Coverage Gap Or Donut Hole Stage

Up to $6,550

During this stage, your discount is less because youll be receiving a minimum level of coverage on brand-name and generic drugs until your yearly out-of-pocket costs reach $6,550.

Some people will move into this stage

Once your yearly out-of-pocket costs reach $6,550, you move to the catastrophic coverage stage.

Centene : Lowest Monthly Rates

Medicare stars: 3.6 out of 5

Avg. monthly cost: $32

Avg. Part D drug deductible: $365

NAIC Complaint Index: 0.15

With both HMO and PPO prescription drug plans available, Cetene and its subsidiary WellCare provide a broad selection of plan options.

The Medicare Part D plans are widely available and moderately well ranked. Rankings do vary by location, so check to see how your local plans score. Notably, WellCare’s prescription insurance has a very low rate of consumer complaints, only about one-sixth of the average rate.

Plans are affordable, averaging $32 per month, and there are no deductible requirements for generic drugs when with WellCare Value Script, WellCare Wellness Rx and WellCare Medicare Rx Select.

Considerations To Make About Switching Plans

If you’re a current Medicare beneficiary who is considering making the switch to a 5-star plan, it’s important to remember these points:

- If you’re enrolled in a Medicare Advantage plan that includes prescription drug coverage and opt to switch to a Medicare Part D plan, you will be automatically disenrolled from your current plan.

- 5-star prescription drug plans may not be available in every area.

- The benefits offered with every 5-star Medicare Advantage plan vary and some may not include prescription drug coverage it’s important to review plans thoroughly before making this switch.

- Late enrollment penalties sometimes apply when moving to a Part D plan outside of the enrollment period.

While 5-star plans do offer older adults the very best coverage Medicare has to offer, they aren’t always the best choice for everyone. While some seniors may not have any available in their geographic area, others may find that the risks of switching Medicare plans may outweigh the benefits of enrolling in a 5-star prescription drug plan. Ultimately, it’s up to you as a Medicare beneficiary to determine which plan is going to best suit your needs.

Don’t Miss: How Do I Know If I Have Part D Medicare

Bluecross Blueshield : Largest Network Of Pharmacies

Medicare stars: 3.9 out of 5

Avg. monthly cost: $69

Avg. Part D drug deductible: $241

NAIC Complaint Index: Variable based on subsidiary

Prescription drug plans from BlueCross BlueShield , and its subsidiary Anthem, have strong average ratings with 3.9 stars. However, the monthly costs are the highest of all of the best-rated providers we profile here.

Despite the cost, plans from BCBS and its subsidiaries have several advantages.

Standard coverage options are robust, and many plans provide features such as additional cost-sharing during the coverage gap and low or $0 copays for generic drugs. There’s a very large network that includes most of the pharmacies in the country, and about half of the pharmacies are considered preferred, giving you wide access to discounted rates. The company also offers medication home delivery for those who regularly take medications.

Keep in mind that the major insurance company has many subsidiaries. The Part D plans that are available in your area may have better or worse ratings based on how your local BCBS subsidiary is managed. For example, BCBS of Massachusetts has an average of 4.25 for its prescription drug plans while BCBS of South Carolina has 3.25 stars.

Finding The Best Medicare Prescription Drug Plans

There are 34 PDP regions nationwide, which means where you live will dictate which plan options are available. There are nearly 1,000 Part D drug plans available for 2021, and they aren’t one-size-fits-all.

The types of prescriptions you take are going to be the single largest influence on your total costs for the year.

