Medicare Advantage Eligibility Requirements

While regular Medicare Advantage does not cover ESRD, you may qualify for a Medicare Special Needs Plan. SNPs are special types of Advantage plans specifically designed for a particular condition or financial situation.

You can keep your Medicare Advantage plan if you purchased it before developing ESRD. And you can buy an Advantage plan after being medically determined to no longer have ESRD usually from a successful kidney transplant.

How To Find Plans That Offer The Giveback Benefit

Not all MA plans offer this benefit, so you must find a plan that does in order to take advantage of the opportunity. In 2021, these plans are offered in nearly all states, so you may find one close to you.

If you enroll in a plan that offers a giveback benefit, you’ll find a section in the plan’s summary of benefits or evidence of coverage that outlines the Part B premium buy-down. Here, you’ll see how much of a reduction you’ll get. You can also call us toll-free at 1-855-537-2378 and one of our knowledgeable, licensed agents will answer your questions and explain your options.

Sign Up: Within 8 Months After Your Family Member Stops Working

- If you have Medicare due to a disability or ALS , youll already have Part A .

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Read Also: How Much Does Medicare Cost Me

Who Is Eligible For Medicaid

You may qualify for free or low-cost care through Medicaid based on income and family size.

In all states, Medicaid provides health coverage for some low-income people, families and children, pregnant women, the elderly, and people with disabilities. In some states the program covers all low-income adults below a certain income level.

- First, find out if your state is expanding Medicaid and learn what that means for you.

- If your state is expanding Medicaid, use this chart to see what you may qualify for based on your income and family size.

Even if you were told you didn’t qualify for Medicaid in the past, you may qualify under the new rules. You can see if you qualify for Medicaid 2 ways:

- Visit your state’s Medicaid website. Use the drop-down menu at the top of this page to pick your state. You can apply right now and find out if you qualify. If you qualify, coverage can begin immediately.

- Fill out an application in the Health Insurance Marketplace. When you finish the application, we’ll tell you which programs you and your family qualify for. If it looks like anyone is eligible for Medicaid and/or CHIP, we’ll let the state agency know so you can enroll.

What Happens If You Enroll In Part D Late

If you dont enroll in Part D when youre first eligible and you didnt have other drug coverage for 63 consecutive days, Medicare may charge a penalty when you enroll, adding it to your monthly premium. Part D premiums vary by plan.

If youre concerned about drug coverage costs, Medicare has a program called Extra Help for people with limited incomes. There is no Part D penalty if you get Extra Help.13

Also Check: Can You Get Medicare At Age 60

Medicare Eligibility: How To Qualify For Medicare Benefits

There are different ways to qualify for Original Medicare, Part A and Part B. Most people become eligible for Medicare by aging into the system when they turn 65. However, you can also qualify for Medicare before 65 if you have certain disabilities.

When it comes to other parts of Medicare, such as Medicare Part C , Medicare Part D , and Medicare Supplement insurance , theres another set of eligibility requirements.

Here are some situations where you may be eligible for Medicare Part A and Part B, Medicare Advantage plans, Medicare prescription drug coverage, and Medigap.

What Is Medicare Part A When Can You Enroll

Medicare Part A is hospital insurance. It covers inpatient hospital, hospice, and skilled nursing facility care. Part A also covers home health care.

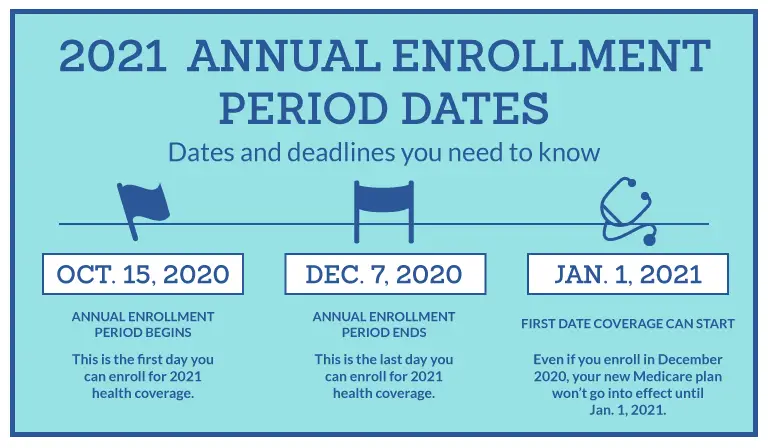

You can sign up for Part A:

- During your Initial Enrollment Period , if youre not automatically enrolled, or

- At any time after youre first eligible. If you qualify for premium-free Part A, you wont have a penalty if you enroll past your IEP.6

Read Also: Does Medicare Part C Cover Dentures

What Happens When You Turn 65

- If you already receive benefits from Social Security or the Railroad Retirement Board , youll be automatically enrolled in traditional Medicare, aka Original Medicare. This consists of Part A hospital insurance and Part B medical insurance. Your Medicare coverage usually starts the first day of the month you turn 65. You should expect to receive your Medicare card in the mail three months before your 65th birthday.

- If you dont receive Social Security or RRB benefits, youll need to enroll. You can sign up for Medicare with Social Security online, over the phone, or in person. You should enroll as soon as your Medicare eligibility period begins, even if youre not ready to receive Social Security retirement benefits.3

- If you dont have any other type of health insurance, you should enroll in Medicare Parts A and B when you turn 65. But if youre still working and you have health insurance through an employer or union, you may not have to enroll in Part B. We talk more about delaying Part B enrollment below.

How Do I Qualify For The Part B Premium Giveback Benefit

You may qualify for a premium reduction if you:

- Are enrolled in Medicare Part A and Part B

- Do not already receive government or other assistance for your Part B premium

- Live in the zip code service area of a plan that offers this program

- Enroll in an MA plan that provides a giveback benefit

This means anyone with Medicaid or other forms of assistance that pay the Part B premium cannot enroll in one of these Medicare Advantage plans.

Read Also: Why Is My Medicare So Expensive

What Can I Do Next

Generally, youre first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65.

Because the company has less than 20 employees, your job-based coverage might not pay for health services if you dont have both Part A and Part B.

Other Ways To Get Medicare Coverage At Age 65

If you dont qualify for premium-free Medicare Part A coverage, you may still be eligible to buy coverage.

You still have to be a U.S. citizen or a permanent resident for at least five years.

Other Medicare Eligibility Options

- You can pay premiums for Medicare Part A hospital insurance. These vary on how long you have worked and paid into Medicare. If you continue working until youve totaled 10 years of paying into the system, you wont have to pay premiums anymore.

- You can pay monthly premiums for Medicare Part B medical services insurance. Youll pay the same premiums as anyone else enrolled in Part B.

- You can pay monthly premiums for Medicare Part D prescription drug coverage. This is the same as anyone else would pay depending on the plan you choose.

You will not be able to purchase a Medicare Advantage plan or Medigap supplemental insurance unless you are enrolled in Original Medicare Medicare Parts A and B.

You May Like: What Is A Hmo Medicare Plan

When Do I Sign Up For Medicare Part A

Some people are automatically enrolled in Medicare Part A, while you may need to manually sign up for it in other cases.

Automatic enrollment in Medicare Part A

If youre currently receiving retirement benefits from Social Security or the Railroad Retirement Board , youre automatically enrolled in both Medicare Part A and Part B starting the first day of the month you turn age 65. If your birthday happens to fall on the first day of the month, then youll be automatically enrolled in Medicare on the first day of the month before your birthday. You should get your Medicare card in the mail three months before your 65th birthday.

Most people dont pay a monthly premium for Medicare Part A as long as you or your spouse paid Medicare taxes for a minimum of 10 years while working. If you havent worked long enough but your spouse has, you may be able to qualify for premium-free Part A based on your spouses work history.

If you are under age 65 and disabled, you automatically get Part A and Part B after you have received disability benefits from Social Security or certain disability benefits from the Railroad Retirement Board for 24 months. You will receive your Medicare card in the mail three months before the 25th month of disability. If you have ALS , you automatically get Part A the first month that your disability benefits begin.

Manual enrollment in Medicare Part A

- Go to Medicare.gov.

How Does The Silversneakers Medicare Program Work

The SilverSneakers Medicare program is available only through select Medicare Advantage plans or a few Medicare Supplement plans. Once you get on a qualifying Medicare Advantage or Medigap plan, youll sign up for the SilverSneakers program and receive a card with a 16-digit number. This number will give you immediate entry to all the classes and equipment the SilverSneakers Medicare program offers.

To see if your current Medicare Advantage or Medigap plan grants you SilverSneakers eligibility, you can use the instant SilverSneakers eligibility checker.

You May Like: Can I View My Medicare Eob Online

Have You Or Your Spouse Worked For At Least 10 Years At Jobs Where You Paid Medicare Taxes

Generally, youre first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65.

Avoid the penalty If you dont sign up when youre first eligible, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

What Does A Silversneakers Membership Include

A SilverSneakers membership comes with access to over 17,000 fitness locations nationwidethats right, with the SilverSneakers program, you can use gyms and all its included amenities in SilverSneakers huge, national network.

But SilverSneakers is probably even better known for its group exercise classes run by qualified instructors which includes equipment available to use in the classes. The SilverSneakers program also offers social events, a fitness app , online resources for home workouts, and more.

Additionally, SilverSneakers repeatedly states that it does not sell shoessilver or otherwiseto anyone. It doesn’t give you a free pair of shoes when you become a member either. So you’ll need to BYOS to bring to SilverSneakers classes.

Recommended Reading: How Do I Get A Lift Chair Through Medicare

How Did You Automatically Get Enrolled In Medicare

President/CEO at Healthcare Solutions Direct, LLC, a nationwide insurance agency focused primarily on the retiree health market.

getty

Medicare is a unique type of health insurance because you do not always have to sign up to get it. Once you turn 65, you will become eligible. If you are already collecting social security benefits, you will automatically be enrolled into what is known as Original Medicare. There is nothing you need to do.

The coverage will begin on the first day of the month in which you turn 65 unless you were born on the first of the month. If that is the case, your coverage will begin on the first day of the previous month. You will get alerted to your coverage automatically in the mail by envelope with your Medicare card enclosed. It is mailed out around three months before your 65th birthday.

For many, Original Medicare is far from complete coverage. It is up to you to decide what changes or additions to your healthcare coverage are necessary. If you are still working, it is also up to you to decide whether you would like to continue using the health insurance offered through your employer or not.

With a decade of experience in the healthcare insurance space, I have talked to thousands of Medicare-eligible individuals. In order to make the best decision on what is right for you, you will need a lot of information. This includes an understanding of what each part within Medicare actually covers.

Which Statesuse Their Own Criteria For Granting Medicaid

Theremaining states do not automatically grant Medicaid to persons withdisabilities who qualify for SSI because they use their own criteria fordetermining whether someone is eligible for Medicaid. These states may haveincome limits that are higher or lower than SSIs, different asset limits, ordifferent requirements for what makes someone disabled.

Inmost of these states, however, the income limitsfor Medicaid arent too different from the income limit for SSI . And many of them use thesame resource limit as SSI program, although several have a lower assetlimit than SSI , and a couple states have a higher asset limit .

These states are called 209 states, named after a sectionof the legislation that created the SSI program in 1972. This legislationprohibited states from making their Medicaid eligibility criteria stricter thanthe criteria the states were using in 1972. In these states, you must apply forMedicaid with your states Medicaid agency or health and human services department.

The 209 states are:

|

Virginia |

Note that Indiana ceased being a 209 state in 2014.

Even though some 209 states have lower income limits than theSSI program, these states have to let Medicaid applicants deduct their medicalexpenses from their income when their eligibility for Medicaid is beingdetermined. This is called spending-down. This means that SSIrecipients with high medical bills will qualify for Medicaid in these states.

You May Like: Why Is My First Medicare Bill So High

Recommended Reading: How Do I Apply For Medicare In Arizona

Who Is Eligible For Medicare Part B

Part B medical insurance, the second piece of Original Medicare, covers outpatient services, such as doctors visits, lab work, and preventive care.

Here are the eligibility requirements to enroll in Medicare Part B.

- If youre entitled to Part A with no monthly premiums, then you qualify for Part B when youre eligible for Part A.

- If you have to buy Part A, then you can get Part B if:

- Youre an American citizen who lives in the country or a permanent resident who has lived here for five or more continuous years, and

- Youre 65 or older or under 65 and qualify for Medicare due to having a disability, ESRD, or ALS.

Your enrollment period for Part B is the same as Part A: during your Initial Enrollment Period when you first qualify for Medicare, or during the General Enrollment Period .

How To Apply Online For Just Medicare

If you are within three months of turning age 65 or older and not ready to start your monthly Social Security benefits yet, you can use our online retirement application to sign up just for Medicare and wait to apply for your retirement or spouses benefits later. It takes less than 10 minutes, and there are no forms to sign and usually no documentation is required.

To find out what documents and information you need to apply, go to the .

Recommended Reading: Can You Get Medicare At 60

How Much Will I Pay For Premiums In 2022

Most people will pay the standard amount for their Medicare Part B premium. However, youll owe an IRMAA if you make more than $91,000 in a given year.

For Part D, youll pay the premium for the plan you select. Depending on your income, youll also pay an additional amount to Medicare.

The following table shows the income brackets and IRMAA amount youll pay for Part B and Part D in 2022:

| Yearly income in 2020: single | Yearly income in 2020: married, joint filing | 2022 Medicare Part B monthly premium | 2022 Medicare Part D monthly premium |

|---|---|---|---|

| $91,000 | |||

| $578.30 | your plans premium + $77.90 |

There are different brackets for married couples who file taxes separately. If this is your filing situation, youll pay the following amounts for Part B:

- $170.10 per month if you make $91,000 or less

- $544.30 per month if you make more than $91,000 and less than $409,000

- $578.30 per month if you make $409,000 or more

Your Part B premium costs will be deducted directly from your Social Security or Railroad Retirement Board benefits. If you dont receive either benefit, youll get a bill from Medicare every 3 months.

Just like with Part B, there are different brackets for married couples who file separately. In this case, youll pay the following premiums for Part D:

- only the plan premium if you make $91,000 or less

- your plan premium plus $71.30 if you make more than $91,000 and less than $409,000

- your plan premium plus $77.90 if you make $409,000 or more

You can request an appeal if: