Medicare Premiums And The Government Who Pays For What

A quick background on what Medicare premiums are may be helpful. Medicare is broken into two parts. Essentially:

- Medicare Part B Standard healthcare services

There are also options for supplemental coverage, notably:

- Medicare Supplement Highly-regulated add-ons that pay your out-of-pocket Medicare costs

- Medicare Advantage Private plans that replace your Parts A, B, and in most cases, D. Also known as Part C.

- Medicare Part D Prescription drug coverage plans, introduced in 2006.

Generally, if youre on Medicare, you arent charged a premium for Part A. However, you are charged monthly premiums for Part B and Part D, and can also be charged for Part C, depending on the plan you select. These premiums are tax-deductible but very few people itemize their tax returns so only a minority of seniors use this deduction. In fact, even if you do itemize, you can only deduct medical expenses, including Medicare premiums, that exceed 10% of your adjust gross income . This further limits the number of people who can deduct their premiums.

Most ofMedicare Part B about 7% is funded through U.S. income tax revenue. But the remaining 25% of Medicare Part B expenses are paid through your premium, which is determined by your income level. Medicare prices are quoted under the assumption you have an average income. If your income level exceeds a certain threshold, you will have to pay more.

Social Security Benefits And Medicare Part B Premiums From 2000 To 2018

Social Security benefits and Medicare Part B premium amounts are adjusted annually using different methods, which typically has resulted in a higher percentage increase in Medicare Part B premiums than in Social Security benefit increases. Specifically, Social Security benefits are adjusted for inflation annually by COLAs. The Social Security COLA is a measure of general inflation based on the CPI-W. By contrast, Medicare Part B premiums are adjusted annually to account for changes in Medicare program expenditures for covered medical services. Medicare Part B premiums represent a percentage of the actual costs of the program, and thus premiums rise as health care costs rise. The annual percentage increase in Social Security benefits and Medicare Part B premiums for years 2000 to 2018 is shown in Figure 1.

Since 2000, Social Security COLAs have ranged from 0.0% to 5.8% with an average Social Security COLA of 2.2%. There was no Social Security COLA increase in 2010, 2011, or 2016 and only a relatively small Social Security COLA in 2017.

Since 2000, the Social Security annual COLA has resulted in a cumulative benefit increase of approximately 50%, considerably less than the Medicare Part B premium growth of close to 195%.58

Although Medicare Eligibility Has Nothing To Do With Income Your Premiums May Be Higher Or Lower Depending On What You Claim On Your Taxes

Medicare eligibility does not vary according to income or if you’re eligible for Medicaid. However, your taxes can impact Medicare premium rates as well. Medicare Part D beneficiaries pay yearly premiums to cover the premiums they receive. Social Security may also ask you to check if your income is higher than your income. The surcharge is only charged to patients receiving Medicare benefits. To set your Medicare cost for 2022, Social Security likely relied on the tax return you filed in 2021 that details your 2020 earnings.

Also Check: How To Get Medicare For Free

How Much You Pay

Paying extra is something you might be able to avoid, but theres good news hidden in these extra charges.

First, heres how the charges break down as of 2022:

- Youll pay an extra $68 monthly for Part B and $12.40 extra for Part D if youre married and make $182,000 to $228,000 jointly, or $91,000 to $114,000 as an individual.

- Youll pay an extra $170.10 monthly for Part B and $32.10 extra for Part D if youre married and make $228,000 to $284,000 jointly, or $114,000 to $142,000 as an individual.

- Youll pay an extra $272.20 monthly for Part B and $51.70 extra for Part D if youre married and make $284,000 to $340,000 jointly, or $142,000 to $170,000 as an individual.

- Youll pay an extra $374.20 monthly for Part B and $71.30 extra for Part D if youre married and make more than $340,000 to $750,000 jointly or more than $170,000 to $500,000 as an individual.

- Youll pay an extra $408.20 monthly for Part B and $77.90 extra for Part D if youre married and make more than $750,000 jointly or more than $500,000 as an individual.

Each of the tiers is an all-or-nothing charge. You only have to be $1 into the next tier to pay the higher amount. There is no prorating within the tiers.

You can expect these figures and income thresholds to change somewhat annually due to inflation adjustments. And keep in mind that Medicare is always a hot political topic. Medicare law often changes as well.

