Does Medicare Cover Bathtub Conversions

Bathtub conversions like walk-in bathtubs arent considered Durable Medical Equipment, they are home modifications. These things dont necessarily improve your health conditions, instead, they make daily tasks easier.

Medicare only covers if its going to improve your condition. Dont expect Medicare to cover the tub remodel or installation.

Also Check: What Is The Deadline To Sign Up For Medicare

Medicare Part B Rarely Covers Nonemergency Transportation

If you want a ride to your doctors appointment or another nonemergency situation, Medicare Part B is unlikely to pay for itexcept for cases where your doctor deems medical transport as medically necessary for you.

Residents of some states may easily be able to get nonemergency transportation, however. If you live in one of the following states, you may be able to participate in a demonstration program for nonemergency transportation:

For more information, read about the company that contracts with Medicare: Fed Pro Services.

What Is Silver Sneakers

Silver Sneakers is a private health and fitness membership program designed for seniors. Itâs available at no cost to those enrolled in a participating Medicare Advantage plan. There are over 16,000 participating Silver Sneaker gym facilities and 70 different types of health and fitness classes available nationwide.

If you join the Silver Sneakers program through a Medicare Advantage plan, you get a no-cost basic gym membership at any participating fitness center across the country. You can also take Silver Sneakers classes, which may include everything from cardio to tai chi to yoga, at no cost. The Silver Sneakers Flex classes are a new type of community-based exercise class that take place both inside the gym and outdoors at places like public parks and walking paths.

Dont Miss: Mens New Balance Walking Sneakers

Also Check: What Are All The Parts Of Medicare

Which Medicare Plans Offer Silversneakers

Most leading insurance providers offer Medicare advantage or Medigap plans that participate in the Silver Sneakers program. It depends from your state and local area whether a plan is available to you.

Regular exercise has been found to help seniors to improve many conditions associated with aging, but make sure to ask your doctor before starting a fitness routine. In addition to a healthy workout, SilverSneakers is a great way for like-minded seniors to meet and socialize.

SilverSneakers® is a registered trademark of Healthways, Inc. © This website and its owner are not affiliated with the described programs or providers. This is not a recommendation or solicitation of insurance. Healthways, Inc. has neither reviewed nor endorsed this post. Although we strive to keep this website current, the information may be incorrect or have changed at the time you read it. Visit silversneakers.com for details.

Is Medicare Advantage Really Free Monthly Plan Premium Explained

You may be surprised to learn that some Medicare Advantage plans have a monthly plan premium of $0. Thats rightzero dollars per month. And that usually includes coverage for services that arent covered under Original Medicare.

For most of us, costs and coverage are the 2 main factors when it comes time to choose a Medicare Advantage plan. Learn more about the $0 monthly premium Medicare Advantage plans, including how they work and how to enroll.

Don’t Miss: Do You Really Need Medicare Supplemental Insurance

Whats The Cost Of Imbruvica With Medicare

The cost of Imbruvica can vary depending on the type of Medicare prescription drug plan you have.

Your Imbruvica prescription may need to go through a review process, called prior authorization, to see if your plan covers the drug. If your Medicare plan covers it, your cost can vary depending on your stage of coverage. For example, you may have a deductible you still need to meet.

You can contact your Medicare plan to verify that Imbruvica is covered and find out what your cost will be.

How Much Do Medicare Advantage Plans Cost

Even though Advantage enrollees have rights and protections under Medicare guidelines, the services offered and the fees charged by private insurers vary widely. A thorough understanding of how these plans work is key to the successful management of your personal health.

Advantage plans can charge monthly premiums in addition to the Part B premium, although 59% of 2022 Medicare Advantage plans with integrated Part D coverage are zero premium plans. This means that beneficiaries only pay the Part B premium .

But across all Medicare Advantage plans, the average premium is about $19/month for 2022. This average includes zero-premium plans and Medicare Advantage plans that dont include Part D coverage if we only look at plans that do have premiums and that do include Part D coverage, the average premium is higher.

Some Advantage plans have deductibles, others do not. But all Medicare Advantage plans must currently limit in-network maximum out-of-pocket to no more than $7,550. The out-of-pocket maximum had previously been $6,700 each year from 2011 through 2020, but it increased as of 2021, under new methodology that was finalized in 2018. CMS will continue to gradually change it over time, although its still $7,550 for 2022.

Copayments for doctors visits differ dramatically, as do the actual health care services and how often enrollees receive those services. Close attention to the details is necessary when assessing these plans.

You May Like: What Age Does Medicare Take Effect

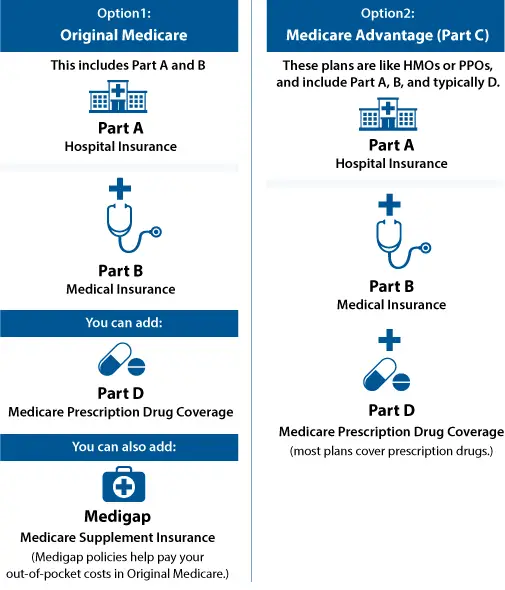

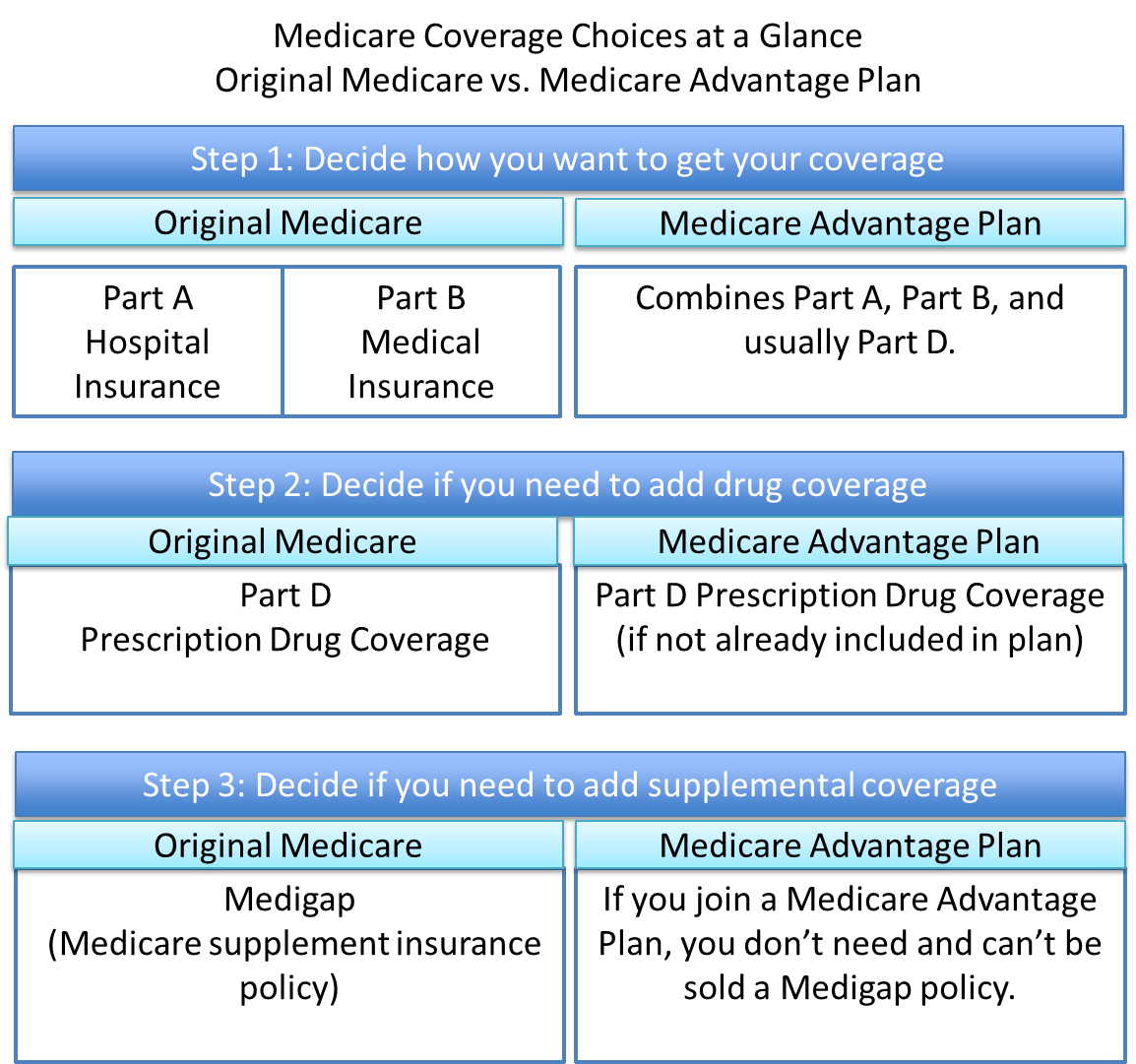

Covered Services In Medicare Advantage Plans

With a Medicare Advantage Plan, you may have coverage for things Original Medicare doesn’t cover, like fitness programs and some vision, hearing, and dental services . Plans can also choose to cover even more benefits. For example, some plans may offer coverage for services like transportation to doctor visits, over-the-counter drugs, and services that promote your health and wellness. Plans can also tailor their benefit packages to offer these benefits to certain chronically-ill enrollees. These packages will provide benefits customized to treat specific conditions. Check with the plan before you enroll to see what benefits it offers, if you might qualify, and if there are any limitations. Learn more about what Medicare Advantage Plans cover.

How Much Does An Aetna Silversneakers Membership Cost

The SilverSneakers benefit comes at no additional cost to your overall Aetna Medicare Advantage plan premium. Aetna Medicare plans will vary in cost from one location to another, and some plans may come with a $0 premium.

There is no deductible or copayment tied to the SilverSneakers benefit, so it does not cost you anything to utilize it.

Dont Miss: Best Sneakers For Outdoor Basketball

Read Also: What Are Cost Plans For Medicare

Look For The Plans’ Out

Medicare Advantage plans are required to put a cap on how much members may pay in out-of-pocket costs. After the cap is reached, the plan pays 100% for the rest of the year. Each plan sets its own cap, but it cant be higher than the maximum out-of-pocket limit set by Medicare each year. Ask the plan provider what their maximum out-of-pocket limit is. Deductibles, co-payments and co-insurance for medical services count toward this. Plan premiums and prescription drug costs do not.

What Do I Do If My Plan Drops Silversneakers

