How To Get Out Of The Donut Hole

In 2020, person can get out of the Medicare donut hole by meeting their $6,350 out-of-pocket expense requirement.

However, there are ways to receive assistance for funding prescription drugs, especially if a person meets certain low income requirements. These include:

- Extra Help:Extra Help is a Medicare program that helps people pay for medications and other aspects of medical care. A person can qualify for Extra Help if their income is $18,735 or less when single or $25,365 or less as a couple. They must also have less than $14,390 as a single person or $28,720 as a married couple in resources. Resources include savings, stocks, or bonds.

- Medicaid: Medicaid is a federal program that helps low income individuals pay for healthcare. People who qualify for Medicaid are automatically enrolled in the program.

- State Health Insurance Assistance Program : These state-specific programs can provide additional assistance for people in funding healthcare costs, including medications.

Many pharmaceutical manufacturers also offer prescription assistance programs that can reduce costs. A doctor or pharmacist can often make suggestions for contacting the drug company.

What Is Medicare Part D

Original Medicare includes two parts.

- Medicare Part A is sometimes called hospital insurance, because it covers inpatient services received in a hospital or skilled nursing facility . Part A also helps pay for hospice care.

- Medicare Part B is sometimes called medical insurance, because it helps pay for outpatient services like doctor visits, mental health care, durable medical equipment, and lab work.

You will notice that neither of those include prescription drug coverage. This is because Original Medicare does not cover prescription medications .

Enter Medicare Part D, which is the result of the Medicare Modernization Act of 2003. This legislation sought to reduce healthcare and prescription drug costs for America’s seniors and is why we have Medicare Part D today.

Beneficiaries have two options when it comes to Medicare prescription drug coverage:

- You may join a standalone Medicare Part D prescription drug plan if you have either Original Medicare or a Medicare Part C plan that doesn’t cover prescriptions

- You may enroll in a Medicare Advantage Prescription Drug plan

Please note that you cannot have both an MA-PD and a standalone Part D plan.

Private insurance companies sell both standalone and Medicare Advantage Prescription Drug plans. That means that coverage and costs vary according to the plan and provider you choose.

Ask For Drug Manufacturers Discounts

Some pharmaceutical companies offer their products at a discount directly to consumers or through doctorâs offices. This is more common for brand-name and specialty drugs, which can be expensive. Ask your doctor or health-care provider when you get the prescription if any discounts are available or if there is a pharmaceutical assistance program. You can also search online as the drug manufacturerâs website may have more information.

Recommended Reading: When To Apply For Medicare When Turning 65

What Is Meant By Initial Coverage Period

You will pay the stated coinsurance or copayment fees for generic or brand-name medications during the first year of coverage. Your specific plan details determine the exact amounts of these costs and vary based on your plan coverage.

Many Medicare enrollees will remain in this stage for the entire program year it all depends on the prices of your prescriptions and the medications you use.

Is The Medicare Donut Hole Ending

So, when does the donut hole end? Although it has shrunk, it hasnt ended quite yet.

Since the Affordable Care Act passed back in 2010, the donut hole has been slowly closing. It used to be that when you hit that point, you would pay 100% of the costs of your prescription drugs while you were in the gap.

However, the government has been reducing that percentage steadily, and as of 2021, the percentage of the cost that you pay for prescriptions during the Medicare donut hole is no more than 25%.

Get more Medicare help on our Facebook community page.

Read Also: How Much Does Medicare Pay For Dental

How Do You Choose A Medicare Part D Plan

The following factors may affect how you choose a Part D plan:

- Consider the medications you takehow many medications do you take, are they available as generics, do you have a chronic condition that requires specialty medications like insulin, nebulizers, etc.?

- If you want prescription drug coverage as part of a Medicare Advantage Plan, make sure you review the details of that drug coverageis it enough to cover your prescription needs?

- Standalone plans can differ among private insurers and offer various levels of drug coverage and different pharmacy networks.

- Review Part D plan options, considering monthly premium and other costs.

What Exactly Is The Coverage Gap

As previously stated, the coverage gap is the Medicare term commonly used to describe the donut hole. Each year, Medicare establishes a limit for out-of-pocket expenses that you can incur before reaching the donut hole.

In 2021, you enter the Medicare donut hole when you and your plans out-of-pocket spending reach a drug cost of $4,130, but catastrophic coverage does not enter until your out-of-pocket costs approach $6,550. As a result, the gap occurs.

Some plans do provide additional discounts during this period, and in many circumstances, you will only pay 25% of the total drug cost. However, you must remain vigilant because if you are taking multiple medications or your prescriptions are very expensive, it is worth considering what alternatives are available.

The best thing you can do is contact Medicare directly or speak with a licensed insurance professional to get personalized advice on your next steps if you fall into the coverage gap.

Don’t Miss: Which Medicare Plan Covers Prescription Medications

Costs In Medicare Coverage Gap

In the past, beneficiaries were responsible for a higher percentage of drug costs when in the Medicare coverage gap. Since the donut hole closed for all drugs in 2020, you now pay 25 percent of the costs of your prescriptions after entering the coverage gap.

This may yield little change from what you paid in the initial coverage period, or it may result in significant increases for expensive brand-name drugs.

Insurance companies that offer Medicare Part D coverage use tiers in its formulary to group and price medications. Costs increase the higher the tier, with the specialty tier representing the highest copay and the most expensive prescription drugs. A plan can change the tier of a drug each calendar year, known as a formulary change.

If you primarily take Tier 1 generic medications, the amount you pay likely wont change much in the coverage gap. But if you take even one generic or brand-name drug in the specialty tier, the 25 percent requirement could result in high out-of-pocket costs.

If a drug retails for $2,500 a month, you pay:

- $135 a month with 5 percent coinsurance and a $10 copay in the initial coverage period.

- $625 a month once you reach the initial coverage limit of $4,020, which you would hit after two months.

Medicare Part D Coverage Gap

The Medicare Part D coverage gap is a period of consumer payment for prescription medication costs which lies between the initial coverage limit and the catastrophic-coverage threshold, when the consumer is a member of a Medicare Part Dprescription-drug program administered by the United States federal government. The gap is reached after shared insurer payment – consumer payment for all covered prescription drugs reaches a government-set amount, and is left only after the consumer has paid full, unshared costs of an additional amount for the same prescriptions. Upon entering the gap, the prescription payments to date are re-set to $0 and continue until the maximum amount of the gap is reached OR the current annual period lapses. In calculating whether the maximum amount of gap has been reached, the “True-out-of-pocket” costs are added together.”TrOOP includes the amount of your Initial Deductible and your co-payments or co-insurance during the Initial Coverage stage. While in the Donut Hole, it includes what you pay when you fill a prescription and of the 75% Donut Hole discount on brand-name drugs, it includes the 70% Donut Hole Discount paid by the drug manufacturer. The additional 5% Donut Hole discount on brand-name drugs and the 75% Donut Hole discount on generics do not count toward TrOOP as they are paid by your Medicare Part D plan.”

Provisions of the Patient Protection and Affordable Care Act of 2010 gradually phase out the coverage gap, eliminating it by 2020.:1

Recommended Reading: Will Medicare Pay For Alcohol Rehab

Medicares Donut Hole Has Shrunk But A Gap Remains

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If you have a Medicare prescription drug plan, theres a gap in coverage after youve spent a certain amount on covered drugs the so-called Medicare “donut hole.” While potential costs associated with the donut hole went down substantially in 2020, there remains a coverage gap that may affect what you pay for prescription drugs.

About 48 million people covered by Medicare are enrolled in Part D drug plans.

Is There Any Medicare Program That Covers The Medicare Part D Donut Hole

There is not a Medicare plan that covers the donut hole.

