Enrollments Periods For Medicare Parts C And D

Once a person enrolls in original Medicare, they may add a Part D plan or switch to Part C during the IEP. A person may also do either during the Open Enrollment Period for Medicare Advantage and Medicare prescription drug coverage, which runs from each year.

The best time to enroll in Part D is during the IEP. If someone waits until open enrollment, they may have a penalty in the form of a higher Part D plan premium.

Recommended Reading: How Many Mastectomy Bras Are Covered By Medicare

Unemployed Applicants Should Use State Or Federal Marketplace

An unemployed person can apply for health insurance on the federal or state exchanges. They may find affordable low-premium options based on family income. Should they not find an affordable option, they may qualify for an exemption, Medicaid, or the CHIP.

Many states offer assistance to low-income families to help them qualify for affordable health insurance including payment assistance. If income is below the minimum needed for Obamacare, then applicants can seek coverage under the applicable state Medicaid program or CHIP for minors.

Also Check: How Can I Get Medicaid In Florida

Delaying Medicare Parts A & B

If you qualify to delay both Medicare Parts A & B, you can do so without penalty as long as you enroll within eight months of either losing your employer coverage or ceasing to work, whichever comes first. You will enroll during a Special Enrollment Period and will need to also provide written proof of creditable drug coverage to avoid Part D penalties.

You May Like: When To Apply For Medicare When Turning 65

Does My Wife Get My Social Security When I Die

If My Spouse Dies, Can I Collect Their Social Security Benefits? A surviving spouse can collect 100 percent of the late spouses benefit if the survivor has reached full retirement age, but the amount will be lower if the deceased spouse claimed benefits before he or she reached full retirement age.

Recommended Reading: Can You Have Two Medicare Advantage Plans

Medicaid As Secondary Insurance

Can you use Medicaid as a secondary insurance? If you take your employers insurance or you have private coverage, you might still have trouble paying deductibles and co-pays. But qualified low-income families and individuals might be able to cover co-pays, deductibles, and insurance premiums by using Medicaid as a secondary insurance.

Just keep in mind that Medicaid is always the last resort payer if you have coverage through another agency. Secondary payers usually cover the smaller amount, like coinsurance or co-pay, while primary insurance covers the bigger costs.

You May Like: How Can I Sign Up For Medicare Part B

Medicare And Employer Coverage: Who Pays First

If your employer has fewer than 20 employees, Medicare becomes primary. Thus, your employer coverage pays second when you have both Medicare and coverage through an employer with fewer than 20 employees.

If your employer has more than 20 employees, Medicare will pay secondary to your group coverage. With small group insurance, we highly recommend enrolling in both Medicare Part A and Part B as soon as you are eligible. If you do not enroll in Medicare once you are eligible, your small employer coverage can refuse to pay your claims. In this case, having Medicare and employer coverage is essential. Thus, we recommend enrolling in Medicare Part B to avoid any gaps in coverage.

Additionally, if you do not enroll in Medicare Part B, you will need to pay the late penalty because your group insurance will not be for Medicare.

You Can Receive Medicare Without Taking Your Social Security Benefits

Medicare and Social Security aid older Americans and their spouses who paid into the programs through FICA taxes during their working years.

Medicare provides both free and cost-effective health insurance coverage for eligible older adults who are 65 years of age or older. Social Security retirement benefits act as a small pension, providing monthly income to those eligible as early as age 62.

Even if you are eligible to start receiving benefits, you do not have to start taking them. In some cases, it may be better to delay or to start taking benefits from one program but not the other.

You May Like: How Much Does Medicare Part B Cost For A Couple

When Older People Are Eligible For Medicare

Older people can qualify for traditional Medicare coverage as early as age 65. You must also:

- Be a U.S. citizen or permanent legal resident

- Meet the work credit requirement

You might also be eligible for Medicare if you are under age 65 and meet one of the following conditions:

- You have a disability.

- You have End-Stage Renal Disease, a permanent kidney failure that requires dialysis or a transplant.

- You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months.

- You have Lou Gehrigs disease.

Once you qualify for Medicare, you are automatically enrolled in Medicare Part A. You can then choose to enroll in other parts of the program or to delay enrollment.