There seems to have been a recent trend of companies dropping coverage for SilverSneakers. Recently, several YMCAs across the country have discontinued their partnership with SilverSneakers, no longer allowing people with a SilverSneakers membership into the popular recreation center. Just last fall, Blue Cross Blue Shield of Tennessee dropped its contract with SilverSneakers entirely according to a story from the Nashville Post.

Luckily, Medicare beneficiaries arent necessarily out of luck. If your plan drops SilverSneakers, your plan may replace it with a similar program such as Silver& Fitwhich was the case for BCBS of Tennessee. Or, if you want only SilverSneakers, you may be able to switch to a plan that offers it. If you need help, consider speaking to a licensed agent.

Read Also: Does Medicare Cover Home Health Care For Seniors

Responsibilities Of Employers Under Msp

As an employer, you must:

- Ensure that your plans identify those individuals to whom the MSP requirement applies

- Ensure that your plans provide for proper primary payments whereby law Medicare is the secondary payer and

- Ensure that your plans do not discriminate against employees and employees spouses age 65 or over, people who suffer from permanent kidney failure, and disabled Medicare beneficiaries for whom Medicare is secondary payer.

Please select Employer Services in the Related Links section below for more information.

What To Do So That You Avoid Over

If you want to pay the least amount possible for their DME, you must make sure that you use a Medicare-enrolled Participating supplier who accepts assignment.

This ensures that you are only going to pay your Medicare co-pay of 20% of the Medicare-approved price, and if you havent already met it, your annual Medicare Part B deductible.

Recommended Reading: How To Find The Best Medicare Prescription Plan

Medicare Advantage Open Enrollment

During the open enrollment period, which runs from October 15 to December 7 each year, you can join, switch or drop a plan for your coverage to begin on January 1 of the following year.

If youre already enrolled in a Medicare Advantage plan, you can switch to a different Medicare Advantage plan or Original Medicare during the Medicare Advantage open enrollment period, which starts on January 1 and ends on March 31 annually. You can only make one switch during that time period.

If youre already enrolled in Original Medicare , you may be eligible to switch to a Medicare Advantage plan . You must be at least 65 years old or have certain disabilities, such as permanent kidney failure or amyotrophic lateral sclerosis . If the Medicare Advantage plan you choose doesnt already have prescription drug coverage, you will have the option to enroll in Part D.

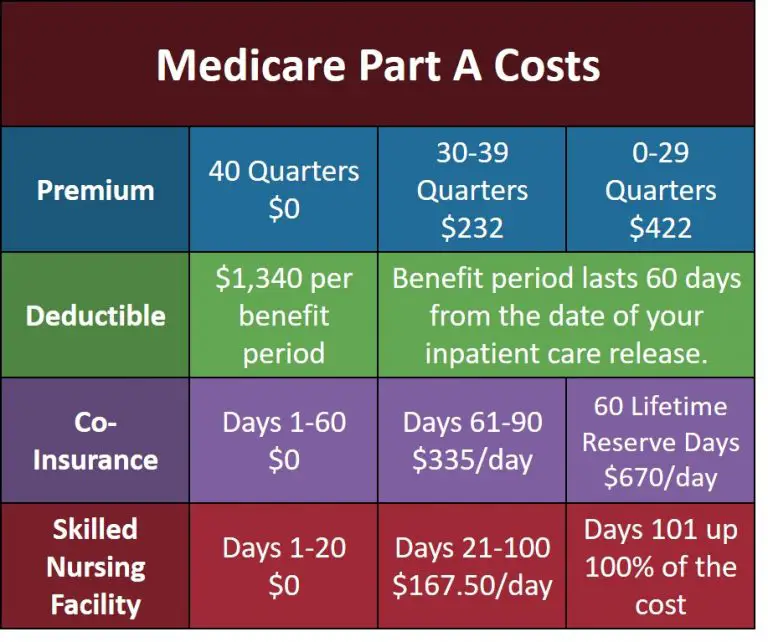

How Much Does Original Medicare Part A Cost

What it helps cover:

- Home healthcare

What it costs:

Most people generally don’t pay a monthly premium for because they paid Medicare taxes while they were working. However, there are costs you may have to cover.

Other Part A costs for 2022:

- An annual deductible of $1,556 for in-patient hospital stays.

- $389 per day coinsurance payment for in-patient hospital stays for days 61 to 90.

- After day 91 there is a $778 daily coinsurance payment for each lifetime reserve day used.

- After the maximum 60 lifetime reserve days are exhausted, there is no more coverage under Part A for inpatient hospital stays.

You May Like: How To Change Medicare Direct Deposit

Medicare Capitation Rates California Counties

The monthly capitation rate is the amount Medicare pays Medicare Advantage plans. The rates are based on county per individual enrolled in Medicare Advantage. These rates are only for Parts A and B of original Medicare. If the Part D prescription drug coverage is included in the plan, there is an additional capitation amount. The highest monthly capitation amount is $1,301.36 in Inyo County. The lowest monthly amount is $939.40 for Imperial County. Some plans can receive a higher or bonus amount based quality ratings.

We all know that the Federal expenditures for Medicare are growing fast and its putting a real strain on our budget. $835 billion dollars was spent on Medicare and Medicaid in 2011. That big number doesnt translate well into an expense per Medicare beneficiary for me. What I wanted to know was, How much does the Federal government actually pay to the private insurance companies to administer either Medicare Advantage Plans or Part D Prescription Drug Plans on behalf of Medicare beneficiaries?

I was curious because I wanted to know how it compared to the individual market for health insurance and how large the subsidy was for each Medicare beneficiary. The answers are not easily found on either an Internet search or picking up the phone and calling someone. What I found out was that determining the actual numbers is complicated at best.

Payments to Plans

Silversneakers Medicare Health Plans And Locations

Original Medicare does not include this benefit, but many additional Medicare health plans offered by private insurance companies do. To find out which Medicare Advantage or Supplemental insurance plans include a SilverSneakers membership, check out the companys Medicare health plan locator. To find a participating fitness facility in your neighborhood visit the location list.

