Younger Enrollees Would Primarily Enroll In Part A

Lowering the age of eligibility for Medicare would also shift enrollment across the various components of the program. For example, 82 percent of 65- to 69-year-olds enrolled in both Part A and Part B in 2019. By contrast, CBO estimates that in 2031 only 53 percent of 60- to 64-year-olds would enroll in both programs. That is because 60- to 64-year-olds would be more likely to enroll exclusively in Part A while also maintaining employer-provided coverage or another form of health insurance. That greater emphasis on Part A which is funded by payroll taxes and has a trust fund that is set to become depleted in 2028 could accelerate Medicares financial difficulties.

How Much Does Medicare Cost

Original Medicare

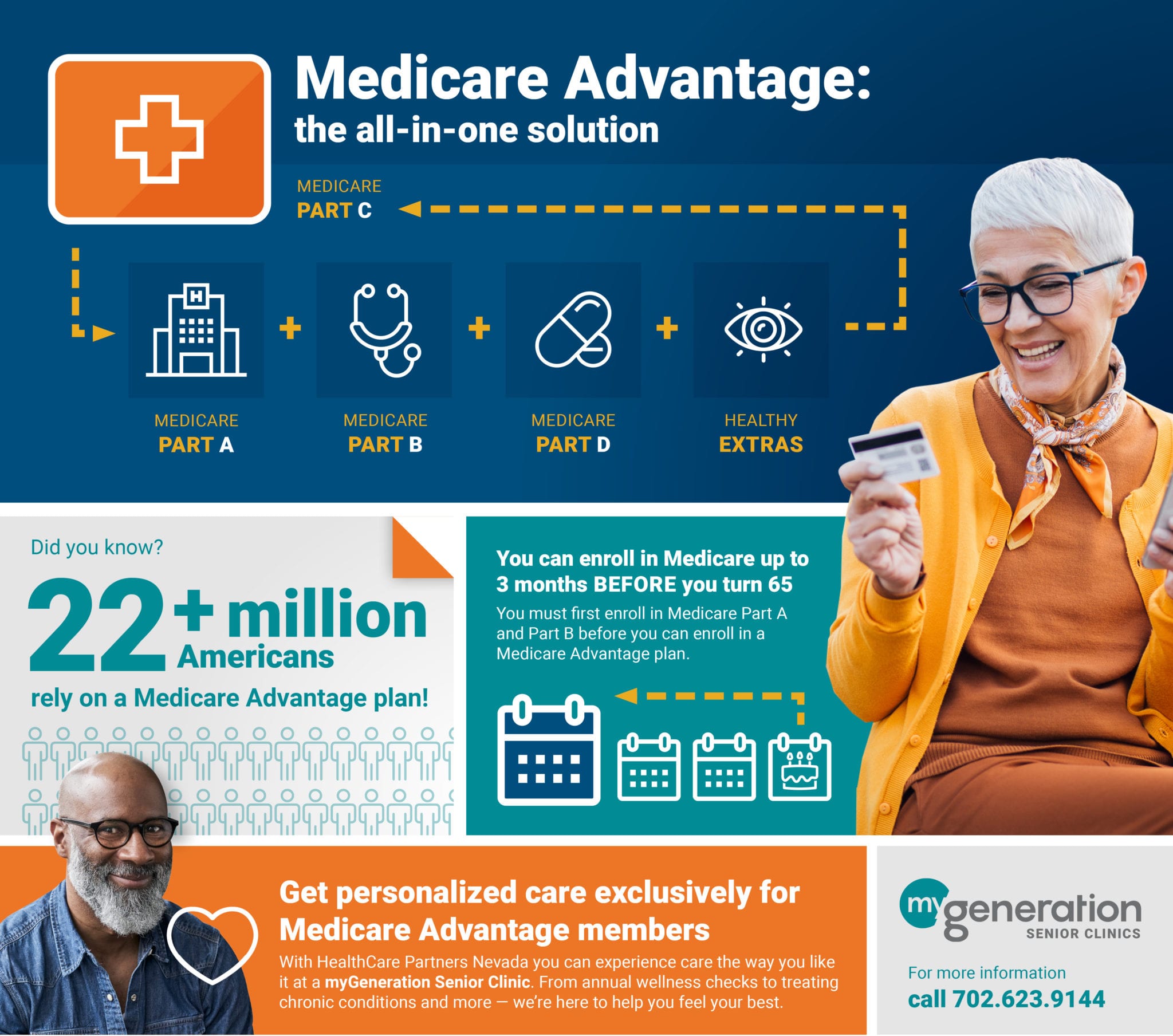

Original Medicare is divided into Part A and Part B .

