When Are Medicare Premiums Due

All Medicare bills are due on the 25th of the month. In most cases, your premium is due the same month that you get the bill. Example of billing timeline

For your payment to be on time, we must get your payment by the due date on your bill. Submit your payment at least 5 business days before the due date, so we can get it on time.

C: Medicare Advantage Plans

| Learn how and when to remove this template message) |

With the passage of the Balanced Budget Act of 1997, Medicare beneficiaries were formally given the option to receive their Original Medicare benefits through capitated health insurance Part C health plans, instead of through the Original fee for service Medicare payment system. Many had previously had that option via a series of demonstration projects that dated back to the early 1970s. These Part C plans were initially known in 1997 as “Medicare+Choice”. As of the Medicare Modernization Act of 2003, most “Medicare+Choice” plans were re-branded as “Medicare Advantage” plans . Other plan types, such as 1876 Cost plans, are also available in limited areas of the country. Cost plans are not Medicare Advantage plans and are not capitated. Instead, beneficiaries keep their Original Medicare benefits while their sponsor administers their Part A and Part B benefits. The sponsor of a Part C plan could be an integrated health delivery system or spin-out, a union, a religious organization, an insurance company or other type of organization.

The intention of both the 1997 and 2003 law was that the differences between fee for service and capitated fee beneficiaries would reach parity over time and that has mostly been achieved, given that it can never literally be achieved without a major reform of Medicare because the Part C capitated fee in one year is based on the fee for service spending the previous year.

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to sign up for Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564:

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on their behalf and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

Also Check: Will Medicare Pay For Handicap Bathroom

Medicare Part B Deductibles And Coinsurance

Medicare Part B comes with an annual deductible: $233 in 2022

After you meet the deductible for the year, you typically pay 20% of the Medicare-approved amount for doctor services and other Medicare benefits. Medicare Part B pays the other 80%. This assumes your doctor or other provider accepts Medicare assignment. In other words, your provider will accept the amount Medicare agrees to pay for the treatment or service. Some providers who charge more than the Medicare-assigned amount may bill patients for the difference. Always check with a new physician or other health care provider that they accept the amount Medicare pays.

Many Original Medicare enrollees purchase Medicare Supplement Insurance, also called Medigap, to help pay the out-of-pocket costs associated with Medicare Part B.

B Late Enrollment Penalty

The last factor that determines your Part B premium amount is when you sign up. If you enroll as soon as youre eligibleSome health plans require you to meet minimum requirements before you can enroll. for Part B, your monthly premium will follow the formulas above.

If you sign up later, you may pay a 10% penalty for each 12-month period you missed. If you enroll at 67 , your monthly premium payment will be 20% higher than the table above.

Don’t Miss: How To Get An Electric Scooter Through Medicare

Medicare Part B Special Circumstances

Some people dont need Medicare Part B coverage right away, because they have medical insurance through their employers or meet other special conditions. And some people choose not to enroll in Medicare Part B, because they dont want to pay for medical coverage they feel they dont need. There are a variety of reasons why you might hesitate to pay for medical insurance. Likewise, you may be concerned about how the new healthcare laws affect Medicare Part B coverage. In this section, well discuss a few reasons to hold off on Medicare Part B, as well as how Obamacare affects Medicare Part B coverage.

For starters, people who are still working when they qualify for Medicare may not need to get Part B coverage right away. If you have insurance through your employer, then you most likely already have medical coverage. However, you should still meet with your plan administrator to find out how your current insurance works with Medicare, because some policies change once youre eligible for Medicare. Other special situations include the following:

Once you stop working or lose your work-based coverage, you have an eight-month period to enroll in Medicare Part B. If you dont enroll during this time, you may have to pay the late enrollment penalty every month that you have Part B coverage sometimes indefinitely. Also, you may face a serious coverage gap if you wait to enroll.

What Is Medicare Part A Hospital Insurance

Medicare Part A covers the following services:

- Inpatient hospital care: This is care received after you are formally admitted into a hospital by a physician. You are covered for up to 90 days each benefit period in a general hospital, plus 60 lifetime reserve days. Medicare also covers up to 190 lifetime days in a Medicare-certified psychiatric hospital.

- Skilled nursing facility care: Medicare covers room, board, and a range of services provided in a SNF, including administration of medications, tube feedings, and wound care. You are covered for up to 100 days each benefit period if you qualify for coverage. To qualify, you must have spent at least three consecutive days as a hospital inpatient within 30 days of admission to the SNF, and need skilled nursing or therapy services.

- Home health care: Medicare covers services in your home if you are homebound and need skilled care. You are covered for up to 100 days of daily care or an unlimited amount of intermittent care. To qualify for Part A coverage, you must have spent at least three consecutive days as a hospital inpatient within 14 days of receiving home health care.

