What Happens When I Retire

It’s important to understand what your options are once you retire. The first step is to find out if you can keep the coverage you have now when you retire, and whether or not it can be combined with Original Medicare coverage. If you have group retiree health coverage, you’ll need to contact the plan’s benefits administrator to learn about how the coverage works with Medicare and what you need to do.

If You Apply For Medicare And Keep Employer Coverage What Are The Out

When considering Medicare open enrollment, there is a lot of things to factor in. If you apply for Medicare, be aware that itâs not free. Most people pay a monthly premium for Medicare Part B . However, you may be eligible to receive premium-free Medicare Part A , as explained above. You may want to apply for Medicare Part A if you want when you are first eligible, and apply for Medicare Part B later when you lose your employer coverage. That might be a cost-conscious way to increase your insurance coverage if you decide to have both Medicare and employer coverage.

Medicare Part A and Part B have deductibles, copayments and coinsurance costs. For example, youâll typically pay 20% after youâve met your annual Part B deductible for medical services and supplies covered under Part B.

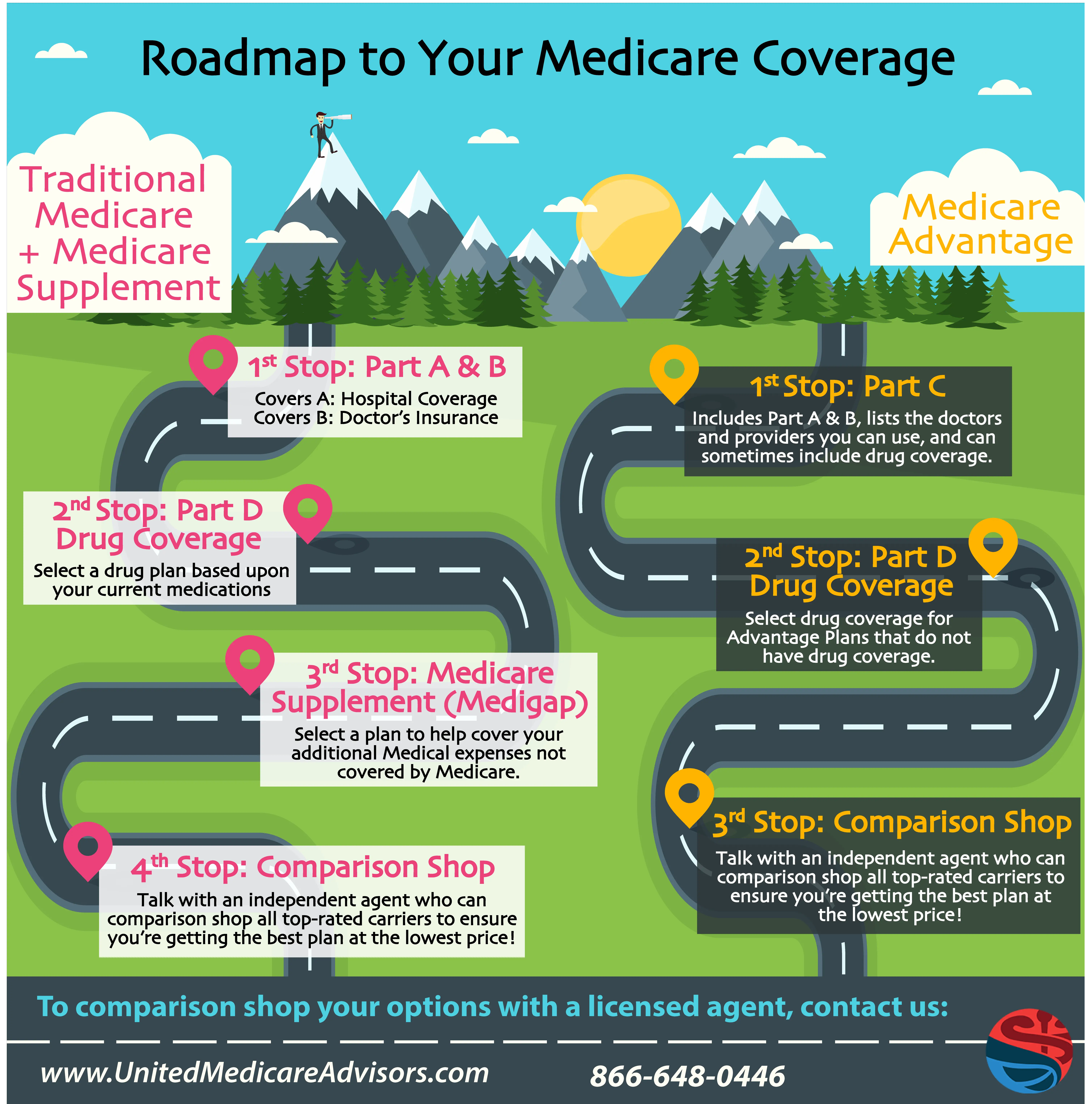

What about the other âpartsâ of Medicare â Part C and Part D ? These Medicare coverage options might charge monthly premiums. And you still need to keep paying your Part B premium as well â if you have Part B. You must be enrolled in Medicare Part A and Part B to qualify for a Medicare Advantage plan under Medicare Part C.