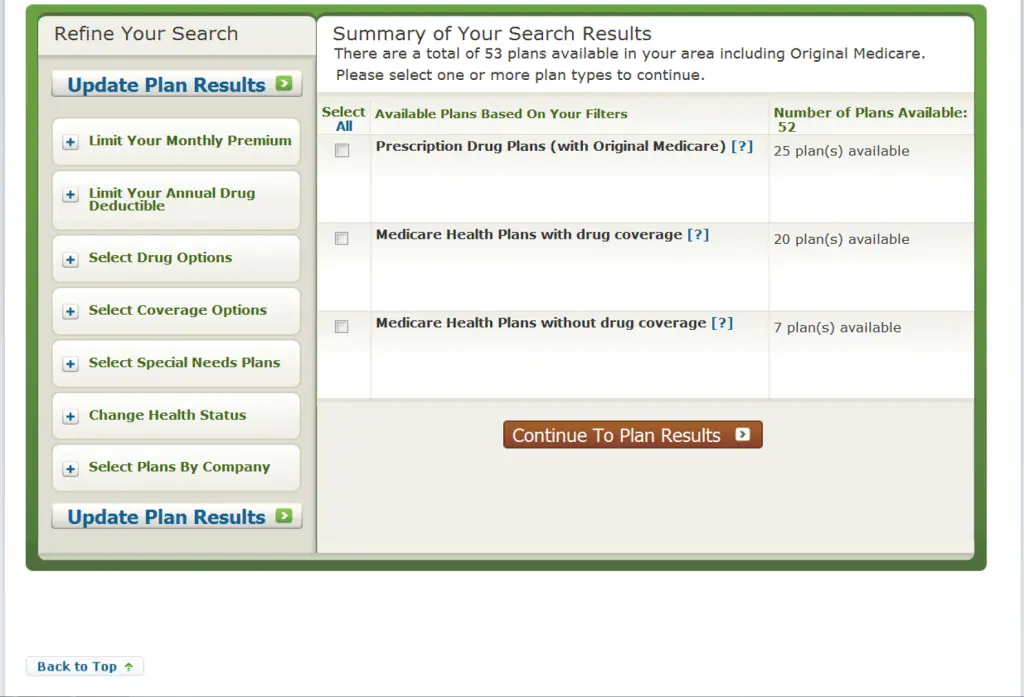

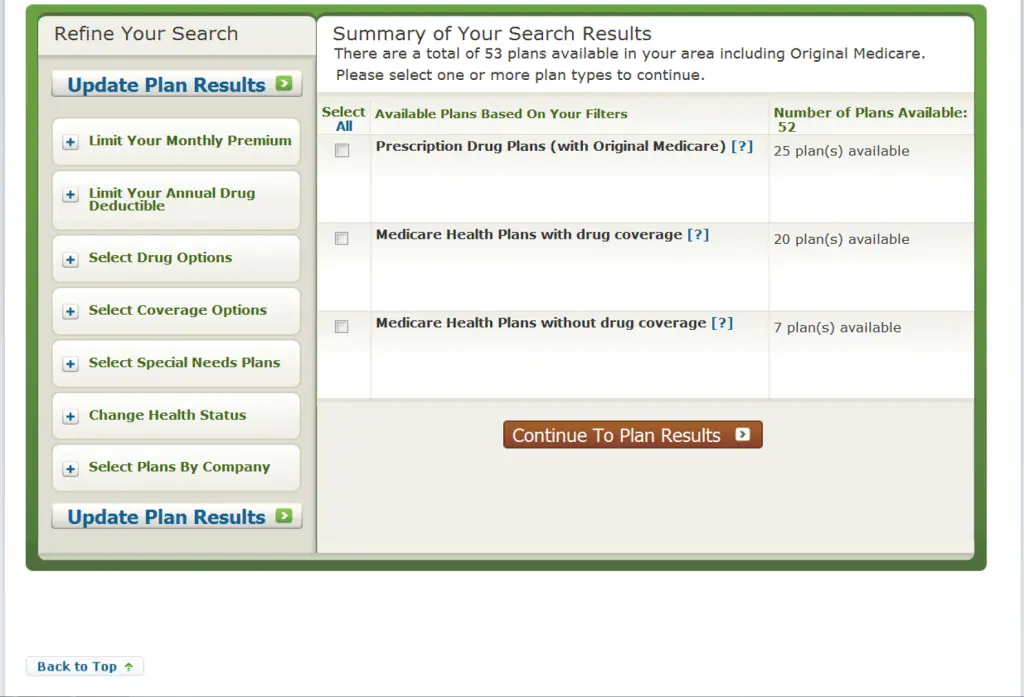

Medicare.gov updated its Plan Finder tool last year, making it easier than ever to run a drug comparison.

