What Is The Standard Part B Premium For 2021

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you’ll pay the standard premium amount and an Income Related Monthly Adjustment Amount . IRMAA is an extra charge added to your premium.

How Much Does Medicare Cost

The total cost of Medicare for you will depend on what parts and plans you select for your coverage.

| Medicare plan |

|---|

- Monthly cost: Usually free

- Annual deductible in 2022: $1,556

According to the Medicare program, 99% of enrollees get Medicare Part A for free. Those who do not qualify will pay between $274 and $499 per month in 2022, with the exact amount based on how much they or their spouse have paid in Medicare taxes.

Medicare Part A costs nothing for most enrollees due to their previous participation in the workforce. If you have worked for more than 10 years or 40 quarters, then you are eligible to pay $0 for Medicare Part A. This is because, during your working years, you contributed to Social Security and Medicare payroll taxes.

A large cost for Medicare Part A is the deductible, which is the amount you have to pay for medical care out of pocket before the plan’s benefits begin.

For 2022, the Medicare Part A deductible is $1,556. That’s a $72 increase from 2021. However, this cost is usually covered if you enroll in a Medigap policy or Medicare Advantage.

How Much Are Medicare Premiums In 2021

There are six income tiers for Medicare premiums in 2022. As stated earlier, the standard Part B premium amount that most people are expected to pay is $170.10 month. But, if your MAGI exceeds an income bracket even by just $1 you are moved to the next tier and will have to pay the higher premium.

Heres a table with the 2022 numbers.

| Individual Taxable Income | Joint Taxable Income | 2021 Monthly Part B IRMAA Premium |

| $91,000 or less | ||

|

$578.30 |

Hold Harmless Provision

What is the hold harmless rule? It ensures that if youre receiving Social Security retirement benefits, the amount of your check wont decline from one year to the next.

Medicare Part B premiums are deducted from Social Security checks, and Social Security benefit amounts are adjusted annually by the cost-of-living adjustment . As long as the COLA is enough to cover the full amount of the Part B premium increase for that year, the full amount of the premium increase can be applied the beneficiarys net Social Security benefit amount wont decrease.

But if the Part B premium increase would be more than the beneficiarys COLA amount, the full amount of the Part B premium increase cant be applied, because that would result in a year-over-year decrease in their Social Security check. The hold harmless provision doesnt apply to people who have to pay the IRMAA surcharge, however, even if theyre receiving Social Security benefits.

Also Check: Does Medicare Help With Dentures

What Is The Medicare Premium For 2020

For 2020, the standard monthly rate is $144.60. However, it will be more if you reported above a certain level of modified adjusted gross income on your federal tax return two years ago. Any additional amount charged to you is known as IRMAA, which stands for income-related monthly adjustment amount. Visit Medicare.gov, point to Your Medicare Costs, and then click Part B costs to see a matrix of premiums corresponding to income ranges across different tax filing statuses.

How Much Does Medicare Part C Cost

Medicare Part C plans are sold by private insurance companies. Therefore, premiums will differ according to provider, plan and location.

Some Medicare Advantage plans offer $0 monthly premiums and $0 deductibles, and all Medicare Advantage plans must include an annual out-of-pocket cost limit. $0 premium plans may not be available in all locations.

Find $0 premium Medicare Advantage plans in your area

Or call 1-800-557-6059TTY Users: 711 to speak with a licensed insurance agent. We accept calls 24/7!

Also Check: Do Doctors Have To Accept Medicare Advantage Plans

If You Disagree With Our Decision

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

You may also request an appeal in writing by completing a Request for Reconsideration , or contact your local Social Security office. You can use the appeal form online, or request a copy through our toll-free number at 1-800-772-1213 . You dont need to file an appeal if youre requesting a new decision because you experienced one of the events listed and, it made your income go down, or if youve shown us the information we used is wrong.

If you disagree with the MAGI amount we received from the IRS, you must correct the information with the IRS. If we determine you must pay a higher amount for Medicare prescription drug coverage, and you dont have this coverage, you must call the Centers for Medicare & Medicaid Services to make a correction at 1-800-MEDICARE . We receive the information about your prescription drug coverage from CMS.

What Do Medicare Parts A And B Cover

Medicare Part A covers inpatient hospital, skilled nursing facility, hospice, inpatient rehabilitation and some home health care services.

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment and certain other medical and health services not covered by Medicare Part A.

Medicare Part D helps cover prescription drug costs.

For more information, here’s what to know about signing up for an Affordable Care Act plan.

Get the So Money by CNET newsletter

Don’t Miss: What Is Medicare Managed Care

How Are Medicare Part D Premiums Calculated

Medicare Part D prescription drug plans are also sold by private insurance companies, so premiums will vary from one plan to the next.

As with Medicare Part B premiums, Part D plans also calculate premiums based on your income from two years prior and may charge an IRMAA.

The table below illustrates how much you can expect to pay for a Part D plan in 2022.

Medicare Part D IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$77.90 + your plan premium |

If you are subject to a Part D IRMAA, you may be able to save money by enrolling in a Medicare Advantage plan that includes prescription drug coverage.

Medicare Premiums And Surcharges

There is no premium or surcharge for Part A. Each year, the Centers for Medicare & Medicaid Services sets the following years Part B premium. As noted previously, the 2019 base Part B premium is $135.50 per month per beneficiary. Most people pay that amount. A small number of people pay a premium that is lower than the base premium because they are protected by the hold harmless rule. The hold-harmless provision protects people from having their previous years Social Security benefit level reduced by an increase in the Part B premium.

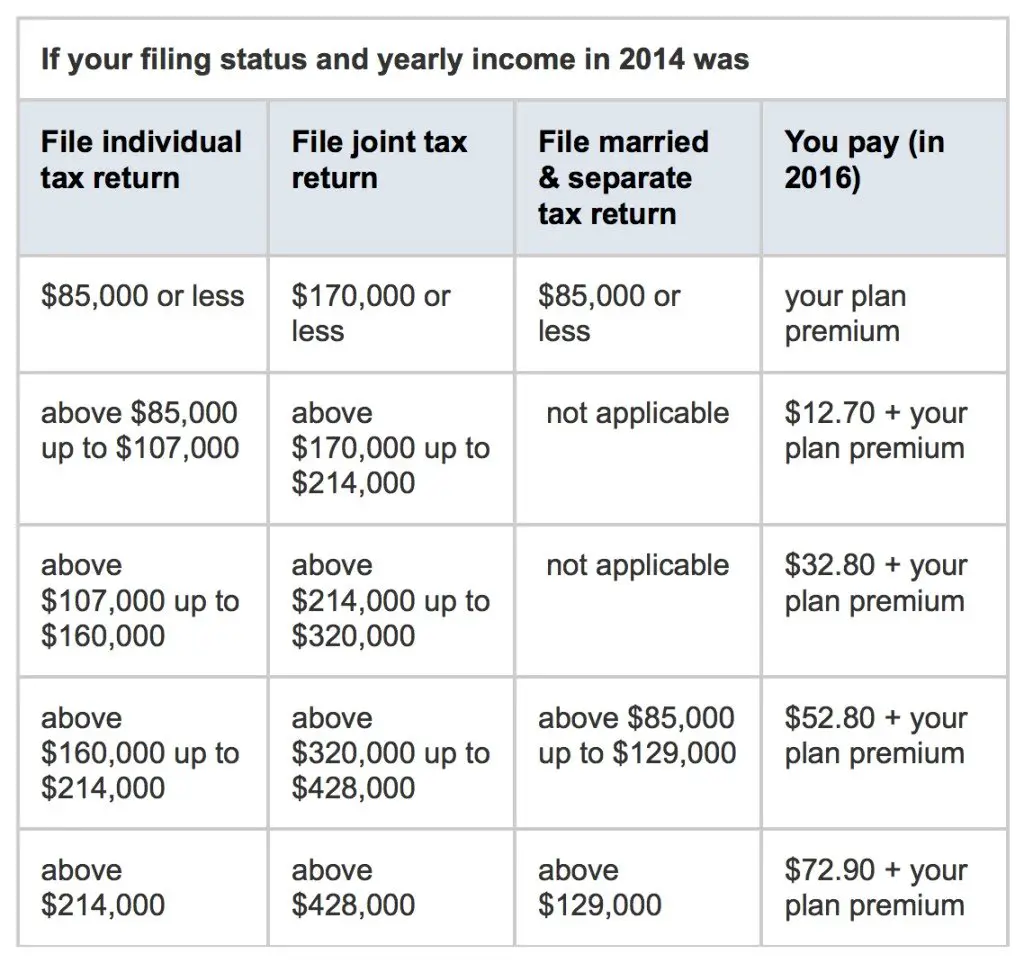

Part D coverage is provided via the individual private plan selected by the beneficiary, and base premiums depend upon the plan chosen. Wealthier taxpayers may also pay Medicare surcharges on Parts B and D in addition to the base premium for traditional Medicare or a Medicare Advantage plan. Higher-income individuals paying surcharges are not shielded by the hold-harmless provision. The table Medicare Parts B and D Premiums for 2019 shows the amounts charged for Part B and Part D at the various income thresholds for individuals and joint filers based upon MAGI from two years prior. In other words, the premiums for 2019 are based upon the reported income tax data from 2017.