Itâs usually simple to find out your employer coverage costs. You can probably see the deduction in your paycheck for your health plan premium. If youâre happy with the coverage, and feel the costs are affordable, you may want to keep it.

What Is The Difference Between Medicare And Medicaid

If youve ever been confused about the differences between Medicare and Medicaid, you are not alone. Simply put, both Medicare and Medicaid are government-regulated health insurance programs that help to provide healthcare service and treatment to millions of Americans, but each program has slightly different rules of eligibility and provides different coverage to different groups of people.

Recommended Reading: Can You Start And Stop Medicare Part B

If My Employee Is On Their Spouse’s Insurance Plan Does Medicare Pay First Or Second

Medicare is the primary payer if both of these situations apply:

- A domestic partner is entitled to Medicare on the basis of age.

- A domestic partner has group health plan coverage based on the current employment status of his/her partner.

Medicare is the secondary payer when:

- The employee’s domestic partner is entitled to Medicare on the basis of disability and is covered by a large group health plan.

- For the 30-month coordination period when the employee’s domestic partner is eligible for Medicare on the basis of end-stage renal disease and is covered by a group health plan on any basis.

- When the employee’s domestic partner is entitled to Medicare on the basis of age and has group health plan coverage on the basis of his/her own current employment status.

If Your Employer Is Small

If you have health insurance through a company with fewer than 20 employees, you should sign up for Medicare at 65 regardless of whether you stay on the employer plan. If you do choose to remain on it, Medicare is your primary insurance.

However, it may be more cost-effective in this situation to drop the employer coverage and pick up Medigap and a Part D plan or, alternatively, an Advantage Plan instead of keeping the work plan as secondary insurance.

Often, workers at small companies pay more in premiums than employees at larger firms.

The average premium for single coverage through employer-sponsored health insurance is $7,470, according to the Kaiser Family Foundation. However, employees contribute an average of $1,243 or about 17% with their company covering the remainder.

At small firms, the employee’s share might be far higher. For example, 28% are in a plan that requires them to contribute more than half of the premium for family coverage, compared with 4% of covered workers at large firms.

Recommended Reading: Does My Doctor Accept Medicare Advantage

When Can You Sign Up For Medicare

Unless you qualify due to a disability, youre first eligible to sign up for Medicare during your Initial Enrollment Period . It lasts for 7 months, beginning 3 months before your 65th birthday. So, if you turn 65 in April, your IEP begins on January 1 and ends on July 31.

Unless you began collecting Railroad Retirement Board or Social Security benefits at least 4 months before turning 65, you have to apply for Medicare. You do this through the Social Security Administration by clicking here. You can also call 1-800-772-1213 . Please note that local Social Security offices are closed due to the COVID-19 pandemic. As of August 2020, there is no information on when offices will reopen.

During your Initial Enrollment Period, you can sign up for Medicare Parts A and B, join a prescription drug plan, or enroll in a Medicare Advantage plan.

If you choose to remain with your employer group plan AND your company employs 20 or more people, youll qualify for a Special Enrollment Period. This begins on the later of the following dates:

- The date your employment ends

- The date your employee coverage ends

There are dozens of ways to qualify for a Special Enrollment Period. Find the full list and guidelines on Medicare.gov here.

Our Find a Plan tool makes comparing Medicare plans easy. Just enter your location and coverage start date to review options in your area.

Dont Miss: What Is A Medicare Medigap Plan

Why I Dropped Obamacare

When I left the corporate world by my own choosing at the end of 2014, I gained several things, including control over my own hours and assignments. But I lost something important: health insurance.

While I was only 33 years old at the time, Ive never been the kind to go without insurance especially when I could afford to have it. I left a steady paycheck behind, but within months I was consistently earning more as a freelance writer and journalist than I ever had in my office job.

To tide me through the first several months of smaller paychecks during the first half of 2015, I elected an insurance plan through the Affordable Care Act which is more well known as Obamacare.

Obamacare did provide me with reduced-cost health insurance that covered all of my basic needs , but the deductibles were through the roof!

I still ended up paying more than $180 per month on a healthcare plan that ordinarily cost $220 per month. And the plan didnt even include any of my usual doctors the ones I liked and had built a rapport with over the years.