You may wonder if a Medigap could help you avoid donut hole costs. Medigap policies are private Medicare supplement insurance plans that are sold to cover additional costs and some services not traditionally covered by Original Medicare. But Medigap plans dont include any drug coverage at all. Rather, youll need to get a standalone prescription drug plan and therefore, the donut hole would still apply.

Your best bet to lower healthcare and prescription drug costs is to apply for subsidies, like Medicare Extra Help, the Senior Savings Model, and Medicare Savings Programs. Before enrolling in Medicare, review the covered prescription drugs under the formulary sections of different Medicare plans and choose the plan that covers the medications you take. Browse plans on medicare.gov.

RELATED: Medicare open enrollment

Additionally, you can follow these steps to save money while youre in the Medicare donut hole:

Recommended Reading: Is Trump Trying To Get Rid Of Medicare

How Do I Get Out Of The Coverage Gap

Once your total spending on covered drugs exceeds the threshold, youll enter the catastrophic coverage phase and no longer be subjected to the high costs of the coverage gap.

In 2022, to get out of the donut hole, the total cost of spending must reach $7,050 thats when catastrophic coverage automatically starts.

Need More Help Check Out These Resources:

The State Health Insurance Assistance Program offers free, independent counseling services and local workshops to help with your health care benefit decisions.

Visit medicare.gov or talk to a Medicare expert, like an agent, broker or health plan sales rep.

Our monthly Medicare newsletter delivers helpful tips straight to your inbox.

Connect with experts

You May Like: Do I Need To Sign Up For Medicare Part B

Read Also: Is Massage Covered By Medicare

What Are The Phases Of A Part D Plan

Your drug coverage will change throughout the year, depending on how much you spend. If you dont spend very much on drugs, or you have drug coverage from another source, you may never reach the donut hole phase.

Bear in mind that Medicare updates the maximum deductible and cost thresholds every year. Heres how Part D coverage breaks down in 2021:

