At What Age Should You Start Looking Into And Applying For Medicare

You should start looking into and applying for Medicare for up to 6 months before you become eligible.

- Was this article helpful ?

Disclaimer: By clicking the button above, you consent to receive emails, text messages and/or phone calls via automated telephone dialing system or by artificial/pre-recorded message from representatives or licensed insurance agents of Elite Insurance Partners LLC, its affiliates or third-party partners at the email address and telephone number provided, including your wireless number , regarding Medicare Supplement Insurance, Medicare Advantage, Medicare Part D and/or other insurance plans. Your consent is not a condition of purchase and you may revoke your consent at any time. This program is subject to our Privacy Policy and Terms of Use. This website is not connected with the federal government or the federal Medicare program.

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

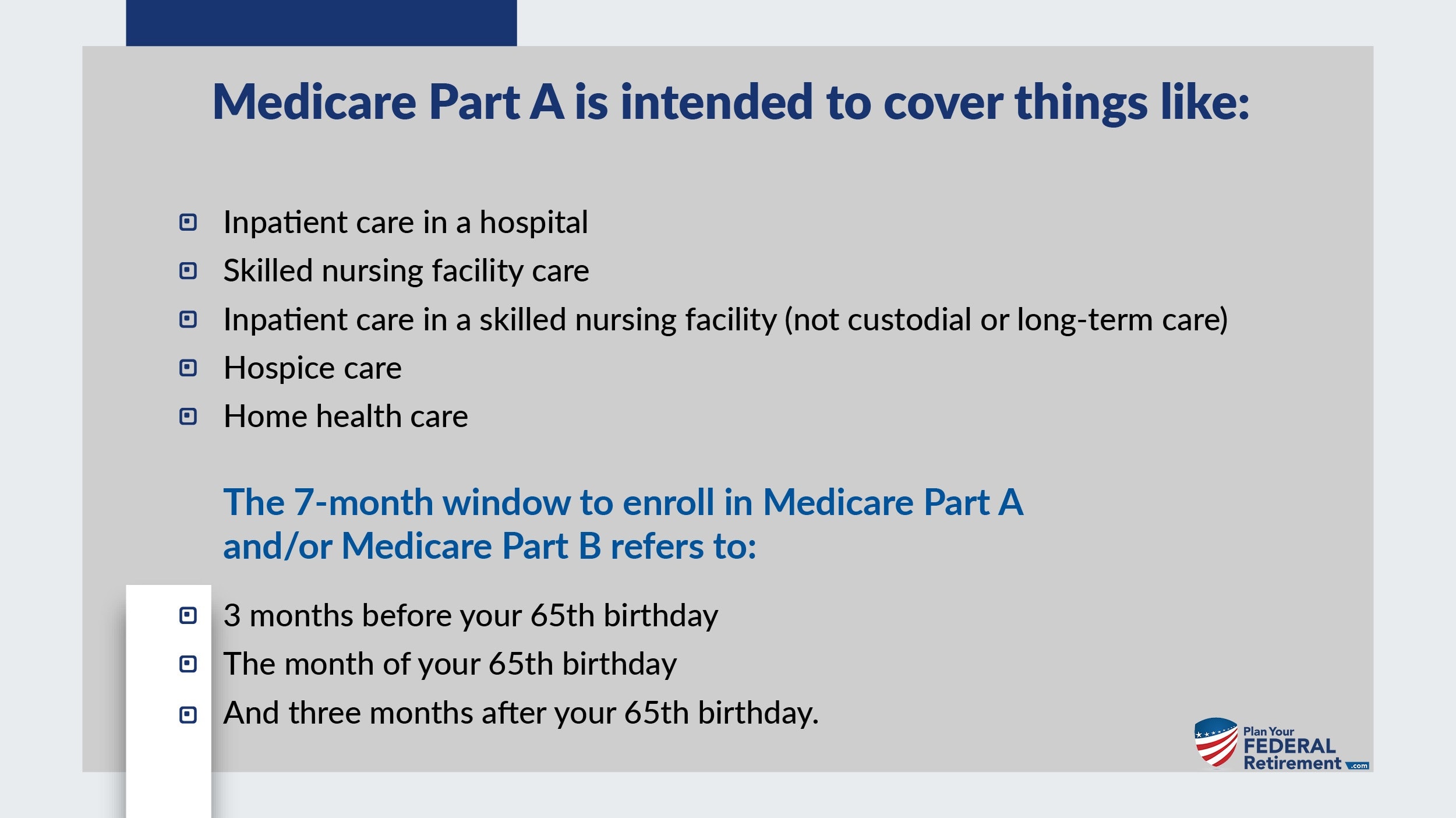

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Medicare Eligibility Age Chart

Most older adults are familiar with Medicare and its eligibility age of 65. Medicare Part A and Medicare Part B are available based on age or, in some cases, health conditions, including:

- Age 65 or older

- Disabled

- End-Stage Renal Disease

Individuals under 65 and already receiving Social Security or Railroad Retirement Board benefits for 24 months are eligible for Medicare. Still, most beneficiaries enroll at 65 when they become eligible for Medicare.

You May Like: Why Is My First Medicare Bill So High

Does Everyone Start Medicare At 65

In the most common of cases, Medicare benefits begin at age 65. Of course, there are age exceptions for Medicare eligibility.

A person younger than age 65 can receive Social Security Disability Income benefits because a disability prevents working at a regular job.

If a family member has a disability but is covered by the familys private insurance, that person could receive Medicare benefits after losing eligibility for their parents health policy.

Health Care Options Between Early Retirement And Medicare

If you plan to retire early, youll need to figure out a plan to pay for health care before you reach Medicare eligibility age. There are a few different options.

If your spouse is still in the workforce, you might be eligible to be covered under their employers health plan if it includes spouses.

You also could opt for COBRA coverage, which allows you to essentially continue using your former employers coverage in some circumstances for a limited amount of time. This option can be expensive since you will have to pay the full premium.

This arrangement may not be sustainable depending on how early you retire since COBRA coverage typically only lasts for 18 to 36 months.

Depending on your financial situation, you may be eligible for Medicaid. Eligibility varies by state, but this is typically an option if you have very little money or income. You also could opt to purchase a private insurance plan.

Don’t Miss: Why Is My Medicare So Expensive

When To Start A Medicare Supplement Plan

Medigap is extra insurance that fills in the gaps in Medicare. Medigap plans can pay for more extended hospital stays. Your one-time Medigap Open Enrollment Period starts on the 1st day of the month youre 65 years old and have Part B.

Signing up for Medigap during Open Enrollment means the insurance company CANT charge you more or deny you coverage. If you wait and sign up, you can be turned down or charged more because of your health.

Medicare Enrollment Can Be Impacted By Social Security Benefits

Depending on your situation, you with either need to enroll in Medicare at age 65 or you may be able to delay. If you continue to work past age 65 and have creditable employer coverage , you can likely delay enrolling in Medicare until you lose that employer coverage. In most cases, people turning 65 will need to get Medicare during their 7-month Initial Enrollment Period to avoid financial penalties for enrolling late. Your IEP begins 3 months before the month of your 65th birthday and ends 3 months after.

Social Security benefits fit in the Medicare enrollment journey in one special way. If you are receiving either Social Security benefits for retirement or for disability, or Railroad Retirement Board benefits, you will be automatically enrolled in Medicare Part A and Part B when you first become eligible.

Also Check: Is Silver Sneakers Available To Anyone On Medicare

At What Age Does Medicare Start

- Asked May 3, 2013 in

Contact Bob Vineyard Contact Bob Vineyard by filling out the form below

Bob VineyardPROFounder, Georgia Medicare Plans, Atlanta,GAFor most people, Medicare starts when you turn age 65. It can start earlier if you are disabled under Social Security definitions and are receiving SSDI.It can also begin before age 65 if you have ALS or ESRD .Your Medicare Part B can begin later if you are covered under a group health insurance plan.Answered on May 3, 2013+2

Contact Bill Loughead Contact Bill Loughead by filling out the form below

Bill LougheadPROPresident, SummitMedigap.com, CO, FL, GA, MI, NC, SC & TXFor most people, Medicare starts the 1st day of the month you turn age 65. You can sign up for Medicare Part A & B which covers about 80% of the costs of care. You can also sign up for a Medicare Supplement plan to cover the difference. Medicare along with a Medicare Supplement is great health insurance. In addition, you can get a Medicare Part D plan to cover your prescription needs.Answered on May 26, 2014+2

The Cost Of Medicare At 60

If Medicare at 60 becomes reality, there are financial concerns that the country must address. Those who age in are eligible for Part A premium-free if theyve paid in while working for at least 40 quarters . The tax money goes to the Hospital Insurance Trust Fund. This fund pays for Part A, which is why it is premium-free for most.

A major concern is that the HI Trust Fund is at risk of insolvency. Meaning, there might not be sufficient revenue to cover Part A premiums in just a few years. The original prediction for when this would happen was 2026, but the pandemic is an additional strain on the fund and is speeding up the timeline.

The HI Trust Fund would need to be well-funded if Medicare at 60 becomes law. Millions more people would need to start receiving the coverage that theyve already paid into.

Recommended Reading: What Does Medicare Supplement Cost

When Does Medicare Start With Ssdi

Discussing Medicare with disability benefits usually refers to people under the age of 65 who developed a disability that has a sudden impact, such as becoming paralyzed or blinded.

When anyone starts Medicare benefits, timing becomes an important factor.

Medicare starts with SSDI after two years of benefits.

A child disabled since birth can receive SSDI disability benefits based on the recent work history of a parent. The parent must have worked and paid Social Security taxes for at least half of the last 3 years.

Depending on conditions, Medicare benefits may begin at a very early age.

What If I Dont Sign Up For Medicare When Turning 65

You can always change your mind, but you could potentially have to pay late enrollment penalties depending on the parts of Medicare you sign up for and your reasons for not signing up when you were first eligible.

- You can sign up for Medicare Part A at any time once youre eligible. However, if you have to buy Medicare Part A and you dont buy it when youre first eligible for Medicare coverage, your monthly premium may go up 10%. Youll have to pay this Part A late enrollment penalty for twice the number of years you were eligible for Part A but didnt sign up. For example, if you were eligible for Part A for two years but didnt sign up, youll have to pay the late enrollment fee for four years.

- If you dont sign up for Medicare Part B when youre first eligible and you arent eligible for a special enrollment period , you typically have to wait to sign up during the general enrollment period that takes place from January 1 March 31 every year. If this is the case, your Medicare coverage will become active on July 1 of that year. However, you may need to pay a Part B late enrollment penalty. Youll pay this penalty each time you pay your monthly premium. The longer you wait to sign up for Part B, the more your penalty will increase. The takeaway? Sign up sooner rather than later.

Don’t Miss: Where Can I Get Medicare Information

Should You Wait Until 65 To Sign Up For Medicare

If you wait to sign up right before your 65th birthday , you may go for months without coverage.

Initial Enrollment Period

Your Initial Enrollment Period will last for 7 months. This Initial Enrollment Period begins 3 months before the month of your 65th birthday and ends 3 months after your birthday month. If you fail to enroll before your birthday month, your coverage will be delayed by a month or more.

General Enrollment Period

Youll have the option to sign up during the General Enrollment Period which falls between January 1 and March 31 every year if you didnt sign up during the Initial Enrollment Period. But youll potentially be charged a late enrollment penalty. Your premiums for Part B will be permanently increased by 10% for each year that you neglected to sign up for Part B and your monthly premiums for Part A will temporarily increase by 10%. As a rule, most people dont pay premiums for Part A, but then again, most people dont delay signing up for Part A. Your coverage will start on July 1, three months after the General Enrollment Period ends.

You may be able to avoid the late enrollment penalty and having to wait for the General Enrollment Period if you qualify for a Special Enrollment Period.

Special Enrollment Period

Its important to check with your insurer or HR department to make sure that your coverage is sufficient to postpone Medicare enrollment.

Signing Up For Part A And/or Partb During The Last 4 Months Of Your Initial Enrollment:

- If you sign up in the month you turn 65, your coverage will start 1 month after you sign up.

- If you sign up in the month after you turn 65, your coverage will start 2 months after you sign up.

- If you sign up 2 months after you turn 65, your coverage will start 3 months after you sign up.

- If you sign up 3 months after you turn 65, your coverage will start 3 months after you sign up.

In some cases, you can become eligible for Medicare before youre 65. You can qualify for Medicare at a younger age if:

- Youve received Social Security or Railroad Retirement disability payments for 24 months. This triggers automatic enrollment.

- You have amyotrophic lateral sclerosis . You will be automatically enrolled in Medicare Part A and B the first month your Social Security and Railroad Retirement disability benefits begin.

- You have end stage renal disease . Your Medicare coverage starts on the 4th month of dialysis treatments. If you participate in a home dialysis training program, your coverage could potentially start on the first month of dialysis.

Also Check: Does Medicare Pay For Urgent Care

Exceptions To The 65 And Older Rule

For people who received SSDI for Amyotrophic Lateral Sclerosis , commonly known as Lou Gehrigs disease, Medicare starts automatically in the first month they receive their SSDI benefit. These beneficiaries do not need to wait 24 months. Additionally, patients with late-stage renal failure may not need to wait for 24 months either. Those with End-Stage Renal DiseaseEnd-Stage Renal Disease , also known as kidney failure, is a condition that causes you to need dialysis or a kidney transplant. People with ESRD are eligible for Medicare coverage regardless of age…. who have had a transplant or receive dialysis treatments would need to be on SSDI to qualify for Medicare.

Additionally, retired railroad workers also qualify for Medicare. This program works a little differently, but the end result is that they are insured through Medicare. The Railroad Retirement Board is who would process your application as opposed to the Social Security office. If you already receive RRB checks, you would be automatically enrolled in Medicare when you turn 65. If you do not receive checks yet when you turn 65, you can apply for Medicare directly through the RRB office.

Whathappens When A Qualifying Spouse Is Younger

A person is eligible for Medicare Part A if they or their spouse have paid Medicare taxes for at least 40 quarters of work.

This might become more challenging when an older adult with a younger spouse did not work 40 quarters but their spouse did.

If a younger spouse worked for 40 quarters, they can qualify their partner for Medicare coverage once they reach 62 years of age and the older, nonworking spouse reaches 65 years of age.

If a person reaches 65 years of age, did not pay Medicare taxes for 40 quarters, and has a spouse under the age of 62 years, they may have to pay for their Medicare Part A benefits until their qualifying spouse reaches 62 years of age.

Also Check: How To Apply For Medicare Without Claiming Social Security

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to enroll in Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on behalf of your employer without your employers signature and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

What Are The Basic Qualifications For Medicare Eligibility

The basic qualifications that make you eligible for Medicare are:

- You are a U.S. citizen or a legal resident who has lived in the U.S. for at least five years, and:

- You are 65 years of age, or

- You have a disability based on Social Securitys definition of total disability, or

- You have ALS , or

- You have ESRD

You May Like: How Much Does Medicare Pay For Dialysis Transport

What Is Not Covered By Medicare

Some of the benefits many people think are covered that arent include long-term care, acupuncture, and routine foot care. Dental, including dentures, doesnt have coverage through Medicare. Further, eye exams, hearing aids, hearing exams, and cosmetic surgery wont be covered through Medicare.

Services Medicare doesnt cover youll pay for yourself.

How Much Does Medicare Cost

One of the biggest misunderstandings about the Medicare program is its costs. It is not free and it does not cover everything.

All Medicare beneficiaries pay a monthly premium for their medical coverage . The premium is based on your annual income. High-income earners pay a little more than those with a lower income. For 2022, the basic Part B monthly premium is $170.10. For high-income earners, the rate is between $238.10 and $578.30 per month.

Some Medicare Advantage plans do not have an additional monthly premium but, you must continue paying your Medicare Part B premium. When a Medicare Advantage plan has a $0 premium it simply means that what you pay for your Medicare Part B each month covers the full cost of the private insurance plan.

Medicare Part A is hospital insurance and is available at no cost to people who worked and paid Medicare taxes for ten or more years. If you did not pay Medicare taxes for a full ten years , you must pay a monthly premium for your Medicare Part A benefits. The amount you pay is based on the number of quarters you paid Medicare taxes. The more you paid in the past, the less youll pay for your premiums.

Read Also: Does Medicare Part B Pay For Hearing Aids