- Part A helps pay for inpatient hospital care, some skilled nursing care, home health care and hospice care.

- Part B helps pay for doctor services, outpatient hospital care, durable medical equipment, home health care not covered by Part A, and other services. Medicare was never intended to pay 100% of medical bills. Its purpose is to help pay a portion of medical expenses. Medicare beneficiaries also pay a portion of their medical expenses, which includes deductibles, copayments, and services not covered by Medicare. The amounts of deductibles and copayments change at the beginning of each year.

Part A Monthly Premium

If you are eligible, Part A is free because you or your spouse paid Medicare taxes while you were working. You earn Social Security credits as you work and pay taxes. For each year that you work, you earn 4 credits.

| $471 | $499 |

You are 65 or older, and you receive or are eligible to receive full benefits fr om Social Security or the Railroad Retirement Board

You are under 65, and you have received Social Security disability benefits for 24 months You are under 65, and you have received Railroad Retirement disability benefits and you meet Social Security disability requirements You or your spouse had Medicare-covered government employment You are under 65 and have End-Stage Renal Disease

Find A $0 Premium Medicare Advantage Plan Today

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

You May Like: Does Medicare Cover Dermatologist Check Ups

Who Is Eligible For Social Security Retirement Benefits

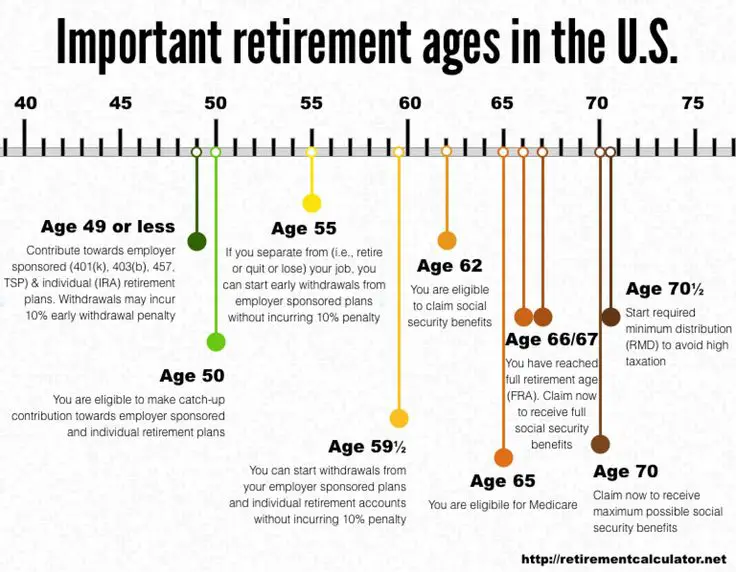

As mentioned, youll need to meet a few requirements to be eligible for Social Security retirement benefits. Just like with Medicare, youll need to be a United States citizen or permanent resident. You might also need to have worked and earned credits. The amount of credits you need depends on your circumstances and the type of benefit youre applying for.

Youll need at least 40 credits in order to apply for retirement benefits. Since you can earn up to four credits a year, youll earn 40 credits after 10 years of work. This rule applies to anyone born after 1929.

The amount youll receive per month will depend on your income throughout your working life. You can use the calculator on the Social Security website to estimate your retirement benefits.

Dont Miss: Does Medicare Cover Private Home Care

How Much Is Medicare Part A 2020

In 2020, the Medicare Part A premium can be as high as $458 per month. Lets say Geralds wife, Jessica, reaches age 62 and has worked for the required number of years to qualify for premium-free Part A once she turns 65. Because Jessica is now 62 years old and has met the working requirement, Gerald may now receive premium-free Part A.

You May Like: What Is The Best Medicare Part D Plan For 2020

How Medicare Works If Your Age 62 Spouse Is Still Working And Youre On Medicare

To qualify for Medicare, your spouse must be age 65 or older. If your spouse is age 62 , he or she could only qualify for Medicare by disability.

Heres an example of when a younger spouse whos not yet on Medicare might help you save money.

- Suppose you reach age 65 and qualify for Medicare, but you havent worked long enough to qualify for premium-free Medicare Part A.

- And suppose your younger spouse has worked at least 10 years while paying Medicare taxes. When your spouse turns 62, youll qualify for premium-free Part A. Your spouse wont qualify for Medicare until they turn 65, but their work record will help you save money by getting Part A with no monthly premium.

NEW TO MEDICARE?

Can A 62 Year Old Widow Get Medicare

When can I receive Medicare benefits? Medicare is the federal health insurance program for people age 65 and older. Generally, individuals are automatically eligible for Medicare if they are 65 years old and have 40 quarters of work credit in Social Security covered employment, or their spouse is eligible for Medicare.

