What Drugs Does Medicare Part B Cover

Medicare Part B is the medical insurance part of Original Medicare. While Part B doesnt typically cover the types of prescription drugs you might get at a retail pharmacy like CVS or Walgreens, it can help pay for other drugs that are more difficult to administer.

Below is a list of the types of drugs Medicare Part B covers.

What Is Medicare Supplement Insurance

Medigram is the Medicare supplement coverage that helps close gaps and is sold through private firms. Medicare covers the cost of coverage of healthcare. Some medical supplement insurance policies can help pay some of the remaining health insurance costs.

Instead, Medicare offers prescription drug coverage under Part D . Medicare enrollees can get prescription coverage either by switching to a Medicare Advantage plan or by purchasing a stand-alone Medicare Part D plan to go along with Original Medicare.

What To Do If Your Drug Isnt Covered

If you have trouble getting the medication that you want covered, you may be able to appeal. You and your doctor can submit a formal request for an exception to a drug coverage rule. For example, you could send a request to get coverage for a drug thats not in your formulary. You could also send a request to waive a step therapy requirement to use a lower-tier drug.

Read Also: Can You Apply For Medicare Part A Online

Does Medicare Cover Prescription Drugs

En español No, Medicare doesnt automatically cover prescription drugs you get at a pharmacy, but you can buy a Medicare Part D plan from a private insurer to help cover those expenses. You can either get a stand-alone Part D plan or purchase a Medicare Advantage plan that provides medical and drug coverage in its benefits package.

