Introduction To Medicare Part D

This section constitutes an introduction to Part D. For more detailed information on any of the topics in this section, please click on the links within the topics. There, you will also find relevant legislative, statutory and CFR citation.

Prior to 2006, Medicare paid for some drugs administered during a hospital admission , or a doctors office . Medicare did not cover outpatient prescription drugs until January 1, 2006, when it implemented the Medicare Part D prescription drug benefit, authorized by Congress under the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. This Act is generally known as the MMA.

The Part D drug benefit helps Medicare beneficiaries to pay for outpatient prescription drugs purchased at retail, mail order, home infusion, and long-term care pharmacies.

Unlike Parts A and B, which are administered by Medicare itself, Part D is privatized. That is, Medicare contracts with private companies that are authorized to sell Part D insurance coverage. These companies are both regulated and subsidized by Medicare, pursuant to one-year, annually renewable contracts. In order to have Part D coverage, beneficiaries must purchase a policy offered by one of these companies.

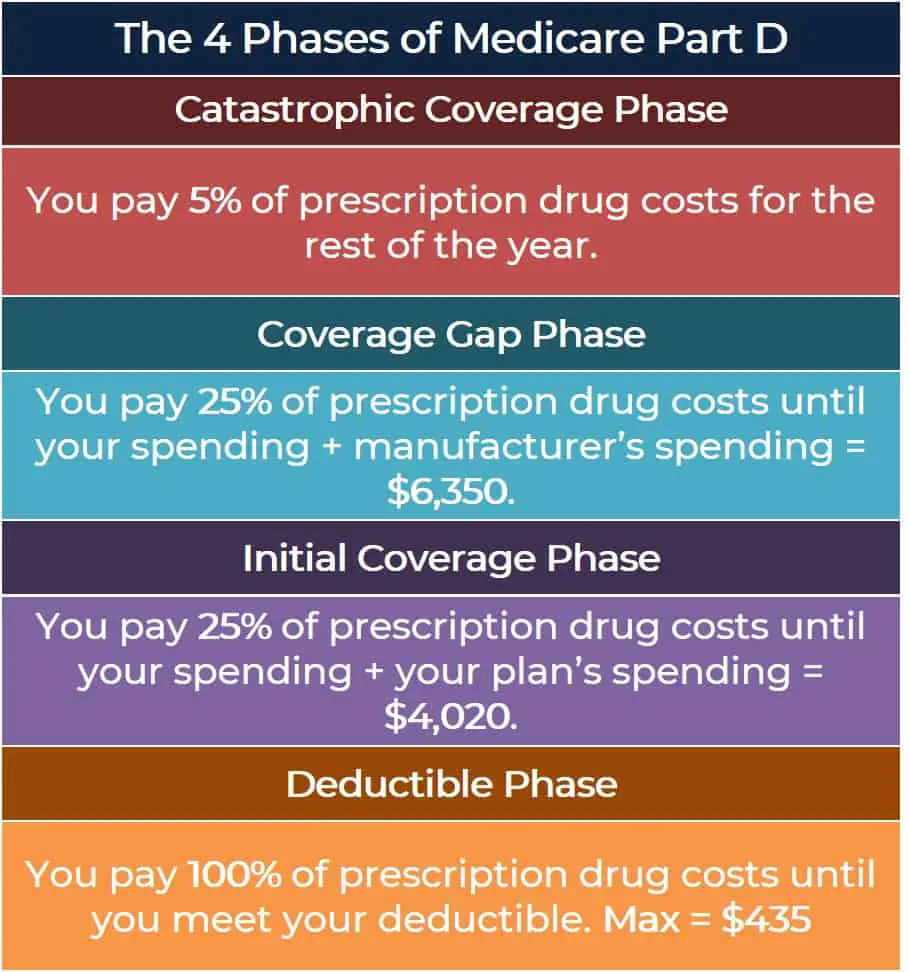

The costs associated with Medicare Part D include a monthly premium, an annual deductible , co-payments and co-insurance for specific drugs, a gap in coverage called the Donut Hole, and catastrophic coverage once a threshold amount has been met.

