Disadvantages Of Pos Plans

Though POS plans combine the best features of HMOs and PPOs, they hold a relatively small market share. One reason may be that POS plans are marketed less aggressively than other plans. Pricing also might be an issue. Though POS plans can be up to 50% cheaper than PPO plans, premiums can cost as much as 50% more than for HMO premiums.

While POS plans are cheaper than PPO plans, plan details can be challenging, the policies can be confusing, and many consumers dont understand how the associated costs work. Read the plan documents especially carefullyand compare them to other choicesbefore deciding whether this is the best option.

Hmo Vs Preferred Provider Organization

A preferred provider organization is a medical care plan in which health professionals and facilities provide services to subscribed clients at reduced rates. PPO medical and healthcare providers are called preferred providers.

PPO participants are free to use the services of any provider within their network. Out-of-network care is available, but it costs more to the insured. In contrast to a PPO, HMO plans require that participants receive healthcare services from an assigned provider. PPO plans usually have deductibles while HMOs usually do not.

Both programs allow for specialist services. However, the designated primary care physician must provide a referral to a specialist under an HMO plan. PPO plans are the oldest anddue to their flexibility and relatively low out-of-pocket costshave been the most popular managed healthcare plans. That has been changing, however, as plans have reduced the size of their provider networks and taken other steps to control costs.

What Is A Point

A point-of-service plan is a type of managed-care health insurance plan that provides different benefits depending on whether the policyholder uses in-network or out-of-network healthcare providers. A POS plan combines features of the two most common health insurance plans: the health maintenance organization and the preferred provider organization .

POS plans represent a small share of the health insurance market. Most policyholders have either HMO or PPO plans.

Recommended Reading: Is It Medicaid Or Medicare

Should You Choose A Ppo Or Pos Plan

Which plan you choose depends on what best meets your needs.

- If you’re looking for a lot of choice and flexibility, you might consider a PPO. No PCP required, no referrals, and coverage for both in- and out-of-network providers. This choice and flexibility comes with higher plan costs, though.

- POS plans cost less, but offer fewer choices than PPOs. If you’re not concerned about having to stay in-network, choosing a PCP, or getting referrals for other providers, then a POS plan may work for you.

Before choosing any health plan, make sure to review the details of coverage. These are high-level descriptions of PPO vs POS plans. Plans can vary widely between insurance carriers and those you may purchase on your own from the .

What Do Medicare Advantage Plans Cover

All Medicare Advantage Plans Cover:

- All the benefits of Part A *

- All the benefits of Part B

Most Medicare Advantage Plans Cover:

The blue bottom right quadrant of the screen swipes left and becomes yellow with purple text.

ON SCREEN TEXT: Vision

The yellow bottom right quadrant of the screen swipes left and becomes purple with light blue text.

ON SCREEN TEXT: Hearing

The purple bottom right quadrant of the screen swipes left and becomes darker blue with light blue text.

ON SCREEN TEXT: Fitness

The bottom half of the screen turns yellow. Blue text appears below blue graphics on the yellow bottom half.

ON SCREEN TEXT: 4 $0 The ease of being an all-in-one plan.

The screen swipes left. Darker blue text appears on a light blue background.

ON SCREEN TEXT: Medicare Made Clear® by UnitedHealthcare

Don’t Miss: How To Opt Back Into Medicare

Medicare Managed Care Plans Vs Medigap Insurance

Medicare managed care plans fill the gaps in basic Medicare, as do medigap policies. However, Medicare managed care plans and medigap policies operate in different ways. Medigap podlicies work alongside Medicare to pay the bills: Medical bills are sent both to Medicare and to a medigap insurer, and each pays a portion of the approved charges.

Medicare managed care plans, on the other hand, provide all the coverage themselves, including all basic Medicare coverage, plus other coverage to fill the gaps in Medicare coverage. The extent of coverage beyond Medicare, the size of premiums and copayments, and decisions about paying for treatment are all controlled by the managed care plan itself, not by Medicare.

