Cons Of Medicare Advantage Plans

The following are some disadvantages of Medicare Advantage plans:

- If you select an HMO Medicare Advantage plan, you may have a small selection of providers to choose from. If you see a provider out-of-network, it can cost you more. However, other plan options will offer a wider provider network.

- With certain plans, you may see additional costs for things like drug deductibles and specialist visit copays.

- If you travel a lot, your plan may not cover services outside your service area.

Medicare Part C Inpatient Coverage

The inpatient coverage youll receive with Medicare Part C will at least match those of Medicare Part A. These services include:

- inpatient hospital care

- vaccinations for flu, hepatitis B, and pneumococcal disease

Any additional coverage for these services will be outlined by the specific plan you choose. For example, some plans offer basic vision exams, while others include allowances for prescription eyeglasses or contact lenses.

The cost of a Medicare Part C plan will depend on a variety of factors. The most common costs within your plan will be:

- your Part B monthly premium, which may be covered by your Part C plan

- your Medicare Part C costs, which include a deductible and monthly premiums

- your out-of-pocket costs, which include copayments and coinsurance

Below are some cost comparisons for Medicare Part C plans in some major cities around the United States. All the plans listed below cover prescription drugs, vision, dental, hearing, and fitness benefits. However, they all differ in cost.

Medicare Part C Premiums

After enrolling in a Medicare Plan C plan, you will still pay the monthly Medicare Plan B premium previously in place. Each Medicare Part C plan can have different costs depending on the coverages provided and the location of the plan, as well as other factors. Some Medicare Part C plans do not charge additional monthly premiums in addition to the existing Medicare Part B monthly premium, while other plans have additional monthly premiums that are charged.

All Medicare Part C plans are required to have a specified yearly out-of-pocket maximum. This caps the amount a patient must pay and all additional covered expenses are paid by the Part C plan. This cap is not available under Medicare Parts A and B coverage.

Don’t Miss: How Long Do You Have To Sign Up For Medicare

Failed Attempt At Savings: 19972003

The BBA’s goals with respect to Medicare Advantage can be summarized in the following question: Could Medicare Advantage be reformed so that Medicare could participate in the managed care dividend enjoyed by private employers? In the latter half of the 1990s, Republicans , centrist Democrats, and some policymakers began to look to Medicare as a source for reducing the deficit . Debate centered on the idea of premium support, in which Medicare beneficiaries would be given a lump sumin effect, a voucherthat could be used to pay for a private plan or for the premium for TM, a model used by some private employers as well as the Federal Employees Health Benefit Program . Aaron and Reischauer , among others, argued that such a policy would promote competition and efficiency in Medicare, give beneficiaries a choice, and capture some of the managed care dividend for Medicare.

After an intense debate, Congress passed the BBA, in which Medicare’s at-risk contracting with health plans was formally designated as Part C of Medicare and named Medicare+Choice . The intent was to encourage competition and the growth of managed care in the Medicare program, with the hope that this would save Medicare funds. Most Democrats, however, vehemently opposed the defined-contribution initiative and succeeded in having the topic assigned to a bipartisan commission for study. In the meantime, Medicare remained a defined benefit program.

Is Medicare Part A Free

Typically, most people dont pay for Part A if they have paid Medicare taxes for a certain amount of time while working. However, if you dont qualify for premium-free Part A, it can be purchased for a monthly premium. This amount may vary each year and is based on how long you or your spouse worked and paid Medicare taxes.

Don’t Miss: How To Get Medical Equipment Through Medicare

Medigap Plans = Supplemental Insurance

- These plans cover costs that Original Medicare doesn’t cover

- There are 10 standard Medigap plans , but not all companies offer all of them

- Plan A covers the least, Plan F covers the most

- You’ll pay a monthly premium for a Medigap plan

- Medigap plans don’t cover prescriptions

- You can’t enroll in a Medigap plan if you have a Medicare Advantage plan

- During your guaranteed issue period you won’t be denied due to a pre-existing condition

Signing Up For Original Medicare

Some people qualify for automatic enrollment, and others have to enroll.

