When Is Medicare The Primary Payer

If you or your covered spouse are age 65 and have Medicare, it is the primary payer when you:

- Have FEHB coverage on your own as an annuitant, or through your spouse who is an annuitant

- Are a reemployed annuitant with the Federal government and your position is excluded from the FEHB, and you are not covered under FEHB through your spouse

- Are a Federal judge who retired under title 28, U.S.C., or a Tax Court judge who retired under Section 7447 of title 26, U.S.C.

- Are enrolled in Part B only, regardless of employment status

- Have Medicare because of end stage renal disease and are beyond the 30-month coordination period when you’re entitled to Medicare

- Are eligible for Medicare due to a disability and have FEHB coverage on your own as an annuitant

- Are covered under the FEHB Spouse Equity provision as a former spouse

After Medicare pays its share, your FEHB plan pays the remaining costs. This could help reduce your out-of-pocket costs since many FEHB plans waive cost sharing for enrollees who have Medicare. Cost sharing is the out-of-pocket costs you’d have such as deductibles, co-payments, and co-insurance.

What Is The Best Medicare Part C Plan

Comparing Costs of Part C Plans

| Plan Name |

|---|

| $80 |

What are my Medicare plan options if I have Massachusetts Medicare?

Massachusetts beneficiaries may also have other Medicare plan options. Keep in mind that certain types of Medicare coverage, such as prescription drug benefits, are only available through private insurance companies that contract with Medicare.

Will Fehb Be My Primary Coverage Or Medicare

If you have FEHB and do enroll in Medicare, then Medicare will be your primary coverage and your FEHB plan will pay after Medicare does. Having Medicare could reduce your out-of-pocket costs, because many FEHB plans waive cost sharing for enrollees who have Medicare. Even if this isnt the case, as long as your provider takes both your FEHB plan and Medicare, the most youd have to pay for care is the difference between what Medicare and your FEHB plan pay and Medicares limiting charge.

. Some states dont allow excess Medicare charges. If you live in one of these states or you see a doctor in any state that accepts Medicares rate as full payment youd only have to pay the difference between what Medicare and your FEHB plan pay and Medicares rate. Part Bs limits on what you can be charged dont apply to some services, and Part A doesnt have these limits.)

If you enroll in Part A but decline Part B, your FEHB coverage will pay after Medicare does for Part A services, but will be your primary insurer for other medical care. Medicare would no longer be your primary insurer if you return to work for the federal government, however, and in that case your FEHB plan would pay first, with Medicare paying at least some of your remaining costs.

Also Check: What Is Medicare Plan N Coverage

Defer Income To Avoid A Part B Premium Surcharge

The standard monthly premium for Part B is $148.50 in 2021 but that assumes you are not earning a higher income. Your yearly income from 2019 will be what will determine the premiums you pay for 2021. If you filed an individual tax return and made $88,000 or less, you will pay the standard premium. If you filed a joint tax return and made $176,000 or less, you will also pay the standard premium. However, anything above these figures will result in a higher premium payment.

You may be able to save yourself a higher monthly premium for at least a year if you can report a lower total on your tax return. And you can do this by deferring income tactically to future tax years since the surcharges are based on previous tax returns.

Medicare beneficiaries who receive Social Security have their Medicare Part B premiums taken directly from their Social Security benefits. With this in place, your premiums will be deducted automatically and worries about missing your Part B payment should be nonexistent.

Basics Of Medicare Part D

There are two ways to get prescription drug coverage through Medicare Part D.

- Enroll in a stand-alone Medicare prescription drug plan . If you enroll in a stand-alone prescription drug plan, it works alongside your Original Medicare benefits.

- Or, enroll in a Medicare Advantage plan with prescription drug coverage, or an MA-PD. A Medicare Advantage plan is an alternative way to get your Original Medicare benefits. These plans might also offer coverage for additional services like routine vision or dental care, and prescription medications.