As my income increased, my health insurance premiums grew, too, and quickly at that.

Before long, I was paying full price. But, because my income varied from month to month, I still had to report my income on a periodic basis.

Read Also: Can I Draw Medicare At Age 62

Read Also: What Is The Best Medicare Part D Plan For 2020

Is Medicare Part B Based On Income

Medicare premiums are based on your modified adjusted gross income, or MAGI. … If your MAGI for 2020 was less than or equal to the higher-income threshold $91,000 for an individual taxpayer, $182,000 for a married couple filing jointly you pay the standard Medicare Part B rate for 2022, which is $170.10 a month.

Medicare And Employer Coverage

Medicare coverage includes two parts. Also known hospital insurance, Medicare Part A covers inpatient services received in a hospital or skilled nursing facility as well as hospice care. Medicare Part B is sometimes called medical insurance. It covers outpatient services, like doctor visits, lab work, and durable medical equipment . Together, Parts A and B make up Original Medicare.

You can get prescription drug coverage with a Medicare Part D plan. While joining a Part D plan is optional, if you delay enrollment and dont have creditable drug coverage elsewhere, you face lifelong late penalties. means a plan that is comparable to Medicare in terms of both price and coverage.

You May Like: How Old Do I Need To Be To Collect Medicare

What If I Am On Medicare And Decide To Go Back To Work

If you are already on Medicare and decide to go back to work, and your employer offers you a health insurance plan, you have the choice to keep your Medicare coverage or drop it and re-enroll in Medicare when you stop working in the future.

But, it is important that you follow the rules or you may face lifetime penalties. To re-enroll in Medicare after you previously dropped it for an employer plan, you have an eight-month special enrollment period , in which you can sign up for Medicare Parts A, B, D, and/or Medigap, or choose a Part C plan.

If you miss the SEP, you must wait for the general enrollment period to enroll in Medicare. The coverage is then not effective until July. You may also face late enrollment penalties for the rest of your life.

If your employer does not offer you health insurance, it is important to not drop your Medicare coverage, because then you will face penalties if you try to get Medicare back at some point in the future.

You Can Receive Medicare Without Taking Your Social Security Benefits

Medicare and Social Security aid older Americans and their spouses who paid into the programs through FICA taxes during their working years.

Medicare provides both free and cost-effective health insurance coverage for eligible older adults who are 65 years of age or older. Social Security retirement benefits act as a small pension, providing monthly income to those eligible as early as age 62.

Even if you are eligible to start receiving benefits, you do not have to start taking them. In some cases, it may be better to delay or to start taking benefits from one program but not the other.

Recommended Reading: Is Pneumococcal Vaccine Covered By Medicare

Don’t Miss: What Is Medicare Spending Per Beneficiary

Medicare And Cobra Insurance

If you are first enrolled in Medicare and then become eligible for COBRA, you may keep both types of coverage. Medicare will serve as the primary payer, and COBRA will act as the secondary payer.

If you are first enrolled in COBRA coverage and then become eligible for Medicare, your COBRA coverage will end. If any of your family members were also covered under your COBRA coverage, their COBRA benefits will remain in place.

Medicare Prescription Drug Coverage

Medicare Prescription Drug Plans are sold by private insurance companies approved by Medicare. All people new to Medicare have a seven-month window to enroll in a PDP three months before, the month of and three months after their Medicare becomes effective. The month you enroll affects the PDPs effective date. All people with Medicare are eligible to enroll in a PDP however, unless you are new to Medicare or are entitled to a Special Enrollment Period, you must enroll or change plans during the Open Enrollment Period for Medicare Advantage and Medicare Part D, Oct. 15 through Dec. 7. There is a monthly premium for these plans. If you have limited income and assets/resources, assistance is available to help pay premiums, deductibles and co-payments. You may be entitled to Extra Help through the Social Security Administration. To apply for this benefit contact SHIIP at 1-855-408-1212 or the Social Security Administration at 800-772-1213 or www.socialsecurity.gov.

Recommended Reading: Does Medicare Cover Synvisc Shots

Medicare Part Aan Easy Choice

Medicare Part A provides hospital insurance. It covers in-patient hospital stays, care in a skilled nursing facility, hospice care and some home care. Most people benefit by enrolling in Medicare Part A at age 65, whether or not they continue to work. There are no premiums, and enrolling now will help you avoid gaps in coverage down the road.

Can My Medicare Part B Enrollment Start The Day My Work Coverage Ends

Yes, you should be able to enroll in your Medicare Part B a few months in advance and select a future Part B start date. That way you can time it that when your work coverage ends, your Medicare Part B all start at the same time. You should not have a gap when your work coverage has ended but your Medicare has yet to begin.

