Long Stay Travel Insurance For Over 65

US citizens do not need Schengen Visa for visiting Europe for up to 90 days. However if they wish to live, work, study or do business in Europe for a long duration then they need to apply for resident visa or national visa of that European country. One of the necessary documents that they need while applying for long term Europe residence permit is long stay Europe travel insurance with a minimum of 30,000 Euros medical coverage, evacuation and repatriation coverage which must be valid though out the entire duration of stay in Europe.

Does Medicare Cover Dialysis Abroad

No, Medicare cannot be used to get any medical treatment as youre travelling internationally, including dialysis. The only time when Medicare could potentially cover dialysis is if t is an emergency and:

- You are in the US, but the nearest hospital that could offer you dialysis is a foreign hospital or

- You are in Canada, on your way back from Alaska, and the nearest hospital that could offer you dialysis is in Canada

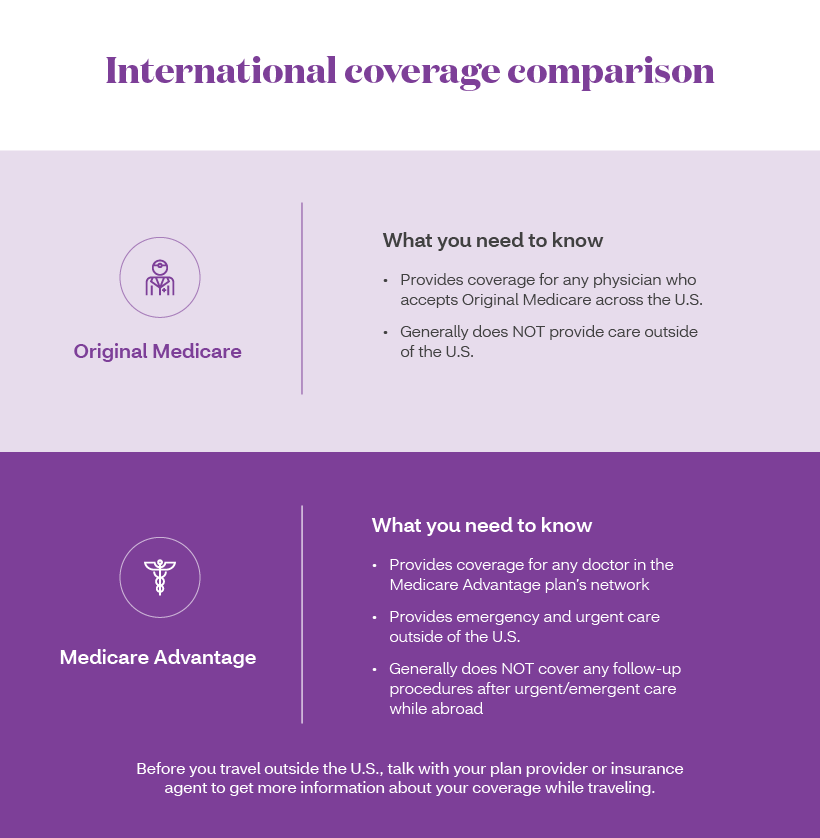

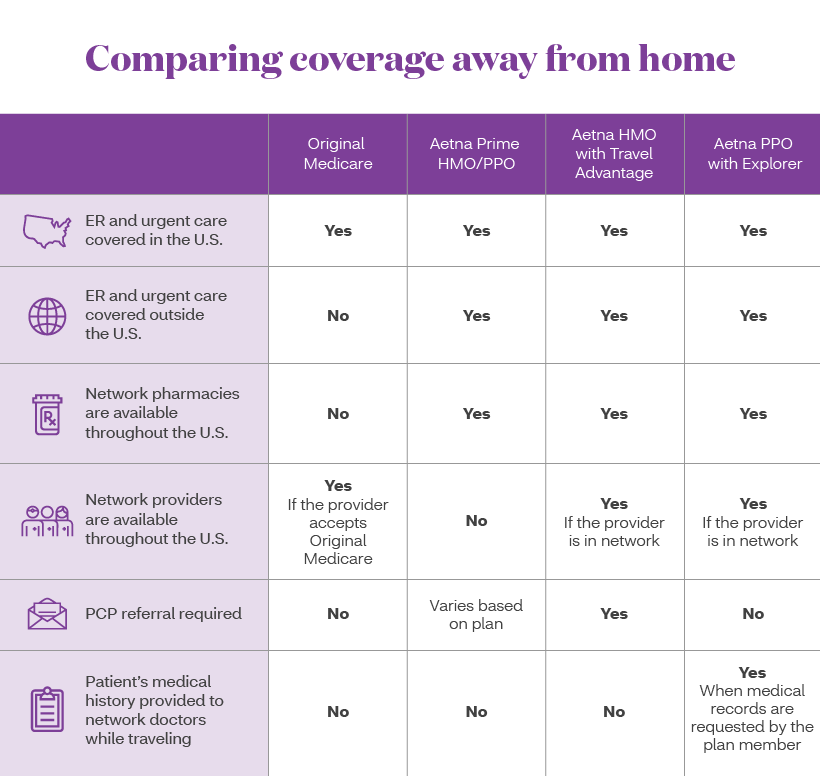

Do Medicare Advantage Plans Work Overseas

Medicare Advantage plans may offer coverage outside the United States. Advantage plan benefits vary by plan and carrier, so you should contact your carrier directly for more information.

Because Medicare offers very little coverage if youretraveling outside of the country, you may want to consider purchasing travelinsurance. Travel insurance can help lower the risk that youll have to payout-of-pocket for services that Medicare wont approve if you get sick and needmedical treatment.

Nothing on this website should ever be used as a substitute for professional medical advice. You should always consult with your medical provider regarding diagnosis or treatment for a health condition, including decisions about the correct medication for your condition, as well as prior to undertaking any specific exercise or dietary routine.

Don’t Miss: Can I Change My Medicare Advantage Plan Now

Look Into Supplemental Travel Insurance

Given all of these restrictions on care, I advise that all international travelers look into purchasing additional insurancebut be sure to do your homework.