- If youre already receiving Social Security or railroad retirement benefits youll be enrolled in Part A and Part B automatically on your 65th birthday. If youre under 65, its the 25th month you receive disability benefits.

- ALS patients are automatically enrolled in Medicare coverage when their Social Security disability benefits begin, regardless of age. If you have end-stage renal disease , you must manually enroll.

If youre eligible for Medicare but dont qualify for automatic enrollment, you can apply online, over the phone or in person at your local Social Security office.

If you worked for a railroad, youll need to contact the Railroad Retirement Board for information on enrollment.

You May Like: How To Get Prior Authorization For Medicare

Medicare Advantage Hmo Plans

Health Maintenance Organization plans are a popular option for those who want additional coverage not offered by original Medicare. In a Medicare Advantage HMO plan, you can receive care from your plans in-network healthcare professionals, but you will need to get a referral to see a specialist.

There are many options for Medicare Advantage HMO plans in each state, including plans with $0 premiums, no deductibles, and low copayments. To enroll in a Medicare Advantage HMO plan, you must already be enrolled in original Medicare.

What Are The Additional Benefits Of Medicare Part C Coverage

Part C plans can offer additional benefits beyond what Original Medicare offers. Medicare Advantage Plans can use rebate dollars paid by Medicare to cover the costs of these benefits . The scope and breadth of these benefits vary depending on your plan, but over 90% of Medicare Advantage Plans in 2022 include some coverage for:

- Eye exams and/or corrective lenses

Other less common additional benefits include:

- Transportation

- Acupuncture

- In-home support

To access any of these additional benefits, you must follow your plans rules, including using network providers and obtaining referrals and prior authorizations. Copays may apply. Beyond routine eye, dental, and hearing exams, most Medicare Advantage Plans provide an allowance for some benefits. For instance, you may receive $150 toward the purchase of eyeglasses if you use an in-network provider. Your benefits and how much you pay are detailed in your plans Evidence of Coverage document.

These additional benefits are not covered by Medicare but are offered as non-covered services by your Medicare Advantage Plan. Your out-of-pocket costs, such as copays, do not apply toward your maximum out-of-pocket spending limit.

You May Like: Is Medical Guardian Covered By Medicare

What Is Medicare Part C Coverage For Outpatient Care

Under Original Medicare, outpatient care is generally covered by Medicare Part B. Outpatient care includes medically necessary services and preventive services to prevent or detect disease. Medicare Part C covers the same benefits as Medicare Part B including:

- Doctor visits

- Laboratory tests and X-rays

Medicare Part C may have different cost sharing amounts for outpatient care than Original Medicare has.

How To Decide If You Need Part D

If you need prescription drug coverage, selecting a Part D plan when you become eligible is often a good ideaespecially if you dont currently have what Medicare considers creditable prescription drug coverage.

Prescription drug coverage that pays at least as much as Medicares standard prescription drug coverage is usually considered creditable, and could be an existing plan you have through an employer or union.

If you dont elect Part D coverage during your initial enrollment periodand youdont have creditable prescription drug coverage, youll probably pay a late enrollment penalty if you decide you want it later. The late enrollment penalty permanently increases your Part D premium.

However, if you do have creditable coverage and keep it, you can generally enroll in Part D later without paying a penalty.

Don’t Miss: What Age Can You Start To Collect Medicare

How Much Does Medicare Part A Cost1

If you or your spouse have worked at least 40 calendar quarters in any job where you paid Social Security taxes, you do not have to pay a premium for Part A.

- Premium: $0 per month

- 2022 Deductible: $1,556 for each benefit period

The 2022 Medicare Part A premium for those who do not qualify for $0 premiums is either $274 or $499 per month, depending on how long you worked and paid Medicare taxes.

Definition Of Medicare Part D

Part D is an optional Medicare benefit that helps pay for your prescription drug expenses. If you want this coverage, you will have to pay an additional premium. Private insurance companies contract with the federal government to offer Part D programs through the Medicare system. For this reason, different plans include different prescription drugs and have different associated costs. Its important to review multiple plans before deciding which plan to buyor if youll buy one at all.

You can buy Medicare Part D only if you also have either Medicare Part A and/or Medicare Part B.

To join a Medicare Advantage plan that offers prescription drug coverage, you must have both Part A and Part B. Not all Medicare Advantage plans offer drug coverage.

You May Like: Does Medicare Part B Cover Hearing Aids

Medicare Part C Insurance Is Usually Limited To In

Medicare Part C plans are usually part of health maintenance organizations or preferred provider organizations .

HMO coverage requires that you choose a primary care doctor who will provide referrals for care from specialists and other covered services. PPO coverage usually allows covered individuals to choose providers and services from a plan network without referrals.

Plans are normally limited in geographic range. When using providers or services out of a plans network, out of pocket costs are usually more expensive.

What Medicare Part C Costs

Out-of-pocket costs vary for Medicare Part C, but will typically include the following expenses:

-

A monthly premium: A large percentage of Medicare Advantage plans charge a $0 premium, but not all of them do.

-

Medicare Part B premium: Youll still be responsible for paying your Part B premium, which is $170.10 per month in 2022. But some Medicare Part C plans pay part or all of your Part B premium as a benefit of the plan.

-

Copays and coinsurance: Different plans charge different amounts each time you see a medical provider, in or out of network.

-

Deductible: The deductible is the amount of eligible medical costs you must pay out of pocket before your plan starts paying for care.

Also Check: What Is Medicare Advantage Premiums Part C

What Does Medicare Part C Cover For Outpatient Care

Medicare Part C generally covers the same outpatient benefits as Medicare Part B that you receive in an outpatient setting in your plans network. Prior authorizations and referrals may apply. Outpatient care includes:

- Diagnostic tests and therapeutic services and supplies, such as x-rays, casts, blood, and lab tests that are received in an outpatient setting

- Outpatient hospital services, such as observation, surgical procedures, emergency care, partial hospitalization for mental health, infusion therapy, and certain screening and preventive services

- Outpatient mental health care, such as individual or group therapy

- Outpatient rehabilitation services, such as physical, occupation, or speech therapy provided in a variety of outpatient settings

- Outpatient substance abuse services, such as individual or group therapy

- Outpatient surgery or other services provided at a hospital outpatient facility or ambulatory surgical center

As with inpatient services, you must follow your plans rules outlined in your Evidence of Coverage document. Cost-sharing is typically structured differently as well. For instance, you may pay a deductible before your plan starts to pay, but most Medicare Advantage Plan carriers offer zero-deductible plans. You may be responsible for copays or coinsurance when you receive services.

Can You Have Both Medicare Part C And Part D

You cant have both parts C and D. If you have a Medicare Advantage plan that includes prescription drug coverage and you join a Medicare prescription drug plan , youll be unenrolled from Part C and sent back to original Medicare.

To help you get specific information on available drug plans and Medicare Advantage plans , the CMS has a Medicare plan finder at Medicare.gov. You have a choice of using this plan finder in either English or Spanish.

Also Check: Is Aquablation Covered By Medicare

What Does Medicare Part C Cover

Part C is also known as Medicare Advantage. Private health insurance companies offer these plans. When you join a Medicare Advantage plan, you still have Medicare. The difference is the plan covers and pays for your services instead of Original Medicare. These plans must provide the same coverage as Original Medicare . They can also offer extra benefits.