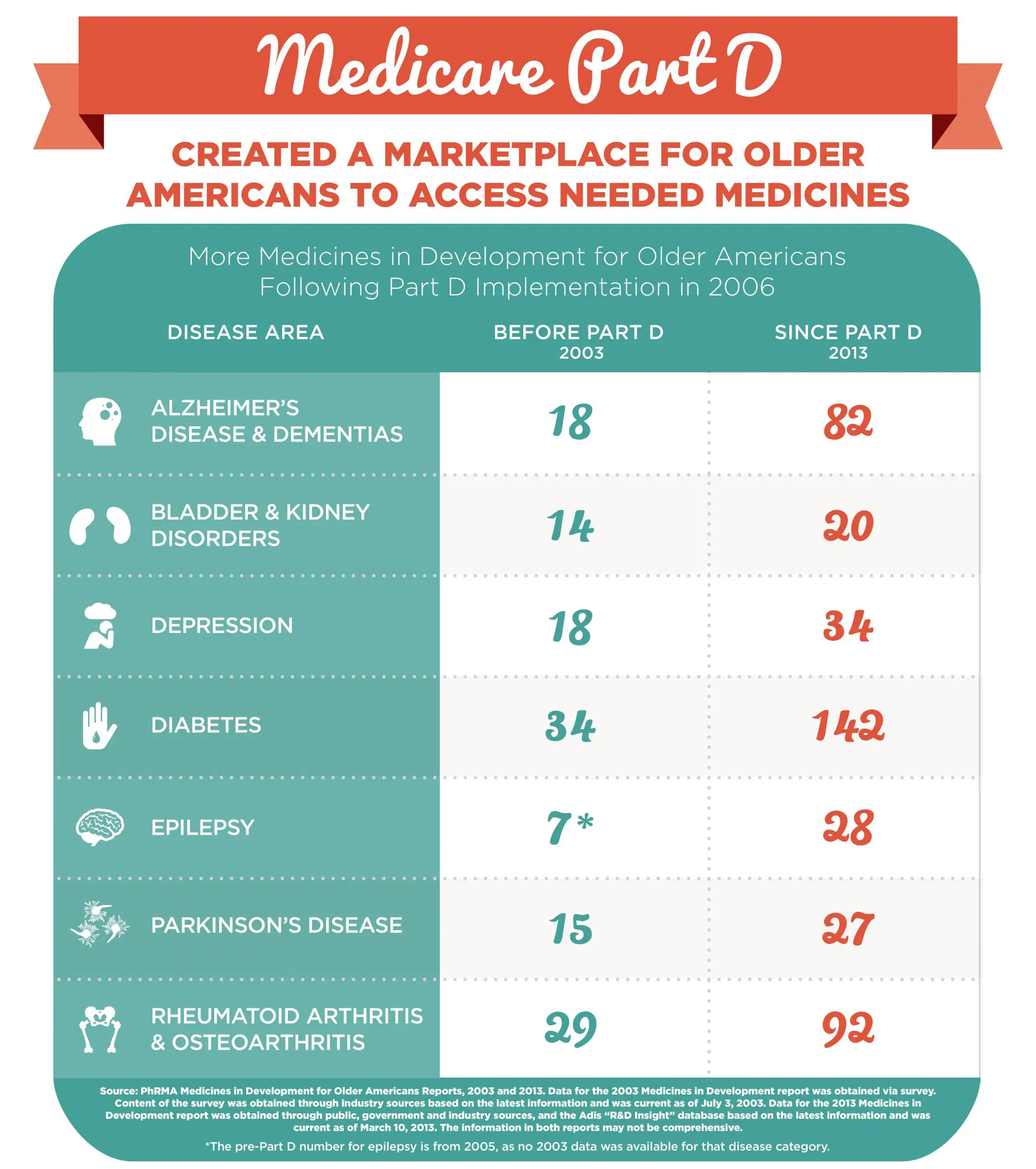

Medicare introduced these prescription drug coverage benefits in 2006. In 2021, 77 percent of all Medicare beneficiaries 48 million people were enrolled in Part D plans. Half had stand-alone Part D plans, and half were in Medicare Advantage drug plans, according to the Kaiser Family Foundation.

Specific coverage varies by plan, and you usually have many to choose from, depending on your location. In 2022 the average Medicare beneficiary had a choice of 23 stand-alone Part D plans and 31 Medicare Advantage plans. Find out about the plans available in your area by typing your zip code into Medicares Plan Finder.

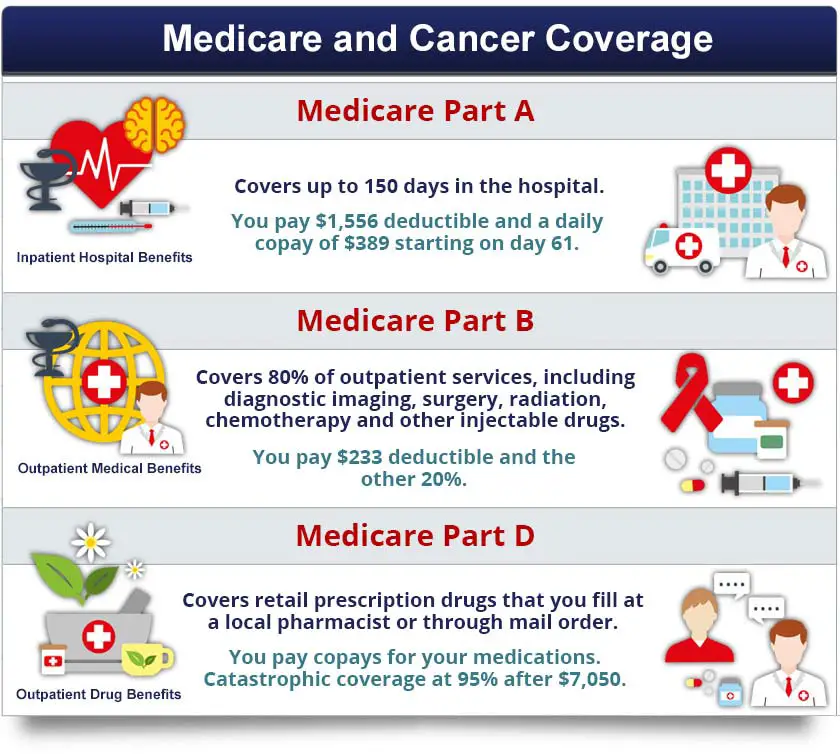

Other parts of Medicare generally cover drugs that medical professionals provide at a doctors office, hospital or specialty clinic. For example, Medicare Part B covers chemotherapy, dialysis and other medications injected or given intravenously at a doctors office or outpatient center.

Medicare Part B Drugs: Cost Implications For Beneficiaries In Traditional Medicare And Medicare Advantage

In the face of rising prescription drug costs, a large majority of the public supports federal efforts to lower drug spending. In his 2022 State of the Union address, President Biden urged Congress to pass legislation to rein in drug costs. In November 2021, the House of Representatives passed the Build Back Better Act , which includes several provisions that would lower prescription drug costs, but the Senate has yet to take action on this legislation. Proposals included in the BBBA would allow the federal government to negotiate the price of some drugs covered under Medicare Part B and Part D require drug companies to pay rebates to the federal government when annual increases in drug prices for Medicare and private insurance exceed the rate of inflation cap monthly insulin costs for people with Medicare and private insurance and cap Medicare beneficiaries out-of-pocket drug spending under Part D .

