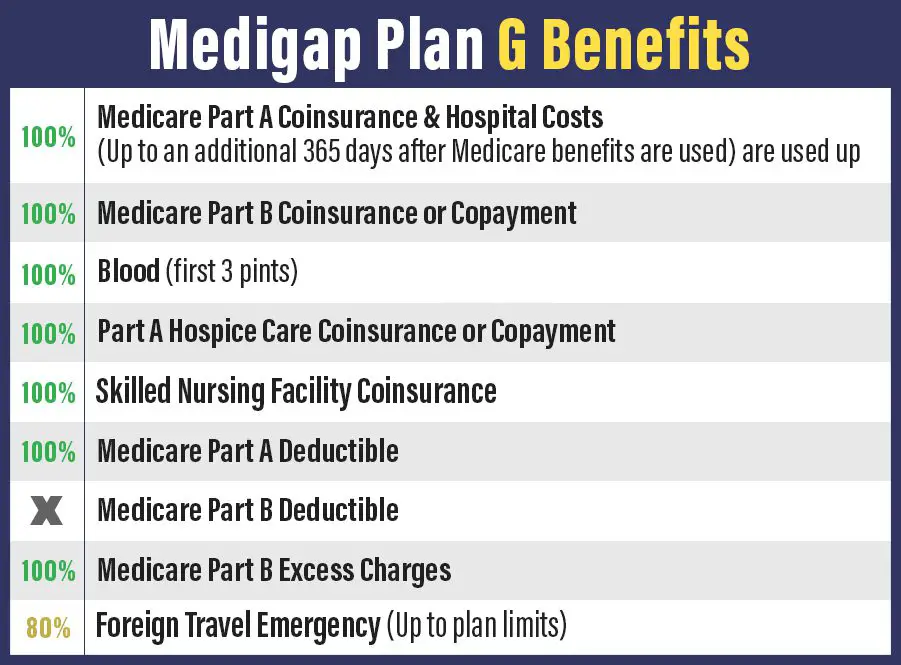

What Medigap Plan G Covers

Heres what Medigap Plan G covers, according to Medicare.gov:

-

Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up.

-

Part A deductible.

-

Part A hospice care coinsurance or copayment.

-

Part B coinsurance or copayment.

-

Part B excess charges .

-

Blood transfusion .

-

Skilled nursing facility care coinsurance.

-

Medically necessary emergency health care service for the first 60 days when traveling outside the U.S. Deductible and limitations apply.

S To Buying A Medigap Policy

So how do you get signed up for a Plan G Medigap policy? Medicare supplement insurance is private insurance which means youll need to go through private health insurance companies to purchase a policy. They will offer Medigap plans in different states. All policies provide similar factors. However, Massachusetts, Minnesota, and Wisconsin provide additional benefits. Depending on your zip code, age, and gender, you will get other quotes.

Most beneficiaries will enroll during the Medigap open enrollment period, which is not the same as the Medicare Advantage plan enrollment period. If youre not, youll want to make sure you have a guaranteed issue right. Private insurance companies use underwriting to determine if theyll accept your application and how much your bill will be. The pricing method for Medigap depends on your underwriting results.

Once you have researched all this information and found some private insurance providers that sell Medigap policies to the state you live in, youll want to shop around. When you find a plan that you like, go ahead and apply and pay attention to the summary of the Medigap policy. Ask questions that you have to a Medicare specialist and make sure you understand the policy before purchasing. Everyone has questions about Medicare, so do not be afraid to ask yours.

Recommended Reading: What Is The Window To Sign Up For Medicare

Whats The Difference Between Medicare Plan F And Plan G

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you’re getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.1

This much coverage means that Plan F may come with a higher premium. However, choosing a high-deductible option for Plan F could help keep your premium down. If youre currently enrolled in the Plan F high-deductible option for 2022, you are required to pay for Medicare-covered costs up to the deductible amount of $2,490 before your Medigap plan begins to cover any expenses.1

The Best Medicare Plan For You: Plan G +rx

The recommended plan is the best fit based on a few questions. There are other personal circumstances that may change this recommendation, including receiving employer sponsored retiree benefits or having specific medical circumstances to consider. Please note that CMS will impose a penalty if you do not have prescription drug coverage . We strongly encourage you review all options with an agent before applying.

Read Also: What Is A Medicare Claim Number

Who Can Enroll In Medicare Supplement Plan G

You can buy a MedSup Plan G policy if:

- Youre over 65.

- Youre not enrolled in a Medicare Advantage plan.

- You live in the plans service area.

Who cant buy a MedSup Plan G policy? One example is people under 65 with Medicare coverage due to a disability or end-stage renal disease. They may not be able to buy one of these plans. They may not be able to buy any MedSup or Medigap policy, period.

If youre in this situation and you want Plan G coverage, contact a few of the insurance companies in your area. They can tell you if youre allowed to buy one or not. If you cant, ask if you can buy any other MedSup policies.

So How Do I Decide Which Company To Choose

Selecting a company can be confusing, but there are two factors that can help you narrow down your decision. We recommend that you check the AM Best ratings for the companies you are comparing to ensure that the company has a positive standing, and then select the company that offers the lowest premium. To make this process easier for you, GoMedigap agents only work with top-rated companies, and we pride ourselves in finding low premiums for our clients.

Recommended Reading: When Is Open Enrollment For Medicare

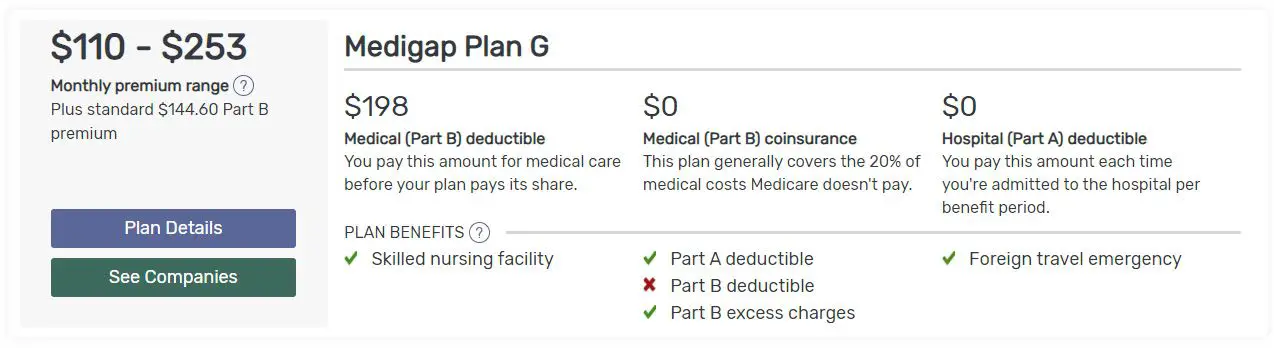

How Much Does Medigap Plan G Cost

Premiums for Medigap Plan G are set by the private health insurance companies that sell it, even though the plans are regulated by the government. Prices vary according to age, location, tobacco use and other factors. In one representative California ZIP code in 2022, premiums for a nonsmoking 65-year-old range from $122 to $206 monthly.

In 2022, some states also offer a high-deductible Plan G, which provides the same benefits, after a deductible of $2,490 is paid. Monthly premiums for the same 65-year-old nonsmoker in ZIP code 92589 range from $30 to $68.

About Plan C And Plan F

Plans C and F include cover for the Part B deductible.

As of January 1, 2020, Medigap policies are no longer able to cover the Part B deductible for those newly eligible for Medicare.

A person can still buy plan C or F if they were eligible for Medicare before that date but had not enrolled.

If a person had plan C or F before January 1, 2020, they may keep the policy.

Don’t Miss: Will Medicare Pay For Handicap Bathroom

What Is Not Covered Under Plan G

Covered? Medicare Plan G will not cover your original Medicare Part B deductible, which is $233 in 2022. You would pay for medical services such as outpatient care, preventative care and ambulance services until you have reached the deductible amount. Then Medicare would cover your health care costs.

What Are Medicare Supplement Insurance Plans

A Medicare Supplement Plan is health insurance that you can buy from private companies.

These plans help pay for the remaining out-of-pocket costs that Medicare Parts A and B dont cover. Some of these expenses include:

The government requires insurance companies to standardize the 10 Supplement Plans that you can choose from. However, if you live in Wisconsin, Massachusetts, or Minnesota, the policies work differently.

Each Medicare Supplement Plan can be identified by a letter A, B, C, D, F, G, K, L, M, and N. Its important not to confuse plans with Medicare parts, which cover basic medical needs.

Depending on the Medicare Supplement Plan you choose, it could pay for:

-

Part of the expense that Original Medicare doesnt cover. This is called the deductible.

-

20% of the amount youre responsible for paying, also known as the copayment.

-

Any other additional medical costs.

Licensed insurance agents also cannot sell you a Medicare Supplement Plan if you already have Medicaid or a Medicare Advantage Plan.

To learn more about these policies and take an in-depth look at the 10 different Medicare Supplement Insurance Plans, take a look at this article.

Key Takeaways:

Read Also: When Am I Available For Medicare

Should I Consider Plan G

Before you consider what type of Medigap plan you should be on you should always first decide whether you want to receive coverage through Original Medicare or Medicare Advantage. You can read our article on Medicare Advantage vs. Original Medicare to find out more.

Once you have decided you want to receive your Medicare coverage through Original Medicare, you may want to consider a Plan G is you want the most comprehensive coverage. However, to receive this coverage, you must also be able to pay the additional premium for Plan Gs which can range widely based on where you live and your age, gender, and health condition.

Even with higher premiums, a Plan G might be worth it if you expect to use health care services extensively during the year .

Changes To Medigap Policies In : Plan G Vs Plan F

Medicare Plan F is a Medigap plan thats very similar to Plan G. The only difference is that it covers the Medicare Part B deductible in full.

While Plan F might seem more inclusive and comprehensive than Plan G, the availability of Plan F policies is now limited. Anyone who became eligible for Medicare after January 1, 2020, will not be eligible for Plan F.

From 2020 forward, all Medigap plans sold to newly eligible beneficiaries will no longer cover the Medicare Part B deductible.

Recommended Reading: Can You Get Medicare Insurance At 62

Medicare Hospital Serviceswhat Plan G Pays

Semi-private room and board, general nursing, and miscellaneous services and supplies.

Must have been in a hospital for at least 3 days and have entered a Medicare-approved facility within 30 days after discharge from the hospital.

Pain relief, symptom management, and support services for the terminally ill. You must meet Medicares requirements, including a doctors certification of terminal illness.

What Is Not Covered By Plan G

There are a few things, however, that Plan G does not cover, including:

Part B deductible

Eye care

Hearing aids

Long-term care

Private-duty nursing

*While Medigap Plan G doesnt cover outpatient prescriptions typically covered by Part D, it does cover the coinsurance on all Part B medications .

Medigap policies also only cover one person. For example, if you and your spouse both want coverage from Plan G, you must both have separate Plan G policies.

You May Like: Does Medicare Part B Cover Shingrix

What Does Medigap Plan G Offer

Original Medicare, which covers hospital care, doctorâs visits, and related services, does not cover all care, according to the Centers for Medicare and Medicaid Services. Youâll still have a deductible, and may have copays or coinsurance fees.

Original Medicare also excludes coverage for certain servicesâsuch as routine dental care, hearing aids, and medically-unnecessary cosmetic procedures. Depending on the cost of your care, you could end up with large copays that eat into your budget, or a deductible that makes it hard for you to cover your care out-of-pocket.

Medigap supplemental insurance covers the cost of Original Medicare deductibles, coinsurance, and copays. It may also cover a range of services excluded from Original Medicare coverage. Medigap Plan G is also available in some states as a high-deductible plan.

The specific additional benefits Medigap Plan G offers include:

- Coverage for an additional 365 days of hospital care after Original Medicare benefits are exhausted, as well as coverage for hospital coinsurance and deductible

- Coverage for Medicare Part B coinsurance and copays

- Coverage for the first three pints of a blood transfusion

- Medicare Part Aâs hospice copayment or coinsurance

- Medicare Part A deductible, but not Part B deductible

- Up to 80% of foreign travel exchange

- Care in a skilled nursing facility

What Is The Difference Between Medicare Supplement Plan F And G

The main difference between the two plans is how Plan G interacts with the Part B deductible. With Plan F, the Medicare Supplement plan pays for the Part B deductible. Under Plan G, you are responsible for the Part B deductible only. Otherwise, all Part A deductibles, copays, and coinsurance are covered.

Recommended Reading: Do You Need A Medicare Supplement

What Are Some Other Options

For Medigap alternatives Plan F and Medicare Supplement Plan N are often chosen instead of Plan G. As mentioned above, Plan F is the most comprehensive plan however, starting January 1, 2020, newly eligible Medicare beneficiaries will not be able to enroll in a Plan F.

Plan N therefore will be the next closest choice but in addition to the Part B deductible, which is not covered under Plan G, you will be responsible for paying:

- Maximum of $20 for doctor visits and $50 for Emergency Room visits

- Part B excess charges

However, Plan N will also come with lower monthly premium costs, given you are responsible for more costs out-of-pocket.

If you are considering comprehensive Medigap plans because you have a chronic health condition, you may also want to consider a Chronic Special Needs Plan Medicare Advantage plan, which is a managed care plan from private health insurance providers that are designed to provide integrated care for people with specific chronic conditions.

What Medigap Plan G Doesnt Cover

Medigap Plan G offers the most coverage of any plan that new Medicare members can buy. However, there are benefits that even the most comprehensive Medigap plans dont cover.

All Medigap plans, including Plan G, sold to new Medicare members dont cover the following:

-

Part B deductible.

-

Private-duty nursing.

Read Also: Does Medicare Cover Wheelchairs And Walkers

Is Medicare Plan G Better Than Plan F

If comparing straight benefits, the answer is Yes. Plan F includes everything Plan G does, plus it covers the $198 Part B deductible that Part G does not. However, the cost to cover that extra $198 varies by location. Thus, it is important to compare the cost of Plan F and Plan G. If the variance for Plan F is greater than the Part B deductible , then Plan G makes more sense.

What Is Medicare Supplement Plan G

Like other Medicare Supplement plans, Medicare Supplement Plan G pays secondary to Original Medicare. Original Medicare does not provide beneficiaries with full coverage for medical services. So, a Medicare Supplement plan helps cover the out-of-pocket costs a beneficiary would otherwise be responsible for covering.

There are ten standardized Medicare Supplement plans, and two high deductible versions available to Medicare beneficiaries nationwide. Each plan is identified by a letter, A through N. Each lettered Medicare Supplement plan has a different coverage level and monthly premium to meet the healthcare and budget needs of any senior on Medicare.

Medicare Supplement Plan G is one of the ten Medicare Supplement plans available to beneficiaries. Medigap Plan G is the most comprehensive plan for new Medicare beneficiaries and is a top option for all Medicare enrollees. When you sign up for Medicare Supplement Plan G, your out-of-pocket costs are a fraction of what they would be with Original Medicare. After meeting the annual deductible, you will be covered at 100% for all additional medical costs that year.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Recommended Reading: Does Medicare Cover Glucose Monitors

How Much Does Aarp Medicare Supplement Plan G Cost

AARP Medicare Supplement Plan G will vary in cost according to where you live. The chart below gives you an idea of how much AARP Plan G may cost in different areas of the country.

All rates listed below are for a 65-year-old non-smoking male. Plan premiums may be different in your area and can change from what is listed below. The premiums listed are from AARP and are subject to change.

| Location |

|---|

How Much Does Medicare Plan G Cost

Medicare Plan G costs between $120 and $364 per month in 2022 for a 65-year-old. You’ll see a range of prices for Medicare supplement policies because each insurance company uses a different pricing method for plans. Furthermore, your exact price for Plan G will also be determined by your location, health, age and gender. For this reason, it is vital to compare rates among different Medicare providers so you can get your best Medicare rate possible.

Read Also: How To Apply For Medicare In Kentucky