You May Like: What Is The Minimum Social Security Retirement Benefit Amount

You May Like: How To Apply For Medicare By Phone

Are You Automatically Enrolled In Medicare Part B

Medicare will enroll you in Part B automatically. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If youre not getting disability benefits and Medicare when you turn 65, youll need to call or visit your local Social Security office, or call Social Security at 1-800-772-1213.

Medicare Eligibility For People Under 62

There are a few exceptions for Medicare age limits that can allow people younger than 65 and under age 62 to enroll in Medicare.

- If you have ALS , you are immediately eligible for Medicare regardless of your age as soon as your Social Security or Railroad Retirement Board disability benefits begin.

- You may also qualify for Medicare if you have kidney failure that requires dialysis or a kidney transplant, which is known as end-stage renal disease .

- You may also qualify for Medicare at age 62 or any age before 65 if you receive disability benefits from either Social Security or the Railroad Retirement Board for at least 24 months.

If you qualify for Medicare under the age of 65 because of a disability, you might also qualify for a Medicare Advantage Special Needs Plan.

You May Like: Does Medicare Pay For Air Evac

How Could Lowering The Medicare Age Affect People Eligible For Full Medicaid Benefits

What is current policy? Today, some people are eligible for both Medicare and full Medicaid benefits, while others may lose Medicaid eligibility once they become eligible for Medicare. A persons status as a Medicare beneficiary does not qualify them for full Medicaid benefits. Instead, a person must independently qualify for Medicaid through an eligibility pathway based on low income or disability. Individuals in the 60-64 age range may qualify for Medicaid through various pathways that may have different eligibility criteria and benefit packages. For example:

What are the key policy choices and implications? Lowering the age for Medicare would require policy choices about whether to allow individuals in the new age range to continue to receive full Medicaid benefits, if eligible under the ACA expansion or other poverty- or disability-related pathways, or whether these individuals would move from Medicaid to Medicare as their sole or primary source of coverage. How these eligibility issues are resolved has important implications for enrollee benefits and cost-sharing as well as state and federal costs . Additionally, Medicare enrollment is limited to specific periods, while Medicaid enrollment is open year-round. However, Medicaid eligibility must be periodically renewed, while Medicare eligibility currently continues without the need to renew eligibility once a person turns 65.

Check Out Our Recent Facebook Live About This Very Topic

I interviewed my mom, Sharon Slovak, who two years ago retired after 30 years in the classroom. After teaching grades from kindergarten through 12th grade English, she found her niche in upper elementary and spent 24 years teaching 4th 6th grades. Read on for 10 surprising and enlightening items about teacher retirement.

1. August/September will always feel like the beginning of the year.

Even if you do not have a classroom to ready or a seating chart to prepare, Labor Day weekend will always be your time for personal resolutions and a fresh start.

2. You will love having the entire calendar year to make plans.

After years of traveling only during winter, spring and summer breaks, you will love the freedom of 52 whole weeks in which to visit new places and old friends.

3. You will still find yourself obsessed with school supply sales.

You will not be able to help yourself from pawing through the racks and bins of supplies on sale. However, you will be able to skip the worries of not locating 35 identical copies of your favorite finds.

4. You will miss creating new learning units.

My mother says that she was surprised to realize how much she misses mapping new themes for a class. She did not foresee how much nostalgia she would feel for research, choosing books and artwork, and locating artifacts.

5. You will miss introducing new authors to students.

6. You will not miss bells.

7.Looking back, the years you had to switch grades ended up being awesome.

Read Also: Are Physicals Covered By Medicare

Effects On Federal Deficits And Debt

CBO and JCT estimate that lowering the Medicare eligibility to 60, if fully implemented in calendar year 2026, would increase deficits by $155 billion over the five-year period between 2026 and 2031. Increased Medicare spending as a result of the additional enrollees would be partially offset by increased Part B premiums, lower disproportionate share payments to hospitals, reduced Medicaid spending, and decreased spending on subsidies for employment-based coverage.

The report focuses on a specific policy that would lower the age of eligibility for Medicare to 60, but CBO and JCT also find that, in general, policies that lower the age of eligibility would increase budget deficits and policies that raise the age of eligibility would decrease budget deficits. Exploring the adjustment of Medicares age requirement is just one possible option to put federal healthcare spending on a more sustainable path, but there are other routes that lawmakers can consider for healthcare reform. Lawmakers should come together to find a balanced reform that both secures Medicares future for the long run and creates a sustainable budget outlook. As it stands currently, parts of this essential program, relied upon by millions of Americans, is set to become unable to pay out full benefits by 2028.

