Medicare Coinsurance Or Copayment Requirements

Your Medicare Part B coinsurance or copayment is the amount that you have to pay for covered services after meeting your annual deductible. The standard Part B coinsurance for most services and items is 20 percent of the Medicare-approved amount.

Using the example from above, you would likely be required to pay 20 percent of the $67 that was left over after you met your Part B deductible. This 20 percent would equal around $13.

In this example, your total spending for your $300 bill would be $246 .

Related Training & Materials

Frequently Asked Questions about Medicare Part A and B Buy-in: The main policy questions, & responses, submitted to CMS to date on the updated Manual for State Payment of Medicare Premiums released on September 8, 2020.

Five Key Policy Topics From the Updated Manual on State Payment of Medicare Premiums: CMS designed this webinar for state policy staff to introduce five key policy topics addressed in the updated Manual for State Payment of Medicare Premiums released on September 8, 2020.

Overview of the CMS State Buy-In File Exchange: A webinar, with associated slides, available as a resource to support states moving to daily exchange submission.

Recommended Reading: Does Medicare Cover Walking Canes

How Much Do Medicare Part A And Part B Cost In 2022

Part A and Part B of Medicare have standardized costs that are the same across every state.

- Most people qualify for premium-free Part A. To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years . Those 40 quarters do not have to be consecutive.

- If you pay a premium for Part A, your premium could be up to $499 per month in 2022.If you paid Medicare taxes for only 30-39 quarters, your 2022 Part A premium will be $274 per month. If you paid Medicare taxes for fewer than 30 quarters, your premium will be $499 per month.

- The standard Part B premium is $170.10 per month in 2022.Some beneficiaries may pay higher premiums for their Part B coverage, based on their income. This change in cost is called the IRMAA .

Find out whether you are required to pay a Medicare IRMAA in 2022.

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Don’t Miss: How Much Copay For Medicare

How Much Does Medicare Part D Cost In 2022

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers.

Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius. High-income Medicare beneficiaries are subject to an income-related monthly adjustment amount , meaning if you make more, youll pay more. For 2022 plans, the additional costs will be based on your 2020 income.

Getting Medicare Part D requires enrolling in Original Medicare, so youll pay any of those premiums, too.

The deductibles vary, but no Medicare Part D plan can have a deductible higher than $480 in 2022, up from $445 in 2021.

Copays and coinsurance vary by plan and tier and whether youve hit the Medicare Part D coverage gap, or donut hole. After the insurer has covered a certain amount on prescriptions, they will temporarily limit how much your plan will help pay for prescriptions.

Learn more about Medicare Part D plans and the donut hole here.

How Much Will Medicare Cost In 2022

Find Cheap Medicare Plans in Your Area

For all Medicare plans, costs will vary depending on what plans you decide to purchase, the company you purchase your plan from, your income and sometimes your age. For this reason, you should carefully balance your coverage needs and the costs of the plans when choosing the right mix of Medicare policies.

You May Like: Will Medicare Part B Pay For Shingrix

What Youll Pay For Medicare Part D

Medicare Part D is prescription drug coverage, and its sold by private health insurance companies, so premiums vary by policy. In 2022, the average Part D plan premium is $33 per month, but drug plan prices range from $5.50 to $207.20 per month, according to the Kaiser Family Foundation.

Like Part B, youll pay more for your Part D coverage if you have a higher income. The same thresholds apply: If your 2020 income was more than $91,000 or $182,000 , youll pay an additional $12.40 to $77.90 per month, on top of your Part D premium.

Theres also a deductible for some Part D plans, which in 2022 can be no higher than $480.

» MORE:How much does Medicare Part D cost?

Are Medicare Supplement Insurance Plans Worth It

Depending on the average cost of Medicare Supplement Insurance plans in your area, you may wonder if the benefits are worth the premium costs.

When deciding whether or not to enroll in a Medigap plan, consider some of the potential costs that you may face without the protection of a Medigap plan.

Health care costs can be unpredictable and unexpected. Having a Medicare Supplement Insurance plan can make your health care spending more predictable, which can help you better budget for your care.

You May Like: How Do I Sign Up For Medicare A

Is Medigap Plan G Better Than Plan F

While there can be a sizable difference in average premiums between Plan F vs. Plan G, there’s only a small difference in benefits these two plans offer.

-

Plan F provides coverage each of the 9 possible benefits that the 10 standardized Medigap plans can offer, including the Medicare Part B deductible.

-

Plan G does not cover the Medicare Part B deductible, but it offers coverage for all of the same out-of-pocket Medicare costs that Medigap Plan F covers.

Medigap Plan F and Plan G are the two most popular Medigap plans.2

In 2022, the Part B deductible is $233 per year.

The $233 annual deductible equates to around $19.00 per month.