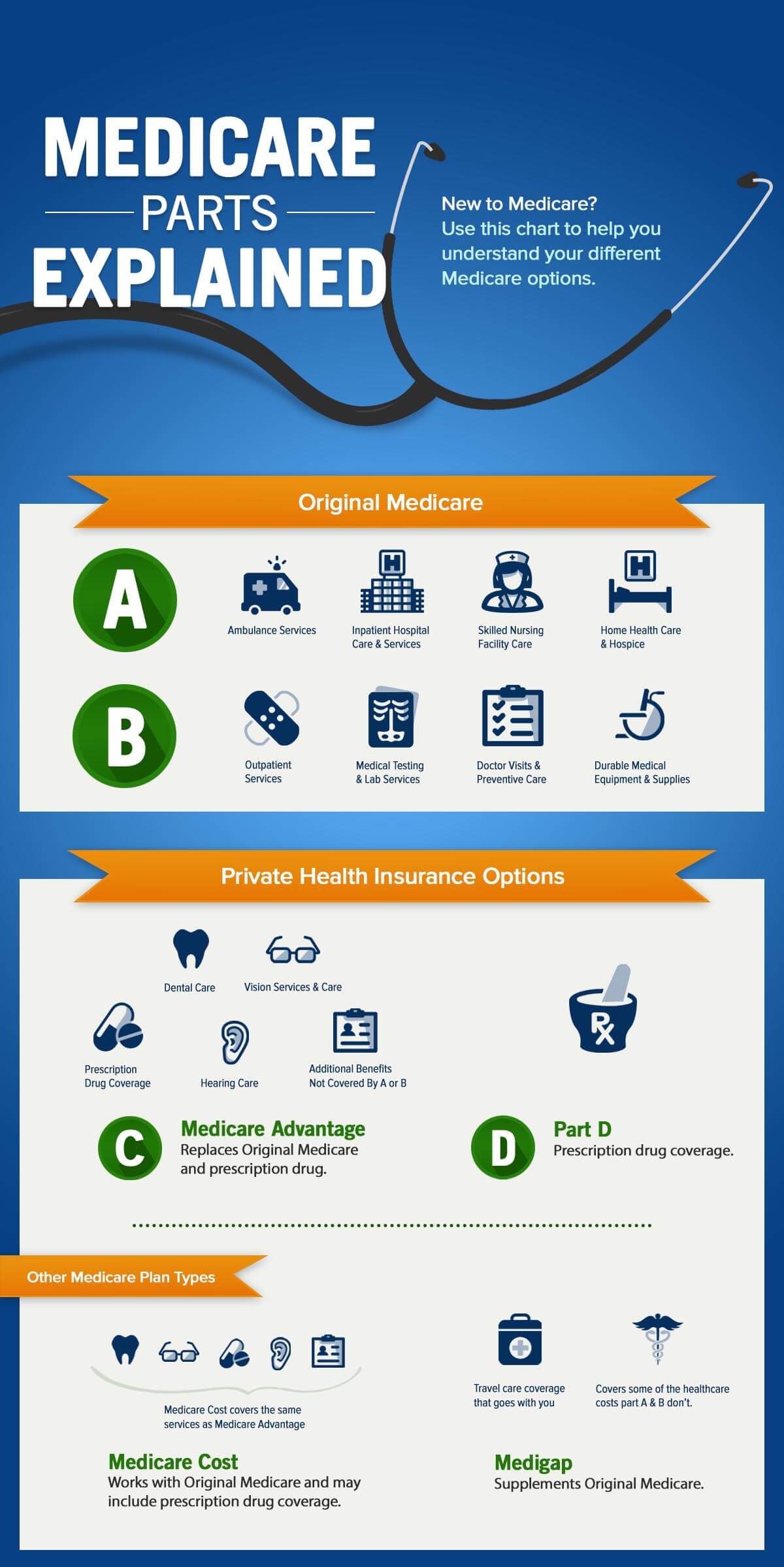

What Do Medicare Parts A B C And D Mean

Who is this for?

If you’re new to Medicare, this information will help you understand the different parts and what they do.