Also Check: Can I Have 2 Health Insurances

Read Also: Does Medicare Cover Inpatient Psychiatric Care

Using Medicaid With Medicare Or Other Medical Insurance

If you have both Medicare and Medicaid, they work together for you. Medicare pays first, and Medicaid pays last.

Medicare has two parts: Medicare Part A and Medicare Part B

Medicare Part A:

- Pays for skilled nursing care and hospital services.

- Pays for most of your hospital expenses.

Medicaid will pay most of the hospital bills that Medicare Part A doesnt pay. You may be billed for a small amount, called co-insurance. You might also have to pay part of the deductible for inpatient hospital care.

Medicare Part B:

- Pays for visits to the doctor

- Pays for lab tests and X-rays.

Not everyone on Medicare has Part B. You have to pay a small amount each month. Medicaid will pay this monthly charge for you. Let your DHS county office know you have Medicare Part B so you wont be charged a Medicare premium. Medicaid also pays most of the charges that Medicare Part B will not pay. You may be billed for a small amount.

If you have health insurance and Medicaid:

Other times when Medicaid will not pay until someone else pays:

- If you are hurt in a car accident, Medicaid will not pay until your car insurance or the other drivers car insurance has paid or denied payment.

- If you are hurt on the job, Medicaid will not pay until workers comp has paid or denied payment.

- If you win a lawsuit because you got hurt or you get a cash settlement from such a lawsuit, you must use the money to pay your medical bills. Medicaid will only pay toward any amount of your medical bills that are left over.

Medicare Premiums And Employer Contributions

According to the Centers for Medicare & Medicaid Services , it is illegal for employers to contribute to Medicare premiums for an employee with Medicare and employer coverage. However, there is an exception for employers who set up a 105 Reimbursement Plan for all employees.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

The reimbursement plan deducts money from the employees salaries to buy individual insurance policies. Beneficiaries who participate can receive tax-free reimbursements for their Medicare Part B premium.

A well-known Section 105 plan is a Health Reimbursement Account. An HRA reimburses eligible employees for their Medicare premiums and other medical costs.

Don’t Miss: Is Drug Rehab Covered By Medicare

Do Medicare Advantage Plans Cover The Donut Hole

Many Medicare Advantage plans also cover many prescription drug costs. One issue that some people worry about is the prescription drug donut hole. The donut hole is a gap in prescription drug coverage that some people encounter each year. However, not everyone enters the donut hole, and the dollar amount to enter the donut hole changes each year. Medicare Advantage plans do not cover this donut hole, but you can avoid it by spending less than the pre-set amount.

Example: Primary And Secondary Payer Coordination

You visit your doctor for a normal checkup. Your doctors office bills both Medicare and the group insurance you have through your employer for the visit. Your group insurance is the primary payer because youre over 65 and your employer has more than 20 employees, so your group health plan pays whatever their standard rate for a doctors office visit is. Medicare is the secondary payer, so they pay whatever charges are left over. If there happens to be any amount left after both Medicare and your group insurance pay what they will cover, you may have to pay the remainder to your doctors office.

Medicare offers a helpful guide on Medicare.gov that covers different situations and how Medicare works with your other insurance. You can also call the Medicare Benefits Coordination & Recovery Center Monday through Friday, from 8:00 a.m. to 8:00 p.m., Eastern Time, except holidays, at toll-free lines: 1-855-798-2627 if you have questions about who pays first.

Read Also: Does Medicare Cover Blood Pressure Machines

If I Have Medicare And Group Health Insurance Which One Pays My Claims

In previous posts, weve described different Medicare plans, but what if you are also covered through a group-sponsored insurance plan from your employer? You may be wondering, how does my Medicare plan work with my other insurance?”

To better understand how your two insurance plans work together to cover your medical expenses, its important to understand some basic terms.

- Payer A payer is just another name for each type of insurance coverage you have.

- Primary payer The primary payer is the insurance that pays your claims first up to the limits of its coverage.

- Secondary payer – The secondary payer pays your claims if there are any costs the primary payer didnt cover. The secondary payer may not pay all the uncovered costs.

- Coordination of benefits When there is more than one payer, the coordination of benefits rules decide which insurance pays first.

Lets talk about when Medicare is the primary payer and when it is the secondary payer behind your group-sponsored plan. There are a lot of different variables that determine whether Medicare is the primary payer or the secondary payer. Some of these include:

- Whether you are over or under 65 years old

- Whether you are currently employed or are retired

- Whether your group coverage is through your employer or your spouses/partners employer

- Whether you are also on Medicaid

- The number of employees your employer has