If You Are Age 65 Or Older

Federal law prohibits insurance companies from refusing to sell you a Medigap policy, or from charging you higher premiums based on your current health status or preexisting medical conditions, provided that you buy it within certain specified time frames:

Outside of these periods, you may still be able to buy a Medigap policy, but in most areas insurance companies would take your current and past medical conditions into account when determining the premium a practice known as medical underwriting making it much more expensive.

However, your state may provide greater protections under its own law. For example, a few states allow you to buy a Medigap policy, or switch to another, with no medical underwriting at any time or to do so every year during your birthday month. To find out requirements and protections in your own state, contact its department of insurance.

Even within periods of guaranteed issue, insurance companies may exclude coverage for preexisting medical conditions for up to six months after the policy takes effect. However, they cannot make you wait in this way if youve had continuous creditable coverage for at least six months before buying the Medigap policy. Creditable coverage includes health insurance from a current or former employer, a government program such as Medicaid or the Department of Veterans Affairs health system, or private insurance you have bought yourself.

How To Cancel Medicare Part B

The Part B cancellation process begins with downloading and printing Form CMS 1763, but dont fill it out yet. Youll need to complete the form during an interview with a representative of the Social Security Administration by phone or in person.

Due to the COVID-19 pandemic, all Social Security Administration offices are currently closed. The SSA is still answering phone calls, and you can access many services on its website. See the latest COVID-19 updates.

You can schedule an in-person or over-the-phone interview by contacting the SSA. If you prefer an in-person interview, use the Social Security Office Locator to find your nearest location. During your interview, fill out Form CMS 1763 as directed by the representative. If youve already received your Medicare card, youll need to return it during your in-person interview or mail it back after your phone interview.

What happens next depends on why youre canceling your Part B coverage.

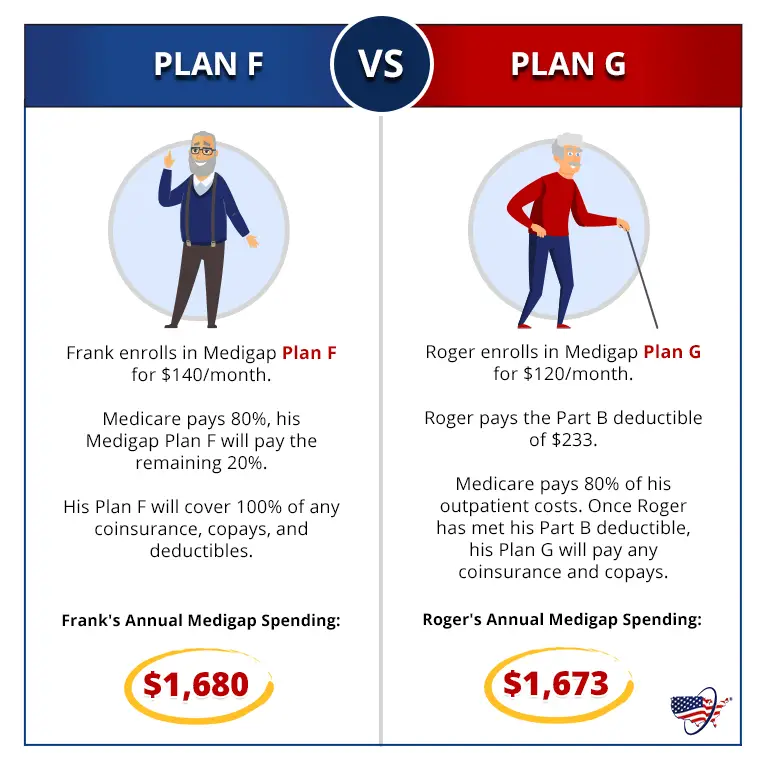

Medigap Plan C And Plan F Changed In 2020

A slight but important change was made to the selection of standardized Medigap plans available in most states.

Plan C and Plan F are no longer available to new Medicare beneficiaries who became eligible for Medicare after January 1, 2020.

