A Closer Look At Medicare Plans F G And N

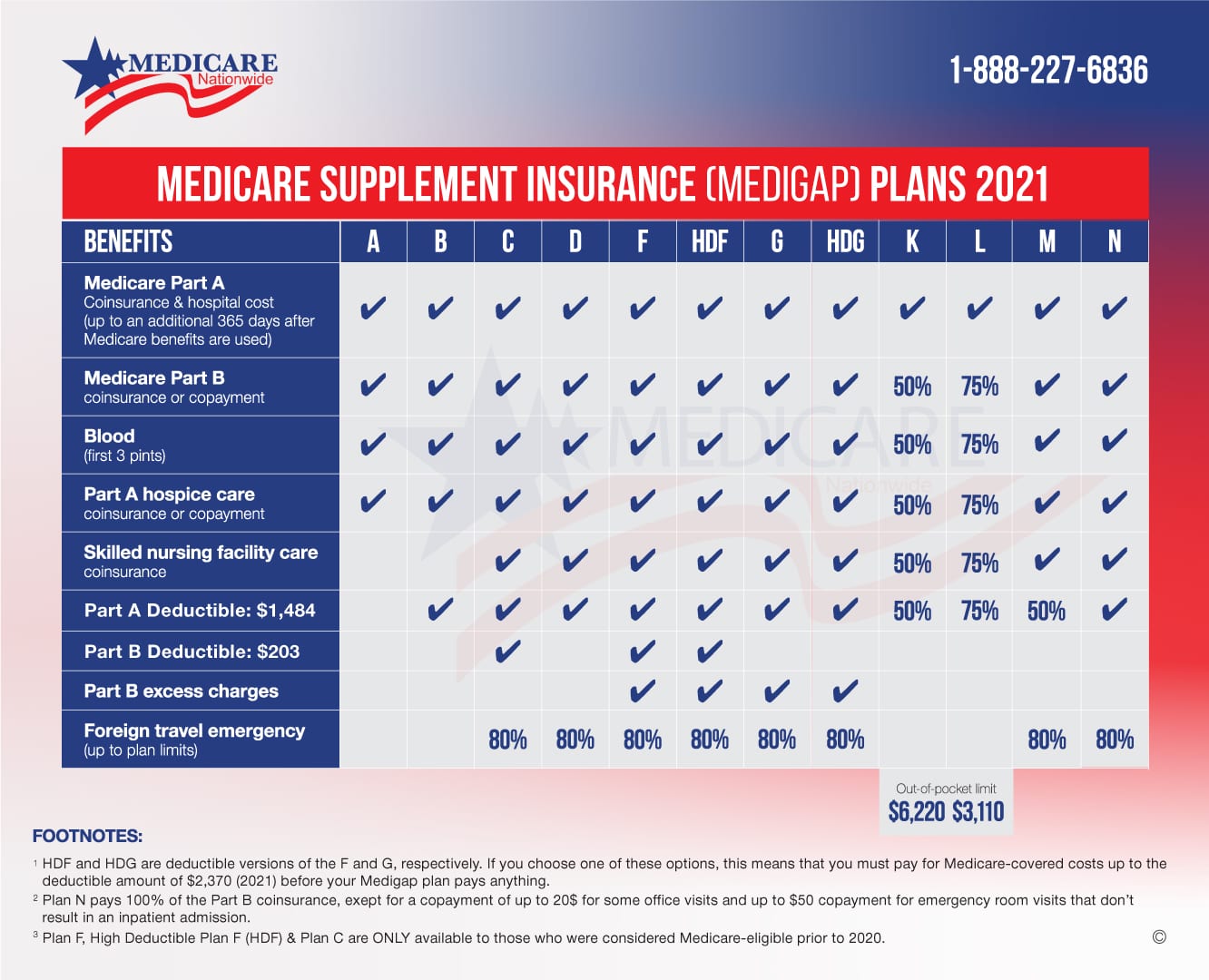

Weve put this chart together so that you can weigh up each of these plans side by side and find one that works best for you.

