The Medicare Part D Donut Hole Coverage Gap

After 2020, Medicare Part D plans have a shrunken coverage gap, or donut hole, which represents a temporary limit on what the plan will cover for prescription drugs.

You enter the Part D donut hole once you and your plan have spent a combined $4,430 on covered drugs in 2022.

Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $7,050 for the year in 2022.

Once you reach $7,050 in out-of-pocket spending, you are out of the donut hole and enter catastrophic coverage, where you typically only pay a small copayment or coinsurance payment for the rest of the year.

What About The Part D Late

Medicare imposes a late enrollment penalty if you dont purchase Part D coverage before the end of your Initial Enrollment Period the seven-month period starting three months before the month you turn 65 or if youve gone 63 consecutive days or more without prescription drug coverage. This penalty is in addition to your monthly premium cost and generally remains in effect for as long as your Medicare drug coverage continues.

Medicare determines the penalty amount by multiplying the number of full months you were eligible for but didnt have drug coverage by 1%, then multiplying that product by the national base beneficiary premium . The result is rounded to the nearest 10 cents. This means the longer you wait to purchase drug coverage, the higher your penalty will be. In addition, because the national base beneficiary premium can change every year, the monthly penalty amount you owe may also increase over time.

Suppose that after your Initial Enrollment Period ended, you waited another full two years without purchasing prescription drug coverage. Your penalty would be 0.24 x $33.06 for a total of $7.93, rounded to $7.90. You would owe this $7.90 each month in addition to your premium cost for as long as you had Medicare drug coverage. This may not seem like much, but it adds up to almost $95 over a year and could get more expensive over time if the national base beneficiary premium rises.

To avoid the Part D late enrollment penalty:

Spouses And Social Security

You can claim Social Security benefits based on your spouses work record. If claiming spousal benefits provides more, claiming before your FRA on a spouses record means youll lose even more than claiming on your own recordthe benefit reduction for a spouse is up to 35% while the reduction for claiming your own benefit is up to 30%. For instance, if youre the spouse of Colleen in the above example and you are the same age, youd be eligible for only $650 a month at age 6235% less than the $1000 a month you would get at your FRA of 67.

Not married? Read Viewpoints on Fidelity.com: Social Security tips for singles

Your decision to take benefits early could outlive you. If you were to die before your spouse, they would be eligible to receive your monthly amount as a survivor benefitif its higher than their own amount. But if you take your benefits early, say at age 62 versus waiting until age 70, your spouses survivor Social Security benefit could be up to 30% less for the remainder of their lifetime.

You May Like: What Does Original Medicare Not Cover

Also Check: Does Medicare Pay For Exercise Classes

Can You Get Help Paying For Prescription Drug Coverage

If you have limited resources, you can apply for Extra Help, worth about $5,000 from the Social Security Administration.12 To qualify, youll need to have a net worth of less than $14,790 and an income of less than $19,320. Married couples who live together can get help if they have a net worth of less than $29,520 if married and living with your spouse and an income of less than $26,130.13

If you meet the requirements for extra help, the cost of prescription drugs is capped at $3.95 each for generics and $9.85 each for brand name medication.14