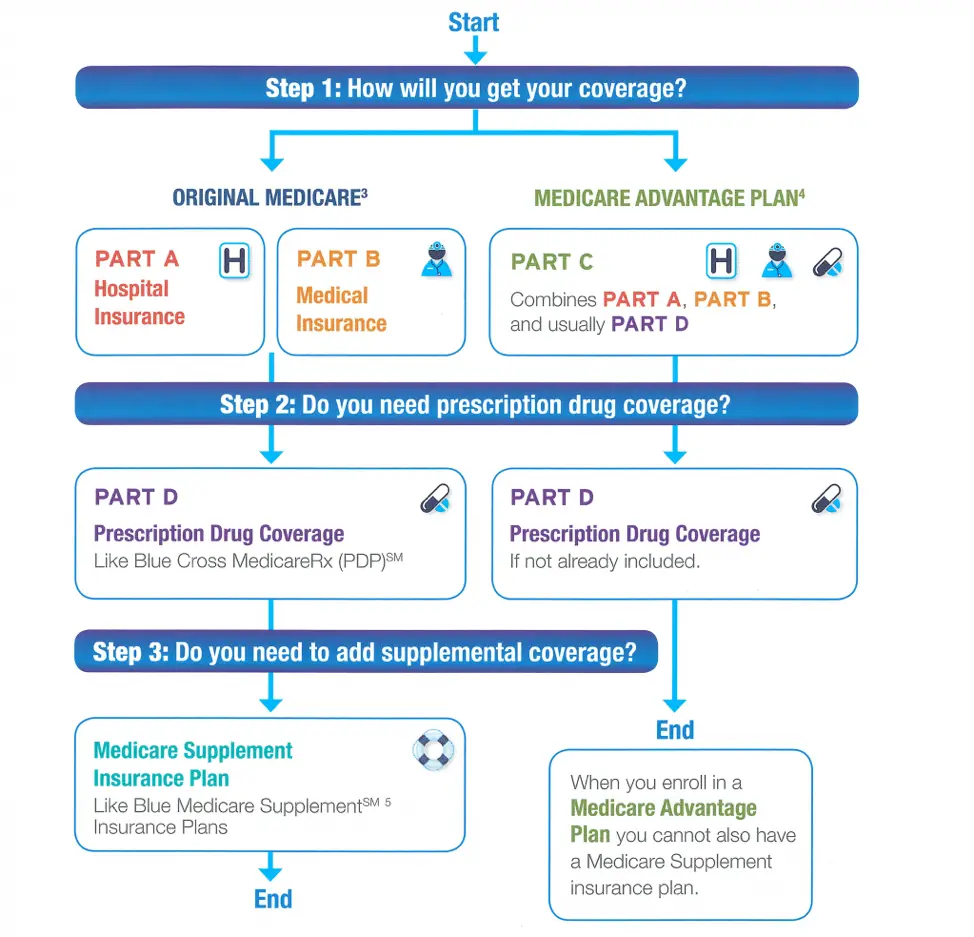

How To Get Prescription Drug Coverage

There are 2 ways to get :

Statement About Healthplanonecom And Privacy

At HealthPlanOne.com, we understand that the process of selecting the right health care coverage for an individual or family member is a personal one. Our goal is protect your privacy while ensuring that you are offered useful and comprehensive information to help you make your decision.

At HealthPlanOne.com, we also understand that relationships are built on trust. So we want to make sure that we clearly disclose to you the kind of information our website may collect and what we do with that information.

Read Also: Is Medicare Part B Based On Income

What Is The Coverage Gap Or Donut Hole

Until your total drug costs hit $4,430, you pay the cost sharing designated in your policy in 2022.

- When you reach the initial coverage limit of $4,430 , you enter the coverage gap, also known as the donut hole.

- You then pay 25% of costs for the costs of brand and generic drugs until your total out-of-pocket Part D spending reaches $7,050

- At that point, the catastrophic limit kicks in and beneficiaries pay the greater of 5% or $3.95 for generic medications and $9.85 for brand-name drugs for the rest of the year.12

Medicare Part D Coverage Is Offered Through Private Plans That Are Approved By The Federal Government Beneficiaries Who Enroll In Medicare Fee

Established in 2006 by the Medicare Modernization Act , more than 42 million, or roughly 73% of all Medicare beneficiaries, are now enrolled in Medicare Part D coverage, either through standard PDPs or Medicare Advantage Prescription Drug plans .

