How To Enroll In The Right Cigna Medicare Supplement

If youve been interested in the Cigna Medicare supplement Plan N, or any plan whatsoever, but you havent enrolled, its likely because youve had limited exposure to The Health Exchange Agency. We function as a broker with Cigna Medicare insurance to provide you with the benefits that youve been looking for. The best Cigna Medicare supplement is not a one size fits all option. With Cigna Medicare insurance, youll be finding yourself looking at a number of valuable plans. The Health Exchange Agency works to provide you with the Cigna Medicare supplemental insurance youve been looking for by pairing you with a specialist who can walk you through each step of the Medicare enrollment journey. By communicating with your counselor on your health care needs and what you see for your future, we are able to pair you with the Cigna Medicare supplemental insurance plan that is best suited for you and your goals.

Get Started Today

- Compare Cigna Medicare Insurance plan options

- Start saving on monthly premiums

- Be confident in your Cigna Medicare Supplement coverage

Selecting A Medigap Plan: Recent Changes Limit Choices

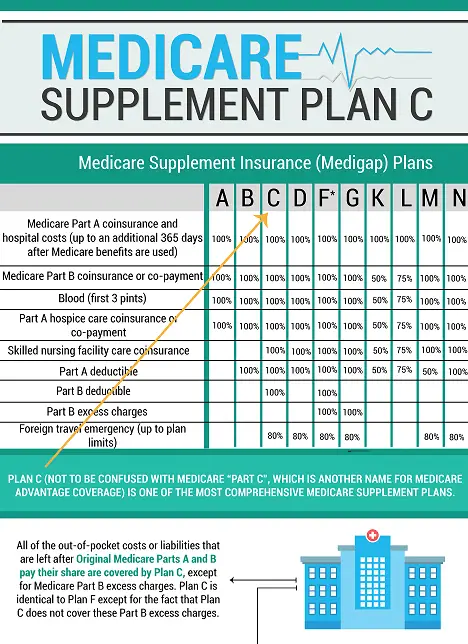

Medigap policies are private plans, available from insurance companies or through brokers, but not on medicare.gov. They are labeled Plans A, B, C, D, F, G, K, L, M, and N, each with a different standardized coverage set. Plans F and G also offer high-deductible versions in some states. Some plans include emergency medical benefits during foreign travel. Since coverage is standard, there are no ratings of Medigap policies. Consumers can confidently compare insurers prices for each letter plan and simply choose the better deal.

As of Jan. 1, 2020, Medigap plans sold to new Medicare beneficiaries aren’t allowed to cover the Part B deductible.

Before 2020, most people who bought Medigap policies chose Plan F, which gave the most comprehensive coverage, including paying for the Medicare Part B deductible . However, in an effort to trim Medicare expenses, Congress suspended Plans C, F, and High Deductible F for people who become Medicare-eligible in 2020 and beyond.

Plan D and Plan G have similar benefits to Plan C and Plan F, except for not covering the Part B deductible. People who signed up or became eligible for Medicare before 2020 can purchase or continue Plans C or F, though prices may rise and it may be a better deal to switch to a plan that doesnt cover the deductible.

What Is Medicare Part C

A Medicare Advantage Plan is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called Part C or MA Plans, are offered by private companies approved by Medicare.

If you join a Medicare Advantage Plan, the plan will provide all of your Part A and Part B coverage. Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or health and wellness programs. Most include Medicare prescription drug coverage .

Medicare pays a fixed amount for your care every month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare. However, each Medicare Advantage Plan can charge different out-of-pocket costs and have different rules for how you get services . These rules can change each year.

Don’t Miss: Which Insulin Pumps Are Covered By Medicare

How Much Does Medigap Plan C Cost

Medicare Supplement Plan C could cost somewhere between $120 to $220 monthly. But the cost of a Medigap policy varies depending on many different factors.

If the premium is a concern, consider comparing quotes with one of our licensed Medicare Specialists that can help you identify the policy that provides the most value for your situation.

What Is Medicare Supplement Plan C

In general, Medicare Supplement plans can help you significantly reduce or eliminate your bills so that you can focus on getting quality healthcare when you need it. Medicare Supplement Plan C covers most of the out-of-pocket costs left from Original Medicare that youd otherwise be responsible for. However, many carriers dont offer Plan C, and you may not be eligible to purchase it.

If you didnt become eligible for Medicare before January 1st, 2020, you wont be able to apply for Medigap Plan C. You can confirm when you became eligible by looking at the Part A start date on your Medicare card. However, if you cant get Plan C, you have other options. Medigap Plan G offers similar coverage, and is typically available at a lower premium than Plan C. Because of this, it may be a better option for you regardless of whether or not youre eligible for Plan C.

Don’t Miss: Is Allergy Testing Covered By Medicare

What Is Medicare Supplement Insurance Plan C

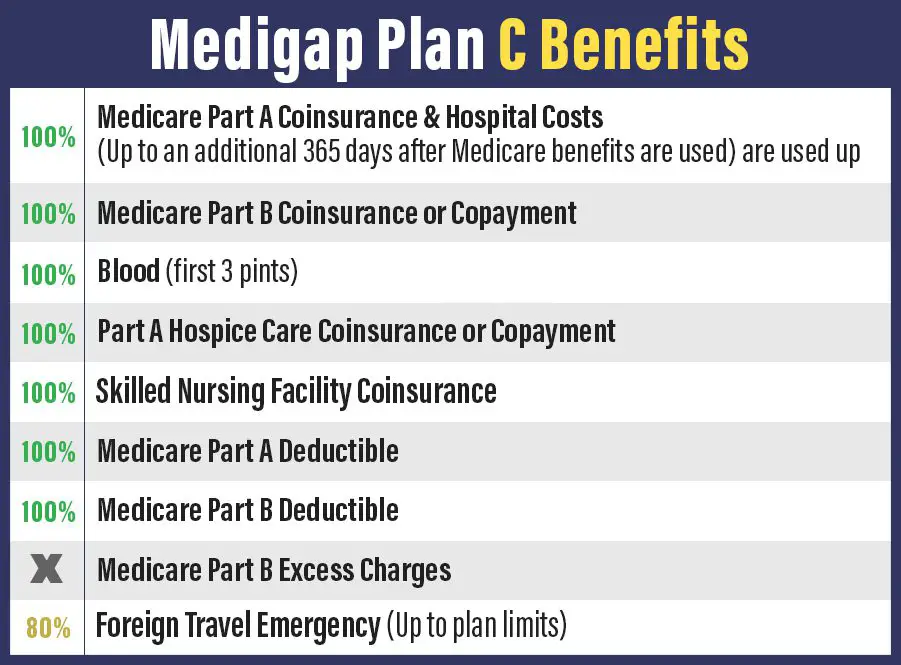

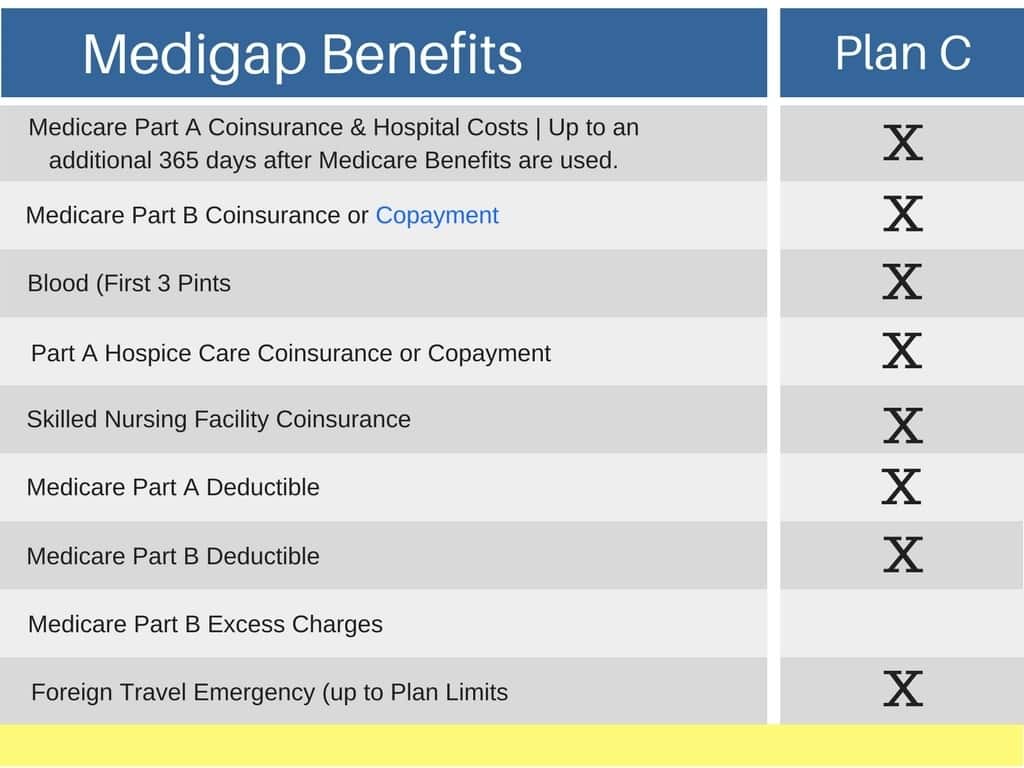

Medicare Supplement Plan C offers coverage for 8 of the 9 available Medigap benefits. Medigap Plan C may work well for individuals who need frequent medical care. Medigap Plan C basic benefits include:

- Medicare Part A hospital coinsurance and hospital costs

- Medicare Part B coinsurance or copayment coverage

- Medicare Parts A and B blood deductibles

- Medicare Part A hospice care coinsurance or copayment

- Medicare Part A deductible

- Skilled nursing facility care coinsurance coverage

- Foreign travel emergency coverage

Medicare Supplement Insurance Plan C Doesnt Cover Everything

Medicare Supplement Insurance Plan C does not offer any coverage for Medicare Part B excess charges.

Doctors who do not accept Medicare assignment reserve the right to charge up to 15 percent more than the Medicare-approved amount for services and items they provide. These costs are called excess charges.

Other Medicare Supplement Insurance plans may cover some or all of the benefits listed above, either partially or in full. Medicare Supplement Insurance Plan F, for example, covers all of them, including Medicare excess charges.

Also Check: Is It Medicaid Or Medicare

