Sign Up: Within 8 Months After You Or Your Spouse Stop Working

- Most people dont have to pay a premium for Part A . So, you may want to sign up for Part A when you turn 65, even if you or your spouse are still working.

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Why Should I Sign Up For Medicare Part D

Medicare Part D is Medicare prescription drug coverage. Itâs optional, but Part D enrollment may be worth it even if you donât take prescription drugs.

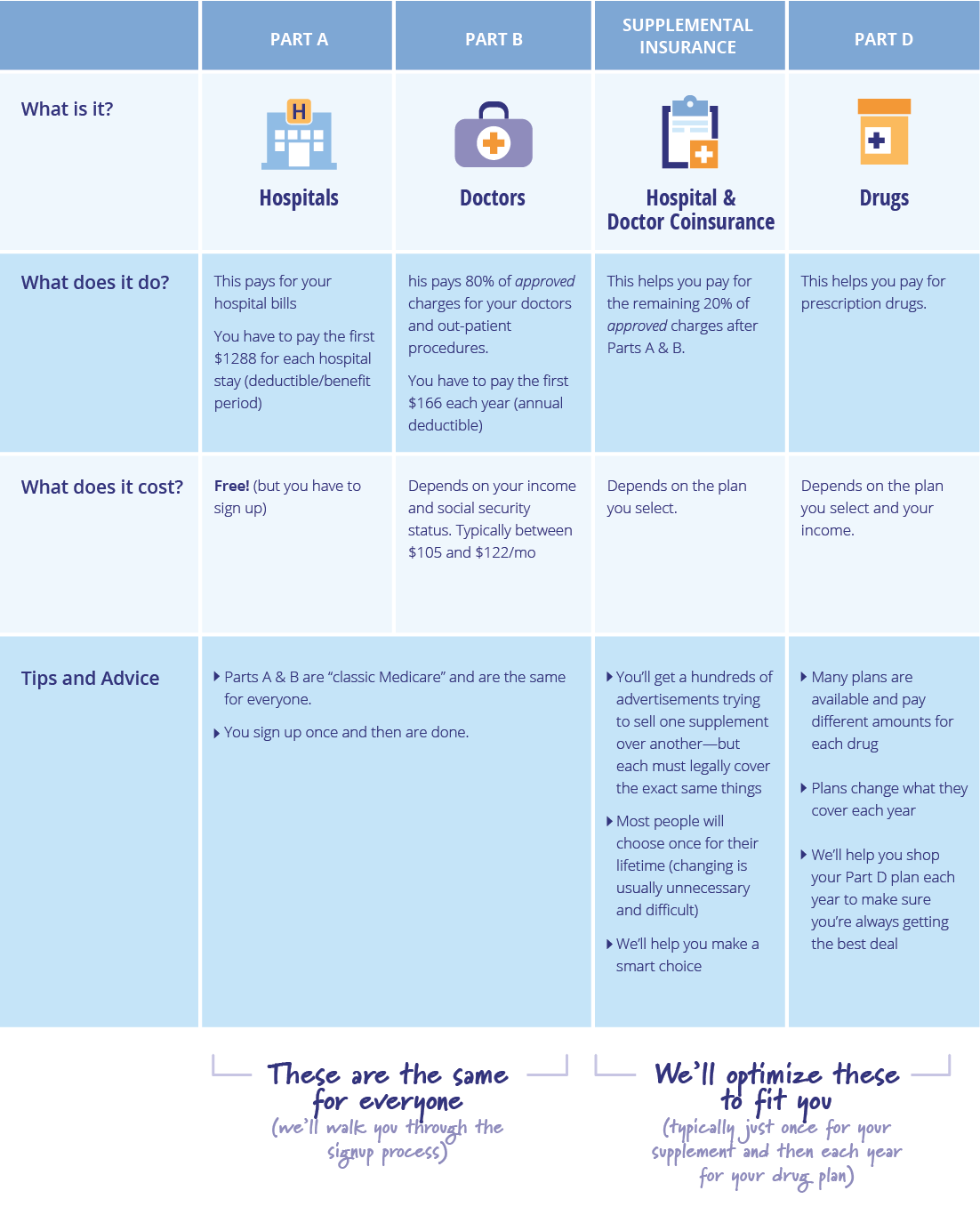

Medicare gives you a choice of two different ways you can get Medicare Part D prescription drug coverage:

- A stand-alone Medicare Part D prescription drug plan that works alongside your Medicare Part A and/or Part B coverage

- A Medicare Advantage prescription drug plan, which includes Medicare Part A, Part B, and Part D benefits in an all-in-one plan

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Which Medicare Advantage Plans Cover Dental Implants

What Will I Pay For Part D Coverage

According to CMS the average Part D plan will costs $33/month in 2022, and thats expected to decrease slightly in 2023, to $31.50/month. But the plans are issued by private insurers, and theres significant variation in terms of the benefits, the formularies and the pricing. Among the Part D plans that are available in 2022, premiums range from under $6/month to more than $207/month.

High-income enrollees pay extra for their Part D coverage. For 2022, the additional premiums range from $12.40/month to $77.90/month.

The premium adjustment for high-income enrollees is based on income tax returns from two years prior, since those are the most recent returns on file at the start of the plan year . Theres an appeals process you can use to contest the income-related premium adjustment if youve had a life-change event that has subsequently reduced your income.

In addition to the premiums, youll pay a copay or coinsurance for drugs. The donut hole in Part D plans has closed, thanks to the Affordable Care Act. It was fully closed as of 2020: Enrollees with standard Part D coverage now pay 25% of the cost of generic and brand name drugs while in the donut hole, which is the same percentage they pay before entering the donut hole.

Once you select a PDP, there are four ways to pay the premium:

- deducted from your personal account

- charged to credit or debit card

- billed monthly or

When Should I Sign Up For Medicare Part D

Even if youre not currently taking medications, the best way to avoid costly, lifetime late-enrollment penalties in the future is to enroll in Medicare Part D as soon as youre eligible for Medicare.

The time of year you choose to sign up for Medicare Part D is important and can impact both costs and eligibility. The seven months of enrollment eligibility framing your 65th birthday apply to Parts A and B, as well as Part D. However, there are a few windows of opportunity for making changes, as follows:

During this Annual Enrollment Period , people may join a new plan or switch from traditional Medicare to Medicare Advantage plans. Their new drug coverage will begin on the first day of the following year. If your plan isnt rated 5-stars, now is the time to switch to one.

During this Medicare Advantage Open Enrollment Period , a person can leave a Medicare Advantage plan and enroll in a Medicare Part D plan alongside traditional Medicare.

Special Enrollment PeriodDuring a Special Enrollment Period , people can sign up for Medicare Part D plans. Reasons for entering SEPs include moving out of a coverage area or entering a nursing home.

During this one-time SEP, a person can choose to join a plan with a 5-star rating from Medicare.

Recommended Reading: How To Sign Up For Medicare At Age 65

Capping Insulin Costs In 2023

The Inflation Reduction Act did have a section modifying how Medicare Part D drug plans work. Some aspects of the IRA will take effect in 2023. Cost-sharing on covered insulins will be capped at $35. This change will help lower costs for many Medicare beneficiaries who must choose between putting food on their table or taking their recommended insulin dosages.

How Can I Be Eligible For Medicare Part D

Not everyone on Medicare is eligible for Medicare Part D coverage.To be eligible for Medicare Part D plan coverage, you must first meet specific requirements to enroll in a Medicare Part D plan. Medicare Part D eligibility requires you first to enroll in Original Medicare.

You may also find that you are dual eligible for Medicare and Medicaid. In this case, you can enroll in Medicare Part D.

However, if you are enrolled in a Medicare Advantage plan that offers prescription drug coverage, you will be ineligible to enroll in a stand-alone Medicare Part D plan.

Read Also: What Is The Medicare Savings Program In Texas

Changes To Part D Under The Inflation Reduction Act

With the passage of the Inflation Reduction Act, which includes several provisions to lower prescription drug spending by Medicare and beneficiaries, major changes are coming to the Medicare Part D program. These provisions will phase in over the next several years starting in 2023. The law:

- requires drug manufacturers to pay a rebate to the federal government if prices for drugs covered under Part D and Part B increase faster than the rate of inflation, with the initial period for measuring Part D drug price increases running from October 2022-September 2023

- adds a hard cap on out-of-pocket drug spending under Part D by eliminating the 5% coinsurance requirement for catastrophic coverage in 2024 and capping out-of-pocket spending at $2,000 in 2025

- shifts more of the responsibility for catastrophic coverage costs to Part D plans and drug manufacturers, starting in 2025

- limits the price of insulin products to no more than $35 per month in all Part D plans and makes adult vaccines covered under Part D available for free, as of 2023, and

- expands eligibility for full benefits under the Part D Low-Income Subsidy program in 2024.

CBO estimates that the drug pricing provisions in the law will reduce the federal deficit by $237 billion over 10 years .

Theres A Push For Change

If the rules governing the transition to Medicare sound complicated, rest assured that experts agree. Moving into Medicare from other kinds of health insurance can be so complicated that it should be a required chapter in Retirement 101, Mr. Moeller said.

The only government warning about the risks associated with late enrollment comes in the form of a very brief notice near the end of the annual Social Security Administration statement of benefits.

The Medicare Rights Center and other advocacy groups have proposed legislation that would require the federal government to notify people approaching eligibility about enrollment rules, and how Medicare works with other types of insurance. The legislation the Beneficiary Enrollment Notification and Eligibility Simplification Act, also would eliminate coverage gaps now experienced by enrollees during the Initial Enrollment Period and General Enrollment Period. The legislation was introduced in Congress last year, and will be reintroduced this year.

In the meantime, Mr. Baker proposes a simple rule of thumb to help people approaching Medicare eligibility to avoid costly errors.

If you are eligible for Medicare, you should really consider it to be your default, primary coverage. If you are going to decline Medicare, think very carefully and take the time to really understand all the rules.

Read Also: Does Medicare Part B Go Up Every Year

Also Check: Does Medicare Cover Laser Surgery

What If I Dont Agree With The Late Enrollment Penalty

You may be able to ask for a âreconsideration.â Your drug plan will send information about how to request a reconsideration.

Complete the form, and return it to the address or fax number listed on the form. You must do this within 60 days from the date on the letter telling you that you have to pay a late enrollment penalty. Also send any proof that supports your case, like a copy of your notice of creditable prescription drug coverage from an employer or union plan.

After You Apply For Medicare Part D

Once youve applied, the plan has 10 calendar days to reply in one of three ways:

- Confirming theyve received your application

- Requesting more information

- Denying your application with an explanation why.

If you merely receive confirmation, you’ll soon get a card in the mail with important documents about your plan details. If they need more information from you, send it to them ASAP. If they’ve denied you, it’s either because you’re not in the plan’s service area or you’re not currently in an enrollment periodget more information about these reasons and try again for another plan.

Read Also: Does Medicare Cover Gastric Bypass Revision

Change Medicare Plans During Medicare Advantage Open Enrollment Period

If youre enrolled in Medicare Advantage and want to switch back to Original Medicare, Part A and Part B, you can do so during the Medicare Advantage Open Enrollment Period , which runs from January 1-March 31 each year. You will also have until March 31 to join a stand-alone Medicare Prescription Drug Plan , and your coverage will go into effect the first day of the month after your new plan gets your enrollment form.

Read Also: Does Medicare Cover Toenail Removal

What Plans Make Sense For You

What Medicare plans and options make the most sense for you can vary depending on your income but will also depend on the health coverage that you need and what options best fit your lifestyle.

High earners have a few different options when examining their coverage choices. They can focus on choices that help minimize the additional money they are spending on premiums, or they can use their earnings to justify enrolling in high-quality plans with many benefits.

Read Also: What Is Medicare Vs Medicare Advantage

What Should I Do After Medicares Enrollment Period Ends

Once the Medicare enrollment period is over, itâs a great time to take a look at your overall financial plan.

- Are you happy with your health insurance?

- Have you rolled over your retirement accounts such as a 401 or IRA?

These are all things we can help you with to give you peace of mind and security that your retirement is going as planned. Plus, the beginning of the year is a great time to meet with us!

The enrollment period in the fall is the busiest time of the year for insurance agents, but the beginning of the year through March is much slower. This gives us extra time to make sure your overall financial and retirement plans are fully taken care of.

If you have any questions about your Medicare Part D drug plan, the enrollment period, or next steps, call us at 833-801-7999. You can also connect with us by filling out a short form. We canât wait to serve you.

How And When Do I Sign Up For Medicare Part D

The how is relatively easy: You can sign up for a prescription drug plan with a private health insurance company that offers them through their website, over the phone, or with a licensed agent. When you can sign up is a little more complicated.

Just like Medicare Part A and Part B, you can enroll in Part D during your Initial Enrollment Period . That’s up to 3 months before and up to 3 months after your 65th birthday. You can also enroll during a qualifying Special Enrollment Period , such as when you or your spouseâs employer-based health coverage ends.

Read Also: What Is A Ppo Medicare Plan

Sign Up: Within 8 Months After Your Family Member Stops Working

- If you have Medicare due to a disability or ALS , youll already have Part A .

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

S To Sign Up For A Part D Plan

1. Compare the Part D options in your area by using the Plan Finder tool at Medicare.gov.

You can log in to your Medicare account to get information about the plans in your area. You also can use the tool without logging in.

2. If you select Continue without logging in, youll be able to choose the type of coverage you want, such as a Part D drug plan. Enter your zip code and select your county.

3. Now indicate whether you get help with your medical expenses. If youre not sure, you can find out by logging in to your Medicare account.

4. If you dont receive any help, youll be asked if you want to see your drug costs when you compare plans. Click Yes so you can get a sense of how much you would spend with each plan.

5. Enter the names of your medications. Be sure to include ones you take regularly so that youll get a good estimate of ongoing costs. Youll also need to select the dosage and quantity and indicate how frequently you need to refill your prescriptions. To add another medication, click Add Another Drug. When youre finished, click Done Adding Drugs.

6. Choose up to five pharmacies where you want to fill your prescriptions. Many plans charge lower copayments for preferred pharmacies. You can see how plans work with the pharmacies and what your copayments would be for each one. Enter the names of pharmacies you use or search by your address or zip code.

For help signing up for a Part D plan, contact your State Health Insurance Assistance Program .

Recommended Reading: Does Medicare Advantage Plan Replace Part B

The Initial Enrollment Period For Original Medicare

When you first enroll in Medicare, youll be enrolled in Original Medicare , a federally run health care program.

Because of their age, the majority of people are eligible for Medicare. If this describes you, your first opportunity to enroll in Medicare is often during your Initial Enrollment Period, which lasts seven months. It begins three months before your 65th birthday includes your 65th birthday month, and concludes three months after. Most people dont have to sign up if youre already getting Social Security or Railroad Retirement Board payments when you turn 65, youll be automatically enrolled in Medicare. If you need to register personally, you can do so during your Initial Enrollment Period .

If youve been collecting Social Security or Railroad Retirement Board disability benefits for two years, you might be eligible for Medicare before you turn 65. In the 25th month of disability benefits, youll be automatically enrolled in Medicare Parts A and B. If you have amyotrophic lateral sclerosis or end-stage renal disease, you may be eligible for Medicare at any age.

Even if you qualify for automatic enrollment in Medicare Part A, you must enroll in Medicare Part B if you live in Puerto Rico. To avoid late-enrollment fines, you may choose to do so during your IEP.

Some people choose to put off signing up for Medicare Part B. You must pay a premium . Perhaps youre still covered under your employers healthcare plan. Learn more about deferring enrollment in Part B.

What Does It Mean If My Prescription Drug Has A Requirement Or Limit

Plans have rules that limit how and when they cover certain drugs. These rules are called requirements or limits. You need to follow the rules to avoid paying the full cost of the drug out-of-pocket. If you do not get approval from the plan for a drug with a requirement or limit before using it, you may be responsible for paying the full cost of the drug. If needed, you and your doctor can also ask the plan for an exception.

Here are the requirements and limits you may see on a drug list:

PA Prior Authorization

If a plan requires you or your doctor to get prior approval for a drug, it means the plan needs more information from your doctor to make sure the drug is being used and covered correctly by Medicare for your medical condition. Certain drugs may be covered by either Medicare Part B or Medicare Part D depending on how they are used. If you dont get prior approval, the plan may not cover the drug.

QL Quantity Limits

The plan will cover only a certain amount of a drug for one copay or over a certain number of days.

ST Step Therapy

The plan wants you to try one or more lower-cost alternative drugs before it will cover the drug that costs more.

B/D Medicare Part B or Medicare Part D Coverage Determination

Depending on how theyre used, some drugs may be covered by either Medicare Part B or Medicare Part D . The plan needs more information about how a drug will be used to make sure its correctly covered by Medicare.

LA Limited Access

Also Check: Does Medicare Cover Dexcom G6 Cgm