If you are over 65 and do not meet any of the above criteria, you still may be eligible to purchase coverage through Medicare Part A. If you are unsure whether you are eligible, you can check using the Medicare Eligibility & Premium Calculator.

The work credit requirement is an algorithm used to determine how long a worker paid into the system.

You May Like: Is Upmc For You Medicare Or Medicaid

How Can I Get More Free Covid

Along with the four free tests from the Postal Service, you have a few options for finding similar at-home tests for free. First and foremost, if you have private health insurance, you can get another eight free tests per person per month. That means a family of four gets 32 free tests monthly.

In January, the Biden administration declared that health insurance companies would be required to cover at-home tests. Participants can either receive their eight free tests a month from provider-based pharmacies or be reimbursed by their provider for up to $12 for each test they purchase.

Major pharmacy chains originally required customers with insurance to pay for tests upfront and get reimbursed, but some have now shifted to a model where most customers with insurance cards can get eight tests per month at no cost. Both Walgreens and CVS allow customers with insurance cards to order COVID-19 tests for free on their websites.

At-home COVID-19 tests are also eligible expenses for flexible spending accounts and health savings accounts.

Medicare was not initially included in the plan to distribute free COVID-19 tests, but in April the Centers for Medicare & Medicaid Services announced that participants with Plan B or those enrolled in Medicare Advantage plans are also eligible to receive eight free tests a month.

It’s still possible to get free COVID-19 test kits through health insurance, Medicare or local health clinics.

You May Like: What Medications Does Medicare Part B Cover

Employer Coverage And Medicare Part D

If your employer group insurance includes creditable prescription drug coverage, you can delay Medicare Part D enrollment with no penalty. In this way, it is similar to Medicare Part B.

Having Medicare with this coverage may not be helpful when you have prescription drug benefits through your employer, as the coverages will not work together. Always compare your group insurance to the benefits and cost of Original Medicare + a Medicare Supplement plan + Medicare Part D. Often, it is more cost-efficient and beneficial to leave group insurance and enroll in Medicare, adding a Medicare Supplement plan and a Medicare Part D plan.

Do I Need To Notify Anyone If Im Delaying Medicare

You don’t need to provide notice that you’d like to delay enrolling unless you’re receiving Social Security or Railroad Retirement Board benefits. If you are receiving either, you’ll be automatically enrolled in Medicare Parts A & B when you turn 65, and you’ll need to let Social Security know you wish to delay Part B. By law though, if you receive Social Security benefits and are eligible for Medicare, you must also have Medicare Part A.

Read Also: Is Mutual Of Omaha A Good Company For Medicare Supplement

Can You Take Employer Coverage Again When On Medicare

If you return to work for an employer who offers health insurance, you can take it. You are allowed to have both Medicare and employer coverage, and you can use them together. One will act as primary coverage and one will act as secondary.

The only thing to keep in mind is that when you have Medicare and an employer plan, you cannot contribute to a health savings account if its offered.

What Are My Insurance Options If I Cannot Get Medicare At Age 62

If you dont qualify for Medicare, you may be able to get health insurance coverage through other options:

- Employer-provided insurance

LeRon Moore has guided Medicare beneficiaries and their families as a Medicare professional since 2007. First as a Medicare provider enrollment specialist and now a Medicare account executive, Moore works directly with Medicare beneficiaries to ensure they understand Medicare and Medicare Advantage Plans.

Moore holds a bachelors degree from Southern New Hampshire University and is A+ Certified with a Medical Records Clerk Certification and Medical Terminology Certification from Midlands Technical College.

Hes passionate about educating, informing, and resolving issues concerning Medicare and Medicare Advantage Plans, and considers it imperative that he does all he can to educate and inform the senior community as much as possible about Medicare.

You May Like: What Is A Medicare Ppo Plan

Can I Delay Medicare Part B After I Retire

Once you retire, employer coverage is no longer creditable for Medicare. Suppose your employer allows you to remain on group benefits through a retiree program. In this case enrolling in Medicare Part B will avoid the late enrollment penalty.

Once you retire and choose to keep Medicare and employer coverage, Medicare Part B will become primary. Thus, your employer coverage will be secondary. Once retired, many seniors find it more suitable to drop employer coverage and enroll in a Medicare Supplement plan.