There are four parts of Medicare. Each one helps pay for different health care costs.

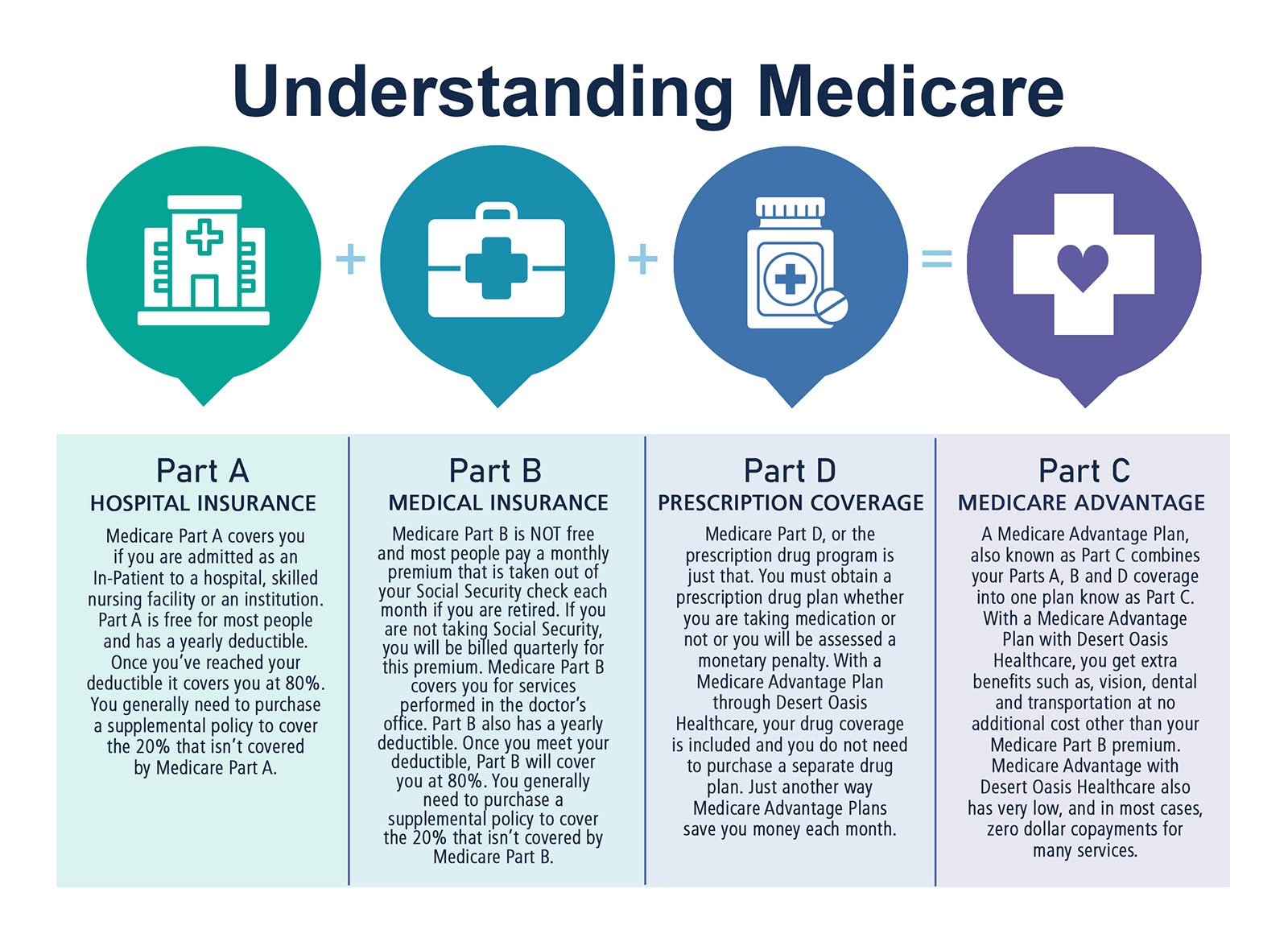

Part A helps pay for hospital and facility costs. This includes things like a shared hospital room, meals and nurse care. It can also help cover the cost of hospice, home health care and skilled nursing facilities.

