Whats A Benefit Period For A Hospital Stay Or Snf Stay

A benefit period is a timespan that starts the day youre admitted as an inpatient in a hospital or skilled nursing facility. It ends when you havent been an inpatient in either type of facility for 60 straight days.

Heres an example of how Medicare Part A might cover hospital stays and skilled nursing facility stays if you have more than one of these in the same year.

| Youre released from the SNF December 2. | Y | If you still havent met the Part A deductible, youll continue paying for December 1 and 2.

Pay SNF costs for December 1 and 2. |

*In this scenario, youve met the condition of having a qualifying hospital stay

**You need to pay the Part A deductible until its all paid for this benefit period. How fast you meet your deductible amount depends on your Medicare-approved Part A costs for your services.

Please note that this is just an example. If you have multiple hospital stays and/or Skilled Nursing Facility stays within a year, you might want to contact Medicare to get details about your coverage. You can call Medicare at 1-800-MEDICARE . TTY users should call 1-877-486-2048. Medicare representatives are available 24 hours a day, seven days a week.

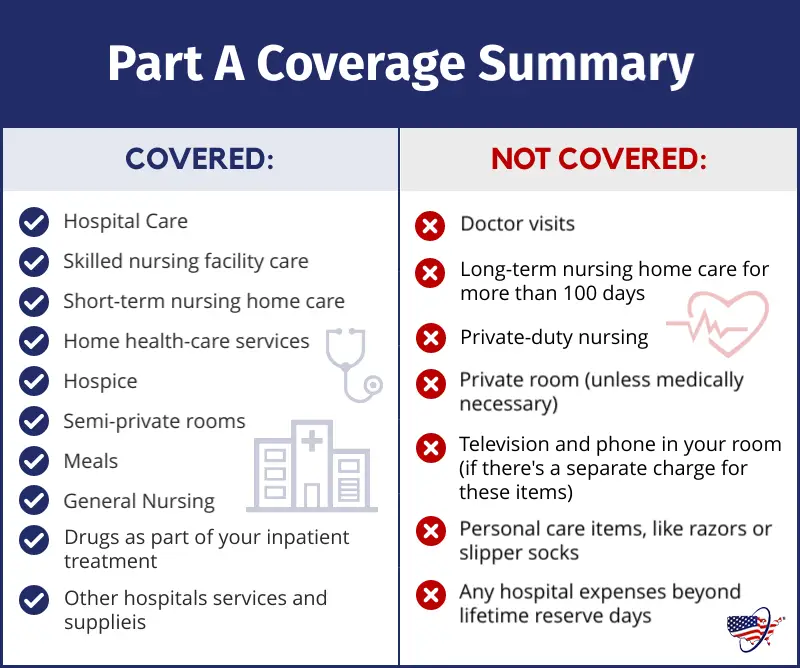

What Medicare Part A Does Not Cover

While this part of Medicare covers stays in a nursing home, it will only do so if it is medically necessary. If you need non-medical long-term care, such as for chronic illness or disability, youâll have to consider other options like long-term care insurance. If you meet the income and asset requirements for Medicaid you can also get long term care coverage.

Medicare Part A covers the cost of an inpatient hospital stay, but fees charged by a doctor or specialist physician will be covered by Part B.

Medicare Part A does not cover the following at any hospital or facility:

-

A private room, unless medically necessary

-

In-room television and phone services

-

Private-duty nursing services

You can see what hospitals accept Medicare and what specific services are covered on Medicare.gov. You can also talk to your doctor or health care provider about whether a service or treatment they are recommending is traditionally covered by Medicare.

You May Like: Can I Sign Up For Medicare Before I Turn 65

Does Medicare Cover Testing For Covid

In April 2022, the Biden Administration finalized an initiative providing for Medicare coverage of up to 8 at-home COVID tests per month for Medicare beneficiaries with Part B, including beneficiaries in traditional Medicare and Medicare Advantage. Under this new initiative, Medicare beneficiaries can get the tests at no cost from eligible pharmacies and other entities they do not need to pay for the tests and submit for reimbursement. Medicare Advantage plans can also opt to cover the cost of at-home tests, but this is not required.

Medicare covers diagnostic lab testing for COVID-19 under Part B. Medicare covers medically necessary clinical diagnostic laboratory tests when a doctor or other health practitioner orders them. Under revised rulesfinalized on September 2, 2020, a beneficiary may receive Medicare coverage for one COVID-19 and related test without the order of a physician or other health practitioner, but then must receive a physician order for any further COVID-19 testing. Medicare also covers serology tests , that can determine whether an individual has been infected with SARS-CoV-2, the virus that causes COVID-19, and developed antibodies to the virus. Medicare Advantage plans are required to cover all Medicare Part A and Part B services, including lab tests for COVID-19.

Read Also: How Much Is Part B Deductible For Medicare

Some Extra Help With Costs

To protect people from the costs, the government worked with private insurers to come up with a set of plans that are designed to help with some of the costs associated with Original Medicare. By paying a monthly premium for a Medicare Supplement plan, you can get financial help with:

- Paying for your Part A deductible and the share of inpatient care costs not covered by Part A

- Paying for your doctor bills for Part B services

- Paying the costs of hospice care not handled by Original Medicare

These benefits mean that if you have a Medicare Supplement plan, you can:

- Pay a predictable up-front premium for your coverage

- Reduce the amount that you have to pay if you have a long inpatient hospital stay or repeat visits to a specialist.

Medicare Part A Deductible

Unlike some deductibles, the Medicare Part A deductible applies to each benefit period. This means it applies to the length of time youve been admitted into the hospital through 60 consecutive days after youve been out of the hospital.

So, if youre discharged from the hospital and return within the 60-day period, you dont need to pay another deductible.

If youre admitted after the 60-day period, then youve started another benefit period and you will be expected to pay another deductible.

Recommended Reading: How Old Do I Have To Be For Medicare

Health Insurance Premium Payment

The Health Insurance Premium Payment program is a Medicaid program that helps families pay for private health insurance. This program is for families who have:

- A parent or a spouse with private health insurance

- A child or a spouse with Medicaid

Medicaid will pay the familys private health insurance if the total cost of that insurance is less than the total cost of care with Medicaid. The total cost of the private insurance includes the premium, coinsurance and deductibles.

If approved, Medicaid may pay the private health insurance costs for the entire family and not just for the family members who get Medicaid. The family will get services through the private health insurance plan.

To learn more or to apply, visit the Get HIPP Texas website or call us toll-free at 800-440-0493. You also can ask us to send you an application. Write to:

Texas Health and Human Services CommissionTMHP-HIPP

Does Medicare Cover Inpatient Rehabilitation

Medicare Part A covers your inpatient care in a rehabilitation facility as long as your doctor deems it medically necessary. In addition, you must receive care in a facility thats Medicare-approved.

Depending on where you receive your inpatient rehab therapy, you may need to have a qualifying 3-day hospital stay before your rehab admission. Well discuss that rule in more detail later.

Also Check: Does Medicare Pay For Laser Spine Surgery

How Much Do I Pay For Part A Hospital Costs

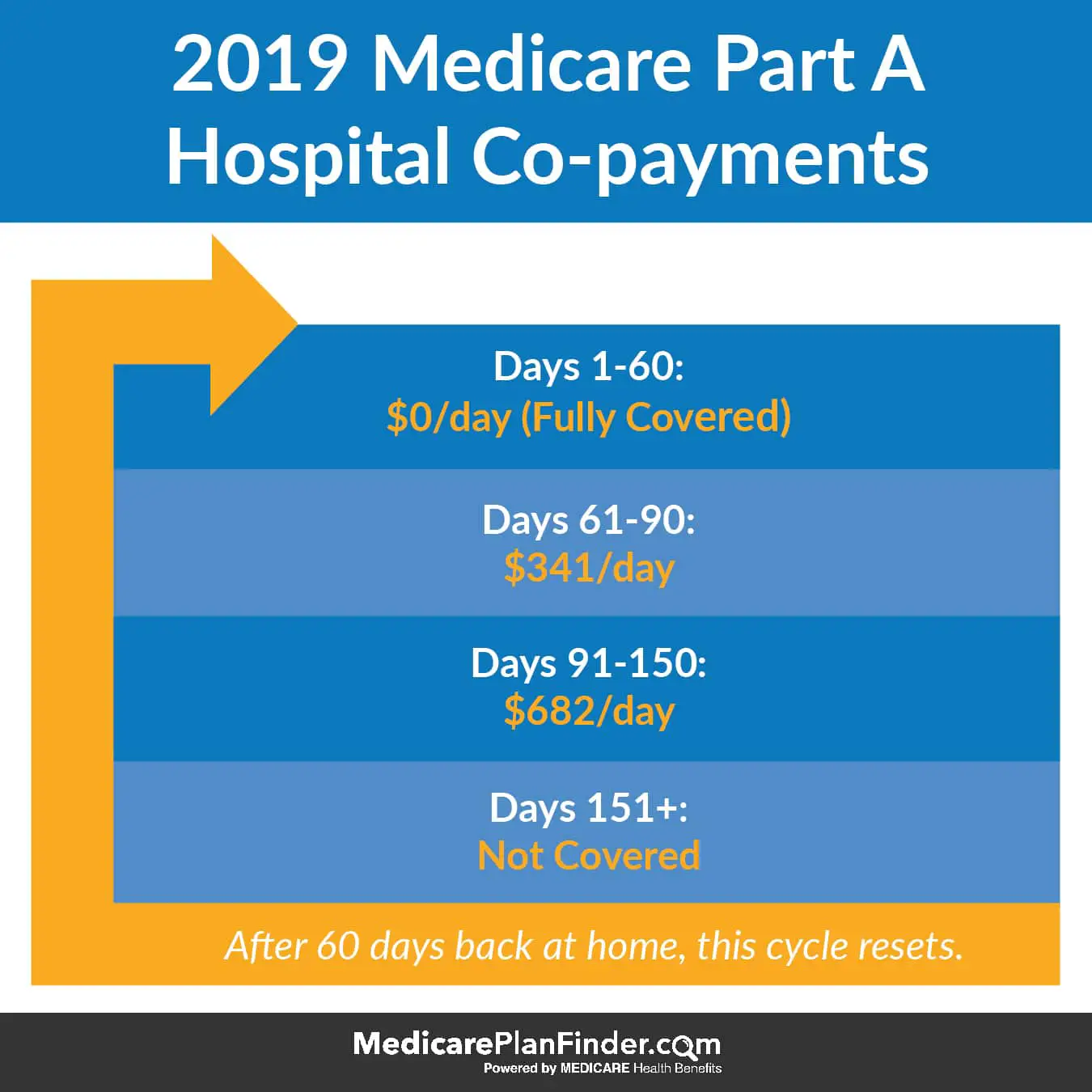

Your costs under Part A depend on the number of days you spend as an inpatient in the hospital during each benefit period. You pay a portion of the cost, called coinsurance, for each day you are in the hospital beyond 60 days in each benefit period.

You pay:

- Nothing additional for the first 60 days of covered inpatient care each benefit period after you pay the $1,556 Part A deductible in 2022.

- $389 daily coinsurance for days 61 to 90 for each benefit period in 2022.

- $778 daily coinsurance for up to 60 lifetime reserve days. Each lifetime reserve day can be used only once but can apply to different benefit periods.

- You pay all costs beyond 90 days per benefit period if you use up your lifetime reserve days.

If you buy a Medicare supplement policy or have other coverage, such as retiree health insurance, that supplemental policy may cover the Part A deductible and hospital coinsurance and may also provide coverage for additional lifetime reserve days.

Keep in mind

Youll receive a Medicare summary notice every calendar quarter that you have Medicare claims, similar to an explanation of benefits for private insurance. It shows information about your claims and the amount you may be billed.

The summary notice also shows how much of the deductible youve paid and the date your benefit period began. You can access this information more frequently if you set up an online Medicare account, previously known as a MyMedicare account.

Why Would I Need To Travel For Medical Care

People sometimes need to travel just to receive routine medical care because of the distance from their homes to their providers. If the only available appointment with a specialist is late in the day, you may prefer to stay in a hotel rather than make the long drive home.

