What Are Some Items That Medicare Part C Offers That Are Not Covered In Original Medicare

does not cover:

- Routine dental exams, most dental care or dentures.

- Routine eye exams, eyeglasses or contacts.

- Hearing aids or related exams or services.

- Most care while traveling outside the United States.

- Help with bathing, dressing, eating, etc. …

- Comfort items such as a hospital phone, TV or private room.

- Long-term care.

What Is Medicare Supplement Insurance

Medicare Supplement Insurance, aka Medigap, works alongside your Original Medicare. It helps cover the costs of certain services that Part A and Part B donât pay for â things like foreign travel and excess charges . It can also help cover the cost of your Part A deductible â which is $1,556 for 2022 â as well as the 20% coinsurance rates youâll be charged for Part B coverage.

Given these costs, âI would say itâs essential to have a Medigap plan to cover some of those copayments,â says Caitlin Donovan, a spokesperson for the Patient Advocacy Foundation.

Even so, a 2021 report from the Kaiser Family Foundation found that about 17% of those with Original Medicare â thatâs about 5.6 million people â donât have supplemental coverage.

Keep in mind that Medicare Supplement Insurance doesnât provide stand-alone coverage, so youâll need to be enrolled in Original Medicare first. Medigap also doesnât cover the cost of prescription medications. For that, youâll need a third plan â Medicare Part D.

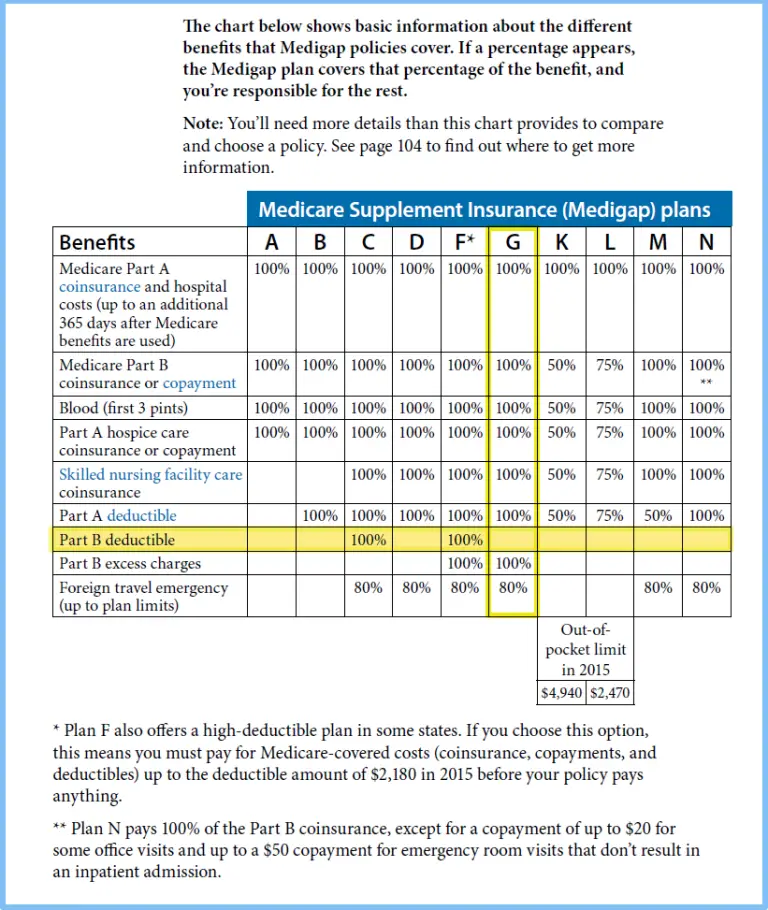

There are currently 10 different Medigap insurance plans: Plans A through D, F and G, and K through N â but Plans C and F are no longer available to people who joined Medicare after January 1, 2020.

Medigap insurance plans cover 100% of your Part A coinsurance costs , and most will cover 100% of your Part B coinsurance and copayment costs.

Overview Of Aarp By Unitedhealthcare Medicare Supplement Plans

AARP by UnitedHealthcare, like all Medicare Supplement insurance providers, can only offer certain standardized plans. Its main plan offerings are A, B, G, K, L and N, though it also offers plans C and F to some seniors. According to new Medicare regulations, plans C, F, and variants thereof can only be offered to those who were eligible for a Medigap policy prior to January 1, 2020. There are additional plans offered by other companies, including plans D and M, which AARP by United Healthcare has chosen not to provide.