While Part D was considered controversial at the time of its passage, primarily due to the cost to government and the use of private plans to operate the new benefit, Part D has been a successful program. It greatly expanded coverage for prescription drugs to millions of Medicare beneficiaries, and the annual costs of the program have been below spending projections.

#ValueOfMAPD

You May Like: Does Medicare Have A Catastrophic Cap

When To Enroll In Part D

It is usually best to go through Medicare Part D enrollment when you first become eligible for Medicare. Remember that your initial enrollment period begins three months before your 65th birthday and runs until three months after your 65th birthday. If you sign up during this time, you will pay the lowest premiums and not have to worry about a late enrollment fee. You can also avoid potential coverage gaps by signing up on time. If you have other creditable prescription drug coverage, you might be entitled to a waiver of the late penalty. This could qualify you for a special enrollment period that allows you to sign up later without incurring penalties. If you wait until an annual open enrollment period, you will likely be forced to pay the penalty.

What Does Medicare Part D Cover

Under Medicare Part D, prescription drug plans are available from private, Medicare-approved insurance companies, so benefits and cost-sharing structures differ from plan to plan. However, the Center for Medicare and Medicaid Services sets minimum coverage guidelines for all Part D plans. These rules require all plans to cover medications to treat most illnesses and diseases.

Each Medicare prescription drug plan uses a formulary, which is a list of medications covered by the plan and your costs for each. Most plans use a tiered copayment system. Prescription drugs in the lowest tiers, usually generic medications, have lower copayments. Brand-name and specialty medications in the higher tiers cost more out-of-pocket.

Medicare Part D only covers prescription drugs that are FDA approved. Experimental medications are generally not covered.

Don’t Miss: Can You Sign Up For Medicare Anytime

What Does It Mean If My Prescription Drug Has A Requirement Or Limit

Plans have rules that limit how and when they cover certain drugs. These rules are called requirements or limits. You need to follow the rules to avoid paying the full cost of the drug out-of-pocket. If you do not get approval from the plan for a drug with a requirement or limit before using it, you may be responsible for paying the full cost of the drug. If needed, you and your doctor can also ask the plan for an exception.

Here are the requirements and limits you may see on a drug list:

PA Prior Authorization

If a plan requires you or your doctor to get prior approval for a drug, it means the plan needs more information from your doctor to make sure the drug is being used and covered correctly by Medicare for your medical condition. Certain drugs may be covered by either Medicare Part B or Medicare Part D depending on how they are used. If you don’t get prior approval, the plan may not cover the drug.

QL Quantity Limits

The plan will cover only a certain amount of a drug for one copay or over a certain number of days.

ST Step Therapy

The plan wants you to try one or more lower-cost alternative drugs before it will cover the drug that costs more.

B/D Medicare Part B or Medicare Part D Coverage Determination

Depending on how they’re used, some drugs may be covered by either Medicare Part B or Medicare Part D . The plan needs more information about how a drug will be used to make sure it’s correctly covered by Medicare.

LA Limited Access

7D 7-Day Limit

What Does Medicare Drug Insurance Cover

Policies vary by which medications they cover, and how much you must pay. But even the least expensive prescription drug plans must cover most of the generic and brand name drugs and the insulin preparations that are generally needed by people on Medicare. And, it must cover all or most of the drugs in the following categories:

- over-the-counter drugs

- sexual or erectile dysfunction

- vitamins and minerals, except for prenatal vitamins, niacin , and fluoride

Plans with enhanced alternative coverage may include some of the drugs on the above list.6

You May Like: Does Medicare Cover Rooster Comb Injections

How To Decide On Part D Coverage

So, how can you decide which Part D coverage is right for you? Most people start with the plan finder tool at Medicare.gov. This will let you see all the available Medicare health insurance plans in your area. This includes both Part D plans and Medicare Advantage plans. You should closely examine all your options when choosing the right coverage. You might find that Original Medicare with an added Part D plan is the best solution for your needs. However, some people will find that a Medicare Advantage plan with prescription drug coverage works best for them.

