Medicare Advantage Vs Medicare Supplement Insurance Plans

Summary:

Are you trying to decide between Medicare Advantage vs. Medicare Supplement insurance? Hereâs a rundown of the two types of coverage.

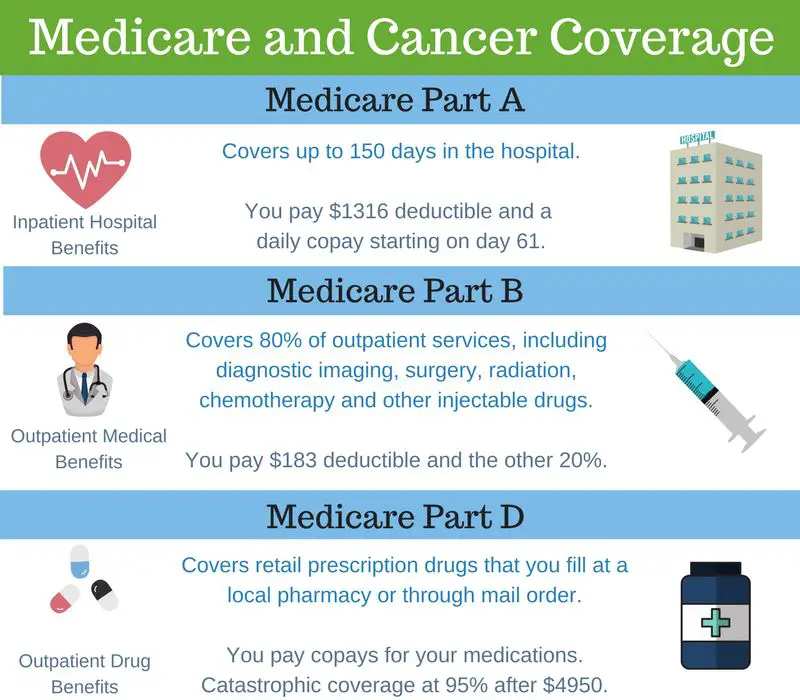

While Original Medicare covers many health-care expenses, it doesnât cover everything. Even with covered health-cares services, beneficiaries are still responsible for a number of copayments and deductibles, which can easily add up. In addition, Medicare Part A and Part B also donât cover certain benefits, such as routine vision and dental, prescription drugs, or overseas emergency health coverage. If all you have is Original Medicare, youâll need to pay for these costs out-of-pocket.

As a result, many people with Medicare enroll in two types of plans to cover these gaps in coverage. There are two options commonly used to replace or supplement Original Medicare. One option, called Medicare Advantage plans, are an alternative way to get Original Medicare. The other option, Medicare Supplement insurance plans work alongside your Original Medicare coverage. These plans have significant differences when it comes to costs, benefits, and how they work. Itâs important to understand these differences as you review your Medicare coverage options.

Ways To Find Out If Medicare Covers What You Need

Getting A Medigap Policy

Once you have original Medicare, you can purchase a Medigap policy from an insurance company. To pick a specific plan and insurance company, many people consult with a trusted family member, friend with a current Medigap policy, or insurance agent.

Others may contact their states SHIP for guidance. Your SHIP should be able to provide free help in choosing a policy as well as a Medigap rate comparison guide.

Your state most likely has more than one insurance company selling Medigap policies. Often, the cost of the same coverage varies from company to company.

