Required Managed Care Nurse Certifications/credentials

The organizational bodies that award Certifications in Managed Care Nursing are the American Board of Managed Care Nursing and the American Association of Managed Care Nurses .

In order to be eligible for the AAMCN’s certification exam, you’ll need the following:

- A valid and unrestricted RN license

- 3-5 years of experience in a clinical setting

- Complete a home study program in manage care nursing which covers the following areas:

- Managed care

- Healthcare economics

- Patient issues

While not always a requirement for managed care nursing positions, earning the Certification in Managed Care Nursing credential is certainly a competitive advantage for managed care nurses seeking employment.

Plans Have Service Areas

This is especially true for HMO plans, but youâd have to visit doctors and facilities within your network, most of which will be in your area. If you travel a lot, your choices could be restricted. Of course, you can once again get around this by choosing a PPO plan, but they do tend to cost a bit more.

The Economics Of Managed Care

The basic premise of managed care is that the member-patient agrees to receive care only from specific doctors, hospitals, and others — called a network — in exchange for reduced overall healthcare costs. This makes Medicare Advantage plans generally cheaper overall than medigap plans.

Several varieties of Medicare managed care plans are available. Some have narrow restrictions on consulting with specialists or seeing providers from outside the network. Others give members more freedom to choose when they see doctors and which doctors they may consult for treatment. Plans that offer more choices in coverage — especially PPOs and HMOs with point-of-service options — charge higher premiums.

If you are considering a Medicare managed care plan, you must decide whether any of the plans available in your area offer adequate care at an affordable cost — including the costs of copayments for doctor visits and prescription drugs.

Here are some of the basic types of managed care plans.

Also Check: Does Medicare Pay For Cosmetic Surgery

Managed Care And People With Disabilities

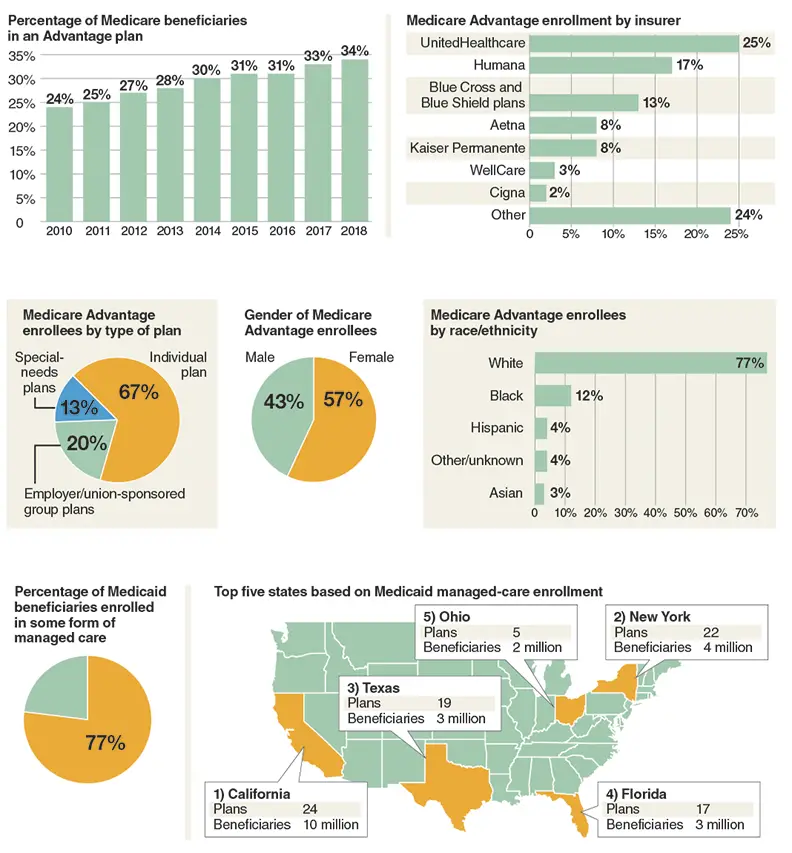

Managed care has been introduced to state Medicaid programs on an incremental basis, beginning in most states with the enrollment of low-income children and parents and proceeding in stages to nonelderly people with disabilities and senior citizens. With some notable exceptions, states have elected to carve out dual eligible beneficiaries and continue paying for long-term services on an FFS basis when they have enrolled seniors and Medicaid beneficiaries with disabilities in managed health care plans. In 2008, just 28 percent of people with disabilities and 11 percent of older beneficiaries were enrolled in comprehensive, risk-based managed care plans. Faced with expanding caseloads and declining revenues, however, states are in the process of sharply expanding managed care enrollments among seniors and people with disabilities.