Image credit: Photo by Brandon Bell / Getty Images

Who Qualifies For Medicare

Who qualifies for Medicare? | Find out if youre eligible | Enrollment | Medicare eligibility FAQs

There are several scenarios that qualify you for Medicare. The first, and most common scenario is when you turn 65 years old. The second scenario is when youve been collecting Social Security Disability Insurance for at least 24 months. The third scenario is when youre diagnosed with End-Stage Renal Disease and are on dialysis or if youre diagnosed with amyotrophic lateral sclerosis .

Don’t Miss: Does Medicare Pay For A Second Opinion

How Might Lowering The Medicare Age Affect State And Federal Costs And Provider Payments

What is current policy? Medicare is a federal program primarily financed by a combination of payroll taxes, general revenue, and premiums. In traditional Medicare, the federal government establishes the methodology for making payments to hospitals, physicians and other health care providers under the traditional Medicare program and uses a formula to establish capitated payments to Medicare Advantage plans. In contrast, Medicaid is financed jointly by states and the federal government, and states determine provider payment rates within broad federal standards.

What are the key policy choices and implications? The precise impact of lowering the Medicare age on federal and state costs depends on how the policy is structured. Transitioning current Medicaid enrollees to Medicare would be likely to increase federal spending and reduce state costs as states would no longer share in the costs of covering these individuals. If individuals 60-64 are permitted to retain their current Medicaid eligibility, states would continue to fund a share of these individuals Medicaid costs, though Medicare would be the primary payer for the benefits it covers. If enrollees move to Medicare and do not retain full Medicaid eligibility, the federal government would no longer pay for a share of benefits that are only available through Medicaid .

Medicare For Individuals Who Are Divorced Or Widowed

Many individuals who are divorced or widowed are concerned that the loss of their spouse will somehow affect their ability to qualify for Original Medicare .

Rest assured your marital status does not affect your ability to qualify for Medicare. You are eligible for Medicare if:

- You are a U.S citizen or legal resident for at least 5 consecutive years and

- Age 65 or older or

- Younger than 65 with a qualifying disability or

- Any age if you have end-stage renal disease or amyotrophic lateral sclerosis .

You May Like: How Can I Enroll In Medicare Part D

You May Like: How Much Does Medicare Pay For Dialysis Transport

In What Month Does Medicare Coverage Begin

Medicare coverage begins the first day of the month in which you turn 65 if you sign up during your initial enrollment period. If your birthday is on the first day of the month, it starts the first day of the previous month.

If you sign up during your initial enrollment period but after your 65th birthday, your Medicare coverage will typically start up to three months after you sign up. As mentioned above, if you sign up for Medicare Part A and/or Part B during the Jan. 1 March 31 general enrollment period, your coverage will start July 1.

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medicare hospital insurance if they have worked and paid Medicare taxes long enough. You can sign up for Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

You May Like: How To Apply For Medicare In Hawaii

What Is The Medicare Eligibility Age

For just about everyone, the Medicare eligibility age is 65. At that point, youll have access to Medicare Part A and are able to purchase Medicare Part B. For some with disabilities or End Stage renal disease, though, eligibility may come at a younger age. Most people are eligible to receive part A without having to pay for it, but there are a few exceptions, which well note in further detail below. For help with healthcare planning and other questions about finances and retirement, consider working with a financial advisor.

New Proposal To Lower Medicare Age To 50 Could Be A Lifeline To Millions

A group of 21 Democratic senators have reintroduced legislation in Congress to lower the qualifying age for Medicare from 65 to 50.

When it comes to providing affordable health care for every American, there is more we must do right now to change the status quo, improve our health care system and lower costs, said Sen. Tammy Baldwin, a Democrat from Wisconsin and one of the cosponsors of the bill.

Baldwin added that this legislation would give millions of Americans an option to get the health care coverage they need at a price they can afford.

Heres what you need to know about the proposed reform and how to find affordable health coverage even if youre nowhere close to age 50.

You May Like: Should I Get Medicare Supplemental Insurance

You May Like: Are Spouses Eligible For Medicare

Medicare Part D Prescription Drug Coverage Eligibility

Like Medicare Advantage and Medicare Supplement, Part D prescription drug coverage is provided by Medicare-approved private insurance companies. These plans accompany Original Medicare. Generally, you cant have a standalone Part D plan if you have a Medicare Advantage plan.

To qualify for a Part D plan, you must meet the following requirements:

- You must have both Part A and B .

- You must live where plans are available.

- You must pay Part A, Part B, and Part D premiums, if applicable.