Social Security Vs Medicare

Social Security provides federal income benefits in retirement based on what youve earned over a lifetime of working. Your Social Security benefits are calculated using your highest 35 years of wages, and the amount you receive is based on your pay over your lifetime and how long you wait to claim your benefits. Social Security also pays benefits to people living with disabilities, survivors of workers who have died and dependents of beneficiaries, according to the Social Security Administration

Medicare provides federal health insurance for people age 65 and older and younger people living with certain disabilities or chronic conditions. Medicare is made up of four parts, including Part A , Part B and Part D . It also includes Part C, or Medicare Advantage, which is a bundled alternative to Original Medicare offered by private insurance companies, including all the coverage of Part A and B, plus some additional benefits.

How Medicare Supplements Work With Your Part B Premiums

Most people will still need to pay for Part B premiums if they have a Medicare Supplement or Medicare Advantage plan. With Original Medicare, Part A is usually free. If you work for at least 40 quarters and pay into the system then you are also entitled to Part B.

There is a premium associated with Part B, but not everyone has to pay it. Those individuals would get assistance through the Medicare Savings Program or other programs through Medicaid.

If you have questions or need help applying for Part B,then please call us at 783-5901 or email us at [email protected] service is 100% FREE and were happy to help you.

Ways To Find Out If Medicare Covers What You Need

Recommended Reading: Is Bevespi Covered By Medicare

If Your Income Has Gone Down

If your income has gone down and the change makes a difference in the income level we consider, contact us to explain that you have new information. We may make a new decision about your income-related monthly adjustment amount for the following reasons:

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy, or reorganization.

If any of the above applies to you, we need to see documentation verifying the event and the reduction in your income. The documentation you provide should relate to the event and may include a death certificate, a letter from your employer about your retirement, or something similar. If you filed a federal income tax return for the year in question, you need to show us your signed copy of the return. Use Form Medicare Income-Related Monthly Adjustment Amount Life-Changing Event to report a major life-changing event. If your income has gone down, you may also use Form SSA-44 to request a reduction in your income-related monthly adjustment amount.

Can I Use Social Security Benefits To Pay My Medicare Premiums

Your Social Security benefits can be used to pay some of your Medicare premiums.

In some cases, your premiums can be automatically deducted If you receive Social Security Disability Insurance or Social Security retirement benefits.

However, this doesnt apply to all Medicare premiums. Each part of Medicare has its own premiums and rules for interacting with Social Security.

Well discuss how this works for each part next.

Read Also: Which Medicare Insurance Is Best

If You Disagree With Our Decision

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

You may also request an appeal in writing by completing a Request for Reconsideration , or contact your local Social Security office. You can use the appeal form online, or request a copy through our toll-free number at 1-800-772-1213 . You dont need to file an appeal if youre requesting a new decision because you experienced one of the events listed and, it made your income go down, or if youve shown us the information we used is wrong.

If you disagree with the MAGI amount we received from the IRS, you must correct the information with the IRS. If we determine you must pay a higher amount for Medicare prescription drug coverage, and you dont have this coverage, you must call the Centers for Medicare & Medicaid Services to make a correction at 1-800-MEDICARE . We receive the information about your prescription drug coverage from CMS.

What Happens If You Miss Your Initial Enrollment Period

If you do not qualify for a Special Enrollment Period and miss your IEP, you risk incurring late fees and a lapse in coverage. The Part A premium is an additional 10% for twice the number of years you could have been enrolled but chose not to.

So, if you became eligible for Part A in January of 2020 but did not sign up until October of 2022, you would pay an additional 10% for four years, since you let two full years pass before enrolling.

The Part B penalty is an additional 10% for every full 12 months you go without signing up. In the above scenario, youd pay an extra 20% for your Medicare Part B premium for signing up late. Youll pay this penalty the entire time you have Medicare.

Missing your IEP means you have to wait for the General Enrollment Period , which lasts from January 1 through March 31, with coverage beginning in July. Once you have enrolled in Parts A and B, you can choose a Medicare Advantage or Part D plan between April 1 and June 30.

To avoid late fees and a lack of coverage, it is best to sign up during your Initial Enrollment Period.

You May Like: How To Change Primary Doctor On Medicare

Medicare Savings Programs: State Help With Medicare

The state programs that help pay Medicare premiums are called Medicare Savings Programs. States pay for these programs with Medicaid money.

The most generous program, the Qualified Medicare Beneficiary program, will pay all of your Medicare Part A and Part B premiums, deductibles, and coinsurance. Its income limits are quite low .

Two other programs, the Specified Low-Income Medicare Beneficiary and the Qualifying Individual programs, have somewhat higher income limits, and thus fewer benefits, than the QMB program. The SLMB and QI programs pay all or part of the Medicare Part B monthly premiums, but don’t pay for any Medicare deductibles or coinsurance amounts. For help determining if you might qualify for help for paying Medicare costs, check with your local social service office.

If You Collect Rrb Or Social Security Benefits Part B Is Deducted Automatically

One of the main perks of Medicare is that you can have your Medicare premiums automatically taken out of your Social Security or Railroad Retirement Board benefits. This makes managing your finances much simpler, since you can never forget payments, and can easily forget about your premiums.

However, there are various ways that your payments can be deducted, and this depends on when you start receiving Social Security benefits, and when you start receiving Medicare coverage. Well go over all of your options, so you know what to expect when you transition to Medicare health insurance.

Don’t Miss: Is My Medicare Number My Social Security Number

Home Health Services Not Covered By Medicare

Now that we have gone through thebasics of Medicare coverage when it comes to home health care, we will briefly discuss some of the items that Medicare does not cover. Home health services can span a wide range of duties, so it can also be helpful to learn what Medicare will not pay for. Here are a few examples.

First, Medicare will not pay for 24-hour care at your home. Remember that Medicare will only cover the service if you need part-time care. Full-time care will not qualify for coverage. Medicare also does not pay for meals to be delivered to your home. While you might need to make arrangements for meals and food since you cannot leave home during your recovery, Medicare will not pay for these meals to be delivered.

Next, Medicare will not pay for any homemaker services that are not directly included in your care plan. Examples of these types of services could include cooking, shopping, cleaning, laundry, or other household duties or social services. Only services necessary for the care plan provided by your doctor will be covered by Medicare.

What If I Dont Want Part B Coverage

It is possible to defer your Part B coverage to a later date. This is quite rare to do, because you may end up paying more for late enrollment. If you dont want your Part B Medicare plan, youll have to get in contact with Medicare directly. It also makes sense to double-check with Social Security, so you can be sure that the Part B premium wont be deducted from your check.

Its also possible to be covered by your employer group plan at the same time as Part B if youre still working when you become eligible. However, this can end up not being worth it for some people, as your group health insurance will have to provide most of your coverage in most instances. This may be worth it for some to avoid the late enrollment penalty, but theres no way to tell without looking at your individual scenario.

Don’t Miss: Does Medicare Cover Motorcycle Accidents

What Are Your Medicare Coverage Options

You have several options, starting with Original Medicare.

Original Medicare consists of Parts A and B. Part A covers things like home health services, inpatient hospital care, and nursing home care. Part B helps pay for outpatient services like doctor visits, preventive screenings, mental health services, and yearly wellness exams.

You can also choose Medicare Part C, better known as Medicare Advantage, which combines your Part A and Part B coverage in a single plan. Advantage plans are offered through private insurers and usually include additional benefits, such as prescription drug coverage and routine dental services.

Note that, while most Medicare Advantage plans include Part D benefits, around 10% do not, so you need to review your options carefully if that is what you want. If you do not have a Medicare Advantage plan that covers medications and do not have creditable coverage elsewhere, you will need to enroll in a Medicare Part D drug plan to cover any needed prescriptions.

How To Appeal A Part B Premium Income Adjustment

You may request an appeal if you disagree with a decision regarding your income-related monthly adjustment amount. Complete a Request for Reconsideration or contact your local Social Security office to file an appeal.

You may be able to skip the formal appeal and simply provide documentation if your income changed due to any of the following:

- You married, divorced or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property due to a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy or reorganization.

These methods apply to the Part B premium. Contact the IRS if you disagree with your adjusted gross income amount, which is provided to Medicare by the IRS.

Also Check: Why Sign Up For Medicare At 65

What Is Social Security

Social Security is a program that pays benefits to Americans who have retired or who have a disability. The program is managed by the Social Security Administration . You pay into Social Security when you work. Money is deducted from your paycheck each pay period.

Youll receive benefits from Social Security once youre no longer able to work due to disability or once youve reached a qualifying age and stopped working. Youll receive your benefits in the form of a monthly check or bank deposit. The amount youre eligible for will depend on how much youve earned while working.

You can apply for Social Security benefits if one of these situations apply to you:

- Youre 62 or older.

- You have a chronic disability.

- Your spouse who was working or receiving Social Security benefits has died.