Read Also: Does Medicare Pay For Orthotics

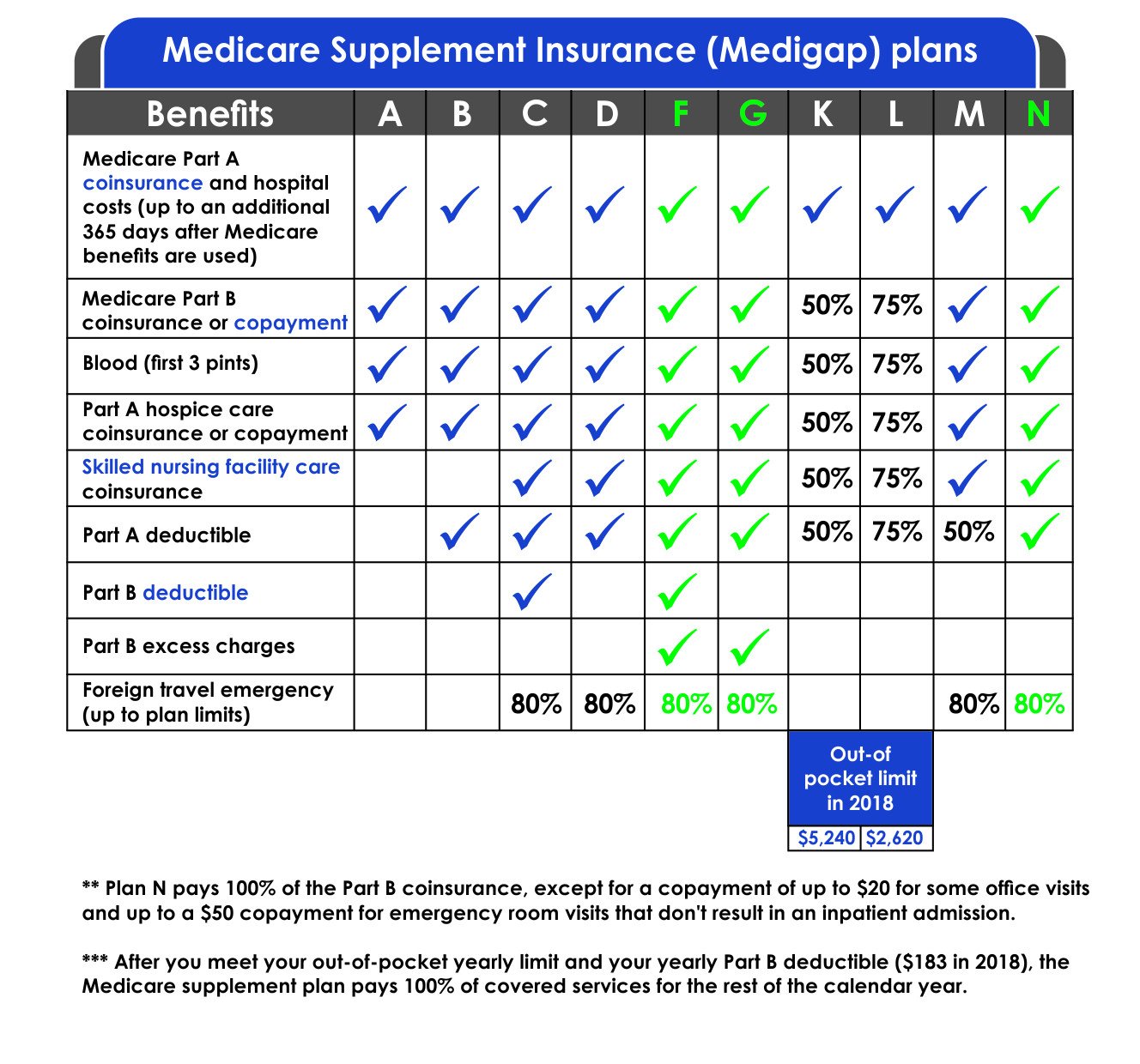

What Does My Medicare Supplement Insurance Plan Cover

Youre closer to turning 65, and soon enough, youre going to start receiving healthcare benefits through the federal government, also known as Original Medicare or Medicare Part A and B. Though you are comforted by the fact that some of your expenses will be covered, you know that youre going to need extra help with other costs. As you grow older, you dont know what your health situation is going to be, and you want to set yourself up for success by signing up for as much coverage as possible.

Thats where Medicare Supplement insurance can step up to the plate and help you out. First, before going into Medicare Supplement insurance, lets look at what Original Medicare covers in terms of your healthcare costs

Medigap & Medicare Advantage Plans

Medigap policies can’t work with Medicare Advantage Plans. If you have a Medigap policy and join a

, you may want to drop your Medigap policy. Your Medigap policy can’t be used to pay your Medicare Advantage Plan copayments, deductibles, and premiums.

If you want to cancel your Medigap policy, contact your insurance company. If you leave the Medicare Advantage Plan, you might not be able to get the same, or in some cases, any Medigap policy back unless you have a “trial right.“

If you have a Medicare Advantage Plan, it’s illegal for anyone to sell you a Medigap policy unless you’re switching back to

. Contact your State Insurance Department if this happens to you.

