Are You Automatically Enrolled In Medicare Part B

Medicare will enroll you in Part B automatically. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If you’re not getting disability benefits and Medicare when you turn 65, you’ll need to call or visit your local Social Security office, or call Social Security at 1-800-772-1213.

Explore Your Other Medicare Coverage Options

Once you are enrolled in Original Medicare, you can explore additional coverage options.

You can decide to:

- Add a Medigap supplement insurance policy.

- Add a Part D prescription drug plan.

- Switch to a Medicare Advantage plan also known as Part C to replace your Original Medicare coverage.

Medicare Part D, Medigap and Medicare Advantage are all administered by private insurance companies that contract with CMS.

You can apply for these benefits online.

Use the Medicare Plan Finder tool to explore and compare plans in your area.

Read Also: When Can I Start Collecting Medicare Benefits

How Do People Under Age 65 With Disabilities Qualify For Medicare

People under age 65 become eligible for Medicare if they have received SSDI payments for 24 months. Because people are required to wait five months before receiving disability benefits, SSDI recipients must wait a total of 29 months before their Medicare coverage begins. People under age 65 who are diagnosed with end-stage renal disease or amyotrophic lateral sclerosis automatically qualify for Medicare upon diagnosis without a waiting period.5 Of those who were receiving SSDI in 2014, 34% qualified due to mental disorders, 28% due to diseases of the musculoskeletal system and connective tissue, 4% due to injuries, 3% due to cancer, and 30% due to other diseases and conditions.6

You May Like: Can I Sign Up For Medicare Before I Turn 65

Review Your Medicare Choices Each Year

Whether you enroll in original Medicare or a Medicare Advantage plan, you generally do not need to renew coverage every year. That being said, plans are sometimes discontinued or their benefits and costs may change to the point that the plan no longer meets your needs. Its not unusual for pharmacy and provider networks to change, for costs to increase, or the list of covered prescription drugs to vary. Thats why its a good idea to review your plan each year and compare it against your current health care needs.

Your health insurer is required to send you an Annual Notice of Change by September 30 each year. The notice outlines any changes in coverage and costs expected to begin the following January. If you decide to change your health care plan after reviewing those updates, you can do so during Medicares open enrollment period. The period runs from October 15 to December 7. During this time, you can switch from original Medicare to Medicare Advantage or vice versa. You can switch from one Medicare Advantage plan to another or from one Medicare Part D plan to another. You can also enroll in Medicare Part D if you have not done so already, although late enrollment penalties may apply.

If you find that the new health care plan is not meeting your needs, you can reverse some plan decisions January 1 to March 31 of the following year. Guidance for the renewal process is offered through the U.S. governments phone line at 1-800-MEDICARE or through your local SHIP.

Signing Up For Premium

You can sign up for Part A any time after you turn 65. Your Part A coverage starts 6 months back from when you sign up or when you apply for benefits from Social Security . Coverage cant start earlier than the month you turned 65.

After your Initial Enrollment Period ends, you can only sign up for Part B and Premium-Part A during one of the other enrollment periods.

Read Also: Do Medicare Advantage Plans Cover Chemotherapy

Am I Eligible For Medicare Part B

When you receive notification that youre eligible for Medicare Part A, youll also be notified that youre eligible for Part B coverage, which is optional and has a premium for all enrollees.

Part B costs $170.10/month for most enrollees in 2022, although Part B costs more if your income is more than $91,000 .

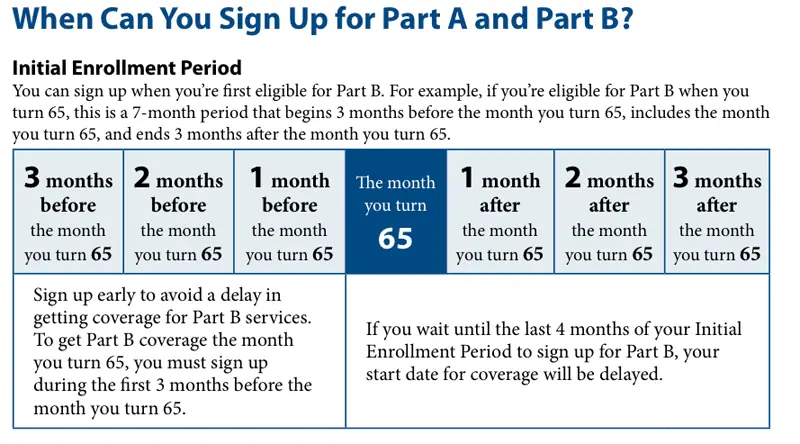

Its important to enroll in both Part A and Part B. You have an enrollment window that runs for seven months . And while you can enroll in the three months following your 65th birthday, its best to enroll in Part B early, or you could have gaps in health coverage. If you wait too long, you could end up locked out of Part B and have to wait until the next general Medicare enrollment period.

