How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Blue Shield Medicare Advantage 65 Plus Hmo

$0 premium in most counties, coupled with no cost for office visits and hospitalization. These Medicare HMO plans include the Medicare Part D Rx plans at no additional cost to you. Blue Shields Medicare Supplement plans offer you the freedom to choose any doctor, specialist, hospital, or other provider that accepts Medicare. In other words, youre not limited to a network! Medicare Advantage HMO Plans

Over 70 years of serving Californians As a not-for-profit health plan, Blue Shield of California is guided by its mission and values to provide Californians with access to quality health care coverage at an affordable price. As fellow Californians, we understand your unique needs and offer several types of health plans designed to meet those needs.

Established in 1939 We are a time tested financially sound company that you can count on. In 2010 Blue Shield received A financial strength ratings from Standard & Poors and AM Best, and covers more than 2 million members with individual and employer group plans throughout California.

Blue Shield offers 5 Medicare Supplement Plans: A, F Extra, G, G Extra and N. The Plans vary in price and each plan offers a different level of coverage.

Birthday Rule we have what is called the Birthday rule with Medicare Supplement plans. You are able to switch companies each year on your birthday regardless of your health status.

Dental & Vision Plan Brochure & Application:

Quick Links:

Medicare Advantage Special Needs Plans May Have Lower Costs

A Medicare Special Needs Plan is a type of Medicare Advantage plan that is designed specifically for someone with a particular disease or financial circumstance.

Many Medicare SNPs cover most of the qualified health care costs for beneficiaries. All SNPs must include prescription drug coverage.

Some Medicare SNPs are designed for people who are dual-eligible, meaning they are eligible for both Medicare and Medicaid. These plans are commonly called Dual-Eligible Special Needs Plans .

Medicare Advantage Special Needs Plans can also cater more specifically to the needs of people with specific medical conditions, such as:

- Dependence issues with alcohol or other substances

- Autoimmune disorders

- Chronic lung disorders

- Strokes

Some SNPs can also be available to people who live in a long-term care facility such as a nursing home.

Recommended Reading: Do Most Doctors Accept Medicare

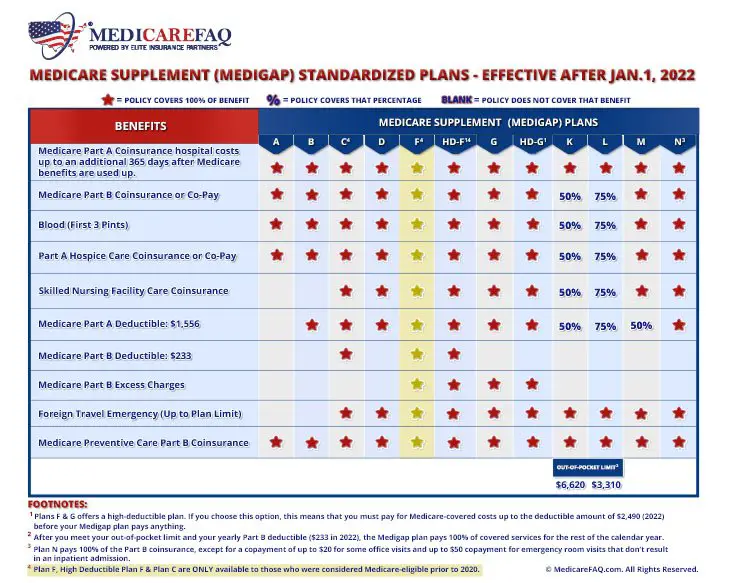

Medigap Supplemental Plans Pick Up Where Medicare Leaves Off But There Are Many Differences And Exclusions Among The Plans Here Is A Sample Of Some Of The Most Popular Benefits And What Is Covered

Yes = the plan covers 100% of this benefit No = the policy doesn’t cover that benefit % of the benefit covered

Some insurance experts are warning people who are already in Plan F and its closest cousin, Plan G, to brace themselves for price increases.

