What Is The Medicare Open Enrollment Period

The Medicare Annual Enrollment Period can feel like a chaotic time for many of those on Medicare. Many worry that they may enroll into the wrong plan or not realize the changes happening to their current plan. Its all too easy to misunderstand the rules or forget to check whether a certain doctor is in the network. Those enrolled in Medicare Advantage plans sometimes find themselves stuck in a plan that they do not like, due to mistakes like these. The Medicare Open Enrollment Period is designed specifically to help Medicare beneficiaries in these situations.

What Changes Are Off Limits With The New Medicare Advantage Open Enrollment Period

Not all 2022 Medicare Advantage plans will have the new benefits, and there may be benefit caps and other rules that apply for those that do. For example, plans may limit the non-medical transportation to 20 trips a year and require you to use certain providers before benefits apply.

During the new Open Enrollment Period for Medicare Advantage, you generally cannot:

- Sign up for a Medicare Advantage plan when youâre not already enrolled in one. In other words, you can switch plans, but not get one for the first time.

- Sign up for a stand-alone Medicare Part D prescription drug plan . But suppose youâre losing this type of coverage by dropping a Medicare Advantage prescription drug plan . You might be able to sign up for a PDP in these cases.

- Switch from one stand-alone Medicare Part D prescription drug plan to another.

The Medicare Advantage Open Enrollment Period doesnât apply to other types of Medicare health plans, such as Medicare Savings Accounts, Medicare Cost plans, or the PACE program .

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealthâs Medicare related content is compliant with CMS regulations, you can rest assured youâre getting accurate information so you can make the right decisions for your coverage.Read more to learn about our Compliance Program.

When Can I Enroll In Medicare Part D

The first opportunity for Medicare Part D sign up is when youre initially eligible for Medicare during the seven-month period beginning three months before the month you turn 65, or during the seven-month period beginning three months before your 25th month of disability.

In both of these cases whether youre turning 65 or are eligible for Medicare because of a disability you likely have the option of selecting a Medicare Advantage plan that includes Part D prescription drug coverage, and using that in place of Medicare A, B, and D.

If you enroll in Medicare during the , you can enroll in a Medicare Advantage plan between April 1 and June 30. But if you already had premium-free Medicare Part A and youre just using the General Enrollment Period to sign up for Part B, youll have to wait until the fall open enrollment period to sign up for a stand-alone Part D plan. This is because Part D can be purchased when you have Part A or Part B, whereas Medicare Advantage requires you to have both. So if youve already had premium-free Part A, you were eligible for Part D as of when your Part A coverage took effect. But your eligibility for Medicare Advantage would only begin when youre enrolled in both Part A and Part B.

If youre enrolled in a Medicare Advantage plan and use the Medicare Advantage open enrollment period to switch to Original Medicare, youll also have the option to sign up for a Part D plan to supplement your Original Medicare coverage.

Don’t Miss: What Does Medicare A And B Not Cover

Let The Medicare Helpline Help You Better Understand The Medicare Advantage Open Enrollment Period

Our licensed insurance agents can provide side-by-side coverage comparisons to make it easier for you to decide which Medicare plan is right for you. Dont miss out on the benefits you deserveget started by entering your zip below.

Privacy Policy | Terms of Service

The Medicare Helpline is a licensed and certified representative of a Medicare Advantage organization and a stand-alone prescription drug plan with a Medicare contract. Enrollment in any plan depends on contract renewal. By completing the contact form above or calling the number listed above, you will be directed to a licensed sales agent who can answer your questions and provide information about Medicare Advantage, Part D or Medicare supplement insurance plans. Availability of carriers and products are dependent on your resident zip code.

The purpose of this communication is the solicitation of insurance. Contact will be made by an insurance agent/producer or insurance company. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and in some states to those under age 65 eligible for Medicare due to disability or End Stage Renal disease. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program.

1https://www.medicare.gov/your-medicare-costs/get-help-paying-costs/find-your-level-of-extra-help-part-d

Initial Coverage Election Period

Another Medicare enrollment period is the Initial Coverage Election Period. The ICEP is your first opportunity to choose a Medicare Advantage plan instead of Original Medicare.

During the ICEP, you can also sign up for prescription drug coverage.

If you enroll in Part B when you turn 65, your ICEP is the same as your IEP. When you join later, your ICEP is the three months before your Part B coverage takes effect.