When To Sign Up For Medicare

As you approach age 65, its important to know which enrollment deadlines apply to your circumstances. Begin by checking on your eligibility. To avoid costly penalties and gaps in coverage, most people should for Medicare Part A and Part B in the seven-month window that starts three months before the month you turn 65 and runs for another three months following your 65th birthday.

If you currently get Social Security, you will be automatically enrolled if not, you need to sign up either online or at your Social Security office.

Keeping Your Coverage If You Move

If you are moving to another county or state, make sure your Medicare plan will still be in effect after you move.

If you have original Medicare, federal rules usually allow you to keep your Medicare supplement policy. There are exceptions to this if you have a Medicare Select plan or if you have a plan that includes added benefits, such as vision coverage or discounts that were available only where you bought the plan.

If you have a Medicare Advantage plan, ask the plan whether its available in your new ZIP code. If the plan isnt available, youll have to get a new one. You can switch to another Medicare Advantage plan in your new area or to original Medicare.

Also Check: How Much Does A Medicare Supplement Cost Per Month

What Is Medicare Advantage

Medicare Advantage takes the place of Original Medicare.

Medicare Advantage plans are managed by private companies that supply health insurance according to strict Medicare rules. To keep costs down, your provider must be inside of a defined network. These savings are passed on to you in the form of low out-of-pocket expenses for in-network primary care visits and prescriptions.

What Does Medicare Supplement Plan C Cost

The average premium cost for Medicare Supplement Insurance Plan C in 2018 was $189.88 per month.1

Its important to note that Medigap plan costs may vary based on factors such as age, gender, your health, how your insurance carrier rates its plans and where you live.

Medigap Plan C costs may also vary based on when you enroll.

The average cost listed above includes Medigap Plan C options that may offer lower premiums than what is listed, as well as some plans with higher premium costs.

