How Do You Sign Up For Medicare

Most people are automatically enrolled in Part A and Part B if they:

- Get retirement benefits from Social Security or the Railroad Retirement Board. You are enrolled the first day of the month you turn 65.

- Are younger than 65 and have been getting disability benefits from Social Security or the Railroad Retirement Board for 24 months.

If you qualify for automatic enrollment, you will be sent your Medicare card 3 months before you turn 65 or your 25th month of disability.

You need to apply to get Part A and Part B benefits if you aren’t getting Social Security or railroad benefits.

You also need to sign up if you have end-stage renal disease. Medicare covers dialysis treatment for people who have permanent kidney failure.

You can get more information and sign up for Medicare by calling the Social Security office at 1-800-772-1213 or by applying online at www.socialsecurity.gov/medicareonly.

Penalty for late enrollment

If you don’t sign up for Parts A and B when you are first eligibleâby the first day of the month you turn 65âyou may pay a higher premium than if you had signed up then. A penalty also may apply for late enrollment in Part D, depending on how long you went without drug coverage.

Kaiser Permanente Medicare Health Plans 2022

Kaiser Permanente Senior Advantage and Senior Advantage Medicare Medi-Cal

Make the most of your coverage by learning more about your plan.

Our Evidence of Coverage documents include detailed benefit information and how to get coverage. You can download a copy below.

We encourage you to read this information and hold onto it because it explains your benefits and rights. If you have questions or would like to request a hard copy, please call Members Services at 1-800-443-0815 or TTY 711 from 8 a.m. to 8 p.m., 7 days a week.

We make it easy to find a doctor or pharmacy to meet your needs. All of our available doctors welcome Kaiser Permanente Medicare health plan members and you can change to another available Kaiser Permanente doctor at anytime, for any reason. You can download a provider directory below.

If you would like help understanding these documents, call Member Services at 1-800-443-0815 or TTY 711 from 8 a.m. to 8 p.m., 7 days a week.

Kaiser Foundation Health Plan, Inc.393 E. Walnut St.

Find general information, plan comparisons, a prescription drug plan finder, search tools, and reference materials.

You also may send a complaint directly to Medicare by using the online Medicare Complaint Form

Search information about Medicare eligibility and enrollment, order a replacement Medicare card, and dig deeper into topics like retirement and disabilities.

Protect your identity. Know the signs of schemes and questionable offers involving Medicare.

Making an appeal

How Do I Apply For Medicare

You can sign up for Medicare Part A, which covers hospital stays, and Medicare Part B, which covers doctor visits and other services, directly through the federal government. You can also sign up for a private Medicare health plan , which may help you get better benefits and lower costs, as well as a private Medicare Part D prescription drug plan.

We can help you figure out which Kaiser Permanente Medicare health plan may be best for you. To speak with a Kaiser Permanente Medicare specialist, call .

You May Like: Is Upmc For You Medicare Or Medicaid

How Do I Get Started

California Insurance Providers and BCBIS has contracted with leading health insurance carriers and Covered California to provide you an easy starting place to receive Covered Ca Plans: call us now at 855-441-2245. We DO NOT charge for our services. It is FREE of charge or fees.

We are a certified agent with Covered California and you can find us here or on coveredca.comBluefin Corporate Benefits & Insurance Services Privacy Policy

We understand there is a lot of valuable and important information shared with us. It is our policy to NOT share any of our clients information with anyone other than ourselves. We are regulated by the California Department of Insurance as well as Covered California. You can find us on both of their websites, and if you are looking for help in finding us, just give us a call and we will walk you through it. We collect all of your information because we are required to do so to process health insurance policies and nothing more. We do not sell any other products besides Covered California Medical policies. Covered California may or may not share your information. This is the clients responsibility to contact and ask Covered California directly 300-1506 for their service department.

Your privacy is very important to BCBIS we are an insurance agent, and our license depends on taking care of our clients. If you have any concerns regarding your privacy, please call us.

Our Privacy Policy states:

Can I Keep Kaiser If I Move To Another State

Youll need to notify your current exchange about your relocation plans and receive a coverage eligibility determination from your new state exchange. But you should be able to move seamlessly without a gap in coverage from one exchange to another, according to the Department of Health and Human Services.27 sept. 2013

Read Also: Is Skyrizi Covered By Medicare

Average Monthly Cost Of Kaiser Permanente Insurance

| Metal tier |

|---|

| $1,237 |

Based on available policies in California.

