What Is Medicare Part B

Medicare Part B | Coverage | Eligibility | Cost | Enrollment | How to save

Medicare can be confusing and sometimes feel like youre staring at a bowl of alphabet soup. Believe it or not, all these letters represent different items. Medicare consists of four partsMedicare Part A, Part B, Part C, and Part D.

Today were going to focus on Medicare Part B and its coverage. Then well discuss Part B eligibility and costs. Finally, well talk about the enrollment process and how you can reduce Part B costs.

Losing Creditable Drug Coverage Through No Fault Of Your Own

If you had a Medicare Advantage plan with prescription drug coverage which met Medicares standards of creditable coverage and you were to lose that coverage through no fault of your own, you may enroll in a new Medicare Advantage plan with creditable drug coverage beginning the month you received notice of your coverage change and lasting for two months after the loss of coverage .

Additionally, if you wish to disenroll from a Medicare Advantage plan with drug coverage and enroll in another form of creditable coverage such as VA, TRICARE or a state pharmaceutical assistance program, you may do so whenever you become eligible for enrollment in the new coverage.

What Is The Medicare Part B Special Enrollment Period

The Medicare Part B SEP allows you to delay taking Part B if you have coverage through your own or a spouses current job. You usually have 8 months from when employment ends to enroll in Part B. Coverage that isnt through a current job such as COBRA benefits, retiree or individual-market coverage wont help you qualify for this SEP, but the SEP lasts for 8 months, so you may still qualify if your employment ended recently.

Don’t Miss: Does Medicare Cover Lung Cancer Treatment

If You Miss Medicare Open Enrollment

If you miss the Medicare open enrollment period you generally cant make any changes to your coverage until the next one rolls around. There are, however, some exceptions. Special Enrollment Periods allow you to update your coverage under certain conditions. You may qualify if you:

- Relocate to an area that isnt in your current plans service area

- Relocate to an area that offers new coverage options for your current plan

- Move into or out of a skilled nursing care facility

- Are released from jail

- Move back to the U.S. after living outside the country

- Leave coverage from an employer or COBRA coverage

- Dropped your coverage in a Program of All-Inclusive Care for the Elderly

- Were but no longer are longer eligible for Medicaid

- Are enrolled in a Medicare Advantage plan or Part D plan that isnt renewed

- Are eligible for both Medicaid and Medicare

- Qualify for the Extra Help program to pay for Medicare Part prescription drug coverage

Those are just some of the situations in which you may be eligible to change your Medicare plan outside of the open enrollment period. You can learn more about special enrollment periods on the Medicare website.

Exceptional Conditions For Medicare Seps

CMS has the legal authority to establish SEPs when a person or group of people meet certain exceptional conditions. Some of these conditions include:

- Individuals making MA enrollment requests into or out of employer-sponsored MA plans

- Individuals disenrolling from an MA plan to enroll in the Program of All-inclusive Care for the Elderly

- Individuals who dropped a Medicare Supplement insurance plan when they enrolled for the first time in an MA plan and are still in a trial period

- Individuals enrolled in a Special Needs Plan who are no longer eligible for the SNP because they no longer meet the specific special needs status

- Non-U.S. citizens who become lawfully present in the U.S.

Also Check: When Is The Medicare Supplement Open Enrollment Period

What Is A Medicare Special Enrollment Period

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

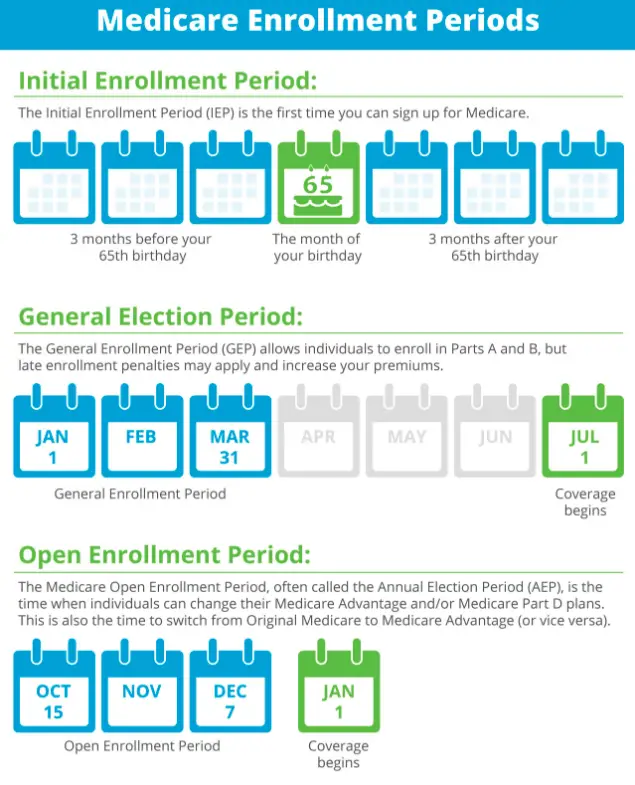

Signing up for Medicare and making changes to Medicare coverage typically happen during specific enrollment periods such as when you’re turning 65 or during Medicares open enrollment period.

But there may be circumstances when you qualify to join Medicare or change Medicare Advantage or prescription drug coverage outside of typical enrollment periods. In those cases, you might be eligible for a special enrollment period or SEP.

Heres what you should know about special enrollment periods.

Is There A Special Enrollment Period For Medicare When Losing Coverage

There are several instances in which you may find you lose your current coverage. When a person loses coverage, that is an indication of eligibility for a Medicare Special Enrollment Period.

You lose employer health coverage

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

When you lose health coverage from an employer or union, you can join a different Medicare plan up to a full two months after.

You lose creditable prescription coverage, or it changes dramatically

Losing drug coverage equal to Medicares means you can switch to another plan with drug coverage or a stand-alone Part D. This Special Enrollment Period continues for two full months after the month you lose your drug coverage, or you get a notification.

You leave a Medicare cost plan

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

If you have Part D through a cost plan and you end up leaving that plan, you can enroll in a new policy for up to two months after you leave your old plan.

Your PACE coverage drops

Dropping your coverage in your PACE plan means you can enroll in a new plan for two months with a SEP.

Also Check: How To Change From Medicare Advantage To Original Medicare

How Long Is Each Special Enrollment Period

How long your special enrollment period lasts will depend on the type of event that qualified you for the period. It typically will last either two months or eight months.

The shorter of the enrollment windows is typically triggered by a qualifying life event. This is any event that causes you to lose your current coverage for example, if you moved and now need to find a new plan or have access to different plans.

Examples of Qualifying Life Events That Trigger a Two-Month Enrollment Period

- You move out of your plans network area

- You move back to the U.S. after living abroad

- You are released from jail

- You no longer qualify for Medicaid or Extra Help

You can also qualify for a longer special enrollment period, which lasts eight months. This period is usually reserved for Americans who stayed in the workforce after they first became eligible for Medicare or had some other form of creditable coverage.

When they retire or lose that coverage, they will then have an eight-month window to enroll in Original Medicare. But its important to remember that, even if you qualify for the eight-month period, you will only have two months to enroll in Medicare Advantage or Part D.

Special Enrollment Periods If You Get Extra Help

- I’m eligible for both Medicare and Medicaid.

-

What can I do?

Join, switch, or drop your Medicare Advantage Plan or Medicare prescription drug coverage.

When?

One time during each of these periods:

If you make a change, it will take effect on the first day of the following month. Youll have to wait for the next period to make another change. You cant use this Special Enrollment Period from OctoberDecember. However, all people with Medicare can make changes to their coverage from October 15December 7, and the changes will take effect on January 1.

- I qualify for Extra Help paying for Medicare drug coverage.

-

What can I do?

Join, switch, or drop Medicare drug coverage.

When?

Most people with Medicare can only make changes to their drug coverage at certain times of the year. If you have Medicaid or receive Extra Help, you may be able to make changes to your coverage one time during each of these periods:

Read Also: Can You Go On Medicare If You Are Still Working

What Qualifies You For A Special Enrollment Period

A Medicare Special Enrollment Period allows you to switch plans or sign up for a Medicare plan outside your standard Medicare enrollment periods. Including outside of the Annual Enrollment Period that occurs October 15th December 7th annually.

There are three primary reasons why you may qualify for a Special Enrollment Period:

The Centers for Medicare and Medicaid Services rates Medicare plans on a scale of 1 to 5 stars, with 5-stars being excellent. Is a Medicare Advantage, Medicare drug plan, or Medicare Cost Plan with a 5-star rating available in your area? If so, you can use the 5-star Special Enrollment Period to switch from your current plan to a 5-star quality rating plan.

Did you delay Medicare enrollment because you had creditable coverage through an employer or other source? Then you may have an 8-month Special Enrollment Period for enrolling in Original Medicare , and expanded Medicare coverage, once you lose creditable coverage.

Find the right Medicare plan for you

What Events Trigger A Special Enrollment Period For Medicare

Medicare is the federal health insurance program designed for people who are 65 years of age or older. It also provides coverage for some younger people with disabilities and people who have end-stage renal disease . When you become eligible for Medicare, you need to decide when to enroll.

You can enroll during the initial enrollment period, which begins near your 65th birthday and lasts for seven months. You can also enroll during the general enrollment period , but you may face late enrollment penalties. If youre already enrolled, you can make changes to your coverage during designated open enrollment periods each year, depending on the type of coverage you have.

But if you need to add or change your coverage outside of these times, you must qualify for a special enrollment period . Several different events can create these enrollment opportunities. Below, youll find which circumstances make you eligible for a special enrollment period, and what Medicare programs you can enroll in.

Read Also: Severe Lower Back And Hip Pain During Period

Read Also: What Is The Best Medicare Supplement Company

What Is A Special Enrollment Period

A special enrollment period, or SEP, is a period when youre allowed to join or make changes to your Medicare coverage based on certain life events, such as leaving a job or moving out of your plans service area. The rules about how long a SEP lasts or what youre allowed to do during the SEP depend on why you qualify for the SEP.

Medicare Supplement Open Enrollment Period

If youre looking to supplement your Original Medicare coverage to help with additional costs, the best time to buy a Medicare Supplement plan is during the six-month enrollment period that starts the first day of the month you turn 65 as long as you have signed up for Medicare Part B.

If you dont sign up for a Medicare Supplement plan during this Open Enrollment Period, you may not be able to buy a Medicare Supplement plan. Unless you have a guaranteed issue right, you may be required to answer medical questions.

You May Like: Is Tori Removal Covered By Medicare

Signing Up For Premium

You can sign up for Part A any time after you turn 65. Your Part A coverage starts 6 months back from when you sign up or when you apply for benefits from Social Security . Coverage cant start earlier than the month you turned 65.

After your Initial Enrollment Period ends, you can only sign up for Part B and Premium-Part A during one of the other enrollment periods.

Column: Medicares Annual Enrollment Period Ends Dec 7

Hello Toni: I retired in April and had a telemarketing agent help me find a Medicare Supplement which began May 1, 2022. No one told me that I had a specific amount of time to enroll in my Medicare Part D plan. I have a serious health issue with Crohns disease and should have enrolled at that time for Medicare Part D.

When I enrolled this September for a new Medicare Part D plan, I was denied because I did not apply on time. I take Stelara which is more than $2,000 a month that I now must pay on my own.

I am 70 years old and was informed that the penalty for not enrolling in a Medicare Part D prescription drug plan will be $.3337 x 60 months, since my Medicare Part A began 5 years ago at 65. I cannot believe that I must pay an extra $20 per month as a Part D penalty.

Please explain this ridiculous Medicare Part D rule and when I can begin my plan. I have not purchased my Stelara since I left my employers health plan. Thank You. Sydney from Atlanta

Sydney: I have good news and bad news, Sydney. The good news: You can enroll in your Medicare Part D plan that covers your expensive Stelara and other prescriptions that you are currently taking during Medicares annual enrollment period from Oct. 15 through Dec. 7. Your effective date will be Jan. 1, 2023, and you can purchase your Stelara on New Years Day if your pharmacy is open.

The LEP penalty for Medicare Part D can be because:

Your company prescription drug benefits were not creditable as Medicare defines it.

Don’t Miss: Do I Need To Keep Medicare Summary Notices

What Happens If I Miss My Initial Medicare Enrollment Period

There are a number of unpleasant consequences you might face if you dont sign up for coverage during your IEP. These apply only if you do not have other creditable coverage, like employer coverage.

Lets break them down:

When can I get Medicare Advantage or Medicare Part D if I miss my IEP?

Theres an Annual Election Period, or AEP, that occurs between October 15 and December 7 each year thats specifically for Medicare Part C and Part D, the Medicare Advantage plans and prescription drug plans. If you miss your initial Medicare enrollment period, you can use the next Annual Election Period to join a plan.During the AEP, you can switch to Medicare Advantage from Original Medicare. You can also change Medicare Advantage plans if youre currently enrolled in one. Should you join a Medicare Advantage plan and later want to leave it, you can use the AEP to return to Original Medicare as well.You can also enroll in a Medicare Part D prescription drug planor switch to a different plan if youre currently enrolled. You can even drop your Part D coverage completely, without penalty, if youve obtained creditable coverage through an employer or other source.

When is the Medicare General Enrollment Period? What happens if you dont enroll in Medicare Part A at 65?

Initial Enrollment Period For Original Medicare And Medicare Advantage

If youre 65 or about to turn 65, youre eligible to join Original Medicare during your Initial Enrollment Period. This seven-month period includes:

- The three months before your birth month

- Your birth month

- The three months after your birthday month

During this time, you can apply for a Medicare Advantage plan if your Original Medicare Part A or B coverage has started and you are paying your Part B premium.

Recommended Reading: Will Medicare Pay For Handicap Bathroom

How To Avoid Part D Late Enrollment Penalties When You Retire After 65

During this Special Enrollment Period, you can enroll in a Medicare Advantage or stand-alone Medicare Part D Prescription Drug Plan. However, the timing is slightly different.

You have 8-months to enroll in Medicare Parts A and B during this Special Enrollment Period. But you only have 60 days to enroll in a Medicare Advantage or Medicare Part D Prescription Drug Plan. If you dont enroll in those first two months, you may face late enrollment penalties for Part D coverage.

Who Is Eligible For A Medicare Special Enrollment Period

In order to qualify for the Original Medicare Special Enrollment Period, you must have been in your Initial Enrollment Period , General Enrollment Period or another Special Enrollment Period between March 17 and June 17 and did not submit an enrollment request to the Social Security Administration.

In other words, if you were eligible to enroll in Medicare Part A or Part B for the first time at any point between March 17 and June 17 but did not do so, you may be eligible for this Special Enrollment Period.

In order to qualify for the Special Enrollment Period for Medicare Advantage, Medicare Part D and Medicare/Medicaid plans, you must have had a valid enrollment period between March 17 and June 30 and did not make any changes to your coverage at this time.

Valid enrollment periods include your IEP, another Special Enrollment Period or the Medicare Advantage Annual Enrollment Period that occurs each fall.

| For either enrollment period, it is not required to show any proof that you failed to take enrollment action due to COVID-19. Qualification is based on the above criteria. |

Recommended Reading: Does Aetna Medicare Advantage Cover Dental

Do You Automatically Get Medicare With Social Security

Once you have received Social Security disability benefits for two years, you will generally be automatically enrolled in Original Medicare, Parts A and B.

Beginning 24 months after the month you were eligible for disability benefits, you will be covered by Medicare. In certain situations, this may have happened before the month in which you got your first check.

Medicare eligibility requires that you have been a citizen of the United States for at least five consecutive years or a legal permanent resident.