The table below provides coverage details for all six of the standardized plans that AARP by UnitedHealthcare offers to those newly eligible for Medicare. All of these plans also include Part A hospital costs and coinsurance plus coverage for 365 days after Medicare benefits end.

| AARP by UnitedHealthcare Medicare Supplement Options |

|

Supplement |

|

$3,310 |

*Copays apply

The above six plans are all available in most locations, but there are a few exceptions. If you live in Massachusetts, Minnesota or Wisconsin, youll be offered a different variety of plans specific to your state. This is simply due to the fact that these states have decided to abide by different regulations. You can learn more about these plan styles by reading How to Compare Medigap Policies and following the included links to information on these states unique regulations.

Helpful Resources

Read Also: What Is Gap Coverage For Medicare

How Much Does Aarp Medicare Supplement Plan G Cost

AARP Medicare Supplement Plan G will vary in cost according to where you live. The chart below gives you an idea of how much AARP Plan G may cost in different areas of the country.

All rates listed below are for a 65-year-old non-smoking male. Plan premiums may be different in your area and can change from what is listed below. The premiums listed are from AARP and are subject to change.

| Location |

|---|

Why You Need Medicare Supplement Insurance

Medicare is a federal program to help older Americans and some disabled Americans pay for the high cost of health care. However, Medicare was never intended to cover all your health care costs. So even if youre covered by Medicare, you are still responsible for a large portion of your health care costs. Without Medicare Supplement insurance, your out-of-pocket costs could add up to more than $51,700 this year alone.

Recommended Reading: Can I Sign Up For Medicare Supplement Anytime

Unitedhealthcares Spending On Care

71.7% for member benefits

Medicare Supplement Insurance providers are required to report data on the premiums they collect and how much they spend to provide benefits for members.

Based on the most recent year of data, AARP/UnitedHealthcare Medicare Supplement Insurance plans spend about 71.7% of premiums on member benefits .

For comparison, the average for all providers is 72.3%. The minimum required by law for individual Medigap policies is 60% .

Aarp Medicare Supplement Plan C

One of the most exhaustive Medicare Supplement options, Plan C covers most out-of-pocket expenses. However, Plan C is being phased out. Those who became eligible for Medicare after January 1, 2020, will not be able to purchase this plan.

Plan C includes all of the benefits offered under Plan A. For those who are eligible, AARPs Plan C also covers:

- Coinsurance for care provided in a skilled nursing facility

- Your Medicare Part A deductible

- 100% of approved foreign travel emergency costs

Also Check: Are Hearing Aid Batteries Covered By Medicare

Moving Forward With Aarp Medicare Plans

AARP offers many options for Medicare health insurance. As you get close to entering Medicare, reach out to an independent professional to compare quotes on AARP Medicare plans. Find out which ones are available in your area, and also get help finding the one that best fits your needs.

- Was this Article Helpful ?

Medicare Costs And Medicare Supplement

Original Medicare doesn’t pay for everything. When you have a Medigap plan to work with Original Medicare it can help with some of the following costs that you would have to pay on your own:

- About 20% in out-of-pocket expenses not paid by Medicare Part B for doctor and outpatient medical expenses .

- Part A coinsurance, and most plans include a benefit for the Part A deductible

- Hospital coverage up to an additional 365 days after Medicare benefits are used up.

- Part A hospice/respite care coinsurance or copayment.

You May Like: Why Choose Medigap Over Medicare Advantage

What Unique Features Do Aarp Medigap Plans Have

Even though the major medical benefits of AARP plans will be the same as those offered by other insurance companies, AARP Medigap plans offer access to additional programs, adding significant value. AARP Medigap subscribers also get:

- Vision: Discounted eye exams, glasses and contacts .

- Dental: Discounted rate of 30%-40% on select services through Dentegra.

- Hearing: Discounted screenings and hearing aids .

- 24/7 nurse line: Ability to call a registered nurse with questions about your health, medication costs and more.

- Fitness: Free gym membership where available . AARP insurance stopped offering SilverSneakers in 2019.

- Mental sharpness: Brain health games and activities .

- Driver safety: Safe driving course, which could help you reduce your car insurance rates.

Which Is Better Medicare Advantage Or Medicare Supplement

Medicare does not offer a one-size-fits-all plan. So, the best policy for you is the policy that best meets your healthcare needs.

Medicare Supplement plans are the best option if you want complete reassurance and predictability with your healthcare but are comfortable paying higher premiums in exchange for lower out-of-pocket costs.

In contrast, Medicare Advantage plans are the best option if you hope to save on monthly premiums and receive additional benefits while accepting responsibility for additional out-of-pocket costs at the doctors office.

For overall ease and reliability, our recommendation is always Medicare Supplement plans. However, we know that may not work for everyone. Our goal is to provide you with your best options regardless of plan type.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

- Was this article helpful ?

Recommended Reading: Does Medicare Cover Dry Needling

How Do Medicare Supplement Insurance Plans Work With Original Medicare

Medicare Supplement plans work alongside your Original Medicare coverage to help cover some of the costs you would otherwise have to pay on your own. These plans, also known as “Medigap”, are standardized plans. Each plan has a letter assigned to it, and offers the same basic benefits. The basic benefit structure for each plan is the same, no matter which insurance company is selling it to you. Note: The letters assigned to Medicare Supplement plans are not the same things as the parts of Medicare. For example, Medicare Supplement Plan A is not the same as Medicare Part A .

What Type Of Coverage Can You Get

The benefits of Medicare Supplement plans are standardized across all companies. This means a Plan G from AARP will offer the same health care benefits as a Plan G from another company. This standardization makes it easy to compare plans, and the Medigap coverage chart from Medicare.gov can help you select the right plan for your needs.

You can sign up for a Medigap policy when you first become eligible for Medicare or during open enrollment. AARP/UnitedHealthcare offers all available Medigap plan letters. However, available plans may vary by location and Medicare qualification date.

- What it covers: All Medigap plans cover some portion of out-of-pocket costs for Medicare Part A and Medicare Part B .

- What it doesnt cover: A supplemental plan will not cover prescription drugs. For that, youll need a separate Medicare Part D plan, and AARP/UnitedHealthcare ranks as the easiest-to-use Medicare Part D provider.

Also Check: How Much Are Premiums For Medicare

Medicare Advantage Vs Medicare Supplement Plans

Home / FAQs / Medigap Plans / Medicare Advantage vs. Medicare Supplement Plans

If you are new to Medicare or are looking to make a change in your plans, you may wonder which plan is right for you. When deciding which plan to enroll in, your first step should be to decide between a Medicare Advantage plan and a Medicare Supplement plan. Understanding which plan type is right for you is essential when enrolling in coverage.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

There are many differences between Medicare Advantage vs. Medicare Supplement plans. So, it is crucial to research and thoroughly understand how each plan type works before deciding. You are not alone in your research, and we are here to help.

What Is The Biggest Disadvantage Of Medicare Advantage

Medicare Advantage can become expensive if you’re sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient’s choice. It’s not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Recommended Reading: How Many Chiropractic Visits Does Medicare Allow

What Is Aarp Medicare Supplement Insurance

AARP Medicare Supplement plans are insured and sold by private insurance companies like UnitedHealthcare to help limit the out-of-pocket costs associated with Medicare Parts A and B. Supplement plans can help pay for some or all of the costs not covered by Original Medicare things like coinsurance and deductibles. They are available to retirees age 65 and older who are enrolled in both Original Medicare Parts A and B. Supplement plans are not available in conjunction with Medicare Advantage plans.

How Do Aarp Medicare Supplement Plans Work

When you buy an AARP Medicare Supplement Insurance plan, youre actually getting a policy from UnitedHealthcare. As part of the business agreement, AARP endorses and does marketing for select UnitedHealthcare plans, and in turn, AARP gets an estimated 4.95% fee for each plan sold.

Medigap policies give you additional benefits on top of Original Medicare . These supplemental plans can reduce your out-of-pocket expenses by covering deductibles, coinsurance or other medical expenses. The level of coverage will depend on the plan you select.

For example, if the cost of a doctor’s visit is $200, Medicare Part B could pay $100 of the bill. Then through a crossover billing practice, your AARP Medigap plan could pay an additional $75 of the bill. Then, you’ll be responsible for any remaining cost, only paying $25 for the $200 doctor’s visit.

Also Check: Who Gets Medicare Part D

Can I Buy Medigap And Medicare Advantage At The Same Time

No. If you have a Medicare Advantage plan, you arenât allowed to enroll in a Medigap insurance plan unless youâre also switching your Medicare Advantage plan back to Original Medicare. If you want to enroll in Original Medicare and buy a Medigap policy, youâll need to contact your Medicare Advantage plan and ask if you can disenroll from it. You may be able to do so only during certain times of the year, known as âenrollment periods.â

What Do Aarp Medicare Advantage Plans From Unitedhealthcare Offer

Many Medicare Advantage plans offer benefits not usually available through Original Medicare, and American Association of Retired Persons Medicare Advantage Plans from UnitedHealthcare are designed to help you make the most of your healthcare spending. While AARP Medicare Advantage Plans from UnitedHealthcare vary by service area, many of them offer both medical and non-medical benefits that help seniors save. Read on for important details about these plans.

Read Also: Does Medicare Ever Call You On The Phone

Customer Reviews Of Aarp By Unitedhealthcare Medicare Supplement Plans

AARP by UnitedHealthcare Medicare Supplement insurance, as its name implies, is offered through the combined efforts of two groups. However, UnitedHealthcare is by far more directly involved in the actual operation of these plans than AARP is. Considering this, it makes the most sense to look at reviews of UnitedHealthcare rather than reviews of AARP when trying to determine the quality of these plans.