If you were already eligible for Medicare before January 1, 2020, you may still purchase Plan C or Plan F in 2020 and beyond if either plan is available where you live.

But anyone who became eligible for Medicare after January 1, 2020, will not be allowed to enroll in either of those two plans.

Anyone currently enrolled in Plan C or Plan F will be allowed to keep their plan going forward.

This 2020 Medigap plans change came as a result of federal legislation that prohibits full coverage for the Medicare Part B deductible. Plan C and Plan F are the only standardized Medigap plans that provide this benefit.

Don’t Miss: What Medicare Premiums Are Deducted From Social Security

When Is The Medicare Supplement Open Enrollment Period

Unlike most other Medicare coverage, theres not a set time of the year for Medicare Supplement Insurance open enrollment. Each Medicare beneficiary has their own Medigap open enrollment period.

Your Medigap open enrollment period starts the first month you have Medicare Part B and are 65 or older, and it lasts for six months. After the period ends, it never happens again .

During your six-month Medigap open enrollment period, companies cant factor your health or medical history into pricing or coverage decisions

Outside of your Medigap open enrollment period, insurance companies can charge you higher premiums or outright refuse to sell you a new plan due to your health or your medical history. As a result, switching plans after you first sign up can be difficult and expensive.

» MORE:Best Medicare Supplement Insurance companies

Medicare Initial Enrollment Period

The earliest time you can enroll in Original Medicare, a Medicare Advantage plan or a Medicare Part D prescription drug plan is during your Medicare Initial Enrollment Period .

Your Initial Enrollment period lasts for seven months:

- It begins three months before you turn 65

- It includes your birth month

- It extends for another three months after your birth month

If you are under 65 and qualify for Medicare due to disability, the 7-month period is based around your 25th month of disability benefits.

Don’t Miss: How To Qualify For Medicare In Ga

What Is The Medicare Supplement Free Look Period

When you switch Medigap policies, you enter a 30-day free look period

When you apply for a new Medigap policy, youll have to promise to cancel your existing policy as part of the application. To take advantage of the free look period, dont cancel it right away. Wait until youre sure you want to keep the new policy, as long as you decide within 30 days.

During the free look period, you need to pay the premiums for both policies.

What Happens If You Need To Change Plans During A Period You Cannot Change Plans

The only way to change Medicare Advantage Plans outside of the standard annual enrollment periods is by qualifying for a Special Enrollment Period. include, but are not limited to:

- Moving outside of your current plans service area.

- Moving to a new address within your current plans service area but which has new plan options.

- Moving into or out of a skilled nursing facility or long-term hospital care.

- You are eligible for both Medicare and Medicaid.

- Becoming ineligible for Medicaid.

- If Medicare takes an official action because of a problem with your current plan that affects you.

- If Medicare terminates or does not renew your current plans contract.

- You joined a plan or chose not to join a plan due to an error by a federal employee.

You generally have 2 months to make a change to your Medicare Advantage Plan during a SEP.

For a complete list of special circumstances that qualify you for a SEP, click here: Special circumstances .

You May Like: What Type Of Insurance Is Medicare Part D

What Is A Free Look Period

If you switch from one Medicare Supplement plan to another, you get 30 days to determine if you like the plan and want to keep it. Sometimes called the free look period, it starts when you get your new plan. If you decide you don’t like it, you can switch back to your old plan without penalty.

Keep in mind that during this time, you’ll have to pay the premiums for both your new plan and your old plan for 1 month.

When Is The Best Time To Buy Medigap

The best time to buy Medigap is when you are first eligible.

Everyone gets a six-month window after enrolling in Medicare Part B, during which they can apply for a Medicare Supplement, or Medigap, policy.

During this time, the medical underwriting process is waived. Medical underwriting allows private insurance companies to ask you questions about your health.

If youre in poor health or have preexisting conditions, an insurer can deny you coverage or force you to pay higher premiums for a policy.

Those rules dont apply when youre first eligible for a Medicare Supplement plan. During your Medigap open enrollment period, you can buy any policy for the same price as people in good health.

This six-month period cant be changed or repeated.

Medicare supplement plans help pay costs not covered by Original Medicare. This can include deductibles, copayments and coinsurance.

When You Can Buy Medigap Without Medical Underwriting

There are two other situations when you can buy a Medigap policy without undergoing medical underwriting.

Don’t Miss: What Are The Different Parts Of Medicare Plans

Medicare Advantage Where You Live

Medicare Advantage plans can be administered on state and local levels.

- Some types of plans may be available in certain regions of a state but not in others.

- Some plans may come with certain premiums and other costs in one part of a state while the same plan features different costs in another county.

- Some health insurance companies and Medicare Advantage plan providers may offer plans in one part of a state but not in others.

Explore Medicare Supplement Plans

Ideal for customers looking for extensive coverage, and a lower premium.

Medicare Supplement Plan N

Lower monthly premium, and predictable out-of-pocket costs.

Medicare Supplement Plan A

A little extra cost protection, beyond what Original Medicare covers.

Medicare Supplement Plan F

Extensive coverage and the lowest out-of-pocket costs.3

Medicare Supplement High Deductible Plan F

Same coverage as Plan F, but you pay the calendar year deductible.3

Medicare Supplement Plans Available to Minnesota Residents

Compare Medicare Supplement Plans

View state disclosures, exclusions, and limitations

1 Insured by Cigna Health and Life Insurance Company, American Retirement Life Insurance Company, Loyal American Life Insurance Company or Cigna National Health Insurance Company. In Kansas, insured by Cigna National Life Insurance Company, Cigna Health and Life Insurance Company and Loyal American Life Insurance Company. American Retirement Life Insurance Company is not available to residents of Kansas. In Pennsylvania, Maryland North Carolina and Utah, insured by Cigna National Health Insurance Company domiciled in Ohio. In New Mexico, Idaho and Ohio, insured by Cigna Health and Life Insurance Company.

2 Plans may be subject to medical underwriting, and coverage may be denied.

3 Plans only available if you first become eligible for Medicare before January 1, 2020 . Or you have qualified for Medicare due to disability before January 1, 2020.

Tennessee Medicare Supplement Policy Forms

Read Also: Can You Get Medicare Early

Do I Need Medicare Part B

We always advise our clients to contact their employer or union benefits administrator before delaying Part A and Part B to learn more about how their insurance works with Medicare. Employer coverage may require that you enroll in both Part A and Part B to receive full coverage.

Common reasons beneficiaries delay Part B include:

Sign Up: Within 8 Months After You Or Your Spouse Stopped Working

Your current coverage might not pay for health services if you dont have both Part A and Part B .

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Read Also: Do You Have To Get Medicare At 65

What If I Miss My Medicare Supplement Open Enrollment Period

Dont worry if you happen to miss your Medigap Open Enrollment Period and face denial of coverage. You still have options.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

If you have a serious health condition that causes a Medigap carrier to deny you, you should be able to enroll in a Medicare Advantage plan. However, youll need to wait until the Annual Enrollment Period to sign up for one of these plans.

Once on a Medicare Advantage plan, youll need to stay within the plans network of doctors. However, you may be able to keep the same doctor if you switch to a Medicare Advantage PPO plan.

Medicare Supplement Open Enrollment Period

Home / FAQs / Medicare Enrollment / Medicare Supplement Open Enrollment Period

The Medicare Supplement Open Enrollment Period is unique to each Medicare beneficiary. This enrollment period allows you to enroll in any Medigap plan without answering health questions. For most beneficiaries, this enrollment period happens once in a lifetime. Thus, it is the best time to sign up for a Medicare Supplement plan.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Although you can still sign up for a Medigap plan at any time of the year, your Medicare Supplement Open Enrollment Period prohibits carriers from denying you coverage because of pre-existing health conditions.

You May Like: Does Medicare Cover Cataract Surgery And Lenses

Switch To Medigap After Trying Medicare Advantage

If you had Medicare Advantage first

If you joined Medicare Advantage or PACE when you turned 65 and first became eligible for Medicare Part A, and then you decide to switch to Original Medicare within the first year, you can buy any Medigap policy offered by any insurer in your state.

If you had Medigap first

If you had a Medigap policy, dropped it to join a Medicare Advantage plan or try a Medicare Select policy, and then decide you want to switch back within the first year, heres what you have the right to buy:

|

Is the same Medigap policy you had before still available from that insurer? |

|

|---|---|

|

You can buy the same policy from that insurer. |

|

|

You can buy Medigap Plans A, B, D, G, K or L, plus Plan C or Plan F if you qualify, from any insurer in your state. |

When Can I Switch Medigap Policies

You may purchase a Medigap policy only to realize it doesnt provide the coverage or benefits you need.

If you want to switch to a different supplement plan, it may be easiest do so within your six-month open enrollment period.

If you join a Medigap plan during this six-month window and decide you dont like the policy, you can switch to a different supplement plan and retain your guaranteed issue rights.

If your six-month period has already ended and you want to make a switch, you may face medical underwriting restrictions. Your premiums may be higher if you have health problems or your application could be denied outright.

But dont let these obstacles deter you, as many people change plans during the year and go through the underwriting process successfully.

If youre in good health and comfortable answering medical questions, you can apply to change Medigap plans at any time of the year.

Medicare Advantage plans and Medicare Part D prescription drug plans can only be changed during certain times of year, but Medicare supplements are different.

Medigap plans are standardized under federal law so consumers can easily compare benefits and premiums across plans.

There are 10 Medicare Supplement plans to choose from. Each has a specific letter, such as Plan F and Plan A. You pay the insurer a monthly premium for the policy.

Connect With a Medigap Professional

Many states provide additional Medigap rights and protections.

States with Expanded Guaranteed Issue Rights

Read Also: Can You Get Medicare At Age 60

Penalty Fees For Late Enrollment

Medicare charges penalty fees for those who do not enroll in their Initial Enrollment Period, or they do not qualify for an exception due to employer insurance or other coverage.

Unless a person qualifies for a special exception, they will pay a monthly premium that is 10% higher for every 12-month period they were eligible for Medicare but did not sign up.

A person can qualify for a Medicare plan before 65 years of age if they meet certain criteria:

- They have end stage renal disease and need dialysis or are on the kidney transplant list.

- They have amyotrophic lateral sclerosis .

- Their doctor confirms that they have a disability.

An estimated 6.2 million people qualify for Medicare because they are disabled, according to the Medicaid and CHIP Payment and Access Commission. However, significantly fewer people use these benefits.

A doctor may declare a disability for people due to several types of medical conditions, including:

- Intellectual or developmental disabilities: These might include Down syndrome, cerebral palsy, or autism.

- Physical conditions: Traumatic brain injury, severe back injuries, or quadriplegia qualify as disabilities.

- Severe behavioral or psychological disorders: People with bipolar disorder or schizophrenia can qualify for Medicare early.

A doctor must submit paperwork to Medicare, declaring that a person has a disability. The individual may have a waiting period before they qualify for full Medicare benefits.

Do Some People Get A Second Open Enrollment Period For Medigap

There are very few situations where a beneficiary will get a second Medigap Open Enrollment Period. Below is a list of a few.

- If you retire, enroll in Medicare Part B, then go back to work and join your employers group health care coverage, youll get a second Medicare Supplement Open Enrollment Period when you retire again and enroll back into Medicare Part B.

- If you get Medicare due to a disability when youre under 65, youll get two Medigap Open Enrollment Periods. The first will start with your Original Medicare Part B effective date before you turn 65. The second will begin when you turn 65.

One reason a beneficiary on Medicare due to disability would choose not to enroll during their first Medigap Open Enrollment Period is due to the minimal Medigap plan options available to them. Only certain states require Medicare Supplement carriers to offer Medigap plans to people under 65.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

In fact, most states only offer Plan A to those under 65. Because of this, someone qualifying due to disability may not have many options when first eligible. Allowing for a second Medicare Supplement Open Enrollment Period gives these beneficiaries access to all plans in their area.

Also Check: What Is A Medicare Claim Number