Medicare Costs At A Glance

Listed below are basic costs for people with Medicare. If you want to see and compare costs for specific health care plans, visit the Medicare Plan Finder.

For specific cost information (like whether you’ve met your

, how much you’ll pay for an item or service you got, or the status of a

| 2021 costs at a glance | |

|---|---|

| Part A premium | Most people don’t pay a monthly premium for Part A . If you buy Part A, you’ll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259. |

| Part A hospital inpatient deductible and coinsurance | You pay:

|

| Part B premium | The standard Part B premium amount is $148.50 . |

| Part B deductible and coinsurance | $203. After your deductible is met, you typically pay 20% of theMedicare-Approved Amountfor most doctor services , outpatient therapy, anddurable medical equipment |

| Part C premium |

Do I Qualify For Social Security Disability And Medicare Benefits

Medicare and disabilitybenefits from Social Security help people who are unable to work due to injuryor disease. You may qualify for Social Security Disability Insurance if youreat least 18 years old, and cant work for 12 months or longer. You can learnmore about the requirements on the Social Security Administrations website, and even apply online.

Youll be eligible and automatically enrolled in Medicare Part A and Medicare Part B once youve been receiving Social Security Disability benefits, or disability benefits from the Railroad Retirement Board, for 24 months. Youll receive your Medicare card in the mail up to three months before your coverage starts. If you want to verify your start date, or havent received your Medicare card, you can contact Social Security directly.

Medicare Part A Hospitalization

For most people, Part A will be provided to you at no charge. If you need to buy Part A, youll pay up to $437 each month.

A deductible amount of $1,364 must be paid for by the insurance policy holder for each benefit period.

Copayments are based on the number of days of hospitalization.

Late enrollment fees can be equal to 10 percent of your premium amount. The fees are payable for twice the number of years you were not enrolled.

Theres no out-of-pocket maximum for the amount you pay.

Also Check: Are Cancer Drugs Covered By Medicare

What Is The Part A Premium

If you or your spouse paid Medicare taxes while working for 40 quarters or more, you are eligible for Premium-free Part A, which means you dont owe any monthly premiums for coverage. If you paid Medicare taxes for 30-39 quarters, youll pay $259 per month those whove paid less than 30 quarters in Medicare taxes will pay $471 a month in premiums.1

How Can I Avoid Paying For Medicare

Delaying enrollment in Medicare when youre eligible for it could result in a penalty that will remain in effect for the rest of your life.

Don’t Miss: How Do I Join Medicare

Do I Have To Pay For Medicare On Ssdi

Medicare isnt free for most people on Social Security Disability Insurance. Unless you qualify for another form of income-based help, youll most likely need to pay the Medicare Part B premium, which for most people in 2021 is $148.50. Its unlikely that youll have to pay for Part A. In addition to the Part B premium, you may be responsible for other costs, as outlined below.

General Fund Revenue As A Share Of Total Medicare Spending

This measure, established under the Medicare Modernization Act , examines Medicare spending in the context of the federal budget. Each year, MMA requires the Medicare trustees to make a determination about whether general fund revenue is projected to exceed 45 percent of total program spending within a seven-year period. If the Medicare trustees make this determination in two consecutive years, a “funding warning” is issued. In response, the president must submit cost-saving legislation to Congress, which must consider this legislation on an expedited basis. This threshold was reached and a warning issued every year between 2006 and 2013 but it has not been reached since that time and is not expected to be reached in the 20162022 “window”. This is a reflection of the reduced spending growth mandated by the ACA according to the Trustees.

Don’t Miss: How To Sign Up For Medicare And Tricare For Life

Medicare Premiums Deducted From Social Security Payments

If you have low income and receive Social Security assistance, you may receive premium-free Medicare.

Depending on your income, some people with Social Security benefits may still have to pay for Medicare. However, you can have your Medicare payments automatically deducted from your Social Security benefits.

You will receive a bill in the mail for your Medicare payments, unless one of the following applies to you:

- If you receive Social Security benefits, your payments may be automatically deducted from your benefits.

