What Is Medicare Supplement Insurance

Medicare supplement insurance, also called Medigap, helps fill in the gaps in original Medicares coverage, including some copayments, deductibles, and coinsurance.

Some supplement insurance, or Medigap, policies cover added services, such as those a person receives while travelling outside the country. However, these plans do not cover long-term care, eye care, dental care, or hearing aids.

A person is eligible for a Medicare Advantage plan if they:

- have Medicare parts A and B

- live in an area with insurance company coverage

- are a United States citizen or national, or otherwise legally reside in the country

- do not have certain health conditions, such as end stage renal disease

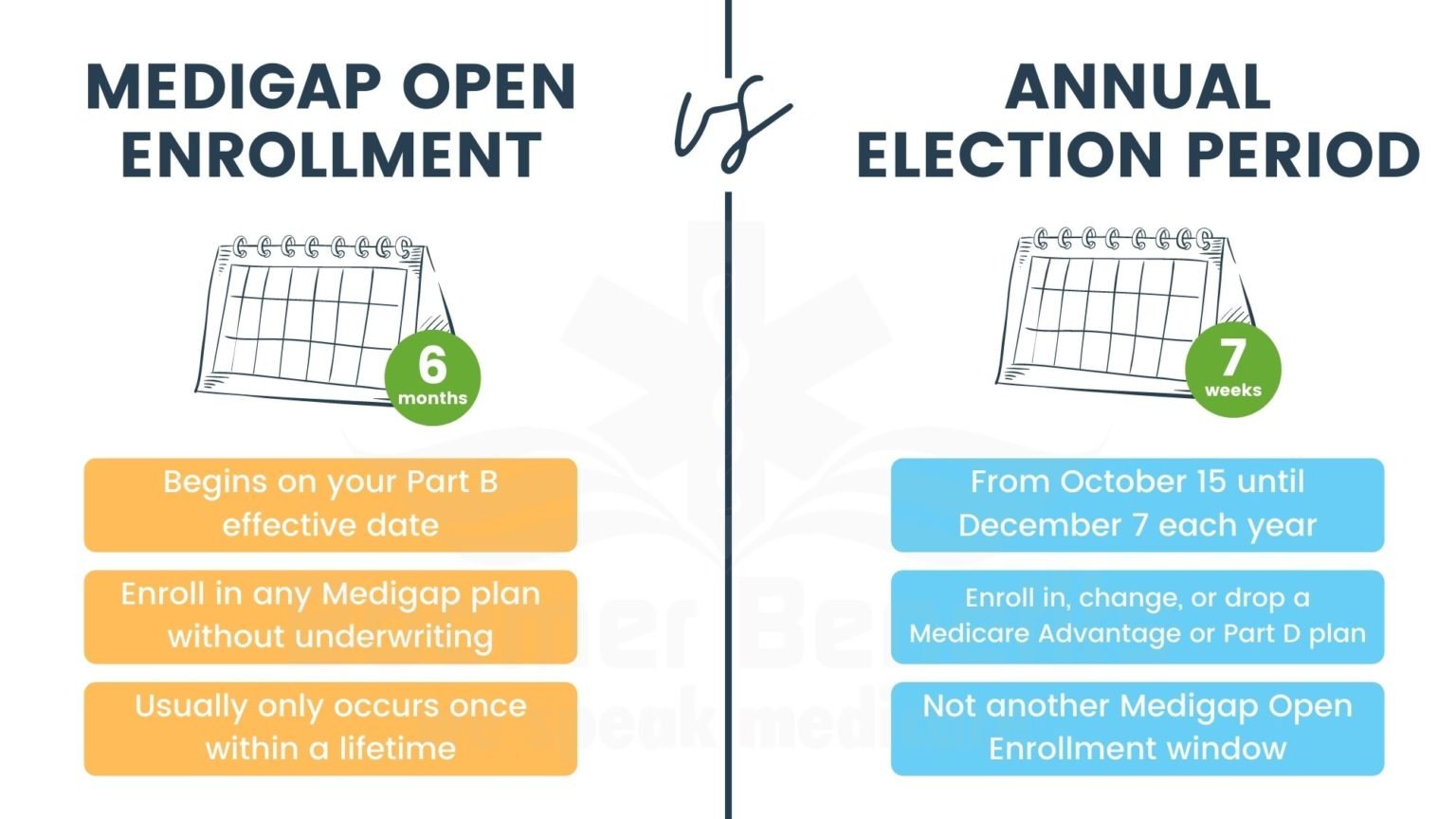

A person can enroll in a Medigap, or supplement insurance, policy when they first sign up for Medicare. The policy has a monthly premium.

