Do You Need To Renew Medicare Every Year

A short answer to this question is no. If youre enrolled in Original Medicare or a Medicare Advantage plan, your plan will renew automatically.

However, there are some exceptions and enrollment information you may not be aware of. Lets explore some of the renewal and enrollment details of common Medicare plans.

Which Companies Sell Medicare Supplement Insurance In Indiana

Companies must be approved by IDOI in order to sell Medicare Supplement policies. All of the companies listed below have been approved by the state. The plans are labeled with a letter, A through J. Not all companies sell all ten plans. Following each company name and phone number, we have listed the Medicare Supplement plans sold by that company based on the following categories:

- Medicare Supplements for Persons 65 and Older

- Medicare Supplements for Persons Under 65 and Disabled

- Medicare SELECT Insurance Companies

Ask If Your Doctor Accepts Assignment

Assignment is an agreement between doctors and other health care providers and Medicare. Doctors who accept assignment charge only what Medicare will pay them for a service. You must pay any deductibles, coinsurance, and copayments that you owe.

Doctors who dont accept assignment may charge more than the Medicare-approved amount. You are responsible for the higher charges. You also might have to pay the full cost of the service at the doctors office, and then wait to be reimbursed by Medicare.

Use your Medicare Summary Notice to review the charges. You get a Medicare Summary Notice each quarter. If you were overcharged and werent reimbursed, follow the instructions on the notice to report the overcharge to Medicare. The notice will also show you any deadlines to complain or appeal charges and denied services. If you are in original Medicare, you can also look at your Medicare claims online at MyMedicare.gov.

Medicare has a directory of doctors, hospitals, and suppliers that work with Medicare. The Physician Compare directory also shows which providers accepted assignment on Medicare claims.

Recommended Reading: How Much Is Supplemental Health Insurance For Medicare

Do You Have To Renew Your Medicare Supplement Every Year

Once you find the best plan, you will likely want to be able to keep it. Fortunately, you will be able to stay with your plan as long as you like in most cases. This is called guarantee renewable. Medicare Supplement insurance plans renew automatically when you make your premium payment.

Do you have to have part a to get Medicare supplement?

You must have Medicare Parts A and B in order to get a Medicare Supplement plan. While there are many Medicare Supplement plans, the three most popular are Plans F, G, and N. Lets take a look at these three plans and see what each has to offer.

When do I get my Medicare contract renewed?

But the plan contract with Medicare IS renewed annually. You will receive a notice each year around late September/early October about the plans status for the following calendar year.

You Can Change Medigap Plans Anytime

My name is Russell Noga with Medisupps.com, and in this article, Im going to cover when you can change plans, why you absolutely should try to change, as well as some other enrollment periods and deadlines that you absolutely need to know about.

So if you did in fact get knocked on your butt with a rate increase letter, Im sorry here that!

One thing we do here at Medisupps.com has contacted you before you even get your rate increase.

Were already shopping the rates so we can have it offered to pass and make sure you dont end up overpaying on your Medicare supplement insurance.

But lets talk about the deadline for changing Medicare supplement plans if you already got one.

The deadline is

None! There is no deadline!

With Medicare supplement insurance, you can change plans anytime during the year. Thats great news.

So if you did get a rate increase, simply click the banner below to get rates online to see how much you can save.

Or you can call us at 1-888-891-0229 which is even faster and easier, and we can show you some rates that were not allowed to display online.

Also Check: Does Medicare Cover Full Body Scans

What Is Medical Underwriting

Essentially, medical underwriting is a risk assessment insurance companies take. The point is to see how likely you are to file a claim based on a survey of your medical history. Questions typically relate to age, any chronic conditions, drug history , weight and more. Some insurers delve more extensively into medical history, and may also include mental health history.

There are some conditions that may lead to your application being rejected, including :

- Cancer or history of cancer

You may also be denied if you use any of the following:

- Implantable cardiac defibrillator

- Medications for COPD or multiple sclerosis

- Supplemental oxygen

You can avoid medical underwriting if you apply for Medicare Supplement Insurance during your Medigap Open Enrollment Period . This starts the first month you are both 65 and enrolled in Medicare Part B. If for no other reason than this, it is best to purchase a plan during your OEP, even if you don’t think you need it yet. Medical underwriting can also be bypassed if you have a guaranteed issue right.

Learn more: Medicare Supplement Underwriting Questions: What to Expect

Changing Medicare Supplement Plans

The best time for you to sign up for a Medicare Supplement plan, also called Medigap, is when you turn 65 and are covered under Medicare Part B. This six-month period, known as your Medigap Open Enrollment Period, typically starts on your 65th birthday if youre already enrolled in Part B. During this period, youre guaranteed acceptance into any Medicare Supplement plan available in your area without submitting to a complete medical review or being denied coverage because of pre-existing conditions. If you choose not to get Medicare Part B right away, then your Medigap Open Enrollment Period may also be delayed and will start automatically once youre at least 65 and have Part B.

Your health status when enrolling in a Medigap plan can play an important role in which Medigap plan you choose, and your age at the time may determine how much you pay for it.

Like anything else, your needs are subject to change, so the plan you originally chose may not cover all of your needs for the rest of your life. There are numerous reasons for switching Medicare Supplement plans some common ones are described below.

Don’t Miss: How Are Medicare Premiums Determined

What Is A Free

You also can get a tryout month with your new policy if you like, called the free-look period. Be aware, its not free. People must pay for both policies that month until they decide at the end of 30 days whether to leave the old policy and stay with the new one, according to the governments Medicare website on changing Medigap plans.

Several states California, Connecticut, Maine, Massachusetts, Missouri, New York, and Oregon have more generous rules on switching Medigap plans, according to Boston Colleges Center for Retirement Research.4 California, for example, allows Medigap policy owners to shop for new coverage each year without fear of being rejected for medical reasons. This happens during the 30 days immediately after their birthday without a medical screening or a new waiting period. The new policy must have the same or fewer benefits than the old policy.

Can I Switch Medigap Policies At Any Time

Yes, but insurers may ask questions about your health if you dont qualify for a guaranteed issue right period, when youre assured of the ability to purchase a plan even if you have health problems.

Thats why its important to think about your present and future needs when you first buy a policy. You may want to find a Medigap policy with a company that has lower premiums or better customer service, because you have more coverage than you need, or so you can qualify for additional coverage such as foreign travel emergencies.

Some states let you change Medigap policies at certain times during the year, regardless of your health:

- In California, you have 60 days after your birthday to swap plans.

- In Missouri, you have up to 30 days before and after the anniversary of the date you purchased the policy to switch to the same letter plan with a different insurer.

- In Oregon, you have 30 days after your birthday each year to buy another Medigap plan with equal or lesser benefits.

In Connecticut, Massachusetts and New York, insurers must sell you any Medigap policy at any time regardless of preexisting conditions. In Maine, you can change policies and insurers as long as you choose a plan with the same or lesser benefits and youve never had a gap in coverage of more than 90 days.

Also Check: Are All Medicare Supplement Plan G The Same

Can I Change From A Medicare Advantage Plan To A Medicare Supplement Plan

If a person enrolls in Medicare Advantage when they first become eligible for Medicare, they can switch to original Medicare and Medigap within the first 3 months of their plan. This benefit is available to protect people who find that the policy they first chose does not work well for their healthcare needs.

Read Also: Are Visiting Angels Covered By Medicare

How Long Is Open Enrollment For Medicare Supplement Policies

Open enrollment for Medicare Supplement spans six months, beginning on the first day of the month in which youre both at least 65 years old and enrolled in Medicare Part B. Some states have additional open enrollment periods, including ones for people under 65, so check with your local Medicare office for additional enrollment options that may be relevant for you.

Also Check: Do You Have Dental With Medicare

What Are My Limits When Changing Medicare Supplement Plans

If youre thinking about changing your Medigap insurance coverage and youre past that initial six-month period, youll most likely have to undergo medical underwriting and you could be denied coverage due to pre-existing conditions. There are some differences by state so understanding your states rules is key.

If you happen to fall into a guaranteed issue rights situation, then you must be issued an insurance policy and you cannot be charged more based on your age and health. The following situations might qualify you for guaranteed issue rights:

- Your current Medicare supplement has left your service area, or youve moved out of their area

- Your original coverage was through an employer group health plan and that coverage is ending

- Your Medigap insurance ends through no fault of yours e.g., they went bankrupt

- Your insurer misled you or broke the law

- You decided to switch to Medicare Advantage from Original Medicare and now you want to move back to the original plan with a Medigap supplement

The General Enrollment Period: January 1march 31

This is the Medicare Advantage General Enrollment Period. During this time, a person can switch from Medicare to Medicare Advantage.

However, they cannot switch the other way round during this window. If a person signs up for traditional Medicare during the General Enrollment Period, coverage will start on July 1.

Recommended Reading: Is Medicare Getting A Raise

Changing Or Switching Medigap Plans: Enrollment Guide

Find Cheap Medicare Plans in Your Area

You can change your Medicare Supplement plan or switch to Medigap at any time.

But if you want a good deal, we recommend that you only change your Medigap plan or sign up for a new plan when you have enrollment protections called “guaranteed issue.” This will prevent you from paying higher rates because of your medical history.

You could qualify for Medigap enrollment protection in situations such as moving or losing other insurance coverage. But most Medigap enrollment protections vary by location. For example, in California, you can change Medigap plans annually because of the state’s expanded regulations, but other states may not offer as much flexibility.

Whats Medicare Supplemental Insurance

Original Medicare pays for a lot of healthcare costs, but doesnt cover everything. A person might purchase a Medigap policy to help pay for any remaining healthcare costs such as copays, coinsurance, and deductibles.

As with Medicare Advantage Plans, Medigap policies are sold by private insurance companies, and you pay a monthly premium in addition to the monthly Part B premium that you pay to Medicare.

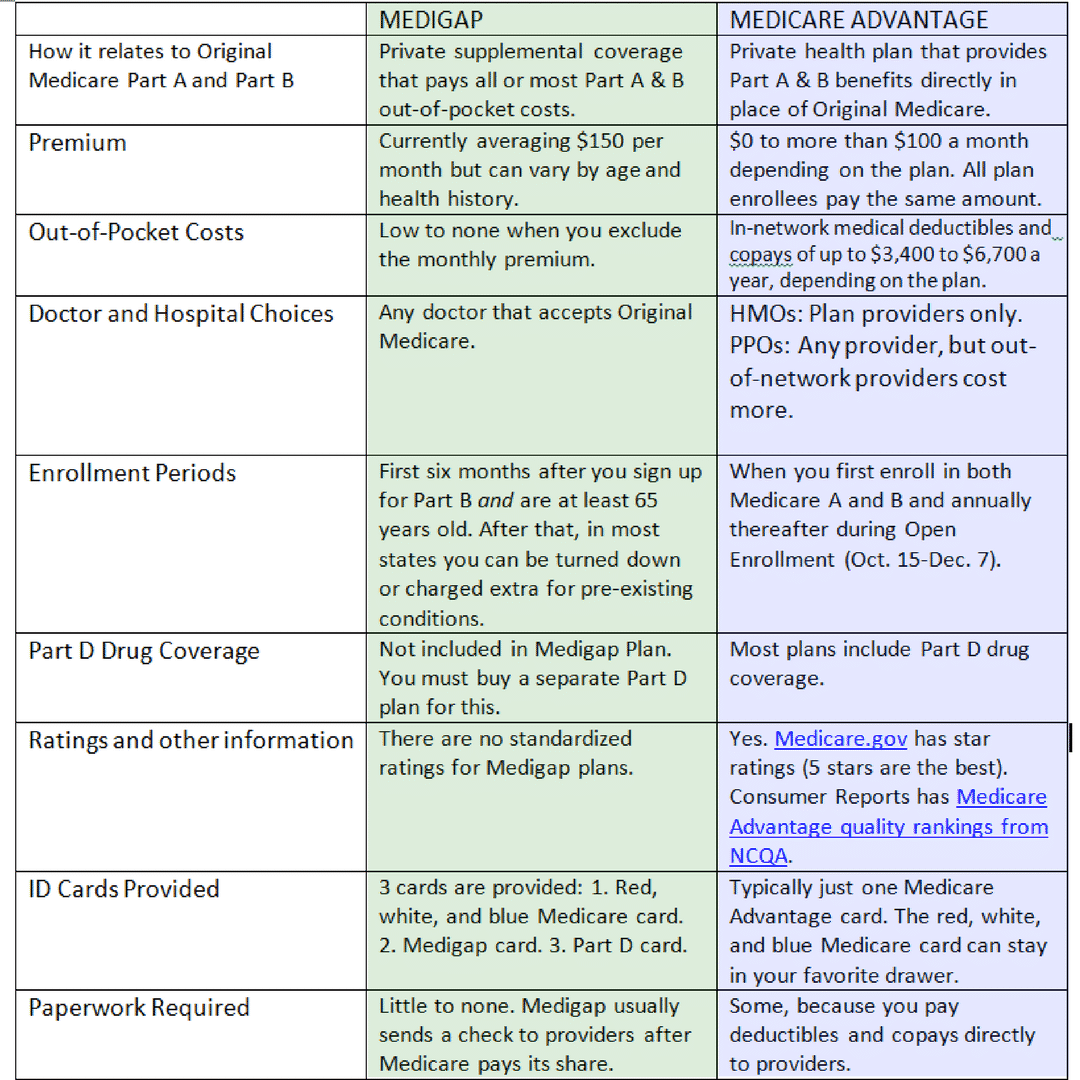

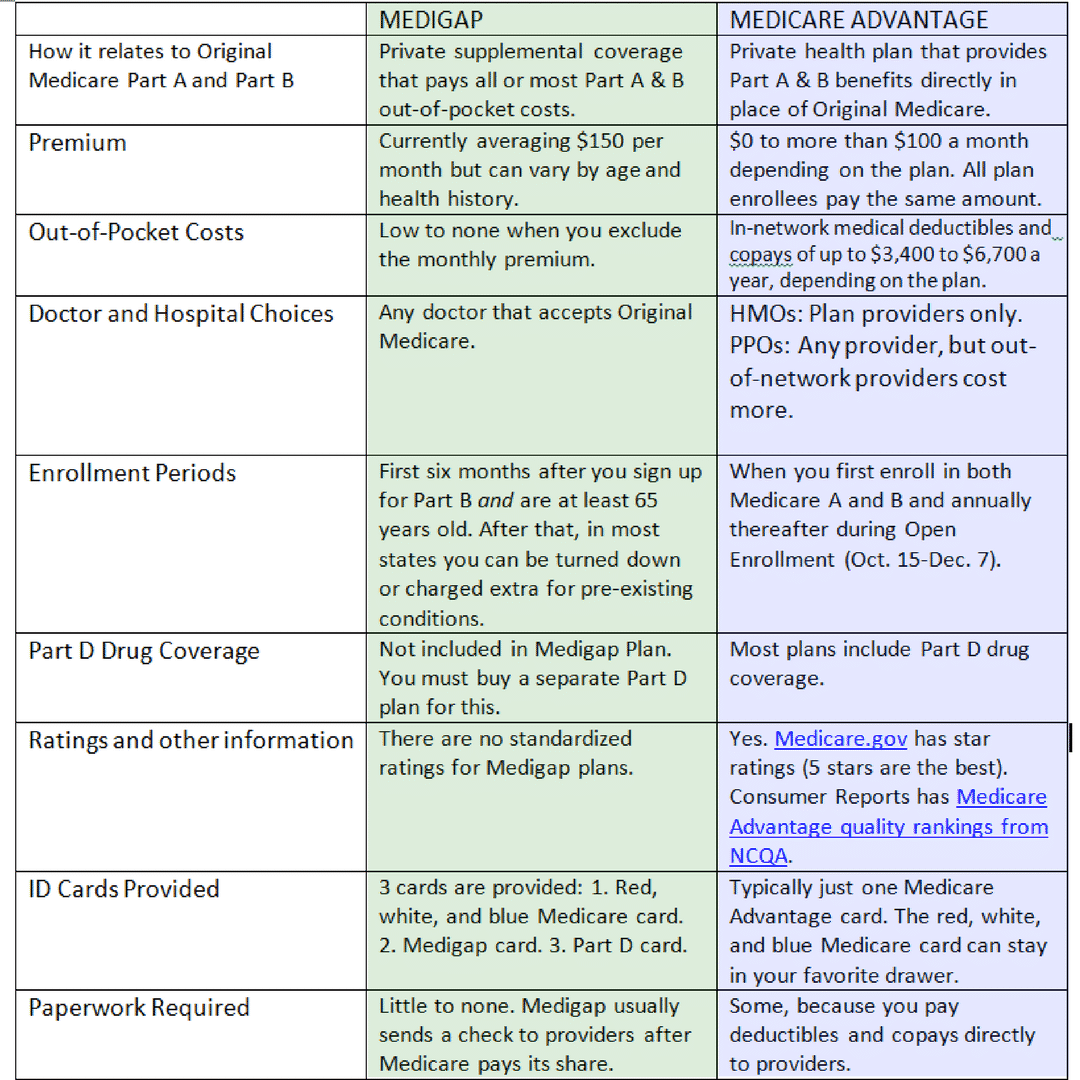

If you want extra benefits beyond Medicare Part A and Part B, both Medicare Advantage Plans and Medigap are options, but you cant have both at the same time.

Recommended Reading: Does A Medicare Advantage Plan Replace Medicare

You May Like: What Does Humana Medicare Advantage Cover

How Medicare Defines A Preexisting Condition

A preexisting condition is any health issue you may have hadand received documented diagnosis or treatment forbefore your new insurance policy is due to start. However, it may still be possible for a condition to be classified as preexisting by Medicare even if its undiagnosed or untreated.

Lets say, for example, youre about to turn 65 and have diabetes requiring insulin and continuous glucose monitoring. You also have sleep apnea and use a CPAP, or continuous positive airway pressure, at night. Both would be classified as preexisting conditions by Medicare because you have a documented diagnosis in your medical record and have been receiving ongoing treatment.

Each state regulates the coverage rules for preexisting conditions under Medigap differently. Check with your states Medicare office to verify eligibility rulesespecially if youre interested in getting a policy outside of your initial enrollment period.

Can I Change My Medicare Plan

Medicare provides certain time periods when you can change Medicare plans. The main one is the Medicare Annual Enrollment Period, which runs from October 15 to December 7 each year. Anyone on Medicare can make coverage changes during this time that then go into effect the following year.

But what do you do if your new Medicare plan doesnt fit your needs? Or if during the year you are caught off guard by changes to your plan benefits? Maybe your refill is denied at the pharmacy counter because your medication is not on your plans list of covered drugs . Or maybe you learn that your doctor is not in your plans network.

If any of these things happen, you may be able to change Medicare plans before the next Annual Enrollment Period. But youll need to meet certain qualifications.

Also Check: Does Medicare Pay For Physical Therapy After Knee Surgery

Choices For Medicare Coverage

When you first sign up for Medicare, youll have several options for receiving your benefits and coverage. You can obtain this protection largely in two ways: A Medicare Advantage Plan, Original Medicare , or Both .

Original Medicare

Health insurance is provided to individuals who qualify through Original Medicare, a government-run program funded partly by the federal government. To qualify for Medicare, you must be at least 65 years old or have a disability that prevents you from working.

The term disabled or person with End-Stage Renal Disease refers to a specific group of people who

After meeting the requirements, you can enroll in Medicare and obtain access to Part A and B benefits. Both sections cover the wide range of medical assistance given to members.

Part A of Medicare

Hospital treatment is what Medicare Part A is best known for. Generally speaking, Part A will pay for medical services rendered in a hospital, nursing home, hospice, or the patients home. It does not pay for visits to a doctors office or medications purchased from pharmacies or other facilities outside of hospitals.

Part B of Medicare

The Original Medicare program includes a mandatory medical insurance component known as Medicare Part B. Outpatient treatment, preventative care, and medically necessary durable equipment are the mainstays of Medicare Part Bs coverage.

Medicare Advantage Plans

Can I Switch Policies

In most cases, you won’t have a right under federal law to switch Medigap policies, unless one of these applies:

- You’re eligible under a specific circumstance or guaranteed issue rights

- You’re within your 6-month Medigap open enrollment period

You don’t have to wait a certain length of time after buying your first Medigap policy before you can switch to a different Medigap policy.

Recommended Reading: Does Medicare Pay For Tens Unit

When Can I Sign Up

- To qualify for enrolling in a Medigap plan, you must first be enrolled in Original Medicare Parts A and B.

- The best time to sign up for a Medigap plan is during the first six months in which you are age 65 or older and also enrolled in Part B. To sign up, contact the private insurance company directly. See Approved Medicare Supplement plans for contact information.

- If you’re under age 65, you might not be able to buy the Medigap plan you want – or any Medigap plan – until you turn 65.

Everyone Can Switch Medigap Plans By Answering Medical Questions

Whether you want to switch from Medigap Plan F to Plan G, you want to work with a different insurance company, or you want to get a better priced Medicare Supplement plan, you can do so at any time by submitting a new application.

In most states, you will have to answer medical questions and could be turned down for pre-existing conditions. That being said, some insurance companies ask fewer medical questions and have easier standards for approval than others.

If you dont fall under one of the states that offer guaranteed switching period , call us at 800-930-7956 and we can help you select the plan with the best chance of approval based on your health situation. We have had great success in this arena.

Recommended Reading: What Are The Qualifications To Get Medicare

Also Check: When Does Medicare Start Age