You may also need to stay in a hotel for a prolonged period if youre undergoing treatment at a hospital or clinic that specializes in a specific form of cancer. Some surgeries may involve travel to a specialty hospital or surgical center. In this case, you may need to stay in a hotel the night before your procedure.

Don’t Miss: Are Legal Residents Eligible For Medicare

Medicare Doesn’t Cover Long

One of the largest potential expenses in retirement is the cost of long-term care. The median cost of a private room in a nursing home was roughly $105,800 in 2020, according to the Genworth Cost of Care Study a room in an assisted-living facility cost $51,600, and 44 hours per week of care from a home health aide cost $54,900.

Medicare provides coverage for some skilled nursing services but not for custodial care, such as help with bathing, dressing and other activities of daily living. But you can buy long-term-care insurance or a combination long-term-care and life insurance policy to cover these costs.

You can also get a long-term care rider on an annuity, which could help defray the cost of long-term care.

Out Of Province Hostel Facilities & Meal Allowance

Patients, who are required by their physician to travel outside the Province, but still within Canada, may qualify for accommodation/meal expenses during a defined period and in accordance with the Medicare Hostel Policy. The patient is required by the treating physician to remain at least three consecutive nights or more at a hostel.

The maximum allowable coverage for hostel, including meals, is $110.00 per day . If a physician confirms that there is a medical need for an escort, one may be approved up to $46.00 per day toward their meals . They are required to share the room with the patient.

For patients requiring long term stay Medicare will not pay lodging in a hotel/motel, rather the patients are expected to rent an apartment which Medicare will pay up to a maximum of $2,500.00 per month.

In these cases, the patient/escort is expected to buy groceries and prepare meals just like they would at home. No meal allowance for either the patient or escort will be forthcoming. Patients for whom hostel expenses are not covered by Medicare are not entitled to a meal allowance either.

Accommodation expenses for patients and/or escorts are only considered when patients are NOT admitted to hospital, and are being treated/assessed on an out-patient basis.

Travel expenses are not covered by New Brunswick Medicare.

Also Check: What Are Some Medicare Advantage Plans

B Covers 2 Types Of Services

- Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice.

- Preventive services: Health care to prevent illness or detect it at an early stage, when treatment is most likely to work best.

You pay nothing for most preventive services if you get the services from a health care provider who accepts

Medicare Part A Coinsurance

Once the deductible is paid fully, Medicare will cover the remainder of hospital care costs for up to 60 days after being admitted.

If you need to stay longer than 60 days within the same benefit period, youll be required to pay a daily coinsurance. The coinsurance applies to an additional 30-day period or days 61 through 90 if counted consecutively.

As of 2020, the daily coinsurance costs are $352.

After 90 days, youve exhausted the Medicare benefits within the current benefit period. At that point, its up to you to pay for any other costs, unless you elect to use your lifetime reserve days.

A more comprehensive breakdown of costs can be found below.

Also Check: Is Gum Surgery Covered By Medicare

Can Medicare Supplement Insurance Help

Medicare Supplement Insurance, or Medigap, can help reduce the hospital expenses that Medicare Part A and Part B dont cover. Depending on the Medigap plan type, you can purchase a policy that covers the Part A deductible, Part A coinsurance and hospital costs, and the first three pints of blood for a transfusion.

Medigap plans are standardized, so you get the same Medicare benefits from any company offering the specific plan type. However, the premiums and available plan types can vary depending on your location, so its important to shop around to find the most affordable plan that best suits your health needs.

Medicare Plans Resource For Assisted Living And Long

Learn about long-term care options and assisted living facilities.

Aging is often accompanied by decreasing ability to perform self-care activities and deal effectively with responsibilities including finances, shopping, medications, and transportation. On average, almost 70% of people who are over 65 years old will need help in the form of long-term care for approximately three years before the end of life.

LTC is generally considered custodial or personal care and is not covered by Medicare. Assisted living facilities are a type of residential LTC option. Medicare does not pay for ALFs either, but whether you are receiving LTC services in your community or at an ALF, Medicare will pay for medically necessary skilled care.

This article includes information about ALFs, LTC options, your rights as a Medicare beneficiary, and ideas about how to help cover out-of-pocket costs.

Read Also: How Old To Get Medicare And Medicaid

Finding A Nearby Hospital That Accepts Medicare

Most doctors and hospitals accept Medicare. In fact, only 1% of non-pediatric doctors in the U.S. chose to opt out of Medicare in 2020, according to a report by the Kaiser Family Foundation. Whatâs more, a report by the American Hospital Association found that the majority of hospitals depend on Medicare or Medicaid payments.

To find a hospital that participates in Medicare, you can visit the Hospital Locator Tool, which allows you to enter your city, state, or ZIP code to find a list of hospitals in your area that accept Medicare. The tool can also sometimes provide details about the quality of care the hospital provides.

For example, some hospitals have a five-star patient survey rating and a five-star overall star rating .

If you have Medicare Advantage, youâll want to be sure that your hospital is in your planâs network. You can do that by checking with your insurance provider.

Ready to get started? Find a plan that fits your budget and covers your doctor and prescription medications now.

*Amounts are calculated based on 2022 rates.

Does Medicare Cover Vaccines And Boosters For Covid

Medicare Part B covers certain preventive vaccines , and these vaccines are not subject to Part B coinsurance and the deductible. Medicare Part B also covers vaccines related to medically necessary treatment. For traditional Medicare beneficiaries who need these medically necessary vaccines, the Part B deductible and 20 percent coinsurance would apply.

Based on a provision in the CARES Act, a vaccine that is approved by the FDA for COVID-19 is covered by Medicare under Part B with no cost sharing for Medicare beneficiaries for the vaccine or its administration this applies to beneficiaries in both traditional Medicare and Medicare Advantage plans. Although the CARES Act specifically provided for Medicare coverage at no cost for COVID-19 vaccines licensed by the U.S. Food and Drug Administration , CMS has issued regulations requiring no-cost Medicare coverage of COVID-19 vaccines that are also authorized for use under an emergency use authorization but not yet licensed by the FDA. This policy of providing vaccines without cost sharing to Medicare beneficiaries also applies to booster doses.

To date, the FDA has issued EUAs for three COVID-19 vaccines from Pfizer-BioNTech, Moderna, and , as well as boosters for Pfizer and Moderna after completing a primary series of the vaccine.

Also Check: Does Medicare Part C Cover

Paying For Hospital Fees With Medicare Part B

Even though youâre being treated in a hospital, that doesnât mean all the care you receive during your stay will be covered under Medicare Part A. Some tests and services will be covered by Medicare Part B. These include:

- Diabetes equipment and supplies

- Medical equipment, including wheelchairs and walkers

- Screenings, including for cancer

- Tests, including X-rays, MRIs, CT scans, and EKG/ECGs

- Occupational therapy

Under Medicare Part B, you generally pay 20% of the Medicare-approved amount for most doctorsâ services you receive at a hospital. Depending on the type of care you receive and the length of your stay, the price tag can be high.

âIf youâre just doing Part A and Part B, with no supplemental coverage like a Medigap plan, youâre going to be paying 20% of your expenses,â says Donovan. âAnd 20% of a very large hospital bill is going to be a lot of money.â

Learn more about Medigap policies and explore your options here.

A Note About Medicare Advantage

Medicare Advantage may provide coverage for some things not covered by traditional Medicare. However, as mentioned above, an April report from the inspector general’s office recently found that some Medicare Advantage insurance providers unnecessarily denied care or payments for care that would have been provided to beneficiaries had they chosen traditional Medicare.

Specifically, the Department of Health and Human Services Inspector General reported that Medicare Advantage insurance providers sometimes delayed or denied patient access to services even though the requests met Medicare coverage rules.

The Advantage insurance providers likewise denied payments to providers for some services that met both Medicare coverage rules and the organizations billing rules. This could prevent or delay needed care for beneficiaries and could result in a burden on medical providers.

The report also found that 13% of the time that Medicare Advantage providers denied prior authorization, the requests met rules making them eligible under original Medicare, suggesting they would have been approved if the beneficiaries had not chosen Advantage instead of standard Medicare.

Often, when challenged, however, the Advantage insurance providers would reverse their decisions. So its important for patients to be able to advocate for necessary coverage if denied.

Don’t Miss: How To Get Money Back From Medicare