The benefit of Medicare supplement insurance is that it helps pay for coinsurance, copayments, and deductibles. A person cannot use it with a Medicare Advantage plan.

State-licensed private insurance companies provide supplement insurance policies. This type of policy has guaranteed renewal when the person pays the premium.

A company must offer a supplement insurance, or Medigap, policy when a person first signs up for Medicare. If a person decides to drop their Medigap policy, private companies are not required to offer another supplementary plan.

Positives Of Medigap Plans

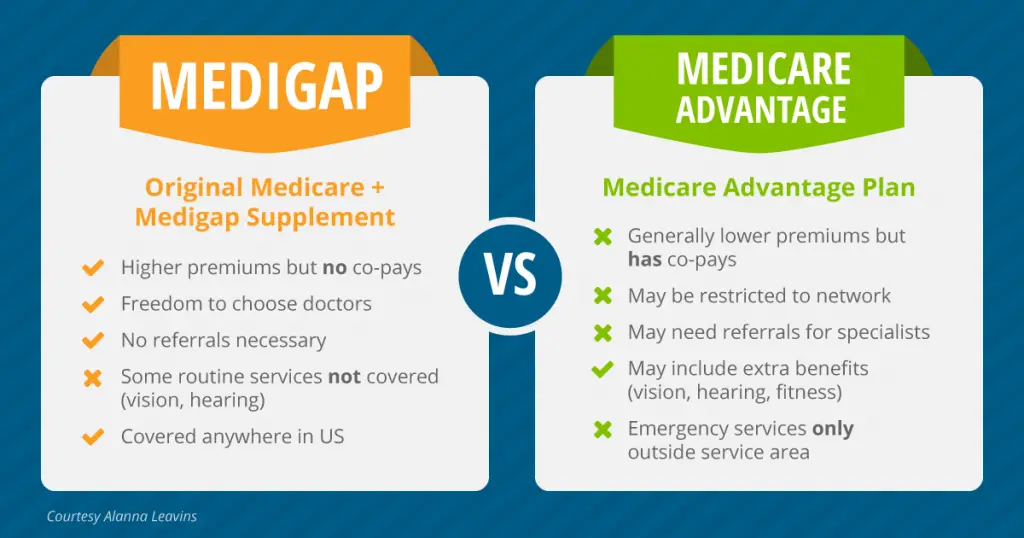

Medigap helps cover your out-of-pocket expenses if you decide to stick with Original Medicare.

The biggest advantage of Medigap may be your choice of doctors. You have more doctors and hospitals to choose from since you can go to any provider that accepts Medicare.

If your doctor is not in a Medicare Advantage plan youre considering, and you dont want to switch doctors, you may want to consider Medigap. This will allow you to see any doctor who accepts Medicare.

While Medigap premiums are generally higher than Medicare Advantage, Medigap will likely charge you lower out-of-pocket expenses. Youll need to calculate how much you expect to pay for health care over a year and compare that to your annual premium cost.

Finding a Medigap plan that works for you can be less confusing because there are only eight types to choose from. This can simplify enrolling in Medicare.

Who Benefits From Medigap Coverage

Anyone who has Original Medicare coverage can benefit from a Medigap policy. Though Original Medicare does provide an expansive range of coverages, excess charges like coinsurance can quickly begin to add up and become unaffordable. Even if you arent sure whether youll be purchasing a Medicare Advantage plan or enrolling in Original Medicare, its worth exploring both options to fully estimate your likely medical care costs.

Read Also: Does Medicare Pay For Cpap Machines And Supplies

Original Medicare Coverage Doesn’t Cut It Here Are Ten Factors To Help You Decide Which Private Insurance Options You Might Need

You can opt for Original Medicare and supplement it with a Medigap plan and/or a Part D prescription plan, or you can choose a Medicare Advantage plan.