Most travel insurance policies have set benefits that can’t be changed. In addition to covering things like non-refundable trip costs and trip cancellations, most will also cover emergency medical expenses. If you want more coverage for medical care, including medical transportation and evacuation, you will have to purchase a more comprehensive policy. Before you sign up, be sure you understand all of the covered risks, exclusions and reimbursement policies. The cheapest policy is often not the best way to go.

Will Medicare Cover Me If I Travel Outside The United States

En español | Unfortunately, no. Medicare doesnt pay for medical services outside the United States or its territories, unless:

- You experience a medical emergency while traveling between Alaska and another state and a Canadian hospital is closest to your location.

- You face a medical emergency while youre in the United States or one of its territories, but the nearest hospital is across the border, for example in Canada or Mexico.

- You live in the United States or one of its territories and need hospital care, regardless of whether its an emergency, but the nearest hospital is in a foreign country, which might be the case if you live in parts of the U.S. Virgin Islands and the closest hospital is in the British Virgin Islands.

- You need medical attention and youre on a ship within six hours of a U.S. port.

Medicare covers all 50 states and the District of Columbia as well as U.S. territories American Samoa, Guam, the Northern Mariana Islands, Puerto Rico and the U.S. Virgin Islands.

Don’t Miss: What Is Medicare Open Enrollment

Should I Have Medicare Coverage If I Retire Abroad

For coverage in your new country, youd need to purchase private health insurance or buy into the countrys public health plan, if that option is available. If youre willing and able to return to the United States for hospital care, youll still have access to Medicare Part A .

But youd need to purchase Medicare Part B in order to have outpatient coverage, and theres a 10% premium increase for each year that you were eligible for Part B but not enrolled . Advocacy groups have pushed for Medicare coverage to be portable for retirees who choose to live overseas, but so far, its not.

Medicare Plans Will Always Cover Emergency Care

The one thing you don’t have to worry about regardless of what kind of Medicare coverage you have is an emergency while travelling in the country. Original Medicare and Medicare Advantage plans are required to cover emergency and urgent care anywhere in the U.S. without any additional costs or rules about coverage.

Everyones travel and health care needs are different, so check and compare your coverage options carefully.

Also Check: Will Medicare Cover Lasik Surgery

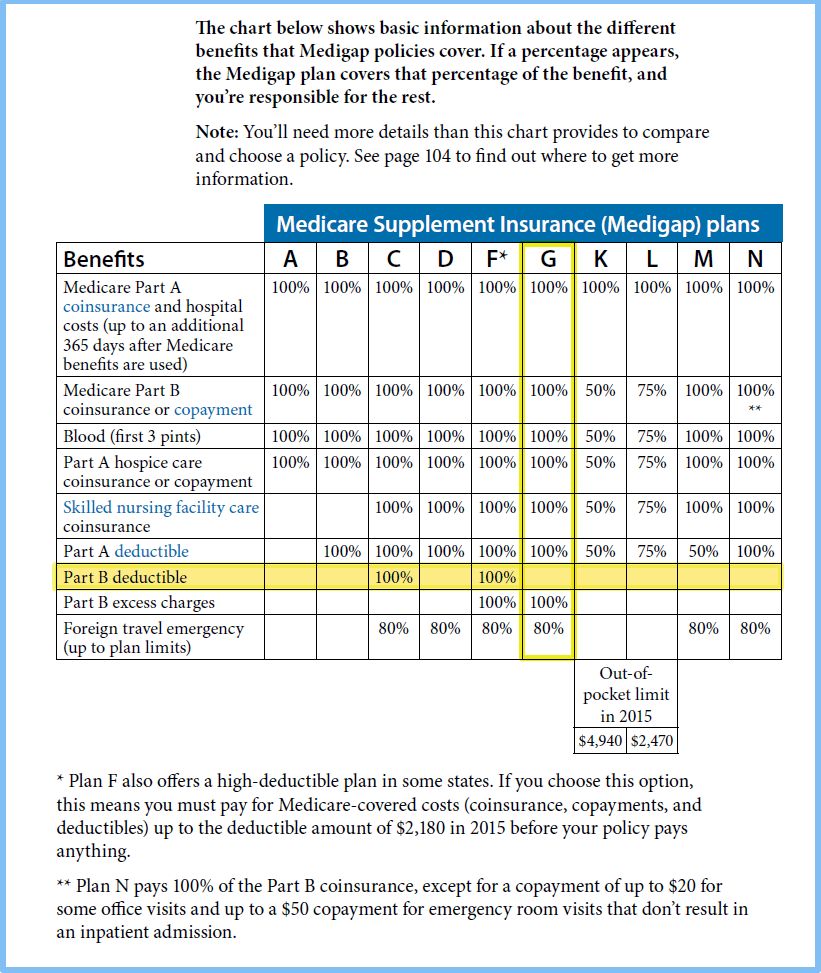

Do Medicare Supplement Plans Cover Foreign Travel

Medicare Supplement plans are a form of secondary insurance to cover the out-of-pocket costs Medicare Part A and Part B leave behind. These policies offset the prices you would pay out-of-pocket if you only had Original Medicare. With a Medicare Supplement plan, beneficiaries do not lose any benefits that come with Original Medicare.

Medicare Supplement plans include additional benefits providing foreign travel emergency coverage. Medicare Supplement Plan C, Plan D, Plan F, Plan G, Plan M, and Plan N provide emergency coverage in foreign countries. Additionally, Medigap High Deductible Plan F and High Deductible Plan G also include coverage overseas.

Medicare Supplement Plan A, Plan B, Plan K, and Plan L do not offer additional foreign travel emergency coverage.

Overview of Medicare Supplement foreign travel emergency coverage:

- Carries a $250 deductible

- Coverage only lasts the first 60 days of your trip

- Your plan pays 80% of your medical bills while out of the country

- The lifetime coverage limit is $50,000.

Your Medicare Supplement plan will provide foreign travel coverage if your health services are for emergencies. If you only have Original Medicare, you will not have this extra coverage outside the U.S.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Medicare Travel Insurance: What Options Do You Have

If you are travelling internationally, you can purchase a travel insurance plan which will cover your medical expenses abroad.

Travel insurance policies, unlike Medicare, offer more than simply health insurance. The best travel insurance policy should have at least the following coverage:

- Medical treatment. If you fall ill or get into an accident during your trip, your travel insurance will cover for medical treatment, doctor consultations, emergency services, hospitalization, surgery, prescription drugs and medicine, etc.

- Trip cancellation, interruption, or curtailment. If you have to cut your trip short or cancel it for some reason, you will be partially reimbursed for any lost travel and or accommodation costs.

- Lost, stolen, or damaged possessions. As long as it is due to recklessness, travel insurers can reimburse you for a part of the cost of your lost or damaged luggage.

- Repatriation and evacuation, in case of an emergency.

Recommended Reading: Do I Need Medicare Part B If I Have Tricare

Will Medigap Cover Me When I’m Traveling Outside The Us

If youre adding a Medigap plan to supplement your Original Medicare, six of the Medigap plan design options provide coverage for medical emergencies outside the United States. Plans C, D, F, G, M, and N provide coverage for medical emergencies while traveling, as long as medical care starts within 60 days of leaving the United States.