Reviews of UnitedHealthcare are plentiful online. Across a variety of websites, including the Better Business Bureau , Google Reviews, and Trustpilot, the company has an average rating of 2.6 out of 5 stars. Most reviews do not directly comment on the Medicare Supplement plans that UnitedHealthcare offers, but they do speak to the quality of the services provided by the company as a whole.

Aarp Medicare Supplement Plans In 2020

AARP offers the following eight Medicare Supplement plans, each of which are insured by UnitedHealthcare:

*Plan C and Plan F are available only to applicants who were first eligible for Medicare prior to 2020.

As mentioned before, each plan offers a different set of benefits. Youll want to review each of these options to find the plan that works best for you.

Read Also: Can You Decline Medicare Coverage

What Is Aarp Medicare Supplement Plan F

Medicare Supplement Plan F has the highest enrollment and very strong coverage, but it’s only available to those who were eligible for Medicare before 2020. If you qualify, you can sign up for Plan F during the annual open enrollment period. If you don’t qualify, we recommend Plan G for the best overall coverage.

An Overview Of Aarp Medicare Supplement Plans

Erika Rasure, is the Founder of Crypto Goddess, the first learning community curated for women to learn how to invest their moneyand themselvesin crypto, blockchain, and the future of finance and digital assets. She is a financial therapist and is globally-recognized as a leading personal finance and cryptocurrency subject matter expert and educator.

Getty Images/Hero Images

AARP Medicare supplement plans are offered through UnitedHealthcare Insurance. Eligible people use these plans to supplement their Medicare plan if they think that their plan may not provide all the health coverage they need. AARP has offered health plans for its group members for more than 50 years.

You May Like: What Is The Medicare G Plan

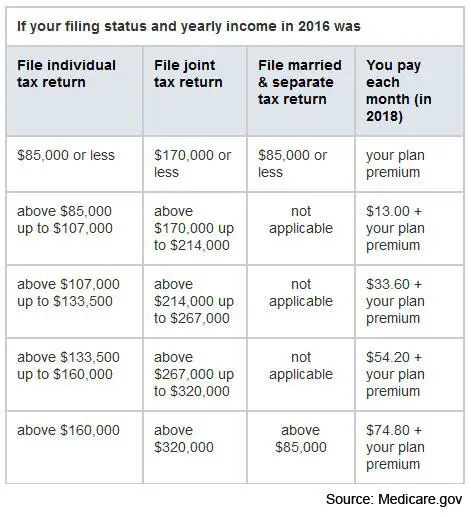

The Cost Of Aarp By Unitedhealthcare Medicare Supplement Plans

Medicare Supplement plans from AARP by UnitedHealthcare have monthly premiums between roughly $60-$300. Plan K, L, and N will typically be the least expensive plans if offered in your area, and plans C and F will be the most expensive.

Your location has a huge impact on your costs, with variations of $100 or more for the same plan in different locations. Large metropolitan areas typically have the highest premiums. Select plans tend to cost about $10 less per month than their regular counterparts, though their coverage is more limited.

One important thing to understand about Medicare Supplement costs is that they can change over time in different ways depending on their pricing models. If your policy has attained age pricing, your premiums increase regularly with your age. Issue age pricing means that your premium cost is based on your age when you first get the policy but does not rise later based on your age. With community pricing, your premium cost is not affected by your age whatsoever.

Attained age pricing is very popular among many companies, but AARP by UnitedHealthcare often chooses to offer community pricing or issue age pricing instead. Which pricing style you get will vary by state. Note that in all of these pricing styles, rates can and will still rise over the years for other reasons, such as in response to inflation.

When Can I Enroll In A Medigap Plan

A person can enroll in an AARP Medigap plan during their initial Medigap open enrollment period. It starts the month a person turns 65 and is enrolled in Medicare Part B.

Insurance companies use a process called medical underwriting to decide if they will accept an application for Medigap and to determine the cost. During open enrollment, a person with health issues can enroll in any Medigap policy in their state for the same price as someone in good health.

After the open enrollment period, an individual may not be able to join a Medigap plan, or it may cost more. In addition, a person with a Medicare Advantage plan cannot also have a Medigap plan.

The premiums for AARP Medigap plans vary depending on a personâs location, and on the method a company uses to set prices. The three systems include:

- community rated, where everyone who has the policy pays the same premium, regardless of their age

- issue-age rated, where the premium is based on a personâs age when they first get a policy, but does not increase because of age

- attained-age rated, where the premium is age-related and may increase as a person gets older

As an example, the chart below shows estimated prices for a 65-year-old female, non-smoker, in Pensacola, Florida.

| Plan |

|---|

Don’t Miss: Do You Have To Pay Medicare Part B