This means that a Plan G with a premium of no more than $19.00 per month more than a Plan F option could actually serve as a better value, provided you meet the entire Part B deductible.

Important: Plan F is not available to new Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you already had Medicare before that date, you can still enroll in Plan F if the plan is available in your area.

Below, Medicare expert John Barkett talks more about this and other Medicare changes.

What Is The Average Cost Of Medicare Supplement Insurance

The average premium paid for a Medicare Supplement Insurance plan in 2019 was $125.93 per month.3

Its important to note that each type of Medigap plan offers a different combination of standardized benefits. Plans with fewer benefits may offer lower premiums.

Other factors such as age, gender, smoking status, health and where you live can also affect Medigap plan rates.

Medicare Supplement Insurance plans help pay for some of the out-of-pocket expenses youll face when you use Medicare Part A and Part B benefits. Medigap plans are sold by private insurance companies.

These costs can include certain Medicare deductibles, coinsurance, copayments and other charges.

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover.

Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

| 80% | 80% |

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Recommended Reading: How Do You Start Medicare

Benefits Of A Medicare Advantage Plan

Many individuals beyond retirement age opt for Medicare Advantage Plans because they reduce annual out-of-pocket health care costs. They feel familiar, too, because theyre essentially the same as other health insurance plans. Seniors can choose plans with dental and vision coverage, and they can also pick from a wide range of deductible and coinsurance options.

Some Medicare Advantage plans pay for a persons Medicare Part B benefits automatically. While they seem more expensive at first glance, these plans make life easier because policyholders no longer have to remember to send a separate check to the government every month.

Also Check: Should I Enroll In Medicare If I Have Employer Insurance

A Late Enrollment Penalty

- Some people have to buy Part A because they don’t qualify for premium-free Part A.

- If you have to buy Part A, and you don’t buy it when you’re first eligible for Medicare, your monthly premium may go up 10%.

- You’ll have to pay the penalty for twice the number of years you didn’t sign up.

Example:

You May Like: Does Medicare Medicaid Cover Dentures

Medicare Advantage Costs In 2022

Medicare Advantage is an alternative to Original Medicare. The plans have been approved by Medicare , but theyâre run by private insurance companies. Many MA plans also bundle Part D into their policies, and they often offer extra benefits such as vision, dental, and hearing services, as well as gym memberships.

Premiums and deductibles for Medicare Advantage plans can vary, depending on which one you choose and the extent of your health coverage. The average additional premium for a Medicare Advantage plan is $18 in 2022, according to the Kaiser Family Foundation. You pay this on top of the base Part B fee.

Is A Plan With A Low Medicare Advantage Premium My Best Option

The Medicare Advantage premium is just one cost of the plan. Keep in mind that plans with lower premiums may also have more basic coverage and plans with higher premiums may have more extensive coverage.

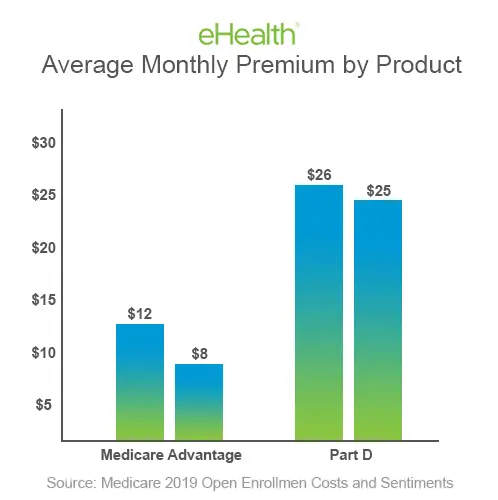

When eHealth asked Medicare beneficiaries about their top health-care concerns, 42% said it was Medicare premiums. Copayments and deductibles were the top concern for 51% of those surveyed. eHealths survey respondents included over 1000 Medicare beneficiaries.

The premium isnt always the only factor affecting your Medicare costs. For example, suppose Medicare Advantage plan 1 has a $0 monthly premium and $0 coverage for routine dental services. If you get $2,000 of dental work, you could pay $2,000.

Suppose Medicare Advantage plan 2 has a $50 monthly premium and $1,000 coverage for routine dental services. You pay $600 in premiums for the year, but with the $1,000 dental coverage, your total spending is only $1,600 compared to $2,000.