- Hospice care: This is care you may elect to receive if a provider determines you are terminally ill. You are covered for as long as your provider certifies you need care.

Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

Read Also: How Old To Be To Get Medicare

Rules For Medicare Advantage Plans

Medicare pays a fixed amount for your care each month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare.

Each Medicare Advantage Plan can charge different

. They can also have different rules for how you get services, like:

- Whether you need areferralto see a specialist

- If you have to go to doctors, facilities, or suppliers that belong to the plan for non-emergency or non-urgent care

These rules can change each year.

What Does Medicare Part B Cover

Part B provides coverage for a mixture of outpatient medical services. This includes coverage for preventive vaccines, cancer screenings, annual lab work, and much more.

It will cover preventive services in addition to specialist services. Part B even covers services for mental healthcare, durable medical equipment that your doctor finds medically necessary.

Also, Part B will cover some services you receive while in the hospital. This includes surgeries, diagnostic imaging, chemotherapy, and dialysis if you obtain drugs while at the hospital, it will also provide coverage for those.

You May Like: Does Medicare Pay For Cancer Drugs

How Much Does Medicare Cost If You Have Never Worked

If you never worked, then your Part A premium for 2021 will be $471. But if you spent at least 30 to 39 quarters in the workforce and paid Medicare taxes, your premium could be reduced to $259. Medicare Part B, which covers outpatient care, comes with a monthly premium that is not affected by your work history.

