What Is A Medigap Policy

A Medigap policy is health insurance sold by private insurance companies to fill the gaps in Original Medicare Plan coverage. Medigap policies help pay some of the health care costs that the Original Medicare Plan does not cover. If you are in the Original Medicare Plan and have a Medigap policy, then Medicare and your Medigap policy will each pay their share of covered health care costs.

Sign Up: Within 8 Months After You Or Your Spouse Stopped Working

Your current coverage might not pay for health services if you dont have both Part A and Part B .

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Medicare Supplements And Enlarged Heart

An enlarged heart is pretty close to what it sounds like. It is identified by imaging showing the individualâs heart is a larger size than it normally should be. However, the issue is not the heartâs enlargement, but rather whatever illness is causing the heart to be enlarged.

An enlarged heart can occur due to short-term stressors like pregnancy or a medical condition. However, it can also be an indicator of a more severe and long-term condition.

Symptoms include the following:

- Discomfort in the upper areas of the body

If youâre concerned about your heart health, contact your doctor.

Because an enlarged heart can occur through a variety of different illnesses, the direct cause is what would or would not prevent you from receiving Medigap coverage. While a short-term condition may pass, a long-term heart condition may be cause for decline.

Enrollment eligibility varies across each state and company, so check with your agent to determine whether your specific heart condition can cause a decline!

Also Check: What Benefits Do You Get With Medicare

When Can You Enroll In A Medicare Supplement Plan Or Medigap Policy

If youre thinking about joining a Medicare Supplement Plan or Medigap policy, figuring out when to enroll can be difficult.

While you can enroll in a Medicare Supplement Insurance at any time, if you enroll at the wrong time it can sometimes limit your choices, cost you more money, and affect your cover.

This article will discuss when you can enroll in a Medicare Supplement Plan and what you should know before you do.

How Do I Enroll In A Medicare Supplement Plan If I Am Under 65

Federal law doesnât require insurance companies to sell Medicare Supplement plans to people under 65 and Medicare beneficiaries under 65 generally donât have Medicare Supplement Open Enrollment Periods. If you are under 65 and have Medicare, you can apply for a Medicare Supplement plan at any time. However, in order to be eligible for Medicare when are you are under 65, you generally must have a disability or serious health condition. A Medicare Supplement plan can consider that disability or health condition and the cost to insure you and reject your application.

Some states have an open enrollment period for eligible individuals under the age of 65. If you are under 65, check with your state insurance department for guidelines.

Don’t Miss: Where Do I Get Medicare Part B

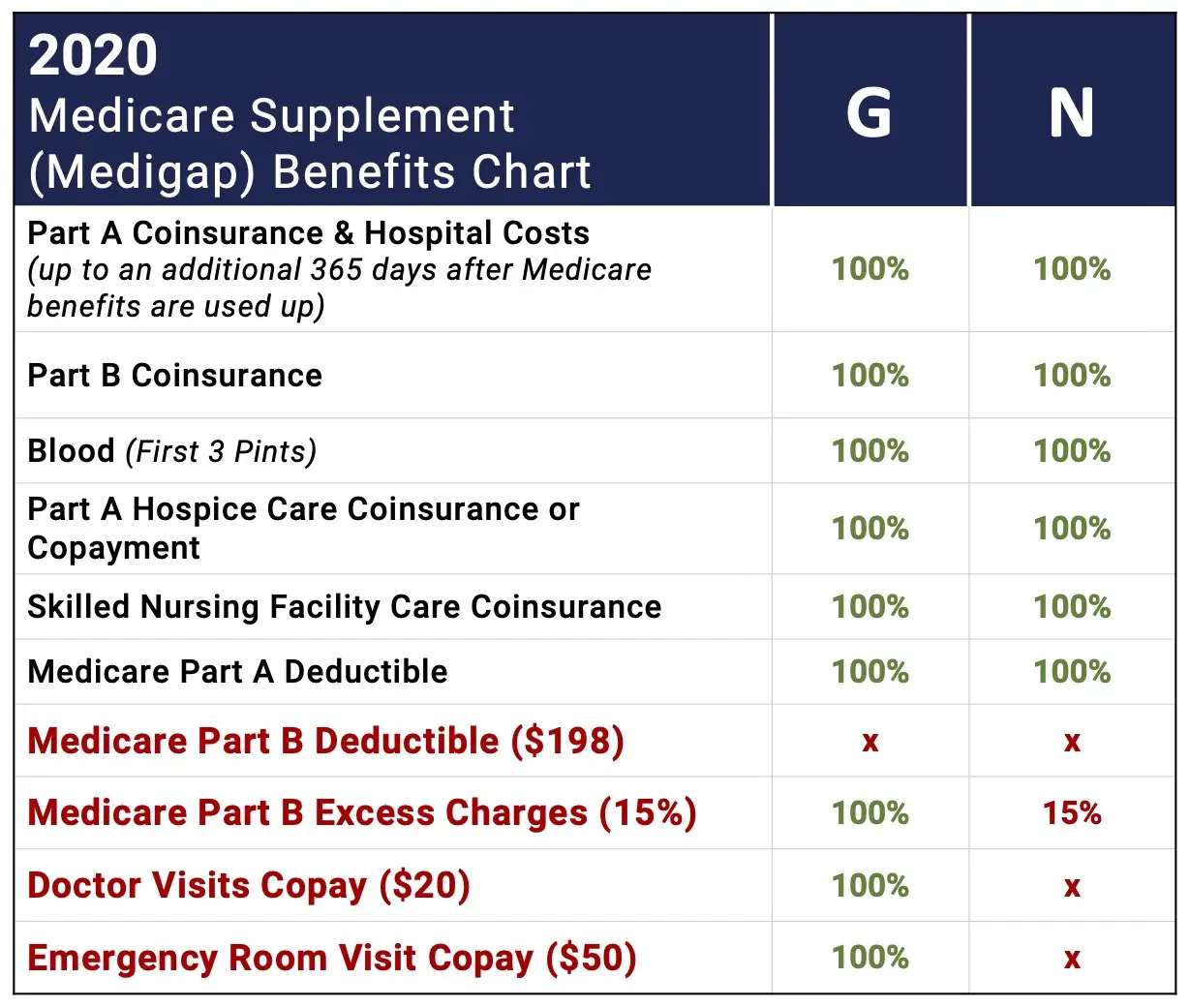

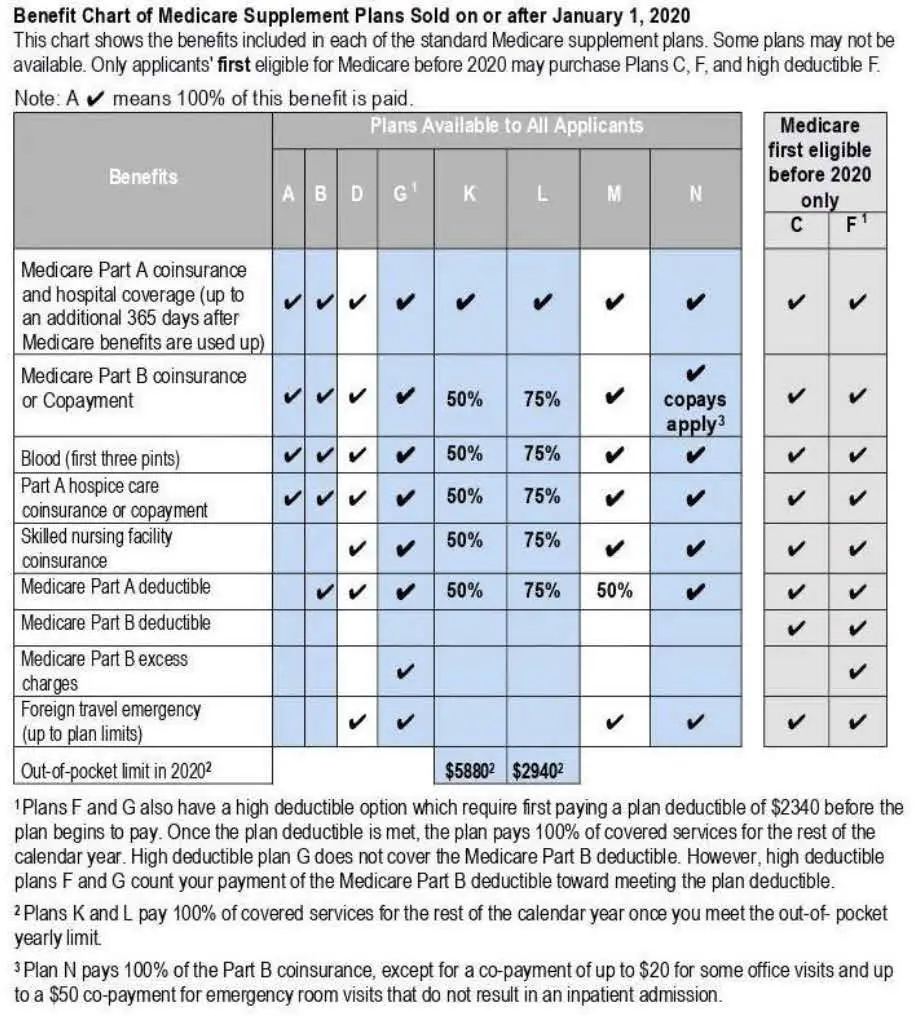

What Isnt Covered In My Medicare That Is Covered By Medigap

You may want to buy a Medigap policy because Medicare does not pay for all of your health care. There are gaps or out-of-pocket costs that you must pay in the Original Medicare Plan. Some examples of costs not covered are hospital stays, skilled nursing facility stays, blood, Medicare Part B yearly deductible and Medicare Part B covered services. A Medigap policy will not cover long-term care, vision or dental care, hearing aids and private-duty nursing.

Can You Have An Advantage Plan And A Supplemental Plan

While you can’t add a Medicare Supplement plan to a Medicare Advantage plan, the added benefits MA plans provide help make up the difference when it comes to out-of-pocket costs. One great feature is the security of an annual limit on out-of-pocket costs, after which you pay nothing for covered services.

You May Like: Does Medicare Pay For Orthotics

I Will Be Turning 65 In A Few Weeks Can You Please Explain The Open Enrollment For Medicare Supplement Insurance Policies

If you are turning 65, your first priority is to make sure you are enrolled in Medicare Part B . Federal law gives you a 6-month “open enrollment” period to apply for a Medicare supplement insurance policy, beginning with the first month that you enroll for benefits under Medicare Part B. For information on available Medicare supplement plans, see: A Consumer’s Guide to Medicare Supplement Insurance . To see exactly what Maine law says on this issue, check out: Bureau of Insurance Rule 275 Section 11. For other questions about Medicare or Medicare Supplement policies, contact the Maine State Health Insurance Assistance Program at 1-800-262-2232 .

When Can I Enroll In A Medicare Supplement Plan

Making sure you have the right Medicare coverage can be confusing. Enrollment timing, different plans, and personal requirements can make shopping around for Medicare a hassle.