Medicaid Disability Benefits Rules

Your ability to qualify for Medicaid is going to vary depending upon which program you are receiving disability benefits through. Many people obtain disability benefits from the Social Security Administration , while some people receive disability income through workers compensation or through a private disability insurer.

If you are receiving disability benefits through workers compensation for a work injury, your workers comp benefits should cover your medical care for all health issues arising from your work injury. With coverage through workers comp for medical care, you may not need Medicaid. If you still want or need Medicaid coverage to supplement the care that workers comp is paying for, your ability to qualify will depend upon your income and resources.

If you are receiving disability benefits through private insurance, your income will also be determinative regarding whether you are eligible for Medicaid. The amount of countable assets you own is going to matter as well. Medicaid is a needs-based program and people with too many resources or with high incomes cannot get benefits coverage.

Also Check: What Is The 1 800 Number For Medicaid

Don’t Miss: Does Medicare Change From State To State

Do I Need To Enroll At 65 If I Work For A Small Company

The laws that prohibit large companies from requiring Medicare-eligible employees to drop the employer plan and sign up for Medicare do not apply to companies with fewer than 20 people. In this situation, the employer decides.

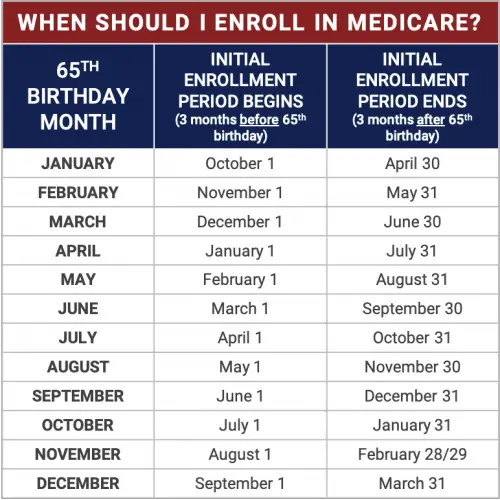

You generally need to sign up for Medicare Parts A and B during your initial enrollment period, which begins three months before and ends the three months after the month you turn 65. If you dont, you could end up with large coverage gaps.

If the employer does require you to enroll in Medicare, which is most common, Medicare automatically becomes your primary coverage at 65 and the employer plan provides secondary coverage. In other words, Medicare settles your medical bills first, and the group plan pays only for services it covers but Medicare doesnt.

So if you fail to sign up for Medicare when required, you essentially will be left with no coverage.

Extremely important: Ask the employer whether you are required to sign up for Medicare when you turn 65 or are eligible to receive Medicare earlier because of a disability. If so, find out exactly how the employer plan will fit in with Medicare. If youre not required to sign up for Medicare, ask the employer to provide the decision in writing.

When Medicare is primary coverage and the employer plan is secondary, you have the right to buy Medigap later with full federal protections. But you must do so within 63 days of the employer coverage ending.

Do I Lose Medicare If I Get A Job

If you’re going back to work and can get employer health coverage that is considered acceptable as primary coverage, you are allowed to drop Medicare and re-enroll again without penalties. If you drop Medicare and don’t have creditable employer coverage, you’ll face penalties when getting Medicare back.

Also Check: What Is The Maximum Out Of Pocket For Medicare

When Can You Actually Lose Your Medicare Coverage

There are two main times that you can straightforwardly lose Medicare coverage. The first is if you have Medicare as the result of a disability and you are no longer medically disabled. Medicare disability coverage is restricted to those who are currently dealing with a disability. This is a rare situation, since most disabilities that qualify dont simply go away.

If you are under 65 and have a disability, and also qualify for Medicare and then return to work, you will be able to keep your coverage without paying premiums for Part A for 8 and a half years. After that, you can still keep your coverage, but will have to pay a premium. This situation can get a bit more complex, and the full details are available from Medicare.gov.

Second, you can lose Medicare coverage if you enroll in a health savings account. Well discuss this in more detail below.

Read Also: How To Calculate Medicare Wages

Can You Get Medicare If You Are Still Working

- Your current employment status is not a factor in whether or not youre eligible for Medicare at age 65.

- If you initially decline Medicare coverage, you may have to pay a penalty if you decide to enroll at a later date.

