Premium Additions For Higher Incomes

Medicare Part D charges higher premiums for people with higher reported income. This means youll pay any premium that is mandated by your selected plan in addition to a flat fee based on your reported income.

Like Part B, the income used to determine your extra premium payment is based on the income you reported on your IRS tax return from two years prior. The table below breaks down what a 2021 Medicare Part D enrollee would have pay for a premium.1

| 2019 Reported Income | 2021 Medicare Part D premium cost |

| $88,000 or less | |

| Plan premium + $77.10 |

Does My Health Play Any Role In My Costs

No. If youre enrolled in Original Medicare , your health wont play a role in how much you pay for your Medicare coverage. Part A is determined by how long you paid Medicare taxes. For Part B, all enrollees pay the same deductible while premiums are calculated using income and whether you signed up on time.

What Doesnt Medicare Part B Cover

Medicare Part B doesnt cover every possible medical expense. Heres a partial list of what Part B doesnt generally cover.

- Hospital inpatient care, such as a semi-private room, meals, and more. These are usually covered under Medicare Part A. Doctor visits in the hospital may still be covered under Part B.

- Some tests and services that your doctor might order or recommend for you. If your doctor wants you to have lab tests, or any services beyond your standard annual wellness visit, you might want to ask whether Medicare covers them. Medicare Part B might cover some of these services.

- Routine dental care

- Routine vision care

- Most prescription drugs you take at home. Medicare Part B may cover certain medications administered to you in an outpatient setting.

- Hearing aids

- 24-hour home health care

- Long-term care, such as you might get in a nursing home. If the only care you need is custodial, meaning help with tasks such as bathing and dressing, Medicare doesnt generally cover it.

Some of these services, such as routine dental and vision care, might be covered under a Medicare Advantage plan.

Read Also: What Is The Coinsurance For Medicare Part B

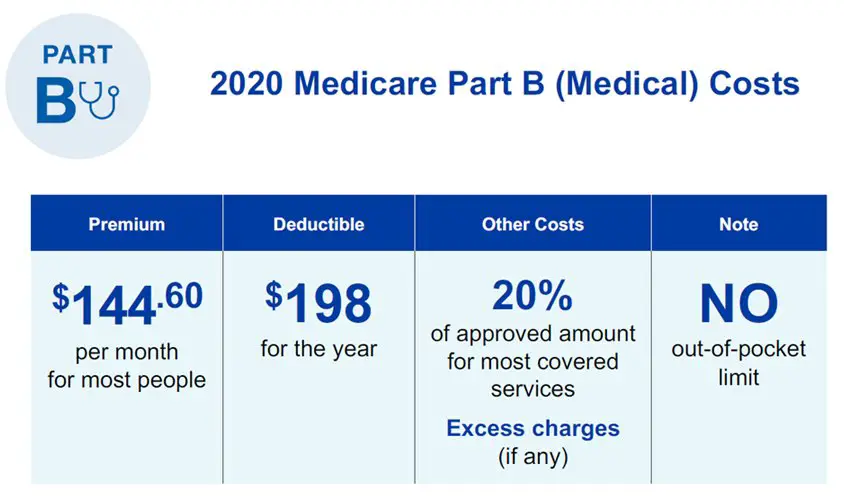

Premium Deductible And Coinsurance

Medicare Part B costs will vary depending on a persons income.

Medicare Part B is the portion of Medicare that covers medical appointments, such as doctors visits, and some medical equipment. Unlike Medicare Part A, Part B has a monthly premium regardless of a persons work history.

This article will cover Medicare Part B-related costs, including how Medicare adjusts the monthly premium based on a persons income.

A person can enroll in Medicare Part B when they qualify for Medicare. Qualification is usually when a person reaches 65 years of age.

Enrollment is usually automatic if a person receives retirement benefits from the Social Security Administration or the Railroad Retirement Board. Before a persons 65th birthday, Medicare will send them a membership card and details of their plan.

If a person is not currently receiving retirement benefits, they can enroll with Medicare through the Social Security Administration as early as 3 months before they turn 65 years old. Applying as early as possible can ensure that the benefits start on time.

If a person waits and applies 3 months after they turn 65 years old, they may have to pay a penalty in addition to their Medicare Part B premium.