If you dont enroll during your initial window, you wont lose eligibility for Part B, but you will be penalized with an increased premium when you eventually enroll, which climbs 10% for each year that youre eligible but dont enroll in Part B . The General Enrollment Period for Medicare A and B runs from January 1 to March 31 each year, for coverage effective July 1 with an increased premium if the late enrollment penalty applies.

What Is The Eligibility Age For Medicare

The eligibility age for Medicare is 65 years old. This applies whether or not youre still working at the time of your 65th birthday. You dont need to be retired to apply for Medicare.

If you have insurance through your employer at the time you apply for Medicare, Medicare will become your secondary insurance.

You can apply for Medicare:

- as early as 3 months before the month you turn age 65

- during the month you turn age 65

- up to 3 months after the month you turn age 65

This time frame around your 65th birthday provides a total of 7 months to get enrolled.

Don’t Miss: When Does One Qualify For Medicare

Got A Question Youd Like Answered

You can ask a question simply by hitting reply to our email newsletter, just as you would with any email in your inbox. If youre not subscribed, fix that right now by clicking here. Its free, only takes a few seconds, and will get you valuable information every day!

The questions were likeliest to answer are those that will interest other readers. So, its better not to ask for super-specific advice that applies only to you.

About me

I hold a doctorate in economics from the University of Wisconsin and taught economics at the University of Delaware for many years. In 2009, I co-founded SocialSecurityChoices.com, an internet company that provides advice on Social Security claiming decisions. You can learn more about that by clicking here.

Got any words of wisdom you can offer on todays question? Share your knowledge and experiences on our. And if you find this information useful, please share it!

Disclaimer: We strive to provide accurate information with regard to the subject matter covered. It is offered with the understanding that we are not offering legal, accounting, investment or other professional advice or services, and that the SSA alone makes all final determinations on your eligibility for benefits and the benefit amounts. Our advice on claiming strategies does not comprise a comprehensive financial plan. You should consult with your financial adviser regarding your individual situation.

Also Check: What Is Statement Of Understanding Medicare

Medicare Eligibility Requirements For 2020

Not sure if youre eligible for Medicare health insurance? The Social Security Administration enrolls some people automatically. But dont expect that or wait for your Medicare card to show up. Find out if youre eligible now so you can enroll at the right time and avoid any Late Enrollment Penalties .

Theres more than one way to qualify for Medicare, and enrolling in the different parts of Medicare differ as well. Plus, how you qualify may determine how you can receive coverage and what your premiums might be.

If youre looking for more of a crash course in the different parts of Medicare and how the program works as a whole, check out our Ultimate Medicare Guide. Otherwise, read on.

Also Check: What Is Medicare Vs Medicare Advantage

If I Retire At Age 62 Will I Be Eligible For Medicare

En español | Nobody can become eligible for Medicare before age 65, unless he or she qualifies at an earlier age on the basis of receiving Social Security disability benefits.

If you retire at any time before 65, you may be able to get health insurance from any of the following sources:

- Your spouses current employer, if youre married and the employer provides health care that covers you

- Your former employer, if youre eligible for retiree health benefits

- COBRA coverage, which extends your former employers coverage for a certain period of time usually 18 months but requires you to pay the full premiums, including what your employer used to pay toward them

- Private insurance purchased through marketplaces set up under the Affordable Care Act

- Private insurance purchased on the open market.

Other Ways To Get Medicare Coverage At Age 65

If you dont qualify for premium-free Medicare Part A coverage, you may be eligible to buy coverage. However, you must still be a U.S. citizen or a permanent resident for at least five years to qualify.

Other Medicare Eligibility Options

- You can pay premiums for Medicare Part A hospital insurance. Premium costs vary based on how long you have worked and paid into Medicare.

- You can pay monthly premiums for Medicare Part B medical services insurance. Youll pay the same premiums as anyone else enrolled in Part B.

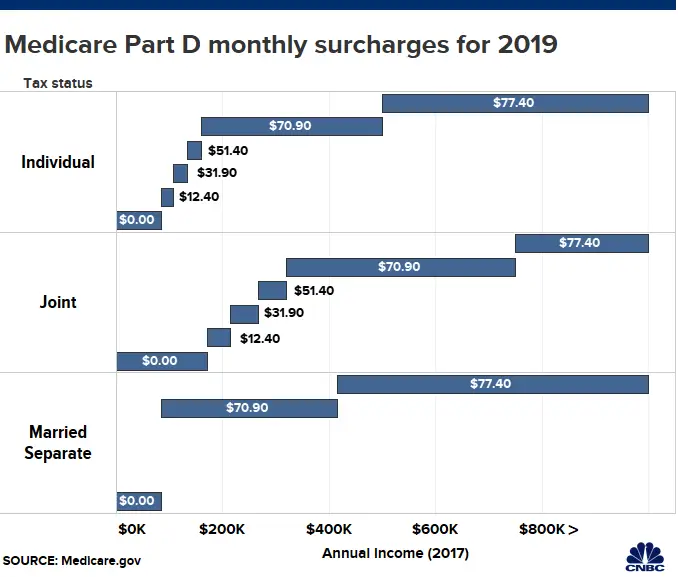

- You can pay monthly premiums for Medicare Part D prescription drug coverage. Your premium will be the standard rate and would depend upon the plan you choose.

You will not be able to purchase a Medicare Advantage plan or Medigap supplemental insurance unless you are enrolled in Original Medicare Medicare Parts A and B.

Read Also: Why Sign Up For Medicare At 65

How Much Does Medicare Cost

Original Medicare

Original Medicare is divided into Part A and Part B .

- Part A helps pay for inpatient hospital care, some skilled nursing care, home health care and hospice care.

- Part B helps pay for doctor services, outpatient hospital care, durable medical equipment, home health care not covered by Part A, and other services. Medicare was never intended to pay 100% of medical bills. Its purpose is to help pay a portion of medical expenses. Medicare beneficiaries also pay a portion of their medical expenses, which includes deductibles, copayments, and services not covered by Medicare. The amounts of deductibles and copayments change at the beginning of each year.

Part A – Monthly Premium

If you are eligible, Part A is free because you or your spouse paid Medicare taxes while you were working. You earn Social Security “credits” as you work and pay taxes. For each year that you work, you earn 4 credits.

| $471 | $499 |

You are 65 or older, and you receive or are eligible to receive full benefits fr om Social Security or the Railroad Retirement Board

You are under 65, and you have received Social Security disability benefits for 24 months You are under 65, and you have received Railroad Retirement disability benefits and you meet Social Security disability requirements You or your spouse had Medicare-covered government employment You are under 65 and have End-Stage Renal Disease

When Can I Enroll In Medicare Part D

To be eligible for Medicare Part D prescription drug coverage, you must have either Medicare Part A or Part B, or both. You can sign up for Medicare Part D at the same time that you enroll in Medicare Part A and B.

As mentioned above, most people who select Medicare Advantage must receive their Part D prescription benefits as part of that same Medicare Advantage plan . Medicare Savings Account plans do not include Part D coverage, nor do some Private Fee-for-Service Medicare plans. If you have an MSA or a PFFS and it doesnt have Part D coverage included, youre allowed to purchase a stand-alone Part D plan to supplement it.

As with Part B, you are still eligible for Part D prescription drug coverage if you dont enroll when youre first eligible, but you may pay higher premiums if you enroll later on, unless you had during the time that you delayed enrollment in Part D.

Don’t Miss: Does Medicare Cover A1c Test

If I Retire At Age 62 Will I Be Eligible For Medicare At That Time

- IV.

Medicare is federal health insurance for people 65 or older, some younger people with disabilities, and people with end-stage kidney disease. Most commonly, you are eligible for Medicare when you turn 65, but there are other health insurance options if you are younger and do not have coverage through you or your spouses employer.

What you should know

| 1. The typical age requirement for Medicare is 65, unless you qualify because you have a disability. | 2. If you retire before 65, you may be eligible for Social Security benefits starting at age 62, but you are not eligible for Medicare. |

| 3. You have options for health insurance if you are too young for Medicare. You may obtain it through your employer, or you can purchase from private-sector insurance companies through the health insurance exchange. You may be eligible for Medicaid, which is based on income. | 4. If you retire before you are 65, you may be eligible for employer-provided group health insurance under the Consolidated Omnibus Budget Reconciliation Act . |

Medicare was established in 1965 in order to provide health coverage for seniors who would otherwise not be covered by employer-sponsored health insurance plans. If you retire at the age of 62, you may be eligible for retirement benefits through social security, but early retirement will not make you eligible for Medicare.