- If you receive Railroad Retirement benefits, your payments may be automatically deducted from your benefits.

- If you retire from civil services, your payments may be automatically deducted from your annuities

Once you receive your bill, there are a few ways you can pay it. You can pay directly through your bank , you can send in a check or money order, you can pay by debit or credit card by filling in the card information on your bill slip and mailing it back in, or you can sign up for Medicare Easy Pay, a free service which will automatically deduct the premium from your bank account.

Keep in mind that aside from your premiums, you may still have to pay copayments when you visit a doctor or other provider.

Your Guide To 2021 Medicare Premiums And Costs

With so many coverage options to choose from, it can be difficult to estimate your Medicare costs for the year. Read this guide for help crunching the numbers.

Everyday Health may earn a portion of revenue from purchases of featured products.Shutterstock

Trying to estimate your Medicare costs can be a challenging task. A variety of coverage options are available, and each comes with its own premiums and other costs.

You will encounter different costs while enrolled in Medicare, so its important to know about the programs that offer financial assistance in case you qualify.

Don’t Miss: Do I Qualify For Medicare If I Am Disabled

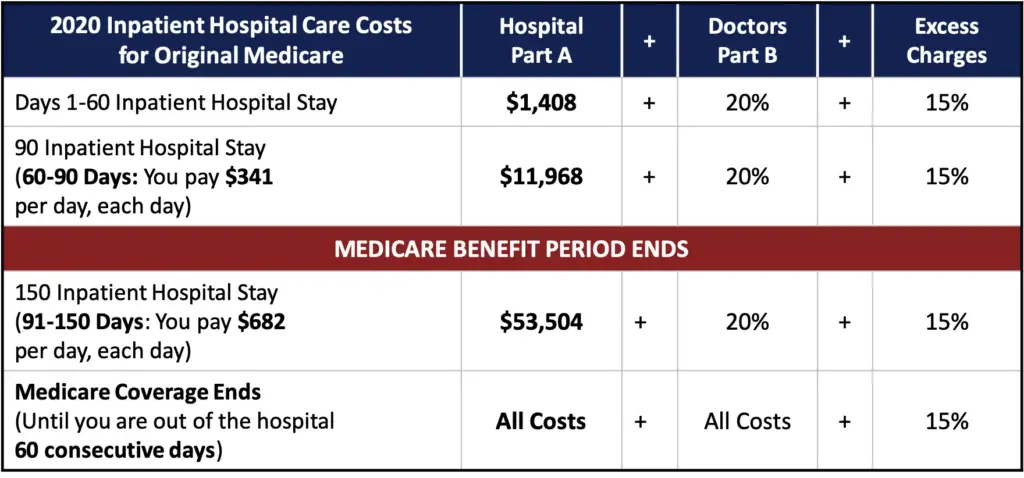

Deductibles And Hospital Coinsurance

With Medicare Part A, youll also pay a deductible and coinsurance costs for each benefit period. In 2021, these costs are:

- $1,484 deductible for each benefit period

- $0 coinsurance for days 1 through 60 in each benefit period

- $371 daily coinsurance for days 61 through 90 in each benefit period

- $742 daily coinsurance for days 91 and beyond in each benefit period

Each day beyond day 90 is considered a lifetime reserve day. You have up to 60 of these days to use in your lifetime. Once youve used all of your lifetime reserve days, you must pay all the costs for the rest of your stay.

Benefit periods reset once youve been out of inpatient care for 60 days or when you begin inpatient care for a new condition.

If you have trouble paying for these costs, you can apply for a Medicare savings program. These state programs help cover the costs of your Medicare deductibles and coinsurance.

Deductibles And Cost Sharing

You will pay full price for care until you reach the $1,484 deductible for each benefit period.

A benefit periodis the time that you are in a hospital or nursing facility, plus the 60 days that immediately follow your stay.

It is possible to have multiple benefit periods within a year, and you would be responsible for meeting the deductible in each of those periods.

Once you have reached that deductible, your costs are determined by the number of days that you remain in the hospital or facility. You will pay $0 per day for each hospital stay under 60 days, $371 per day for each hospital stay that lasts 61 to 90 days, and $742 per day for stays that exceed 90 days.