Read Also: Does Medicare Cover End Of Life Care

How Is A Beneficiarys Premium Determined

The Social Security Administration reviews a beneficiarys most recent federal tax information in order to determine what their premium will be. Based on the image below, the distribution of income among Medicare beneficiaries is represented by 50% with incomes below $23,500. And for those with incomes over $93,900, the beneficiary is required to pay a high premium. This adjustment is based on a sliding scale which is based upon the Modified Adjusted Gross Income and is the beneficiarys total adjusted gross income and tax-exempt interest income.

Chart source âKFF

Also Check: Will Medicare Pay For A Tummy Tuck

How Are Medicare Premiums Calculated

Not all Medicare parts require a monthly premium payment. But for the ones that do, the plan premium amount will vary from year to year.

For example, the vast majority of Medicare Part B is funded by the U.S. income tax revenue. But the rest of your Part B expenses are paid by your plan premium, calculated according to your yearly income level.

Medicare premiums are determined based on the assumption that you have an average income. The average income amount is determined by the CMS and is updated and released annually.

For 2022, the average income threshold is $91,000 a year for individual filers and $182,000 for joint filers. If your income goes over that average a surcharge is applied, and your monthly premium may be higher.

The income-related monthly adjustment amount is an added surcharge determined by the Social Security Administration that you might have to pay in addition to your Medicare base premium if your modified adjusted gross income is over the average threshold.

The adjustment is based on the adjusted gross income amount you reported on your taxes two years prior.

Your MAGI is calculated by adding your AGI to any of your other income. This includes untaxed foreign income, non-taxable Social Security benefits, tax-exempt interest, and income from within the US territories not already included in your AGI. For most individuals, your MAGI will be the same as your AGI.

So How Are The Medicare Premiums You Pay For Calculated

These additional Medicare premiums are all calculated through something called IRMAA, which stands for Income-Related Monthly Adjustment Amount. It is an additional amount that you may have to pay along with your Medicare premium if your modified adjusted gross income is higher than a certain threshold.

Your MAGI is calculated by taking your adjusted gross income plus any of the following that apply to you: untaxed foreign income, non-taxable Social Security benefits, tax-exempt interest, and income from within the US territories that was not already included in AGI. For most people, your MAGI will be the same as your AGI but read this report by the Congressional Research Service here for further details.

In 2022, the IRMAA surcharges only apply if your MAGI is more than $91,000 for an individual or more than $182,000 for a couple. Most people have income below these levels, so the majority of enrollees will pay the standard premium, $170.10 per month.

Also Check: Does Aetna Medicare Advantage Cover Dental

B Deductible Also Increased For 2021

Medicare B also has a deductible, which increased to $203 in 2021, up from $198 in 2020. After the deductible is met, the enrollee is generally responsible for 20% of the Medicare-approved cost for Part B services. But supplemental coverage often covers these coinsurance charges.

For people who became eligible for Medicare before the start of 2020, there are Medigap plans available that cover the Part B deductible, in addition to coinsurance charges. But those plans are no longer available for Medicare beneficiaries who became eligible for Medicare after the end of 2019.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

Also Check: Does Medicare Cover Gastric Bypass Revision

What Is The Medicare Part B Premium

The Medicare Part B premium is a monthly fee that Medicare beneficiaries pay if they choose to enroll in it to supplement the services available to most seniors for free with Medicare Part A.

- Medicare Part A is hospital insurance. It is available primarily to U.S. citizens and permanent residents age 65 and older. Most pay no premium for it.

- Medicare Part B covers other medically necessary services and preventative care like doctorâs services, lab tests, and outpatient care. Most pay a flat monthly premium for it, which is adjusted annually.

There is also a Medicare Part D, which covers prescription costs. It is available from insurance companies that are approved to offer it.

You May Like: What Is The Most Expensive Medicare Supplement Plan

Monthly Medicare Premiums For 2022

The standard Part B premium for 2022 is $170.10. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $91,000 Married couples with a MAGI of $182,000 or less | 2022 standard premium = $170.10 |

| Your plan premium + $77.90 |

The Medicare Part B Premium

Medicare Part B covers inpatient services like doctor visits and lab work. The standard monthly Part B premium in 2022 is $170.10. This accounts for around 25 percent of the monthly cost for Part B, with the government paying the remaining 75 percent. The percentage paid by high-income beneficiaries ranges between 35 and 85 percent, depending on their income as reported to the IRS.