- If youre newly eligible for Medicare because you turned 65, you can sign up for a Medicare Advantage Plan or Prescription Plan.

- When on Medicare because of a disability, you can select a Medicare Advantage Plan or Medicare Drug Plan. Medicare coverage begins 24 months after SS or RRB disability benefits.

- If youre already eligible for Medicare because of a disability and you turned 65, you can sign up for a Medicare Advantage Plan or a Prescription Drug Plan.

- You can also switch from your current Medicare Advantage or Prescription Drug Plan to another plan.

- Additionally, you can drop a Medicare Advantage or Prescription Drug Plan altogether. If you sign up for a Medicare Advantage Plan during this time, you can drop that plan during the next 12 months and return to Original Medicare.

Don’t Miss: What Insulin Pumps Does Medicare Cover

How Do I Enroll In Medicare Advantage

To join a Medicare Advantage Plan, you will need to have Original Medicare coverage and live in an area where an Advantage plan is offered.

A Medicare Advantage plan will wrap your Medicare Part A and Part B coverage into one plan. But youll still have to pay the government a premium for Part B, in addition to the premium you pay for Medicare Advantage .

You can enroll in a Medicare Advantage plan when youre first eligible for Medicare, or during the annual Medicare open enrollment period in the fall .

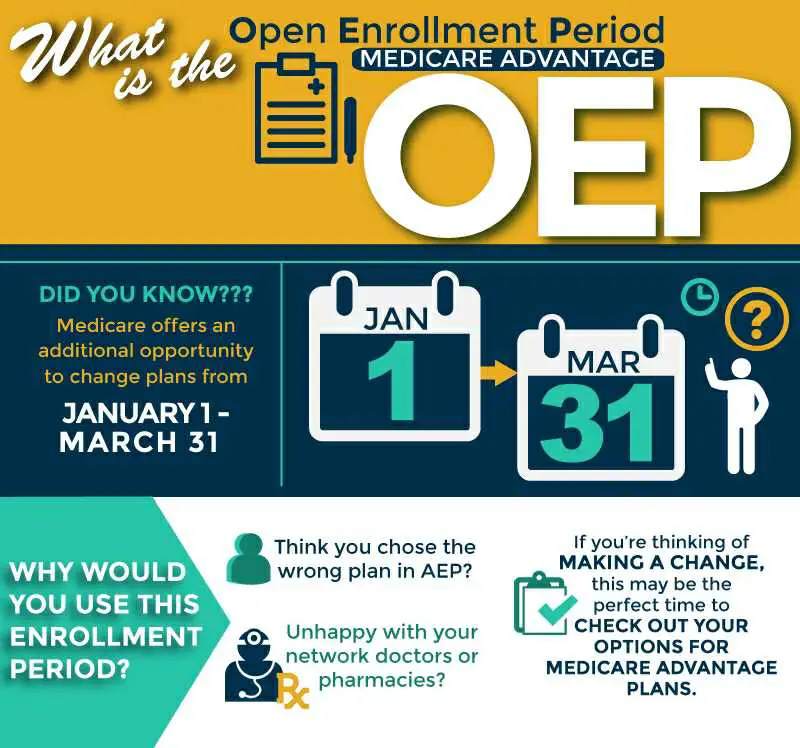

What Is The Medicare Oep

In 2019 the Centers for Medicare and Medicaid Services changed the rules, allowing Medicare beneficiaries to use a period called the Medicare Advantage Open Enrollment Period to make a one-time change at the beginning of the calendar year.

This Medicare Advantage Open Enrollment Period is not new. It used to be a regular enrollment period before the ACA legislation discontinued it. The ACA law signed in 2010 ended the Medicare OEP and replaced it with a Medicare Advantage Disenrollment period. This period ran from January 1st to February 14th. During this time Medicare Advantage enrollees could only go back to Original Medicare. They werent allowed to change from one Medicare Advantage plan to another.

That has now changed, allowing this to go back to the way before the ACA legislation. Lets take a look at what changes you can make in the 2022 Medicare OEP.

Read Also: How Does Medicare Work For Nursing Homes

What Can You Not Change During Open Enrollment

You typically cannot change Medigap plans during the fall open enrollment period.

There are typically only three situations in which you can change your Medigap policy:

- Within your six-month Medigap open enrollment period

- If you are eligible under specific circumstances such as the policy provider becomes insolvent

- If you have guaranteed issue rights

But if you are switching from Medicare Advantage to Original Medicare, you may be able to buy a Medigap policy. However, the company may deny you a plan if you fail its medical underwriting requirements. Or the Medigap company may charge you more for a plan than if youd signed up during your Medigap open enrollment period.

Benefits Of Buying Medigap During Open Enrollment

Purchasing a Medicare Supplement Insurance policy during the Medigap OEP provides several consumer protections. During the OEP, you have the following protections:

You can apply for a Medigap policy outside of your OEP, but there are fewer consumer protections than if you buy a policy during your OEP. After your OEP has passed, Medigap insurance companies are usually allowed to use medical underwriting, which helps the insurer determine whether or not to accept your application and the policys premium.

Medical underwriting is not allowed during your open enrollment period. Medicare.gov states that if you apply during your Medigap open enrollment period, you can buy any Medigap policy the company sells, even if you have health problems, for the same price as people with good health.

Don’t Miss: How To Apply For Medicare Without Claiming Social Security

What Other Medicare Enrollment Periods Are There

AEP, Medigap OEP and Medicare Advantage OEP are just three Medicare enrollment periods. For more information about other Medicare enrollment periods, visit our Medicare Eligibility and Enrollment Guide.

If youre ready to compare Medicare Advantage plans and consider enrollment, or if youre simply gathering free plan quotes to compare your options before Medicare Open Enrollment, you can request a free plan quote or call to speak with a licensed insurance agent who can help answer your questions.

How Medicare Defines A Preexisting Condition

A preexisting condition is any health issue you may have hadand received documented diagnosis or treatment forbefore your new insurance policy is due to start. However, it may still be possible for a condition to be classified as preexisting by Medicare even if its undiagnosed or untreated.

Lets say, for example, youre about to turn 65 and have diabetes requiring insulin and continuous glucose monitoring. You also have sleep apnea and use a CPAP, or continuous positive airway pressure, at night. Both would be classified as preexisting conditions by Medicare because you have a documented diagnosis in your medical record and have been receiving ongoing treatment.

Each state regulates the coverage rules for preexisting conditions under Medigap differently. Check with your states Medicare office to verify eligibility rulesespecially if youre interested in getting a policy outside of your initial enrollment period.

Read Also: How Much Will Medicare Pay For Physical Therapy

Medicare Oep: Everything You Need To Know

by Medicare Educators Team | Jan 17, 2022

2022 Medicare Advantage and Part D plans went into effect on January 1. Now that youve had a little time to see what your plan is like, theres a chance youre disappointed. From Jan. 1 to March 31, individuals that are currently enrolled in a Medicare Advantage Plan have a second chance. If youre unhappy with your plan, you can switch to a different Medicare Advantage Plan whether it has prescription drug coverage or not. You can also go back to Original Medicare and join a Medicare Prescription Drug Program.

How Is the Medicare Advantage Open Enrollment Period Different from the Medicare Annual Election Period?

The AEP happens between Oct. 15 and Dec. 7 with coverage beginning Jan. 1. Anyone who is enrolled in Medicare can participate in the AEP. Generally people age 65 or older, younger people with disabilities and those living with permanent kidney failure qualify for original Medicare. In order to enroll in a Medicare Advantage Plan you must have Medicare Part A and Part B . During AEP, you should review the plans in your area and consider whether a new plan might be a better fit for your needs.

The Medicare Advantage Open Enrollment Period is only for people who are currently enrolled in Medicare Advantage and are unhappy with their plan. The period runs between Jan. 1 and March 31, and coverage starts the month after enrollment.

What If I Want to Switch Medicare Advantage Plans?

What If Im Unhappy with Medicare Advantage?

What Is The Medicare Advantage Open Enrollment Period

One of the many perks of switching to a Medicare Advantage plan is that, for MA enrollees, there is a bonus enrollment period just for them. It is fittingly called the Medicare Advantage Open Enrollment Period.

Today, weâre going to explore what that means and what the differences are between this enrollment period and the Annual Open Enrollment Period in the fall.

Read Also: How To Sign Up For Medicare And Tricare For Life

What Can You Do During Open Enrollment For Medicare

You can do the following during the Medicare open enrollment period

-

Switch from Original Medicare to a Medicare Advantage plan, or vice versa.

