What About The Part D Late

Medicare imposes a late-enrollment penalty if you dont purchase Part D coverage before the end of your initial enrollment period the seven-month period starting three months before the month you turn 65 or if youve gone 63 consecutive days or more without creditable prescription drug coverage. This penalty is in addition to your monthly premium cost and remains in effect for as long as your Medicare drug coverage continues.

The penalty is 1% of the national base beneficiary premium per month that you were eligible to enroll but didnt. Theres no cap on the number of months. If you thought you didnt need a Part D plan because you werent taking any prescriptions, then 72 months later you need an expensive drug, youll be hit with a 72% penalty. Its applied every month for the rest of your retirement.

Heres how it works:

M = number of full months you were eligible for drug coverage but didnt have it.NBBP = national base beneficiary premium, which is $33.37 in 2022.

Monthly penalty = x NBBP.

The result is rounded to the nearest 10 cents. Since the national base beneficiary premium can change every year, the monthly penalty amount you owe may increase over time.

Here’s an example:

Suppose that after your initial enrollment period ended, you waited another 24 months before purchasing prescription drug coverage.

Monthly penalty = x $33.37.Monthly penalty = $8.01, or $8 after rounding.

What Are Medicare Advantage Plans Plus

Medicare Advantage plans, also known as Part C plans, provide coverage beyond Original Medicare Parts A and B . These plans are offered through Medicare-approved private insurance companies, not the federal government.

A Medicare Advantage plan is an alternative to having a Part D and Medicare Supplement plan. You cannot have both a Medicare Advantage plan and a Medicare Supplement plan.

Medicare Advantage plans offer the same coverage as Medicare Parts A and B. They also include prescription drug coverage and may include extra benefits like vision, hearing and dental, as well as access to care management services.

These plans also provide financial protection through annual limits on out-of-pocket expenses. Medicare Advantage plans offer a low or no-cost monthly health plan premium beyond what you pay for Part B and give you access to care from doctors and hospitals that are within the plan’s network.

To find out which doctors are included in the network, contact Sharp Health Plan or UnitedHealthcare, which offer Medicare Advantage plans accepted by Sharp.

What Services Does Medicare Part B Pay For

Medicare Part B helps pay for medical care you get when youre not in the hospital. This includes visits to the doctor mental health care home health services screening exams, procedures and tests supplies and equipment occupational, speech, and physical therapy immunizations and other outpatient services.

Part B will only pay for these expenses when they are medically necessary. If theyre not determined to be medically necessary, Part B wont pay for them.

You May Like: Does Medicare Pay For Cosmetic Surgery

How Much Will Medicare Cost In 2022

Find Cheap Medicare Plans in Your Area

For all Medicare plans, costs will vary depending on what plans you decide to purchase, the company you purchase your plan from, your income and sometimes your age. For this reason, you should carefully balance your coverage needs and the costs of the plans when choosing the right mix of Medicare policies.

Medicare Supplement Insurance :

- Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

- You must keep paying your Part B premium to keep your supplement insurance.

- Helps lower your share of costs for Part A and Part B services in Original Medicare.

- Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

You May Like: How Much Do Medicare Leads Cost

What To Do Next When You Become Eligible For Medicare

If you currently have a health plan through Covered California:

If you dont currently have a health plan through Covered California:

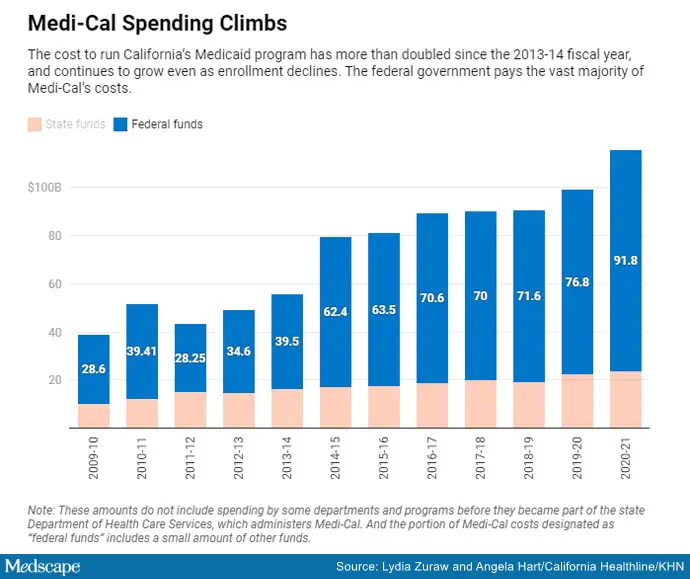

If youre currently enrolled in Medicare Part A, or eligible for premium-free Medicare Part A, you cant enroll in new coverage through Covered California. This is because Medicare Part A is considered minimum essential coverage under the Affordable Care Act. But depending on your income and assets, you may be eligible for additional coverage through Medi-Cal. Once youre enrolled in Medicare, you can contact your local county office or complete the Covered California application to see if you also qualify for Medi-Cal.

Since 2015 The Highest Share Of Medicare Advantage Enrollees Are In Plans That Receive High Quality Ratings

For many years, CMS has posted quality ratings of Medicare Advantage plans to provide beneficiaries with additional information about plans offered in their area. All plans are rated on a 1 to 5-star scale, with 1 star representing poor performance, 3 stars representing average performance, and 5 stars representing excellent performance. CMS assigns quality ratings at the contract level, rather than for each individual plan, meaning that each plan covered under the same contract receives the same quality rating most contracts cover multiple plans.

In 2022, nearly 9 in 10 Medicare Advantage enrollees are in plans with a rating of 4 or more stars, an increase from 2021 and the highest share enrolled since 2015. An additional 3 percent of enrollees are in plans that were not rated because they are in a plan that is too new or has too low enrollment to receive a rating. Plans with 4 or more stars and plans without ratings are eligible to receive bonus payments for each enrollee the following plan year. The star ratings displayed in the figure above are what beneficiaries saw when they chose a Medicare plan for 2022 and are different than what is used to determine bonus payments.

Don’t Miss: How To Apply For A Replacement Medicare Card

Most Medicare Advantage Enrollees Have Access To Some Benefits Not Covered By Traditional Medicare In 2022 And Special Needs Plan Enrollees Have Greater Access To Certain Benefits

Medicare Advantage plans may provide extra benefits that are not available in traditional Medicare. The cost of these benefits may be covered using rebate dollars paid by CMS to private plans. In recent years, the rebate portion of federal payments to Medicare Advantage plans has risen rapidly, totaling $432 per enrollee annually for non-Medicare supplemental benefits, a 24% increase over 2021. The rise in rebate payments to plans is due in part to incentives for plans to document additional diagnoses that raise risk scores, which in turn, generate higher rebate amounts that make it possible for plans to provide extra benefits. Plans can also charge additional premiums for such benefits, but most do not do this. Beginning in 2019, Medicare Advantage plans have been able to offer additional supplemental benefits that were not offered in previous years. These supplemental benefits must still be considered primarily health related but CMS expanded this definition, so more items and services are available as supplemental benefits.

Medigap Vs Medicare Advantage Plans

Medigap and Medicare Advantage Plans are very different. You are eligible for either type of plan when you are enrolled in Medicare Part A and B, but you cannot have both at the same time. Both Medigap and Medicare Advantage Plans are offered by Medicare-approved private insurance companies. You can only choose to join plans that are available in your area.

Compare your options:

|

||

| When its best | If you frequently access your Part A and B benefits, want your out-of-pocket expenses covered, and want to choose your providers. | If you want all of your health and drug coverage through one plan, want extra benefits, and are willing to follow your plans rules and network restrictions. |

Read Also: Does Medicare Part B Cover Blood Tests

California Medicare Supplement Plan Enrollment

Medicare Supplement plans are the perfect way to protect yourself from high medical expenses. Some people might enroll in Medigap policies because they want the most comprehensive health insurance.

Others may need it due to age or physical fragility, making them more susceptible to illnesses that can strike without warnings, such as diabetes, heart disease, or a stroke!

Medicare Supplements enrollees make up 27.2% of all Californias Medicare Beneficiaries. 1,035,631 Californians are enrolled in Medicare Supplement insurance policies thus far, but it may rise as more people are looking for quality healthcare options.

| Plan | |

| 25 | 65,187 |

Its hard to understand which is right for you with the different Medicare plan options. Fortunately, the government has implemented a standardization system that makes things simple!

Massachusetts, Wisconsin, and Minnesota are the only states that do not follow the federal standardization process. Plans in these states still follow all national guidelines, such as allowing you can see any doctor nationwide that accepts Medicare. The plan benefits of their programs work differently than all other states.

What Affects Medicare Part D Costs Each Year

Several factors can play into determining the cost of a Medicare Part D plan, such as:

- Drug formularyEach Medicare Part D plan contains a formulary, which is a list of drugs covered by the plan. Covered drugs are divided up into different tiers. Generic drugs are typically on lower tiers and cost less, while brand name drugs and specialty drugs are typically on higher tiers and cost more.

- Local competitionMedicare Part D plans are sold by private insurance companies. These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers.

- Cost-sharingSome Medicare Part D plans have deductibles and copayments or coinsurance. The cost of your Part D premium may depend on the amounts of coinsurance or copayments you pay with your plan, as well as whether or not your plan has a deductible.

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

Copayments and coinsurance are the amounts that you must pay once your plans coverage does begin.

A copayment is usually a fixed dollar amount while coinsurance is most often a percentage of the cost . Plans might have different copayment or coinsurance amounts for each tier of drugs.

Also Check: How Old Do You Have To Be To Draw Medicare

How Do I Know If A Health Insurance Plan Is Right For Me

When reviewing your Medicare options, Medicare Beneficiaries are eligible for a California Medicare Supplement Insurance plan or a Medicare Advantage plan. Both of these plans require you to be enrolled in Medicare Parts A and B before you are able to apply for either option.

Medicare beneficiaries choose a Medicare Supplement plan for a number of reasons, including:

Medicare Beneficiaries apply to Medicare Advantage plans for the following reasons:

As Soon As You Are Automatically Enrolled In Medicare

You will no longer qualify for financial help to pay for your Covered California plan after your two-year waiting period ends. You will need to cancel your health plan through Covered California at least 14 days before you want your coverage to end. If you were enrolled in Medi-Cal instead of Covered California, you can ask your local county office if you will continue to qualify for other Medi-Cal programs that can lower your Medicare costs.

Also Check: When Is Open Enrollment For Medicare

Do You Need A Medicare Supplement In California

| Should you consider a Medicare supplement? | |

Yes, if you:

|

No, if you:

|

Learn More About Your Medicare Advantage Prescription Drug Coverage Options

The cost of a Medicare Part D plan may vary from one insurance company to the next and from one location to another.

One way to learn about your Medicare prescription drug coverage options is to speak with a licensed insurance agent. You can compare Medicare Advantage plan costs in your area and find a plan that covers the prescription drugs you need.

Also Check: Does Blue Cross Blue Shield Offer A Medicare Advantage Plan

What Is A Medigap Plan

A Medicare Supplement plan which is also knowns as a Medigap plan is a federal Medicare program established to supplement Original Medicare. The Medigap plan is a secondary insurance policy that can help pay some or all of the out-of-pocket costs that are not covered by Original Medicare, such as copayments, coinsurance, and deductibles.

Because a Medigap plan is a secondary policy it does not replace Original Medicare but rather fills in the gaps of coverage. As a result, Medicare Beneficiaries keep all of their earned health care benefits while increasing the available coverage.

There are 10 different types of Medigap plans that are standardized by the federal government, each with its own set of benefits.

Similar to the Affordable Care Act which is broken down by specific metal plans Medicare Supplemental plans are identified by a specific letter .

The most popular type of plan was the Medigap Plan F prior to January 1, 2020, which covers the most out-of-pocket costs including your Medicare Part B deductible. After this date, Plan F was no longer available to new Medicare beneficiaries,s, and Medigap Plan G is now the most popular plan for those who live in California and beyond.

How Much Does Medicare Cost

The total cost of Medicare for you will depend on what parts and plans you select for your coverage.

| Medicare plan |

|---|

- Monthly cost: Usually free

- Annual deductible in 2022: $1,556

According to the Medicare program, 99% of enrollees get Medicare Part A for free. Those who do not qualify will pay between $274 and $499 per month in 2022, with the exact amount based on how much they or their spouse have paid in Medicare taxes.

Medicare Part A costs nothing for most enrollees due to their previous participation in the workforce. If you have worked for more than 10 years or 40 quarters, then you are eligible to pay $0 for Medicare Part A. This is because, during your working years, you contributed to Social Security and Medicare payroll taxes.

A large cost for Medicare Part A is the deductible, which is the amount you have to pay for medical care out of pocket before the plan’s benefits begin.

For 2022, the Medicare Part A deductible is $1,556. That’s a $72 increase from 2021. However, this cost is usually covered if you enroll in a Medigap policy or Medicare Advantage.

Don’t Miss: Is Ed Medication Covered By Medicare

Medicare In California By The Numbers

Table reflects the latest Beneficiary Demographics Data: Medicare Geographic Variation by National, State & County

Average HCC Score:The Hierarchical Condition Category score gauges a populations overall health. The score is based on a value of 1.0. Populations with an HCC score of less than 1.0 are considered relatively healthy. The score can be used to estimate health costs.

Does your plan offer extra benefits and cost savings?