Keep in mind that these base rates are for individuals paying full price for health insurance. Health insurance subsidies through the Affordable Care Act can help reduce your monthly insurance bills, and you can qualify for these health insurance discounts based on your income and family size.

The cost of Kaiser health insurance is usually about average when compared to all other insurance providers, but it’s cheaper than other major insurance companies such as BlueCross BlueShield.

Do Kaiser Medicare Plans Include Dental Coverage

Depending on the type of Kaiser Medicare plan you choose, you may receive coverage for preventive dental services such as exams, cleanings and X-rays every six months. Dental services may require a small copayment.

More advanced dental services may also be covered at a reduced rate and may include diagnostic and restorative services, endodontics, periodontics, extractions and prosthodontics.

Don’t Miss: Does Medicare Pay For Naturopathic Doctors

Medical Benefits Under Kaiser Medicare Advantage Plans

Before we begin, itâs important to know that Kaiser Permanente is not available in all states. Even in the states where Kaiser operates, Medicare Advantage plans may not be available in your zip code, so investigate this upfront. Plan benefits may also vary by your location. Here are the states in which Kaiser offers Medicare Advantage plans:

- California

- Washington

- Washington D.C.

There are several different types of Medicare Advantage plans, and the model of care offered by Kaiser is a Health Maintenance Organization style plan. With HMO plans, you will typically need to choose a primary care provider withiin the organization. You will need authorizations from your primary care provider in order to see specialists or to get certain tests, according to the official U.S. government website for Medicare.

One of the benefits of Kaiserâs HMO-style Medicare Advantage plans is that they bring all the medical services you might need into one simple plan. With Original Medicare, there is separate coverage for hospital care , medical services , and drug coverage . With Kaiser Medicare Advantage, youâll get comprehensive healthcare coverage bundled into one unified plan.

Another benefit of Kaiser Medicare Advantage is the cost savings. An annual deductible is the amount of money you must pay out-of-pocket before insurance starts to pay your medical bills. With Kaiser Medicare Advantage plans, the annual deductible for outpatient services is zero for most plans.

Kaiser Permanente Insurance To Pay For Hospice Care

Hospice care provides support for individuals who are facing the end of their life and need health coverage throughout that time. There are some Kaiser Permanente coverage options available here. There are some policies that cover both palliative care and hospice care. Most of the time, an individual who needs hospice care will have high medical bills as well as significant medication needs. This type of coverage is generally a part of the Kaiser Permanente insurance coverage.

In addition, those who have Medicare or Medicaid, with or without Kaiser Permanente coverage, generally have access to hospice cover. This type of coverage often includes senior centers offering hospice care, 24-hour locations, specialized hospice centers, as well as in-hospital care for hospice needs. In order to access this type of care, a medical doctor overseeing the care of the patient must make the decision that hospice is necessary. This will be necessary to obtain before entering any location for this type of care.

You May Like: What Are The Guidelines For Medicare

Additional Kaiser Medicare Advantage Coverage

Kaiser Medicare Advantage plans include all of the same basic benefits found in Original Medicare . That includes inpatient care administered at hospitals, skilled nursing facilities and other inpatient centers as well as doctors appointments, rehabilitation and outpatient procedures and appointments.

In addition to these basic benefits, Kaiser Medicare Advantage plans may also include prescription drug coverage and coverage for certain over-the-counter health items purchased from pharmacies or other retailers.

Kaiser Permanente Insurance Review: Why Is It Top

Good for

- Those who want top-tier customer service and coverage.

- Those who want access to Kaiser’s medical specialists.

- Healthy people who want strong preventive coverage.

Bad for

- Residents outside of coverage areas.

- Those who want the flexibility to see any doctor.

- Frequent travelers who want routine care anywhere.

You May Like: Can You Get Medicare Advantage Without Part B

Kaiser Permanente Medicare Advantage Plans Reviews And Ratings

Kaiser Permanente isnt just a health insurance company its one of the largest managed care organizations in the United States with its own network of hospitals and medical providers. Your plan premiums directly fund the hospitals and medical offices, so there should be no issues with unexpected bills or denial of coverage for care that you receive within its network.

Trusted ratings and reviews can help you understand how an insurers plans stack up against the competition. See how Medicare, A.M. Best, the Better Business Bureau and more rate Blue Cross Blue Shield Medicare plans.

Kaiser Adult Dental Coverage

| Not Covered | Not Covered |

The companys dental insurance plan is called Teethkeepers, a triple-choice dental program. This type of policy offers dental benefits to consumers on a direct-pay basis. Anyone can enroll in this program. It is not an actual insurance policy but a discount opportunity for those who enroll. It is ideal for seniors who want good benefits at a low cost to get it.

There are three options for consumers to select from through the Teethkeepers plan. They include the following:

Read Also: What Is My Deductible For Medicare

Aged & Disabled Federal Poverty Level Program

If you are aged or disabled and are not eligible for the SSI program, you may be able to get Medi-Cal through the Aged & Disabled Federal Poverty Level program. To qualify, you must:

This Medi-Cal program uses SSI countable income rules as well as a few extra rules you should know. For more information, visit the Medi-Cal section of the Disability Benefits 101 website.

General Coverage And Enrollment

Q: How do I find out about changes in services covered by Medicare?A: Throughout the year, the Centers for Medicare & Medicaid Services sends out updates about additional covered services or changes to existing covered services. These notifications are called National Coverage Determinations . View the .

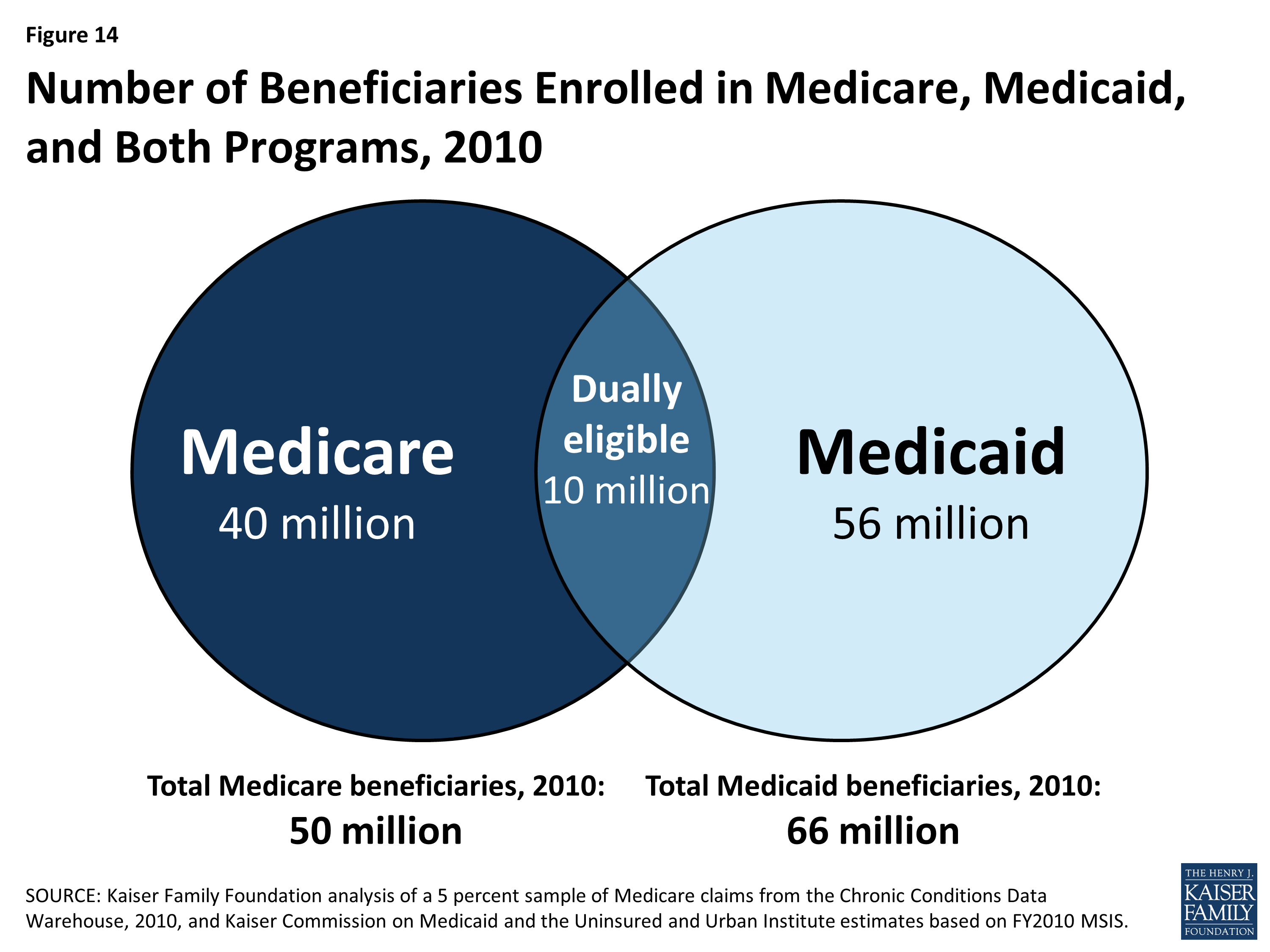

Q: Whats the difference between Medicaid and Medicare? A: Medicare is a federal program that provides health coverage to people age 65 and older, and to people with certain disabilities, such as end-stage renal disease. Medicaid is a public program that provides health coverage to people with low incomes.Q: If I sign up for a Kaiser Permanente Medicare health plan, will I lose my Medicare coverage? A: No. You wont lose Part A and Part B coverage. When you become a member, Kaiser Permanente will provide your Medicare benefits to you. Keep in mind that to sign up for a Kaiser Permanente Medicare health plan, youll need to be enrolled in Medicare Part B. Q: Can I be dropped from a Kaiser Permanente Medicare health plan? A: You can’t be disenrolled because of your health. Your membership can be ended for other reasons, which may include, but are not limited to:

- Failing to pay your Kaiser Permanente premium, if your plan has one

- Living outside a Kaiser Permanente service area for 90 days to 12 months

- Moving permanently out of a Kaiser Permanente service area

- Not staying enrolled in Medicare

Don’t Miss: Is A Sleep Study Covered By Medicare

Can Kaiser See Me Without Insurance

Our Medical Financial Assistance program helps low-income, uninsured, and underserved patients receive access to care. The program provides temporary financial assistance or free care to patients who receive health care services from our providers, regardless of whether they have health coverage or are uninsured.

What Is Medicare Advantage

Medicare Advantage, or Medicare Part C, is an alternative to original Medicare where Medicare contracts with a private insurance company to provide services to Medicare members.

Medicare Advantage plans will provide Medicare Part A and Part B coverage as well as some additional services. These may include prescription drug coverage and vision, hearing, dental, or health and wellness programs.

HMOs and PPOs are two examples of common Medicare Advantage plans. Insurance companies like Kaiser contract with doctors and medical facilities to receive discounts in return for their members choosing their services.