-

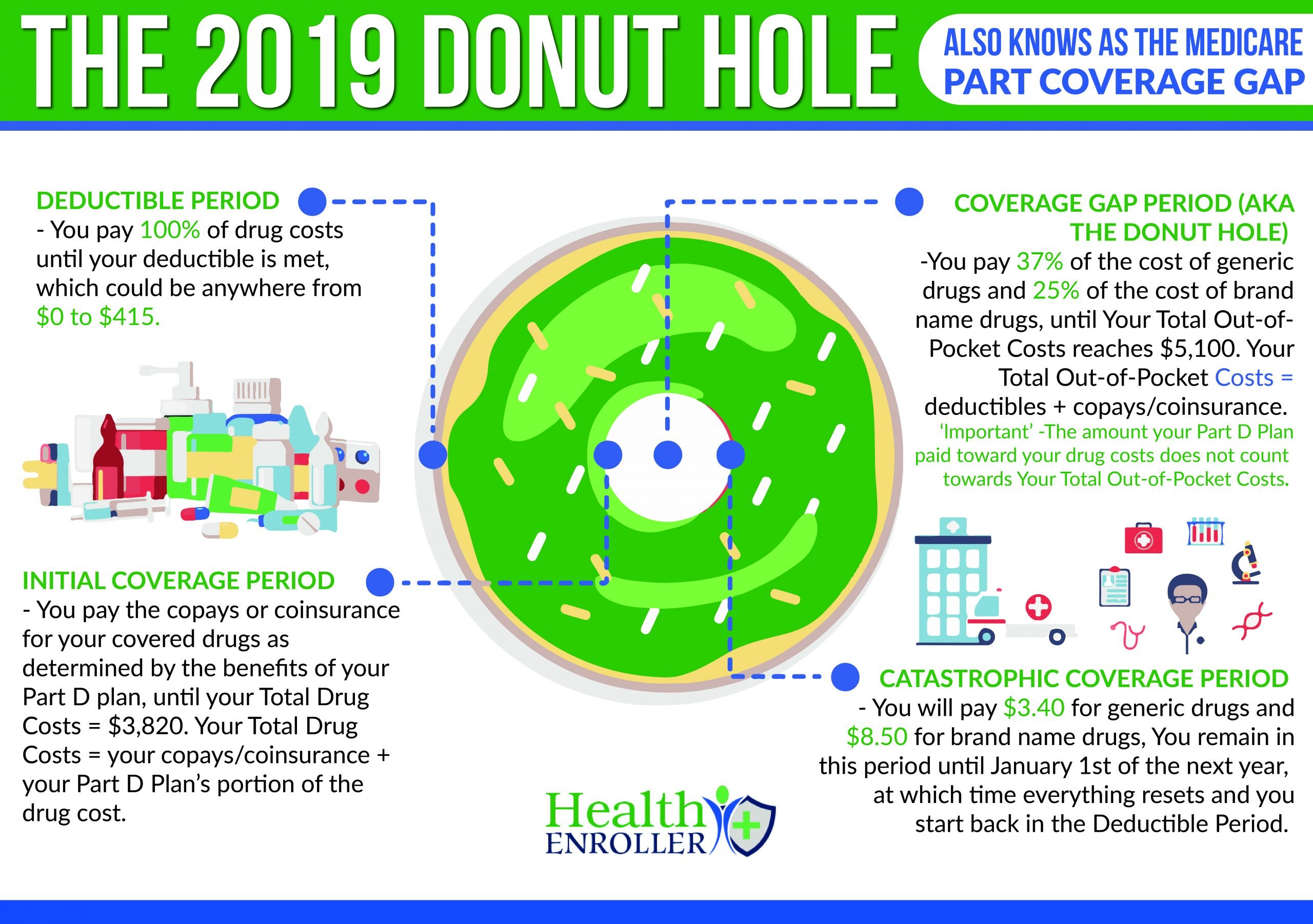

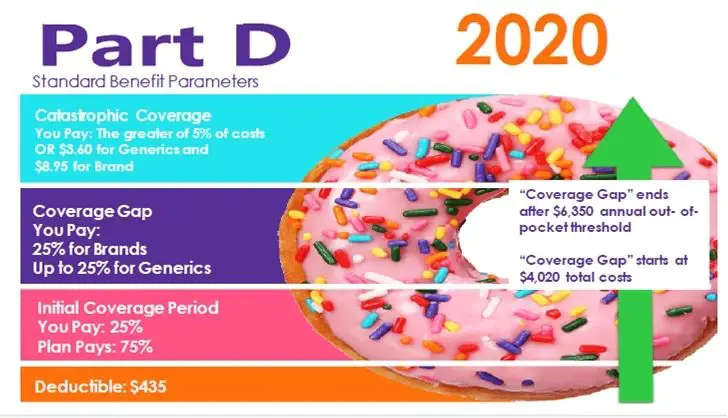

Phase 1: Deductible: You start out the year paying full price for your medications until you reach your deductible. Deductibles vary by plan, but the maximum deductible allowed by Medicare in 2021 is $445.

-

Phase 2: Initial coverage: You pay your plans designated copay or coinsurance when filling your prescriptions until total medication expenses including the deductible but not including premiums reach $4,130.

-

Phase 3: Modified coverage : At this stage, you pay no more than 25% of the cost of your prescription drugs. For brand-name drugs, the manufacturers kick in 70% of the cost, and your insurer pays the other 5% . This payment structure lasts until the spending total reaches $6,550. How long it takes you to get there depends on whether youre buying generic or brand-name drugs.

-

Phase 4: Catastrophic coverage: Your copay drops substantially until the end of the year. For each drug, you pay whichever amount is larger:

-

5% coinsurance

-

copays of $3.70 for generics and $9.20 for brand-name drugs

When the year ends, you start over at Phase 1.

The Initial Coverage Period

After you meet your Part D deductible, you enter the initial coverage period. During this phase, you pay a copayment or coinsurance for your covered medications.

Copayment and coinsurance amounts will vary by plan. Many plans will feature different amounts for generic and brand name drugs. You can check with your plan formulary to learn more about what your costs might be for different drugs.

Generic drugs are typically on a lower tier and have lower costs than brand name drugs, which are typically on a higher tier.

Once you and your plan combine to spend $4,430 for drugs during the calendar year in 2022, you enter the donut hole coverage gap.

Read Also: Is Unitedhealthcare Dual Complete A Medicare Plan

Shop Around For A New Prescription Drug Plan

Every fall, your plan will send you an Annual Notice of Coverage. Take a look at it and see if your plan has changed your prescription drug coverage or costs.

Even if your plan coverage hasnât changed, you might want to compare Medicare prescription drug plans in your area. You might be surprised to find a plan with better coverage for your needs. An eHealth study found that the vast majority of people with Medicare prescription drug plans could save money by switching to a different plan. Among those surveyed:

- Only about 9% of people with Medicare Advantage prescription drug plans were enrolled in the plan that could save them the most money â an average savings of $1,144 per year.

- Only about 8% of people with stand-alone Medicare Part D prescription drug plans were enrolled in the plan that could save them the most money â an average savings of $798 per year.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealthâs Medicare related content is compliant with CMS regulations, you can rest assured youâre getting accurate information so you can make the right decisions for your coverage.Read more to learn about our Compliance Program.

What Are The 4 Phases Of Medicare Part D

The four phases of Medicare Part D are:

- Deductible Phase

- Coverage Gap Phase

- Catastrophic Coverage Phase

During the deductible phase, you are responsible for 100 percent of your prescription drug costs until you meet your Part D plans annual deductible. The insurance companies that provide Part D plans set their own costs, including deductibles and premiums. However, they must work within guidelines established by the Centers for Medicare & Medicaid Services . In 2022, the maximum Part D deductible is $480.

Also Check: How Do I Get A Medicare Explanation Of Benefits

The Part D Donut Hole What Is It

If Medicare Part D prescription drug coverage is new to you, or you havenât used many prescription drugs under your Part D coverage, you may wonder what the Medicare donut hole is. Put simply, the Medicare donut hole refers to the third of four progressive payment stages in Medicare Part D prescription drug coverage. These four payment stages are:

You may have had Medicare Part D coverage for many years and never experienced some of these stages and their related out-of-pocket expenses. For example, you may select a Medicare plan with prescription drug coverage that doesnât have a deductible. In that case, you skip the deductible stage and go immediately to the initial coverage stage. Or you may take generic prescription drugs. If so, the cost you and your Medicare Part D plan pay for your medications may never reach amounts that put you in the Medicare donut hole or catastrophic coverage stages.

But if you do have high prescription drug costs, you could still enter the âcoverage gapâ phase once you and the Medicare Part D plan have spent a certain amount .

Youâll pay no more than 25% of the cost of your covered medications during this phase.

Then, if your spending on covered medications reaches $7,050 , youâll enter the catastrophic coverage stage. Your Medicare prescription drug plan will pay most of the cost of your covered medications for the balance of the year.

The Medicare Donut Hole

Get A Free Medicare Quote

The donut hole is more formally known as the Medicare Part D coverage gap. During the prescription drug coverage gap, beneficiaries notice a higher cost in out-of-pocket expenses than the other stages.

The gap in coverage is intended to encourage beneficiaries to use generic drug alternatives that are less expensive, costing the Part D program less money.

Don’t Miss: How Do I Get A Lift Chair Through Medicare

What Happens When I Exit The Medicare Donut Hole

After you get out of the donut hole, you will be eligible for catastrophic coverage. This means youll be required to pay whatever is higher for the rest of the year: 5% of the prescriptions cost or a small copay.

The minimum copay for 2022 has increased over the years from 2021:

- Generic drugs: the minimum copay is $3.95, slightly higher compared to $3.70 in 2021.

- Brand-name drugs have a minimum copay of $9.85, up from $9.20 in 2021.