In the first part of this analysis, we examine Medicare claims data for 2019 to assess cost-sharing liability for Part B drugs for beneficiaries in traditional Medicare . In the second part of our analysis, we use Medicare Advantage benefit design data for 2022 to examine the range in cost-sharing amounts at or below 20% coinsurance charged by Medicare Advantage plans for in-network Part B drugs. We also analyze variation in cost-sharing amounts for out-of-network Part B drugs charged by plans that provide out-of-network coverage.

You May Like: How Do I Get A Replacement Medicare Card Online

How To Save Money On Medicare Part B

Medicare coverage is a great starting point, but there may be out-of-pocket expenses and there is no maximum spending limit.

Medicare Savings Programs are a great option to help reduce the costs of Part B. If you qualify for an MSP, it would help pay for part of your Part A and Part B deductibles, coinsurance, and copayments. MSP qualifications are determined by the state and in many cases you must have income and resources below a specified limit to be eligible.

Another option that may reduce Part B costs is Medicare Supplement Insurance Plans . Medigap policies are designed to help fill in the gaps in Original Medicare and are sold by private companies. These policies may help pay the remaining costs from Original Medicare like copayments, coinsurance, and deductibles. If a service is required, Medicare will pay its share of the covered healthcare cost and then the Medigap insurance plan will pay its share.

A third option is a Medicare Advantage Plan. These plans are sometimes called Part C of Medicare. They combine your Medicare Part A and Medicare Part B benefits into one privately-administered plan. These plans are administered by private insurance companies and have their own fee schedules.

Part C plans must cover the same benefits as Original Medicare and have a cap on what an individual can spend during a year.

Not to mention with Medicares prescription drug coverage gap, youre responsible for 25% of the cost of your prescription.

Monthly Part D Premiums

Its not exactly clear what this will mean for Medicare Part D premiums, said Neuman.

She said that negotiated prices and inflation rebates are expected to reduce Medicare Part D drug spending, according to the Congressional Budget Office , which will put downward pressure on premiums.

But the law also improves coverage under Part D by adding an out-of-pocket cap, and that could increase Medicare spending and premiums, she added.

Anticipating this uncertainty, she said, the law limits annual Medicare Part D premium increases to no more than 6 percent each year for the next several years.

Also Check: How Can I Enroll In Medicare Part D

What Does Medicare Part D Cover

Each Medicare Part D plan uses a list of approved drugs to decide whats covered and what isnt. This list is called a . Generally, drugs in a lower tier will cost less than drugs in a higher tier. Here is one example of a typical Medicare drug plans tier system :

- Level or Tier 1: Preferred, low-cost generic drugs

- Level or Tier 2: Nonpreferred and low-cost generic drugs

- Level or Tier 3: Preferred brand-name and some higher-cost generic drugs

- Level or Tier 4: Nonpreferred brand-name drugs and some nonpreferred, highest-cost generic drugs

- Level or Tier 5: Highest-cost drugs including most specialty medications

Paying For Drugs When You Have A Medicare Supplement

For the average person, the transition into Medicare is a positive step that almost everyone has in common with. Despite being universal in nature, the total coverage offered under Medicare varies significantly among the individual. Medicap is an affordable Medicare Supplement program with many different coverage types and price ranges. Can Medicare cover prescription drug costs? For a clarification, Medicare does not pay for prescription medications.

Also Check: What Is A P10 Number For Medicare

How Does Medicare Part D Work With Other Insurance

If you already have prescription drug coverage through another plan, there will usually be some coordination of benefits between Medicare and your current drug coverage provider. Depending on your current coverage, Medicare will be either your primary or secondary payer for prescription drug coverage.

See Medicares to see coverage options that may apply to you.

Merging Medicare Parts B And D

The American Patients First plan considers moving Part B prescription drug coverage into Part D. Unfortunately, if you have certain medical conditions, this could actually raise how much you pay under the current system.

First, not all Medicare beneficiaries purchase Part D coverage alone or as part of a Medicare Advantage plan. In order to gain drug coverage, this proposal would require that they purchase a Part D plan and pay monthly premiums. With basic premiums costing $32.74 per month in 2020, this would add an extra $392.88 per year in healthcare costs to people who may least be able to afford it. Keep in mind that it does not include the cost of copayments or coinsurance.

Second, it is unclear if all medications or only a select group of drugs would be included in this proposal. There could be significant implications for people who require frequent IV medications, especially biologics for autoimmune and rheumatologic conditions.

These medications may be less expensive for people under Part B, especially since Part D plans can charge expensive copayments or coinsurances for higher-tiered medications on their formulary. They may even require prior authorizations or choose to not cover certain medications at all.

While the Medicare program itself could save money in the long run, the American Patients First proposal is likely to increase costs for many people on Medicare.

You May Like: What Are Advantages Of Medicare Advantage Plans

How Does A Tiered Formulary Work

Many plans have a tiered formulary where the plan’s list of drugs are divided into groups based on cost. In general, drugs in low tiers cost less than drugs in high tiers. Additionally, plans may charge a deductible for certain drug tiers and not for others, or the deductible amount may differ based on the tier.

Formulary tiers:

D Does Not Cover Over

Medicare Part D does not pay for nonprescription drugs like antacids and cold medicines that you find at a pharmacy. Nor does it cover drugs for erectile dysfunction, hair loss or weight control, even if a doctor prescribes them.

You can use money from a health savings account tax free to pay for over-the-counter medications. You cant contribute to an HSA after you enroll in Medicare, but you can withdraw money for eligible expenses at any time without paying taxes.

Read Also: What Does Medicare Part D Provide

Understanding The Donut Hole Coverage Gap

For most Medicare prescription plans, there is a temporary limit on what the plan covers. This is called the coverage gap, or the donut hole. In 2022, this coverage gap will be triggered once you and your plan spend a combined $4,430 on covered medications. Once youre in the coverage gap, you will pay a maximum of 25% of the cost for brand-name drugs in your plan. Although you pay only a fraction of the cost of your prescriptions, almost the full price of the drugs count toward your out-of-pocket costs.

Where Do I Find A List Of Drugs Covered By Medicare Part D

Medicare Part D drug coverage can vary from one plan to another. The list of drugs covered by a Part D plan is called a formulary.

Part D plans typically cover a wide range of drugs. And while the formularies can vary by plan, there are certain drugs that must be covered by every Part D plan, such as cancer drugs or HIV/AIDS medications.

Part D plans cover both generic and name brand drugs and typically do so at different tiers. Common generic drugs are typically placed into a lower tier and typically covered at a lower cost, while rare or brand name drugs are placed into a higher tier and may require more costs to the beneficiary.

Each plans formulary can usually be found along with its summary of benefits. When shopping for a Part D plan , the drug formulary should be listed alongside the other plan details.

Its important to note that a plans formulary can change every year as drugs may be added to or dropped from a particular plans benefits, or a drug may be moved to a different coverage tier.

If there is a specific drug you want to obtain coverage for, contact a licensed insurance agent and they will be able to gather up the plans available in your area that provide coverage for your medication.

Don’t Miss: What Is The Most Popular Medicare Supplement Plan

What Does Part B Of Medicare Cover

Medicare Part B helps cover medically-necessary services like doctors services and tests, outpatient care, home health services, durable medical equipment, and other medical services. Part B also covers some preventive services. Look at your Medicare card to find out if you have Part B.

The basic medically-necessary services covered include:

- Abdominal Aortic Aneurysm Screening

- Bone Mass Measurement

- Cardiac Rehabilitation

- Durable Medical Equipment

- Foot Exams and Treatment

- Kidney Dialysis Services and Supplies

- Kidney Disease Education Services

- Outpatient Medical and Surgical Services and Supplies

- Pap Tests and Pelvic Exams

- Smoking Cessation

- Speech-Language Pathology Services

- Transplants and Immunosuppressive Drugs

To find out if Medicare covers a service not on this list, visit www.medicare.gov/coverage, or call 1-800-MEDICARE . TTY users should call 1-877-486-2048.

How Much Do Drugs Cost With Medicare Part B

Drugs covered by Medicare Part B are typically covered the same way other Part B services and items are covered. That means the annual Part B deductible applies followed by a 20% coinsurance of the Medicare-approved amount.

Preventive vaccinations are covered in full by Part B, and the deductible does not apply.

Recommended Reading: Is Rifaximin Covered By Medicare

The Different Parts Of Medicare

The Medicare plan offers several ways for coverage. You can get a private policy that goes in addition to government coverage, if you need more coverage. Original Medicare isn’t a one-stop insurance system. In contrast with certain forms of health care where a single plan provides healthcare coverage for patients in hospitals, Medicare covers the whole of health care in different ways. Medicare includes four sections: a deductible A deductible A deductible A deductible A deductible A deductible B.

How Does Medicare Cover Self

When you receive outpatient hospital services during an emergency room visit, observation stay, or outpatient surgery center, you may be given medications to take during your stay.

You may be charged for these medications before you leave the outpatient center. Youll then need to reach out to Medicare for reimbursement.

A 2018 analysis of Medicare Part B claims and U.S. Census Bureau data showed that low-income Medicare beneficiaries are especially vulnerable to high out-of-pocket costs for outpatient observation stays.

Hospitals can waive charges or discount the cost of noncovered self-administered drugs given during a covered outpatient stay. However, this depends on the policies of each facility, because the facility cant bill Medicare for waived or discounted fees.

Its important to ask questions and be prepared before your outpatient procedure or observation stay whenever possible. You can talk with your doctor and the hospital about charges for self-administered medications ahead of time.

Also Check: What Is Extra Help With Medicare

Cutting Part B Reimbursement

Medicare pays for medications administered in the healthcare provider’s office a bit differently than the ones you get from the pharmacy. Your practitioner purchases these medications in advance. Because their office is responsible for storing these medications and preparing them for use, medical professionals are paid 6% above the wholesale acquisition cost of the drug. They are paid separately to actually administer the medication.

Concerns have been raised that some healthcare providers may have been abusing the system, ordering the most expensive drugs in order to make a profit. Because patients are still required to pay 20% of the treatment cost, this also increases out-of-pocket expenses for patients.

Medications covered by the Centers for Medicare and Medicaid Services are paid at a 6% rate, while there’s a 3% add-on cost for new prescription drugs.

How Parts B And D Work Together

Medicare Parts B and D pay for medications you receive in the ambulatory setting but they won’t pay towards the same prescription. You can only turn to one part of Medicare or the other. However, you may be able to use them both for drugs you receive in a hospital setting.

Medications you receive in the hospital when you are admitted as an inpatient will be covered by your Part A deductible. It is important to understand what happens when you are evaluated in the emergency room and sent home or are placed under observation, even if you stay overnight in the hospital. In this case, you can turn to Parts B and D to pay for your drugs.

When you are placed under observation, Part B will still pay for the medications reviewed above. If you receive IV medications, these will generally be covered. However, you may also receive oral medications during your observation stay that are not on the Part B list of approved medications. In this case, you will be billed for each pill administered by the hospital.

Send copies of your hospital bills to your Part D plan for reimbursement. Unfortunately, if you receive a medication that is on your Part D formulary, your plan may not pay for it.

Don’t Miss: What Documents Do I Need To File For Medicare

How To Get Prescription Drug Coverage With Medicare

There are different ways to get prescription drug coverage.

A person can purchase Part D plans individually, providing they already have Original Medicare, or parts A and B. Someone can also use prescription drug coverage, if they select it, alongside:

- select Private Fee-for-Service plans

- some Medical Savings Account plans

- Medicare Cost plans

Alternatively, a person can get Part D as part of a Medicare Advantage policy. Medicare Advantage typically bundles A, B, and D together in one plan. It is important to note that an individual must have Medicare parts A and B to be eligible for Medicare Advantage.

Some types of Medicare Advantage plans may not offer Part D coverage, so a person should compare plans before enrollment. In those cases, an individual may be able to add Part D coverage.

However, in this case, someone may be disenrolled from Medicare Advantage and returned to original Medicare coverage. Examples of plans that this policy could affect include:

- Health Maintenance Organization plans

- HMO Point-of-Service plans

- Preferred Provider Organization plans

A person who wishes to do this without losing their Medicare Advantage coverage can only do so in:

- private fee-for-service plans

- some employer-sponsored Medicare health plans

- registering online, either through the Medicare Plan Finder or the insurance providers website

- completing and mailing a paper enrollment form

As long as the Part D policy is active, the monthly premium will include the calculated penalty.