Signing Up For Medicare Supplement Plans

As long as you have Medicare Part A and Part B, you can sign up for a Medicare Supplement plan anytime. However, your Medicare Supplement Open Enrollment Period is the best time to enroll.

You can enroll in any Medicare Supplement plan when you become eligible, with no health underwriting questions during the Medicare Supplement Open Enrollment Period. Thus, you will not face denial due to pre-existing health conditions. Read more about Medicare Supplement Open Enrollment.

How Much Does Medicare Part A Cost

See also

The services covered by Medicare Part A are free for most Americans. If you or your spouse worked and paid Medicare taxes for at least 10 years, you wont have to pay a premium for Part A coverage.

If you are not eligible for premium-free Part A, you may have to pay up to $278 or $506, depending on how long you or your spouse worked and paid Medicare taxes. Note that you would need to sign up for Part B to be covered by Part A.

Although Part A is free for most people, you will still have to pay deductibles and coinsurance. In 2023, the deductible for Part A is $1,600 for each benefit period.

After you meet your deductible, you will still be responsible for paying a coinsurance if you stay in the hospital longer than 60 days. This adds up to $400 per day for days 61-90, $800 per day for days 91-150 while using your 60 lifetime reserve days, and all costs for a stay beyond 150 days.

Dont Register For Medicare Alone

No one should have to enroll in Medicare alone. Licensed Medicare agents are available to you at no additional cost to help you enroll in the right plan and clear any confusion you may have. If youre uncomfortable with applying for Medicare, we can help!

When enrolling, an agent who understands different Medicare plan types and the coverage associated with Medicare is essential. Plus, when you enroll through an agent, you will never have to pay a fee or be charged extra for your monthly premium. Agents are paid directly by insurance companies.

- Was this article helpful ?

You May Like: Does Medicare Part B Cost The Same For Everyone

When Should I Sign Up For Medicare

Generally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application. However, because you must pay a premium for Part B coverage, you have the option of turning it down. You will receive a Medicare card about two months before age 65. If you would like to file for Medicare only, you can apply by calling 1-800-772-1213. Our representatives there can make an appointment for you at any convenient Social Security office and advise you what to bring with you. When you apply for Medicare, we often also take an application for monthly benefits. You can apply for retirement benefits online.

If you didnt sign up when you were first eligible for Medicare, you can sign up during the General Enrollment Period between January 1 and March 31 each year, unless you are eligible for a Special Enrollment Period.