-

Change from one Medicare Advantage plan to a different Medicare Advantage plan.

-

Change from a Medicare Advantage plan without drug coverage to a Medicare Advantage plan with drug coverage, or vice versa.

-

Enroll in a Medicare prescription drug plan.

-

Jump from one Medicare drug plan to a different Medicare drug plan.

-

Quit your Medicare prescription drug coverage.

If you return to Original Medicare during this annual enrollment period and you want Medicare Supplement Insurance, also known as Medigap, you may pay more than you expected for a supplement policy, or you may be denied coverage.

Coverage will begin Jan. 1 for all changes made by Dec. 7.

If you find that youre not happy with your Medicare Advantage plan after the Medicare open enrollment period, you can make changes during the Medicare Advantage open enrollment period, which runs from Jan. 1 to March 31 each year.

Who Is Eligible To Make Changes During Annual Open Enrollment

During Medicare annual open enrollment, anyone with any type of Medicare plan can make changes to their coverage.

Who Can Make Changes During Medicares Annual Open Enrollment

- People with Original Medicare can switch to Medicare Advantage .

- People with Medicare Advantage plans can switch to Original Medicare .

- People with a Medicare Advantage plan can switch to a different Medicare Advantage plan.

- People with a Medicare Part D drug plan can switch to a different Part D plan.

- People with Original Medicare can enroll in a Part D plan for the first time.

- People with a Medicare Part D plan can drop it completely.

Read Also: Should I Sign Up For Medicare While Still Employed

How Do People Know If They Need To Change Plans

People in a Medicare health or prescription drug plan should always review the materials their plans send them, like the Evidence of Coverage and Annual Notice of Change . If their plans are changing, they should make sure their plans will still meet their needs for the following year. If theyre satisfied that their current plans will meet their needs for next year and its still being offered, they dont need to do anything.

Do I Really Need Supplemental Insurance With Medicare

The degree to which you can benefit from Medicare Supplement insurance depends on your budget, your health status, the medical services you use and how frequently you use them. Generally, Medicare Supplement beneficiaries enjoy the extra layer of financial protection Medicare Supplement plans provide, as they often cover a percentage of copays, coinsurance and deductibles not covered by Original Medicare. Should you experience a health emergency or serious illness, the extra coverage can help minimize out-of-pocket costs associated with receiving the care you need.

Recommended Reading: Will Medicare Pay For A Bed

Financial Assistance If You Cant Afford Medicare

If you are having trouble affording your Medicare premiums, copays and other out-of-pocket costs, the federal government has four Medicare Savings Programs that provide help for people with limited incomes. There is also a program called Extra Help that assists beneficiaries with their out-of-pocket costs for prescription drugs. Even if you havent qualified for these programs before, the open enrollment period is a good time to check to see if your financial circumstances now allow you to qualify.

The Inflation Reduction Act also may soon come into play. Beginning in 2024, Medicare beneficiaries with annual incomes of up to 150 percent of the federal poverty limit who also meet the programs resources limit can qualify for full benefits under the Extra Help program. The income threshold for full benefits currently is 135 percent of the federal poverty guidelines .

How to get help picking a Medicare plan

Beneficiaries can compare plans and change their enrollment by going to www.medicare.gov. During the open enrollment period, there is also live chat assistance on the website.

In addition, Medicare has a 24-hour, seven-day-a-week hotline where representatives can answer your open enrollment questions. That toll-free number is 800-633-4227. Also, every state has a State Health Insurance Assistance Program with counselors who can help answer your questions.

More on Medicare

Switching Between Medicare Options

Heres what to consider if you are thinking about switching from one Medicare option to another during open enrollment:

- Switching from original Medicare to a Medicare Advantage plan. Make sure your providers are covered in network in the MA plan you select. Also be aware that you will likely be subject to more management of your care: Some plans will require referrals to specialists, and MA plans often require prior authorization from the plan for some diagnostic tests and other services.

- Switching from Medicare Advantage back to original Medicare. The rules let you do this, but theres a big caveat: If you want to go back to original Medicare, you may not be able to get a supplemental plan or at least one thats affordable that helps you pay for some out-of-pocket costs under original Medicare.

- Switching between MA plans. This is the time of year for you to take a hard look at your current Medicare Advantage plan and shop around to see if there might be a plan where you live that will better suit your needs and your pocketbook.

Also Check: Is Medicare Part D Necessary