How Much Does Medicare Cost If You Are Still Working

Most people don’t pay anything for Medicare while they’re still working because if you have health insurance through a job, you can postpone enrolling in Medicare Part B without a penalty. In situations where you’re working part time or are self-employed, you’d typically pay $164.90 per month for Part B, plus any additional coverage options such as Medicare Advantage, Medicare Part D or Medicare Supplement.

Who Needs The Shingles Vaccine

According to the Centers for Disease Control and Prevention , the Advisory Committee on Immunization Practices recommends the shingles vaccine for people aged 50 and older. It is a manufactured inactivated vaccine intended to prevent shingles. The vaccine is administered in two separate doses given by intramuscular injection, separated by two to six months.

The shingles vaccine is considered an important vaccine for seniors because our immune system weakens as we age. The recommendation for vaccination is based on the potential severity of symptoms and long-term complications.

A shingles vaccine called Zostavax is no longer used in the U.S. as of November 2020. If you received that vaccine, the CDC recommends talking with your doctor about getting the Shingrix vaccine.

| The CDCs fact sheet on shingles lists these risks and potential complications: |

|

|

|

|

|

Shingrix is more than 90% effective at preventing shingles, but it does not prevent chickenpox.

How Much Do Urgent Care Offices That Accept Medicare Cost

When you suffer a medical emergency, you might ask, Does urgent care take Medicare? You can find affordable urgent care offices that accept Medicare, but it depends on the office and your Medicare plan.

The Social Security Administration explains more about the various Medicare parts, including the commonly chosen Part A and Part B. Medicare Part B covers all urgent care offices, regardless of whether they take Medicare as payment.

Paying for treatment with Medicare requires paying a standard deductible, which is currently at $148.50 for Part B.

If youre searching for walk-in clinics that accept Medicare near me, be advised that youll pay 20% of all Medicare-approved costs, including all services and tests.

Part C is commonly called Medicare Advantage, and it provides the same coverage as Part A and Part B. Sold through some of the best insurance companies, Part C customers can obtain extra coverages, like vision and dental.

The cost and coverage of Part C depend on the insurance company. Customers will have a specific amount theyll pay when visiting an urgent care office. This amount impacts the total cost from urgent care offices that accept Medicare quotes.

For those traveling abroad, the Medigap plan picks up where Medicare leaves off.

Medigap is supplemental insurance sold by private companies. Customers will receive coverage for the first 60 days theyre out of the country, and the $250 deductible covers 80% of medical expenses.

Recommended Reading: Does Medicare Pay For Ct Scans

Medicare Advantage Special Needs Plans May Have Lower Costs

A Medicare Special Needs Plan is a type of Medicare Advantage plan that is designed specifically for someone with a particular disease or financial circumstance.

Many Medicare SNPs cover most of the qualified health care costs for beneficiaries. All SNPs must include prescription drug coverage.

Some Medicare SNPs are designed for people who are dual-eligible, meaning they are eligible for both Medicare and Medicaid. These plans are commonly called Dual-Eligible Special Needs Plans .

Medicare Advantage Special Needs Plans can also cater more specifically to the needs of people with specific medical conditions, such as:

- Dependence issues with alcohol or other substances

- Autoimmune disorders

- Chronic lung disorders

Some SNPs can also be available to people who live in a long-term care facility such as a nursing home.