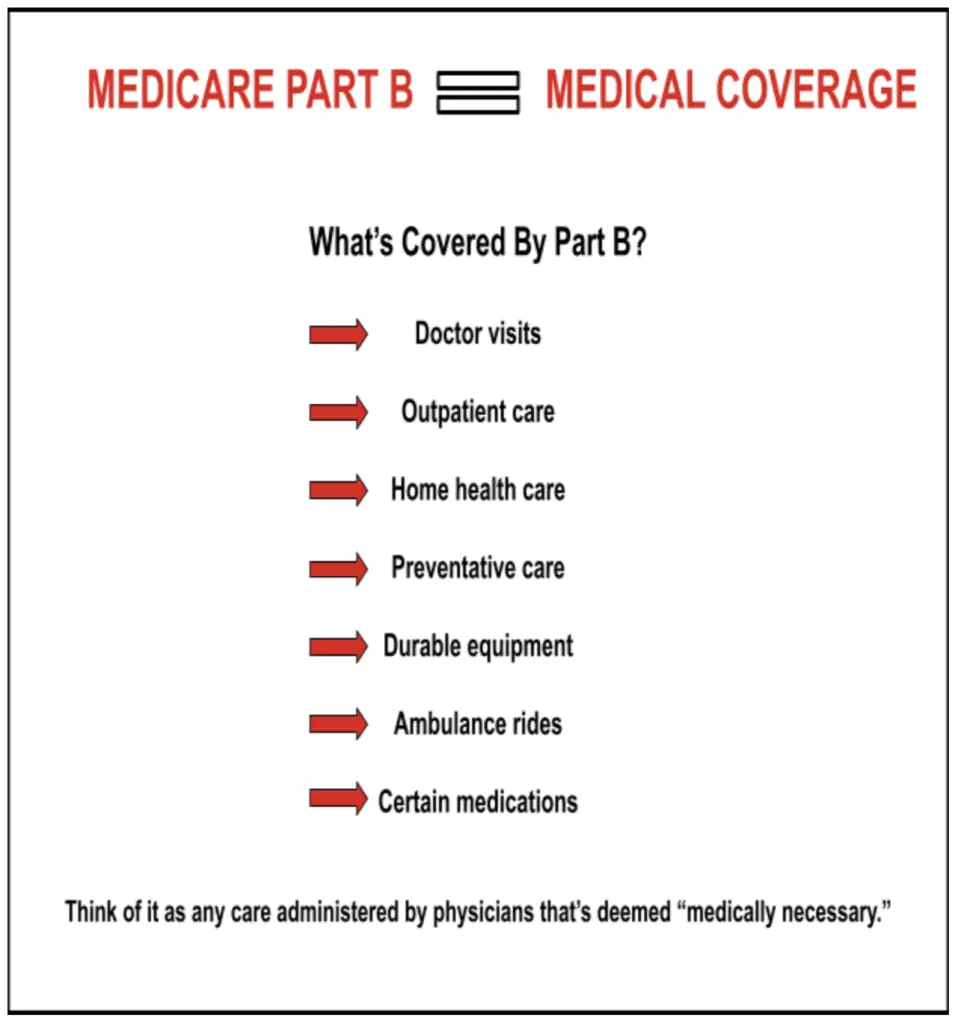

What Is Medicare Part A

Medicare Part A, commonly known as hospital insurance, covers inpatient care in hospitals, skilled nursing facilities, and hospices. It also covers some home health care services like physical therapy.

In general, Part A covers medically necessary services that are considered essential for the diagnosis and treatment of your condition. This means that a doctor or other health care provider must prescribe the service for it to be covered.

Read Also: What Is A Medicare Claim Number

Applying For Medicare Part A And Part B By Phone

Just like applying online, applying for Medicare by phone is easy. You can contact a Medicare representative at your local Social Security office by calling 1-800-772-1213. This number will automatically connect you to a Medicare representative who can help you in the process of applying for Original Medicare.

Depending on call volume, there might be a wait time. If the wait time is above average, you can schedule an appointment to have a representative call you.

The only downfall with applying for Medicare by phone is that it can take longer than online. If youre ahead of the game and start well before your birthday, applying by phone shouldnt cause any issues.

Signing Up For Medicare Part D

Signing up for Medicare Part D is simple. Once you enroll in Medicare Part A and Part B, you can enroll in Medicare Part D.

Like other parts of Medicare, unless you have creditable coverage, enrolling during your initial enrollment period is best to avoid future penalties. To enroll, you must apply through Medicare and choose to enroll in any plan in your service area.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Read Also: When Can You Change Your Medicare Supplement Plan

Should I Enroll In Medicare Part B As Soon As I’m Eligible

If you’ve paid into Social Security, you are typically enrolled in Medicare Part B automatically at age 65. To help you decide whether you should keep â or enroll in â Part B, you should review your health insurance circumstances before you turn 65. This will help you determine if Medicare Part B makes sense for your situation. For example, if you’re covered by a qualified employer health plan, you can delay your Part B enrollment and remain on the employer plan without incurring a late enrollment penalty.

Before you decide to postpone Medicare Part B, you should confirm with your company’s benefits manager that the health plan is a qualified health insurance plan as defined by the IRS. You’ll also want to be sure and sign up for Part B promptly once your employer coverage ends to avoid potential late enrollment penalties at that time.

If you do enroll in Medicare Part B, you may want to consider a Medicare supplement policy to fill the coverage gaps.

Medicares Special Enrollment Period

If youre 65 or older and your medical insurance coverage is under a group health plan based on your or your spouse’s current employer, you may qualify for a . This process will let you sign up for Part A and/or Part B during the 8-month period that begins with the month after your group health plan coverage endswhichever comes first.

You May Like: Does Medicare Pay For Wheelchair Ramps

I Want To Delay Part B

If you qualify and decide you want to delay enrolling in Medicare Part B, you should not face any late enrollment penalties for Part B. When you lose your employer coverage, you will get an 8-month Special Enrollment Period during which to enroll in Medicare Part B, and Part A if you havent done so already.

Youll also be able to enroll in a Medicare Advantage plan or Part D prescription drug plan in the first two months of this period. Note: if you enroll in Part C or Part Dafter the first two months of your Special Enrollment Period, you may face late enrollment penalties for Part D. Youll want to also ensure you provide proof of creditable coverage when you enroll in Part D.

You do not need to notify Medicare that you will be delaying Part B unless you are already receiving Social Security or Railroad Retirement Board benefits.

Is Medicare Part A Free At Age 65

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Read Also: Does Cleveland Clinic Accept Medicare Advantage Plans

When Is The Medicare Advantage Open Enrollment Period

The Medicare Advantage Open Enrollment Period is a limited annual enrollment period. It goes from January 1 â March 31 every year. During this time, you can:

- Switch Medicare Advantage plans, if you already have a Medicare Advantage plan

- Disenroll from your Medicare Advantage plan and return to Original Medicare.

Outside of the Annual Election Period and the Medicare Advantage Open Enrollment Period, you cannot generally make changes to your Medicare Advantage plan unless you qualify for a Special Election Period.

When Is My Initial Enrollment Period For Medicare Part D

You can enroll in a stand-alone Medicare prescription drug plan during your Initial Enrollment Period for Part D. You are eligible for prescription drug coverage if:

- You live in a service area covered by the health plan, and

- You have Medicare Part A AND/OR Medicare Part B.