It can also be helpful to find a trusted insurance agent who can help you with the process. Your agent can help explain all the coverage details of the different plans. You will want to find the one that minimizes your overall health care expenses based on your personal health situation. Things like how often you visit the doctor, how many medications you take, and other factors can have an effect on which type of plan will work best for you.

What Is The Donut Hole

The donut hole is a coverage gap that begins after you pass the initial coverage limit of your Part D plan. Your deductibles and copayments count toward this coverage limit, as does what Medicare pays. In 2021, the initial coverage limit is $4,130.

The federal government has been working to eliminate this gap and, according to Medicare, youll only pay 25 percent of the cost of covered medications when youre in the coverage gap in 2021.

Theres also a 70 percent discount on brand-name medications while youre in the donut hole to help offset costs.

Once your out-of-pocket expenses reached a certain amount, $6,550 in 2021, you qualify for catastrophic coverage. After this, you will only pay a 5 percent copay for your prescription medications for the rest of the year.

Here are a few points to remember when choosing a plan:

Don’t Miss: When Is The Earliest You Can Apply For Medicare

For Insurance Quotes By Phonetty 711 Mon

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MedicareInsurance.com, DBA of Health Insurance Associates LLC, is privately owned and operated. MedicareInsurance.com is a non-government asset for people on Medicare, providing resources in easy to understand format. The government Medicare site is www.medicare.gov.

This website and its contents are for informational purposes only and should not be a substitute for experienced medical advice. We recommend consulting with your medical provider regarding diagnosis or treatment, including choices about changes to medication, treatments, diets, daily routines, or exercise.

This communications purpose is insurance solicitation. A licensed insurance agent/producer or insurance company will contact you. Medicare Supplement insurance plans are not linked with or sanctioned by the U.S. government or the federal Medicare program.

MULTIPLAN_GHHK5LLEN_2023

Who Qualifies For Medicare Part D Extra Help

Eligibility for Medicare Part D Extra Help is based on your income and assets, and the limits change yearly. In 2021, you may be eligible for Medicare Part D Extra Help if:

- Individual: your annual income no more than $19,320, and the value of your assets is no more than $14,790.

When counting your resources to determine eligibility for Extra Help, Medicare includes items such as:

- Real estate other than your primary residence

Medicare doesnt consider the following resources when it comes to eligibility:

- Burial plot and up to $1,500 for burial costs if youve set aside money for this purpose

- Personal or household items

You may automatically qualify for Extra Help if you have Medicare and also:

- Receive full Medicaid coverage .

- Are enrolled in a Medicare Savings Program, which pays for your Part B premium.

- Receive Supplemental Security Income benefits.

Even if you automatically qualify this year, you may not next year if your income or resources change, or the Extra Help program adjusts its eligibility limits. Youll receive a notice in the mail on grey paper by the end of September if this is the case. Even if you get this, you may still qualify, but youll need to reapply.

If the amount of Extra Help youre receiving changes, youll get a notice on orange paper with your new copayment amounts. If you dont get any notices in the mail, you can expect to receive the same level of assistance with prescription drug costs that you got the previous year.

Also Check: How To Find A Medicare Number For A Patient

For People With Both Medicaid And Medicare

The Medicare Modernization Act of 2003 added prescription drug benefits for Medicare beneficiaries and is known as Medicare Part D. Medicare Part D offers prescription drug coverage through Medicare. A Medicare Part D eligible individual is one who is entitled to or enrolled in Medicare benefits under Part A and/or Part B.

Dual eligibles are people who have both Medicare and Medicaid.

Dual eligibles receive their prescription drug coverage through Medicare rather than through the Medicaid program. Medicare Part D replaces Medicaid as the pharmacy coverage for dual eligible enrollees.

If enrollees do not participate in a Medicare prescription drug plan, they may lose all their Medicaid benefits. However, some people on Medicare and Medicaid may receive a letter from their employer or union stating that if they enroll in Medicare Part D they will lose the health care benefits provided by the union or employer. If an enrollee has received this letter, they may disenroll from the Medicare Prescription Drug program by calling 1-800-MEDICARE . They must also give a copy of this letter to their Medicaid worker in order to continue receiving Medicaid benefits.

What If I Dont Qualify For Medicare Extra Help

If you dont qualify to receive Extra Help, there are still ways to save money. Your State Medical Assistance office or your State Health Insurance Assistance Program can provide you more information on payment assistance for prescription drug costs. You can look up your local Medicaid and SHIP offices here.

Here are other ways to reduce costs for Medicare Part D prescription medications:

- Switch to a generic form of the prescription drug if available .

- Ask your doctor about less expensive brand-name drugs.

- Use a mail-order pharmacy, which may provide savings if youre ordering a larger quantity of medications.

- Compare Medicare Part D coverage options to find plans with lower costs.

- Find out if the pharmaceutical company that makes your medication offers help paying for it. Some manufacturers may offer discounts through pharmaceutical assistance programs.

Also Check: Do We Have To Pay For Medicare

In 2019 Around 1 In 10 Low

Figure 10: Weighted Average Monthly Premiums for Low-Income Subsidy Enrollees, 2006-2019

In 2019, 1.0 million LIS beneficiaries pay a premium for Part D coverage, even though they may be able to obtain coverage without paying a premium by enrolling in a benchmark PDP. This total includes 0.7 million PDP enrollees who are not enrolled in benchmark PDPs, and more than 0.3 million enrollees in MA-PDs that charge a premium. MA-PDs are not designated as benchmark plans by CMS, although most of the LIS enrollees in MA-PDs are currently enrolled in zero-premium plans. On average, the 1.0 million LIS beneficiaries paying Part D premiums in 2019 pay nearly $24 per month, or nearly $300 per year. This amount is down 7 percent from 2018, but is 2.6 times the amount in 2006.

| Data and Methods

This analysis uses data from the Centers for Medicare & Medicaid services Part D Enrollment, Benefit, Landscape, and Low Income Subsidy files for the respective year, with enrollment data from March of each year. The analysis excludes plans with small enrollment counts in estimates that are plan-enrollment weighted. For analysis of cost sharing for formulary tiers in PDPs and MA-PDs, we did not analyze which drugs are on what tier under each type of plan and whether this has changed over time, factors which would also influence enrollees out-of-pocket costs. |

What Is Medicare Part C

Medicare Part C, also known as Medicare Advantage, offers an all-in-one style plan that allows many options to tailor your healthcare coverage.

Medicare Part C provides all the benefits of Medicare parts A and B, also known as original Medicare. These plans also typically offer additional benefits, such as dental, vision, and prescription drug coverage.

For Medicare Part C, the Centers for Medicare and Medicaid Services contracts with public or private organizations to offer a variety of health plan options.

Recommended Reading: Is Medicare Getting A Raise

What Is Medicare Part D Prescription Drug Coverage

Medicare Part D helps cover the cost of prescription drugs. Part D is optional and only provided through private insurance companies approved by the federal government. However, Part D is offered to everyone who qualifies for Medicare. Costs and coverage may vary from plan to plan. Read on to learn more about Medicare Part D prescription drug coverage, how to get it and what it covers.

When Can I Enroll In A Medicare Prescription Drug Plan

You can enroll in a plan at any time during your Medicare Initial Enrollment Period, which starts three months before your 65th birthday month, includes your birthday month, and extends for three additional months. If you get Medicare because of a disability, you can generally enroll in Medicare Part D after you are on Social Security disability for 24 months.

You can make changes to your prescription drug coverage each year during the Fall Open Enrollment Period . If you get Medicare Part D as part of your Medicare Advantage plan, you can also make changes during the Medicare Advantage Open Enrollment Period which runs from January 1st through March 31st.

Its important to enroll in a plan when you are first eligible if you want to avoid a late enrollment penalty with your monthly premium. If you go without creditable prescription drug coverage and you dont enroll in Part D when you are first able, youll pay a penalty of 1% of the national base premium for each month you go without coverage. You pay this penalty for as long as you have Medicare Part D coverage.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

Also Check: What Is The Best Medicare Supplement Insurance Company