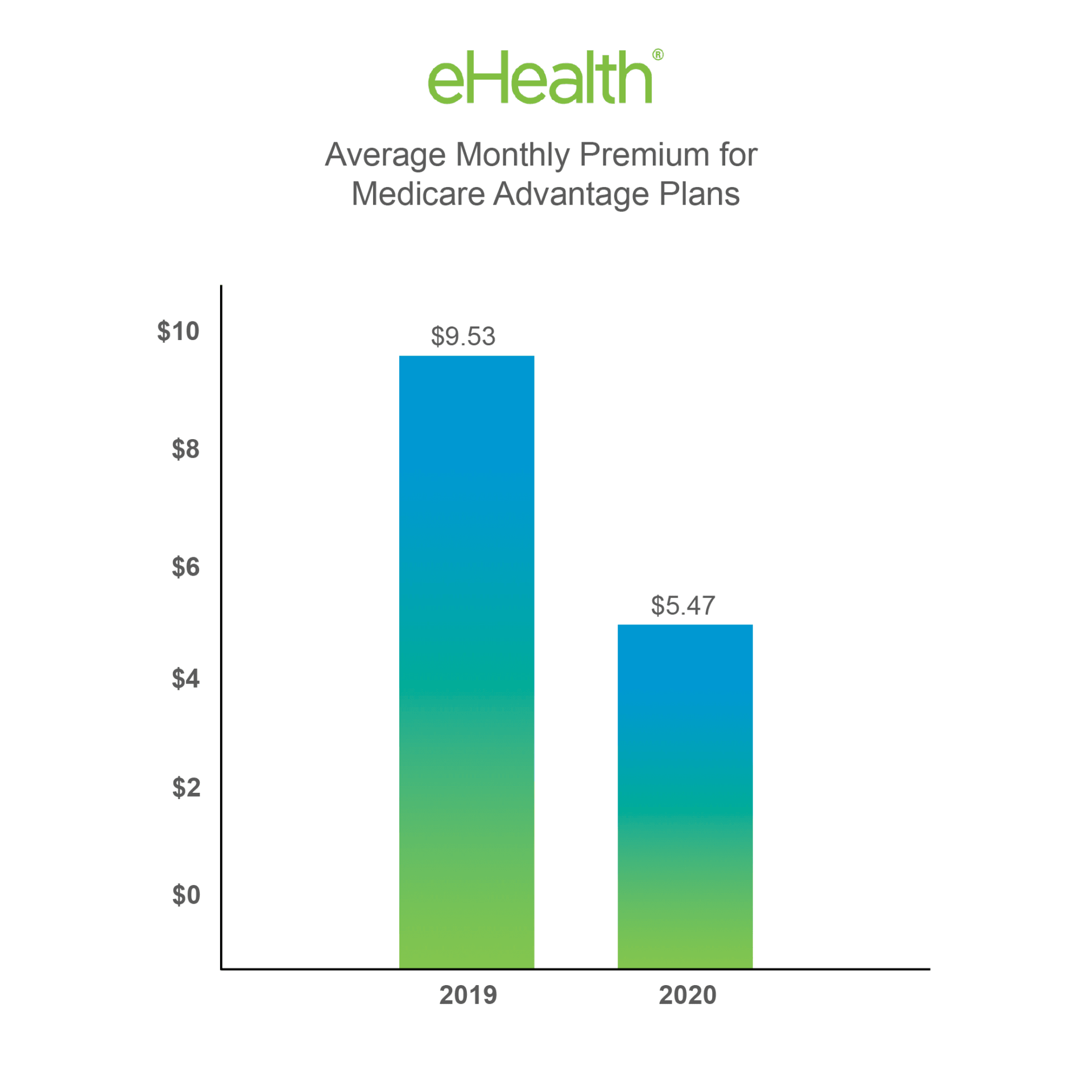

*This report reviews costs and trends among people who purchased Medicare insurance products through eHealth from January 1 through March 31, 2018 and the same period in 2019.

Do you have more questions about Medicare Advantage plan premiums? Just enter your zip code on this page to begin searching for plans in your area.

Recommended Reading: Does Medicare Cover Respite Care Services

Additional Medicare Part B Costs

The premium, deductible and coinsurance are the three main expenses associated with Medicare Part B.

But there are two additional costs that Part B beneficiaries might face.

- Excess chargesWhen you visit a health care provider who accepts Medicare assignment, that means they accept Medicare reimbursement as full payment for the services they provide that are covered by Medicare.But if you visit a provider who does not accept Medicare assignment, that means they still treat Medicare patients but they do not accept Medicares reimbursement as full payment. These providers are allowed to charge you up to 15 percent more than the Medicare-approved amount for your care. This extra amount is called an excess charge, and you are responsible for paying for Part B excess charges in full.The Medicare-approved amount is a pre-determined amount of money that is paid to health care providers for each service or item rendered.

- Late enrollment penaltyIf you do not sign up for Medicare Part B during your Medicare Initial Enrollment Period , you could be subject to a late enrollment penalty if you decide to sign up later on.The Part B late enrollment penalty raises your Part B premium by up to 10 percent for each year that you were eligible for the coverage but did not sign up. The penalty remains in force for as long as you continue to be enrolled in Part B.

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Set Up Online Bill Payment With Your Bank

Set up your one-time or recurring payment correctly with your bank. Enter your information carefully, to make sure your payment goes through on time.

Give the bank this information:

- Your 11-character Medicare Number: Enter the numbers and letters with NO DASHES, spaces, or extra characters. Where to find your Medicare NumberThe letters B, I, L, O, S, and Z arent used in Medicare Numbers. If you see a 0 in your Medicare Number, enter it as a zero, not the letter O.

- Payee name: CMS Medicare Insurance

- Payee address:St. Louis, MO 63179-0355

- The amount of your payment

The bank might mail a paper check even if youve set up an online payment. Why would the bank mail my payment?

Generally, online payments process in 5 business days. If your bank mails a check, it may take longer. Your bank statement will show a payment made to CMS Medicare.

Pay the correct amount

If you want to have automatic payments set up that will update if your premium changes, sign up for Medicare Easy Pay. Get details about Easy Pay.

Recommended Reading: Does Medicare Help With The Cost Of Hearing Aids

Planning For Medicare Taxes Premiums And Surcharges

A little foresight can reduce costs.

Image by mordolff/iStock

Medicare and budgeting for future medical expenses are important elements of personal financial planning. Sometimes, controlling Medicare premium costs is overlooked and estimating future medical out-of-pocket expenses is understated. Accordingly, this article focuses on Medicare planning issues that CPA financial planners should consider when advising clients. These issues include an overview of Medicare taxes, the determination of premium surcharges, projected future health care costs, and strategies to mitigate the impact of the escalating Medicare charges paid by many higher-income clients.

Comparing The Costs Of Medigap Plans

There are 10 Medigap plan types, and each is identified by a letter.

Medicare requires each plan type of the same letter to offer basic, standardized benefits.

While the coverage in Medigap plans is standardized, costs are not.

If you want to save money, its important to shop around, compare coverage, get quotes and ask questions.

However, according to Vice President of Senior Market Sales Brian Hickey, picking the right Medigap plan isnt all about price.

There are other factors that should be considered, including rate increase history, financial stability, customer service experiences and claims history, Hickey told RetireGuide.com. Talking to a professional that has experience across all plans is key in making the right decision.

If you are trying to switch to a better plan and you are in poor health, make sure to ask if the insurer considers your current health status before enrolling.

Also Check: Is Omnipod Covered By Medicare

Also Check: How To Enroll In Medicare Part D

What Is The Average Cost Of Medicare Advantage Plans

Private insurance companies offer Medicare Advantage plans to those eligible for Medicare. Plan availability depends on your county of residence and the carriers determine the costs for the plans. There are even some plans that partially or fully pay your Part B premium.

To enroll in a Medicare Advantage plan, you must first sign up for Original Medicare. Medicare Advantage plans are also known as Part C and are commonly called replacement plans because they stand in for Original Medicare.

With a Medicare Advantage plan, you will still be responsible for applicable premiums for Medicare Parts A and B. Thus, a Medicare Advantage plan with a zero-dollar premium does not mean your Medicare is free.

When enrolling in a Medicare Advantage plan, there are multiple considerations you must make. When it comes to price, you will want to take into account the monthly premium as well as the deductible you must reach for prescription drug coverage.

However, not all Medicare Advantage plans include prescription drug coverage. Though, if yours does, you must meet the deductible for the coverage to kick in. So, for an affordable plan, look beyond the price of the premium and see if the deductibles are also reasonable.

The average monthly premium for Medicare Advantage plans ranges from $4 to $89 across the 49 states where they are available. Prescription drug deductibles for Medicare Advantage plans range from $182 to $448.

Discounts And Financial Assistance

Just like there are various methods of paying Medicare premiums, there are also some different ways to get help paying them.

- Medicare Savings Programs can help pay for Part A and Part B premiums, and potentially other out-of-pocket costs.

- Extra Help is a federal program that helps pay for Part D premiums.

- PACE can help alleviate the cost of a Part D plan.

In addition, because Medicare Advantage, Part D and Medigap plans are sold by private insurers, companies may offer various discounts and cost-saving incentives to customers.

Some of the offers that can be found may include discounts for households or married partners, non-smokers and more, but these will vary based on the plan provider.

Also Check: Can I Sign Up For Medicare Part B Online

You May Like: How Do I Sign Up For Medicare Part C

What Medicaid Helps Pay For

If you have Medicare and qualify for full Medicaid coverage:

- Your state will pay your Medicare Part B monthly premiums.

- Depending on the level of Medicaid you qualify for, your state might pay for:

- Your share of Medicare costs, like deductibles, coinsurance, and copayments.

- Part A premiums, if you have to pay a premium for that coverage.

Recommended Reading: How To Apply For Medicare Supplemental Insurance