Luckily, thatâs why Medicare Allies is here. We can give you the bite-sized low-down on all things Medicare coverage so you make the most informed decisions possible without having to spend unnecessary time in the weeds.

Through different advertisements, letters, or word-of-mouth, you have probably heard enticing stories of savings and extra benefits through a Medicare Supplement plan.

Here is all you need to know about your options regarding Medicare Supplement plans.

You May Like: What Is Medicare Plan F

What Medicare Does Not Cover

You may not know that private provider Part D prescription benefits are suspended after you reach a certain dollar amount. This interrupted period is referred to as the Medicare donut hole.

After you reach your plans deductible for prescription expenses, Medicare will pay for a certain percentage of your prescription drug costs. They cover a portion of the costs until you reach the donut hole level of costs. The donut hole is when Medicare Part D stops paying for prescription care and the level when your prescription costs reach catastrophic levels. Once you reach the catastrophic level, Medicare will pay 95% of prescription drug costs.

Seniors might stop taking their medications once they reach this gap in coverage, making them more susceptible to illness and even death. Seniors should never be put in the position of having to choose between medicine and other necessities. You do not have to worry about being without life-sustaining prescription medications if you have proper Medicare gap coverage.

Another flaw of Medicare is that it leaves seniors without important coverage for other essential services such as vision and hearing. A large percentage of all seniors who are on Medicare have vision or hearing problems. Again, here is another way where Medicare gap coverage can make the difference for seniors to be able to afford the health care services they really need.

Recommended Reading: What Eye Care Does Medicare Cover

Enrolling In Humana Medicare Supplement Plan G

You can apply for Medicare Supplement Insurance at any time of the year. The best time to apply for Plan G, however, is during your Medigap Open Enrollment Period or during any other time you have guaranteed issue rights.

Your Medigap Open Enrollment period begins the month you are at least 65 years old and enrolled in Medicare Part B, and it lasts for six months.

During this time, you have guaranteed issue rights. That means insurance companies like Humana are not allowed to use medical underwriting to determine your plan premiums. But if you wait to enroll outside of this protected window, you no longer have guaranteed issue rights and insurance companies reserve the right to perform physical exams and issue medical questionnaires that can dictate your rate.

Contact a licensed insurance agent to learn about your cost for Humana Plan G and for help comparing Humana Plan G against other Humana plans.

Also Check: When Are You Required To Sign Up For Medicare

Are You Considering A Medicare Supplement Plan

SHIIPs interactive tool allows you to compare Medicare supplement by entering your age, gender the Medicare supplement plan you want to compare and whether or note you use tobacco products to receive a list of companies offering that plan along with their estimated premiums.

You will not be auto enrolled into a Medicare supplement policy and must make application directly with the insurance company. You will need to contact the insurance company that sells the specific policy that you wish to purchase, or you may contact an agent who sells the specific policy you want. We recommend that you apply at least 30 days before you want the policy to start. If you do not have thirty days, apply as soon as possible. Supplement premiums are paid directly to the insurance company and are not deducted from your Social Security payments.

When Is The Best Time To Buy A Plan

The Medicare Supplement Open Enrollment period starts on the 1st day of the 1st month in which youre age 65 or older and enrolled in Medicare Part B. In some states, you can buy a plan on the 1st day youre enrolled in Medicare Part B, even if youre not yet 65.

If you meet certain criteria, such as applying during your Medicare Supplement Open Enrollment Period, or if you qualify for guaranteed issue, a company cant use your medical history to determine your eligibility. Rules in some states may vary.

Don’t Miss: Can I Draw Medicare At Age 62

How Much Does Humana Medicare Supplement Plan G Cost

Humana Medicare Supplement Plan G premiums can vary by age, gender, location and when you apply for a policy. The best way to find out how much you can expect to pay for Humana Plan G is to contact a licensed insurance agent who sells Humana Plan G in your area.

You can visit Humana-MedicareSupplement.com to request a free quote for Humana Plan G and other Humana Medigap plans available in your local area, or you can call to speak with a licensed insurance agent who can help you compare plans and apply, if youre eligible.

What Can I Do Next

Generally, youre first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65.

Because the company has less than 20 employees, your job-based coverage might not pay for health services if you dont have both Part A and Part B.

Read Also: Which Blood Glucose Meters Are Covered By Medicare

How To Apply Online For Just Medicare

Are you within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet? You can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

Cobra Coverage From An Employer Plan

Federal and state law allows people who leave their jobs to continue their employer-sponsored health coverage for a period of time. Be aware of the following:

- You have an eight-month period after your employment ends to enroll in Medicare. If you dont enroll during that eight-month window, you might have to pay a penalty when you enroll.

- If youre in your Medicare initial enrollment period, you must enroll in Medicare during that time to avoid a possible penalty.

- If you dont buy a Medicare supplement policy during your open enrollment period, youll be able to buy some Medicare supplement plans within 63 days of losing your COBRA coverage.

Talk to your employer about COBRA and Medicare eligibility.

Also Check: How Do I Apply For Medicare Part B Online

General Features Of Medicare Supplement Insurance Plans

Medicare Supplement insurance plans work with Original Medicare to help with out-of-pocket costs not covered by Parts A and B. The following are also true about Medicare Supplement insurance plans:

- Predictable costs help you stay ahead of unexpected out-of-pocket expenses.

- No network restrictions mean you can see any doctor who accepts Medicare patients.

- You don’t need a referral to see a specialist.

- Coverage goes with you anywhere you travel in the U.S.

- There is a range of plans available to fit your health needs and budget goals.

- Purchasing a Medigap plan and a Medicare Part D prescription drug plan could give you more complete coverage.

- Guaranteed coverage for life means your plan can’t be canceled.

As long as you pay your premiums when due and you do not make any material misrepresentation when you apply for this plan.

For PA residents only: As long as you pay your premiums when due. You do not misstate one or more material facts when you apply for this plan. UnitedHealthcare has 2 years to act on misstatements. The 2 year limit does not apply to fraud.

Rates are subject to change. Any change will apply to all members of the same class insured under your plan who reside in your state. can provide peace of mind by helping with some of these costs.

Medicare Select Insurance Policies

Medicare SELECT policies are a type of Medicare Supplement insurance sold by a few private insurance companies. A Medicare SELECT policy is one of the 8 standardized supplement policies.

It differs from Medicare Supplement insurance because you are expected to use a network of hospitals associated with the insurance company. In return, you will usually pay lower premiums. Also, in order to enroll in a Medicare SELECT plan, you must live within the service area of a network facility.

Don’t Miss: How Is Medicare Part B Penalty Calculated

What Do I Need To Claim Guarantee Issue Rights

Now that we know what situations are subjected to the availability of guarantee issue rights lets check the requirements we need to keep in handy.

- A copy of any letters, notices, emails, or denials of claims that bear your name as evidence that your coverage has ended.

- These papers arrive in a postage-paid envelope as evidence that they were mailed.

To demonstrate that you have a guaranteed issue right, you might need to submit a copy of some, all, or all of these documents together with your Medigap application.

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B. Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your Initial Enrollment Period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

Note: Important Upcoming Change Rules for 2023 and later: If you accept the automatic enrollment in Medicare Part B or if you sign up during the first three months of your IEP, your coverage will start the month youre first eligible. Beginning January 1, 2023, if you sign up during the month you turn 65 or during the last three months of your IEP, your coverage starts the first day of the month after you sign up.

The following chart shows when your Medicare Part B becomes effective in 2022:

| In 2022, if you sign up during this month of your IEP | Your Part B Medicare coverage starts |

|---|---|

| One to three months before you reach age 65 | The month you turn age 65. |

| The month you reach age 65 | One month after the month you turn age 65. |

| One month after you reach age 65 | Two months after the month of enrollment. |

| Two or three months after you reach age 65 | Three months after the month of enrollment. |

The following chart shows when your Medicare Part B becomes effective in 2023:

Also Check: Who Can Get Medicare Before Age 65

What States Require Guarantee Issue Rights For Medigap Beyond The Scope Set By The Federal Government

States have the freedom to enact Medigap consumer safeguards that go above and beyond the minimum federal requirements.

Although many states have used this freedom to increase Medigap guarantee issue rights in specific situations, 15 states and the District of Columbia chose the conventional path, instead relying solely on the minimal guarantee issue standards set forth by federal law.

Only four states mandate that Medigap insurers provide Medicare enrollees aged 65 and older with coverage options. One of these states, Maine, mandates that insurers only offer Medigap Plan A during an annual one-month open enrollment period. Three of these statesConnecticut, Massachusetts, and New Yorkhave continuous open enrollment with guaranteed issue rights throughout the year.

In accordance with federal law, if an applicant does not have six months of ongoing creditable coverage before purchasing a plan during the initial Medigap open enrollment period, the Medigap insurers in New York, Connecticut, and Maine may impose up to a six-month waiting period to cover services related to pre-existing conditions. For Massachusetts Medicare supplement insurance policies, pre-existing condition waiting periods are not permitted.

The federal minimum requirements have been narrowly enhanced in several other states by mandating that Medigap insurers issue insurance to qualified applicants during qualifying events, as we have discussed before.

Whats A Medicare Supplement Guaranteed Issue Right

Who is this for?

If youâre shopping for a Medicare supplement plan, this information can help you understand if you qualify for a guarantted issue right and what that means.

Medicare supplement plans donât have annual enrollment periods, so when you apply is very important. If youâre new to Medicare or youâre losing your current coverage, you may qualify for a guaranteed issue right. Itâs the best time for you to apply because it guarantees youâll get coverage and you may get a better price. Learn more in When should I apply for a Medicare supplement plan?

Read Also: Does Medicare Cover Incontinence Supplies 2020