Recommended Reading: How Old To Be To Get Medicare

The Interaction Between Medicare Premiums And Social Security Colas

Social Security and Medicare assist in providing financial security to most elderly and disabled individuals in the United States. Certain interactions between Social Security and Medicare may have important financial implications for individuals who are enrolled in both programs.

Social Security provides monthly cash benefits to retired or disabled workers and their family members. The Social Security benefits that are paid to retired workers are based on workersâ past earnings. Medicare is a federal insurance program that pays for covered health care services for most individuals aged 65 and older. Medicare Part B and Part D are voluntary, premium-based programs for Medicare beneficiaries providing coverage for physician services and prescription medications . Standard Medicare Part B and Part D premiums are set at a rate each year to cover approximately 25% of per capita program costs. High-income beneficiaries may pay higher than standard premiums. Individuals who are enrolled in both Social Security and Medicare must have their Medicare Part B premiums automatically deducted from their monthly Social Security benefit and may choose to have their Medicare Part D premiums automatically deducted from their monthly Social Security benefit.

E Regulatory Flexibility Act

The RFA requires agencies to analyze options for regulatory relief of small businesses, if a rule or other regulatory document has a significant impact on a substantial number of small entities. For purposes of the RFA, small entities include small businesses, nonprofit organizations, and small governmental jurisdictions. Individuals and States are not included in the definition of a small entity. This notice announces the monthly actuarial rates for aged and disabled beneficiaries enrolled in Part B of the Medicare SMI program beginning January 1, 2022. Also, this notice announces the monthly premium for aged and disabled beneficiaries as well as the income-related monthly adjustment amounts to be paid by beneficiaries with modified adjusted gross income above certain threshold amounts. As a result, we are not preparing an analysis for the RFA because the Secretary has determined that this notice will not have a significant economic impact on a substantial number of small entities.

establishes certain requirements that an agency must meet when it publishes a proposed rule or other regulatory document that imposes substantial direct compliance costs on State and local governments, preempts State law, or otherwise has federalism implications. We have determined that this notice does not significantly affect the rights, roles, and responsibilities of States. Accordingly, the requirements of do not apply to this notice.

Don’t Miss: What Is The Best Secondary Insurance With Medicare

You’ve Just Met Irmaa

Since 2007, higher-income beneficiaries must pay more for Medicare Part B, medical insurance. This monthly increase in premium is known as the Income-related Monthly Adjustment Amount, IRMAA for short. This letter notifies you that Social Security has determined you are one of those higher-income beneficiaries.

Social Security uses a special modified adjusted gross income for IRMAA purposes. This is the total of tax-exempt interest and adjusted gross income from your income tax statement two years prior to the current year. The threshold in 2022 is $91,000 for an individual filer and $182,000 for a couple. Social Security looks at the tax return two years prior to the current year. For example, Social Security reviewed 2020 tax returns to identify those who are subject to IRMAA in 2022. The additional amounts that a higher-income beneficiary pays in 2022 range from $68 to $408.20 for Part B.

Be aware: If you must pay more for Part B, you may also be subject to Part D, prescription drug coverage, IRMAA. The amounts in 2022 range from $12.40 to $77.90. Check out this year’s adjustments for Part B and Part D.

How Did Medicare Supplement Insurance Change In 2022

Medicare Supplement Insurance, or Medigap, helps pay for certain Part A and Part B out-of-pocket expenses, such as deductibles, coinsurance and copayment.

As of 2020, Medigap Plan C and Plan F will no longer be sold to new Medicare beneficiaries.

If you became eligible for Medicare before January 1, 2020, you may still be able to buy Medigap Plan F or Plan C if either is available where you live. If you already have either plan, you can keep it.

You May Like: Where To Get A New Medicare Card

How Medicare Premiums Are Calculated

If you’re currently on Medicare, you probably know that your monthly premium is subject to change each year. But exactly how your premium changes isnt based on the factors you might think, like your health, annual income, or chosen Medicare plan.

Instead, your Medicare Part B premiums will likely increase due to rising healthcare costs.