The Economics Of Managed Care

The basic premise of managed care is that the member-patient agrees to receive care only from specific doctors, hospitals, and others — called a network — in exchange for reduced overall healthcare costs. This makes Medicare Advantage plans generally cheaper overall than medigap plans.

Several varieties of Medicare managed care plans are available. Some have narrow restrictions on consulting with specialists or seeing providers from outside the network. Others give members more freedom to choose when they see doctors and which doctors they may consult for treatment. Plans that offer more choices in coverage — especially PPOs and HMOs with point-of-service options — charge higher premiums.

If you are considering a Medicare managed care plan, you must decide whether any of the plans available in your area offer adequate care at an affordable cost — including the costs of copayments for doctor visits and prescription drugs.

Here are some of the basic types of managed care plans.

Also Check: Does Medicare Cover End Of Life Care

How Much Do Medicare Managed Care Plans Cost

The cost of a Medicare managed care plan will depend on which plan you select, and the plans available to you will depend on where you live. Managed care plans are often specific to a state, region, or even city.

You can find plans in a variety of price ranges. For example, plans in St. Louis, Missouri, range from $0 to $90 per month.

The cost for a Medicare managed care plan is in addition to your cost for original Medicare. Most people receive Part A without paying a premium, but the standard Part B premium in 2021 is $148.50.

The cost of your managed care plan will be on top of that $148.50. So, if you select a plan with a $0 premium, youd continue to pay $148.50 per month. However, if you selected a $50 plan, youd pay a total of $198.50 per month.

Youll need to be enrolled in both Medicare Part A and Part B to be eligible for a managed care plan. You can become eligible for parts A and B in a few ways:

- by having a diagnosis of ESRD or amyotrophic lateral sclerosis

Once youre enrolled in Medicare parts A and B, youll be eligible for a managed care plan.

Is A Pos Right For You

When shopping for a health plan for you and your family, ask these questions to see if a POS may be right for you:

- What type of health care do I expect for the coming year?

- Are the doctors and hospitals I use now, and may need in the future, in the POS network?

- If not, am I willing to see different providers so I have a lower monthly premium?

- Which POS plans are available, compared with the broader PPO networks?