Social Security retirement benefits are designed to replace a portion of the monthly income you earned before you retired.

Medicare And Social Security: What You Need To Know

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Medicare and Social Security are government programs that provide a social safety net in retirement and other life circumstances, such as having a disability. U.S. workers pay into both programs through payroll taxes.

Although the programs are separate and provide different benefits, theyre connected in a few ways.

Also Check: Does Medicare Cover Prescription Glasses

Are My Medicare Premiums Tax Deductible

Medicare premiums are tax deductible. However, you can deduct premiums only once your out-of-pocket medical expenses reach a certain limit.

The IRS has set that limit at 7.5 percent of your adjusted gross income . Your AGI is the money you make after taxes are taken out of each paycheck.

The IRS allows you to deduct any out-of-pocket healthcare expenses, including premiums, that are more than 7.5 percent of your AGI.

So, if you have an AGI of $50,000, you could deduct healthcare expenses after youve paid $3,750 in medical expenses. Depending on your premiums and other healthcare spending, you might not reach this number.

If your spending is less than 7.5 percent of your AGI, you cant deduct any healthcare expenses, including premiums. However, if your healthcare spending is more than 7.5 percent of your income, you can deduct it.

Keep careful track of your out-of-pocket medical expenses throughout the year so you can make the proper deductions at tax time.

You can pay your Medicare bills online or by mail if they arent automatically deducted. You wont pay an added fee for parts A, B, or D, based on your payment method.

There are several ways to pay:

B Premium Can Be Limited By Social Security Cola But That Hasnt Been An Issue For Most Beneficiaries Since 2019

