I Didnt Sign Up For Part B When I First Became Eligible But Want To Sign Up Now I Know There Is A Penalty For Late Enrollment Is There Any Way To Avoid The Penalty

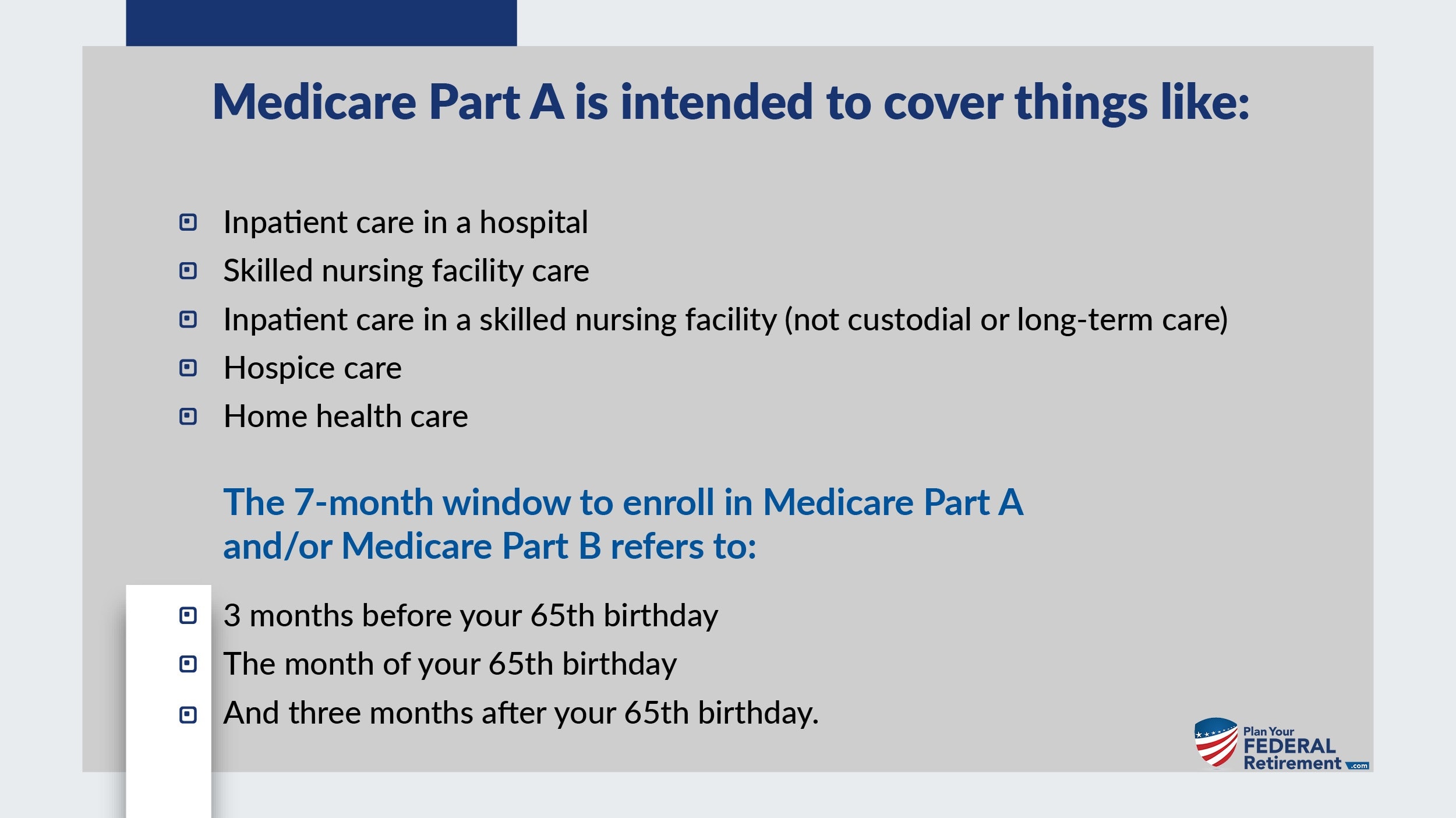

Generally, no. In most cases, if you missed your Part B enrollment window, which runs from the three months before the month of your 65th birthday through the three months after the month of your 65th birthday, you will face a late enrollment penalty once you do enroll, which will be added to your premium costs for the remainder of your enrollment. The penalty equals 10% of the standard monthly premium for each 12-month period that you delayed enrollment.

If you did not enroll for Part B during your initial enrollment period, you may qualify for a Special Enrollment Period to sign up for Part B anytime as long as you or a spouse is working and youre covered by a group health plan through that employment. For people age 65 or over who have coverage through a group health plan, there is also an 8-month SEP which starts the month after the employment ends or the group health plan coverage ends. If you sign up during an SEP, the late enrollment penalty will not apply.

Will Medicare Mail Me An Enrollment Letter

We talk to people often that are worried because they neverreceived a letter from the government tipping them off to .

I hate to be the bearer of bad news, but there is no suchletter.

Many people know there are penalties for not signing up forMedicare, but for many reasons, they do not know when they need to sign up.

Medicare gives five scenarios to help people understand whether they will be automatically enrolled in Medicare or if they need to take the task upon themselves:

When Do I Get My Medicare Card

In most circumstances, youll get a Medicare I.D. card several weeks after your initial application. However, waiting times can be up to 90 days. If you are automatically enrolled in Medicare because you already get Social Security benefits, you will receive your I.D. card two months before turning 65.

Don’t Miss: Can I Buy Into Medicare

How To Apply For Medicare Part B

If youâre nearing 65 and youâre not receiving Social Security or Railroad Retirement Board benefits, youâll want to apply for Part B as soon as you can. Similar to Part A, you can apply doing any of the following:

- Go to your local Social Security office

- Sign up online at ssa.gov

If you already receive Social Security or RRB benefits, you donât need to do anything. Youâll receive a Medicare red-white-and-blue card about three months before your 65th birthday. If disabled, youâll receive your card during your 25th month of disability. Even if you dont want Part B, you can follow the instructions on that same card and return it.

Dont Register For Medicare Alone

If youre uncomfortable with applying for Medicare alone, we can help! Our services are completely free for you. If you would like an agent by your side when applying, contact us. We can walk you through setting up all your coverage, including Medicare, Medigap, Part D, and more.

Plus, when you use us to apply, you get unlimited support from our Client Service Team. That means if you have any issues with claims or appeals, we can help at no additional cost. You can compare rates online or give us a call today at the number above.

- Was this article helpful ?

Also Check: Does Medicare Pay For Bunion Surgery

Don’t Miss: Is Obamacare Medicaid Or Medicare

Is There Any Way To Get Out Of Late Enrollment Penalties

There are two possible scenarios:

1) If you receive bad advice from a federal employee about Medicare enrollment.

You can request equitable relief from the Social Security Administration if you are charged late enrollment penalties for failing to enroll in Medicare due to erroneous advice you received from a federal employee. To do this, you should write a letter to your local Social Security office. Be sure to include as many specific details as you can, such as who you spoke to, the date and time of your conversation, any notes you took, and the actions you took as a result of the advice you received.

2) If you had creditable coverage, but your Medicare plan does not have a record of it.

If you receive notice from your Medicare drug plan or Medicare Advantage plan that you owe late enrollment penalties, you can request a review by completing the reconsideration request form you get with the notice. You can include whatever proof necessary to make your case, such as information you have about previous creditable drug coverage.

If you lose creditable coverage through an employer or through another source, your Medicare carrier will reach out to verify your prior qualifying coverage. Be sure to respond to any correspondence about verifying creditable coverage. Without a response, a penalty will be assessed and it can be difficult to appeal the decision.

Applying For Medicare Online

Applying for Medicare online is a quick and easy process on the Social Security website, taking approximately ten minutes. After you have applied for Medicare online, you can check the status of your application and/or appeal, request a replacement card, and print a benefit verification letter.

You can easily apply online for Medicare and Social Security retirement benefits or just Medicare.

Once you apply for Part B, give us a call so we can help you choose a supplement plan to cover what Medicare doesnt.

If youre not comfortable applying for Medicare online, you can do so over the phone.

You May Like: Who Qualifies For Medicare Part C

Enrolling In Medicare Part D

Medicare Part D covers prescription drugs. You can add a stand-alone prescription drug plan to augment your Medicare A and B, or you can choose a Medicare Advantage plan that provides all of the benefits of Medicare A and B, plus prescription drugs and often other benefits as well.

Youre first eligible to enroll in Part D when youre first eligible for Medicare. When you apply, you will enroll in a private plan and must enroll during a seven-month period that starts three months prior to the month that you reach age 65. If you dont enroll during this period, you may pay a late-enrollment penalty that will raise your Part D premium when you do decide to purchase coverage .

If youre Medicare-eligible because youre disabled AND youve reached age 65, you can enroll in a Part D plan, switch Part D plans, or drop your Part D plan during this seven-month period.

If youre newly eligible because youre disabled, you can enroll starting 21 months after you began receiving RRB or Social Security benefits and have through the 28th month to enroll . Your Part D coverage will start at the beginning of your 25th month of receiving RRB or Social Security benefits.

And if, later on, you want to change to a different Part D plan, you can do that during Medicares Open Enrollment period that runs from October 15 to December 7 each year.

After youve chosen from the various PDP offerings, you can enroll by:

- filling out the paperwork sent by mail from Medicare, or

Reasons To Delay Medicare

If youre thinking about deferring Medicare, discuss the pros and cons with your current insurer, union representative, or employer. Its important to know how or if your current plan will work with Medicare, so you can choose the most comprehensive overage possible.

Some of the common reasons you may want to consider deferring Medicare include:

- You have a plan through an employer that you want to keep.

Also Check: Do I Qualify For Medicare If I Am Disabled

B Late Enrollment Penalty

If you didn’t get Part B when you’re first eligible, your monthly premium may go up 10% for each 12-month period you could’ve had Part B, but didn’t sign up. In most cases, you’ll have to pay this penalty each time you pay your premiums, for as long as you have Part B. And, the penalty increases the longer you go without Part B coverage.

If you have limited income and resources, your state may help you pay for Part A, and/or Part B. You may also qualify for Extra Help to pay for your Medicare prescription drug coverage.

Sign Up For Medicare Part B Online

For many people, signing up for Medicare Part B doesnt require you to leave the comfort of home. Please visit our Medicare Part B webpage at if:

- Youre enrolled in Medicare Part A.

- You would like to enroll in Part B during the Special Enrollment Period.

You can complete form CMS-40B at www.cms.gov/Medicare/CMS-Forms/CMS-Forms/CMS-Forms-Items/CMS017339 and CMS-L564 at online.

You can also fax the CMS-40B and CMS-L564 to 1-833-914-2016 or return forms by mail to your local Social Security office. Please contact Social Security at 1-800-772-1213 if you have any questions.

Note: When completing the forms:

- State, I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If your employer is unable to complete Section B, please complete that portion as best you can on behalf of your employer without your employers signature.

- Submit one of the following types of secondary evidence by uploading it from a saved document on your computer:

- Income tax returns that show health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Please let your friends and loved ones know about this online, mail, or fax option.

Don’t Miss: Does Medicare Cover Ct Scans

Applying For Medicare With Employer Coverage

Can you still enroll in Medicare coverage, even if youre not yet seeking retirement? The answer is yes! Medicare coverage can coincide with your group coverage through your employer. If your employer has more than 20 employees, your group coverage will work as your primary insurance, and Medicare will be your secondary insurance.

You can choose to apply for Part B, or you can wait until leaving your employer group coverage. For more information on the benefits of obtaining Medicare while receiving group coverage through work, give our team a call, and we can review the pros and cons.

Sometimes beneficiaries dont want to apply for Part B when they initially become eligible because of employer health coverage. Should you lose your health insurance through your employer, or if you prefer to switch over to Medicare, you can apply any time while receiving coverage through your employer.

Medicare Initial Enrollment Period

Your first chance to enroll in Medicare is around age 65 when you have a seven-month window to apply. During the Medicare Initial Enrollment Period, you can enroll in Original Medicare Parts A and B. You can look at plans or sign up at any time during the three months before, the month of, and the three months after your 65th birthday. Need coverage the month you turn 65? Sign up in the three-month window before your birthday.

Take a deeper dive in our related article about all-things Medicare Initial Enrollment Period.

Don’t Miss: How Do I Know If I Have Part D Medicare

What Is The Penalty For Not Taking Medicare Part B

waited before signing upHere are some examples of the way the penalty works:

- Suppose your IEP ended on November 30, but you waited and signed up on January 25th, during the next General Enrollment Period. Because you didnt let a full 12-month period go by, you will not pay a penalty.

- Suppose your IEP ended on December 30, 2013, but you did not sign up for Part B until March 31, 2017. You waited 40 months, or 3 years and 5 months, to enroll. This counts as three full 12-month periods, and you will pay a 30 percent penalty every month.

How Does Medicare Work With My Job

Once you stop working, Medicare will pay first and any retiree coverage or supplemental coverage that works with Medicare will pay second.

You may be able to get COBRA coverage to continue your health insurance through the employers plan .

Dont wait until your COBRA coverage ends to sign up for Part B Getting COBRA doesnt extend your limited time to sign up for Medicare.

|

If you get COBRA: |

This happens: |

|---|---|

|

Before you sign up for Medicare |

Your COBRA coverage will probably end when you sign up for Medicare. |

|

After you sign up for Medicare |

COBRA pays after Medicare . |

Recommended Reading: Where Can I Sign Up For Medicare

Medicare Faqs And Information To Consider

Automatic Enrollment:

If you are already receiving Social Security benefits, Railroad Retirement benefits, or Federal Retiree benefits, your enrollment in Medicare is automatic. Your Medicare card should arrive in the mail shortly before your 65th birthday. Check the card when you receive it to verify that you are entitled to both Medicare Parts A and B.

Initial Enrollment Period:

If you are not eligible for Automatic Enrollment, contact the Social Security Administration at 800-772-1213 or enroll online at www.socialsecurity.gov, or visit the nearest Social Security office to enroll in Medicare Part A and Medicare Part B. You have a seven month window in which to enroll in Medicare without incurring a penalty. If youre not automatically enrolled in premium-free Part A, you can sign up for it once your Initial Enrollment Period starts. Your Part A coverage will start six months back from the date you apply for Medicare, but no earlier than the first month you were eligible for Medicare. However, you can only sign up for Part B during the times listed below.

General Enrollment Period:

- General Enrollment Period for Medicare Parts A & B

If you have coverage through a current employer, you are not required to enroll in Medicare Part A and B. Below are some things to keep in mind about each part of Medicare.

Recommended Reading: Which Of The Following Is True Regarding Medicare Supplement Policies

How To Enroll In The Various Medicare Plans

There are three types of Medicare plans that all have different ways of signing up. Each of these plans also has different enrollment periods. Delaying your Medicare Enrollment could result in various penalties and fees. Its helpful to set reminders for these important dates, especially when signing up for Medicare for the first time.

| Plan | |||

|---|---|---|---|

| Original Medicare |

|

Automatic or three months before the month you turn 65 and extends three months after. | 10 percent of the monthly premium |

| Medicare Advantage Plans |

|

None | |

|

|

Six months after the month youre 65 and enrolled in Medicare Part B. | None | |

|

|

It depends on how long you went without Part D |

Read Also: Can I Use Medicare For Dental

Medicare Part B Special Circumstances

Some people dont need Medicare Part B coverage right away, because they have medical insurance through their employers or meet other special conditions. And some people choose not to enroll in Medicare Part B, because they dont want to pay for medical coverage they feel they dont need. There are a variety of reasons why you might hesitate to pay for medical insurance. Likewise, you may be concerned about how the new healthcare laws affect Medicare Part B coverage. In this section, well discuss a few reasons to hold off on Medicare Part B, as well as how Obamacare affects Medicare Part B coverage.

For starters, people who are still working when they qualify for Medicare may not need to get Part B coverage right away. If you have insurance through your employer, then you most likely already have medical coverage. However, you should still meet with your plan administrator to find out how your current insurance works with Medicare, because some policies change once youre eligible for Medicare. Other special situations include the following:

Once you stop working or lose your work-based coverage, you have an eight-month period to enroll in Medicare Part B. If you dont enroll during this time, you may have to pay the late enrollment penalty every month that you have Part B coverage sometimes indefinitely. Also, you may face a serious coverage gap if you wait to enroll.