When Can I Enroll

You should know that you dont have to enroll in Medicare Part C coverage. If youre on Medicare and you choose not to enroll in Part C, you will continue to receive your Medicare Part A and/or Part B benefits, as well as any drug coverage you may have from a stand-alone drug plan. If you do decide to enroll in Medicare Advantage, there are different enrollment periods in which you may do so. These include specific dates during the year, when you turn 65, or when you are under 65 and have a disability. Below are 4 types of enrollment periods for Medicare Advantage plans.

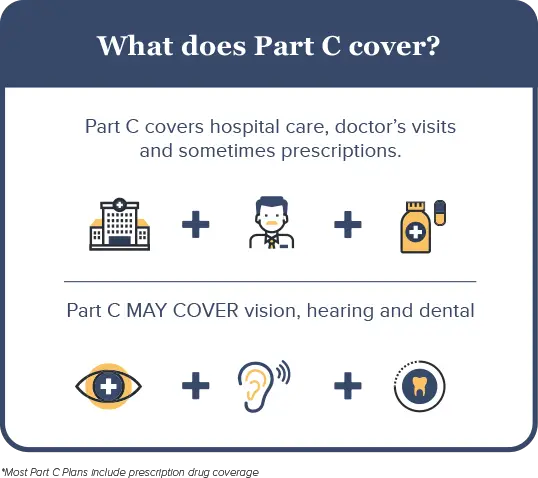

What Does Medicare Part C Cover For Inpatient Care

Medicare Part C generally provides the same inpatient benefits as Medicare Part A. These include:

- Inpatient hospital care if you have a doctors order and the hospital is in your plans network. Depending on your plans rules about how you obtain inpatient benefits, you may need a referral and prior authorization. Hospital care may be for acute illness or injury, rehabilitation, long-term care, or mental health.

- Cost-sharing is structured differently with a Medicare Advantage Plan. Original Medicare Part A charges a deductible for each benefit period. Medicare Advantage Plans typically charge a copay for the first several days of an inpatient stay. If you stay longer, your copay is $0. A transfer from one type of inpatient facility to another is considered a new admission and initial copays apply.

- Skilled nursing facility care and rehabilitation services provided on a continuous, daily basis in an in-network skilled nursing facility . Services are paid for in accordance with Medicare guidelines.

When you receive services in an inpatient setting, your Medicare Advantage Plan covers medically necessary care in accordance with Medicare guidelines and your plans rules. These services typically include:

- A semi-private room

- Physical, occupational, and speech therapy

Medicare Part C Medicare Advantage

A Medicare Advantage Plan is another plan choice you may have as part of Medicare. These plans, sometimes called Part C or MA Plans, are offered by private insurance companies approved by Medicare. The premiums are a flat rate, regardless of age.

If you join a Medicare Advantage Plan, it will provide:

- Medicare Part A coverage

- Limits on the out-of-pocket costs you pay

Most include:

- Provider networks to help manage costs

- Extra coverage, such as vision, hearing, dental, and/or health and wellness programs

In all types of Medicare Advantage Plans, youre always covered for:

- Emergency and urgent care

Plans can charge different copays, coinsurance, and deductibles for these services.

Depending on the Medicare Advantage Plans offered in your area, you may have these options:

Also Check: When Can You Join Medicare

Recommended Reading: How To Compare Medicare Drug Plans

What Does A Medicare Advantage Plan Cost

Depending on your Medicare Advantage plan, the costs you pay out-of-pocket can vary:

- You may pay a deductible, a certain amount you must meet before your plan begins to pay.

- There may be copays for doctor visitsthis is a flat fee usually due at the time of the visit.

- You may have to pay a share for lab services and medical equipment.

- You will pay a monthly plan premium if there is one.

- You will continue to pay the Original Medicare Part B monthly premium, as well.

- Additional coinsurance or copays if you see providers outside your plan network.

To help control your costs, make sure you understand the terms of your plan and the out-of-pocket costs you may be required to pay.

Dental Vision And Other Extra Benefits

Another advantage of enrolling in Medicare Part C is that many plans cover dental and vision services, which arent covered by Original Medicare. Depending on the plan selected, Medicare Part C may cover fillings, tooth extractions, cleanings, dentures, and other dental services. Covered vision services may include eye exams, glasses, or contact lenses. Some plans also cover hearing aids, or the exams needed to ensure hearing aids fit properly. Each plan has its own rules for determining whats covered and whether you need a referral before receiving covered services.

Don’t Miss: What Medicare Advantage Plans Cover Acupuncture

Why Do I Need To Buy A Private Health Plan

Private Medicare health plans like Medicare Advantage or Medicare Cost plans cover everything Original Medicare does, and usually include more coverage for services you might need. Plus, they can include extra perks and benefits.

Find out more in the article, 4 reasons to buy a private health plan.

Rules For Medicare Advantage Plans

Medicare pays a fixed amount for your care each month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare.

Each Medicare Advantage Plan can charge different

. They can also have different rules for how you get services, like:

- Whether you need areferralto see a specialist

- If you have to go to doctors, facilities, or suppliers that belong to the plan for non-emergency or non-urgent care

These rules can change each year.

Don’t Miss: How To Renew Medicare Benefits

How Do You Enroll In A Medicare Advantage Plan

If you want to enroll in a Medicare Advantage plan, you must:

- Be eligible for Medicare

- Be enrolled in both Medicare Part A and Medicare Part B

- Live within the plans service area

- Not have end-stage renal disease

Want more information about enrollment? Visit Medicare Part C Eligibility and Enrollment Information

Key Things To Remember About Medicare Advantage Plans

Medicare Advantage plans are diverse and unique, so here are some key things to remember.

- Medicare Advantage plans are provided by private insurers only.

- You must be enrolled in Medicare Part A and Part B before you can enroll in Part C.

- Medicare Advantage plans include coverage for items under Medicare Part A and B and may include coverage for other health care benefits such as prescriptions drugs, dental and vison.

- Costs, plan benefits and plan availability vary by plan provider and geographical location.

- All Medicare Advantage plans have an annual out-of-pocket maximum.

You May Like: What Age Am I Medicare Eligible

Costs For Medicare Advantage Plans

What you pay in a Medicare Advantage Plan depends on several factors. In most cases, youll need to use health care providers who participate in the plans network. Some plans wont cover services from providers outside the plans network and service area.

Medicare Advantage Plans have a yearly limit on your out-of-pocket costs for all Part A and Part B services. Once you reach this limit, youll pay nothing for services Part A and Part B cover.

Are You Eligible For Medicare Part C

You qualify for Medicare Part C if you already have Medicare parts A and B, and if you live in the service area of the Medicare Part C provider you are considering.

Due to law passed by Congress that went into effect in 2021, people with end stage renal disease are eligible to enroll in a broader range of Medicare Advantage plans. Before this law, most plans would not accept you or limit you to a Special Needs Plan if you had a diagnosis of ESRD.

what you need to know about enrolling in medicare

- Enrollment into Medicare is time-sensitive and should be started roughly 3 months before you turn age 65. You can also apply for Medicare on the month you turn 65 and the 3 months following your 65th birthday although your coverage will be delayed.

- If you miss the initial enrollment period, open enrollment runs from October 15 through December 7 every year.

- You can sign up for original Medicare online through the Social Security Administration website.

- You can compare and shop for Medicare Part C plans online through Medicares plan finder tool.

There are two main types of Medicare Advantage plans offered, which well go over in detail next.

Don’t Miss: Do You Have To Take Medicare

Medicare Part C Coverage

Unlike Original Medicare, which has the same benefits and out-of-pocket costs everywhere in the U.S., Medicare Advantage coverage varies from one plan to another. Private health insurance companies issue the plans. These companies are allowed to design their coverage within certain parameters set by the federal government.

Some Medicare Advantage plans are Special Needs Plans designed to cater to enrollees with specific health needs. But most Medicare Advantage plans are open to all beneficiaries, and it’s important to carefully compare the various options before selecting a plan.

Medicare Part C plans must cover all of the services covered by Medicare Part A and Part B .

Most Part C plans also provide Part D coverage for prescription drugs as of 2022, 89% of Medicare Advantage plans have integrated Part D coverage .

But the specifics of the coverage for Part A and Part B benefits will vary considerably from one Part C plan to another. And out-of-pocket costs will not be the same as they are under Original Medicare.

The majority of Part C plans also include additional benefits that aren’t covered by Original Medicare, such as dental and vision coverage, hearing exam/aid coverage, acupuncture, gym memberships, etc. The scope of these extra benefits varies widely from one plan to another.

The government-set cap is $7,550 in 2022, although many Part C plans have a maximum out-of-pocket cap that’s lower than this.

How To Find The Right Medicare Advantage Coverage For You

If youre approaching the age of 65, navigating another qualifying event or reviewing plan options ahead of the Medicare Advantage Open Enrollment period, there are several details to consider when comparing Medicare Advantage plans. To make that process easier, we created the downloadable checklist below.

You May Like: Are Lidocaine Patches Covered By Medicare

When Your Coverage Starts

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month.

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

Part B : Coverage starts based on the month you sign up:

|

If you sign up: |

|---|

How Do I Sign Up For Medicare Part C

To join a Medicare Advantage plan, you must qualify for Original Medicare, which is available to people aged 65 and older, and younger disabled individuals. Medicare Advantage plans are available to U.S. citizens, U.S. nationals, and other people who are lawfully present in the United States. You must also live in the service area covered by the plan. You must be enrolled in Medicare Part A and B to join a Medicare Advantage plan.

For people who meet the eligibility requirements, its important to compare Medicare Advantage plans, since coverage and costs vary. Youll have to enter your ZIP code to find plans in your area. After choosing a plan, its necessary to fill out an enrollment form and pay the required premium to receive coverage under Medicare Part C.

LeRon Moore has guided Medicare beneficiaries and their families as a Medicare professional since 2007. First as a Medicare provider enrollment specialist and now a Medicare account executive, Moore works directly with Medicare beneficiaries to ensure they understand Medicare and Medicare Advantage Plans.

Moore holds a bachelors degree from Southern New Hampshire University and is A+ Certified with a Medical Records Clerk Certification and Medical Terminology Certification from Midlands Technical College.

Don’t Miss: How To Become A Medicare Provider In Florida

Medicare Part D: Prescription Drugs

Prescription drug coverage, known as Part D, is also administered by private insurance companies. Part D is optional and is normally included in any Medicare Advantage plan. Depending on your plan, you may have to meet a yearly deductible before your plan begins covering your eligible drug costs. Some Part D plans have a co-pay.

Medicare prescription drug plans have a coverage gapa temporary limit on what the drug plan will cover. The coverage gap is often called the “doughnut hole,” and this gap kicks in after you and your plan have spent a certain amount in combined costs. For example, in 2022 the donut hole occurs once you and your insurer combined have spent $4,430 on prescriptions.

Once you have paid $7,050 in out-of-pocket costs for covered drugs, you have reached the level of “catastrophic coverage,” for 2022 in out-of-pocket costs for covered drugs. This means you are out of the prescription drug “donut hole” and your prescription drug coverage begins paying for most of your drug expenses again.

Many states have insurance options that will close the coverage gap, but these may require paying an additional premium.

Disenrolling From Medicare Advantage

Besides certain SEPs that allow you to disenroll from or drop your Medicare Advantage plan, you can drop your plan and return to Original Medicare during the Medicare Open Enrollment Period . October 15 to December 7 is the Medicare Open Enrollment Period. It allows you to disenroll from Medicare Advantage and re-enroll in Original Medicare with coverage effective January 1. During this time, you can also:

- Switch from your Part C plan to another

- Join, drop, or switch prescription drug plans

Read Also: Can I Receive Medicare And Medicaid

What To Do If Something You Need Isn’t Covered By Medicare Part C

If you do not have other prescription drug coverage, join an HMO or PPO that includes it. You cannot have a separate drug plan and an HMO or PPO at the same time. You can only purchase a separate drug plan if you are enrolled in a Part C plan that doesnt offer drug coverage, such as a PFFS or MSA.

You may be able to get other coverage under a second insurance plan. For example, if you are still working, you may be able to combine your Medicare Part C coverage with the coverage provided under an employer-sponsored health insurance plan. If you have private insurance, that plan usually pays first if your employer has at least 20 employees. Once the private plan processes the claim, a second claim is submitted to the Medicare Advantage insurer. You are responsible for any charges not covered by either plan.

Paying A Premium For Medicare Part C

A premium is an amount you pay each month to purchase your coverage . Some Medicare Part C plans have premiums, while others do not.

People with Medicare Part C still have to pay the monthly premium for Medicare Part B since the Part C plan provides the benefits of Medicare Part A and Part B combined into one private plan.

For most Medicare beneficiaries, Medicare Part A does not have monthly premiums. But for those who don’t have enough work history to qualify for premium-free Medicare Part A, there will be a premium for Part A as well as Part B.

In 2022, the Part B premium for most Medicare beneficiaries is $170.10/month . So most people with Medicare Part C have to pay at least that amount for their coverage.

As of 2022, 59% of Medicare Part C plans have no additional premium other than the premium for Part B, and these are the plans that tend to be favored by Part C enrollees. The majority of these plans also include Part D coverage in addition to the Part A and Part B benefits, but the beneficiaries only pay the premium for Part B.

Some of these plans even have a “giveback” rebate that pays a portion of the Part B premium on the enrollee’s behalf. So in some areas, it’s possible to have Medicare coverage under a Part C plan and pay less than the standard Part B premium each month.

The other 41% of Part C plans have a premium that has to be paid in addition to the Part B premium. These premiums vary from one plan to another.

You May Like: How Long Does It Take To Get Medicare After Applying

Pros And Cons Of Medicare Advantage Plans

Medicare Advantage plans tend to benefit healthier people who use fewer services with lower costs, says Orestis. But regardless of your health care needs, there are pros and cons of Medicare Advantage plans worth considering. Below, our experts break down some of the more common advantages and disadvantages of MA plans.

| Pros | Cons |

|---|---|

| Many plans feature $0 monthly premiums. Most of the time, you dont pay anything upfront for services, excluding the Part B premium, which everyone must pay each month, says Ari Parker, co-founder and head advisor at Chapter, an independent Medicare advisor organization. Theres an out-of-pocket limit. Medicare Advantage plans dont impose a lifetime coverage limit, and they do provide a maximum out-of-pocket limit guarantee, which protects enrollees from costs of expensive treatments spiraling out of control, says Orestis.They provide comprehensive coverage. These plans often include ancillary benefits, such as dental, vision and hearing coverage, which are not typically provided by Original Medicare. | Many plans do have network restrictions. One of the limitations of Medicare Advantage plans is that they often impose network restrictions on the providers you can see, says Parker. They are more similar to the HMO or PPO plans you may have had through an employer. |