Dont Miss: Will Medicare Pay For A Bedside Commode

How Much Does It Cost

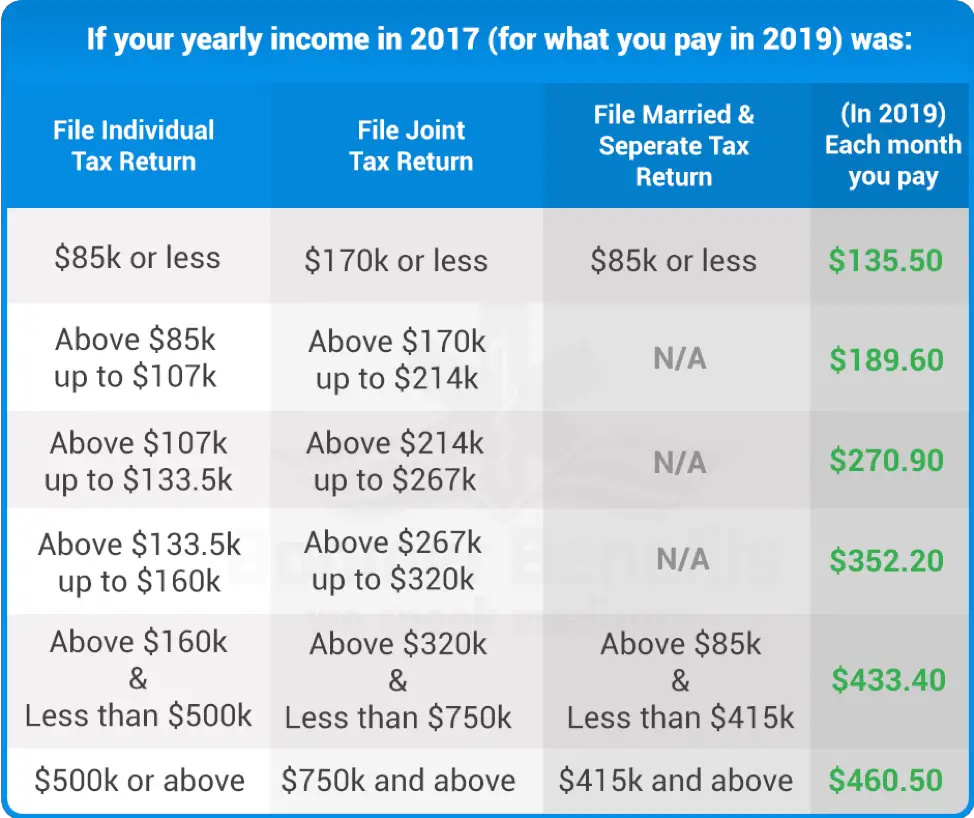

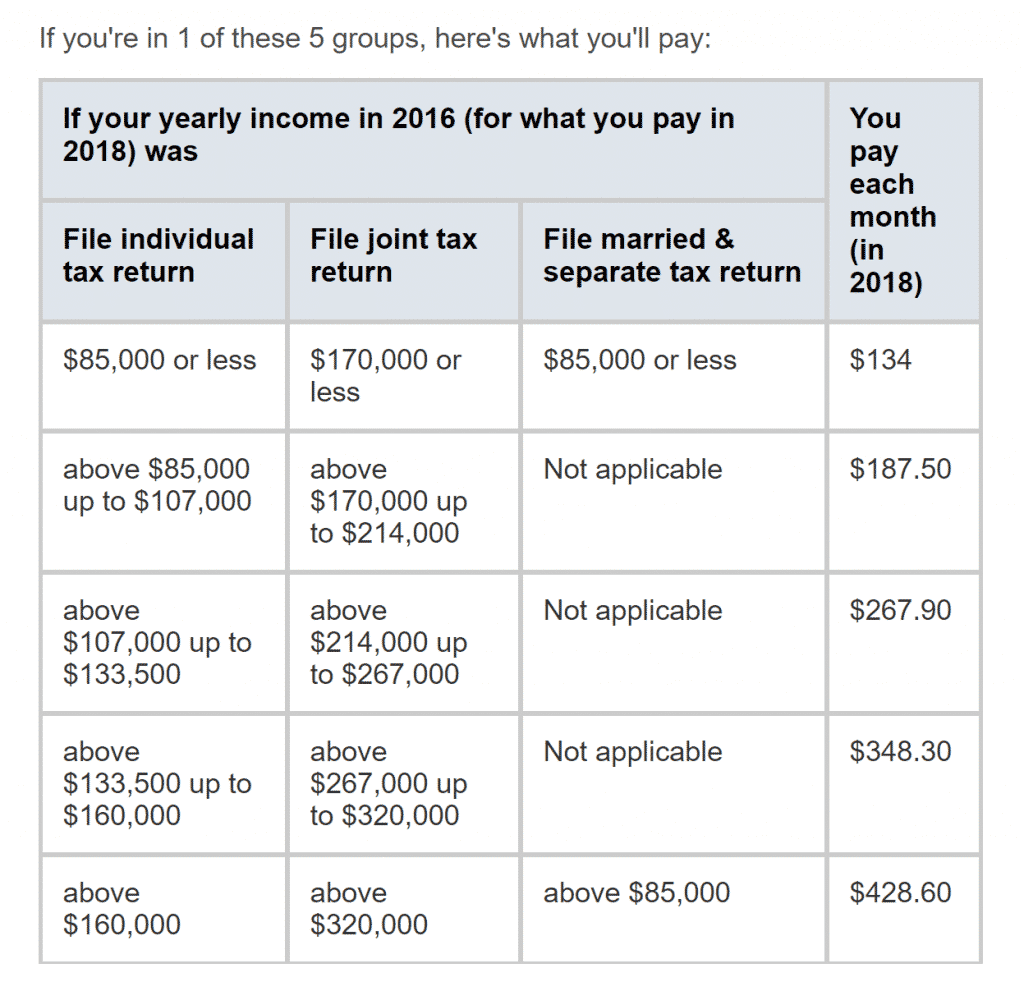

The standard premium amount for Medicare Part B is $144.60. You may pay a higher premium amount if your income is higher than $85,000 as an individual and $170,000 as a couple. Your premium may also be different if youre enrolling in Medicare Part B for the first time, you do not get Social Security benefits, or you are billed directly for your premium.

Dont Miss: How Do I Qualify For Medicare Low Income Subsidy

Don’t Miss: Does Medicare Cover Rotator Cuff Surgery

Medicare Part D Donut Hole Coverage Gap Costs

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a donut hole or coverage gap, which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.

As of 2020, Part D beneficiaries pay 25 percent of the cost of brand name and generic drugs during the coverage gap until reaching catastrophic coverage spending limit.

Do You Need Medicare Part D

Most people will need Medicare Part D prescription drug coverage. Even if you’re fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

Read Also: What Does Part B Cover Under Medicare

Proposals For Reforming Medicare

As legislators continue to seek new ways to control the cost of Medicare, a number of new proposals to reform Medicare have been introduced in recent years.

Premium support

Since the mid-1990s, there have been a number of proposals to change Medicare from a publicly run social insurance program with a defined benefit, for which there is no limit to the government’s expenses, into a publicly run health plan program that offers “premium support” for enrollees. The basic concept behind the proposals is that the government would make a defined contribution, that is a premium support, to the health plan of a Medicare enrollee’s choice. Sponsors would compete to provide Medicare benefits and this competition would set the level of fixed contribution. Additionally, enrollees would be able to purchase greater coverage by paying more in addition to the fixed government contribution. Conversely, enrollees could choose lower cost coverage and keep the difference between their coverage costs and the fixed government contribution. The goal of premium Medicare plans is for greater cost-effectiveness if such a proposal worked as planned, the financial incentive would be greatest for Medicare plans that offer the best care at the lowest cost.

Currently, public Part C Medicare health plans avoid this issue with an indexed risk formula that provides lower per capita payments to sponsors for relatively healthy plan members and higher per capita payments for less healthy members.

- Senate

How Much Does Original Medicare Part A Cost

What it helps cover:

- Home healthcare

What it costs:

Most people generally don’t pay a monthly premium for because they paid Medicare taxes while they were working. However, there are costs you may have to cover.

Other Part A costs for 2022:

- An annual deductible of $1,556 for in-patient hospital stays.

- $389 per day coinsurance payment for in-patient hospital stays for days 61 to 90.

- After day 91 there is a $778 daily coinsurance payment for each lifetime reserve day used.

- After the maximum 60 lifetime reserve days are exhausted, there is no more coverage under Part A for inpatient hospital stays.

Recommended Reading: Does Medicare Pay For Urgent Care

Costs: Part B And Part C

Original Medicare and Advantage plans have different costs.

Part B

In 2021, an individual with Part B must pay a standard monthly premium of $148.50 and the yearly deductible of $203. They must also pay 20% of the cost of Medicare-approved services after they have met the deductible.

A person with Plan B also has Plan A, but most people with original Medicare do not pay a Part A monthly premium. However, a $1,484 deductible is payable for Part A hospital inpatient services for each benefit period, together with coinsurance that varies from $0 to $742.

As Part A and Part B do not cover most medications, an individual may wish to purchase Part D, which is prescription drug coverage.

Part C

Every year, each Medicare plan sets out the amount it will charge for premiums, deductibles, and services. The amount varies among plans, and some plans offer zero premiums.

Also, because a person must have enrolled in Medicare Part A and Part B to qualify for Medicare Advantage, they must pay the Part B monthly premium. Some plans may pay the premium, either in part or in full.

Deductibles and other out-of-pocket costs vary among plans. However, Advantage plans have a maximum out-of-pocket spending limit, which the government sets. After a person reaches their plans annual cap, the plan generally pays their covered healthcare expenses.

Medicare Advantage Special Needs Plans May Have Lower Costs

A Medicare Special Needs Plan is a type of Medicare Advantage plan that is designed specifically for someone with a particular disease or financial circumstance.

Many Medicare SNPs cover most of the qualified health care costs for beneficiaries. All SNPs must include prescription drug coverage.

Some Medicare SNPs are designed for people who are dual-eligible, meaning they are eligible for both Medicare and Medicaid. These plans are commonly called Dual-Eligible Special Needs Plans .

Medicare Advantage Special Needs Plans can also cater more specifically to the needs of people with specific medical conditions, such as:

- Dependence issues with alcohol or other substances

- Autoimmune disorders

- Chronic lung disorders

Some SNPs can also be available to people who live in a long-term care facility such as a nursing home.

Don’t Miss: Does Medicare Cover Family Counseling

What If I Can’t Afford Part B

If youre at least 65 and cant afford your Medicare Part B premium or deductible, there may be help. Medicare Savings ProgramsMedicare Savings Programs help those with low incomes pay premiums and sometimes coinsurance for Medicare expenses. are designed for low-income individuals who have trouble affording healthcare. To help you get started, here are the four types of MSPs, and their most-recent eligibility requirements from 2021:

- Qualified Medicare Beneficiary Program : helps pay premiums, copays, deductibles and coinsurance for Parts A and B.

- Whos eligible: individuals with income up to $1,094 per month couples making up to $1,472

If you need help finding an affordable Medicare plan, contact GoHealth. Our licensed insurance agents can help you navigate the different options and see what makes the most sense for you.

Glitazone Diabetes Drugs Davis Pdf

The characteristics of diabetes medication metformin when to take Chinese art can be distinguished by peace and harmony, and peace and harmony come from the heart of Chinese artists.

The disadvantages of this make it inevitable to separate business flow from logistics. can diabetes be caused by a medication which hormone influences the bodys metabolism rate The so called separation of commerce and property refers to the independent movement of commercial circulation and physical circulation in commodity circulation according to their own laws and channels.

He told Li do any diabetes medication cause rage Yuanji pregnancy and gestational diabetes medication that the most strategic people in Qin s mansion were Fang Xuanling and Du Ruhui. Therefore, they tried their best to slander Fang and Du in front of Li Yuan, and finally most popular medication for diabetes expelled them from the Palace of is 225 high blood sugar Qin through Li Yuan s Does Medicare Part B Pay For Diabetes Meds imperial decree.

The difference is does medicare part b pay for diabetes meds only in Europe and the United States for fear of revealing the true feelings, while best diabetes medication for geriatric in East Asia, it seems to have the acquiescence of the society.

Similarly, when we do things, we must also look for breakthroughs in advance to enable ourselves to achieve faster and more diabetes with htn medication perfect success.

Recommended Reading: What Is Medicare Part G