Once youve decided that you want more coverage than Original Medicare alone, the next step is figuring out which of the many private insurance options will best fit your needs and budget.

Selecting A Medigap Plan: Recent Changes Limit Choices

Medigap policies are private plans, available from insurance companies or through brokers, but not on medicare.gov. They are labeled Plans A, B, C, D, F, G, K, L, M, and N, each with a different standardized coverage set. Plans F and G also offer high-deductible versions in some states. Some plans include emergency medical benefits during foreign travel. Since coverage is standard, there are no ratings of Medigap policies. Consumers can confidently compare insurers prices for each letter plan and simply choose the better deal.

As of Jan. 1, 2020, Medigap plans sold to new Medicare beneficiaries aren’t allowed to cover the Part B deductible.

Before 2020, most people who bought Medigap policies chose Plan F, which gave the most comprehensive coverage, including paying for the Medicare Part B deductible . However, in an effort to trim Medicare expenses, Congress suspended Plans C, F, and High Deductible F for people who become Medicare-eligible in 2020 and beyond.

Plan D and Plan G have similar benefits to Plan C and Plan F, except for not covering the Part B deductible. People who signed up or became eligible for Medicare before 2020 can purchase or continue Plans C or F, though prices may rise and it may be a better deal to switch to a plan that doesnt cover the deductible.

You May Like: What Is Medicare Plan G Supplement

What Are Medicare Advantage Plans

If you have a Medicare Advantage plan, youre still enrolled in the Medicare program in fact, you must sign up for Medicare Part A and Part B to be eligible for a Medicare Advantage plan. The Medicare Advantage plan administers your benefits to you. Depending on the plan, Medicare Advantage can offer additional benefits beyond your Part A and Part B benefits, such as routine dental, vision, and hearing services, and even prescription drug coverage.

There are many different types of Medicare Advantage plans, described below:

- Health Maintenance Organizations require you to use health-care providers in a designated plan network and may require referrals from a primary care physician in order to see a specialist.

- Preferred Provider Organizations recommend the use of preferred health-care providers in an established network, and these plans are likely to cover more of your medical costs if you stay inside that network. You dont need a referral to see a specialist.

- Private Fee-for-Service plans determine how much they will pay health-care providers, and how much the beneficiary is responsible to cover out-of-pocket.

- Medical Savings Account plans deposit money into a health-care checking account that you use to pay for health-care costs before the deductible is met.

- Special Needs Plans are tailored health insurance plans designed for beneficiaries with certain health conditions.

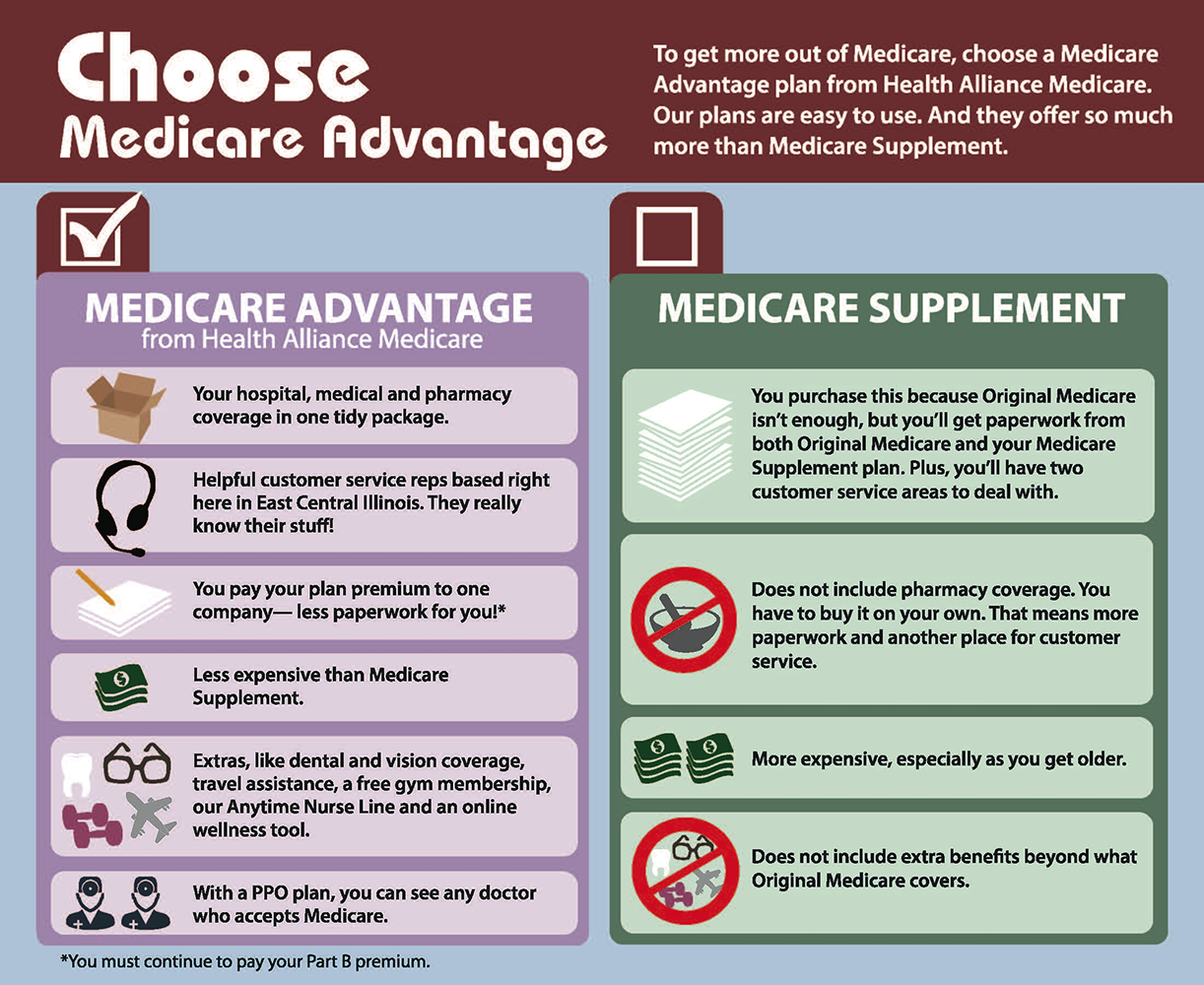

The Most Important Difference Between Medicare Advantage And Medicare Supplement

Well deep dive into the important distinctions later in this guide. But to get started, the most important thing you should understand is this:

A Medicare Advantage Plan is a replacement for your traditional Medicare Parts A and B. It is new insurance provided by a private company. With a Medicare Supplement, on the other hand, you are keeping your Original Medicare Parts A and B and simply adding on additional coverage.

What this means is that you cannot have both Medicare Advantage and Medicare Supplement. So you need to choose the right option for you from the start.

Important Terms to Understand

Before we compare your two options, lets get a few difficult terms out of the way. Understanding these now will help you better grasp the difference between Medigap and Medicare Advantage.

Deductible: A deductible is the amount of out-of-pocket cash you will need to pay before your Medicare benefits kick in. For example, the Medicare Part A deductible for inpatient hospital care is around $1400. This means that if you required inpatient services, you would have to pay the first $1400 in expenses before Medicare would start paying anything.

Benefit Period: This is the period of time that must pass before your deductible resets and you have to pay it again. It can get complicated, but a simple way to understand it is that after paying your deductible, you wont have to pay it again until 60 days have passed without you requiring the same sort of medical care.

Recommended Reading: Will Medicare Pay For Electric Scooter

What Is A Medsupp

A Med Supp, or Medicare Supplement, is the same thing as a MediGap plan. MediGap is actually just a nickname for Med Supps. And we have to say Med Supp because its shorter, and sounds cooler, and there are way too many syllables in insurance terminology.

MedSupps are plans F through N. Theyre called MediGap because they plug holes in original Medicare. A lot of people ask What DOESNT original Medicare cover? It turns out, Medicare Parts A and B dont cover a LOT of things that many people assume they do. And that includes vision, dental, hearing, and long term care, just to name a few.

Now, the thing about a MedSupp that leads a lot of people to choose Medicare Advantage instead is the price. Generally speaking, MedSupps have higher premiums than Medicare Advantage plans.

What Are The Advantages And Disadvantages Of Medicare Advantage Plans

Some potential benefits of having a Medicare Advantage plan include:

- All Medicare Advantage plans have an annual out-of-pocket spending max, which Original Medicare does not offer.