Medicare Part D enrollment provides you with choices of plans in most service areas. All plans are required by Medicare to offer a standard level of coverage. Some plans may offer additional benefits beyond this standard. The cost of plans may include monthly premiums, deductibles, copayments, and coinsurance. The amounts can vary from plan to plan.

Prescription Drug plans include formularies, which are a list of the medications that are covered under the plan. Some formularies have tiers. Medications in lower tiers may have lower costs. Generic medications are often included in the lower tiers. When you are preparing for Medicare Part D enrollment, it is important to make sure the medications you take are included in the plans formulary.

You May Like: How Do I Check On My Medicare Part B Application

Don’t Miss: What Does Part B Cover Under Medicare

What Is Not Covered Under Medicare Part C

Although insurers are allowed to cover more services than Original Medicare does, not all Part C plans pay for routine dental care, hearing aids, or routine vision care. If you are in need of inpatient care, Medicare Part C may not cover the cost of a private room, unless its deemed medically necessary.

Medicare Part B Enrollment Options And Penalties

Medicare Part B is optional, but in some ways, it can feel mandatory, because there are penalties associated with delayed enrollment. As discussed later, you dont have to enroll in Part B, particularly if youre still working when you reach age 65.

However, if you dont qualify for a Special Enrollment Period , then you may incur penalty charges. These penalty charges are indefinite for as long as you keep Medicare Part B. When should you enroll in Medicare Part B? If youre not automatically enrolled because of the aforementioned conditions, then here are your enrollment options:

- You have a seven-month initial period to enroll in Medicare Part B. The seven months include the three months prior to your 65th birthday, the month containing your 65th birthday and the three months that follow your birthday month. If you turn 65 on March 8, then you have from December 1 to June 30 to enroll in Medicare Part B.

- If you delay enrollment, then you have to wait until the next general enrollment period begins. For Medicare Part B, you have from January 1 through March 31 to enroll. Coverage doesnt begin until July.

Recommended Reading: Does Medicare Pay For Lift Chairs For The Elderly

How Much Does Medicare Part B Cost In 2022

Unlike Part A, which is premium-free for most people, everyone pays a monthly Part B premium. The standard Part B premium for 2022 is $170.10. However, your Part B premium cost will depend on your modified adjusted gross income as reported on your IRS tax return from 2 years prior .

Depending on your income, your Part B premium could cost anywhere from $170.10 up to $578.30.

Part B also includes a deductible and copayments for most medical services, durable medical equipment and outpatient mental health care.

- For 2022, the Part B deductible is $233.

- For 2022, the Part B copayment for covered medical services, durable medical equipment and outpatient mental health care is20 percent of the Medicare-approved amount.

What Is Part B

Medicare Part A and Part B, together, are called Original Medicare. Through the Center for Medicare & Medicaid Services, the United States government set up Original Medicare to cover a wide range of medical expenses for individuals 65 and older and individuals with certain disabilities. Part A is hospital insurance.

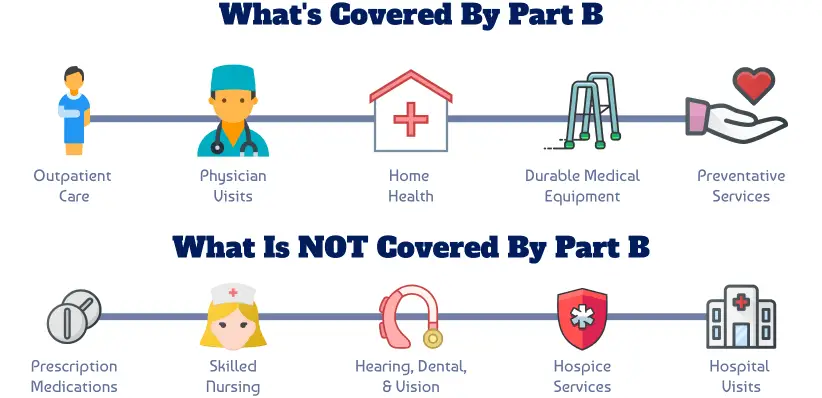

Medicare Part B is medical insurance coverage includes :

- Medically necessary doctor services

A range of preventive treatments, tests, services, and supplies are covered by Part B.