You can get Medicare if youre still working and meet the Medicare eligibility requirements.

You become eligible for Medicare once you turn 65 years old if youre a U.S. citizen or have been a permanent resident for the past 5 years. You can also enroll in Medicare even if youre covered by an employer medical plan.

Read on to learn more about what to do if youre eligible for Medicare and are still employed.

Don’t Miss: Does Medicare Pay For Lift Chairs For The Elderly

Enrolling In Medicare When Working Past 65

Even if you plan to keep working, you still have a 7-month Initial Enrollment Period when you turn 65. Moreover, if an employer has fewer than 20 employees or your spouse’s employer requires you to get Medicare to remain on their plan as a dependent, you will need to enroll during your IEP to avoid late enrollment penalties.

Hey Alan I Need Medicare But I Dont Know If Im Ready To Retire Yet Can I Work Full

This is a question that I dont hear too often. But in my opinion, its a question that should get asked a lot more! This is one of those questions that all of the confident planners of the world should be asking themselves before they make a major financial and/or insurance decision. So if youre asking yourself, can I work full-time while on Medicare, then congratulations! Youre already on your way to making fantastic decisions for your financial future. And if you werent asking yourself this question and you just so happened to stumble upon this blog post, then congratulations! Youve stumbled upon a valuable resource that will help you make financial decisions for your financial future!

So, lets dive right in. First, well go over the basics of Medicare. Then, well address the question, can I work full-time while on Medicare as well as other frequently asked questions. And to wrap it all up, well talk about some of the best options available to you and how you can learn more about Medicare and start comparing Medicare quotes for free.

Yup! Free. Exciting, right?

But more on that in a minute. First, lets go over the basics:

Recommended Reading: What Are Medicare Requirements For Bariatric Surgery

Signing Up For Medicare Part D At 65 If Youre Still Working

To make sure you have prescription medication coverage, you need either from work, Medicare Part D, or a Medicare Advantage plan with drug coverage. Your employer can tell you if your workplace coverage is creditable, meaning its as good as or better than Part D.

Once you , you could lose your workplace prescription coverage, and you may not be able to get it back.

If you dont have either and you dont enroll in Part D on time, youll pay higher Part D premiums.

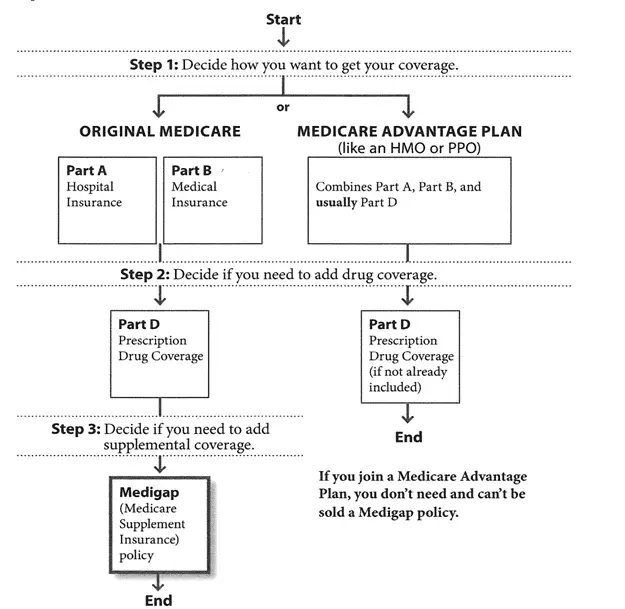

How Does Medicare Work

If youve been following this blog for a while now, then youre practically an expert in Medicare. Weve gone over the basics of Medicare. Weve talked about the various Parts of Medicare plans. Weve even talked about whether or not you should change your current Medicare plan!

So whether youre a Medicare expert or one of our wonderful new-comers, heres a brief breakdown of Medicare for you:

Medicare is a national health insurance program in the U.S. To qualify for Medicares health insurance coverage, you must be 65 or older. Some younger folk can also qualify for Medicare if they have been diagnosed with certain disabilities or an End-Stage-Renal Disease. Medicare plans are broken down into various Parts, each with their own requirements and coverage options. For more information on the various Medicare Parts, check out this post.

Read Also: Does Medicare Cover Alcohol Rehab