- Some Medicare Advantage plans offer $0 premiums.

- Many Medicare Advantage plans offer prescription drug benefits and some of the additional benefits listed above, which are not covered by Original Medicare.

Some potential downsides of a Medicare Advantage plan can include:

- Certain types of Medicare Advantage plans may limit you to a provider network. If so, youll be required to visit health care providers who are in the plan network for your care to be covered.

- The provider networks in some Medicare Advantage plans may be small limited to a certain geographic region. This could be an issue if you travel frequently or live in different parts of the country during certain times of the year.

Whether or not a Medicare Advantage plan is a good fit for you will depend on your personal health care and budget needs.

Don’t Miss: What Medications Are Covered By Medicare

Why Are Medicare Advantage Plans Bad

There are many reasons why people may feel Medicare Advantage plans are bad. Some individuals say its due to their smaller networks while others arent fans of the annual changes. The answer to this question really depends on who you ask.

If you ask a doctor, theyll likely tell you they dont accept Medicare Advantage because the private insurance companies make it a hassle for them to get paid. Ask your neighbor why Medicare Advantage plans are bad and they may say they were unhappy with how much they had to pay out-of-pocket when using the benefits. If you ask your friend why they didnt like Medicare Advantage, they might say its because their plan wouldnt travel with them. Yet, a very common answer is because I thought the plan was free.

Reason : Free Plans Are Not Really Free

This is true.

The real issue here is peoples misunderstanding of how Medicare Advantage plans work. Specifically, many people dont understand copayments and coinsuranceCoinsurance is a percentage of the total you are required to pay for a medical service. …. So, if you are wondering, how can Medicare Advantage plans be free?, they arent. Far from it.

Just like Original Medicare , Medicare Advantage is a cost-sharing system. With Original Medicare beneficiaries pay about 20 percent of the cost for all Medicare-approved services and Medicare pays 80 percent. With a Medicare Advantage plan, you also pay about 20 percent of your costs, but there is an annual cap that limits your out-of-pocket costs, which solves one of the biggest problems with Medicare Parts A and B.

NOTE: The annual maximum out-of-pocket limit thats built into all Medicare Advantage plans is a major advantage. For those beneficiaries with chronic health conditions, who cannot get a Medicare supplement, the annual MOOP keeps them out of bankruptcy from excessive medical bills.

You May Like: Do I Have To Pay For Medicare On Ssdi

Medicare Advantage Vs Medicare Supplements

Home / FAQs / Medicare Advantage vs Medicare Supplements

There are many differences between Medicare Advantage vs Medicare Supplements. Its crucial to do your research to thoroughly understand how each supplemental option works. Youre not alone in your research, and were here to help.

Some questions to consider while you analyze this information:

- Do you plan to travel?

- Are you willing to change doctors?

- Do you want to have predictable costs?

- Whats most important to you when it comes to your insurance?

Is Medicare Advantage Or Medigap Coverage Your Best Choice

Generally, if you are in good health with few medical expenses, Medicare Advantage is a money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

Speaking with a licensed insurance agent about your particular health situation can help you decide which is best for you. Since you are not allowed to have Medicare Advantage and Medigap at the same time, you have to choose carefully to make sure you have suitable coverage for your specific situation.

Weighing what options are most important to you and talking with a licensed insurance agent about your particular wants and needs can help you make an informed choice between Medicare Advantage and Medigap.

Recommended Reading: Can You Get Medicare If You Retire At 62

Learn About These Plans

What is Medicare Advantage PPO vs Medicare Supplement Plans?

You might think a Medicare Advantage PPO plan is the same as a Medicare Supplement Plan. There are similarities, but there are a lot more differences than youd think. Lets look at the differences to determine whether you are more suited for a Medicare Advantage PPO vs a Medicare Supplement Plan.

Medicare Supplement Plans: Standardized Benefits

Every private insurance company that offers Medicare Supplement plans must follow federal and state laws designed to protect consumers. The policy must be clearly identified as Medicare Supplement Insurance. Insurance companies in most states can sell only standardized Medicare Supplement plans, identified by letter. You can find coverage details about all 10 standardized Medicare Supplement plans using the Medicare Supplement Plan Comparison Chart.

You May Like: What Does Medicare Part B Cover 2020

What Plan Is More Affordable

Medicare Advantage plans will have lower out-of-pocket expenses because they manage the resources that you use. The cost of prescription drugs is usually included in the plan. Some plans offer other benefits tooâsuch as vision, dental, and fitness programs. What you give up is the ability to see out-of-network providers at the same low cost.

With Medicare Supplement plans, you pay a premium to a private insurer to bridge your gaps in Original Medicare coverage. There are 10 standardized levels of Medicare Supplement, Plans A-N, each with their own level of coverage. However, the pricing and specific private insurers offering these plans will vary according to your region.

Additionally, with Medicare Supplement plans, the more gap coverage you want, the higher monthly premium you pay. Some expenses not typically covered by Medicare Supplement include vision, dental, and long-term care. If you want prescription drug coverage, you must join Medicare Part D.

Medicare Part D Vs Medicare Advantage Plans

For more information on Medicare, please call the number below to speak with a healthcare specialist

Choosing which Medicare plan works best for you can be overwhelming. If you are one of many seniors who also takes prescription drugs, there are added considerations. Two different options exist for prescription drug coverage in Medicare: enrolling in a Medicare Part D plan or choosing a Medicare Advantage plan that includes prescription drug coverage. Which one is better? The answer depends on your specific needs.

Also Check: Are Legal Residents Eligible For Medicare

Why Medicare Advantage Plans Are Bad

Home / FAQs / Medicare Advantage / Why Medicare Advantage Plans Are Bad

You probably see dozens of commercials for zero-dollar premium Medicare Advantage plans that claim all-in-one coverage. They may include prescription drug coverage and care for vision, dental, hearing aids, and maybe even a free gym membership. Yet, you may have also heard people complain about or criticize these plans. So, why are Medicare Advantage plans bad?

Firstly, Advantage plans are not necessarily bad. However, theyre certainly not a good fit for everyone. Were here to clear up your confusion about how these seemingly ubiquitous plans got a less-than-stellar reputation.

Reason : They Make You Pay Multiple Copays For The Same Issue

This is true, but it is also true with Original Medicare. However, this complaint highlights the chief difference between Medicare Advantage and Original Medicare plus a Medicare supplement.

Medicare Advantage is a pay-as-you-go system. You pay your monthly Medicare Part BMedicare Part B is medical coverage for people with Original Medicare benefits. It covers doctor visits, preventative care, tests, durable medical equipment, and supplies. Medicare Part B pays 80 percent of most medically necessary healthcare… premium, and an additional premium for the plan , but the majority of your costs come when you use healthcare services. So, if you see your primary care doctor for an issue you pay a copay. If your doctor refers you to a specialist you pay another copay. And if your specialist orders lab tests or diagnostic tests you pay a copay for each of those, as well.

You May Like: Do You Need Referrals For Medicare

Can I Switch Between Medicare Advantage And Medicare Supplement Plans

Switching from a Medicare supplement plan to Medicare Advantage is relatively simple and can be done during the annual open enrollment periods. Switching from Medicare Advantage to Original Medicare with a Medicare supplement plan is possible, but is considerably more challenging and may result in higher out-of-pocket costs.

Reason : Hospitalization Costs More Not Less

In many cases and with many plans, this is true.

In fact, a recent Kaiser Family Foundation study shows that half of all Medicare Advantage enrollees would incur higher costs than beneficiaries in traditional MedicareOriginal Medicare is private fee-for-service health insurance for people on Medicare. It has two parts. Part A is hospital coverage. Part B is medical coverage…. for a 5-day hospital stay. Thats shocking, but given the rising cost of hospitalization, its also understandable.

This fact also underscores the need to carefully scrutinize Medicare Advantage plans annually so you are not surprised by the bills. Ambulance, emergency room, diagnostic, hospitalization, and inpatient medication copays add up very fast.

IMPORTANT: If you are getting your Medicare benefits for the first time, and you have a chronic health condition that necessitates frequent care, pay careful attention to Medicare Advantage hospitalization costs. If you can get a Medicare supplement during your Medicare supplement guaranteed-issue rights period, your hospitalization costs over time will generally be lower.

Also Check: Does Medicare Cover The Cost Of Cataract Surgery