You May Like: Best Socks To Wear With Sneakers

Don’t Miss: How To Check Medicare Payments

What Is The Silversneakers Program

Are you looking for a senior fitness program? If you have a Medicare Advantage or Medigap plan, your health insurance may include a free fitness membership for adults 65+ called SilverSneakers. A SilverSneakers membership includes access to roughly 14,000 recreation centers, churches, senior communities, and other neighborhood locations across the nation. Youll get access to fitness equipment, social events, a variety of exercise classes, including boot camp, circuit training, strength and balance, tai chi, yoga, water aerobics, and Zumba, plus access to amenities like swimming pools, tennis courts, and walking tracks if available at certain locations. Sounds pretty good, right? Heres what else you may want to know about the program.

How Has Health Reform Impacted Medicare Advantage

The Patient Protection and Affordable Care Act has restructured payments to Medicare Advantage plans in an effort to reduce budget spending on Medicare, but for the last few years, the payment changes have either been delayed or offset by payment increases. When the law was first passed, many people including the CBO projected that Medicare Advantage enrollment would drop considerably over the coming years as payment reductions forced plans to offer fewer benefits, higher out-of-pocket costs, and narrower networks.

But that has not been the case at all. Medicare Advantage enrollment continues to grow each year. There were more than 29 million Advantage enrollees in 2022, which accounts for nearly 46% of all Medicare beneficiaries. Thats up from just 13% in 2004, and 24% in 2010, the year the ACA was enacted.

The number of Medicare Advantage plans available has increased for 2022 to the highest in the last decade, with a total of 3,834 plans available nationwide. The majority of beneficiaries still have at least one zero-premium plan available to them, and the average enrollee can select from among 39 plans in 2022.

Also Check: Does Medicare Cover Bariatric Surgery

When Can I Sign Up For Medicare Advantage

If you have alreadysigned up for and have Medicare coverage, you can then sign up for a Medicare Advantage plan during the Annual Enrollment Period. Medicares Annual Enrollment period begins every year, with coverage for your selected plan beginning on January 1. For more information on Medicare, Medicare Advantage and Annual Enrollment, check out ourMedicare & Health Insurance resource page.

The Annual Enrollment period can be a confusing time. There are many different plans to choose from, which is why we recommend sitting down with an insurance representative or agent to help choose the plan that best suits your lifestyle.

At Iora, we can recommend agents that our patients know and trust. We are happy to refer you to someone if you have insurance questions. If you are interested in learning more, reach out and well give you a call.

Calquence Drug Class And Form

Calquence contains the active ingredient acalabrutinib and belongs to a class of medications called kinase inhibitors. Calquence works by blocking the growth of cancer cells.

Calquence comes as a capsule that you swallow. Its available in one strength: 100 mg. Youll typically take Calquence once every 12 hours.

- Monthly premiums vary based on which plan you join. The amount can change each year.

- You must keep paying your Part B premium to stay in your plan.

- Deductibles, coinsurance, and copayments vary based on which plan you join.

- Plans also have a yearly limit on what you pay out-of-pocket. Once you pay the plans limit, the plan pays 100% for covered health services for the rest of the year.

Don’t Miss: Do You Have To Take Medicare

The Pros And Cons Of Medicare Advantage

Medicare Advantage plans have benefits and drawbacks. While they’re a slam-dunk choice for some people, they’re not right for everyone.

Pros:

-

Potentially lower premiums for coverage.

-

Limits on how much you may have to pay out of pocket for hospital and medical coverage. This limit is determined by the Centers for Medicare & Medicaid Services, and in 2022 it is $7,550.

Cons:

-

Less freedom to choose your medical providers.

-

Requirements that you reside and get your nonemergency medical care in the plans geographic service area.

-

Limits on your ability to switch back to Original Medicare with a Medicare Supplement Insurance policy.

-

The potential for the plan to end, either by the insurer or by the network and its included medical providers.

Does Medicare Advantage Cover A Walk

Medicare Advantage is regulated by Medicare but operated by private insurance companies. If you are thinking of getting financial assistance for the walk-in shower, then this might help you.

However, Medicare Advantage is giving out different health-related benefits to the people, such as reducing the need for emergency care, preventing or treating a disease or injury, making up for physical weaknesses or injuries, and helping the function or psychological effect of physical health issues.

Moreover, the senior member still has to qualify that he needs a shower model, which would be safer for him/her. The benefits of Medicare Advantage vary from state to state, so it is always better to seek the right information from your states office.

Read Also: Is Medicare Medicaid The Same

Recommended Reading: Does Southeastern Spine Institute Accept Medicare