Simply go to Medicareâs Plan Finder tool and start by entering your zip code. The system will prompt you through the rest of the steps. The first plan to appear is the lowest cost plan.

Rest assured we have licensed insurance agents who can offer a free drug plan comparison. We go through these same steps but can help with common pitfalls, including:

- Ensuring you know which pharmacy is preferred in-network, which can save you thousands

- Ensuring you’re choosing a reliable carrier with a great track record

- Ensuring your specific prescriptions will be covered by the plan

- Explaining what your monthly costs will be, both in premium and at the pharmacy

While you can do this on your own, why would you when we offer this service for free? Call us at for help!

Read Also: Will Medicare Pay For A Patient Lift

Does Medicare Cover Insulin

How Medicare covers insulin depends upon the type you use. For example, if you use injectable insulin, Medicare Part D covers the insulin as well as supplies you may need to inject the insulin, such as alcohol swabs and syringes.

However, if you use insulin administered via an insulin pump, Medicare Part B will usually pay for the insulin. Medicare may cover only certain insulin pump types and insulin, so its important to check for covered pump types before purchasing.

The Best Drug Plan With The Lowest Price

Once you enter your zip code, the prescriptions you take, and your preferred pharmacies, youâll get this big list of drug plans, probably somewhere between 20-40 plans. They are automatically sorted by lowest annual cost, so the plan at the top of the results page is the most competitive.

Many individuals get hung up on the monthly premium, but don’t make that mistake! Premiums are only one part of your healthcare expenses. You also have deductibles, coinsurance, and copays at the pharmacy counter.

Donât make the mistake of choosing a plan because it has the lowest monthly premium only to find out later that your deductible is absurdly high. Instead, you want to find the plan that will have the lowest out-of-pocket costs for the year. Medicare’s Plan Finder makes this easy by taking all of your costs into account and sorting the plans accordingly.

Additionally, take note of the plan rating.

Sometimes, a low rating can mean that a company has bad customer service or their rates go up unexpectedly in the middle of the year.

A company with a 4 or 5-star rating often means that their customer service is reliable, and the rates tend to stay the same. There are always exceptions to this rule, but this is the general rule of thumb.

Itâs somewhat of a balancing act, but try to choose the plan that has the lowest annual cost with the highest overall star rating.

Recommended Reading: Does Medicare Pay For Naturopathic Doctors

Exclude Any Plans That Don’t Include Prescription Drug Coverage

Start narrowing down your options by only looking at Medicare Advantage plans that cover prescription drugs.

With Medicare Advantage, most people can’t add on a stand-alone prescription drug plan through Medicare Part D. To get prescription drug coverage, you usually need to bundle it with your medical coverage.

Prescription drugs can be expensive, costing hundreds or thousands of dollars per month. Therefore, we recommend only looking at plans that include prescription drug coverage. On average, this will eliminate about four plans from your available options, helping you to start focusing on the best plans.

How Can I Choose The Best Medicare Part D Prescription Drug Plan For My Needs

En español | Your goal in choosing a Part D plan is to pick a plan that covers all of your drugs with the lowest out-of-pocket cost, provides good service, and meets your own needs and preferences. You can do this in three ways:

Use the online plan finder on Medicares website. Enter your zip code, then enter the name of each prescription drug you take, plus its dosage and how often you take it. The plan finder does the math to identify the plan in your area that covers your drugs at the lowest cost.

You can also:

- Get details on how much your drugs would cost under each plan, monthly and throughout the year.

- See which plans put restrictions on any of your drugs and which offer preferred pharmacies that charge lower copays.

- See how Medicare has rated each plan for service .