If you want to switch to Original Medicare and buy a Medigap policy, contact your Medicare Advantage Plan to see if you’re able to disenroll.

If you join a Medicare Advantage Plan for the first time and you arent happy with the plan, you have a trial right under federal law to buy a Medigap policy and a separate Medicare drug plan if you return to Original Medicare within 12 months of joining the Medicare Advantage Plan.

Recommended Reading: Does Medicare Pay For Ambulance To Hospital

A Snapshot Of Sources Of Coverage Among Medicare Beneficiaries In 2018

More than 62 million people, including 54 million older adults and 8 million younger adults with disabilities, rely on Medicare for their health insurance coverage. Medicare beneficiaries can choose to get their Medicare benefits through the traditional Medicare program, or they can enroll in a Medicare Advantage plan, such as a Medicare HMO or PPO. Medicare Advantage plans provide all benefits covered by Medicare Parts A and B, often provide supplemental benefits, such as dental and vision, and typically provide the Part D prescription drug benefit. Many traditional Medicare beneficiaries also rely on other sources of coverage to supplement their Medicare benefits. Supplemental insurance coverage typically covers some or all of Medicare Part A and Part B cost-sharing requirements and, in some instances, provides benefits not otherwise covered by Medicare. Beneficiaries can also enroll in a Part D plan for prescription drug coverage, either a stand-alone plan to supplement traditional Medicare or a Medicare Advantage plan that covers drugs.

Figure 1: In 2018, 9 In 10 Medicare Beneficiaries Either Had Traditional Medicare With Supplemental Coverage Or Were Enrolled In Medicare Advantage

Whats The Purpose Of Medigap

With Original Medicare, you pay the deductibles, copays, and 20% for services you receive from doctors. Medicare Supplement plans can pay some or all of these costs for you. They supplement or fill the gaps in Original Medicare. If Medicare doesnt cover the service, then generally your Medicare Supplement plan doesnt cover the costs either and you would pay for those services yourself.

Medicare Supplement or Medigap policies are designed to pay your costs related to Original Medicare. Depending on the plan you choose, they could pay the Part A hospital deductible, the Part B deductible, and the 20% coinsurance that you are responsible for, as well as other out-of-pocket costs.

In general, Medicare plans are individual plans and only cover one person per policy. This is a great advantage since a husband and wife with different needs can have different plans. They are able to pick the plan that is right for them.

Also Check: How Soon Should You Sign Up For Medicare

How Do Medicare Supplement Plans Work With Original Medicare

Once you enroll in Original Medicare, you become eligible for a Medicare Supplement plan. When you have Original Medicare, you do not have 100% coverage for Medicare-covered services. This leaves beneficiaries with out-of-pocket costs that can quickly add up.

To offset these costs, beneficiaries can enroll in Medicare Supplement plans. Once Original Medicare pays its portion of the bill, your Medicare Supplement plan will pay second. Depending on your plan, you may not pay anything out-of-pocket once you meet your plans deductible.

After factoring in your monthly premium, Medicare Supplement plans begin saving you money as early as your first doctor appointment of the year.

Here’s How To Find Out If Your Medication Is Covered

To stay on top of which of your medications are covered by Medicare, Gang recommends reviewing your drug plan formulary each year. “The 2023 plan details and formulary will be released on October 1st, which is a good time to review your medications,” she notes. “Medicare Annual Enrollment Period lasts from October 15th to December 7th, and you can enroll in a new plan for the upcoming calendar year,” Gang adds.

In fact, she says many people can save significantly on their medications. “Last year our clients, on average, saved over $1,000 by reviewing and changing their Medicare drug plans, so don’t miss this opportunity,” she advises.

Best Life offers the most up-to-date information from top experts, new research, and health agencies, but our content is not meant to be a substitute for professional guidance. When it comes to the medication you’re taking or any other health questions you have, always consult your healthcare provider directly.

Also Check: How To Check My Medicare Account

What Are Guaranteed Issue Rights

Guaranteed issue rights require insurance companies to sell you a Medigap policy that:

- covers preexisting health conditions

- doesnt cost more on account of past or present health conditions

Guaranteed issue rights typically come into play when your healthcare coverage changes, such as if youre enrolled in a Medicare Advantage Plan and it stops providing care in your area, or if you retire and your employees healthcare coverage is ending.

Visit this page for more information on guaranteed issue rights.

What Are The Benefits Of A Medicare Supplement Plan

One of the primary benefits of Medicare Supplement plans is that they help mitigate the costs of health care not covered by Original Medicare, such as copayments, coinsurance and deductibles. Any Medicare beneficiary whos concerned about incurring potentially high out-of-pocket costs should consider Medigap plans and how they can help cover these expenses.

Some Medicare Supplement plans also provide coverage for services that Original Medicare doesnt cover, such as medical care needed during travel outside the U.S. Medicare enrollees who enjoy frequent travel often enjoy the additional layer of protection.

Don’t Miss: What Is The Average Premium For Medicare Advantage Plans

General Features Of Medicare Supplement Insurance Plans

Medicare Supplement insurance plans work with Original Medicare to help with out-of-pocket costs not covered by Parts A and B. The following are also true about Medicare Supplement insurance plans:

- Predictable costs help you stay ahead of unexpected out-of-pocket expenses.

- No network restrictions mean you can see any doctor who accepts Medicare patients.

- You don’t need a referral to see a specialist.

- Coverage goes with you anywhere you travel in the U.S.

- There is a range of plans available to fit your health needs and budget goals.

- Purchasing a Medigap plan and a Medicare Part D prescription drug plan could give you more complete coverage.

- Guaranteed coverage for life means your plan can’t be canceled.

As long as you pay your premiums when due and you do not make any material misrepresentation when you apply for this plan.

For PA residents only: As long as you pay your premiums when due. You do not misstate one or more material facts when you apply for this plan. UnitedHealthcare has 2 years to act on misstatements. The 2 year limit does not apply to fraud.

Rates are subject to change. Any change will apply to all members of the same class insured under your plan who reside in your state. can provide peace of mind by helping with some of these costs.

What Are Medicare Supplement Plans

Medicare Supplement plans are designed to help pay your share of health-care costs under Medicare Part A and Part B. For example, they may pay your Medicare Part B coinsurance for Medicare-approved doctor visits and lab tests. Medicare Supplement plans are sold by private insurance companies, but they have standard benefits designed by the government. In other words, Medicare Supplement Plan A offered by Company ABC will have the same basic benefits as Plan A sold by Company XYZ. Some companies choose to offer additional benefits, but they must include the standard benefits, at a minimum.

Please note that Medicare Supplement Plan A is not the same as Medicare Part A. There are four parts of Medicare, and there are up to 10 lettered, standardized Medicare Supplement plans in most states.

Don’t Miss: Does Medicare Cover Droopy Eyelid Surgery

Applying For A Medicare Supplement Insurance Plan

The best time to enroll in a Medicare Supplement plan is during your Medicare Supplement Open Enrollment period because your acceptance is guaranteed. It starts on the first day of the month in which you’re both age 65 or older and enrolled in Medicare Part B. Some states have additional Open Enrollment periods and Guaranteed Issue requirements.

If you apply outside of Open Enrollment or Guaranteed Issue periods, you may be denied coverage or charged more based on your health history. This does not apply to residents of Connecticut and New York where Open Enrollment and Guaranteed Issue is ongoing and Medicare supplement plans are guaranteed available.

Scroll for Important Disclosures

UnitedHealthcare pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers. AARP does not employ or endorse agents, brokers or producers.

AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals.

Please note that each insurer has sole financial responsibility for its products.

AARP® Medicare Supplement Insurance Plans

AARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare.

In some states, plans may be available to persons under age 65 who are eligible for Medicare by reason of disability or End-Stage Renal Disease.

Important Things To Know About Medicare Supplement Insurance Plans2

- Medicare Supplement insurance plans are not the same as Medicare Advantage plans.

- A Medigap policy only covers 1 person. If you and your spouse both want Medigap coverage, you must buy separate policies.

- Medigap policies do not include prescription drug coverage. If you want prescription drug coverage, you can join a .

- You will pay a monthly premium when you have a Medicare Supplement plan in addition to the Part B premium to Original Medicare.

- A Medicare Supplement policy is guaranteed renewable even if you have health problems. This means your private insurance company cant cancel your policy as long as you pay the premium and provided accurate information on your application.

- Medigap policies generally dont cover long-term care, vision or dental care, hearing aids, eyeglasses or private-duty nursing.

Also Check: How To Get A Medicare Number As A Provider

Dropping Your Entire Medigap Policy

You may want a completely different Medigap policy . Or, you might decide to switch to a Medicare Advantage Plan that offers prescription drug coverage.

If you decide to drop your entire Medigap policy, you need to be careful about the timing. When you join a new Medicare drug plan, you pay a late enrollment penalty if one of these applies:

- You drop your entire Medigap policy and the drug coverage wasn’t creditable prescription drug coverage

- You go 63 days or more in a row before your new Medicare drug coverage begins

What Does Medicare Supplement Insurance Cover

Medicare Supplement Insurance helps cover some costs not paid by Original Medicare Part A and B. These plans help pay copays, coinsurance, and deductibles for your Part A and Part B , as well as additional out-of-pocket costs for things like hospitalization, doctors services, home health care, lab costs, durable medical equipment, and more.

Medicare will pay its share of the Medicare-approved amount for covered health costs. Then, your Medicare Supplement Insurance plan will pay its share of the costs it covers.

There are a wide range of Medicare Supplement plans that differ in coverage and costs, from basic to extensive. Compare Medicare Supplement plans

VIDEO

Also Check: How Do I Know What Medicare Plan To Choose

Medigap Policies Are Standardized

Every Medigap policy must follow federal and state laws designed to protect you, and it must be clearly identified as “Medicare Supplement Insurance.” Insurance companies can sell you only a standardized policy identified in most states by letters.

All policies offer the same basic

but some offer additional benefits, so you can choose which one meets your needs. In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way.

Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

- Don’t have to offer every Medigap plan

- Must offer Medigap Plan A if they offer any Medigap policy

- Must also offer Plan C or Plan F if they offer any plan

What You Pay With Original Medicare

For Medicare parts A and B, you pay monthly premiums, and deductibles, copays, and coinsurance. You also pay the full cost of any services that Medicare doesnt cover.

- Premiums are amounts you pay to keep your Medicare coverage. Most people dont have to pay a Part A premium, but everyone must pay the Part B premium. The premium amounts may change each year in January.

- A deductible is the amount you must pay for medical expenses before Medicare begins to pay.

- A copayment is a set dollar amount you usually have to pay each time you see a doctor or go to the hospital.

- Coinsurance is the percentage of the cost of a service that you pay after Medicare pays its portion of the cost. This means that if Medicare pays for 80% of the cost of a service, youll pay the remaining 20%.

Recommended Reading: What Is The Monthly Premium For Medicare Part B

How Does Medicare Supplement Insurance Work

Medicare Supplement insurance plans, also known as Medigap, help supplement Original Medicare. They may help pay some of the healthcare costs that Original Medicare does pay like copayments, coinsurance and deductibles.

A Medigap plan may be purchased from a private insurance company. To be eligible, you must be enrolled in Medicare Parts A and B, you must live in the state where the policy is offered and be age 65 or over. In some states, you can be under age 65 with a disability or end-stage renal disease .

Each standardized Medicare insurance supplement plan covers different types of costs. How much you pay out of pocket will depend on the services covered and the plan you choose.

How Much Does Medicare Supplement Cost

Medicare supplements vary in rate by carrier and plan choice. Not every carrier offers all plans, says Brandy Corujo, partner of Cornerstone Insurance Group in Seattle. Policy prices for Medigap are set by the individual insurance companies selling them. Companies set their premium pricing in one of three ways:

- Community-rated: Premiums are the same regardless of age.

- Issue or entry age-rated: Premiums are cheaper if the policy is purchased at a younger age. Premiums do not increase with age.

- Attained-age-rated: Premiums are based on your age at the time of purchase. As you age, your premium increases.

Some factors that may also influence your rates include your location, gender, marital status and lifestyle .

Medigap plans are purchased through a private insurance company, and you pay a monthly premium for the policy directly to the company. Medigap policies can be purchased from any insurance company licensed to sell one in your state, but available policies and prices will depend on your state. Medigap plans only cover one person, so married couples need to purchase separate policies.

Also Check: Can You Draw Medicare At 62