Medicare Parts B and D premiums for 2019

Recommended Reading: Are Resident Aliens Eligible For Medicare

Recommended Reading: Does Medicare Cover Home Health Care Costs

Can I Appeal The Irmaa Determination

You can appeal the IRMAA determination filing for a redetermination if you believe that your calculation is erroneous. In addition, if you have had a life-changing event such as a loss of income or divorce, then you can refile or you can file for a redetermination using Form SSA-44.

If you do not agree with a redetermination, there is a formalized appeal process the third level of appeal technically called the .

When Is Medicare 2020

8:07 AM. If youre currently on Medicare or reaching the age where you are considering Medicare, its important to understand the basics. Furthermore, you should consider how premiums are calculated in order to have an idea of what kind of premium youll be looking at. Here is a quick guide showing you what Medicare is, …

Also Check: Who Can Help With Medicare Enrollment

Monthly Medicare Premiums For 2022

The standard Part B premium for 2022 is $170.10. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $91,000 Married couples with a MAGI of $182,000 or less | 2022 standard premium = $170.10 |

| Your plan premium + $77.90 |

How Record Social Security Cost

News that inflation rose to a historic high in November probably comes as no surprise to retirees.

But they may be in for another shock when they receive their monthly Social Security checks in January.

The Social Security Administration announced in October that beneficiaries will get a 5.9% boost to their checks in 2022 the biggest annual cost-of-living adjustment in four decades.

Yet since then, another key measurement for inflation the Consumer Price Index has also reached historic highs.

In November, that measurement for a basket of consumer goods and services climbed to a 6.8% year-over-year increase the highest since 1982.

More from Personal Finance:You need at least $1 million saved to retire in these cities

At first it was more, Wow, look at how great this is, said Kelly LaVigne, vice president of consumer insights at Allianz Life Insurance Company of North America, of reactions to the Social Security COLA for 2022.

Now its a recognition after they see this latest CPI news, Oh, thats why they did it, LaVigne said.

For retirees who have been living on a fixed income for a long period of time, higher prices can cut into their ability to pay for rent, food and prescriptions.

They havent even received this larger check yet, LaVigne said. So theyre experiencing these higher prices without even getting more money, which will start in January.

More than 64 million Social Security beneficiaries are due for increases to their monthly checks.

Read Also: Does Medicare Part B Cover Specialists

The Medicare Part B Premium

Medicare Part B covers inpatient services like doctor visits and lab work. The standard monthly Part B premium in 2022 is $170.10. This accounts for around 25 percent of the monthly cost for Part B, with the government paying the remaining 75 percent. The percentage paid by high-income beneficiaries ranges between 35 and 85 percent, depending on their income as reported to the IRS.

How Medicare Premiums Are Calculated

If you’re currently on Medicare, you probably know that your monthly premium is subject to change each year. But exactly how your premium changes isnt based on the factors you might think, like your health, annual income, or chosen Medicare plan.

Instead, your Medicare Part B premiums will likely increase due to rising healthcare costs.

Understanding how your Medicare premiums are determined can help you better plan your healthcare finances, which is especially important for seniors on a fixed income.

Lets take a closer look at what Medicare is, how monthly payments are calculated, and the current rates you can expect.

Recommended Reading: How Often Does Medicare Pay For Diabetic Foot Care

What Is The Medicare Part B Premium For 2022

$170.10In November 2021, CMS announced that the Part B standard monthly premium increased from $148.50 in 2021 to $170.10 in 2022. This increase was driven in part by the statutory requirement to prepare for potential expenses, such as spending trends driven by COVID-19 and uncertain pricing and utilization of Aduhelm.

Tap Your Philanthropic Side

If you’re at least age 70½, a qualified charitable contribution, or QCD, is another way to keep your taxable income down. The contribution goes directly from your IRA to a qualified charity and is excluded from your income.

“It’s one of the few ways you can really get money out of an IRA completely tax-free,” Meinhart said. “And when you’re 72, that charitable distribution can help offset your required minimum distributions.”

The maximum you can transfer is $100,000 annually if you’re married, each spouse can transfer $100,000.