- See alerts that flag low-performing plans.

- Find out which plans are available nationally.

And much, much more.

If you call Medicare at 800-633-4227 , you can ask a customer service representative to perform the same search for you. Be sure to make a list of the drugs you take, their dosage and how often you take them, so the rep can feed them into the online plan finder. You can ask for the results to be mailed to you.

To understand how Part D works, see AARPs consumer guide to the program.

You May Like: Are Blood Glucose Test Strips Covered By Medicare

Top 5 Rated Medicare Prescription Drug Plans For 2022

Home / FAQs / Medicare Part D / Top 5 Part D Plans

When choosing Part D coverage, its important to know which is the best Medicare prescription drug plan for 2022. Also, by knowing what to expect, you can stay ahead of the game.

Drugs can be costly, and new brand-name drugs can be the most expensive. With age, youre more likely to require medications.

Medicares standalone Part D plan can cover you. Part D plans have a monthly premium that insurance companies determine.

There may be several plans as well as companies to choose from in your state. Policies vary by county, so moving may warrant a plan change.

What Is The Difference Between Medicare Part B And Part D

Medicare Part B is the portion of Medicare that covers medical expenses. This includes doctors visits and some durable medical equipment. Medicare Part B also covers some medications. As a general rule, Medicare Part B covers medications that you dont give yourself. Examples would include an infusion, some vaccinations, or other injections you receive at a doctors office.

Medicare Part D usually covers medications that you give to yourself. There are some exceptions, such as some oral cancer drugs and immunosuppressive drug therapy. If you arent sure which Medicare Part covers a particular drug, you can visit Medicare.gov and search Does Medicare Cover My Item, Test, or Service or review your Part D drug plan formulary.

Also Check: What Age Can You Get Medicare Health Insurance

How To Choose The Best Medicare Part D Plan For You

Most people will have about 30 Medicare Part D plans to choose from, and it’s not always clear which is the best plan for your prescription medication needs. To help you choose your plan, ask yourself these seven questions:

What If I’m Not Taking Prescription Drugs

No one can predict the future. Even if you’re a super fit 65-year-old and you’re not taking any prescription drugs, you could need a prescription because of a sudden illness or accident. Without prescription drug coverage, you could wind up paying the full cost, which could be hundreds or thousands of dollars.

Even if you don’t take prescription drugs currently, if you need them later and you try signing up for a Part D plan late, you could face a penalty of 1% for each month you went without coverage. Not having Part D coverage could be a costlyand long-termmistake.

You should consider enrolling in a Part D prescription drug plan as soon as you become eligible for Medicare , regardless of your current prescription drug needs.2

Read Viewpoints on Fidelity.com: Getting ready for Medicare Part D to learn more about late penalties.

Recommended Reading: Is There A Copay For Doctor Visits With Medicare

How Do I Enroll In Medicare Part D

You can enroll in Medicare Part D as soon as you have your Medicare Number. You will receive this via a card when you join Medicare Parts A and/or B. You can search for prescription drug plans via Medicares Plan Finder or by individual insurance companies.

Once you select your plan of choice, you can apply. The application will ask for your Medicare Number as well as when you were first eligible for coverage.

Consider Provider Reviews And Trade

With most Medicare Advantage plans, there’s a trade-off with a plan having some great qualities while falling short on others.

Insurance reviews can help you to quickly understand these trade-offs so that you can choose the best coverage for your needs and priorities. For example, consider some of the pros and cons of Medicare Advantage plans from these top companies.

| Insurer |

|---|

You May Like: Does Medicare Cover Full Body Scans

How Drug Tiers Work

Some plans group their formulary, or Drug List, into tiers. Tiers help determine the amount youll pay for your prescription. Typically, drugs in lower tiers cost less than those in higher tiers.

