Do Medicare Advantage Plans In California Cover Silver Sneakers

One way for insurance companies to make their Advantage policies more competitive is to add extra services like the following:

- Silver Sneakers memberships

- Wellness programs

Here are a few changes:

- Starting in 2020, insurance companies that provide Medicare Advantage plans in California will be able to add some supplemental non-health-related benefits to particular beneficiaries, such as providing help with making structural changes to the home when needed. This change helps those who might need doorways widened or ramps installed for their homes.

- The Centers for Medicare and Medicaid Services approved a 1.66% payment increase to Medicare insurers that offer Medicare Advantage plans in California for 2021.

Generally Speaking You Can’t Have Over $2000 In Assets As An Individual Or$3000 As A Couple

They do not include the following:

- Your primary home

- Household goods and personal belongings

- Life-insurance policy with a face value of $1,500 per person

- Prepaid burial plan and burial plot

If we pass the asset qualification, they then look at income.

This depends on a few factors but you can get more informationhere.

You’ll notice that there are little break-outs from the core incomequalification based on such things as disability.

Which Medigap Plan In California Is Right For Me

Depending on your specific needs and preferences, Medicare has various options for you. Some people want plans with higher premiums that offer complete coverage, while others prefer less expensive options but good medical benefits if something significant happens!

Two plan options have high deductible options. They are Medigap Plan F and G versions known as HDF and HDG. These Medicare Supplement policies are Medigap insurance policies that provide complete protection at a lower price than regular plans.

With the different Medicare plans available, you must explore which one will be best for your needs. For example, if you are on Plan F but want to save money on your premiums, look at G or N, as they offer more benefits with lower premiums!

Another great thing about living in California with a Medicare Supplement is that you can review and change companies and plans annually using your California Birthday Rule. There arent many states that allow additional ways to change your plan without the need for medical underwriting.

Recommended Reading: What Does Medicare Supplement Cover

Save Money: Compare Medicare Advantage Plans

Enrollment in Medicare Advantage plans has nearly doubled over the past 10 years more than 20 million people have enrolled. Of the 10,000 people turning 65 every day, many choose Medicare Advantage plans because they offer healthcare services and features they need at affordable prices.

Competition for members is fierce among Medicare Advantage plan providers, which means its a buyers’ market, and thats good news for you. Tools like the Medicare.gov plan finder and resources such as CMS.gov and J.D. Power and Associates mean its easier than ever to research and compare plans to find one thats right for you.

Do Medicare Advantage Plans In California Have A Network

Many restrictions may apply to Medicare Advantage plans in California, but three limitations are most common:

- Network Restrictions. Some Medicare Advantage plans require you to pick a doctor within a dedicated network, while others give you more freedom. PPO or PFFS policies are the least restrictive.

- Emergency Medical Care. How your medical expenses are covered if you need emergency care while traveling depends on the terms of your policy. Urgent care and emergency services are covered by HMO and PPO policies, but it may cost more if you see out-of-network providers.

- Moving. You must secure a new plan if you move to a new state. You will qualify for a special enrollment period.

You May Like: What Is Medicare Plan G Supplement

Is Medicare Annual Enrollment For Me

Toni,

I turn 65 in April and am overwhelmed by all the mail I am getting this year for Medicare Annual Enrollment. What do I do? The mail from companies says theirs is the best, but they all offer the same thing with dental, vision, and gym membership.

One Medicare Advantage commercial on TV says that they can put money back in your Social Security check. I am not receiving my Social Security check and wonder how I can get the money.

If I do not enroll in Medicare at the right time everybody says I will get a penalty that will last the rest of my life. How does someone know what is the right decision for their situation? Look forward to your answer.

Nathan from Nashville, TN

Nathan,

You do not need to do anything NOTHING, NADA during the Medicare Annual Enrollment Period because you are not 65yet and have not enrolled in Medicare.

Next years, Medicare Annual Enrollment Period is when you can make a change to your Medicare Part D plan, change, or enroll in a Medicare Advantage plan with or without a Medicare Part D prescription drug plan. The Medicare Annual Enrollment Period is discussed in detail in Chapter 6 of the Medicare Survival Guide Advanced edition.

You MUST have already turned 65 or be under 65 and enrolled in Medicare to change or enroll in a Medicare Part D prescription drug plan or a Medicare Advantage plan during Medicares Annual Enrollment Period.

Outside Oep With Guaranteed Issue Rights

In California, you can purchase a Medicare Supplement insurance policy if you have Guaranteed Issue Rights.

In this case, private health insurance companies are required by law to:

- Sell you a Medigap insurance policy

- Cover any health condition

You may qualify for these rights if you have comparative health coverage that changes.

Recommended Reading: Why Is My First Medicare Bill For 5 Months

What Are My Costs

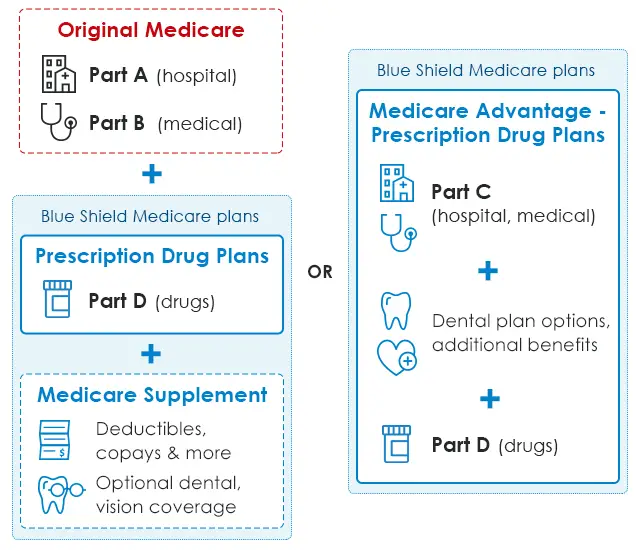

- Original Medicare

-

- For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance.

- You pay a premium for Part B. If you choose to join a Medicare drug plan, youll pay a separate premium for your Medicare drug coverage .

- There’s no yearly limit on what you pay out of pocket, unless you have supplemental coveragelike Medicare Supplement Insurance .

- Medicare Advantage

-

- Out-of-pocket costs varyplans may have different out-of-pocket costs for certain services.

- You pay the monthly Part B premium and may also have to pay the plan’s premium. Plans may have a $0 premium or may help pay all or part of your Part B premium. Most plans include Medicare drug coverage .

- Plans have a yearly limit on what you pay out of pocket for services Medicare Part A and Part B covers. Once you reach your plans limit, youll pay nothing for services Part A and Part B covers for the rest of the year.

Health Insurance Counseling & Advocacy Program

The California Department of Aging offers Medicare counseling through HICAP. They provide:

- information on Medicare enrollment

- explanations of Parts A, B, and C, and how to determine what coverage you need

- answers to questions about Part D prescription drug coverage, costs, and eligibility

HICAP is confidential and free for anyone eligible for Medicare or about to become eligible. You can search for local HICAP services by county or call 800-434-0222.

You May Like: Does Medicare Require Prior Authorization For Specialist

What Does Medicare Not Cover

At its heart, Medicare operates like an 80/20 plan with deductibles.

Two deductibles actually:

- Part A deductible for hospital and facility chargesPart B deductible for physician costs

These go up a bit each year with inflation and you can check the current level when you run your quote here:

QUOTE

There are really 3 major holes to fill in with a supplement, and actually, one that’s a deal-breaker.

First, you have the deductibles. This is a fixed dollar amount so we know what your exposure is.

A deductible is an amount you pay first before the plan kicks in. It annual regardless of when you come on board.

The real reason to get a supplement deals with what happens after the deductible is met.

That’s the 20% co-insurance.

This means you pay 20% of the expenses after the deductible is met.forever!

For example, if we had a $100K bill in the hospital:

- We would first pay the Part A deductible We would then pay 20% of 98,500

That 20% share is a big risk…just short of $20,000!

There’s no cap to this 20% under traditional medicare so we want to address it first and foremost.

Then there’s a hidden risk that most people new to Medicare don’t know about.

Excess.

Essentially, doctors can choose to charge up to 15% higher than what Medicare allows.

This is called excess.

Here’s the issue…more and more doctors are choosing to do this as the reimbursement is under pressure from Medicare due to budget constraints.

There’s no cap to this as well!

What To Know About Medicare In California

With more than 1 in 6 people in the state age 65 and older, California offers a wide variety of Medicare and Medicare Advantage plans.

-

The average monthly premium in 2022 for a Medicare Advantage plan in California is $18.12.

-

There are 458 Medicare Advantage plans available in California in 2022.

-

Ninety-five percent of Medicare-eligible people in California have access to a $0-premium Medicare Advantage plan.

Don’t Miss: Does Medicare Pay For Orthotics

Quote Anthem Mediblue Plan Formedi Medito View Rates And Plans Side By Side For Both Carriersfree

Again, there is absolutely no cost to you for our services.

20 years of experience in the California health insurance market has taught usonething… Competent and experienced guidance is INVALUABLE

We are licensed Covered Ca agents with in-depth knowledge of their plans,process, andtax credits.

LINKS

Best Medicare Supplement Plans In California: Other Plan Types

While Plans G, F and N are the most sought-after, other plans are also available but offer less-comprehensive coverage. MoneyGeeks analysis included companies that provided online estimates. The letter plan you want will determine your best medicare supplement plans provider in California.

- United Healthcare is a top option for Plans A, B, K and L.

- Health Net is best for Plan D.

- Humana has the best Medigap supplement Plan C in California. However, it’s not available to you if you were eligible for Medicare after January 1, 2020.

The Best Medicare Supplement in California – Alternate Plans

- Show more

Don’t Miss: How Much Money Can I Make On Medicare

When Can I Enroll In Medicare In California

The initial coverage enrollment period is a 7-month period that starts three months before your 65th birthday and ends 3 months after you turn 65 years old. If you enroll, your coverage will begin the first of the month that you turn 65 years old.

You can also make changes during Medicares open enrollment period between each year.

If youre already on a Medicare Advantage plan and want to switch to another Medicare Advantage plan or go to original Medicare, you can do that between each year.

The general enrollment is between each year. If you have Medicare Part A and want to enroll in Part B, a Medicare Advantage plan, or Part D coverage you can do it during this time.

Special enrollment periods allow you to enroll outside the normal enrollment periods under special circumstances.

Medicare Survival Guide Advanced Edition

What You Dont Know Will Hurt You!

Turning 65 in America is a milestone and one of the markers is enrolling in Medicare. But the system is so complicated, and there is a lot of false information out there.

In Toni Kings Medicare Survival Guide Advanced: Basics and Beyond, Toni gives you the critical steps you need to enroll in Medicare properly. Toni shares various situations that she has experienced with her many clients during Medicare consultations, and gives you the information and tools you need to enroll on time to avoid the famous Medicare Part B and D penalties.

Medicare Survival Guide Advanced helps you understand Medicare step by step

Learn How to Enroll the Correct Way Still Working Past 65

Part B Penalties Part D IRMAA Penalties

If you are enrolling in Medicare and are confused by the commercials and telemarketers, or from the information that well-meaning friends or family members give, let Toni guide you through the maze of Medicare. Preorder TODAY!

Recommended Reading: What Does Medicare A And B Not Cover

How To Find The Best Medicare Advantage Plan In California

When selecting a Medicare Advantage plan, the most important thing to remember is to take your own medical and financial situation into account. Take stock of your medical needs, as well as any financial limitations that might affect the affordability of some plans. By combining these two factors, youll be sure to find a plan that covers everything you need without putting any significant strain on your wallet.

When looking at plans, consider ones that provide coverage for specialist medical services that you need. If its prescription drug coverage youre after, verify that the plan includes the medication you need by looking at the plans formulary. Also, be sure to check the plans service area to make sure you can enroll.

Each Medicare Advantage plan also comes with a star rating. Medicare awards star ratings to various plans based on a handful of factors. For Medicare Advantage plans:

-

Efficacy of screenings, tests, vaccines, and other preventative services

-

Assistance in managing chronic illnesses

-

Responsiveness from the plan provider

-

Member complaints and the number of plan disenrollments

-

Customer service

Star ratings can be a great way to get a sense of the quality of a health plan, though, as mentioned previously, be sure to check the plans finer details to make sure you have the coverage you need.

California Medigap Birthday Rule

California Medigap beneficiaries get a unique enrollment opportunity each year. The California birthday rule is excellent for CA residents because it grants an annual chance to enroll in a Medigap plan without the need to answer health questions.

This rule gives you 91 days surrounding your birthday to enroll in a Medicare Supplement plan. The window begins 30 days before your birthday and ends 60 days after your birthday. During this time, carriers cannot deny you coverage based on pre-existing health conditions.

Also Check: Do Walk In Clinics Take Medicare

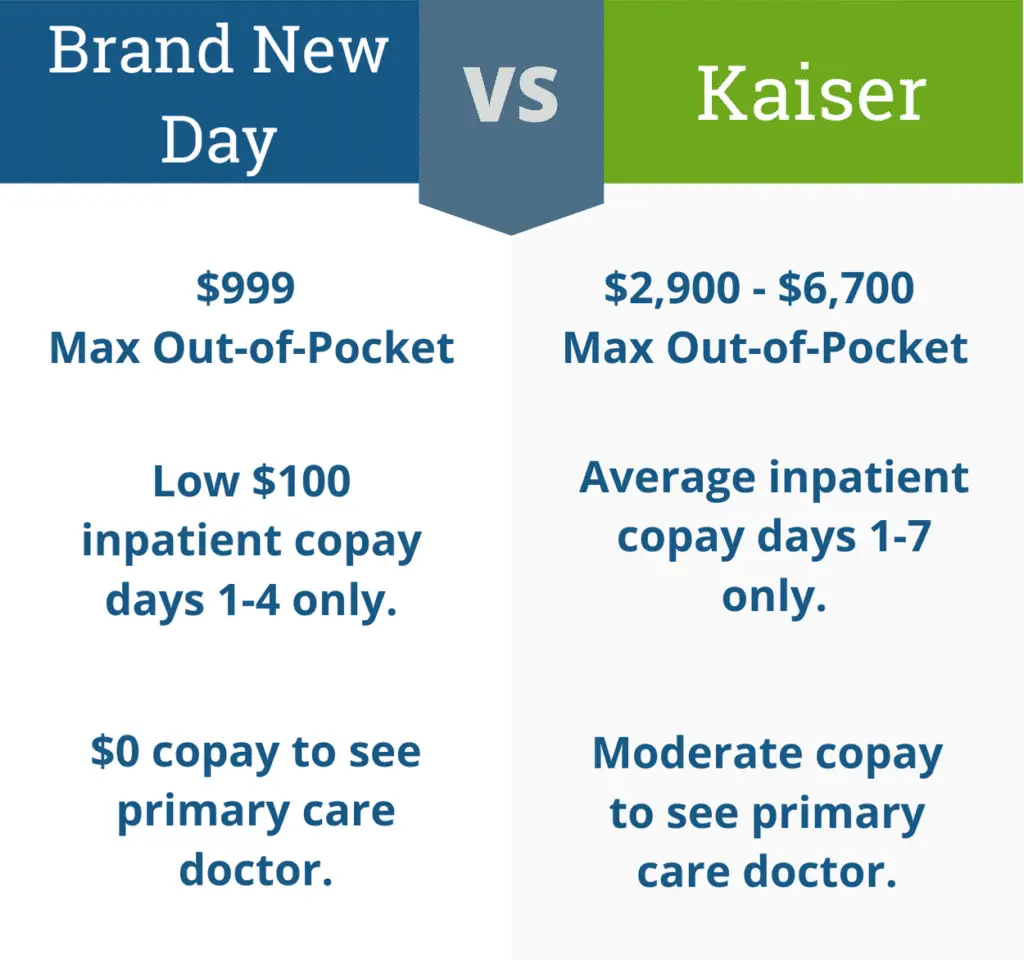

Best For Customer Satisfaction: Kaiser Permanente

-

Highest average NCQA rating nationwide

-

Five-star Medicare rating

-

#1 in J.D. Powerâs U.S. Medicare Advantage Study

-

Lowest deductibles, on average, compared to all other major providers

-

Only available in 8 states and D.C.

-

Only offers HMO plans

-

No transportations benefits

Kaiser Permanente customers are very happy with their plans. All Medicare Advantage plans receive five stars from Medicare, which is the highest rating available. And the average NCQA rating is 4.75 out of 5 stars, making Kaiser Permanente the highest-rated Medicare Advantage provider by the National Committee for Quality Assurance. The company also took top billing in the 2022 J.D. Power U.S. Medicare Advantage Study, beating the runner up by 20 points.

Not only this, but compared to the other largest players, Kaiser Permanente drug deductibles are the lowest nationwideâ only $5.60, on average, for 2023. One reason the company can keep member costs low may be that it only offers HMO plans for Medicare coverage, which means youâll need to stay strictly in-network. And unlike every other provider on this list, Kaiser doesnât cover transportation costs to health-related appointments.

You need to reside in California, Colorado, Georgia, Hawaii, Maryland, Oregon, Virginia, Washington, or the District of Columbia to be eligible for coverage.

Read more in our Kaiser Permanente Medicare review.

Best Medicare Advantage Plans California In 2023

Medicare Advantage plans offer at least the same coverage as traditional Medicare, though many plans now offer additional coverage and benefits not offered in Medicare Parts A and B.

There are hundreds of Medicare Advantage plans in California to search through. Where do you start?

Choosing the right plan can be overwhelming, which is where we can help!

Our licensed insurance agents can easily help you find the right Medicare Advantage plan for you. Or, you can easily use our website to begin shopping for and enrolling in a plan on your own.

Don’t Miss: How Old Should You Be To Apply For Medicare

Average Cost Of Medicare Advantage Plans In California

The average costs for Medicare Advantage plans in California range from $2,080 to $7,850, according to Medicare.gov. Rates depend on many factors such as location, income and plan features such as prescription drug coverage, dental, hearing and vision options. Here are a few examples of plan rates:

| Plan Name | |

|---|---|

| $7,850 | N/A |

Of course, these rates are estimates and vary from plan to plan, so check with individual providers to verify the prices and features included.

Unitedhealthcare Has Nationwide Coverage Satisfied Customers And $0 Copays

We recommend the best products through an independent review process, and advertisers do not influence our picks. We may receive compensation if you visit partners we recommend. Read our advertiser disclosure for more info.

Medicare Advantage plans are an attractive alternative to Original Medicare, and often include prescription drug benefits. In fact, nearly half of all people eligible for Medicare enrolled in a Medicare Advantage plan in 2022. This is because MA plans offer benefits that Original Medicare does not, such as an annual limit on out-of-pocket expenses, plus coverage for dental, vision, and hearing care. In exchange , you generally need to use in-network providers and services. But since MA plans are administered by commercial insurance companies, costs and benefits differ, making it essential to shop around.

You can sign up or change plans during Medicare open enrollment once a year or during your initial enrollment period, so itâs important to choose wisely. We compared key factors, including quality of care, customer satisfaction, available benefits, cost, coverage in the Medicare donut hole, and plan service areas to determine the best Medicare Advantage companies and plans for 2023. All of the following providers offer plans with vision, dental, and hearing care plus coverage for fitness programs, worldwide emergencies, and telehealth services.

Don’t Miss: Is Medicare Premium Going Up