A 2011 50-state survey of Medicaid managed care programs found that states expect to substantially increase their reliance on managed care delivery systems in the years ahead. Of the 45 states responding to the survey, 27 reported plans to expand the use of managed care. Of these 27 states, six indicated that they plan to extend mandatory managed care enrollment to additional Medicaid populations , and four states reported plans to expand managed care to additional geographic areas of the state . The following are additional key findings of the survey:

How Can I Find Which Medicare Advantage Plans Are Available In My Area

Im available to help you understand your options. If you prefer, you can request information via email or schedule a phone call at your convenience by clicking one of the links below. To view some plans you may be eligible for, use the Compare Plans button below.

*Out-of-network/non-contracted providers are under no obligation to treat Preferred Provider Organization plan members, except in emergency situations. For a decision about whether we will cover an out-of-network service, we encourage you or your provider to ask us for a pre-service organization determination before you receive the service. Please call our customer service number or see your Evidence of Coverage for more information, including the cost-sharing that applies to out-of-network services.

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

Also Check: What Does Medicare Part B

Beneficiaries Access And Choice Of Plans

From 1997 to 2003, the widespread exit of MA plans reduced beneficiaries choices and weakened confidence in Part C. Moreover, with the exception of floor counties, the BBRA and the BIPA failed to reverse the declining participation of the plans and the enrollment of beneficiaries. By 2003, the number of what Medicare now called coordinated-care plan contracts had fallen 50 percent, to 151 from 309 in 1999 , although some of the drop was attributable to the health plans mergers and acquisitions. There still were few other plan types offered besides HMOs, and there continued to be a wide geographic variation in plans availability across markets, with 40 percent of beneficiaries still lacking access to a Medicare managed care plan .

Find A $0 Premium Medicare Advantage Plan Today

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Recommended Reading: What Is A Hmo Medicare Plan

What Is A Medicare Managed Care Plan

Medicare Managed Care plans are also known as Medicare Advantage plans, available through the Medicare Part C program. These plans are another way to get your Medicare Part A and Part B coverage . Some plans offer additional benefits, like routine vision care and prescription drug coverage.

New Medicare Managed Care Rules For 2021

There are a few changes to Medicare managed care plans in 2021.

One of the biggest changes is that people who are eligible for Medicare through a diagnosis of end stage renal disease are now able to purchase a managed care plan. Previously, they could enroll in only original Medicare and Medicare Part D.

Another change is the addition of two special enrollment periods. This is a time outside of the yearly enrollment windows when you can change your Medicare plan. It generally includes major life changes, like moving or retirement.

Starting in 2021, youll also qualify for a special enrollment period if:

- you live in a disaster area, as declared by the Federal Emergency Management Agency for example, if your area has been struck by a hurricane or other natural disaster

- your current health plan is a poor performer, according to Medicare

- tour current health plan is having financial trouble and has been placed in receivership

- your current health plan has been sanctioned by Medicare

Other changes include a revised managed care enrollment form and the ability to sign your enrollment documents with an e-signature.

Also Check: Does Medicare Part B Pay For Hearing Aids

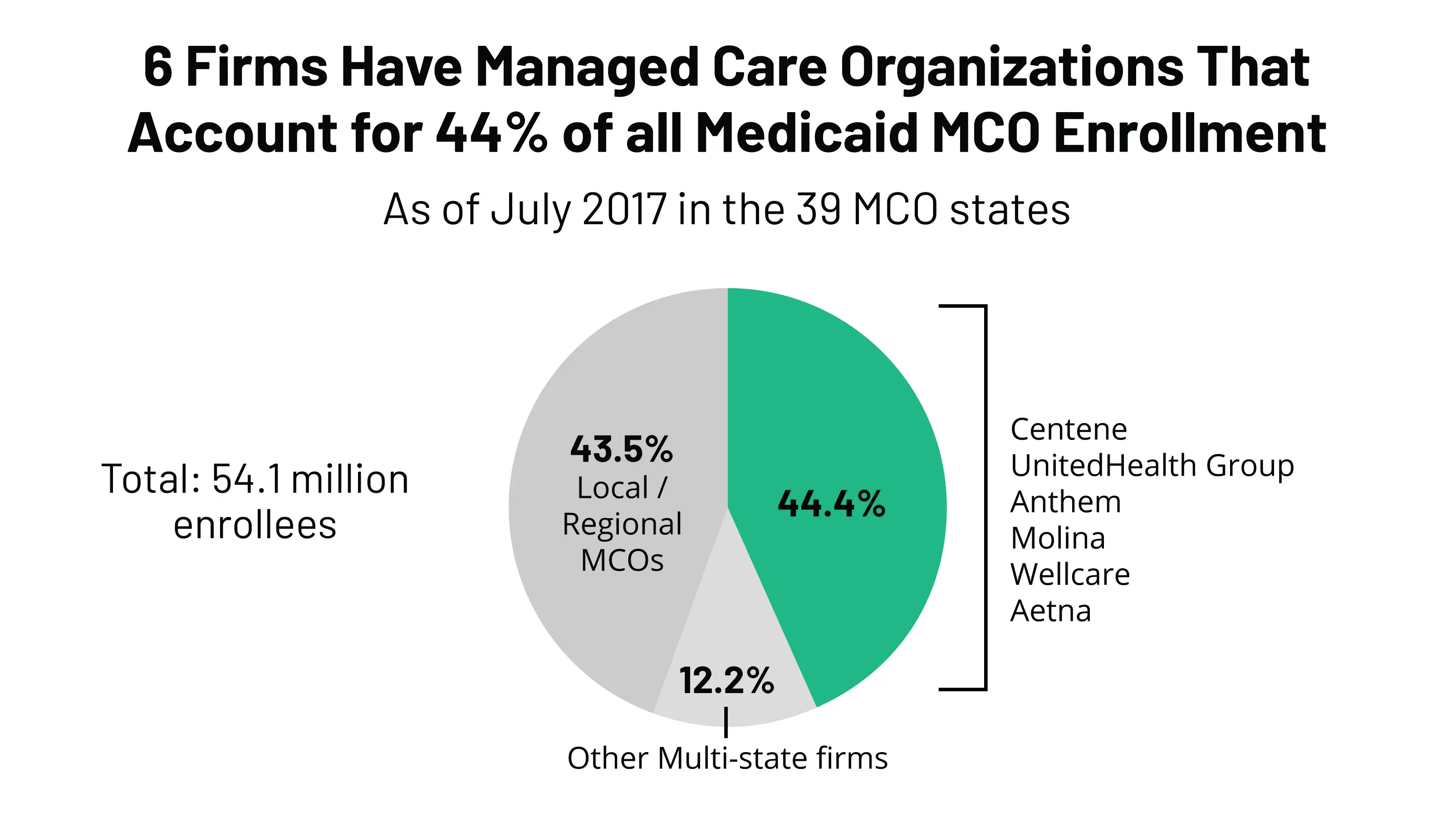

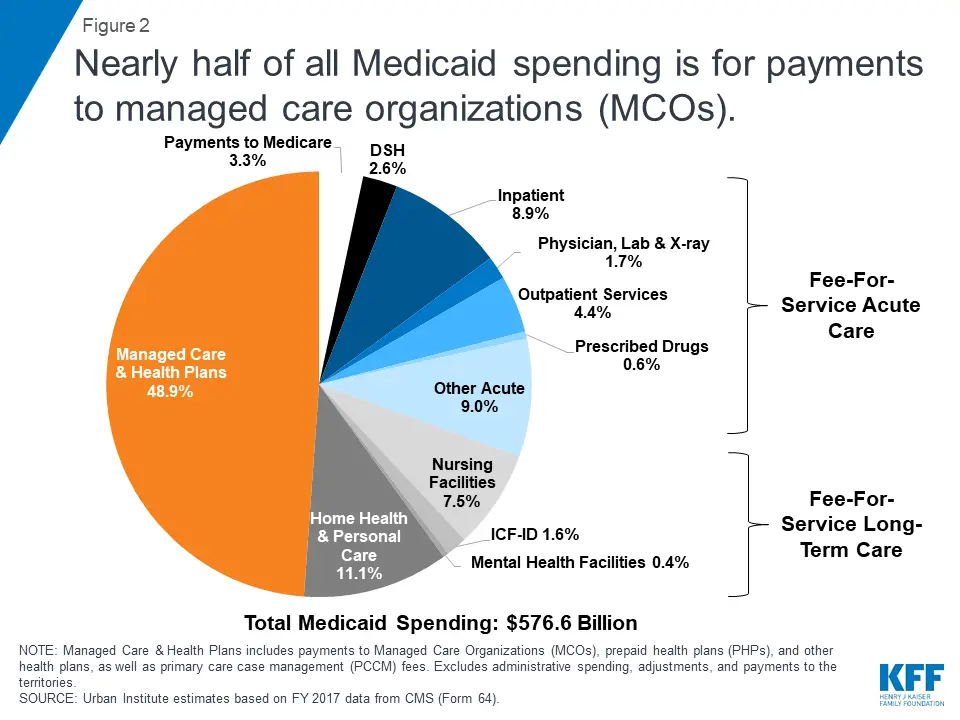

Chapter 1an Overview Of Medicaid Managed Care

Medicaid plays an integral role in financing health care services in the United States, accounting for 16 percent of total health spending and providing coverage for one out of every six Americans. Among the more than 60 million citizens who rely on Medicaid are about 9 million nonelderly people with disabilities, including 1.4 million children. While people with disabilities constituted 16.5 percent of Medicaid enrollees in fiscal year 2008, expenditures on their behalf represented 44 percent of total Medicaid outlays.

The Medicaid program serves a diverse array of people with disabilities, ranging widely in age and type and severity of disability, and has an extraordinary impact on the health and quality of life of beneficiaries with disabilities. The program rolls include children with physical, sensory, intellectual, and developmental disabilities working-age adults with spinal cord and traumatic brain injuries children and adults with severe and persistent mental illnesses and low-income adults with other serious, chronic illnesses and disorders such as diabetes and cardiac and pulmonary diseases.

Medicare Advantage Managed Care

Created by FindLaw’s team of legal writers and editors

The Health Insurance for the Aged and Disabled Act, better known as “Medicare,” strives to make health insurance available to nearly every American 65 and older. Medicare services come in two basic types, “fee-for-service” and “managed care.” In theory, managed care attempts to consolidate and coordinate all of a patient’s health care services into a single network in order to maximize benefits and minimize costs.

Medicare Advantage managed care is provided by groups such as HMOs and PPOs and has become the preferred method of coverage because of the potential cost savings that it offers. The following is an overview of Medicare Advantage managed care, including information about its cost structure and your options.

You May Like: Is Silver Sneakers Available To Anyone On Medicare

What Is Medicare Managed Care

Medicare managed plans are an alternative to original Medicare . Sometimes referred to as Medicare Part C or Medicare Advantage, Medicare managed care plans are offered by private companies.

These companies have a contract with Medicare and need to follow set rules and regulations. For example, plans must cover all the same services as original Medicare.

You can choose from among a few kinds of Medicare managed care plans. The plan types are similar to what you mightve had in the past from your employer or the Health Insurance Marketplace.

Types of Medicare managed care plans include:

Three Different Kinds Of Managed Care Plans Are Available

Most likely, youve come across this terminology: HMO , PPO and POS .

- HMO: lower monthly premiums, comprehensive benefits

With an HMO plan, a primary care physician typically must be selected. The PCP is responsible for coordinating all the members healthcare a referral is often required before seeing a specialist or another physician. HMOs also have provider networks, and require healthcare services within their network.

- PPO: offers provider flexibility, higher monthly premiums

Like an HMO, PPO plans also have a network. The big difference is that members can go out of network for their healthcare often without a referral but they will pay more. Most of the time, monthly premiums are higher than an HMO.

- POS: benefit levels vary for in-network vs. out-of-network

POS plans are much like HMOs in that members must select a primary care physician. Theyre also similar to PPOs members can seek healthcare outside the network but they will pay more. Monthly premiums are also typically higher than an HMO.

Don’t Miss: What’s The Difference Between Medicare And Medicaid

What Are Some Managed Care Nurse Duties

Duties commonly carried out by managed care nurses include the following:

- Closely assess a patient’s emotional, physical, and psychological state in order to ensure they receive timely interventions and quality care

- Act as a link between patients, healthcare providers, insurance companies, and doctors to ensure effective low-cost healthcare

- Teach patients, along with their loved ones or caregivers, about preventive care measures

- Encourage regular doctor visits and staying up to date on vaccinations to help patients maintain their health and to reduce medical costs

- Assess the care plans of patients and make recommendations to ensure efficacy and cost-effectiveness

Get Legal Help With Your Medicare Advantage Managed Care Plan

Signing up for Medicare typically doesn’t involve legal disputes or discrepancies, but everyone’s situation is different and you may need some legal muscle on your side. For instance, you may have a billing dispute that involves Medicare and other parties. If you need legal assistance with a Medicare managed care issue, reach out to a local health care attorney today.

Thank you for subscribing!

Don’t Miss: Does Medicare Part B Cover Prolia Shots

How Does Medicare Advantage Work

When you enroll in Medicare, you automatically join Medicare Part A, which covers your hospitalization costs, also known as inpatient services.

If you want outpatient coverage, which includes screenings, lab tests, doctor’s visits, etc., then you have to enroll in Medicare Part B and pay a monthly premium.

Medicare Part A and Part B are known as Original Medicare, and it covers your basic inpatient and outpatient services.

Who Benefits From Medicare Advantage Managed Care

There are four basic players in the managed care system: the government, the insurance company, doctors, and the patient. Understanding the dymanics among these players — and, more to the point, who benefits — is crucial when considering such a plan.

1. The Government

The federal government is the big spender in providing Medicare, paying most of the insurance premiums in these plans. In theory, at least, it has the most to gain in terms of cost savings. This is not always the case, however, because managed care only lowers the price of the health care service , which is a cost borne by the insurance company, not the government.

This means that the true cost savings of managed care pass directly to insurance companies, who may or may not pass on the savings to the government through insurance premiums.

2. Insurance Companies

Insurance companies are the greatest beneficiaries of managed care, since it focuses on lowering the cost of the actual service. Like any business, when an insurance company lowers the costs of doing business, this results directly in larger profits. So why would an insurance company pass on its profits in the form of lower premiums?

3. Doctors and Hospitals

The end result is fewer options for patients and greater profits for insurance companies.

4. Patients

Also Check: What Is A Medicare Claim Number

Medicare Managed Care: Growing Enrollment Adds Urgency To Fixing Hmo Payment Problem

HEHS-96-21Skip to Highlights

Pursuant to a congressional request, GAO reviewed Medicare payments to health maintenance organizations , focusing on: current trends in Medicare beneficiary enrollment in HMO flaws in Medicare’s rate-setting method that prevent it from realizing potential savings from HMO and the Health Care Financing Administration’s efforts to test HMO payment reforms.

What Is The Difference Between Medicare And Medicare Managed Care

There are different ways to receive your Medicare benefits, including Original Medicare , Original Medicare with Medigap, and Medicare Managed Care. Medicare Managed Care plans are legally required to include all the services provided under Original Medicare but they come with a variety of additional benefits. There is also no need to buy a Medigap plan when you have Managed Care in fact you cannot have both. With so many different plans and options, we want to help break it down for you.

You May Like: How To Qualify For Medicare In Florida

Managed Care Vs Indemnity

Indemnity health insurance plans are fee-for-service plans. Before HMOs, PPOs, and others, Indemnity plans were the main plans to choose from. Indemnity plans pre-determine the percentage of what they consider a reasonable and customary charge for certain services. Carriers pay a percentage of charges for a service and the member pays the remainder.

Costs fluctuate from physician to physician no set contracts are in place. That means insurance companies can bill the beneficiary for anything the plan doesnt cover. Members will receive reimbursement for medical expenses .

Indemnity plans have no provider network, members can visit the doctor of their choice. Contrarily, managed care plans have a network of providers, with different plan options.

How Does Original Medicare Work

Original Medicare is a government-funded medical insurance option for people age 65 and older. Many older Americans use Medicare as their primary insurance since it covers:

- Inpatient hospital services. These benefits include coverage for hospital visits, hospice care, and limited skilled nursing facility care and at-home health care.

- Outpatient medical services . These benefits include coverage for preventive, diagnostic, and treatment services for health conditions.

Original Medicare generally doesnt cover prescription drugs, dental, vision or hearing services, or additional healthcare needs.

However, for people who have enrolled in original Medicare, there are add-ons such as Medicare Part D prescription drug coverage and Medicare supplement plans that can offer additional coverage.

Also Check: How To Sign Up For Medicare Online

How To Become A Managed Care Nurse

Typically, before making the transition into managed care nursing, individuals will gain several years of clinical experience as a traditional RN, working in public or private settings. Some managed care nurses will have backgrounds in social work or social services before choosing to go into nursing. A strong understanding of medical insurance organizations, processes, benefits, and resources is a must for this job role.

After gaining a number of years of clinical experience, nurses can seek out a Certification in Managed Care Nursing credential through the American Board of Managed Care Nursing.

Managed Care Vs Medicare Supplement Insurance

Some people confuse Medicare Managed Care with Medicare Supplement Insurance, which is also known as Medigap.

But they are not related to each other and provide coverage in different ways.

With Medicare Managed Care, you are still getting your coverage through Medicare, but your benefits are managed by an insurance company.

With Medigap, your coverage comes from a private insurance company to fill any gaps in your Medicare coverage .

Medicare Supplement Insurance may cover costs for expenses within Medicare such as copayments, deductibles, and coinsurance. It may also cover you during international travel, which is not covered by regular Medicare.

To be eligible for Medicare Supplement, you must have Medicare Parts A and B, just like Medicare Managed Care. Additionally, you have to pay a premium to the private insurance provider for your Medigap coverage.

You May Like: Does Medicare Pay For Catheters