Understanding how your Medicare premiums are determined can help you better plan your healthcare finances, which is especially important for seniors on a fixed income.

Lets take a closer look at what Medicare is, how monthly payments are calculated, and the current rates you can expect.

B Premium Can Be Limited By Social Security Cola But That Hasnt Been An Issue For Most Beneficiaries Since 2019

In 2022, most enrollees will pay $171.10/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2021 , in 2020 , and in 2019 . Some enrollees pay more than the standard premium, if theyre subject to a high-income surcharge .

But thats in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium. The standard premium in 2018 was actually $134/month, but the cost of living adjustment for Social Security wasnt quite large enough to cover all of the increase from 2017s premium for most enrollees. Thats why most people paid about $130/month.

The standard Part B premium increased by about $9/month in 2020. But the 1.6% Social Security COLA for 2020 increased the average beneficiarys Social Security benefit . Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees paid the standard premium in 2020. And for 2021, the 1.3% COLA was adequate to cover the increase to the new standard premium for virtually all enrollees. The COLA for 2022 was the largest it had been in 30 years, and more than adequate to cover even the substantial increase in Part B premiums.

You May Like: How To Apply For Medicare In Alaska

How Does Medicare Determine Your Income

Original Medicare is two-fold, comprised of Part A and Part B . They differ not only in the Medicare benefits covered but also in how the premiums are determined.

Part A premium based on credits earned

Most people eligible for Part A have premium-free coverage. The premium is based on credits earned by working and paying taxes. When you work in the U.S., a portion of the taxes automatically deducted are earmarked for the Medicare program. Workers are able to earn up to four credits per year. Earning 40 credits qualifies Medicare recipients for Part A with a zero premium. A sliding scale is used to determine premiums for those who work less than 40 quarters. In 2020, this equates to $252 per month for 30 to 39 quarters and $458 per month for less than 30 quarters.

Part B premium based on annual income

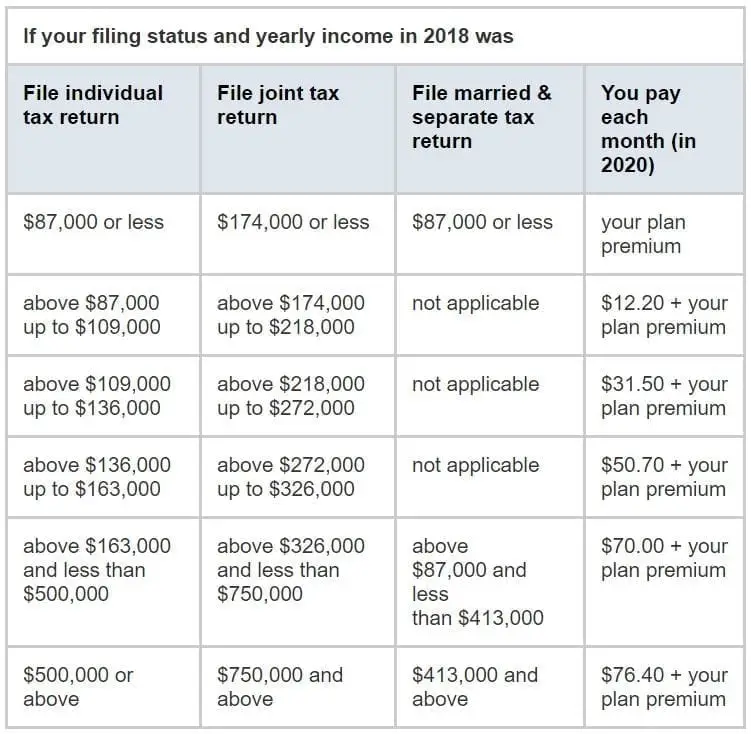

The Part B premium, on the other hand, is based on income. In 2020, the monthly premium starts at $144.60, referred to as the standard premium. Once you exceed $87,000 yearly income if you file an individual tax return, or $174,000 if you file a joint tax return, the cost goes up to $202.40. As your income rises, so too does the premium amount until a certain level of income is exceeded based on tax return filing status. At that level, the monthly premium is set at $491.60. The amounts are reevaluated by Medicare annually and may change from year to year. Any amount charged above the standard premium is known as an income-related monthly adjustment amount .

Related articles: