Does Medicare Cover Dental Care

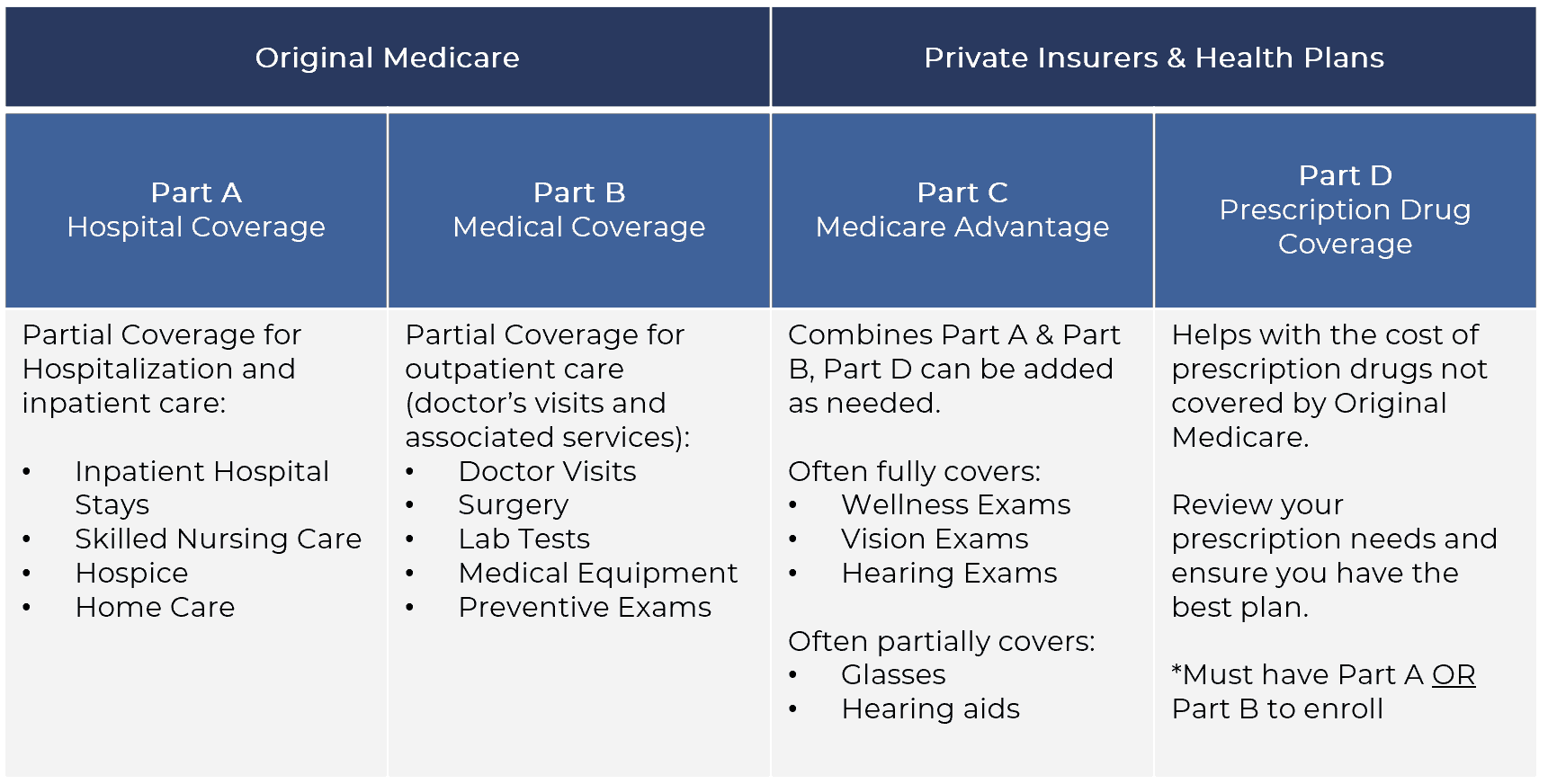

When it comes to Medicare, you have two main options. You can either enroll in Original Medicare or a Medicare Advantage plan. You cannot have both. Understanding the difference is important when it comes to dental care.