In most states, Medigap plans are only available with no medical underwriting during your initial enrollment period , so its wise to plan ahead and choose Medigap coverage with international emergency benefits if you think you might travel during retirement.

With a Medigap plan that covers foreign travel emergencies, the patient pays a $250 deductible plus 20% coinsurance, and theres a lifetime benefit maximum of $50,000.

Is Medicare Accepted Everywhere

Medicare is accepted almost everywhere, but there are a few exceptions.

Most pharmacies and hospitals accept Medicare, as do most doctors. However, there are a few exceptions. For example, some dentists do not accept Medicare, and some cruise ships do not accept it either.

Overall, Medicare is accepted in most places. If you are not sure whether a particular location accepts it, you can always call ahead and ask.

Don’t Miss: How Many Parts Are In Medicare

Do I Have Medicare Coverage Abroad

No, in most cases, Medicare does not offer coverage for medical treatment outside the US or its territories. Medicare does not cover international travel. The instances where you could potentially be covered abroad are very limited, as follows:

- Youre within the US when you have a medical emergency, but a foreign hospital is closer to your location than the closest US hospital than can treat your emergency.

- You are within Canada, on your way back from Alaska. If you have a medical emergency as you are travelling across Canada without unreasonable delay* directly between Alaska and another US state and a Canadian hospital is closer than a US hospital.

- Non-emergencies: Only if you live in the US but the hospital that can treat your medical condition closest to you is a foreign hospital rather than a US hospital.

*To be determined by Medicare on a case-by-case basis.

If you fit into one of the situations described above, then you can be reimbursed for medical expenses as follows:

- Inpatient hospital care, when you have been admitted in a foreign hospital with a doctors order

- Emergency services . This includes the services you receive immediately prior to and during your hospital stay.

Basically, in the instances described above and only those, you will be covered in the same manner as you would in the US, including all coinsurance/copayments and deductibles.

What Situations Qualify For Medicare Coverage While Traveling Abroad

Medicare doesnt cover most routine healthcare servicesoutside of the U.S. and its territories. However, exceptions may be made foremergency care under the following circumstances:

- A medical conditionoccurs while youre in the U.S., but the nearest hospital is in a foreigncountry

- An emergency occurswhile youre traveling through Canada by a direct route between Alaska andanother state, and a Canadian hospital is the nearest alternative

- The best option totreat your condition is one located in a foreign country

Don’t Miss: Are Chemo Drugs Covered By Medicare

Do Medicare Advantage Plans Cover Overseas Travel

Summary:

When it comes to Medicare coverage, everyone has different needs. Some people are more interested in wellness benefits, for example, while others look for the best coverage for prescription drugs. If youâre enrolling in Medicare and youâre hoping to do some international traveling, one question has extra importance: do Medicare Advantage plans cover overseas travel? This article will give you the basics on Medicare and overseas travel, and how Medicare Advantage plans compare when it comes to choosing the right Medicare coverage for you.

Do Medicare Supplement Plans Provide Travel Insurance Abroad

Medicare Supplement plans are supplementary insurance that fills in the gaps left by Medicare Parts A and B. If you only had Original Medicare, these plans would help to offset the costs you would have to pay out of pocket. Beneficiaries who choose a Medicare Supplement plan maintain all Original Medicare benefits.

Additional features that provide emergency coverage for international travel are included in Medigap Plans C-G and Plan M & N of the Medicare Supplement Insurance Program cover emergencies abroad. Additionally, coverage abroad is provided under Medigap High Deductible Plans F and G.

The Medicare Supplement Plans A, B, K, and L do not provide supplementary emergency coverage for international travel.

Read Also: Can You Start And Stop Medicare Part B

How Does Original Medicare Work If You Live Overseas

Original Medicare will not cover any medical services you receive overseas. So, if you are living overseas full-time, it makes sense to disenroll from Original Medicare. If Medicare Part A coverage is zero-premium for you, you can keep the coverage if you plan to return to the U.S.

If you travel back to the U.S. frequently, you may want to continue paying the monthly premium for Medicare Part B. However, you can only use those benefits within the United States and its territories.

International Travel Insurance For Us Citizens Enrolled In Medicare

When you are on a ship and need coverage, Medicare will not pay for health care services when the ship is more than 6 hours away from the US port. The Medicare prescription drugs plan don’t offer coverage for the drugs purchased outside the United States. All the 50 US states, the District of Columbia, Puerto Rico, the U.S. Virgin Islands, Guam, the Northern Mariana Islands, and American Samoa are considered part of the U.S and accept US Medicare. As Medicare offers limited coverage for travel outside the US, It is advisable to buy adequate international travel health insurance to get proper medical coverage while outside the US borders.

