How Much Does A Medicare Supplement Insurance Plan Cost

- Medigap helps to pay for some of the healthcare costs that arent covered by original Medicare.

- The costs youll pay for Medigap depend on the plan you choose, your location, and a few other factors.

- Medigap usually has a monthly premium, and you may also have to pay copays, coinsurance, and deductibles.

Medicare supplement insurance policies are sold by private insurance companies. These plans help pay for some of the healthcare costs that arent covered by original Medicare. Some examples of the costs that may be covered by Medigap include:

- deductibles for parts A and B

- coinsurance or copays for parts A and B

- excess costs for Part B

- healthcare costs during foreign travel

- blood

The cost of a Medigap plan can vary due to several factors, including the type of plan you enroll in, where you live, and the company selling the plan. Below, well explore more about the costs of Medigap plans in 2021.

So what are the actual costs associated with Medigap plans? Lets examine the potential costs in more detail.

Can I Buy A Medicare Supplement Insurance Plan At Any Time

You can enroll in a Medigap plan or change Medigap plans at any time of the year. However, you may be subject to medical underwriting as part of the application process.The best time to buy a Medigap plan, however, is during your Medigap Open Enrollment period or during another time when you have a Medigap guaranteed issue right. This can help protect you from potentially paying higher Medicare Supplement Insurance costs due to your health.

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Can I Buy A Medicare Supplement Plan At Any Time

If you don’t sign up for a Medicare Supplement Insurance plan when you first become eligible or when you have a guaranteed issue right, you could be subject to medical underwriting.

That means the insurance company selling the plan can base your premium on the status of your health. The worse your health, the higher your premiums might be. Depending on your health, you could even be denied a Medigap plan all together.

If you sign up for a Medigap plan during your Medigap Open Enrollment Period , you do not have to go through medical underwriting.

Your Medigap Open Enrollment Period starts as soon as you are at least 65 years old and enrolled in Medicare Part B.

In addition to your Medigap OEP, there are several Medigap guaranteed issue rights that allow you to sign up for a Medigap plan without medical underwriting. However, your choice of plan type may be limited.

Recommended Reading: How Much Will Medicare Pay For Mental Health Services

What Is The Average Cost Of Medicare Supplement Plans

The benefits of a Medicare Supplement plan are standardized, so the same plan has identical benefits across carriers. However, Medicare Supplement costs such as premiums will vary by the beneficiary. Three of the significant factors that impact your Medicare Supplement rates are your location, age, and gender.

To help you understand how the cost of the same Medicare Supplement plan varies per individual, we include examples of Medicare Supplement rate quotes from three ZIP Codes across the United States, for people of different ages and genders. Please note that all of our examples are for non-tobacco users. If you use tobacco, you can expect to see premiums that are 10% higher.

What Is A Medigap Plan F

Medigap Plan F is a Medicare supplement insurance plan that helps you pay for out-of-pocket expenses associated with Medicare. Its only available for people who have Original Medicare. Medicare Supplement Plans dont work with Medicare Advantage.

However, Medicare Plan F was discontinued as of January. 1, 2020. People who had purchased Plan F before January. 1 were grandfathered in and new plans were eliminated from that point on.

Key Takeaways

- Medigap is supplemental insurance that helps Original Medicare beneficiaries pay out-of-pocket costs.

- Medigap Plan F covers copayments, coinsurance and deductible costs.

- Medicare Supplement Plan F doesnt cover services not covered by Original Medicare, such as eye care, dental, and hearing aids.\

- Medigap Plan F also has a high-deductible option.

- New Medicare members not eligible for Medicare Plan F have other options, such as Plan G, which has similar benefits and costs, except it doesnt cover the deductible.

Also Check: How To Pay For Medicare Without Social Security

Can You Switch Yes But Theres A Catch

Its logical to consider enjoying the cost savings of a Medicare Advantage plan while youre relatively healthy, and then switching back to regular Medicare if you develop a condition you want to be treated at an out-of-town facility. In fact, switching between the two forms of Medicare is an option for everyone during the open enrollment period. This Annual Election Period runs from October 15 to December 7 each year.

Heres the catch. If you switch back to regular Medicare , you may not be able to sign up for a Medigap insurance policy. When you first sign up for Medicare Part A and Part B, Medigap insurance companies are generally obligated to sell you a policy, regardless of your medical condition. But in subsequent years they may have the right to charge you extra due to your age and preexisting conditions, or not to sell you a policy at all if you have serious medical problems.

Some states have enacted laws to address this. In New York and Connecticut, for example, Medigap insurance plans are guaranteed-issue year-round, while California, Massachusetts, Maine, Missouri, and Oregon have all set aside annual periods in which switching is allowed. If you live in a state that doesnât have this protection, planning to switch between the systems depending on your health condition is a risky business.

Choosing Traditional Medicare Plus A Medigap Plan

As noted above, Original Medicare comprises Part A and Part B . You can supplement this coverage with a stand-alone Medicare Part D prescription drug plan and a Medigap supplemental insurance plan. While signing up for Medicare gets you into Parts A and B, you have to take action on your own to buy these supplemental policies.

Read Also: How To Become A Licensed Medicare Agent

Average Cost Of Other Medicare Supplement Plans

The letter plan itself is a factor that affects your Medicare Supplement costs and premium rates. Less popular Medicare Supplement plans are priced differently than the top three. This is due to the lesser benefits they offer. Lets take a look at sample rates for the rest of the Medicare Supplement plans.

Like Medicare Supplement Plan F, Medicare Supplement Plan C is considered first-dollar coverage. This means that the plan begins to pay from the first dollar Medicare does not cover. Thus, the beneficiary pays no out-of-pocket costs.

| Plan C Average Monthly Cost in Las Vegas, NV * |

| Gender: Female, Age: 65 |

Medicare Supplement Insurance Plans

Medicare Supplement Plans can fill the gaps in Original Medicare.

- VII.

Medicare Supplement Plans are standardized plans sold by private insurance companies. These plans are designed to pick up costs where Original Medicare leaves off in coverage. Medicare supplements will only pay for approved Medicare charges. A supplement plan cannot pay on claims declined by Medicare.

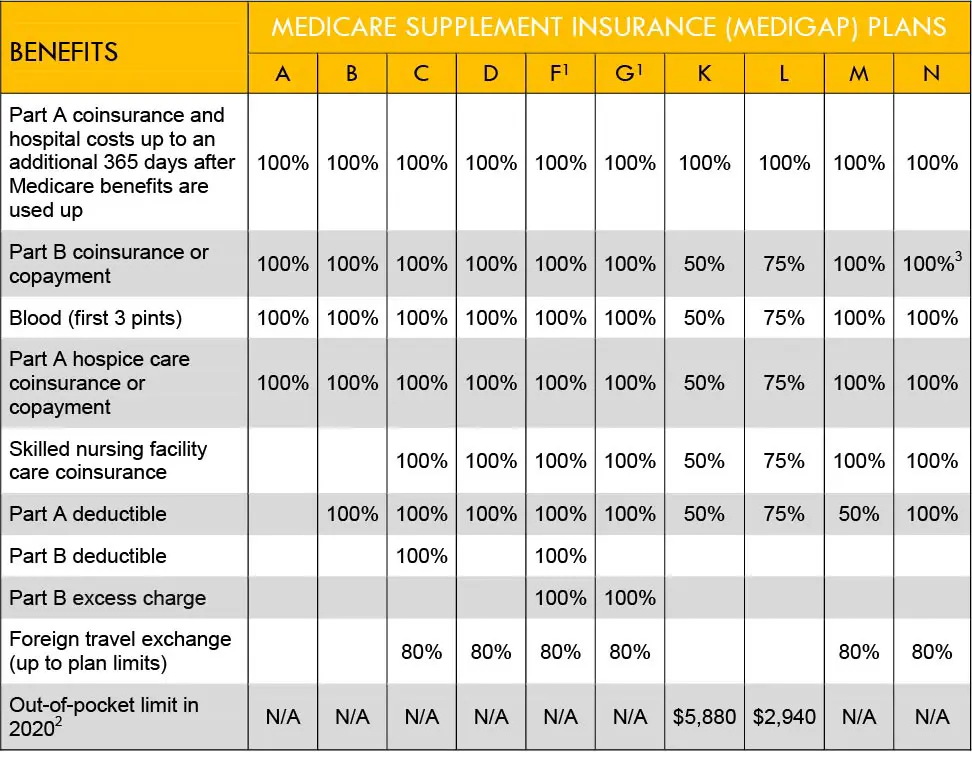

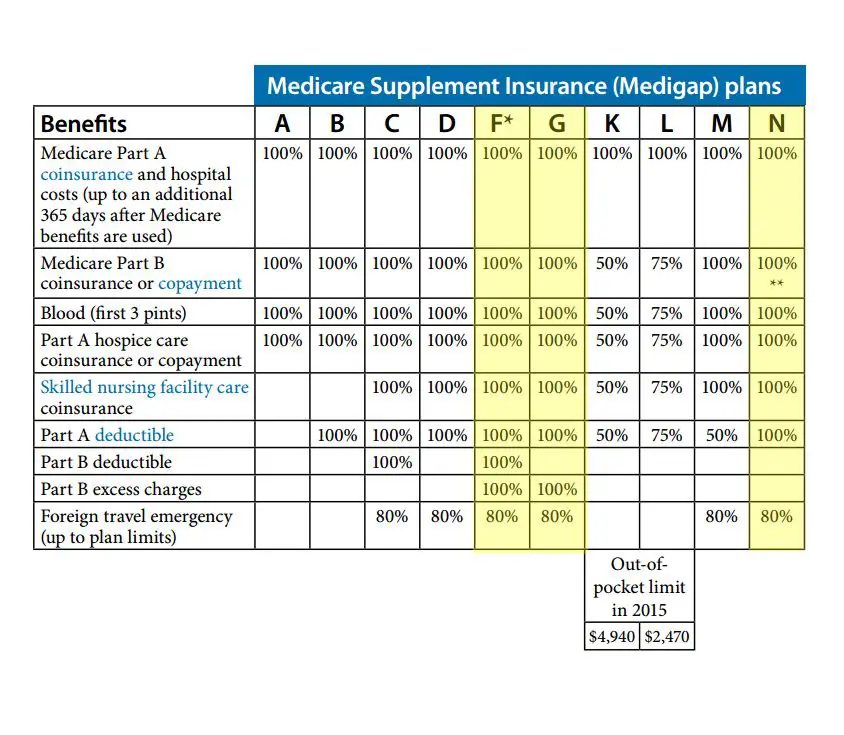

These plans are overseen by state insurance departments and must follow federal and state laws. Plans may cover deductibles for Part A, Part B, copays, coinsurance, and some other out-of-pocket costs. Depending on the type of plan, the cost of Medicare supplement insurance may vary by factors, such as age, ZIP code, plan, smoking status, company and, sometimes, gender.

Don’t Miss: Are Synvisc Injections Covered By Medicare

How To Choose The Best Medicare Supplement Plan

The average cost of a Medicare Supplement plan is $163 per month in 2022. However, rates can vary widely from $50 to more than $400 per month.

The best Medicare Supplement plan for you will depend on which policy provides the best benefits for your medical needs and fills in the coverage gaps where you expect to spend the most on health care.

For example, if you need skilled nursing coverage or want more protection for foreign travel emergencies, then consider how well each plan covers those categories of care. If you expect to need hospital care, a plan that pays for the Medicare Part A deductible can help protect you from a large hospital bill.

Say you need surgery in the upcoming year. For the 2022 plan year, the Medicare Part A deductible is $1,556. Some Medicare Supplement policies, such as Plan A, provide no coverage for this deductible. Therefore, you would be responsible for paying the entire $1,556 out of pocket before your Original Medicare coverage would kick in.

On the other hand, if you choose Medigap Plan G, the $1,556 deductible would be fully covered by your Supplement policy. This means you would begin having your claims covered immediately, rather than first having out-of-pocket costs for medical care. However, you should also consider the cost of the plan since Plan G can be more expensive than Plan A.

What Doesnt Medicare Supplement Plan F Cover

Medicare Plan F wont cover any services not covered under Original Medicare.

Most notably, Medicare Plan F wont cover costs associated with preventative care, like routine doctor visits or prescription drugs. Instead, you need Part D prescription drug coverage to help with prescription costs.

Medicare supplemental insurance, including Plan F, will also not cover the following:

- Eyecare

Don’t Miss: How Much Do You Get From Medicare

Selecting A Medigap Plan: Recent Changes Limit Choices

Medigap policies are private plans, available from insurance companies or through brokers, but not on medicare.gov. They are labeled Plans A, B, C, D, F, G, K, L, M, and N, each with a different standardized coverage set. Plans F and G also offer high-deductible versions in some states. Some plans include emergency medical benefits during foreign travel. Since coverage is standard, there are no ratings of Medigap policies. Consumers can confidently compare insurers prices for each letter plan and simply choose the better deal.

As of Jan. 1, 2020, Medigap plans sold to new Medicare beneficiaries aren’t allowed to cover the Part B deductible.

Before 2020, most people who bought Medigap policies chose Plan F, which gave the most comprehensive coverage, including paying for the Medicare Part B deductible . However, in an effort to trim Medicare expenses, Congress suspended Plans C, F, and High Deductible F for people who become Medicare-eligible in 2020 and beyond.

Plan D and Plan G have similar benefits to Plan C and Plan F, except for not covering the Part B deductible. People who signed up or became eligible for Medicare before 2020 can purchase or continue Plans C or F, though prices may rise and it may be a better deal to switch to a plan that doesnt cover the deductible.

Is There An Alternative To Plan F

Since Plan F has been phased out for newer members, the best alternative is Plan G. Medicare Plan G covers all the same things that Plan F covers, except for the Medicare Part B deductible. Plan G doesnt cover the Part B deductible, which was a selling point with Plan F. The cost of Plan F and Plan G is very similar, so thats a good alternative to Plan F.

Don’t Miss: How To Enroll In Medicare Part B Special Enrollment

What Is The Average Cost Of Medicare Supplement Insurance Plan F

by Christian Worstell | Published January 26, 2022 | Reviewed by John Krahnert

Medicare Supplement Insurance Plan F offers the most benefits of any of the 10 standardized Medigap plans available in most states.

Some Medicare beneficiaries might assume that Plan F is also the most expensive, but an examination of the average cost of Medigap plans reveals otherwise.

You May Like: When Are You Eligible For Medicare Part B

Which Companies Sell Medicare Supplement Insurance In Indiana

Companies must be approved by IDOI in order to sell Medicare Supplement policies. All of the companies listed below have been approved by the state. The plans are labeled with a letter, A through J. Not all companies sell all ten plans. Following each company name and phone number, we have listed the Medicare Supplement plans sold by that company based on the following categories:

- Medicare Supplements for Persons 65 and Older

- Medicare Supplements for Persons Under 65 and Disabled

- Medicare SELECT Insurance Companies

Also Check: Does Medicare Pay For Personal Care Services

How Do You Enroll In Medicare Supplement Insurance

You can buy a Medicare supplement policy anytime enrolled in Part A and Part B. However, there are enrollment periods that offer certain advantages with no underwriting.

The best time to purchase a Medigap plan is during the six-month Open Enrollment Period. It begins on the first day of the month in which you are 65 or older and enrolled in Part B. When you apply for a supplement during this time, you will have guaranteed acceptance and you cannot be charged a higher premium because of health conditions. If you delay enrolling in Part B because of group coverage based on your current employment, the Medigap Open enrollment period wont start until you sign up for Part B.

There may be other enrollment periods that offer similar protections, such as when you leave an employer-sponsored health plan.

Following a few simple steps can make it easy to enroll:

1. Contact a licensed agent in your area for assistance

2. Use Medicare.gov find a plan search tool

3. Contact a plan directly to join

4. Call MEDICARE or 633-4227. TTY users can call 486-2048 .

How Much Does Supplemental Insurance For Medicare Cost On Average

Medicare is the federal health insurance program that covers some medical expenses for people age 65 or older and younger people with disabilities. Yet, the program doesnt cover all medical costs of most long-term care.

Medicare has four main federal components that offer healthcare benefits to retired people or people with disabilities, including Part A, B, C, and D. Whats more, the program also has the Medicare Supplement option, which is private insurance, meant to help with covering out-of-pocket costs such as copays, coinsurance, and deductibles.

Now, if youre enrolled in Medicare, or youve just found out that youll soon be eligible for the program, you may be considering buying a Medicare Supplement Insurance plan as well to help cover your major healthcare costs alongside your Part A and B coverage.

Naturally, you want to find out more about Medicare Supplement insurance and how much you should expect to pay for it. Keep reading below to find out more!

Don’t Miss: Does Medicare Cover Bed Rails

Should I Choose Medigap Plan F

The true cost of a Medigap plan is not limited to just the monthly premium. You may also want to consider how much you will end up spending on out-of-pocket Medicare costs over the course of the year that your Medigap plan doesnt cover.

One potential benefit of choosing Plan F is that it covers many out-of-pocket Medicare costs.

The chart below shows how Plan F compares with of other types of Medigap plans.

| 80% | 80% |

How Much Does Medigap Policy Cost On Average

Now, lets get to the main question that probably everybody interested in getting Medigap has on their minds, what is the average cost of supplemental insurance from MedicareWire?. The average Medicare Supplement policy premium cost $154.50 per month in 2022.

But, theres no easy answer on how much you should expect to pay on the monthly premium on your Medicare Supplement plan. Thats because there are a few factors that can affect premiums, including:

- How much cover you want with your plan.

- The insurance company you buy from.

- Your location.

- Your age.

Lets explore these four factors more and see how they influence Medigap insurance plan costs:

Also Check: Does Medicare Cover Full Body Scans

How Much Does Medicare Plan G Cost

The premium you pay for a Plan G policy may depend on where you live, your gender and depending on when you apply for Plan G your health status. According to MedicareSupplement.com, the average monthly premium for Plan G is $122.78 per month.

Its easy to see how Plan G can quickly save you money, depending on the health care services you need. All those Medicare copays and coinsurance costs for supplies and services can add up quickly.

Donât Miss: Does Medicare Offer Home Health Care

Your Medicare Supplement Plan Costs Include:

- Deductible â The amount you pay before Florida Blue begins to pay its share of the cost.

- Copay â A flat dollar amount you pay each time you receive care.

- Coinsurance â A percentage you pay for your care after you meet your deductible.

- Premium â A fixed, monthly amount you pay for your Medicare supplement plan coverage.

You May Like: Will Medicare Pay For A Tummy Tuck

Medicare Supplement Plan Costs

A Medigap plan can help cover the medical and related out-of-pocket expenses that Original Medicare, Part A and Part B, doesnt cover. For example, theres a cost category called Part B excess charges that some Medigap plans cover. This is the amount that a medical provider is legally allowed to charge, in some situations, thats higher than the Medicare-approved amount.

There are 10 different standardized Medigap available in most states. Each plan is designated by a letter , and benefits are standardized across each plan type. This means that coverage is the same for each plan letter no matter which insurance company you buy from. For example, if you buy a Medicare Supplement Plan F in Athens, GA, its benefits will be the same as a Medicare Supplement Plan F in Fargo, ND. Note that Medicare Supplement plans in Massachusetts, Minnesota, and Wisconsin are standardized differently.

It may be well worth taking the time to compare plans before enrolling in a Medigap plan. Since the benefits are exactly the same for plans of the same letter, the main difference is the cost.

Note: Medigap Plan A, Plan B, Plan C, and Plan D are different from Medicare Part A, Part B, Part C, and Part D, despite the similar-sounding names.

Learning the best time to enroll in a Medicare Supplement plan and how insurers price Medigap premiums can help make sure that you get accepted into a Medicare Supplement plan at a price that may work for your budget.