Don’t Miss: What Is The Medicare Out Of Pocket Maximum

When To Enroll In Medicare Supplement Plans

When youre first eligible: The best time to enroll in a Medicare Supplement plan is when youre first eligible. You are eligible to purchase a Medicare Supplement policy on the first day of the month in which you turn 65. This marks the beginning of your Medigap Open Enrollment Period which lasts for six months.

You must already be enrolled in Medicare Part A and Part B at this time. During this period, you can buy any Medigap policy sold in your state, regardless of any health issues. And youll generally see better prices and more choices among Medigap policies during this period.

Outside open enrollment: While its often better to get coverage when youre first eligible, you can still apply for Medigap insurance after your initial enrollment period. However, if you apply for coverage after your initial enrollment period, theres no guarantee that an insurance company will sell you a policy if you dont meet the medical underwriting requirements.

What Does Medicare Supplement Plan A Cover

Medicare Supplement Plan A is not the same as Medicare Part A, but is one of the Medicare Supplemental insurance plans available to Medicare beneficiaries. It is a basic plan that covers:

- Medicare Part A coinsurance payments up to an additional 365 days after Original Medicare benefits are exhausted

- Medicare Part B copayment or coinsurance expenses

- The first three pints of blood used in a medical procedure

- Part A hospice care coinsurance expense or copayment

Medicare Supplement Plan A has the fewest individual benefits of the ten standardized Medicare Supplement insurance plans available in most states.

Among the Medicare out-of-pocket costs not covered is the Part A deductible for inpatient hospital stays.

In 2021, the Medicare Part A deductible is $1,484. Medicare Part A covers inpatient hospital care, skilled nursing facility care, hospice care, and certain home health-care services. If you expect to use many of these services and want to avoid the deductible, you may want to consider a Medicare Supplement plan that covers the Part A deductible. Out of the 10 standardized Medigap plans, Medicare Supplement Plans B, C*, D, F^, G, and N fully cover the Medicare Part A deductible. Medicare Supplement Plans K, L, and M also provide partial coverage for the deductible.

If a health insurance company wishes to offer Medigap coverage, then it must at least offer the basic Medigap Plan A and its benefits.

Recommended Reading: How Much Is Medicare Plan B

What Does Medicare Supplement Insurance Plan C Cost

The cost for Medicare Supplement Insurance Plan C depends on the insurance carrier, age, location, gender, and tobacco use. You may also be responsible for paying additional fees, such as hospital coverage that extends beyond the covered period. Foreign travel is covered under this insurance plan, but it will cost you a deductible of estimating $250. After that, youll get 80% travel coverage up to a limit of $50,000.

With a generous enrollment period and coverage for nearly all of lifes medical expenses, Medicare Supplement Plan C is one of the most popular types of insurance plans for seniors. If you want to know more about the plan or get a quote, call Plan Medigap at today.

Cigna Vs Competitor Medicare Supplement Carriers

We compared Plan G rates in Virginia for Cigna, AARP and Anthem Health Plans of Virginia. For the most part, premiums increase over time for the companies due to the use of âattained ageâ rating, which is allowed in Virginia.

As you can see, Cigna has the highest rates among the three companies except for the 75-year-old age group. However, when moving from age 75 to age 85, Cigna rates increase greatly versus a smaller price jump for AARP and no increase at all for the Anthem plan. Ultimately, you will pay a considerably higher rate for Cigna at age 85 versus the other plans shown here.

Cigna offers the below Medigap options in Virginia and confirms that premiums will increase yearly as a memberâs age increases.

| Plan name |

|---|

Read Also: Can You Change Medicare Part D Anytime

Read Also: What Does Medicare Pay On Cataract Surgery

What Is Medigap Plan C What You Need To Know

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Medigap Plan C is one of 10 Medicare Supplement Insurance plans that assist with some out-of-pocket expenses not met by Original Medicare.

However, Plan C is no longer available to most new enrollees. If you’re new to Medicare and arent eligible for Plan C, there are other Medigap alternatives for you.

What Doesnt Medigap Plan C Cover

The only benefit not included in Medigap Plan C is coverage for Medicare Part B excess charges. Excess charges are additional expenses you may have to pay for if the doctor or provider you use doesnt accept assignment meaning they wont accept the Medicare-approved amount as full payment for covered services.

The difference between what Medicare pays for a certain medical service, and what your doctor or provider charges for it, is the Medicare Part B excess charge, which youre responsible for paying out-of-pocket. In some cases, you may be charged up to 15% more than the Medicare-approved amount for a service.

You can avoid Medicare Part B excess charges by choosing doctors who agree to accept assignment, which can be found using Medicare’s Physician Compare tool.

To see how the basic benefits of Medicare Supplement Insurance Plan C coverage compares to those of other Medigap plans, refer to the chart below.

| 80% | 80% |

* Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

2 Plan K has an out-of-pocket yearly limit of $6,620 in 2022. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

Recommended Reading: Does Medicare Plan F Cover Acupuncture

Is Medigap Plan C And Medicare Part C The Same

Plan C is often mistaken with Medicare Part C, also known as Medicare Advantage, but the two are very different. Medigap Plan C is supplemental insurance for people who have Original Medicare. Medicare Part C is a private health insurance alternative to Original Medicare.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

- Was this article helpful ?

When Can You Enroll In Medicare Supplement Plan C Insurance

To get Plan C Medicare Supplement coverage, you must be at least 65 years old and have Medicare Part A and B. When you turn 65, the best time to enroll in any Medicare Supplement would be during the Medigap Open Enrollment Period. This period begins the month you turn age 65 and enrolled in Medicare Part B.

You May Like: Is There A Charge For Medicare Part B

Do Medicare Supplement Plans Cover Pre

While insurance companies cant make you wait for your coverage to start, they may make you wait for coverage for a pre-existing condition. Coverage for pre-existing conditions can be excluded if the condition was treated or diagnosed within 6 months before the coverage starts under the Medicare Supplement plan.

After the 6-month period, the Medicare Supplement plan will cover the condition that was excluded. However, it is possible to avoid or shorten the waiting period for a pre-existing condition if you buy a Medicare Supplement plan during your Medigap open enrollment period to replace creditable coverage Medigap plan.2

What Happened To Medigap Plan C In 2020

Plan C is one of the more comprehensive standardized Medigap plans. Plan C offers coverage for all of the standardized Medigap benefits except for Part B excess charges.

Due to recent legislation, Plan C is not available for sale to Medicare beneficiaries who become eligible for Medicare on or after January 1, 2020.

If you became eligible for Medicare before Jan. 1, 2020, you may still be able to enroll in Plan C after that date .

If you are enrolled Plan C before Jan. 1, 2020, you may be able to keep your Plan C coverage going forward .

You May Like: What Is Medicare Red White And Blue Card

Medicare Part B Coinsurance Or Copayment

Medicare Part B helps cover costs for things like doctors appointments, medical devices and preventive care.

After you meet your Medicare Part B deductible , you are typically responsible for a coinsurance or copay of 20 percent of the Medicare-approved amount for covered services.For example, if you suffer a foot injury and need to use a wheelchair, Part B will help cover 80 percent of the cost of your wheelchair . For illustration purposes, if it costs $800 to buy the wheelchair and Medicare Part B covers it as durable medical equipment , your Part B coinsurance cost would be $160.

Medigap Plan C would fully cover your $160 Part B coinsurance.

Plan C In 2022 And Beyond

Effective Jan. 1, 2020, Section 401 of the Medicare Access and CHIP Reauthorization Act stipulates that newly eligible Medicare beneficiaries are unable to sign up for a Medicare Supplement Insurance plan that covers the Medicare Part B deductible . The only two plans that cover the Part B deductible are Plan C and Plan F.

Beneficiaries who already have Plan C or Plan F prior to 2020 will be able to keep their plans. Beneficiaries who came eligible for Medicare prior to 2020 may be able to buy Plan C and Plan F if they are available where they live after Jan. 1, 2020.

If you become eligible for Medicare in 2020 and beyond, Medicare Supplement Plan C and Plan F will no longer be options.

Read Also: Can You Have Humana And Medicare