After the change, Plan G will survive as the most comprehensive plan for newcomers. It is identical to Plan F with one exception: People must pay Medicares deductible before insurance coverage kicks in each year. This year, the deductible is $185. About 27% of people in supplements are now in Plan G, according to CSG Actuarial.

Prices arent expected to soar immediately. In fact, some insurance companies have been cutting premiums recently in both Plan F and Plan G to lure customers in advance of changes. But insurance experts warn retirees that as insurance companies adapt to government-imposed changes after 2020, people in both Plan F and Plan G could be shaken by rate increases.

So people choosing supplements now are being advised to pick deliberately so a price shock doesnt upset their budgets later.

Paying the deductible now seems fairly painless, and financial planners already have been urging clients to select Plan G as a bargain compared with Plan F. But there is a question about whether Plan G will remain a bargain as the 2020 changes play out.

Newsletter Sign-up

Barron’s Preview

Get a sneak preview of the top stories from the weekend’s Barron’s magazine. Friday evenings ET.

Questions? Comments? Write to us at

Saving On Premiums May Cost More In The Long Run

Jesse Slome, executive director of the American Association for Medicare Supplement Insurance, a trade group, concurs. At 65, you want the best. Sign me up for the free colonoscopy. My internist wants me to go for a test. If it is totally covered by Medicare, Im there, baby, Slome says. By 65, you learn where to save and where not to save. At the end of the day, you arent going to save on your health care.

Recommended Reading: Where Can I Go To Sign Up For Medicare

Is There An Alternative To Plan F

As noted above, Plan F will be gradually phased out. But you might be able to buy Medicare Supplement Plan G or high-deductible Plan G. Plan G has the same basic benefits as Plan F except it doesnt cover the Medicare Part B deductible.

As a Medicare beneficiary, you may be able to find other Medigap plans with lower premiums. However, if you see the doctor frequently, require a lot of health-care services, or are facing mounting out-of-pocket expenses, the comprehensive coverage of Plan F generally offers the most help with your Original Medicare costs.

The product and service descriptions, if any, provided on these eHealth web pages are not intended to constitute offers to sell or solicitations in connection with any product or service. All products are not available in all areas and are subject to applicable laws, rules, and regulations.

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

Dollars And Cents: Comparing The Costs Of Plan F Vs Plan G

Even though Plan F pays the annual Part B deductible, chances are youll still wind up with more cash in your pocket at the end of the year with a Plan G, instead.

For example, we can use our online Medicare Supplement quote tool to show the following comparisons for a 65-year old non-smoking male looking to purchase a Medigap plan for the first time in Florida, New York, Texas, and Kentucky :

In each situation, our example Medigap customer would come out ahead by purchasing a Plan G, even after taking into account the cost of his once-a-year Part B deductible.

Recommended Reading: Does Medicare Pay For Someone To Sit With Elderly

Why Should I Enroll In A High

High-deductible Plan F policies usually have lower premiums than standard Plan F policies. As a result, if you need or want to keep your monthly payments to a minimum, this might be your best option as far as Medicare Supplement policies are concerned.

Just know that youll have to deal with higher out-of-pocket costs if you get sick or otherwise need medical care. Given that, people who are fairly healthy are the best candidates for high-deductible Medigap Plan F coverage.

Plan F Monthly Premium Rates For 65

$135

Here are some things to think about when you are contemplating Medigap insurance and thinking about choosing Plan F.

Understand what youre getting when you choose Plan F. Heres a summary of what the various plans cover, as published on the Medicare website. With Plan F, the website Senior65.com calculates that you could save nearly $1 million in a single year of serious illness, compared to going without a Medigap policy at all.

Shop for price. If you go to Medicare.govs Find-a-Plan section and put in your Zip Code, youll see that there are an array of Medigap policies named Policy A through Policy N. All the plans with the same letter are required by the government to offer the same coverage, yet the prices vary greatly, depending on a variety of factors, including where you live. A good place to start is by figuring out the range of prices for Plan F in your Zip Code. There is no quick way to do that. Medicare lists the companies that sell Plan F in your Zip, but it doesnt list prices. It is up to you to contact the companies that you are interested in or get an insurance broker to do it for you.

Take a look at other Medigap plans. Plan G, for instance, covers everything that F does except that it doesnt pay the annual Part B deductible, which in 2016 is $167. Often, Plan F and Plan G are only priced a few dollars apart and you wont save anything at all choosing Plan G, but you never know without checking.

Follow me on Twitter .

Recommended Reading: Can I Change My Medicare Advantage Plan Now

Medicare Part D Donut Hole Coverage Gap Costs

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a donut hole or coverage gap, which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.

As of 2020, Part D beneficiaries pay 25 percent of the cost of brand name and generic drugs during the coverage gap until reaching catastrophic coverage spending limit.

What Is Medicare Plan F

Medicare Plan F is a supplemental Medigap health insurance plan that is offered to individuals who are disabled or over the age of 65. Known better as simply Plan F, the policy is the most comprehensive of the 10 Medigap plans offered in each state. Plan F is a supplemental policy to the standard Medicare parts A and B plans and can fill many of the gaps of standard Medicare policy and provide broader assistance with out-of-pocket costs. However, not all health insurance gaps will be covered by Plan F.

Read Also: What Is The Coinsurance For Medicare Part B

What Is Medicare Supplement Plan F

Medicare Supplement Plan F is far and away the least expensive Medicare Supplement Plan that offers the most coverage. This means it isor wasthe most popular supplement for Original Medicare, especially because Plan F covers the Part B deductible. However, as of January 1, 2020, Plan F is being phased out, making it ineligible for new enrollees unless you were eligible for Medicare before January 1, 2020. If youre new, you can enroll in Plan G instead.

Can Anyone Enroll In Medicare Part F Or Who Is Eligible To Enroll In Part F Plans

You should be able to buy Medicare Supplement Plan F coverage if:

- Youre over 65.

- Youre enrolled in both Medicare Part A and Part B.

- Youre not enrolled in a Medicare Advantage plan.

- You live in the plans service area.

- You didnt become eligible for Medicare on or after Jan. 1, 2020.

If you go to buy Plan F or any other MedSup plan outside of a Medicare open enrollment period, you might have to jump through a few extra hoops. One is that you may have to pass a medical screening, which means answering a number of questions about your medical and health history. Another is that your doctor or physician may have to get involved in various ways.

Also, if youre under the age of 65 and you have Medicare coverage due to a disability or end-stage renal disease, you may not be able to buy any MedSup or Medigap policy. Or you may not be able to get the one you want.

Don’t Miss: What Does Original Medicare Mean

What If I Want A Different Medsup Plan Can I Switch From Medsup Plan F To Another Medsup Plan

While you can switch from one Medicare Supplement plan to another in most cases, you may pay for it. After all, if you go to switch MedSup policies and you dont meet certain requirements, youll probably have to pass a medical screening before another insurer will sell you a plan. And depending on the results of that medical screening, you may end up paying a lot more for your new plan than you did for your old one.

Its even possible you wont be allowed to switch MedSup plans, depending on your situation. Given this, thoroughly research all of your options in this area before you enroll a policy. That way, you wont have to worry about how changing from one to another could negatively impact you.

Get Help From A Medicare Specialist

Medigap plans are nuanced when it comes to pricing. For example, not everyone understands that there is only one Medigap Enrollment Period in your lifetime, not an annual one like there is for other Medicare plans. Signing up late can cause your rates to go up based on preexisting conditions. Your local State Health Insurance Assistance Program or State Insurance Department can help you with issues like this. You can also ask your broker for details.

Read Also: What Month Does Medicare Coverage Begin

Who Shouldnt Buy Medicare Part F Or Why Shouldnt Someone Buy This Medsup Plan

Medicare Supplement Plan F is great because it provides the most coverage of the 10 currently available MedSup plans.