Medicare Part B covers the following:

Preventive and diagnostic services

*Doctor services dont include routine physical exams except the one-time Welcome to Medicare exam. You can get this free exam from a Medicare-assigned doctor during the first 12 months youre enrolled in Part B. After youve had Part B for longer than a year, youre covered for one annual Wellness visit every 12 months.

Doctor, hospital, and home health care

Preventive shots

- Flu shots are covered one time per year during flu season.

- Pneumococcal vaccines are covered for all beneficiaries with Part B.

- Hepatitis B shots are covered if youre at medium or high risk for the disease.

Also Check: How Much Is Part B Medicare For 2020

Enrollment Period For Medigap

Medigap is Medicare supplement insurance. The time to buy a plan is during the Medigap Open Enrollment Period. This is a 6-month time span that begins the month someone turns 65 and enrolls in Part B.

Once this period ends, an individual may not be able to enroll in a Medigap plan. If a company accepts their late application to Medigap, they may have to pay a higher premium due to any health conditions they have.

In contrast, if a person signs up during the Medigap Open Enrollment Period, the company selling the plan cannot charge more than they would charge someone with no health problems.

How Do Tricare For Life And Medicare Process Claims

Typically, your provider will file claims with Medicarefirst. After Medicare calculates its share, it will forward the claiminformation to TFL.

If you have other health insurance, Medicare will submitclaims to that insurance company first. Afterwards, you can send a claim to TFLfor any outstanding amount not covered by Medicare or the other insurer. Forinstance, if you also have a Medicare Supplement and TFL, Medicare would payfirst, and the supplement would pay second. Afterwards, TFL would payremaining, eligible expenses.

Also Check: Can You Get Dental On Medicare

Medicare Part B Features Costs

This is the part of Medicare that we think of most when it comes to health care insurance plans. Part B coverage offers medically necessary doctors services, outpatient care, and most other services that Part A does not cover. These may include physical or occupational therapies and some home health care services.

Part B also covers some preventive services. Though many services and products are covered, keep in mind that Part B is still not a complete medical insurance coverage plan. Original Medicare covers many health care services and supplies. However, there are many costs or gaps it doesnt cover.

Most people have to pay a premium for Part B. You can check to see if you qualify to receive help from your state to pay for premiums and deductibles. If you dont qualify for this, then the premiums are usually deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. There are other payment options for premiums, such as quarterly bills or check drafts.

You have a seven-month window when enrolling in Medicare Part B, centered around your 65th birthday. Medicare gives such a wide window to enroll to give people time to learn about Medicare, talk to an agent, and decide on a plan. This period encompasses the three months before your birthday month, the birthday month, and three months after.

How To Enroll In Part B

A person becomes eligible for Medicare Part B when they reach 65 years of age.

However, people with specific disabilities qualify for Medicare Part B earlier, including those with end stage renal disease and individuals with amyotrophic lateral sclerosis , also known as Lou Gehrigs disease.

If a person receives benefits from Social Security or the Railroad Retirement Board, these organizations will automatically enroll them in Parts A and B.

Some people may choose to delay enrollment in Part B because other sources provide coverage, such as insurance for which their employer or their spouses employer pays.

If a person cannot pay the Medicare Part B premium, they can apply for Extra Help or Medicaid, which helps individuals with a low-income access and pay for insurance.

Also Check: How Many Days Does Medicare Pay For Nursing Home Care

Forms Necessary For Enrolling In Medicare Part B

There are two forms you need to submit for Medicare Part B.

First is Form CMS-40B, Application for Enrollment in Medicare Part B.

Next is Form CMS-L564, Request for Employment Information.

When you complete these forms you must state I want Part B coverage to begin in the remarks section for CMS-40B.

Complete Section B if your employer is unable to the best you can.

Do I Have To Enroll Or Renew Medicare Part B Every Year

Medicare Part B will continue as long as you are paying your insurance premiums. For most people, these fees are subtracted for your Social Security payments. If you do not receive Social Security, Medicare sends a bill.

If you miss three payments in a row, you will receive a cancellation notice. If you do not pay what is due at that time, your plan will get cancelled, and you will have to wait until the next general enrollment period to get your Part B reinstated. Just be aware that you will likely have a penalty fee at that time.

Dont Miss: When Does My Medicare Coverage Start

Don’t Miss: How Much Does Medicare Pay For Assisted Living Facility

How To Cancel Medicare Part B

The Part B cancellation process begins with downloading and printing Form CMS 1763, but dont fill it out yet. Youll need to complete the form during an interview with a representative of the Social Security Administration by phone or in person.

Due to the COVID-19 pandemic, all Social Security Administration offices are currently closed. The SSA is still answering phone calls, and you can access many services on its website. See the latest COVID-19 updates.

You can schedule an in-person or over-the-phone interview by contacting the SSA. If you prefer an in-person interview, use the Social Security Office Locator to find your nearest location. During your interview, fill out Form CMS 1763 as directed by the representative. If youve already received your Medicare card, youll need to return it during your in-person interview or mail it back after your phone interview.

What happens next depends on why youre canceling your Part B coverage.

What Are Covered Services Under Part B

Generally speaking medically necessary physician and specialist service and the equipment they need to care for you. Other benefits include outpatient care and durable medical equipment, preventative services and screenings, physical therapy, and physician-administered medicine.

Also known as Part B drugs, this drug plan includes some chemotherapy drugs, cortisone shots for arthritis, and other medicine of that nature. Part B will not cover optional or elective services, such as hearing aids, glasses, alternative health care, routine chiropractic or massage therapies, prescription drug coverages, or custodial care.

However, Medicare will recognize eye diseases, such as cataracts disease, and will cover costs associated with those treatments.

Also Check: Does Medicare Cover A1c Test

Whats The Difference Between Medicare Part A And Medicare Part B

Part A is the hospital services part of Medicare. This benefit covers inpatient care, hospital stays, skilled nursing facility care, hospice care, and medically needed home health care services.

Part B is the medical services part of Medicare. It covers many of the medically necessary services not covered in Part A, such as outpatient and preventive services. This involves things like x-rays, bloodwork, doctors visits, and outpatient care. It will also cover other medical items such as diabetic test strips, nebulizers, and wheelchairs.

Do I Need Medicare Part B If Im A Veteran

Some people have 2 different coverages that they can choose independent of one another. Federal employees who can opt to use their FEHB instead of Medicare are one group. The most common situation though is with Veterans.

Not all veterans qualify for VA coverage. Your length of military service and your discharge characterization affect your eligibility. If you plan to use VA healthcare coverage as your only coverage, be sure that you apply for VA coverage before your initial enrollment window for Medicare expires. That window runs 3 months before and after your birth month.

Once enrolled in VA coverage, you can choose to skip Medicare and get all of your care at VA clinics and hospitals only. However, I do not advise this. The VA system has been the subject of considerably negative press for years over long waiting times. I have seen many people personally experience this.

Enrolling in Medicare Parts A and B gives you a civilian option. Medicare will pay for Medicare-covered services or items, and Veterans Affairs will pay for VA-authorized services or items.

Be aware that if you opt out of Part B and then later decide to join, you will pay a Part B late penalty. Youll also need to wait until the next General Enrollment Period to enroll, which means there could be a delay before your coverage becomes active.

In my opinion, most Veterans should sign up for Part B. You can read more about VA coverage and Medicare here.

Also Check: How To Apply For Medicare Card Replacement