Original Medicare is Medicare Part A and Part B. It is referred to as original because these parts of Medicare came into existence when the Social Security Amendments were first passed in 1965.

In 1997, Medicare Part C was created. It was initially called Medicare+Choice, but its name was changed to Medicare Advantage in 2003.

These plans cover everything Original Medicare does, but they are overseen by insurance companies rather than the federal government. The insurance companies are allowed to offer additional services, known as supplemental benefits, above and beyond what Original Medicare covers.

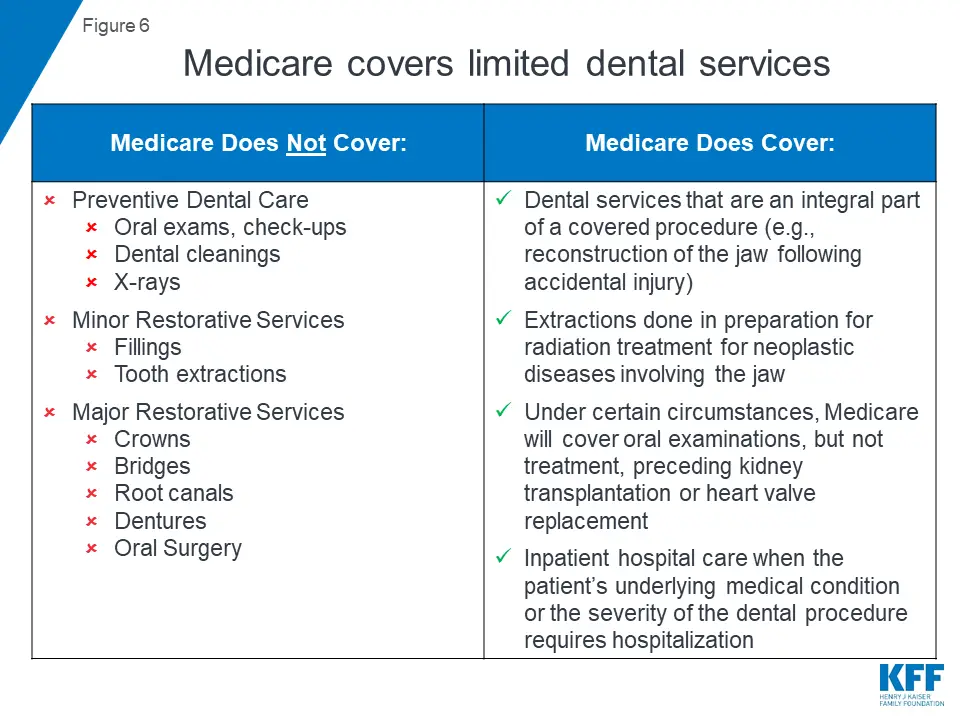

Original Medicare covers dental care, but in limited circumstances. Medicare Advantage plans, on the other hand, can offer dental care as a supplemental benefit.

Depending on the plan you choose, this can include a wider range of services, including but not limited to routine dental cleanings, bridges, crowns, dentures, fillings, root canals, tooth extractions, and X-rays. Most plans set a cap on how much they would pay for dental care annually.

What Do Medicare Part A And Part B Have In Common

Medicare Part A and Part B share some characteristics, such as:

- Both are parts of the government-run Original Medicare program.

- Both may cover different hospital services and items.

- Both may cover mental health care .

- Both may cover home health care.

- Both have annual deductibles, as well as coinsurance or copayments, that may apply to certain services.

- Both have monthly premiums, although many people dont have to pay the Part A premium .

Dental Vision And Hearing

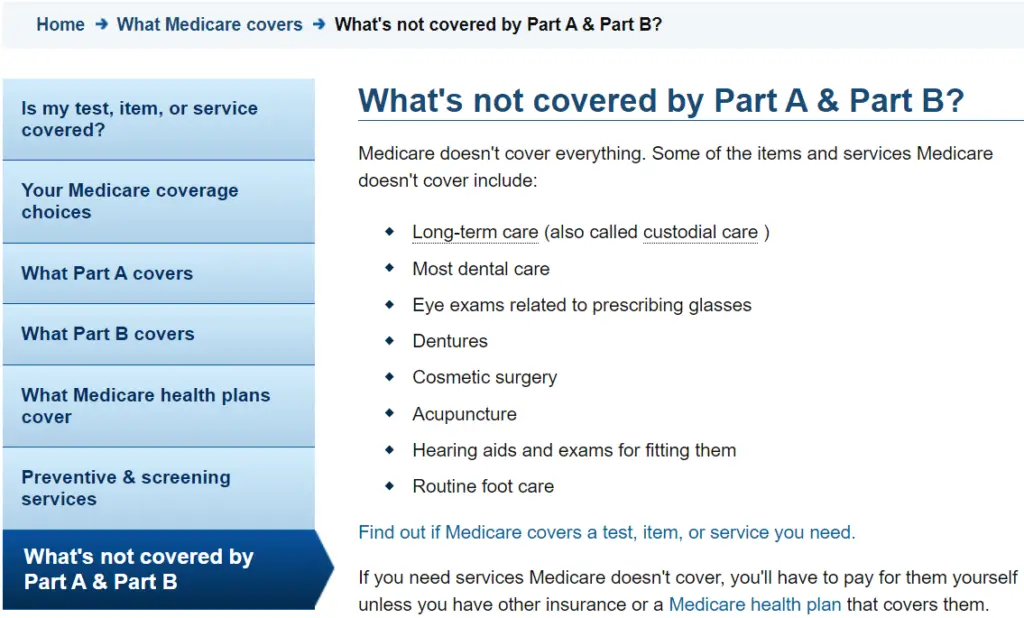

Generally, Original Medicare does not cover dental work and routine vision or hearing care.

Original Medicare wont pay for routine dental care, visits, cleanings, fillings dentures or most tooth extractions.

The same holds true for routine vision checks. Eyeglasses and contact lenses arent generally covered.

However, Medicare Part B may cover tests and treatments for certain serious eye conditions, although you will still owe a copayment, and your Part B deductible applies.

Vision Care Covered by Medicare Part B

- Yearly eye exam for people with diabetes

- Glaucoma tests for people at high risk

- Macular degeneration tests and treatment

- Cataract removal surgery

- One pair of eyeglasses or one set of contact lenses after cataract surgery

Finally, Original Medicare wont pay for hearing aids or the exam required to select and fit these devices.

Medicare Part B may pay a portion of diagnostic hearing and balance exams but only if a doctor orders them in an emergency or to determine whether you need medical treatment.

For example, a doctor may order these tests to diagnose the cause of dizziness or vertigo.

If you decide to go with a Medicare Advantage plan, theres a good chance dental and vision will be included. However, coverage may be limited.

Don’t Miss: Can You Get Medicare If You Work Full Time

What Is The Difference Between Part B And Part D Drugs

Medicare Part B covers drugs that usually are not self-administered. That is, they are given by a doctor or other health care professional in a doctors office, other outpatient facility or at home by a home health aide or caregiver. These drugs are generally administered by infusion or injection.

Medicare Part D covers drugs that are prescribed by your doctor and then filled at a pharmacy and are self-administered. These can include both oral and injectable drugs.

As mentioned above, Part B is one of the two parts of Original Medicare . Original Medicare is publicly funded and provided by the federal government. Medicare Part D prescription drug plans and Medicare Advantage plans that include drug coverage are sold by private insurance companies, though they are regulated by the Centers for Medicare & Medicaid Services .

Medicare Part D coverage can exist as a standalone plan or as part of a Medicare Advantage plan .

Medicare Part A Costs

Premium. Most people do not pay a monthly premium for Part A coverage because of Medicare taxes paid by them or their spouse. For those who do have to pay, the costs for 2018 are $422 per month for those who paid less than 30 quarters worth of Medicare taxes. If you paid between 30 and 39 quarters, your premium would be $232.

Deductible. The Part A inpatient deductible for 2018 is $1,340 per benefit period. This is the amount out-of-pocket that you must pay in full before your Part A benefits kick in.

Coinsurance. Part A includes a coinsurance for inpatient services that scales based on the duration of your stay. Up to 60 days in a benefit period are free. Beyond that, youll pay $335 per day until you reach 91 days, at which point the daily coinsurance increases to $670.

You May Like: Who Must Apply For Medicare

Medicare Doesn’t Cover Deductibles And Co

Medicare Part A covers hospital stays, and Part B covers doctors services and outpatient care. But youre responsible for deductibles and co-payments. In 2022, youll have to pay a Part A deductible of $1,556 before coverage kicks in, and youll also have to pay a portion of the cost of long hospital stays — $389 per day for days 61-90 in the hospital and $778 per day after that. Be aware: Over your lifetime, Medicare will only help pay for a total of 60 days beyond the 90-day limit, called lifetime reserve days, and thereafter youll pay the full hospital cost.

Part B typically covers 80% of doctors services, lab tests and x-rays, but youll have to pay 20% of the costs after a $233 deductible in 2022. A medigap policy or Medicare Advantage plan can fill in the gaps if you dont have the supplemental coverage from a retiree health insurance policy. Medigap policies are sold by private insurers and come in 10 standardized versions that pick up where Medicare leaves off. If you buy a medigap policy within six months of signing up for Medicare Part B, then insurers cant reject you or charge more because of preexisting conditions. See Choosing a Medigap Policy at Medicare.gov for more information. Medicare Advantage plans provide both medical and drug coverage through a private insurer, and they may also provide additional coverage, such as vision and dental care. You can switch Medicare Advantage plans every year during open enrollment season.

Medicare Part D And Medigap

Medicare Part D covers prescription drug benefits. Part D plans help pay for antidepressants, mood stabilizers, and most other protected mental health treatment medications.

If you do not have a Medicare Advantage plan, Medigap may also pay for some of your deductibles, copayments, and coinsurance related to inpatient or outpatient care.

Don’t Miss: How Much Money Is Deducted From Social Security For Medicare

Medicare Part D: Prescription Drug Coverage

Medicare Part D is responsible for the coverage of various prescription medications. Part D may cover both name-brand and generic medications, but the exact medications that are covered will depend on your plans formulary, which is a pre-approved list of covered prescription drugs.

Medicare Part D can often be bundled into a Medicare Advantage plan, which will usually save you money on its monthly premiums. If desired, however, Medicare Part D can also be purchased in the form of standalone plans.

Medicare Part D: Prescription Drug Coverage carries a yearly deductible, copayments and/or coinsurance, and coverage gap costs. The exact amount you will pay for Part D depends on both your income level and the plan in which you are enrolled.

At MedicareInsurance.com, our licensed insurance agents are committed to helping your research and compare Medicare health insurance options that work for you. In addition to helping you find great plans for great prices, we can also help you determine your eligibility and even submit forms that may entitle you to cost-saving programs. To get started, contact us today!

Does Medicare Cover Hearing Tests

In some cases, yes, but only if recommended by your primary care doctor or another physician. In other words, you can’t go to a hearing clinic without a referral and expect Medicare to pay for it.

Here’s how Medicare explains hearing exam coverage: “Medicare Part B covers diagnostic hearing and balance exams if your doctor or other health care provider orders them to see if you need medical treatment. You pay 20% of the Medicare-approved amount for your doctor’s services for covered exams, and the Part B deductible applies. Medicare doesnt cover hearing exams, hearing aids, or exams for fitting hearing aids.”

Recommended Reading: How Much Will Medicare Pay For Nursing Home Care

Medigap Plans Can Help Cover Your Medicare Costs

Keeping up with exactly how much Original Medicare will cover and not cover can be stressful, especially if youre worrying about keeping medical costs down.

Medigap plans can help fill in the coverage gaps left behind by Original Medicare and help you pay less out of pocket for medical costs.

Some Medigap plans even offer coverage for services not covered by Original Medicare at all, such as emergency health care while traveling abroad.

There are 10 standardized Medigap plans available in most states. You can use the 2019 Medigap plans comparison chart below to compare the benefits of each type of plan.

What Does Medicare Not Cover Learn About Each Part Of Medicare And What Is And Isn’t Covered

Medicare doesnt cover everything. Its important to know that just using Medicare Part A and B can leave some expensive gaps in your healthcare coverage.

The four Medicare plans include:

Medicare Part A is your hospital insurance. This covers inpatient hospital care, lab tests, surgery, skilled nursing facilities, hospice and home healthcare.

Medicare Part B covers doctors and healthcare providers services and outpatient care. It also covers durable medical equipment, home health care and some preventive services.

Medicare Part C is like a preferred provider organization or health maintenance organization plan. Its a health plan choice thats offered by private companies approved by Medicare. It provides both your Part A and Part B coverage. Medicare Advantage plans might also offer coverage for vision, hearing, dental and/or health and wellness services. Most include Medicare prescription drug coverage your Medicare Part D.

Medicare Part D provides for covered prescription drugs. Medicare Part D plans can vary the prescription drugs that they cover, which is called a formulary. They also differ in how they place drugs into different tiers on their formularies.However, Medicare Part D drug plans must give at least a standard level of coverage set by Medicare.

Read Also: Should Retired Federal Employees Take Medicare Part B

Medigap Can Help With Affordability

If you believe you will have difficulty affording your Part B premiums or the other out-of-pocket expenses that come with your care, consider purchasing Medicare Supplement Insurance. These plans are sold by private insurance companies like Cigna and Humana.

Medicare supplement insurance plans do not cover additional services. They help you with your Original Medicare out-of-pocket costs i.e., copayments, coinsurance, and deductibles.

Why Do I Need To Buy A Private Health Plan

Private Medicare health plans like Medicare Advantage or Medicare Cost plans cover everything Original Medicare does, and usually include more coverage for services you might need. Plus, they can include extra perks and benefits.

Find out more in the article, 4 reasons to buy a private health plan.

Don’t Miss: Is Aarp Medicare Part D

Where To Get Vaccinated

You have a choice on where to get vaccinated.

In your doctors office: You can get vaccinated in your doctors office. If the office is set up to bill Part D directly for your vaccination, you may only have to pay a copay at the time of your shingles shot. If not, you may have to pay all costs upfront and submit a claim to your Part D plan for reimbursement.

At your local pharmacy: You can go to your local pharmacy to get your shingles shot as long as they offer the vaccine and appropriately trained staff members administer it. The rules for pharmacy vaccination vary by state. You will likely need to pay for the vaccination upfront. Pharmacies are not legally required to dispense medications without payment.

Other Medically Necessary Services

Many other items are covered by Part B in addition to preventive services. A deductible may apply to several of them, and you may have to pay 20% of the Medicare-approved cost. There’s no yearly limit on how much you may have to pay in out-of-pocket costs for health care services.

Many people also have a Medicare Supplement policy for this reason, sometimes called a Medigap policy because it helps cover the gaps in coverage. These supplemental policies may provide more complete coverage with the assurance of annual out-of-pocket cost limits.

Some items covered by Part B which may be subject to the deductible and copay include:

- Ambulance services

- Physical therapy

- Second surgical opinions

- Tests such as MRIs, CT scans, EKG/ECGs, and a CPAP trial for up to three months if you’ve been diagnosed with obstructive sleep apnea

Medicare Part B also covers most lab services, such as blood tests, urinalysis, and tests on tissue samples. You usually won’t have to pay extra for these lab services. Additional services not listed here may also be covered.

Read Also: How To Renew Medicare Benefits

What Medical Services Are Not Covered By Original Medicare

Original Medicare covers costs associated with doctors and hospital services that it deems medically necessary. This means that any kind of cosmetic or alternative health treatments you may be interested in may not be covered.

Dental, vision and hearing services are also not covered by Original Medicare.

The following is a list of some of services not included in Medicare coverage:

-

Long-term careHelp with daily tasks such as bathing, dressing and using the bathroom is not covered under Original Medicare, unless you are receiving skilled care in a nursing facility.

-

Most types of dental carePart A will pay for emergency dental procedures as well as some dental services while you are in the hospital. It does not cover dentures.

-

Most types of vision careExcept when necessary after cataract surgery, Original Medicare does not cover routine eye exams or fittings for glasses or contacts.

-

Hearing aids

-

Routine foot care and some other types of preventive care are not covered.

-

Care in foreign countriesWith few exceptions, you will pay the entire cost of medical care received outside of the U.S.

If you are looking to find out if a specific test, item or service is covered by Original Medicare, you can use the search tool found on Medicare.gov.

What Does Medicare Part B Cost

Some of your Part B cost is a monthly premium of $148.50 however, your premium could be less or more or less depending on your income.

Some services are covered under Medicare Part B at no additional cost to you if you see a doctor that accepts Medicare. If you need a service outside of what is covered by Medicare, you will have to pay for that service yourself.

Also Check: Is Omnipod Covered By Medicare

Will Coverage On Hearing Aids Change

Over the years, many organizations and lawmakers have tried to update Medicare to cover vision, hearing and dental costs for seniors.

Many people would like to see Medicare evolve to cover dental, vision and hearing care. A Commonwealth Fund report details the financial and health burdens these gaps place on older adults. The report said:

“Among Medicare beneficiaries, 75 percent of people who needed a hearing aid did not have one 70 percent of people who had trouble eating because of their teeth did not go to the dentist in the past year and 43 percent of people who had trouble seeing did not have an eye exam in the past year.”

However, so far, no one has been successful at getting changes made to this part of Medicare coverage. In the summer of 2019, several U.S. representatives introduced H.R. 4056, a bill that would require Medicare to pay for certain audiological services. Time will tell if this bill gets passed.

Are Hearing Aids Covered By Medicare

No. Medicare is very clear about this on their website:

“Medicare doesn’t cover hearing aids or exams for fitting hearing aids. You pay 100% for hearing aids and exams. Some Medicare Advantage Plans offer extra benefits that Original Medicare doesnt cover – like vision, hearing, or dental. Contact the plan for more information.”

Read Also: When Do You Stop Paying Medicare And Social Security Taxes

The Cares Act Of 2020

On March 27, 2020, former President Trump signed a $2 trillion coronavirus emergency stimulus package, called the CARES Act, into law. It expanded Medicare’s ability to cover treatment and services for those affected by COVID-19, the novel coronavirus. The CARES Act also:

- Increased flexibility for Medicare to cover telehealth services.

- Increased Medicare payments for COVID-19-related hospital stays and durable medical equipment.

For Medicaid, the Families First Coronavirus Response Act clarified that non-expansion states can use the Medicaid program to cover COVID 19related services for uninsured adults who would have qualified for Medicaid if the state had chosen to expand. Other populations with limited Medicaid coverage are also eligible for coverage under this state option.

Who Is Eligible For Medicare

If you are 65 years old and eligible for Social Security, then Medicare is an option for you. If you’ve received Social Security Disability Insurance for 24 months, Medicare becomes available. Individuals who have certain disabilities, like ALS or permanent kidney failure, are automatically eligible.

You May Like: What’s Part B Medicare