That coverage comes at a cost, however specifically, Plan F is the most expensive of all the MedSup policies on the market today.

Before you decide to pass on Plan F, though, do your due diligence and see how much the insurance companies that serve your area charge for it. Its possible you wont pay much more for this coverage than you would for Plan G or some other MedSup or Medigap plan.

What Is The Difference Between Medicare Plan F And G

For decades, Medicare Supplement Plan FMedicare Supplement Plan F is the most comprehensive Medicare supplement plan available. This plan covers all Original Medicare deductibles, coinsurance, and copayments, leaving you with no out-of-pocket costs on all Medicare-approved services…. has been the best supplemental Medicare insurance that money can buy. Simply put, it covers all of the gaps in Original MedicareOriginal Medicare is private fee-for-service health insurance for people on Medicare. It has two parts. Part A is hospital coverage. Part B is medical coverage…..

As youre probably aware, Original Medicare thats your Medicare Part A and Medicare Part B coverage has deductiblesA deductible is an amount a beneficiary must pay for their health care expenses before the health insurance policy begins to pay its share…., coinsuranceCoinsurance is a percentage of the total you are required to pay for a medical service. …, and copaymentsA copayment, also known as a copay, is a set dollar amount you are required to pay for a medical service…. that you pay out-of-pocket. Heres a quick overview of these out-of-pocket costsOut-of-Pocket Costs for Medicare are the remaining costs that are not covered by the beneficiary’s health insurance plan. These costs can come from the beneficiary’s monthly premiums, deductibles, coinsurance, and copayments….:

Don’t Miss: Does Medicare Cover Chronic Pain Management

Am I Still Eligible For Medicare Supplement Plan F

Congress passed the Medicare Access and CHIP Reauthorization Act in 2015. One part of the law aimed to reduce access to Medicare Supplement Plans that covered the Part B deductible. Those plans, Plan C and Plan F, are no longer available to new beneficiaries, but you can still sign up for them if you were eligible for Medicare and born before January 1, 2020.

What Is The Average Cost Of Medicare Part D Prescription Drug Plans

In 2021, the average monthly premium for a Medicare Part D plan is $41.64 per month.1

Medicare Part D plan provide coverage solely for prescription medications. Part D plan costs may vary based on your plan and your location.

Learn about the average cost of Part D plans in your state.

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.2

Depending on your income, you may be required to pay a higher Part D premium. As with Medicare Part B premiums, this adjusted amount is called the IRMAA .

If you are required to pay a higher Part D premium, it will be based on your reported income from two years ago .

Medicare Part D IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $412,000 |

$77.10 + your plan premium |

Recommended Reading: Should I Enroll In Medicare If I Have Employer Insurance

Best For Discounts: Blue Cross Blue Shield

Blue Cross Blue Shield

-

Household discounts

-

New to Medicare Discount

-

User-friendly website

-

Also offers dental, hearing, vision, and Part D plans

-

Few states with High-Deductible Plan F

-

Rates increase based on age

Founded in 1929, BCBS was the first insurance company to manage Medicare claims in 1966. Blue Cross Blue Shield is the umbrella company for Anthem, CareFirst, Highmark, and the Regence Group. Altogether, BCBS offers Plan F in 43 states, excluding Alabama, Arkansas, Hawaii, Massachusetts, Minnesota, North Carolina, and Wisconsin. High-Deductible Plan F is available in 14 states: Alaska, Delaware, Illinois, Maryland, Michigan, Montana, New Mexico, New York, North Dakota, Oklahoma, Pennsylvania, South Carolina, Texas, and West Virginia.

BCBS members have access to a 24/7 nursing hotline. Depending on your state, a wide variety of discount programs are also available. Blue California, for one, offers a New to Medicare discount , a household discount when two or more enrollees live together , an automatic bank payment discount , and discounts for enrolling in a dental plan at the same time . Be sure to ask about available discounts in your state.