All of these plans are standardized across America. This means that the benefits for Plan N in California will be the same as Plan N in New Jersey, for example.

How to read the comparison chart:

On the left-hand side of the chart, you can see the nine basic benefits that Medicare Supplements F, G and N cover.

Where you see a percentage, the plan will cover that percentage of the benefit and you must pay the rest.

| Benefits | |

|---|---|

| 80% | 80% |

When you compare each of these Medicare Supplement Plans, you can see that they all offer similar comprehensive coverage.

Although these plans seem nearly identical, they each have subtle differences that affect your coverage and how much you would pay. Lets take a closer look.

Terms You Need to Know:

Deductible: This refers to the set amount you pay for health care services before your insurance begins to pay. For example, if you have a $2,500 deductible you have to pay $2,500 before your insurance kicks in.

Coinsurance: The percentage of costs you pay after your deductible has been met.

Copayment: A set rate you must pay for doctor office visits, hospital stays and prescriptions.

Out-of-pocket expenses: This term refers to costs that are not covered by Medicare and that you must pay for yourself. For example, a consultation fee for an appointment with a specialist.

Aarp Dental Insurance Review: Overview

As mentioned above, AARP Dental Insurance is for people aged 50 and over, so itâs ideally placed for covering treatment related to normal wear and tear and aging. The minimum enrollment period is for 12 months, but you can opt out within the first 30 days of enrolling if you change your mind about the plan.

PPO plans and a dental HMO plan are offered, with coverage available in most States. AARP members are guaranteed acceptance into the dental plans on offer, with coverage for a wide range of dental procedures.

Plan F: Best Medicare Supplement Plan For Coverage

As you can see by the chart above, there is one Medicare Supplement plan that stands above the rest when it comes to the benefits offered.

Plan F is the only Medigap plan to offer coverage in each of the nine benefit areas offered by this type of insurance. Members of Plan F enjoy little to no out-of-pocket expenses because their Medigap plan picks up nearly all health care costs not paid for by Original Medicare . Roughly half of all Medigap beneficiaries are enrolled in Plan F.

However, Plan F does come with one downside. Federal legislation has made Plan F off-limits to anyone who first became eligible for Medicare on or after January 1, 2020. Only those who became eligible for Medicare before that date may enroll in Plan F. Because of that rule, we can expect to see Plan F enrollment decrease every year until it eventually no longer exists.

Medigap Plan C is the only other type of Medigap plan that is subject to the same enrollment rule as Plan F. If you were eligible for Medicare before 2020, you may still be able to enroll in Plan F or Plan C if either plan is available where you live.

Don’t Miss: Does Medicare Pay For Dental Cleaning

How Do I Choose A Plan Thats Right For Me

Although Medicare Supplement Plans F, G and N offer similar benefits, there are subtle differences between each one that will affect your coverage and budget.

One of the best ways to weigh up each of the plans is to determine what your individual health care needs are.

Medicare Plan N vs Plans G and F

If you have chronic conditions or visit the doctor often, Plan F or G will likely be more cost effective and youll have peace of mind that you will be covered for a wide range of benefits.

However, if you dont need to visit the doctor regularly and are okay with copayments Plan N might work better for you.

To help you decide, ask yourself these questions:

-

Which basic benefits are the most important to me?

-

How often will I need to use my Medicare Supplement Plan?

-

How much is the monthly premium?

-

Will I be able to afford the premium when the price increases each year with inflation?

-

How much am I willing to spend on out-of-pocket expenses?

Its also important that you check with your State Insurance Department to see if the Medicare Supplement Plan you are interested in is available where you live.

Who Can Purchase A Medicare Supplement Plan In Maine

In Maine, in order to be eligible for a Medicare Supplement Plan, you have to already be enrolled in Original Medicare Parts A and B. This means you must be a U.S. citizen or a permanent legal resident for at least five continuous years. You need to be 65 or older, or diagnosed with end stage renal disease , or receiving disability benefits, or diagnosed with ALS . If you have worked ten years or more and paid Medicare taxes, and meet the stated requirements, you are automatically enrolled in Part A and B .

In some states, you may be able to purchase a Medicare Supplement Plan if you are under 65, but the premium may be higher, and the insurer may be able to evaluate you medically and screen you for certain conditions, which could affect your coverage.

Read Also: How Much Does Medicare Pay For Urgent Care Visit

Which Medicare Plans Will Be Most Helpful If You Need Dental Implants

Medicare Advantage plans with supplemental dental coverage that includes dental implants will be most helpful. You may have to pay an additional monthly premium, and there will always be a maximum dental benefit amount allowed, along with either a copay or coinsurance. If you need dental implants, you will incur some amount of out-of-pocket expense.

Not all MA plans cover dental implants. Some MA plans specifically exclude dental implants, even if they offer other comprehensive dental benefits.

MA plans list dental implants as either a covered item or an exclusion in the Evidence of Coverage document associated with each plan. If dental implants are covered, you will be responsible for a copay or coinsurance until the max annual benefit is reached. You will then be responsible for the remaining costs of the services you receive that year.

Dental coverage is detailed in the EOC, but the terminology, codes, and lists of dental procedures can be overwhelming. It is best to talk with a dental provider who routinely works with insurance companies and understands all the terms and codes associated with prosthodontic procedures.

What Is A Fee

Seven years ago, I was helping my dad make his Medicare decision. We turned to the Medicare Coach to guide us through Medicare to save time and money. Since getting help, I have joined the organization and have helped thousands of people easily make their right Medicare decision.

The Medicare Coach is the leading fee-based expert in the country, but there are a few other companies offering a similar service. And because the Medicare Coach is fee-based, they do not accept insurance company commissions. This means their advice and guidance is completely unbiased, giving you the confidence youre getting the best advice for your supplement plan recommendations.

Whether you choose to go directly to an insurance company, to a local insurance agent, or a fee-based Medicare expert, please make sure that you are 100% confident in your Medicare decision. Due to Guaranteed Issue Rights in most states, you may not be able to change plans in the future, meaning the first plan you pick could be the plan you have for the rest of your life. Therefore, its critical you make the right Medicare decision the first time.

- Emily Gang

Emily Gang is the leading Medicare advocate, providing independent, unbiased advice to Americans approaching their Medicare decision, including her parents. Her mission is to help people navigate Medicare rules and insurance company confusion to help them make the right decision for their unique situation.

You May Like: Does Medicare Cover Ice Therapy Machines

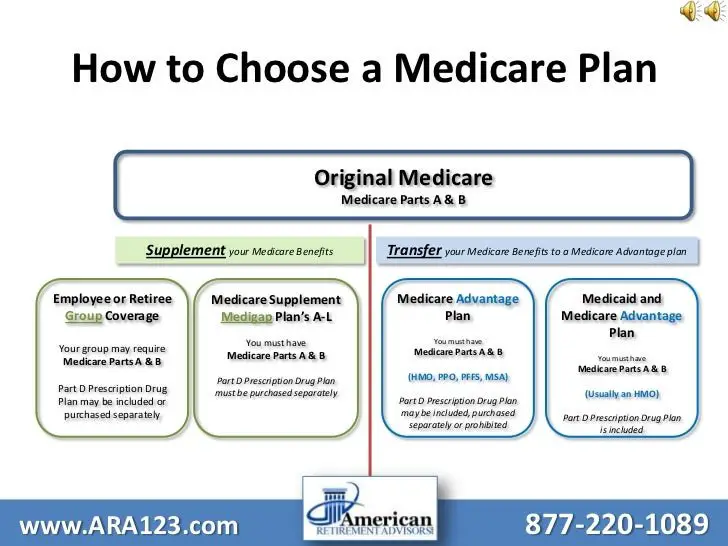

How To Choose A Medicare Supplement Insurance Plan

Everyone has different health care needs and spending concerns, so deciding on the best Medicare Supplement Insurance plan for you requires assessing your own personal situation.

It can be helpful to make note of which type of care you spend the most money on to determine where your biggest savings opportunity might lie. Some questions to ask of yourself include:

- Do you travel frequently within or outside the U.S.?

- Were you eligible for Medicare before January 1, 2020 ?

- Do you have a monthly budget in mind?

- How often do you see a doctor?

Not every plan is available in every location, so the best plan for you is really the best available plan for you.

Working with a licensed insurance agent can be a good way to determine the best Medigap plan for your needs.

What Costs Are Not Covered By Original Medicare

You can use this tool to check whether Medicare covers a specific service or item, such as medical imaging or a particular vaccine. Some of the items and services not covered by original Medicare are:

-

Long-term care

-

Hearing aids

-

Private nursing care

Medicare Parts A and B don’t include prescription drug coverage, and neither does Medigap. For that, you’ll need to purchase Medicare Part D to keep your out-of-pocket drug costs down, or use copay cards for specific items like inhalers. Coupons from GoodRx also can help you spend less on your medications.

Don’t Miss: What Preventive Care Does Medicare Cover

How Do I Enroll In Medicare Supplement Insurance Plans

You must first have Medicare Parts A and B to qualify for a Medicare Supplement Plan.

The best time to enrol into one of these plans is during the Medicare Supplement Open Enrollment Period. This window happens once in your life and lasts for six months.

This is because Medicare beneficiaries are likely to get better premiums and have more options to choose from.

Key Point: An insurance company cannot sell you a Medicare Supplement Plan if you have Medicaid or a Medicare Advantage Plan

Medicaid is a federal and state program that helps people with limited resources and income with medical expenses.

Also known as Medicare Part C, a Medicare Advantage Plan is hospital and medical insurance provided by private companies instead of the government.

If youd like to take an even closer look at Medicare Supplement Plans, make sure you read this article.

Comparing Insurance Companies And Rates

After you decide which plan options appeal to you, find out what insurance companies offer Medicare Supplement plans in your state. You can find these companies by searching online, visiting the Medicare plan finding tool, talking to an insurance agent, contacting your states health insurance assistance program or speaking to friends and family who already have Medicare Supplement plans. Once youve compiled a list of prospective companies, doing some leg work will really pay off, as companies offer the same plans at very different rates. Make sure you know if youre in your open enrollment period or have a guaranteed issue right before starting your calls. Its also a good idea to ask each agent if the company they represent offers discounts or additional benefits. The most common option is the household discount, which lowers the rates of people living together with similar policies. You can also ask about their history of rate increases, which can give you an idea of what to expect going forward.

Once you choose a plan that suits your needs and budget, you can begin the application process and youre on your way to attaining supplemental coverage that will help protect you and your family for years to come.

Don’t Miss: Does Medicare Cover Insulin Pens

The Standard Is The Standard

Medicare Supplement plans are standardized. What does that mean? Every Plan G offers the same coverage no matter which company offers it. A Humana Plan G and an Aetna Plan G and a UnitedHealthcare Plan G and a Mutual of Omaha Plan G are identical.

That means you can compare plans purely based on price. We recommend you narrow your selection down to a subset of Medicare Supplement plans, then compare across the lowest premium version of each plan.

Not all companies are required to offer all plans, and they typically do not offer all plans.

When To Sign Up For Medicare

As you approach age 65, its important to know which enrollment deadlines apply to your circumstances. Begin by checking on your eligibility. To avoid costly penalties and gaps in coverage, most people should for Medicare Part A and Part B in the seven-month window that starts three months before the month you turn 65 and runs for another three months following your 65th birthday.

If you currently get Social Security, you will be automatically enrolled if not, you need to sign up either online or at your Social Security office.

Recommended Reading: What Is The F Plan For Medicare

The Popular Kid In Town

For years, Medicare Supplement Plan F was the most popular plan. More than 50% of plans purchased were Plan F. However, Medicare beneficiaries who become eligible after January 1, 2020, will no longer be able to purchase Plan F. Plan F was popular because it covered all out-of-pocket expenses.

Plan G has recently taken over as the most popular plan. It covers all out-of-pocket expenses, except the Part B deductible, which is $198 in 2020.

This plan is particularly popular, because it reduces your medical expense volatility. Its usually the highest premium plan , but at least you know what youre going to pay.

The most you could pay in a year is your monthly premium multiplied by 12, plus $198. No matter how much treatment you receive, you will only pay that much.

What Are Medigap Plans

Medigap plans are Medicare Supplement Insurance offered by Medicare-approved private insurance companies to help cover cost sharing requirements of Original Medicare Parts A and B.

While Medicare pays for a large percentage of the health care services and supplies you may need, you are still responsible for a portion of the costs in the form of deductibles, copays, and coinsurance. Medigap policies help with these costs and sometimes offer more coverage for excess charges and foreign travel health emergencies.

Medigap plans are standardized by Medicare and regulated by state laws and insurance commissioners. You pay a monthly premium for Medigap. Costs and availability of Medigap plans vary depending on several factors including your age and gender, the insurer, and your state of residence. Learn about Medigap in Nebraska so you can determine which plan best meets your needs.

- In 2019, there were about 181,000 Medicare Supplement enrollees in Nebraska.

- Plans F and G are the most popular and comprehensive Medigap plan types in Nebraska. Plan F is no longer available to people who are eligible for Medicare after December 31, 2019.

- Monthly premiums for Plan G for a 65 year old female who doesnt use tobacco range from $98 to $447.

- About half of Nebraskas Medicare recipients have supplemental Medigap coverage.

Read Also: What Is The Best Medicare Supplement Insurance Plan

How Much Does Medicare Supplement Insurance Cost

The cost of a Medicare Supplement plan varies depending on the insurance company. The average monthly premium price can range from $150 to $200.1 To choose the best Medicare Supplement plan for your needs, you must be aware of any out-of-pocket costs that come with each plan. These costs can include monthly premiums and yearly deductibles.

Positives Of Medigap Plans

Medigap helps cover your out-of-pocket expenses if you decide to stick with Original Medicare.

The biggest advantage of Medigap may be your choice of doctors. You have more doctors and hospitals to choose from since you can go to any provider that accepts Medicare.

If your doctor is not in a Medicare Advantage plan youre considering, and you dont want to switch doctors, you may want to consider Medigap. This will allow you to see any doctor who accepts Medicare.

While Medigap premiums are generally higher than Medicare Advantage, Medigap will likely charge you lower out-of-pocket expenses. Youll need to calculate how much you expect to pay for health care over a year and compare that to your annual premium cost.

Finding a Medigap plan that works for you can be less confusing because there are only eight types to choose from. This can simplify enrolling in Medicare.

Also Check: What Type Of Insurance Is Medicare Part D

What Is The Best Medicare Supplement Plan For 2022

The best Medicare Supplement plans for 2022 include Plan F, Plan G, and Plan N. When it comes to finding the best Medicare Supplement plans for 2022, theres no one size fits all option.

Many different factors go into deciding which Medicare Supplement plan is the best. The best choice for your neighbor may not be the best choice for you.

What Are The Ten Plans

Medigap plans are each given an identifying letter: A, B, C, D, F, G, K, L, M, and N. Each plan of the same letter must offer the same benefits across all the states, with the exception of Massachusetts, Minnesota, and Wisconsin.

However, costs can vary from state to state, and between the different insurance companies.

Medigap plans are guaranteed renewable, which means that if someone pays their monthly premium, the insurer cannot stop their plan. This applies even if someone becomes ill after purchasing a plan.

Not all plans are available in all states.

Some Medigap policies provide additional benefits, such as healthcare when traveling outside the United States.

Also Check: Will Medicare Part B Pay For Shingrix