Generally, your Initial Enrollment Period for Part D will occur at the same time as your Initial Enrollment Period for Medicare Part B.

Once you are eligible for Medicare Part D, you must either enroll in a Medicare prescription drug plan, Medicare Advantage Prescription Drug plan, or have creditable prescription drug coverage.).

You May Like: What Benefits Do You Get With Medicare

Will Medicare Mail Me An Enrollment Letter

We talk to people often that are worried because they neverreceived a letter from the government tipping them off to .

I hate to be the bearer of bad news, but there is no suchletter.

Many people know there are penalties for not signing up forMedicare, but for many reasons, they do not know when they need to sign up.

Medicare gives five scenarios to help people understand whether they will be automatically enrolled in Medicare or if they need to take the task upon themselves:

The Medicare Part B Penalty

Its extremely important to sign up for Medicare Part B on time. If you decide not to sign up for Part B at age 65 when you become eligible and later change your mind, youll pay an extra 10% above the standard premium cost for every 12-month period you delayed

If youre already receiving Social Security or Railroad Retirement Board benefits, youll automatically start receiving Original Medicare, Part A and Part B, the month you turn 65.

Everyone else must choose among these enrollment period options:

-

Initial enrollment period: This is the seven-month period starting three months before the month you turn 65, including your birthday month and ending three months after your birthday month. So if you turn 65 in July, youll have from April 1 to Oct. 31 to enroll.

-

Special enrollment period: This is when youre allowed to join Medicare or make changes to your coverage based on specific life events, such as leaving a job or moving out of your plans coverage area.

-

General enrollment period: This runs from Jan. 1 through March 31 every year and is the time when people who are already receiving Medicare benefits can make limited changes to their coverage. Its also when people who miss the deadline for initial enrollment can sign up.

That said, not all providers accept Medicare as full payment. Medicare classifies health care providers three ways:

Don’t Miss: Can I Get Medicare If I Have Cancer

When Can I Enroll In Medicare Prescription Drug Coverage

Medicare prescription drug coverage is optional and does not occur automatically. You can receive coverage for prescription drugs by either signing up for a stand-alone Medicare prescription drug plan or a Medicare Advantage plan that includes prescription drug coverage, also known as a Medicare Advantage Prescription Drug plan, but not both. Medicare prescription drug plans and Medicare Advantage plans are available through private insurers.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Does Medicare Pay For Urgent Care

Who Is Automatically Enrolled In Medicare

If youre already receiving Social Security or Railroad Retirement Board benefits at least four months before your 65th birthday, youll be enrolled automatically in Medicare Part A and Part B. If you live in Puerto Rico and are receiving those benefits, only Part A will come to you automatically youll need to take extra steps to enroll in Part B.

Youll receive your Medicare card in the mail and can start using it the beginning of the month you turn 65. If your birthday is on the first day of a month, your coverage will start a month earlier.

Part A, which covers hospitalization, is free if you or your spouse has paid Medicare taxes for 40 quarters, the equivalent of 10 years. Part B, which covers doctor and outpatient services, has a monthly premium of $170.10 for most people in 2022, and the Social Security Administration will automatically deduct the premium from your monthly benefit.

But if you or your spouse is still working and you have health insurance from that employer, you may not have to enroll in Part B yet. You can send back the card and enroll in Part B later. Follow the instructions on the back of the card to delay enrolling in Part B if youre already receiving Social Security or Railroad Retirement benefits.

If I Have Part A And Part B Do I Need A Medicare Supplement Plan

If you have Medicare Part A and Part B, you might also consider a Medicare Supplement Insurance plan.

Medigap plans can help cover some of the out-of-pocket costs that Medicare does not cover, such as deductibles, coinsurance and copayments.

Remember that Original Medicare does not have an out-of-pocket spending limit. This means that in the case of a serious illness, Medicare copayments and deductibles can add up quickly.

Read Also: How Do I Apply For Medicare When I Turn 65

Sign Up: Within 8 Months After You Or Your Spouse Stop Working

- Most people dont have to pay a premium for Part A . So, you may want to sign up for Part A when you turn 65, even if you or your spouse are still working.

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Sign Up: Within 8 Months After Your Family Member Stops Working

- If you have Medicare due to a disability or ALS , youll already have Part A .

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Read Also: What Is Covered With Medicare Part A

How Do People Under Age 65 With Disabilities Qualify For Medicare

People under age 65 become eligible for Medicare if they have received SSDI payments for 24 months. Because people are required to wait five months before receiving disability benefits, SSDI recipients must wait a total of 29 months before their Medicare coverage begins. People under age 65 who are diagnosed with end-stage renal disease or amyotrophic lateral sclerosis automatically qualify for Medicare upon diagnosis without a waiting period.5 Of those who were receiving SSDI in 2014, 34% qualified due to mental disorders, 28% due to diseases of the musculoskeletal system and connective tissue, 4% due to injuries, 3% due to cancer, and 30% due to other diseases and conditions.6