Part B helps pay for medical costs. This is care that happens outside of a hospital. It includes things like doctor visits and outpatient procedures. It also covers some preventive care, like flu shots.

Parts A and B together are called Original Medicare. These two parts are run by the federal government. Find out more about what Original Medicare covers in our Help Center.

Part C helps pay for hospital and medical costs, plus more. Part C plans are only available through private health insurance companies. Theyre called Medicare Advantage plans. They cover everything Parts A and B cover, plus more. They usually cover more of the costs youd have to pay for out of pocket with Medicare Parts A and B. Part C plans put a limit on what you pay out of pocket in a given year, too. Some of these plans cover preventive dental, vision and hearing costs. Original Medicare doesnt.

You can see a list of the Medicare Advantage plans we offer and what they cover.

Don’t Miss: How Much Does Medicare Part B Cover

How Does Medicare Part D Work

Part D adds prescription drug coverage to your existing Medicare health coverage. You must have either Medicare Part A or Part B to get it. When you become eligible for Medicare , you can elect Part D during the seven-month period that you have to enroll in Parts A and B.

If you dont elect Part D coverage during your initial enrollment period, you may pay a late enrollment penalty that permanently increases your Part D premium.

For Part D coverage, youll pay a premium, a deductible, and copays that differ between types of drugs. Drugs covered by each Part D plan are listed in their formulary, and each formulary is generally required to include drugs in six categories or protected classes: antidepressants, antipsychotics, anticonvulsants, immunosuppressants for treatment of transplant rejection, antiretrovirals, and antineoplastics.

The drugs in the plans formulary may be further placed into different tiers that determine your cost. What tiers are called and what they include can differ between plans, but heres an example:

- Tier 1: The most generic drugs with the lowest copayments

- Tier 2: Preferred brand-name drugs with medium copayments

- Tier 3: Non-preferred brand name drugs with higher copayments

- Specialty: Drugs that cost more than $830 per month, the highest copayments, for years 2022 and 2023.

Beginning in 2022, some plans may offer a second, lower-cost specialty tier.

How To Enroll In Medicare Part D

You can enroll in a Medicare Part D plan during initial enrollment for Medicare parts A and B.

If your prescription drug plan isnt meeting your needs, you can change your Medicare Part D option during open enrollment periods. These open enrollment periods happen twice throughout the year.

Costs depend on the plan you choose, coverage, and out-of-pocket costs. Other factors that affect what you may pay include:

- your location and plans available in your area

- type of coverage you want

- coverage gaps also called the donut hole

- your income, which can determine your premium

Costs also depend on medications and plan levels or tiers. The cost of your medications will depend on which level your medications fall under. The lower the level, and if theyre generic, the lower the copay and cost.

Here are a few examples of estimated monthly premium costs for Medicare Part D coverage:

- New York, NY: $7.50$94.80

- Atlanta, GA: $7.30$94.20

- Des Moines, IA: $7.30$104.70

- Los Angeles, CA: $7.20$130.40

Your specific costs will depend on where you live, the plan you choose, and the prescription medications youre taking.

Read Also: Can You Draw Medicare At 62

Drug Coverage In Medicare Advantage Plans

Most Medicare Advantage Plans include prescription drug coverage . You can join a separate Medicare Prescription Drug Plan with certain types of plans that:

- Cant offer drug coverage

- Choose not to offer drug coverage

Youll be disenrolled from your Medicare Advantage Plan and returned to Original Medicare if both of these apply:

- Youre in a Medicare Advantage HMO or PPO.

- You join a separate Medicare Prescription Drug Plan.

Note: