Medicare Prescription Drug Coverage

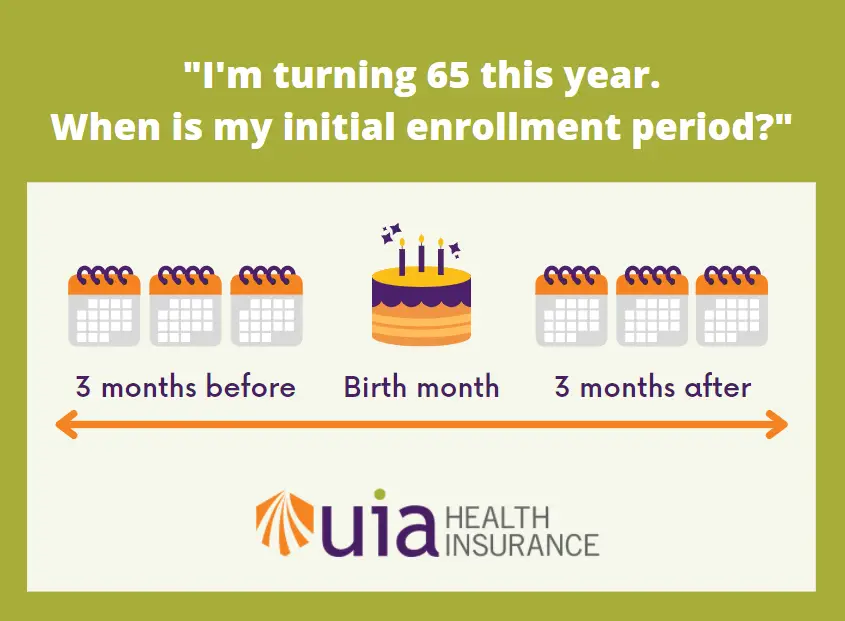

Medicare Prescription Drug Plans are sold by private insurance companies approved by Medicare. All people new to Medicare have a seven-month window to enroll in a PDP three months before, the month of and three months after their Medicare becomes effective. The month you enroll affects the PDPs effective date. All people with Medicare are eligible to enroll in a PDP however, unless you are new to Medicare or are entitled to a Special Enrollment Period, you must enroll or change plans during the Open Enrollment Period for Medicare Advantage and Medicare Part D, Oct. 15 through Dec. 7. There is a monthly premium for these plans. If you have limited income and assets/resources, assistance is available to help pay premiums, deductibles and co-payments. You may be entitled to Extra Help through the Social Security Administration. To apply for this benefit contact SHIIP at 1-855-408-1212 or the Social Security Administration at 800-772-1213 or www.socialsecurity.gov.

Employer Or Military Retiree Coverage

If you or your spouse has an Employer Group Health Plan as retiree health coverage from an employer or the military , you may not need additional insurance. Review the EGHPs costs and benefits and contact your employer benefits representative or SHIIP to learn how your coverage works with Medicare.

Applying For Medicare Supplement Insurance At Age 65

When you turn 65, you will be granted a Medigap Open Enrollment Period during which you can apply for a Medigap plan. This six-month period will begin once you turn 65 and are enrolled in Medicare Part B .

During this period, insurance companies cant use your medical history like your hearing loss as a reason to raise your premiums or deny your coverage completely. They must issue you a plan at the same rate as someone with no significant medical history.

You May Like: What Is A Medicare Special Needs Plan

What Does Medicare Cover

Medicare helps pay for certain health care services and durable medical equipment. To have full Medicare coverage, Medicare beneficiaries must have Part A and Part B .

The following is a partial list of Medicare-covered services. The covered services listed below may require payment of deductibles and Co-Payments.

If you have questions about covered services, call Medicare at 1-800-633-4227.

Medicare Eligibility For Medicare Advantage Before 65

After youre enrolled in Original Medicare, you may choose to remain with Original Medicare or consider enrollment in a Medicare Advantage plan offered by a private, Medicare-approved insurance company.

Medicare eligibility for Medicare Part C works a little differently. Youre eligible for Medicare Advantage plans if you have Part A and Part B and live in the service area of a Medicare Advantage plan. If you have End Stage Renal Disease , you usually cant enroll in a Medicare Advantage plan, but there may be some exceptions, such as a Medicare Advantage plan offered by the same insurance company as your employer-based health plan, or a Medicare Special Needs Plan .

When you enroll in a Medicare Advantage plan, youre still in the Medicare program and need to pay your monthly Medicare Part B premium and any premium the plan charges. The Medicare Advantage program offers an alternative way of receiving Original Medicare coverage but may offer additional benefits. For example, Original Medicare doesnt include prescription drug coverage or routine dental/vision care, but a Medicare Advantage plan may include these benefits and more. Benefits, availability and plan costs vary among plans.

New To Medicare?

Becoming eligible for Medicare can be daunting. But donât worry, weâre here to help you understand Medicare in 15 minutes or less.

You May Like: How Does Tricare For Life Work With Medicare

Should I Sign Up During My Initial Enrollment Period

For most people, the answer is yes. They need to sign up for Medicare during their seven-month initial enrollment period , which starts three months before the month you turn age 65 and ends three months after your birthday month. If your 65th birthday is in June, your IEP begins March 1 and ends Sept. 30.

If your birthday falls on the first day of a month, the whole initial enrollment period moves forward one month. For example, if your birthday is June 1, your IEP begins Feb. 1 and ends Aug. 31.

If you or your spouse is still working and you have health insurance coverage from that active employer, you may be able to wait. But otherwise, you need to sign up for Medicare during your IEP to avoid late enrollment penalties and delayed coverage.

The phrase active employer is key. If you have other insurance that isnt from your own or your spouses current employer, you will still need to sign up for Medicare during your initial enrollment period. You need to sign up during your IEP in all of these circumstances: If you have

- COBRA health coverage that extends the insurance you or your spouse received from an employer while working

- Health insurance that you bought yourself and no employer provided it

- No health insurance

- Retiree benefits from your own or a spouses former employer

- Veterans benefits from the Department of Veterans Affairs health system but no insurance from a current employer

Traveling Or Moving Out Of The Area

Medicare plans grant coverage for urgent and emergency care within the United States. For all other non-emergency medical services while traveling, coverage depends on the kind of plan you have. For example, PPO plans offer some extended coverage while some HMO plans require you to stay within your plans service area. Please contact our team for details.

Coverage outside of the country varies depending on the plan. To confirm your travel benefits, you can refer to your plans Evidence of Coverage and Summary of Benefits or contact our team.

Medicare Advantage plans are based on the county you live in. If you are moving outside of your current county or to another state, please contact us to discuss your plan options. You may or may not need to change your plan depending on where you move. If you move within the same county, you only need to inform us of your new address.

Also Check: How Do I Find Out My Medicare Card Number

You’re Eligible For Medicare

Medicare eligibility begins at age 65, and you can even sign up for coverage beginning three months before the month of your 65th birthday. It pays to enroll in Medicare on time, because if you don’t, you could end up subject to costly penalties that make your Part B premiums more expensive.

If you’ll be signing up for original Medicare , you’ll need a Part D plan for prescription drug coverage as well. Medicare Part A will cover your hospital care and Part B will cover outpatient care, but drug coverage is separate.

Image source: Getty Images.

How Do I Sign Up For Medicare At Age 65 If Im Still Working

Medicare Part A is premium-free for most people but you typically pay a monthly premium for Medicare Part B.

So, you may want to delay enrollment in Part B if youre still working and have health insurance through your employer or other organization when you turn 65.

You should check with your plan benefits administrator before you turn 65 to see if your employer coverage changes when you become eligible for Medicare.

If you have the option to choose between Medicare and your employer plan, compare your monthly premiums and benefits before you turn 65 so you know which option makes the best financial sense for you.

Be aware that theres a late enrollment penalty for Medicare Part B if you dont sign up during your Initial Enrollment Period. You may avoid the penalty if you qualify for a Special Enrollment Period for example, if youre covered under an employment-based group health plan.

Also Check: What Are The Types Of Medicare Advantage Plans

The Basics On Signing Up

Medicare enrollment in Part A and Part B is automatic if you have claimed Social Security benefits before your 65th birthday your Medicare card will arrive in the mail and coverage begins the first day of the month in which you turn 65. There is no premium charged for Part A in most cases, and you may be able to turn down Part B at that point without incurring late-enrollment penalties if you are still working and receive your primary insurance through work.

If you have not yet applied for Social Security, signing up for Medicare requires proactive steps to avoid problems.

Medicare offers an Initial Enrollment Period around your 65th birthday. If you miss that window, you will be subject to a late enrollment surcharge equal to 10 percent of the standard Part B premium for each 12 months of delay a penalty that continues forever. That can really add up. In 2017, 1.3 percent of Part B enrollees paid penalties , according to the Congressional Research Service. On average, their total premiums were 31 percent higher than what they would have been.

Medicares prescription drug program comes with a much less onerous late enrollment penalty, equal to 1 percent of the national base beneficiary premium for each month of delay. In 2019, the base monthly premium is $33.19, so a seven-month delay would tack $2.32 onto your plans premium.

Late enrollment also exposes you to significant gaps while waiting for Medicare coverage.

Documents You Need To Apply For Medicare

To begin the application process, youll need to ensure you have the following documentation to verify your identity:

- A copy of your birth certificate

- Your drivers license or state I.D. card

- Proof of U.S. citizenship or proof of legal residency

You may need additional documents as well. Make sure to have on hand:

- Your Social Security card

- W-2 forms if still active in employment

- Military discharge documents if you previously served in the U.S. military before 1968

- Information about current health insurance types and coverage dates

If you are already enrolled in Medicare Part A and have chosen to delay enrollment in Medicare Part B, you must complete the additional forms .

- 40B form:This allows you to apply for enrollment into Medicare Part B only. The 40B form must be included in your online application or mailed directly to the Social Security office.

- L564 form:Your employer must complete this form if you delayed Medicare Part B due to creditable group coverage through said employer. You must also include the completed L564 form in your online application, or mail it directly to the Social Security office.

Read Also: When To Apply For Medicare When Turning 65

Sign Up: Within 8 Months After Your Family Member Stopped Working

- Your current coverage might not pay for health services if you dont have both Part A and Part B .

- If you have Medicare due to a disability or ALS , youll already have Part A coverage.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

If You Do Medicare Sign

-

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

Give this article

- Read in app

Tony Farrell turned 65 four years ago the age when most people shift their health coverage to Medicare. But he was still employed and covered by his companys group insurance.

When his birthday came around, he began researching whether he needed to move to Medicare, and determined he could stick with his employers plan, said Mr. Farrell, a marketing and merchandising executive for specialty retailers. At the time, he was working for a company that makes infomercials in San Francisco.

Four months later, Mr. Farrell was laid off, but he kept the companys health insurance for himself and his family under the Consolidated Omnibus Budget Reconciliation Act , the federal law that allows employees to pay for coverage as long as 36 months after a worker leaves a job.

I just thought, this is great the coverage wont change, he recalled. I was just relying on my own logic and experience, and felt that if I didnt need a government service, I wouldnt sign up for it.

But Mr. Farrell unknowingly ran afoul of one of the complex rules that govern the transition to Medicare and now he is paying the price.

Don’t Miss: How Much Does Medicare Cover For Knee Replacement

You Can Claim Social Security

The earliest age you can sign up for Social Security is 62, and so if you’re turning 65 this year, claiming benefits is definitely an option. But that doesn’t mean you should rush to file.

You won’t be eligible for your full monthly benefit based on your earnings history until you reach full retirement age. If you were born in 1957, full retirement age doesn’t kick in until 66 and 6 months. Filing for benefits at 65 will mean reducing them in the process — for life.

Whether it pays to claim Social Security at age 65 will depend on different personal factors, like whether you’re still working full-time and what your retirement savings balance looks like. If your health is forcing you to cut down to part-time hours, then you may need your Social Security benefits to supplement your income.

On the other hand, if you’re still working full-time and aren’t thrilled with how much you’ve saved for retirement, you may want to sit tight and wait until full retirement age to claim Social Security. Scoring a higher monthly benefit could help compensate for having less money than you’d like in your IRA or 401.

As you get ready to celebrate your 65th birthday, be sure to keep these important details in mind. They could help lead you to wise financial decisions that serve you well throughout your senior years.

The Motley Fool has a disclosure policy.

How Do I Get Full Medicare Benefits

If youve worked at least 10 years while paying Medicare taxes, there is no monthly premium for your Medicare Part A benefits. But if you havent worked, or worked less than 10 years, you may qualify for premium-free Part A when your spouse turns 62, if she or he has worked at least 10 years while paying Medicare taxes. However, to be eligible for Medicare, you need to be 65 years old. You also need to be an American citizen or legal permanent resident of at least five continuous years.

So, to summarize with an example:

- Bob is 65 years old. Hes on Medicare, but he pays a monthly premium for his Medicare Part A benefits. He only worked for seven years and no longer works.

- His wife, Mary, has worked for over 30 years.

You May Like: Can You Still Get Medicare Plan F

How Do I Apply For Traditional Medicare

If youre not automatically enrolled in Medicare Part A and Part B, you need to sign up. You should enroll during your IEP, or a Special Enrollment Period if you qualify for one. As mentioned above, one example of a Special Enrollment Period might be if you delayed enrollment in Medicare Part A and/or Part B because you had employer coverage.

You typically sign up for Medicare through the Social Security Administration . You can go to the website at ssa.gov. Or, go in person to a Social Security office. You can reach the SSA at 1-800-772-1213 . Representatives are available Monday through Friday, from 7AM to 7PM, in all U.S. time zones.

Should I Take Medicare Part B

You should take Medicare Part A when you are eligible. However, some people may not want to apply for Medicare Part B when they become eligible.

You can delay enrollment in Medicare Part B without penalty if you fit one of the following categories.

Employer group health plans may cover items normally not covered by Medicare Part B. If so, and you meet one of the categories above or below, then you may not need to enroll in Medicare Part B and pay the monthly premium.

If you are:

- a spouse of an active worker

- a disabled, active worker

- a disabled spouse of an active worker

and choose coverage under the employer group health plan, you can refuse Medicare Part B during the automatic or initial enrollment period. You wait to sign up for Medicare Part B during the special enrollment period, an eight month period that begins the month the group health coverage ends or the month employment ends, whichever comes first.

You will not be enrolling late, so you will not have any penalty.

If you choose coverage under the employer group health plan and are still working, Medicare will be the “secondary payer,” which means the employer plan pays first.

If the employer group health plan does not pay all the patient’s expenses, Medicare may pay the entire balance, a portion, or nothing. An employer group health plan must be primary or nothing.

Also Check: Is Keystone 65 A Medicare Advantage Plan

Can You Get Social Security And Not Sign Up For Medicare

Yes, many people receive Social Security without signing up for Medicare.

Most people arent eligible for Medicare until they turn 65. As you can start collecting Social Security retirement benefits at 62, individuals may have Social Security without Medicare for several years.

Most people enroll in Part B once they turn 65, but you may decide to delay enrolling in Part B if you or your spouse has health insurance through an employer. Be sure to learn more about how Medicare enrollment works in your specific case, though. If you delay enrollment in Medicare Part B when youre first eligible and you dont have other creditable coverage, you could face late enrollment penalties for the rest of the time that you have Part B once you sign up.

As most people dont pay a premium for Part A, theres no reason to cancel the coverage, even if you dont think you need it. You are free to decline other Medicare plans, such as Parts B and D, though again you should make sure you wont cause yourself to go without coverage or have to pay late enrollment penalties in the future.