Recommended Reading: When Can Medicare Plans Be Changed

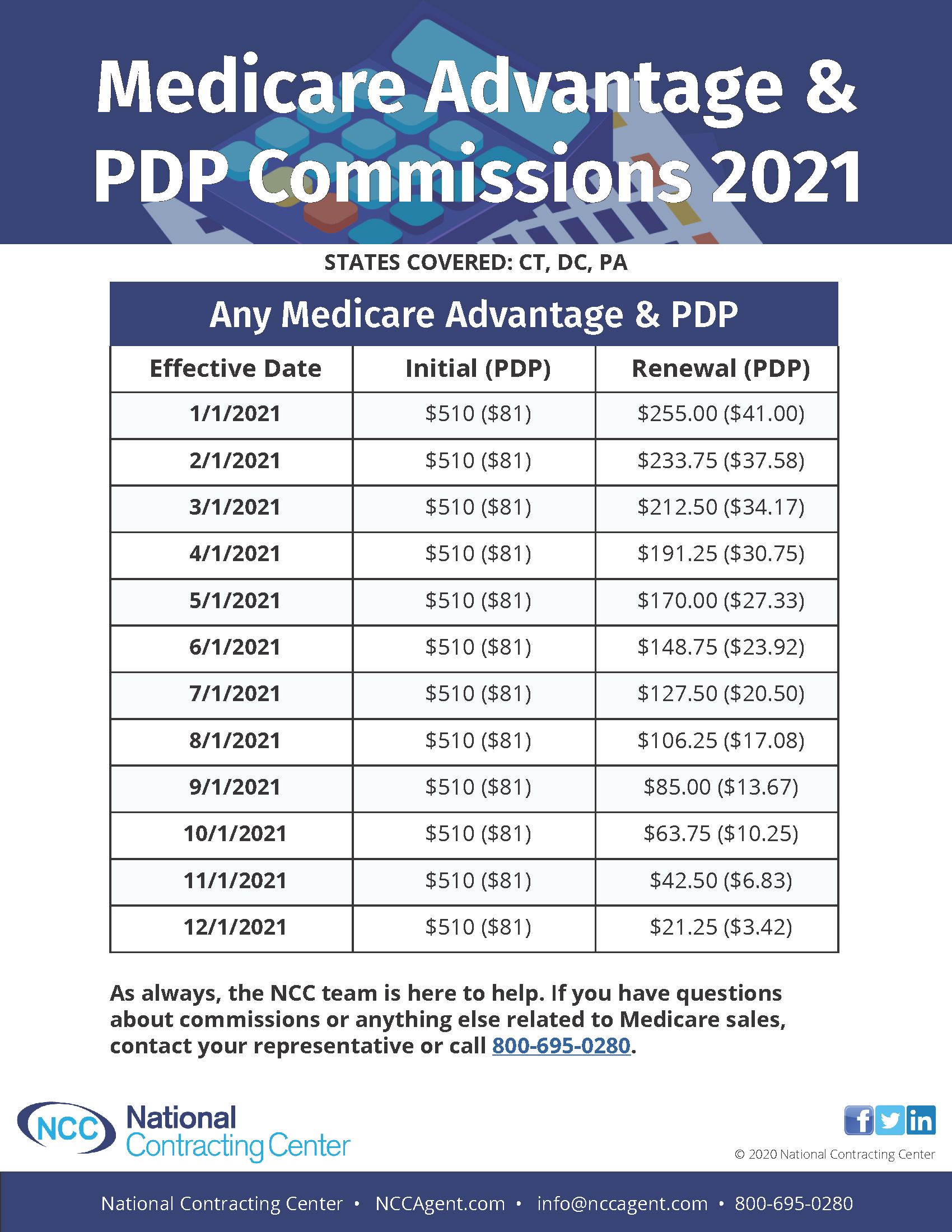

New Medicare Managed Care Rules For 2021

There are a few changes to Medicare managed care plans in 2021.

One of the biggest changes is that people who are eligible for Medicare through a diagnosis of end stage renal disease are now able to purchase a managed care plan. Previously, they could enroll in only original Medicare and Medicare Part D.

Another change is the addition of two special enrollment periods. This is a time outside of the yearly enrollment windows when you can change your Medicare plan. It generally includes major life changes, like moving or retirement.

Starting in 2021, youll also qualify for a special enrollment period if:

- you live in a disaster area, as declared by the Federal Emergency Management Agency for example, if your area has been struck by a hurricane or other natural disaster

- your current health plan is a poor performer, according to Medicare

- tour current health plan is having financial trouble and has been placed in receivership

- your current health plan has been sanctioned by Medicare

Other changes include a revised managed care enrollment form and the ability to sign your enrollment documents with an e-signature.

The Best Option For You

To determine if the HMO-POS plan is the best option for you, ask yourself some questions.

Do you travel within the U.S. a lot? Do you mind having to coordinate your health care services with the help of your primary care physician? Does your favorite doctor participate in the HMO-POS network?

If the answer to any of these is yes, an HMO-POS plan may be the best option for you. Although, members should consult with their Medicare agent prior to making any plan changes.

You May Like: Can You Receive Medicare Without Social Security

What Is Medicare Managed Care

Medicare managed plans are an alternative to original Medicare . Sometimes referred to as Medicare Part C or Medicare Advantage, Medicare managed care plans are offered by private companies.

These companies have a contract with Medicare and need to follow set rules and regulations. For example, plans must cover all the same services as original Medicare.

You can choose from among a few kinds of Medicare managed care plans. The plan types are similar to what you mightve had in the past from your employer or the Health Insurance Marketplace.

Types of Medicare managed care plans include:

The Role Of The Primary Care Physician

The insured party must choose a primary care physician from the network of local healthcare providers under an HMO plan. A primary care physician is typically an individuals first point of contact for all health-related issues. This means that an insured person cannot see a specialist without first receiving a referral from their PCP.

However, certain specialized services, such as screening mammograms, do not require referrals. Specialists to whom PCPs typically refer insured members are within the HMO coverage, so their services are covered under the HMO plan after co-pays are made. If a primary care physician leaves the network, subscribers are notified and are required to choose another PCP from within the HMO plan.

You May Like: Is Aarp Medicare Part D

What Is An Hmo

A health management organization with a point of service option is a type of Medicare Advantage plan, an alternative way to receive Medicare benefits.

HMO-POS plans offer coverage for members that travel a lot within the country, different from the location restrictions of HMO plans. Although, members should expect a higher cost when using the point of service option .

Which Parts Of Medicare Are Included In Managed Care Plans

Managed care plans take the place of original Medicare. Original Medicare includes Medicare Part A and Medicare Part B .

When you have a managed care plan, all your costs will be included. You dont need to know whether Part A or Part B cover a service because your managed care plan will cover all the same things.

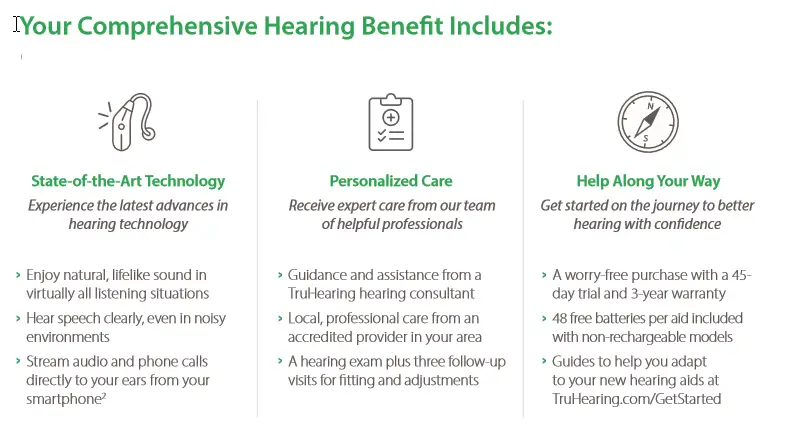

Managed care plans are also referred to as Medicare Part C plans. These plans cover everything original Medicare does, and they often cover additional services as well. For example, original Medicare doesnt cover routine dental care, but many managed care plans do.

Managed care plans sometimes include coverage for Medicare Part D, which is prescription drug coverage. Managed care plans often include this coverage with your plan. This means all your coverage will be under one plan. A managed care plan that includes Part D coverage is known as a Medicare Advantage Prescription Drug plan.

Recommended Reading: What Are The Guidelines For Medicare

Less Common Types Of Advantage Plans

Additional options for Advantage plans may also be available to some people. Infrequently offered or accessed, they include:

-

Medical savings account plans: These combine a high-deductible health plan with a savings account that your plan deposits money in. Theyre like health savings accounts, which are offered outside of Medicare, but far less common. There are very few MSA plans offered nationwide. They dont offer prescription drug coverage.

-

HMO point-of-service plans : With a typical HMO, you must stay within your network to have medical care or services covered by your plan. An HMOPOS, like a PPO, allows you to go outside your network, provided youre willing to pay more for that care.

What Is Medicare Supplement Plan G

Plan G is sold by private health insurance companies and can be offered through a Medicare brokerage. Medicare Supplement insurance works alongside Original Medicare Part A and Medicare Part B. Plan G will only pay out when Medicare pays its share first. Therefore, if Medicare will not cover a service, neither would Plan G.

Medicare Supplement Plan G does not have network restrictions. You can visit any doctor, specialist, or hospital in the United States and use your Supplement plan if the doctor or facility accepts Medicare. If the doctor doesnt accept Original Medicare, then Plan G will not be able to provide coverage for your healthcare services.

You May Like: Does Medicare Pay For Inogen Oxygen Concentrator

How We Use The Information We Collect

Because we respect your privacy and value our relationship with you, we only use your Personal Information to offer you information about and the opportunity to purchase health care coverage that is right for you or your family. We also use third party partners and affiliates to help us to provide these services so we may share your information with these third parties and affiliates for such purposes. These third parties and affiliates are not authorized by us to use your Personal Information in any other way.

For example, we provide your Personal Information to our parent company, HealthPlanOne, LLC, so that they can help you to find and apply for Medicare and health insurance. We have also contracted with other third parties to provide the same services so as to ensure that your questions are answered and so that more than one opinion may be made available to you.

Since Aggregate Information does not include Personal Information, we reserve the right to use and share this information with others. However, we primarily use this information to customize your experience on our Site, to help us improve the quality of the Site, and to make your use of the Site easier and more valuable to you.

We do not sell, license, transmit or disclose Personal Information that you provide to us except with the following exceptions:

EFFECTIVE DATE: OCTOBER 7, 2010

Ppo Vs Pos Plans: Whats The Difference

In general the biggest difference between PPO vs. POS plans is flexibility. A PPO, or Preferred Provider Organization, offers a lot of flexibility to see the doctors you want, at a higher cost. POS, or , have lower costs, but with fewer choices. There are many more details you’ll want to compare, as well.

Don’t Miss: Does Medicare Part B Cover Home Health Care Services

What Is Pos Health Insurance

In general, a Point of Service health insurance plan provides access to health care services at a lower overall cost, but with fewer choices. Plans may vary, but in general, POS plans are considered a combination of HMO and PPO plans. You can access care from in-network or out-of-network providers and facilities, but your level of coverage will be better when you stay in-network. If you have a point of service plan, depending on your specific plan design, you may be required to get referrals from your primary care provider .

What Is A Health Management Organization Medicare Advantage Plan

An HMO plan is a type of MA plan. HMOs provide you with the same benefits, protections, and rights as Original Medicare, but with different costs, and rules. HMO plans also offer additional supplemental benefits that you might need such as dental, vision and hearing services. HMO plans require you to have a primary care physician who will act as your care coordinator. This ensures your care is in the hands of someone that you know and trust. These plans require that your PCP and specialists they refer you to be within the HMOs network. If you choose to see a doctor or other provider outside of that network, you will likely be responsible for higher costs. Most MA HMOs offer Medicare Advantage Prescription Drug Plans as part of their plan benefits, including all plans offered by Aspire Health Plan.

Read Also: What Is A Medicare Physical Exam

Accessing Health Care Services

Canadians most often turn to primary health care services as their first point of contact with the health care system.

In general, primary health care:

- delivers first-contact health care services

- coordinates patients’ health care services to support:

- continuity of care, which means receiving high quality care from diagnosis to recovery

- ease of movement across the health care system when more specialized services are needed from specialists or in hospitals

The provinces and territories also provide supplemental coverage to certain groups of people, such as:

- seniors

- children

- social assistance recipients

This helps pay for health care services that are not generally covered under the publicly funded health care system. These services include:

- vision care

What Is An Hmo Point Of Service Plan

An HMO POS plan is a Health Maintenance Organization plan with added Point of Service benefits. These added benefits give you more flexibility when you need care.

Under the HMO benefits of the plan, you have access to certain doctors and hospitals, called your HMO provider network. You choose a primary care physician from the HMO network who will manage your care. Youll need a referral to see a specialist to receive the HMO benefits.

With a Blue Cross and Blue Shield of Texas HMO POS plan, you also have the choice to go outside the network or see a specialist without a PCP referral. When you do this, the cost of the care will be covered at the POS benefit level, which is lower than in-network coverage. This means youll pay more out-of-pocket, but will have some benefits you wouldnt have with an HMO.

When using your POS plan benefits:

- Youll pay more of the bill when you see an out-of-network provider, or see a network provider without a referral from your PCP.

- Youll have a higher deductible and coinsurance costs.

- Your benefits may cover only part of the costs.

Recommended Reading: Is Medicare Medicaid The Same