Don’t Miss: What Is The Difference Between Medicare Supplemental And Advantage Plans

How Does The Health Insurance Marketplace Affect Medicare

The health insurance marketplace is a way for people who don’t have health insurance to get coverage. The marketplace is part of the Affordable Care Act. Here are some important things to know:

- If you have Medicare, the insurance marketplace doesn’t affect your coverage.

- It’s illegal for anyone to try to sell you a health insurance plan if they know you have Medicare.

- If you aren’t yet eligible for Medicare, you can seek insurance through the marketplace.

- If you are eligible for Medicare but aren’t yet enrolled, you can get a marketplace plan to cover you before you go on Medicare. Your marketplace plan would stop when Medicare starts. You can’t have Medicare and a marketplace plan at the same time.

What Is A Kaiser Medicare Annual Wellness Visit

While the Medicare annual wellness visit thats covered by Kaiser Medicare plans is similar to a routine physical, its important to note that the annual wellness visit is not the same thing as a general routine physical. Your annual wellness visit does not actually include a physical examination or lab work.

The following services are some of the important health steps you can expect as part of your annual wellness visit covered by a Kaiser Medicare plan.

Recommended Reading: Does Medicare Pay For In Home Hospice Care

Enrolling In Kaiser Medicare Dental Coverage

Follow these steps to apply for a Kaiser Medicare plan that may include dental coverage.

Keep in mind that many Medicare Advantage plans include dental coverage, and many do so for a $0 monthly premium. An agent who is licensed on behalf of multiple insurance carriers can help you review additional dental plan options available in your location.

Do You Have To Pay For Medicare

Part A

- A monthly payment, or premium, is not required for people who are 65 or older and paid Medicare taxes while they were working.

- You don’t pay a premium if you are 65 or older and you get retirement benefits from Social Security or the Railroad Retirement Board. You also don’t pay a premium if:

- You are younger than 65 and have received Social Security or Railroad Retirement Board disability benefits for 24 months.

- You have and need dialysis or a transplant.

Part B

- Most people pay a standard monthly premium and an annual deductible. Above a certain income, you pay more based on the amount of your income.

- Most preventive servicesâsuch as flu shots, mammograms, colorectal screeningsâare free if the provider accepts Medicare.

Part C

These plans have different costs depending on the plan you choose. You may have monthly premiums, as well as deductibles and co-pays.

Part D

You pay a premium for the drug plan, which can vary based on what is covered in the plan.

Don’t Miss: How Do You Apply For Extra Help With Medicare