All of the popular international travel destinations for US citizens like Canada, Mexico, the Caribbean islands, Latin and South American nations, Europe, Australia and Asia are not covered by regular Medicare coverage.

Read Also: Does Medicare Require Prior Authorization For Prolia

Does Medicare Advantage Have Limitations On Travel

If you get a Medicare Advantage plan, then your plan doesnt always cover medical services while traveling outside of the United States. It depends on what kind of plan you signed up and how long you travel for. It also depends on where you travel and the kind of care that you need while you are traveling.One thing is certain that if you travel outside of a Medicare Advantage plans service are for more than six months, you will likely be disenrolled. Medicare Advantage plans have service areas that are based on the region of where you originally signed up for Medicare. This means that even if you are traveling in the United States, you may be disenrolled from a Medicare Advantage plan unless you notify that you are changing geographic locations. This simply places you in Original Medicare if you are disenrolled from your plan. You also receive a Special Enrollment Period to join a new Medicare Advantage plan if you are disenrolled based on your new geographic location.Of course, not all plans have that policy to disenroll their members. You will receive notification if that is the case from your healthcare carrier. Some plans also include benefits to allow people to stay on a plan even if they are traveling long-term.

Additional Insurance For International Travel

If youre on a budget, another option is to obtain supplemental travelers insurance. This isnt medical insurance, but is instead a short-term plan that covers emergencies while youre out of the country. You may also be able to buy short-term insurance through a travel planner.

The catch is that youll need to buy the coverage ahead of time for a specified itinerary. You cant buy travelers insurance once youve already left the country.

Also, not all supplemental plans cover preexisting conditions. If you have chronic health conditions, be sure to review the exclusions before you purchase travel insurance.

Also Check: Can I Submit A Claim Directly To Medicare

Other Than Medicare What Coverage Should I Consider When I’m Traveling

For added peace of mind, many Medicare beneficiaries choose to purchase travel medical insurance prior to a trip. Travel medical plans are widely available, but be aware that in many cases, they restrict the amount of coverage available to seniors.

Although travel plans are frequently available with medical benefit maximums as high as seven figures, that limit is often reduced to $50,000 or less for applicants over 70 years old. Travel medical insurance can be used in conjunction with Medigap coverage or other health insurance.

Many travel medical insurance plans include separate medevac coverage, but it can also be purchased on a stand-alone basis from private carriers. Medevac return to the United States is not included in the foreign travel emergency coverage provided by Medigap plans. So beneficiaries with Original Medicare plus Medigap coverage might want to consider purchasing Medevac coverage prior to a trip abroad.

Do I Need To Take My Medicare Card Overseas

There is no definitive answer to this question as it depends on your specific situation. However, in general, you should not need to take your Medicare card overseas as it is not typically accepted outside of the United States.

There are a few exceptions, however. If you are travelling to a country that participates in the Medicare International Reciprocal Agreement, your Medicare card may be accepted. This agreement allows for certain countries to accept each others Medicare cards as a form of payment for healthcare services.

If you are not travelling to a country that participates in the Medicare International Reciprocal Agreement, you may still be able to receive healthcare services while overseas. In this case, you would need to contact your Medicare provider to see if they have a reciprocal agreement with a foreign healthcare provider.

If you are not able to use your Medicare card while overseas, you may need to purchase travel insurance that includes medical coverage. This will help ensure that you have access to the necessary healthcare services while you are away from home.

Recommended Reading: What Walkers Are Covered By Medicare

What Travel Insurance Is Best For Seniors

When it comes to travel insurance, there are a lot of different options to choose from. However, when it comes to seniors, there are a few specific things to look for in a policy.

The first thing to consider is whether you will need medical coverage while you are traveling. Many travel insurance policies include medical coverage, but it is important to make sure that you are covered in case of an emergency.

Another important thing to look for is coverage for lost or stolen luggage. If you are traveling with a lot of expensive belongings, it is important to make sure that they are covered in case of theft or loss.

Finally, you should also consider whether the policy includes trip cancellation or interruption coverage. If something comes up and you have to cancel your trip, you will want to be sure that you are covered.

When choosing a travel insurance policy for seniors, it is important to consider all of these things. Make sure to compare different policies to find the one that is best for you.