After 90 days, you will be using what are known as “lifetime reserve days. All Medicare recipients are granted 60 of these days in their lifetime. Once you have used all of them, you are responsible for all costs incurred during any subsequent hospital stays.

Don’t Miss: Which Insulin Pumps Are Covered By Medicare

Effects Of The Patient Protection And Affordable Care Act

The Patient Protection and Affordable Care Act of 2010 made a number of changes to the Medicare program. Several provisions of the law were designed to reduce the cost of Medicare. The most substantial provisions slowed the growth rate of payments to hospitals and skilled nursing facilities under Parts A of Medicare, through a variety of methods .

PPACA also slightly reduced annual increases in payments to physicians and to hospitals that serve a disproportionate share of low-income patients. Along with other minor adjustments, these changes reduced Medicare’s projected cost over the next decade by $455 billion.

Additionally, the PPACA created the Independent Payment Advisory Board , which was empowered to submit legislative proposals to reduce the cost of Medicare if the program’s per-capita spending grows faster than per-capita GDP plus one percent. The IPAB was never formed and was formally repealed by the Balanced Budget Act of 2018.

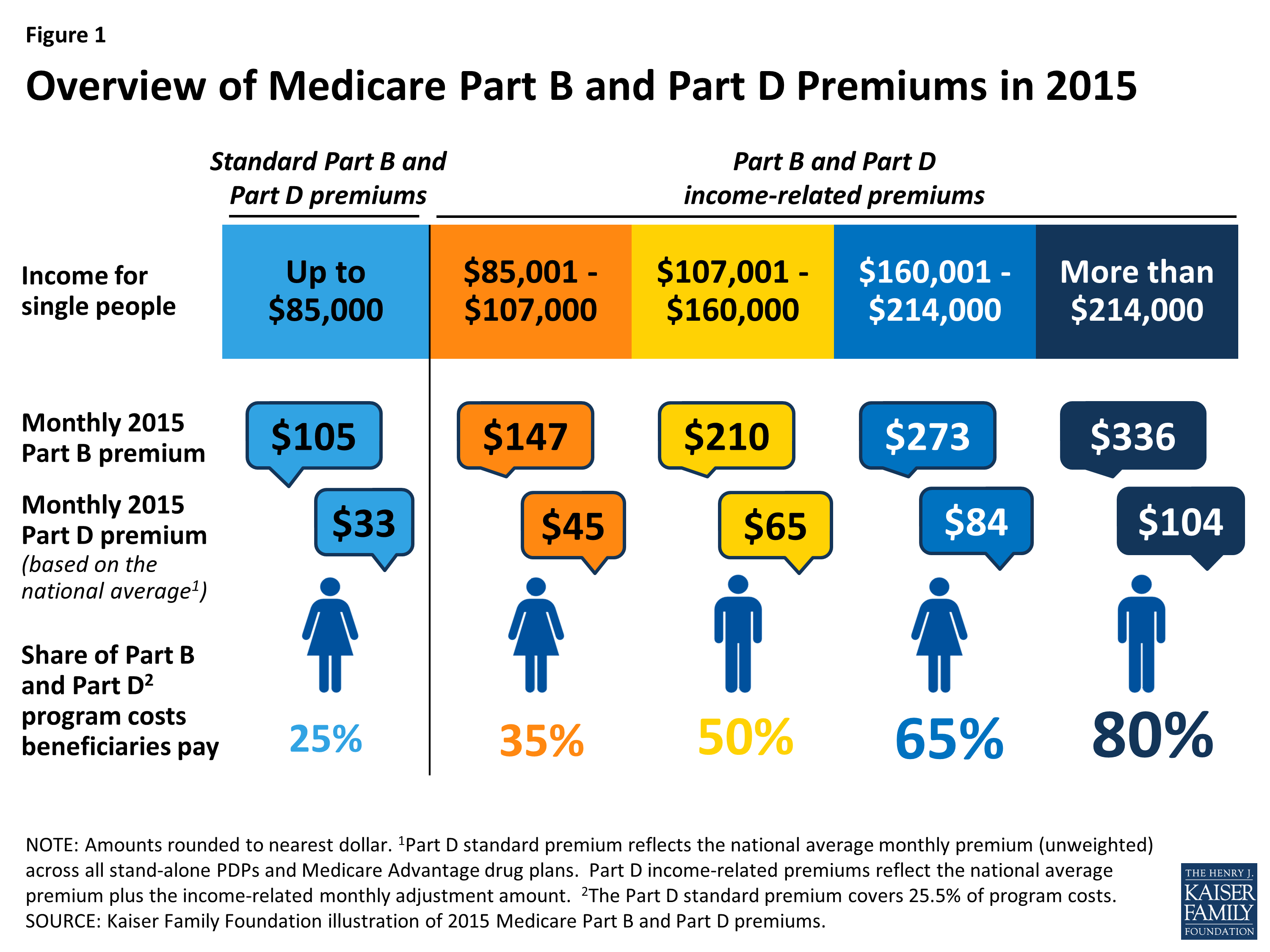

Meanwhile, Medicare Part B and D premiums were restructured in ways that reduced costs for most people while raising contributions from the wealthiest people with Medicare. The law also expanded coverage of or eliminated co-pays for some preventive services.

Medicare Part B Medical/doctor Visits

Most people pay $135.30 each month. Some who are at a higher-income level pay more.

The deductible is $185 per year. After your deductible is met, you typically pay 20 percent of the cost of the services.

You can expect to pay:

- $0 for Medicare-approved laboratory services

- $0 for home healthcare services

- 20 percent of the Medicare-approved amount for durable medical equipment, such as a walker, wheelchair, or hospital bed

- 20 percent for outpatient mental health services

- 20 percent for outpatient hospital services

Late enrollment fees can be equal to 10 percent of your premium amount. The fees are payable for twice the number of years you were not enrolled.

Theres no out-of-pocket maximum for the amount you pay.

Read Also: When Does Medicare Part D Start

How Much Does Medicare Cost At Age 65

The United States national health insurance program known as Medicare has been providing people with health care insurance coverage since 1966. Today, Medicare provides this coverage for over 64 million beneficiaries, most of whom are 65 years and older.

The U.S. government has set the age of eligibility for Original Medicare Parts A and B at 65. And, while most people enroll at this age, others continue working and choose to stay on their employers insurance plan until the time they retire.

If your 65th birthday is coming up and you are planning to enroll for your Medicare benefits, you may be wondering what your costs will be. Here is a look at what you pay for Medicare insurance at the age of 65.

What Medicare costs do you have at age 65?The four parts of Medicare have their own premiums, deductibles, copays, and/or coinsurance costs. Here is a look at each part separately to see what your costs may be at age 65.

Part A

If you are not receiving Social Security benefits three months before your 65th birthday, you must sign up for Part A during your initial enrollment period which lasts for a period of seven months based on your 65th birth month.

There is no monthly premium for Part A if you meet the following requirements for premium-free Part A:

You are currently receiving retirement benefits from either the SSA or the RRB.

You have not applied for SS or RRB benefits yet, but you are eligible for them.

Days 1 60: $0 coinsurance per benefit period

Part B

Why Is Healthcare Important For Elderly

Regular medical check-ups can help identify risk individuals and take preventative measures additionally, older adults are more susceptible to illnesses due to a weakened immune system and mental illnesses such as dementia and depression are among the major health issues that the elderly population faces.

Recommended Reading: Should I Enroll In Medicare If I Have Employer Insurance

Medicare Eligibility For End

If you have Lou Gehrigs disease orESRD, you dont have to wait through the 24-month period before youre eligiblefor Medicare. If you have ALS, your Medicare coverage starts when you begin collectingdisability benefits.

If youre beingtreated for ESRD, youll become eligible for Medicare 3 months after dialysisbegins, or after you receive a kidney transplant. You wont be automaticallyenrolled, so you need to contact Social Security or the Railroad RetirementBoard to start the process.

Additional Cares Act Funding

On March 27, 2020, former President Donald Trump signed the CARES Acta $2 trillion coronavirus emergency relief packageinto law. A sizable chunk of those funds$100 billionwas earmarked for healthcare providers and suppliers, including those that are Medicare and Medicaid enrolled for expenses related to COVID-19.

Below are some examples of what the additional funding covers:

- A 20% increase in Medicare payments to hospitals for COVID-19 patients.

- A scheduled payment reduction was eliminated for hospitals treating Medicare patients from May 1, 2020, through Dec. 31, 2020.

- An increase in Medicaid funds for states.

Recommended Reading: Does Medicare Pay For Laser Cataract Surgery

What Does Medicaid Cover

- If you have Medicare and full Medicaid coverage, most of your health care costs are covered. You can get your Medicare coverage through Original Medicare or a Medicare Advantage Plan.

- If you have Medicare and/or full Medicaid coverage, Medicare covers your Part D prescription drugs. Medicaid may still cover some drugs that Medicare doesnt cover.

- People with Medicaid may get coverage for services that Medicare doesnt cover or only partially covers, like nursing home care, personal care, transportation to medical services, home- and community-based services, anddental, vision, and hearing services.

PACE is a Medicare and Medicaid program offered in many states that allows people who otherwise need a nursing home-level of care to remain in the community. To qualify for PACE, you must meet these conditions:

- Youre 55 or older.

- You live in the service area of a PACE organization.

- Youre certified by your state as needing a nursing home-level of care.

- At the time you join, youre able to live safely in the community with the help of PACE services.

Do You Need Medicare If You Have Va Benefits

Are you a veteran with medical coverage through the U.S. Department of Veterans Affairs who is eligible, or nearing eligibility for Medicare coverage? If you already have medical coverage through the VA health program, you may be wondering if you also need to enroll in Medicare. The answer is that you could probably benefit from having both VA benefits and Medicare. The VA encourages you to consider enrolling in Medicare as soon as youre eligible because Medicare and VA benefits dont work together and you may have to pay a penalty if you end up enrolling in Medicare later.

VA health care benefits typically only cover services received at a VA facility, and for Medicare to cover your care, you must visit a non-VA facility that accepts your Medicare coverage. Having coverage through both the VA health program and Medicare gives you wider coverage and more choices of where you can be treated. Therefore, Medicare coverage may be particularly important if, say, you dont live near a VA facility or your local facility has long wait times. With Medicare, youre not limited to being treated at VA facilities you can visit one of the many doctors, hospitals, and facilities that accept Medicare. Follow along to learn more about Medicare and VA benefits.

Don’t Miss: What Does Bcbs Medicare Supplement Cover

Medicaid Part B Reimbursement Options

In an effort to promote access to Medicare coverage for low-income adults or those with disabilities, the Centers for Medicare & Medicaid Services developed a program to help dually eligible individuals with Part B costs. If you’re dually eligible, it means you have both Medicare and Medicaid.

If you qualify, your state will enroll you in Medicare Part B and pay the full Part B premium on your behalf.

In 2019, states paid the monthly Part B premiums for more than 10 million individuals, helping them afford healthcare and enroll in Medicare while freeing up their funds for other necessities. This buy-in ensures Medicare is the primary payer for Medicare-covered services for eligible beneficiaries, helping to reduce overall state healthcare costs.

Cost Of Medicare Part B

The cost of Medicare Part B will depend on your adjusted gross income . Generally, when you file your taxes, if you make less than $88,000 a year, then you would pay $148.50 per month. Below you can find an exact breakdown of the different income thresholds for Medicare Part B premiums. If you file joint taxes, then you can double these income levels to figure out what your monthly Part B premium would be. These figures are updated annually by the Social Security Administration .

| Individual income | |

|---|---|

| Greater than $500,001 | $504.90 |

Besides the monthly premium, enrollees in Medicare Part B are also responsible for paying the deductible if they do not have another policy such as Medicare Supplement that covers it. For 2021, the Part B deductible is $203, which means you would need to pay $203 before coinsurance benefits would kick in.

You May Like: Can You Get Dental On Medicare