Medicare Part B Costs

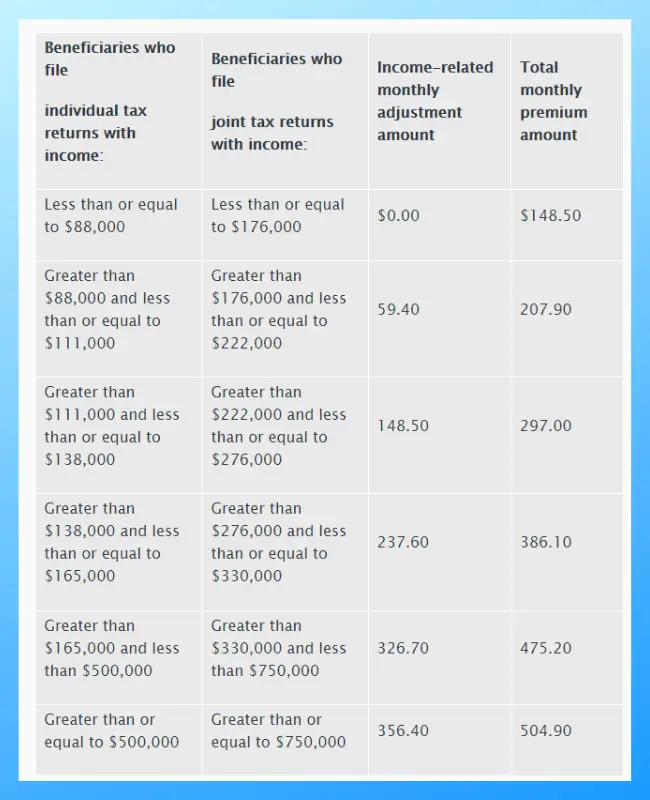

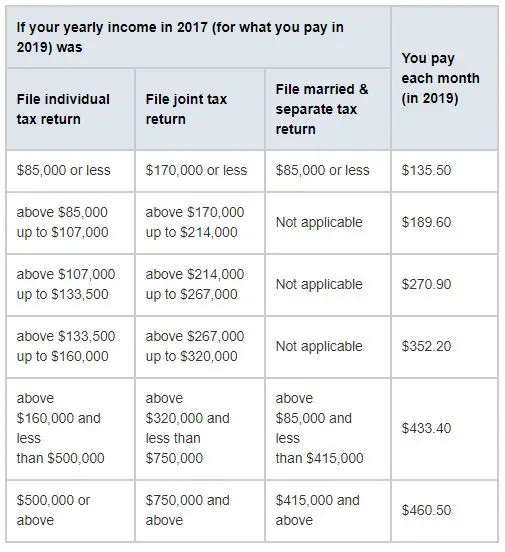

In 2022, there is an annual deductible for Medicare Part B of $233. The monthly premium typically costs $170.10, which is what most people pay.

However, if your income is above a certain amount, you may also pay an income-related monthly adjustment amount . Medicare looks at the gross income you reported on your taxes from 2 years ago. If your annual income exceeds $91,000 as an individual, your monthly premium may include an IRMAA. Married people with combined incomes over $182,000 also pay higher monthly premiums.

The Social Security Administration will send you an IRMAA letter in the mail if it is determined you need to pay a higher premium.

Also Check: Does Aetna Medicare Advantage Have Silver Sneakers

What Are The Different Types Of Medicare

There are four types of Medicare: A, B, C, and D. Part A covers payments for treatment in a medical facility. Part B covers medical services including doctorâs visits, medical equipment, outpatient care, outpatient procedures, purchase of blood, mammograms, cardiac rehabilitation, and cancer treatments. Part C, also known as Medicare Advantage, seeks to cover any coverage gaps. Part D covers prescription drug benefits.

Cost Of Medicare Part B

- Standard cost in 2023: $164.90 per month

- Annual deductible in 2023: $226

For most people, the cost of Medicare Part B for 2023 is $164.90 per month. This rate is adjusted based on income, and those earning more than $97,000 will pay higher premiums.

For high earners, the cost of Medicare Part B is based on your adjusted gross income from your previous year’s taxes. Only about 7% of enrollees will pay these higher rates. If you file joint taxes, then you can double these income levels to figure out what your monthly Part B premium would be. These figures are updated annually by the Social Security Administration .

| Individual income | |

|---|---|

| $500,001 or more | $560.50 |

Those with low incomes can get help paying for Medicare Part B through several government programs including Medicaid, Supplemental Security Income and the Medicare Savings Program.

Besides the monthly premium, enrollees in Medicare Part B are also responsible for paying the deductible.

For 2023, the Medicare Part B deductible is $226, which means you would need to pay $226 before coinsurance benefits would kick in.

If you have Medicare Supplement Plan C or Plan F, the supplemental policy will pay for this Part B deductible. If you have a Medicare Advantage plan, the Part B deductible doesn’t apply because the plan will set its own deductible.

Recommended Reading: Does Medicare Pay For Mens Diapers

Information On The Shingles Vaccine

Although it may start as a rash, the condition called Shingles will lead to a debilitating condition, if it isnt stopped during the early stages. The rashes will be formed in a kind of ailment and they will slowly become agonizing. Many old people go through these symptoms. This particular virus is of the same family as the one causing chickenpox but is a lot more violent in symptoms, causing severe rashes. Thats the main reason why you need to take all of the precautions.

Your doctor can confirm that the virus causing the chickenpox is something you can never get rid of in most cases. It will lie dormant in our bodies. In some particular cases, when a person is affected by shingles it will cause the chickenpox virus to revive. The shingles vaccine is something greatly recommended to people in the age group of forties or older. You should seek the shingles vaccine only if your immune system is within normal parameters and not compromised in such a way that it isnt functioning normally anymore.

You May Like: Who Makes The Best Shingles

Does Medicare Cover Shingles Vaccines In 2022

Shingles is a viral infection caused by the varicella-zoster virus . It produces a painful rash with fluid-filled blisters and typically shows up on one side of the body. The same virus that causes chickenpox causes shingles. Anyone who has had chickenpox in the past is at risk of getting shingles.

Shingles is a painful rash that occurs along the distribution of a nerve, called a dermatome, says Erum N. Ilyas, MD, a fellow of the American Academy of Dermatology and founder of AmberNoon. The virus lays dormant in the nervous system. Immunity likely plays a role in preventing the virus from reactivating. When immunity is low, the virus replicates and spreads down the nerve causing pain, inflammation, and blistering.

The Centers for Disease Control and Prevention recommends that adults older than 50 get the shingles vaccine. Shingles can cause long-term nerve pain and nerve damage. Getting two shingles vaccine doses two to six months apart has proven to be very effective at preventing shingles.

Shingrix is a brand-name shingles vaccine and is currently the only shingles vaccine available in the United States. Zostavax, a previous zoster vaccine, wasdiscontinued in 2020.

Recommended Reading: Do You Always Have A Rash With Shingles

Don’t Miss: How Much For Part B Medicare

Medicare Costs Vary For Medicare Advantage Plans

All Medicare Advantage plans have different Medicare costs including premium, copay, deductible, and coinsurance amounts. The average Medicare Advantage monthly premium is currently $18 in 2023. However, many Medicare Advantage plans across the country have a $0 premium or a low monthly Medicare cost in general.

While this coverage with low Medicare costs can seem appealing to many Americans, you want to be sure that you are looking at the full costs of Medicare including premiums, out-of-pocket costs, and more. Saving on the premium is a great perk. However, these Medicare Advantage plans often come with high maximum out-of-pocket limits, as well as doctor and hospital restrictions.

Due to these hidden Medicare costs and restrictions with Medicare Advantage plans, you might find lower Medicare costs by signing up for a Medicare Supplement plan with a higher monthly premium and lower out-of-pocket costs. You can also use any doctors, as Medicare Supplement plans have no network restrictions.

What Is The Difference Between Original Medicare And Medicare Advantage

Definitions:

- Premium: The monthly fee you pay to have Medicare or your health plan.

- Deductible: What you must pay before Medicare or your health plan starts paying for your care.

- Copayment/coinsurance: Your share of the cost you pay for each service.

- Part A: Medicare hospital insurance for inpatient care.

- Part B: Medicare medical insurance for outpatient care.

- Part D: Medicare drug coverage.

- Medigap: Supplemental insurance that helps pay your out-of-pocket cost in Original Medicare.

Also Check: What Is Medicare Prescription Gap Coverage

Based On Enrollment Decisions For 2019 The Average Monthly Premium For Stand

Figure 5: Average Monthly Premium for Medicare Part D Plans, 2006-2019

In 2019, PDP enrollees are in plans with a weighted average monthly premium of $39.63, a 4 percent reduction from 2018. The average monthly PDP premium amount has remained within a few dollars of this amount since 2010. The combined average Part D premium for PDP and MA-PD enrollees is $29.20 in 2019, a reduction of 8 percent from 2018. The overall Part D premium is lower than the average for stand-alone PDPs due in part to the ability of MA-PD sponsors to use rebate dollars from Medicare payments for benefits covered under Parts A and B to lower their Part D premiums.

How To Apply Online For Just Medicare

Are you within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet? You can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

Don’t Miss: Can You Start And Stop Medicare Part B

Is Medicare Free At Age 65

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Original Medicare And Urgent Care Coverage

If you only have Original Medicare and no supplemental health coverage, youâll be covered for urgent care under Medicare Part B, because urgent care is considered outpatient care.

Medicare Part B has a deductible , and after the deductible is met, you typically pay a 20% coinsurance on the Medicare-approved amount.

So, if you only have Original Medicare, youâd be looking at paying fees up to $183, and then 20% of the fees after that .

You May Like: Does Medicare Part B Cover Specialists

Does Medicare Pay For All Hospital Expenses

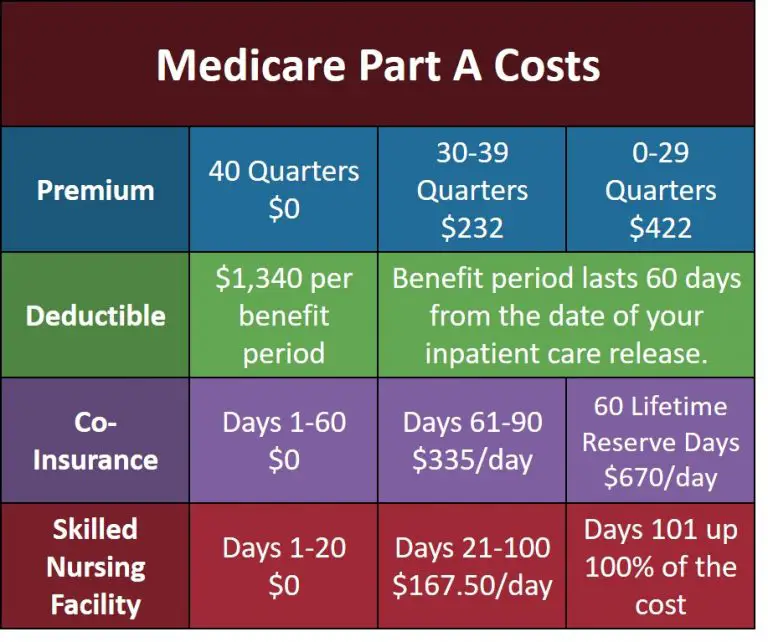

If youâre a hospital inpatient, Medicare Part A generally covers your care for a limited time. A deductible or copay generally applies.

Deductible â The Part A deductible doesnât apply per year, but per benefit period. A benefit period starts when youâre admitted as an inpatient, and ends when you havenât had inpatient care for 60 days. Itâs possible to have two or more benefit periods per year â and you may have to pay the full deductible amount for each benefit period.

In 2023, the Part A deductible per benefit period is $1,600.

Copayment â This amount depends on the length of your inpatient hospital stay. These amounts are for 2023.

- Days 1-60 â You pay $0 per day

- Days 61-90 â You pay $400 per day.

- Days 91 â 150 â You pay $800 per day, until your lifetime reserve days are used up. You get a total of 60 lifetime reserve days, during which Medicare will cover your care except for the copayment.

- Days 151 and up â You pay all costs

Do Medicare Supplement Plans Cover Dental And Vision Care

Medicare supplement insurance, also known as Medigap, provides no dental insurance. Instead, they provide coverage for certain costs a Medicare individual may incur, including the cost of coinsurance. Medicare Advantage isn’t exactly identical. Medigap plans cannot work together with Medicare Advantage plans.

The waiting period for dental and vision plans vary by company. Most common carriers don’t have definite time frames for pre-existing conditions. You can still wait until you get coverage for dental treatments and other medical procedures. How do I find my Medicare plan?

Don’t Miss: How Soon Before Turning 65 Should You Apply For Medicare

How Much Does A Visit To Urgent Care Cost

The average urgent care visit costs between $150 and $200, according to Debt.org, a financial consulting organization serving the public. Factors such as where you receive urgent care and the type of care needed to diagnose and treat your symptoms influence your actual cost.

Urgent care centers are popular because of their convenience. Unlike doctor visits, most urgent care centers dont require appointments, and urgent care centers are usually open on weekends and evening hours.

Many people, with and without health insurance, find urgent care a great option for symptoms that need same-day treatment for a minor injury or illness. Physicians, nurses, and physician assistants typically staff urgent care centers. While they arent familiar with your medical history and prescription medications, as your doctor is, they can diagnose and treat your symptoms in most cases. They typically can provide basic lab and x-ray services and order prescription medications if you need it. They can also advise you if your symptoms warrant an immediate trip to the hospital or a follow-up visit with your regular doctor.

Q: How Much Does It Cost To Go To Urgent Care

A: On average, a trip to an urgent care center will cost you between $50 and $150if you have health insurance. You may pay more than that, though, if your health plan has a high deductible or high copays. Also, youll pay more than that if you dont have health insurance. The kind of care you receive while at an urgent care clinic impacts your final bill, too.

Recommended Reading: Group Homes That Take Medicaid

You May Like: Does Medicare Pay For Psychological Counseling

Do I Have To Make An Appointment

The COVID-19 vaccine requires making an appointment ahead of time at CVS.com. Most other vaccines are available on a walk-in basis. Same-day appointments are often available online. You can also answer the vaccine-specific questionnaire online instead of filling it out in person.

You may want to call ahead to your local CVS Pharmacy and make sure your desired vaccine is in stock. You can also check to see if theres a wait at the store or clinic.

Medicare Doesn’t Cover Most Dental Services

Medicare does not reimburse dental care that is performed every day, including dental cleanings, fillings, and dentures. Medicare Advantage policies cover basic cleanings and radiographs, but typically the annual limit is $1500. It can be covered under either dental coverage or discounts on dental insurance policies. Alternatives to making money on an HSA after completing Medicare include medical insurance and dental insurance. 5 out of 5 stars.

Recommended Reading: Why Do I Need Medicare Part C