Recommended Reading: Is Humana Medicare Part D

And 2022 Irmaa Brackets

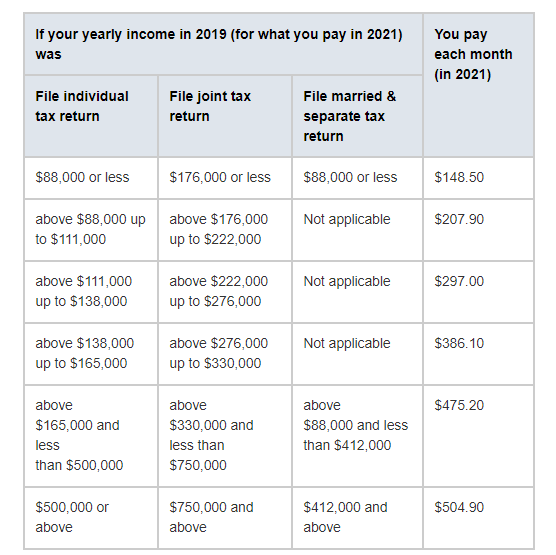

The IRMAA income brackets started adjusting for inflation in 2020. Here are the IRMAA income brackets for 2021 coverage and 2022 coverage. Before the government publishes the official numbers, Im able to calculate based on the inflation numbers and the formula set by law. Remember the income on your 2020 tax return determines the IRMAA you pay in 2022. The income on your 2021 tax return determines the IRMAA you pay in 2023.

| Part B Premium |

|---|

| Single: > $500,000Married Filing Jointly: > $750,000 |

The standard Medicare Part B premium is $148.50/month in 2021. A 40% surcharge on the Medicare Part B premium is about $700/year per person or about $1,400/year for a married couple both on Medicare. In the grand scheme, when a couple on Medicare has over $176k in income, they are probably already paying a large amount in taxes. Does making them pay another $1,400/year make that much difference? Nickel-and-diming just annoys people. People caught by surprise when their income crosses over to a higher bracket by just a small amount get mad at the government. Rolling it all into the income tax would be much more effective.

Oh well, if you are on Medicare, watch your income and dont accidentally cross a line for IRMAA.

Medicare Part B Premium Appeals

OMHA handles appeals of the Medicare programs determination of a beneficiarys Income Related Monthly Adjustment Amount , which determines a Medicare beneficiarys total monthly Part B insurance premium.

The Social Security Administration notifies a beneficiary of his or her Part B insurance premium and any IRMAA with the beneficiarys annual notice of Social Security benefits . SSA is responsible for issuing all initial and reconsideration determinations. It is important to remember that IRMAAs apply for only one year. A beneficiary will be notified by SSA near the end of the current year if he or she has to pay an IRMAA for the upcoming year.

Read Also: How Can You Have Both Medicare And Medicaid

How Much Will Medicare Premiums Be In 2021

There are six income tiers for Medicare premiums in 2021. As stated earlier, the standard Part B premium amount that most people are expected to pay is $148.50 month. But, if your MAGI exceeds an income bracket even by just $1 you are moved to the next tier and will have to pay the higher premium.

Medicare Supplement Insurance :

- Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

- You must keep paying your Part B premium to keep your supplement insurance.

- Helps lower your share of costs for Part A and Part B services in Original Medicare.

- Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

Also Check: Does Medicare Automatically Enroll You

How To Calculate Medicare Premiums

By: Mathew J. Ryan, MBA, CFP®, EA

As you hit the retirement milestone, one of the items you’ll likely need to address is enrolling in Medicare. Medicare has many complexities and the calculation of premiums that you will pay is one of them. The questions and confusion can be endless.

Just a quick, high-level review. Medicare is available for those attaining age 65. Although, you can postpone enrolling if you choose to continue to work and have qualified employer coverage.

Medicare Part A is typically free to all beneficiaries. In contrast, Part B and Part D require premium payments. Thus, collectively speaking, the government covers approximately 75% of the program’s overall costs while the premium payments from enrollees account for the remaining 25%. So, how much will you pay?

Now Modify Your Adjusted Gross Income To Calculate Magi

Now that we have your adjusted gross income, we have to add back some items to call it modified. This is how you calculate MAGI! Add back to your AGI.

You add back tax-exempt interest .

The taxable portion of your social security is already in your AGI, what about the non-taxable portion of your social security?

For IRMAA purposes, you dont include the non-taxable portion of social security for IRMAA.

Specifically for Premium ACA tax Credits, however, you add back the non-taxable portion of social security! This means you probably dont want to claim social security between 62-65 if you want to get Premium ACA tax Credits.

Table 1

Above, find the differences for IRMAA and ACA Premium Tax Credits.

Note that you add back tax-exempt interest and interest from US savings bonds for higher education to both.

In addition, foreign earned income is also added to both. Please note this is income from wages, not investment income. You can still deduct your Foreign Income Credit from your international investments.

The non-taxable portion of social security is added back for ACA Premium Tax Credits but not for IRMAA.

Recommended Reading: When Am I Available For Medicare