Tier 1: Preferred genericsusually includes more common, lower-cost, generic prescription drugsTier 2: Genericsusually includes higher cost generic prescription drugs and some lower-cost brand prescription drugsTier 3: Preferred brandbrand-name drugs that don’t have a generic equivalentTier 4: Non-preferred drughigher-priced brand and generic drugs with no preferred cost shareTier 5: Specialty tierthe most expensive drugs, usually used to treat complex conditions such as cancer, multiple sclerosis or rheumatoid arthritis

If you’re currently taking prescription medication, you can use our search tool to look up a specific drug. It will tell you if the drug is covered by Humana and which tier it’s listed under. It may also offer alternatives and generics that might save you money.

How Does Medicare Prescription Drug Coverage Work

Medicare prescription drug coverage is an optional benefit. Medicare drug coverage is offered to everyone with Medicare. Even if you dont use prescription drugs now, you should consider joining a Medicare drug plan. If you decide not to join a Medicare drug plan when youre first eligible, and you dont have other creditable prescription drug coverage or get Extra Help, youll likely pay a late enrollment penalty if you join a plan later. Generally, youll pay this penalty for as long as you have Medicare prescription drug coverage. To get Medicare prescription drug coverage, you must join a plan approved by Medicare that offers Medicare drug coverage. Each plan can vary in cost and specific drugs covered.

There are two ways to get Medicare prescription drug coverage:

- Medicare Prescription Drug Plans. These plans add drug coverage to Original Medicare, some Medicare Cost Plans, some Medicare Private Fee-for-Service plans, and Medicare Medical Savings Account plans. You must have Part A and/or Part B to join a Medicare Prescription Drug Plan.

- Medicare Advantage Plans or other Medicare health plans that offer Medicare prescription drug coverage. You get all of your Part A, Part B, and prescription drug coverage , through these plans. Medicare Advantage Plans with prescription drug coverage are sometimes called MA-PDs. Remember, you must have Part A and Part B to join a Medicare Advantage Plan, and not all of these plans offer drug coverage.

Read Also: How Much Does Medicare Cost Annually

Best Customer Service Availability: Silverscript

SilverScript

-

Large pharmacy network, including CVS

-

24-hour customer service line

-

Choice plan available in 50 states and the District of Columbia

-

Only two plans to choose from

-

Plus plan not available in Alaska

SilverScript is a CVS Health company, adding convenience in terms of retail pharmacy access. CVS Health and Aetna merged in 2018, so CVS is now a subsidiary of Aetna, which is listed as the benefits provider when searching for this plan. This merger has enabled CVS Health to grow its Part D plans, and an estimated 23% of all Part D subscribers held a CVS Health policy in 2019 .

SilverScript Insurance Company holds the most popular of CVS Healths available plans: the SilverScript Choice plan. This plan includes a $0 deductible on Tier 1 and Tier 2 medications with low to no copays if you use a SilverScript preferred pharmacy. Prices will vary by state and other factors, such as costs of healthcare in the region, your age, and overall health. For comparison purposes, we reviewed the SilverScript Choice Plan for Houston, Texas, where the monthly premium was quoted at $21.20.

SilverScripts Plus plan is pricier at $77.30 in Houston. However, the drug deductible is $0 . The Plus plan has a more expansive formulary, which may be beneficial to you if you take several medications or specialty medications.

What Is The Best Medicare Supplement

As mentioned above, your best Medicare Supplement plan will be the plan that balances costs and coverage. In general, policies with more comprehensive coverage for deductibles and care will have higher monthly premiums.

For instance, Plan G is good for people who want very few medical bills and are willing to pay about $190 each month. This can give you peace of mind so that you won’t be surprised by unexpected medical costs. However, if you expect your out-of-pocket medical costs to be less than the plan’s annual cost of about $2,280, then a cheaper Supplement plan may be more cost-effective.

Note that because of a recent legislation change, Plans C and F are not available for new enrollees. Below you can find a chart of the level of coverage and 2022 monthly premium ranges for all of the Medicare Supplement plans. The Medigap plan names are along the top, and on the left are the coverage categories.

| Plan A |

|---|

Don’t Miss: Is Medical Assistance The Same As Medicare