Should I Take My Social Security At 62

The minimum age to claim benefits is 62. 1 If you are turning 62 and need the income from Social Security to support yourself, then you can start claiming your benefits now. However, if you have enough other income to keep you going until you are older, you may want to delay increasing the size of your monthly benefit.

Healthcare Retirement Planning Tips

- Retirement planning and saving for healthcare costs are two essential factors of your financial life. But, you dont have to figure it all out on your own. If youd like some guidance from a professional, we can help. Our SmartAsset financial advisor matching tool connects you with up to three financial advisors in your area within minutes. From there, you can compare their qualifications and specialties before deciding to work with one.

- Healthcare cost can vary widely by your location. Therefore, you may want to retire somewhere where healthcare costs the least. To help, weve developed a study on the best states for healthcare access.

Medicare For Individuals Who Are Divorced Or Widowed

Many individuals who are divorced or widowed are concerned that the loss of their spouse will somehow affect their ability to qualify for Original Medicare .

Rest assured your marital status does not affect your ability to qualify for Medicare. You are eligible for Medicare if:

- You are a U.S citizen or legal resident for at least 5 consecutive years and

- You are:

- Age 65 or older or

- Younger than 65 with a qualifying disability or

- Any age if you have end-stage renal disease or amyotrophic lateral sclerosis .

Recommended Reading: Does Medicare Cover The Cost Of A Shingles Shot

You May Like: How To Enroll In Medicare Part D

How Much Can You Earn While Collecting Widows Benefits In 2020

The Social Security earnings limits are established each year by the SSA. For 2020, those who are younger than full retirement age throughout the year can earn up to $18,240 per year without losing any of their benefits. After that, youll lose $1 of annual benefits for every $2 you make above the threshold.

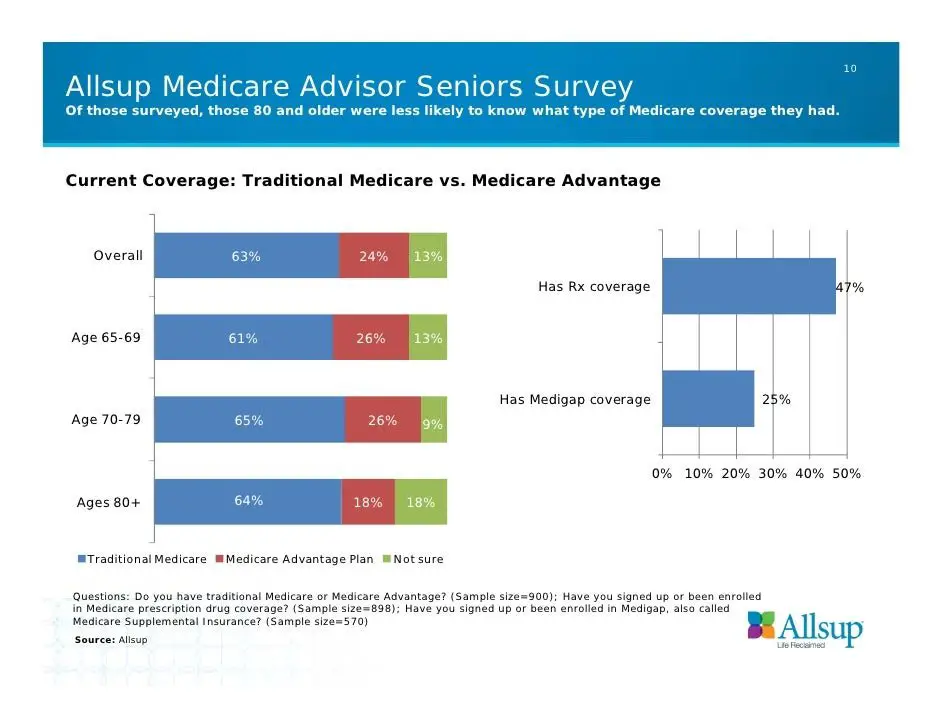

Does The Eligibility Age Change For Types Of Medicare Coverage

No. You need to have Medicare Part A and Part B if you want to sign up for a Medicare Advantage plan or a Medicare Supplement insurance plan. If you sign up for a stand-alone Medicare prescription drug plan, you need Part A and/or Part B.

So, itâs not like you can get a Medicare Advantage plan, for example, when youâre younger than 65 unless you qualify by disability.

Also Check: Does Medicare Part B Cover Home Health Care Services

Find A $0 Premium Medicare Advantage Plan Today

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Demonstration Or Pilot Programs

Medicare developed demonstration or pilot programs as research to test improvements. They are usually only available for a short time. To qualify, a person must live in a specific area, belong to a specific group of people, or both. To check whether a demonstration or pilot program is available, a person can call Medicare at 1-800-MEDICARE .

Also Check: How To Get Medicare Eob Online

How Much Do You Lose By Retiring At 65

62-year-old: 30 percent. 63-year-old: 25 percent. 64-year-old: 20 percent. 65-year-old: 13.3 percent.

What percentage do I get if I retire at 65?

If you start collecting benefits at age 65, you could receive about $ 33,773 a year or $ 2,814 a month. Thats 44.7% of your last years income of $ 75,629.

How much money do you lose if you retire at 65 instead of 66?

65-year-old: 13.3 percent. 66-year-old: 6.7 percent.

What Are My Insurance Options If I Cannot Get Medicare At Age 62

If you dont qualify for Medicare, you may be able to get health insurance coverage through other options:

- Employer-provided insurance

LeRon Moore has guided Medicare beneficiaries and their families as a Medicare professional since 2007. First as a Medicare provider enrollment specialist and now a Medicare account executive, Moore works directly with Medicare beneficiaries to ensure they understand Medicare and Medicare Advantage Plans.

Moore holds a bachelors degree from Southern New Hampshire University and is A+ Certified with a Medical Records Clerk Certification and Medical Terminology Certification from Midlands Technical College.

Hes passionate about educating, informing, and resolving issues concerning Medicare and Medicare Advantage Plans, and considers it imperative that he does all he can to educate and inform the senior community as much as possible about Medicare.

You May Like: Does Medicare Cover Rides To The Doctor

If My Spouse Is 65 And Im 62 How Can That Affect My Spouses Medicare Costs

Traditional Medicare refers to Part A and Part B. Almost everyone has to pay a Part B monthly premium. But most people donât have to pay a Part A monthly premium.

For Medicare Part A, your monthly premium amount depends on how long you or your spouse worked and paid taxes.

If youâve worked at least 10 years while paying Medicare taxes, you donât pay a monthly premium for your Medicare Part A benefits. But if you havenât worked, or worked less than 10 years, you may pay a premium.

Hereâs where your spouse might benefit from your work history, or vice versa. Say youâre age 62 or older, and your spouse is 65. Your Medicare-eligible spouse has worked for less than 10 years. You, on the other hand, arenât eligible for Medicare yet at age 62, but youâve worked at least 10 years while paying taxes.

Well, tell your spouse he or she owes you a grand night out on the town. Because of your work history, your spouse will qualify for premium-free Part A.

So, to summarize with an example:

- Bob is 65 years old. Heâs on Medicare, but he pays a monthly premium for his Medicare Part A benefits. He only worked for seven years and no longer works.

- His wife, Mary, has worked for over 30 years.

Can I Claim My Deceased Husbands State Pension

You may be entitled to extra payments from your deceased spouses or civil partners State Pension. However, this depends on their National Insurance contributions, and the date they reached the State Pension age. If you havent reached State Pension age, you might also be eligible for Bereavement benefits.

5/5Disableddisabilityreceive Medicarereceivereceive Medicareread here

When Medicare StartsIn general, the two-year waiting period for Medicare is calculated from your date of SSDI entitlementwhen you are eligible to start receiving monthly benefits. This is usually the date your disability began, plus five months .

Likewise, do I have to pay for Medicare Part B if I am disabled? Most people who receive Social Security Disability do not have to pay for Medicare Part A. Most of the people who receive Social Security Disability benefits do have to pay a premium for Medicare Part B, but you may choose to opt out of this program if you already have medical insurance.

Correspondingly, what disability qualifies for Medicare?

Medicare is available for certain people with disabilities who are under age 65. These individuals must have received Social Security Disability benefits for 24 months or have End Stage Renal Disease or Amyotropic Lateral Sclerosis .

How much does Medicare cost on disability?

Read Also: Why Is Medicare Advantage Bad

Reason #: Retire Early If You Are Ready To Simplify

Living more frugally is not a necessity in retirement, but if you think that you can simplify your spending, then you can probably retire at 62 or earlier if you really want to.

When you retire, you have the opportunity to prioritize what is important to you and let the rest slip away. Prioritization can help you reduce your spending levels. And, this can be incredibly freeing.

Medicare Doesn’t Kick In Until 65

Medicare benefits dont start until you turn 65. If you retire at 62, youll need to make sure you can afford health insurance until age 65 when your Medicare benefits begin.

With the Affordable Care Act, you are guaranteed to get coverage even if you have a pre-existing condition. You also can’t be charged more than someone who is healthier. But health insurance pricing can vary by location. Many retirees whose employers paid for their insurance get caught off guard by how expensive it can be.

Also, keep in mind that Medicare does not cover all healthcare costs. Many people purchase additional health coverage to supplement their Medicare benefits. Get quotes on your health insurance costs. Build that expense into your retirement budget.

Read Also: How To Prevent Medicare Fraud

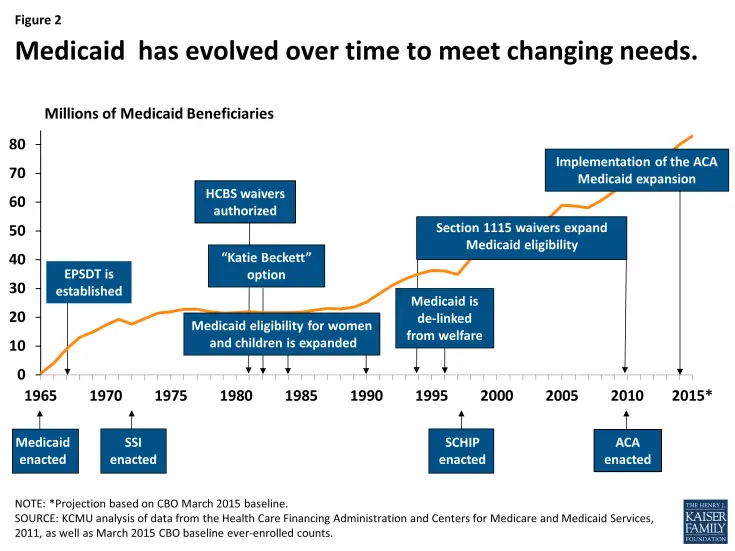

The Challenges Of Changing Medicares Age Of Eligibility

First, there are the funding issues. If lowering the age to access increased the cost to administer the Medicare program, the chances of proposed changes passing will drop.

The Part A account that funds the hospitalization and related services faces insolvency by 2026. Insolvency means that Medicare wouldnt be able to fully reimburse hospitals, nursing homes, and home health agencies for promised benefits.

If this happens, Medicare patients would be hit hard. Theres no way around this. You cannot cut provider payments for medical services without impacting the beneficiaries of those services.

In response to the funding concerns, the Democrats who are sponsoring this bill say that Medicares funding wouldnt be touched under the proposed legislation since those buying the coverage would be required to pay the entire cost.

That means whatever the cost is to the government, would also be the cost to the individual.

Second, youre going to get lots of pushback from healthcare and health insurance companies. Theyll spend millions to lobby against this, which could impact the outcome of the law changes.

From the hospitals perspective, theyll be losing millions of Americans from their most profitable group of patients: Those who are 50 and up and covered by private healthcare. There is a big difference between the reimbursement rate between a Medicare patient and a patient with private health insurance.

How Much Can I Make Part Time While On Social Security

If you are receiving benefits and working in 2022 but not due to hit FRA until a later year, the earnings limit is $19,560. You lose $1 in benefits for every $2 earned over the cap. So, if you have a part-time job that pays $25,000 a year $5,440 over the limit Social Security will deduct $2,720 in benefits.

Don’t Miss: Does Medicare Cover 100 Percent Of Hospital Bills

What Happens If You Retire Before Full Retirement Age

If a worker begins to receive benefits before his or her normal age, he or she will receive a reduced benefit. An employee can retire at the age of 62, but this can lead to a reduction of up to 30 percent.

How much do you lose if you retire at 65 instead of 66?

65-year-old: 13.3 percent. 66-year-old: 6.7 percent.

What happens to my Social Security if I retire at 55?

The SSA does not punish working retirees forever. You will receive all benefits withheld by the government after reaching full retirement age. At that time, the SSA will recalculate the amount of your benefit.

Can You Draw Social Security And State Retirement At The Same Time

When you retire, you will receive your public pension, but dont count on getting the full Social Security benefit. Under federal law, any Social Security benefits you earned will be reduced if you were a federal, state, or local government employee who earned a pension with wages not covered by Social Security.

What is the maximum amount of Social Security retirement you can draw?

What is the maximum of social security? The maximum that an individual filing for Social Security retirement benefits in 2021 can receive per month is: $ 3,895 for someone filing at age 70. $ 3,148 for someone presenting at full retirement age .

Will my retirement check affect my Social Security benefits?

We will reduce your Social Security benefits by two thirds of your government pension. In other words, if you get a monthly civil service pension of $ 600, two-thirds of that, or $ 400, must be deducted from your Social Security benefits.

Recommended Reading: How Do I Change Medicare Supplement Plans

Also Check: Does Medicare Cover In Home Care For Seniors

If I Retire At Age 62 Will I Be Eligible For Medicare

En español | No, you cant qualify for Medicare before age 65 unless you have a disabling medical condition.

People younger than 65 who receive Social Security Disability Insurance benefits can generally get Medicare 24 months after they become eligible for disability benefits. This waiting period is waived for people who have permanent kidney failure, known as end-stage renal disease , or amyotrophic lateral sclerosis , better known as Lou Gehrigs disease.

Everyone else needs to wait until age 65 to become eligible for Medicare, no matter when they retire. You can sign up during your seven-month initial enrollment period , which begins three months before the month you turn 65 and lasts for three months after your birthday month. The coverage begins no earlier than the month you turn 65. If your birthday is on the first of the month, coverage starts at the beginning of the previous month.

Medicare Coverage For Spouses

Medicare is an individual insurance system, but there are times when one spouses eligibility may help the other receive certain benefits.

Also, the amount of money you and your spouse make combined may affect your Medicare Part B insurance premiums.

Keep reading to find out how you or your spouse may be able to qualify for Medicare based on work history and age.

Read Also: What Is The Deadline For Changing Medicare Plans

Collecting Social Security Medicare And More

Chip Stapleton is a Series 7 and Series 66 license holder, passed the CFA Level 1 exam, and is a CFA Level 2 candidate. He, and holds a life, accident, and health insurance license in Indiana. He has eights years’ experience in finance, from financial planning and wealth management to corporate finance and FP& A.

Are you hoping to retire at 62? If so, you’re not alone. Age 63 is the average time of retirement in the U.S. But before you quit your job, there are some things you can do to make sure you’re ready. Get your finances in order before you retire, to make sure you’re in the best position to enjoy your freedom.

Who Is Eligible For Medicare

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease . Medicare has two parts, Part A and Part B . You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to receive Social Security or Railroad benefits but you have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

To find out if you are eligible and your expected premium, go the Medicare.gov eligibility tool.

If you did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A. If you are under age 65, you can get Part A without having to pay premiums if:

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You are a kidney dialysis or kidney transplant patient.

While most people do not have to pay a premium for Part A, everyone must pay for Part B if they want it. This monthly premium is deducted from your Social Security, Railroad Retirement, or Civil Service Retirement check. If you do not get any of these payments, Medicare sends you a bill for your Part B premium every 3 months.

Don’t Miss: Will Medicare Pay For A Tummy Tuck

Reason #: Retire Early If You Dont Need To Start Social Security Collecting Early

The earliest you can start Social Security benefits is age 62. However, just because you can start benefits does not mean that you should.

Your monthly Social Security paycheck increases significantly for every month and year you delay starting, up until your full retirement age . Depending on your work history, waiting to start Social Security can mean something like $100,000 or more in additional money over your lifetime.

So, if you are planning on an early retirement, it is best to do so without starting Social Security.

Start Planning Your Early Retirement