What Youll Pay For Medicare Part B

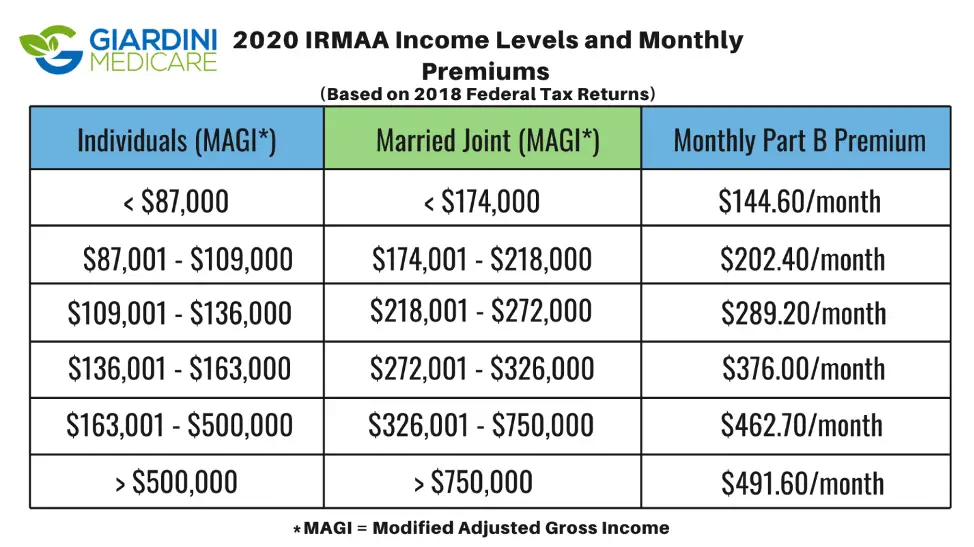

Most people pay a standard monthly premium for Medicare Part B, which is $170.10 in 2022. Depending on your income, you may have to pay more. In 2022, Medicare beneficiaries with reported income of more than $91,000 or $182,000 in 2020 pay from $238.10 to $578.30 a month for Part B.

Your Part B premium is based on your modified adjusted gross income that was reported on your tax return two years prior. So the additional amount you pay for Part B called the Income Related Monthly Adjustment Amount, or IRMAA may vary.

There’s also a deductible for Part B. In 2022, the Part B deductible is $233.

Read Also: Can Medicare Take My Settlement

Cost Of Medicare Supplement

For 2022, a Medicare Supplement plan costs an average of $163 per month. However, costs will depend on two factors: the policy you choose and the pricing structure in your state.

Firstly, different plan letters have different prices since each policy provides a different level of coverage. For example, Medigap Plan G, a more comprehensive plan, costs more than Plan K, a cheaper plan with less coverage. Below are the average monthly premiums of each Medigap plan for 2022. Notice that a range is given since costs can vary.

| Medigap plan |

|---|

| $102-$302 |

Monthly premium for a 65-year-old female nonsmoker

Secondly, Medigap prices will differ based on state regulations and whether the plan can set rates based on age or health status. There are three different ways in which Medigap policies can be priced:

- Community-rated

- Issue-age-rated

- Attained-age-rated

The simplest rating system is community-rated, which means the same monthly premium is charged to everyone who has the same Medigap policy. This means your premium will not be based on your age but could go up because of inflation.

Issue-age-rated has a premium structure in which your monthly premium is based on the age you are when you buy the Medicare Supplement plan. In this case, premiums will be lower for people who buy at a younger age. For example, if you bought a Medigap policy at age 65, your premium could be $200, but if you bought the same plan at 80, that policy might cost $300.

D Late Enrollment Period

A Part D late enrollment penalty will be applied if you went 63 days or more without having Part D or another approved prescription drug plan following the close of your initial enrollment period.11 The amount of the penalty depends on the number of days you were without prescription drug coverage.

The penalty is calculated by taking 1% of the national base beneficiary premium and multiplying that by the number of months you were not enrolled. This figure is then added to your Part D premium and may be enforced for as long as you have Part D.11

Don’t Miss: Who Do You Call To Sign Up For Medicare

How Do I Enroll In Part D

You must enroll in a Medicare Part D plan in the service area where you live. You can enroll in Part D directly with a Medicare Part D insurance provider or through an agent that specializes in Medicare products. Enrolling through an agent means you will have an extra resource for help when you have questions or problems with your drug plan.

You can also enroll in Medicare Part D via Medicares website or by calling Medicare at 1-800-MEDICARE.

Some Medicare Advantage plans also include built-in Part D drug coverage. Its important to check exactly which medications a Medicare Advantage plan includes before enrolling. Be sure that your plan covers the medications you need. You can only be enrolled in one Part D plan at a time. You cannot be enrolled in both Medicare Advantage and Part D at the same time.

The Right Medicare Plan Can Save You Hundreds Of Dollars Each Month

See your options to find savings.

What You Need to KnowMedicare beneficiaries still face a coverage gap for…

Updated: December 21st, 2021ByKate Ashford×

We do not sell insurance products, but there may be forms that will connect you with partners of healthcare.com who do sell insurance products. You may submit your information through this form, or call 855-617-1871 to speak directly with licensed enrollers who will provide advice specific to your situation. Read about your data and privacy.

Our mission is to provide information that will help everyday people make better decisions about buying and keeping their health coverage. Our editorial staff is comprised of industry professionals and experts on the ACA, private health insurance markets, and government policy. Learn more about our content.

Also Check: How Is Medicare Irmaa Calculated

Cost Of Medicare Part B

- Standard cost in 2022: $170.10 per month

- Annual deductible in 2022: $233

For most people, the cost of Medicare Part B for 2022 is $170.10 per month. This rate is adjusted based on income, and those earning more than $91,000 will pay higher premiums.

For high-earners, the cost of Medicare Part B is based on your adjusted gross income from your previous year’s taxes. Only about 7% of enrollees will pay these higher rates, and below you can find an exact breakdown of the different income thresholds for Medicare Part B premiums. If you file joint taxes, then you can double these income levels to figure out what your monthly Part B premium would be. These figures are updated annually by the Social Security Administration .

| Individual income | |

|---|---|

| $500,001 or more | $578.30 |

Those with low incomes can get help paying for Medicare Part B through several government programs including Medicaid, Supplemental Security Income and the Medicare Savings Program.

Besides the monthly premium, enrollees in Medicare Part B are also responsible for paying the deductible.

For 2022, the Part B deductible is $233, which means you would need to pay $233 before coinsurance benefits would kick in.

If you have Medicare Supplement Plan C or Plan F, the supplemental policy will pay for this Part B deductible. If you have a Medicare Advantage plan, the Part B deductible doesn’t apply because the plan will set its own deductible.

When Can I Enroll In Medicare Part D

You can enroll in Medicare Part D during your Medicare initial enrollment period . This is the same as when you qualify for Medicare in general, which is 3 months before your 65th birthday, your birthday month, and 3 months after you turn age 65.

Some people may qualify for Medicare Part D at an earlier age if they have medical conditions such as amyotrophic lateral sclerosis , end stage renal disease , or a disability that qualifies for Social Security Disability Insurance.

Here is a list of all the times throughout the year when you can join a Part D plan:

- 3 months before your birthday to the 3 months after: this is your IEP

- open enrollment period for Medicare or when you can make changes to your current Part D plan

- the time period you can enroll in Medicare Part D if you have Medicare Advantage, but wish to switch to original Medicare with or without Part D

Don’t Miss: Does Medicare Cover Blood Pressure Machines

How Much Does Medicare Part C Cost Per Month

You may be surprised how affordable Plan C coverage can be.

Medicare Advantage plans, often called Medicare Part C, are an alternative option to Original Medicare. Instead of having to get separate Part A , Part B , and prescription drug coverage, Medicare Advantage plans allow you to bundle your coverage together into one simple insurance plan.

However, Medicare Part C isnt run by the government, so youll have to pay for Medicare Advantage plans. How much does Medicare Part C cost per month? While your actual cost is dependent on several factors, you may be surprised by how affordable Medicare Advantage Plans can be. According to the Kaiser Family Foundation, the average monthly premium for enrollees of Medicare Part C plans was $25 for 2020.

With Medicare Advantage plans, Medicare pays a fixed amount toward your care each month to the private companies providing Medicare Part C plans.

While the average cost for Medicare Part C is $25 per month, its possible to get a Medicare Advantage plan with a $0 monthly premium. In fact, according to Kaiser Family Foundation, 60 percent of Medicare Advantage plan enrollees pay no premium for their plan, other than their Medicare Part B premium.

However, prices for Medicare Advantage plans can range widely. According to the National Council on Aging, plans can range from $0 to $270 per month. How much youll pay is dependent on your MA plan type.

In general, the lower your deductible, the higher your premium will be.

What Will It Cost

- Part D requires a monthly premium for most people. The average premium is about $33 per month.

- You may also have copays and out-of-pocket costs.

- Your prescription drugs.

- If you have a Part C plan, it may already include prescription drug coverage.

- To find out which plans cover your drugs, go to the Medicare.gov Plan Finder . Enter your ZIP code and your prescription drugs.

If you already have drug coverage thats as good as Part D, you wont have any penalty if you decide to enroll in Part D later.

If youre covered by employer or retiree insurance and enroll in Part D, you risk permanently losing your coverage. Check with your current plan administrator before you make any decisions.

Important: If you don’t have drug coverage, avoid lifelong penalties by enrolling in a Part D plan or a Part C plan with drug coverage during your Initial Enrollment Period. Even if you dont have prescribed medications now, enrolling may save you money in the long run. If you suddenly need prescriptions, you might have to wait to sign up for coverage and you’ll probably pay more.

Recommended Reading: Is Ed Medication Covered By Medicare

Special Election Periods For Medicare Part D

Once enrolled in Medicare Part D, you are locked into the plan for the rest of the calendar year. You must wait for the next Annual Election Period to change or disenroll. However, Medicare recognizes that there might be certain circumstances in which you need to change mid-year. They have created Special Election Periods for this.

An example would be if you move out of state or lose your group medical coverage mid-year. These kinds of situations create a short Special Election Period during which you can make the necessary change. Your application for the new Part D plan must be coded properly to take advantage of that SEP. An incorrect code on the application can cause a rejection, so be sure to work with an agent who specializes in these plans.

Be aware that your insurance agent cannot solicit you for Part D, so if you wish to enroll, you must initiate that with your agent.

Cms Releases 2022 Projected Medicare Part D Average Premium

The Centers for Medicare & Medicaid Services today announced that the average basic monthly premium for standard Medicare Part D coverage is projected to be approximately $33 in 2022. CMS releases the projected average basic monthly premium annuallycalculated based on plan bids submitted to CMSto help beneficiaries understand overall premium trends before open enrollment, when they can select from plan options for the upcoming benefit year.

The average 2022 basic Part D premium is projected to increase by 4.9% from $31.47 in 2021. The projected average basic premium is calculated based on plans expectations of per capita drug spending in the coming year. CMS anticipates releasing the final 2022 premium and cost-sharing information for 2022 Medicare Advantage and Part D plans in mid- to late-September 2021.

As part of todays announcement, CMS is also releasing other informationsuch as the Part D national average monthly bid amountto help Part D plan sponsors finalize their premiums and prepare for Medicare open enrollment. Medicare open enrollment for coverage beginning January 1, 2022 will run from October 15 to December 7, 2021.

Get CMS news at cms.gov/newsroom, sign up for CMS news via email and follow CMS on Twitter .

Also Check: Does Medicare Cover Hepatitis A Vaccine

What Are The Costs For Medicare Part D

En español | Medicare doesnt automatically cover prescriptions, but you can buy Part D drug coverage from a private insurer. The costs you may pay out of pocket include:

- A premium, your plans monthly bill

- A copayment, a set fee based on the plans rules that you pay to a pharmacy for each of your prescriptions after you meet any deductible

- A deductible, the set amount you pay to a pharmacy each year before the insurance kicks in

- Coinsurance, the percentage of costs you pay to a pharmacy for each of your prescriptions after you meet any deductible

You can purchase either a stand-alone Part D plan or get health and drug coverage through a Medicare Advantage plan. You can acquire this coverage when you first enroll in Medicare or during open enrollment, Oct. 15 to Dec. 7 each year for coverage starting Jan. 1.

You also may be eligible to buy coverage or switch plans at other times. The average Medicare beneficiary has a choice of 54 Medicare plans with Part D drug coverage in 2022, including 23 stand-alone Part D plans and 31 Medicare Advantage plans with drug coverage, according to the Kaiser Family Foundation.

The private companies that sell Medicare Part D coverage set their own premiums, deductibles and copayments but need to follow the federal governments rules. For example, Part D plans can decide to charge a deductible, but the maximum deductible in 2022 cannot be more than $480.