Will I Be Enrolled In Medicare Automatically

You will generally be automatically enrolled in Medicare if:

- Youâre receiving Social Security retirement benefits when you turn 65.

- Youâre younger than 65 and youâve been getting Social Security disability benefits for 24 months. Youâll typically be enrolled in Medicare in the 25th month of getting these benefits.

- Youâre younger than 65 and have amyotrophic lateral sclerosis , also known as Lou Gehrigâs disease. Youâre automatically signed up for Medicare the same month your Social Security disability benefits start

You typically have to sign up for Medicare yourself if:

- Youâre not yet receiving Social Security retirement benefits when you turn 65.

- Youâre under 65 and have end-stage renal disease, a type of kidney failure. You might qualify for Medicare at any age, but you are not signed up automatically.

- You live in Puerto Rico. You may be automatically enrolled in Medicare Part A when you turn 65, but youâll need to sign up for Part B.

You might have to pay a late enrollment penalty if you donât sign up for Medicare when youâre first eligible. Learn more about the late enrollment penalties.

Recommended Reading: Does Medicare Cover Dexa Scan

Exceptions To Medicare Age Eligibility Requirements

There are a few exceptions to Medicares eligibility age requirement. These include:

- Disability. If youre younger than age 65 but youre receiving Social Security Disability Insurance, you may be eligible for Medicare. After 24 months of receiving Social Security, you become Medicare-eligible.

- ALS. If you have amyotrophic lateral sclerosis , youre eligible for Medicare as soon as your Social Security disability benefits begin. Youre not subject to the 24-month waiting period.

- ESRD. If you have end stage renal disease , you become Medicare eligible after a kidney transplant or 3 months after dialysis treatment begins.

- Family relationship. In some instances, you may be eligible for Medicare under age 65 based on your relationship with a Medicare recipient. These relationships include:

- widows who have a disability and are under age 65

- surviving divorced spouses who have a disability and are under age 65

- children who have a disability

Whathappens When A Qualifying Spouse Is Younger

A person is eligible for Medicare Part A if they or their spouse have paid Medicare taxes for at least 40 quarters of work.

This might become more challenging when an older adult with a younger spouse did not work 40 quarters but their spouse did.

If a younger spouse worked for 40 quarters, they can qualify their partner for Medicare coverage once they reach 62 years of age and the older, nonworking spouse reaches 65 years of age.

If a person reaches 65 years of age, did not pay Medicare taxes for 40 quarters, and has a spouse under the age of 62 years, they may have to pay for their Medicare Part A benefits until their qualifying spouse reaches 62 years of age.

You May Like: How To Apply For Medicare In Alaska

Your First Chance To Sign Up

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Avoid the penaltyIf you miss your 7-month Initial Enrollment Period, you may have to wait to sign up and pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty goes up the longer you wait. You may also have to pay a penalty if you have to pay a Part A premium, also called Premium-Part A.

Am I Eligible For Medicare

To receive Medicare, you must be eligible for Social Security benefits.

Part A Eligibility

Most people age 65 or older are eligible for Medicare Part A based on their own employment, or their spouse’s employment. Most people have enough Social Security credits to get Part A for free. Others must purchase it.

You are eligible for Medicare Part A if you meet one of the following criteria:

- You are eligible for Social Security or Railroad Retirement benefits, even if you do not receive those benefits.

- You are entitled to Social Security benefits based on a spouse’s, or divorced spouse’s work record, and that spouse is at least 62 years old.

- You have worked long enough in a federal, state, or local government job to be eligible for Medicare.

If you are under 65, you are eligible for Medicare Part A if you meet one of the following criteria:

- You have received Social Security disability benefits for 24 months.

- You have received Social Security benefits as a disabled widow, divorced disabled widow, or a disabled child for 24 months.

- You have worked long enough in a federal, state, or local government job and meet the requirements of the Social Security disability program.

- You have permanent kidney failure that requires maintenance dialysis or a kidney transplant.

- You are diagnosed with ALS or Lou Gehrig’s disease.

Part B Eligibility

If you are eligible for Part A, you can enroll in Medicare Part B which has a monthly premium.

Will I Need To Prove My Age?

Automatic Enrollment

Recommended Reading: How Can I Enroll In Medicare Part D