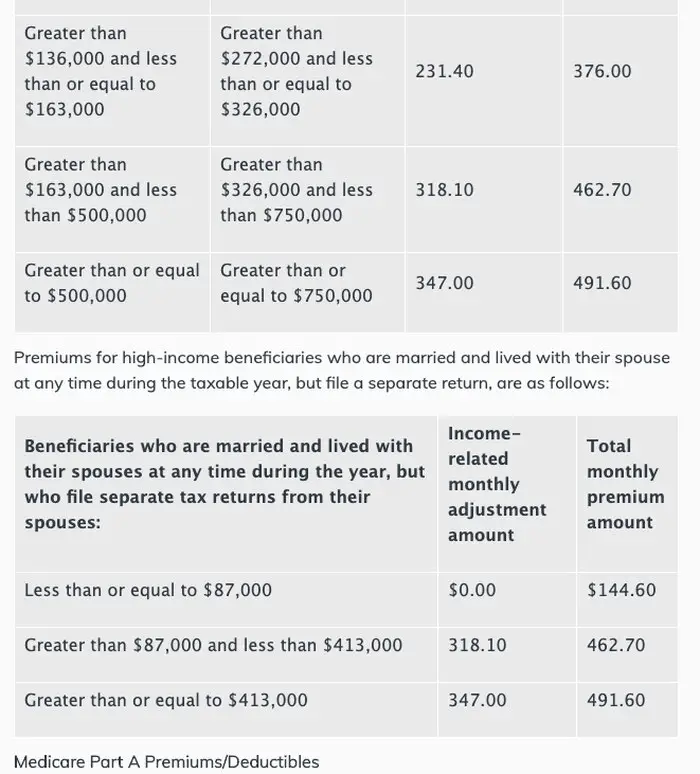

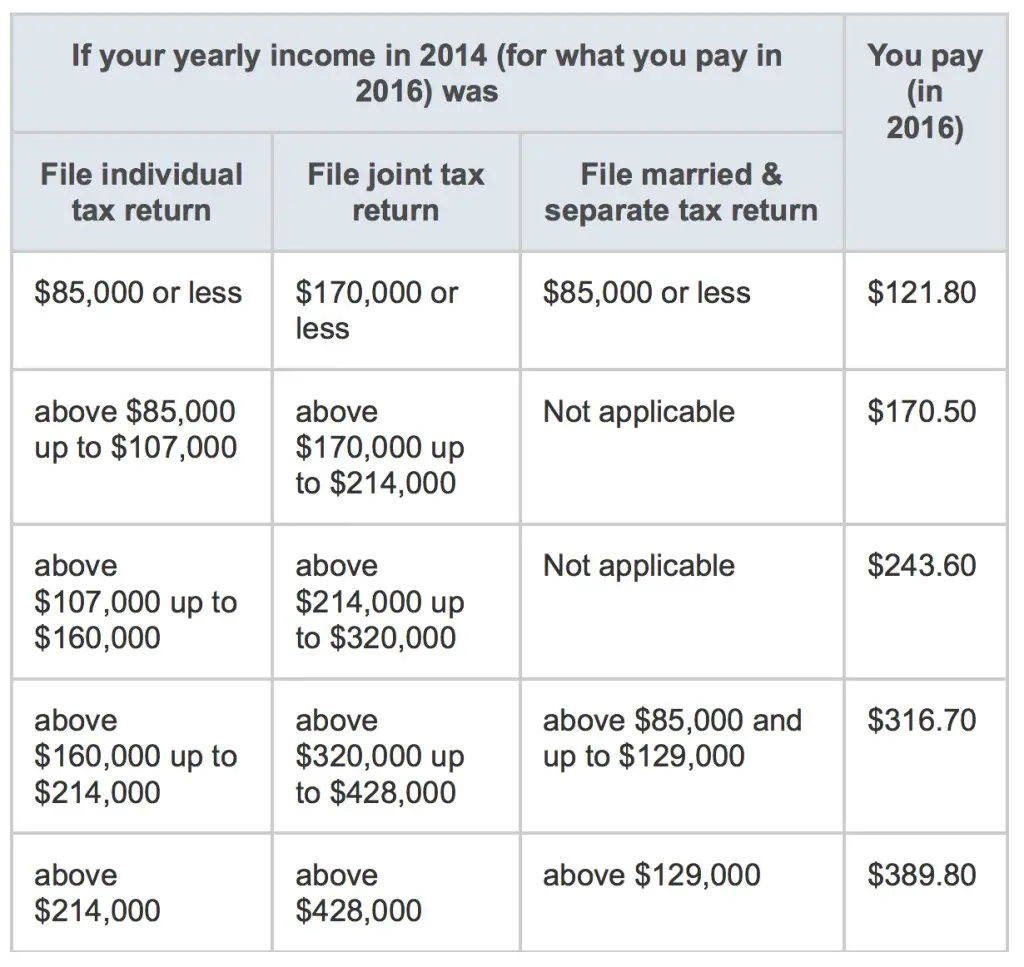

In 2023, most enrollees will pay $164.90/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2022 , in 2021 , in 2020 , and in 2019 . Some enrollees pay more than the standard premium, if theyre subject to a high-income surcharge .

But thats in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium. The standard premium in 2018 was actually $134/month, but the cost of living adjustment for Social Security wasnt quite large enough to cover all of the increase from 2017s premium for most enrollees. Thats why most people paid about $130/month.

The standard Part B premium increased by about $9/month in 2020. But the 1.6% Social Security COLA for 2020 increased the average beneficiarys Social Security benefit . Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees paid the standard premium in 2020. And for 2021, the 1.3% COLA was adequate to cover the increase to the new standard premium for virtually all enrollees.

The COLA for 2022 was the largest it had been in 30 years, and more than adequate to cover even the substantial increase in Part B premiums. The 8.7% COLA for 2023 is even larger, at a time when Part B premiums are declining. So the COLA that Social Security recipients will see in 2023 will not need to be used to cover any additional Part B premiums.

You May Like: What Are The Five Steps In The Medicare Appeals Process

Medicare Part B Premiums For Those Not Held Harmless

As noted earlier, certain individuals receiving Social Security benefits and those not receiving Social Security benefits are not protected under the hold-harmless provision. However, by law, standard Medicare Part B premiums are calculated to cover 25% of the expected costs of Medicare Part B program costs. In years in which a large number of individuals are held harmless and pay reduced premiums, aggregate Part B premiums may not cover 25% of costs unless the entire share of a premium increase is shifted onto those not held harmless. Thus, in certain years, those not held harmless may bear the burden of meeting the 25% requirement disproportionately. For example, in 2010 there was no Social Security COLA and approximately 70% of Medicare Part B enrollees were held harmless from the Medicare Part B premium increase. Those who were held harmless, on average, paid a Medicare Part B premium of $96.40 whereas Medicare Part B beneficiaries not held harmless paid the 2010 standard Medicare Part B premium of $110.50 .65

Low-income beneficiaries who receive premium assistance from Medicare Savings Programs are not held harmless. However, because they do not pay the Medicare Part B premiumâMedicaid will typically pay low-income beneficiaries’ Medicare Part B premiumâthe costs of low-income beneficiaries’ rising Medicare Part B premiums generally would be borne by Medicaid rather than by the beneficiaries themselves.