Some people may qualify for Medicare at an earlier age if they meet the following criteria:

- their doctor declares that they have a disability, and they receive Social Security disability benefits

- they have end stage renal disease

- they have amyotrophic lateral sclerosis

You May Like Also

The Medicare Part D Donut Hole Coverage Gap

After 2020, Medicare Part D plans have a shrunken coverage gap, or donut hole, which represents a temporary limit on what the plan will cover for prescription drugs.

You enter the Part D donut hole once you and your plan have spent a combined $4,430 on covered drugs in 2022.

Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $7,050 for the year in 2022.

Once you reach $7,050 in out-of-pocket spending, you are out of the donut hole and enter catastrophic coverage, where you typically only pay a small copayment or coinsurance payment for the rest of the year.

Recommended Reading: What Age Am I Medicare Eligible

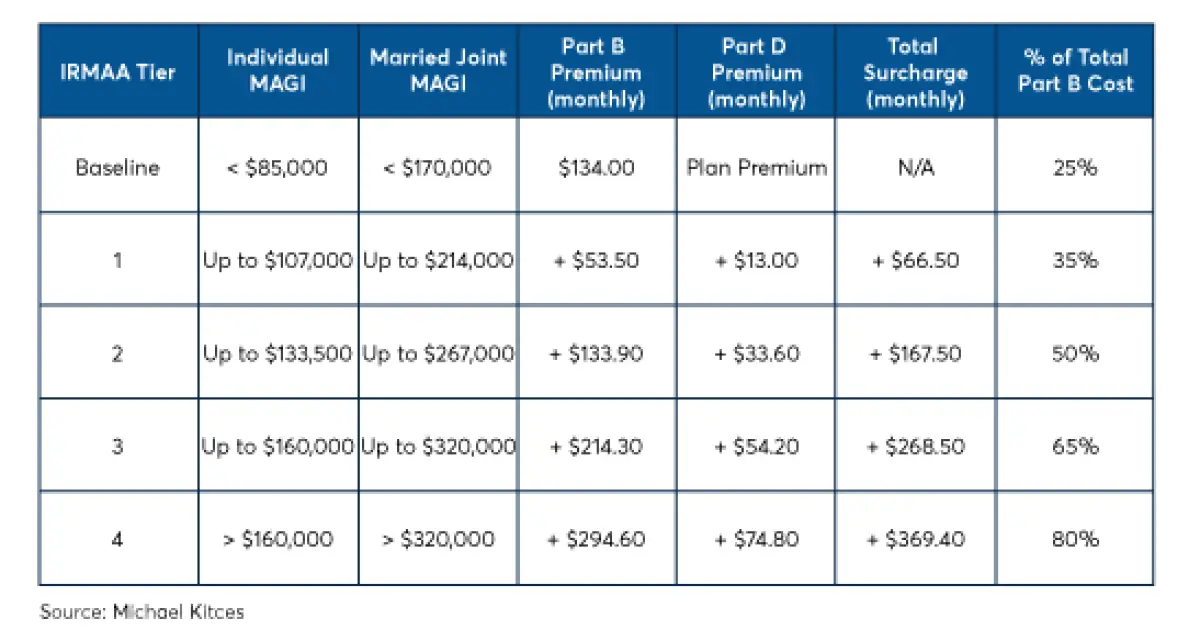

Medicare Part B Premiums For Those Not Held Harmless

As noted earlier, certain individuals receiving Social Security benefits and those not receiving Social Security benefits are not protected under the hold-harmless provision. However, by law, standard Medicare Part B premiums are calculated to cover 25% of the expected costs of Medicare Part B program costs. In years in which a large number of individuals are held harmless and pay reduced premiums, aggregate Part B premiums may not cover 25% of costs unless the entire share of a premium increase is shifted onto those not held harmless. Thus, in certain years, those not held harmless may bear the burden of meeting the 25% requirement disproportionately. For example, in 2010 there was no Social Security COLA and approximately 70% of Medicare Part B enrollees were held harmless from the Medicare Part B premium increase. Those who were held harmless, on average, paid a Medicare Part B premium of $96.40 whereas Medicare Part B beneficiaries not held harmless paid the 2010 standard Medicare Part B premium of $110.50 .65

Low-income beneficiaries who receive premium assistance from Medicare Savings Programs are not held harmless. However, because they do not pay the Medicare Part B premiumâMedicaid will typically pay low-income beneficiaries’ Medicare Part B premiumâthe costs of low-income beneficiaries’ rising Medicare Part B premiums generally would be borne by Medicaid rather than by the beneficiaries themselves.

Most Medicare Advantage Plans Offer Prescription Drug Coverage

Medicare Advantage plans are an alternative to Original Medicare .

Medicare Advantage plans provide all of the same coverage as Medicare Part A and Part B, and many plans include some additional benefits that Original Medicare doesnt cover.

Some of these additional benefits can include things like:

- Routine dental, vision and hearing care

- Membership to health and wellness programs like SilverSneakers

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

You May Like: How Old Before You Qualify For Medicare

Medicare Part D Premiums

Each year, the Medicare Part D base premium is set at 25.5% of the expected per capita costs for standard prescription drug coverage.49 Beneficiary premiums are based on average bids submitted by participating drug plans for basic benefits each year and are adjusted to reflect the difference between the standardized bid amount of the plan the beneficiary enrolls in and the nationwide average bid. The actual cost of coverage and premiums, however, varies by plan. Medicare Part D enrollees may pay premiums to their plans directly or may have premiums automatically deducted from their Social Security benefits.50

In 2018, the Medicare Part D base premium is $35.02.51 However, as noted, actual premiums vary by plan and the average Medicare Part D premium, weighted for enrollment, is $41.00.52

What Is Part A Coinsurance

Medicare refers to the payments that you make when you see a doctor, stay in a skilled nursing facility, or have an extended hospital stay as coinsurance, although theyre fixed amounts rather than a percentage of costs. For the 61st to 90th day of inpatient hospital treatment with Medicare, you must pay coinsurance of $389 per day. The next 60 days are part of your lifetime reserve benefit, and youll owe $778 per day, up to 60 days over your lifetime.3

Youll also have to pay coinsurance for skilled nursing care for days 21 through 100 at a rate of $194.50 per day.4

Recommended Reading: Is Omnipod Covered By Medicare

What Is The Part A Late Payment Penalty

If you have to pay Medicare Part A premiums but dont enroll at age 65, your monthly premiums may cost 10% more. And you may be required to pay those higher premiums for twice the number of years you didnt sign up.5

A Word of Advice

While calculating the costs of Medicare can feel overwhelming, figuring out the cost of each part can help you devise a good estimate of your total Medicare costs.

When Can I Enroll In Plan A And Plan B

Your first chance to sign up for Original Medicare is during your Initial Enrollment Period The Initial Enrollment Period is the seven-month period around your 65th birthday when most people are eligible for the first time to enroll in Medicare.. To figure out your IEP, follow the seven-month rule your enrollment window includes the three full calendar months before the month you turn 65. It remains open during your birth month, and the three months after. For example: If your birthday is in June, your seven-month window will open Mar. 1 and close Sept. 30.

3 months before your 65th birthday: May, April, Mar.Your birth month: 3 months after you turn 65: July, Aug., Sept.

If you missed your IEP, there are other enrollment periods available. You may be eligible for a Special Enrollment Period due to a Qualifying Life Event Qualifying Life Events are life changes that allow you to enroll in a new health insurance plan during a Special Enrollment Period. These include having or adopting a child, losing other coverage, marriage, a change of income and moving.. There is also a designated time to change your Medicare plan. Learn all about Medicares different enrollment periodsand how GoHealth can help you.

Recommended Reading: What Is Aarp Medicare Supplement

Medicare Deductible: Part B

The annual Medicare Part B deductible 2022 is $233. This amount represents an increase of $30 over the 2021 Part B deductible, which was $203.

If you have Original Medicare, you will usually pay 20% of the Medicare-approved costs for healthcare after your deductible has been met.

Unlike Medicare Part A, the Part B deductible is only required once per calendar year. The Part B annual deductible resets every January.

Any covered outpatient expenses you have will go towards meeting your Part B deductible. These include the costs associated with doctors visits, laboratory tests and everything else that Part B covers.

What wont go towards your deductible is the cost of your monthly Part B premiums. In 2022, most people pay $170.10 a month for Medicare Part B.

The Part B premium also applies if you switch to a Medicare Advantage plan.

Medicare Part A Premiums

Medicare calculates Part A premium costs by how long you or your spouse have paid Medicare taxes.

Here is an explanation of monthly premiums for Plan A in 2021:

If you or your spouse paid Medicare taxes for ten years or more

$259/mo.

If you or your spouse paid Medicare taxes for more than 7.5 years but less than 10

If you paid Medicare taxes for fewer than 7.5 years

Don’t Miss: When Will I Get Medicare

Why Are They Pushing Medicare Advantage Plans

The Centers for Medicare & Medicaid Services is the principal source of funding for Advantage plans, paying insurance companies for each beneficiarys expected healthcare costs. Thus, the more people who enroll in Advantage plans, the more funds Medicare gives insurance companies offering these plans.

Medicare Part B Deductible

Part B beneficiaries must pay the first $233 of covered Part B services out of their own pocket before their Part B coverage kicks in in 2022. This is considered the Part B deductible.

The Part B deductible is annual, meaning it resets with each calendar year.

Example: The first time you receive services or items that are covered by Part B during the year, you are billed for $300. You must pay the first $233 of that bill out of your own pocket. Your Part B coverage is then applied to the remaining $67 of the bill.

You have now met your deductible for the year. You will not have to pay anything more towards your Part B deductible until the following year when the deductible resets.

Read Also: Does Medicare Cover Oral Surgery Biopsy

Enrolling In Medicare Part B

Some people are automatically enrolled in Part A and Part B. These people include:

- those who are going to turn 65 and are already receiving Social Security or RRB retirement benefits

- people who have a disability and have been receiving disability benefits from Social Security or the RRB for 24 months

Some people will have to sign up with the SSA to enroll in parts A and B. These people include those not already collecting Social Security or RRB retirement benefits at age 65 or those with ESRD or ALS.

For people who are automatically enrolled, Part B coverage is voluntary. That means that you can choose not to have it. Some people may wish to delay enrollment in Part B because they already have health coverage. Whether or not you choose to delay enrolling in Part B can depend on the specific health insurance plan that you have.

What Is The Average Cost Of Medicare Part D Prescription Drug Plans

In 2022, the average monthly premium for a Medicare Part D plan is $47.59 per month.1

Medicare Part D plan provide coverage solely for prescription medications. Part D plan costs may vary based on your plan and your location.

Learn about the average cost of Part D plans in your state.

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.2

Depending on your income, you may be required to pay a higher Part D premium. As with Medicare Part B premiums, this adjusted amount is called the IRMAA .

If you are required to pay a higher Part D premium, it will be based on your reported income from two years ago .

Medicare Part D IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$77.90 + your plan premium |

Also Check: What Does Regular Medicare Cover

What Is Medicare Part C

Part C, or Medicare Advantage, is an alternative to original Medicare and is offered by private insurance companies.

A person enrolled in Part A and Part B can join a Medicare Advantage plan. In addition to hospital and medical coverage, most Advantage plans also cover:

- prescription drugs

- dental, vision, and hearing care

- additional perks, such as gym memberships

Medicare Advantage offers different benefits through several plan options, which a person can choose from to suit their medical situation.

Medicare Part B Premiums

Some Medicare beneficiaries might pay more or less than the standard Part B premium in 2022 due to a few factors.

- The hold harmless provisionThe hold harmless provision limits the Part B premium for certain beneficiaries. It means that any increase in the Part B premium in one year can be no greater than the increase in a beneficiarys Social Security benefits from the year prior.

- Income-Related Monthly Adjustment Amount The Income-Related Monthly Adjustment Amount is the adjusted amount that higher income earners must pay for their Part B premium.The adjustment is based on your reported income from two years prior, and beneficiaries with higher incomes must pay more for their coverage.

The chart below outlines the 2022 Part B premiums for beneficiaries affected by IRMAA based on their 2020 income.

Medicare Part B IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$578.30 |

Read Also: How Can I Sign Up For Medicare

Offer From The Motley Fool

The $16,728 Social Security bonus most retirees completely overlook: If you’re like most Americans, you’re a few years behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $16,728 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

The Motley Fool has a disclosure policy.

The Motley Fool is a USA TODAY content partner offering financial news, analysis and commentary designed to help people take control of their financial lives. Its content is produced independently of USA TODAY.

Medicare Supplement Insurance :

- Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

- You must keep paying your Part B premium to keep your supplement insurance.

- Helps lower your share of costs for Part A and Part B services in Original Medicare.

- Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

Don’t Miss: Does Medicare Pay For Chair Lifts For Seniors

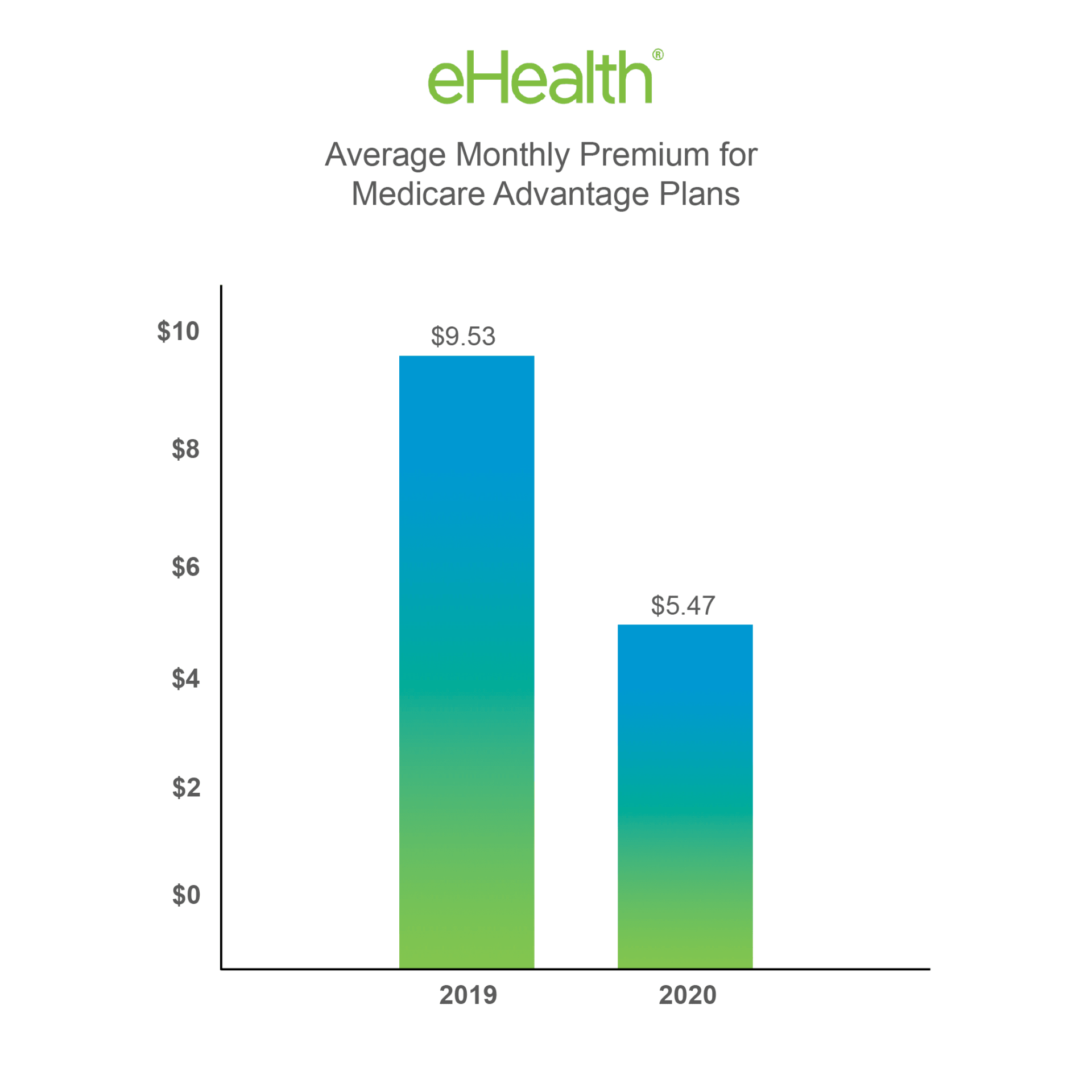

How Much Does Medicare Advantage Cost

Medicare Advantage plans are private, Medicare-approved health insurance plans that provide Part A and Part B coverage, and may also include other types of coverage, such as vision or dental. The costs of these plans varies, depending on the benefits provided. Each plan offers different coverage and associated premiums, deductibles, and copay. Participants must also pay their Part B premium, along with the adjustment for high earners, if applicable.

Average premiums for 2022 are expected to drop to $19 a month.9