B Premiums And Medicare Benefits

You can choose the Original Medicare Plan or the Medicare Advantage Plan . Medicare Advantage plans are offered by private insurance companies and cover everything Original Medicare has to offer and more.

Even if you choose a Medicare Advantage plan and pay your premiums to your insurance company, you still have to pay your Part B premiums to the government. This added value must be taken into account.

How Much Does Medicare Part C Cost In 2022

The premium for Medicare Part C â also called Medicare Advantage â depends on your plan and the insurer, since these health plans are provided by private insurance companies.

Deductibles, copays and coinsurance for Medicare Part C vary by plan. However, there is a limit to how much you can spend on out-of-pocket expenses. After that limit, your Medicare Part C plan will pick up all the remaining cost of covered health care services. The out-of-pocket limit for Medicare Advantage canât exceed $7,550 a year for in-network services. That means you could save more money if you have a lower out-of-pocket expenses limit. The limit is $11,300 for out-of-network services.

The average out-of-pocket limit for Medicare Advantage enrollees was $5,059 in 2019, according to the Kaiser Family Foundation.

Learn more about Medicare Part C.

Medicare Part D Donut Hole Coverage Gap Costs

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a donut hole or coverage gap, which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.

As of 2020, Part D beneficiaries pay 25 percent of the cost of brand name and generic drugs during the coverage gap until reaching catastrophic coverage spending limit.

Read Also: Does Medicare Cover Smoking Patches

Medicare Advantage Premiums In 2022

The CMS estimates that the average Medicare Advantage premium of $21 for 2021 is the lowest in 14 years. The agency figured monthly premiums dropped an average of nearly 8.7 percent from $23 in 2020.

CMS projected that 24.4 million people were enrolled in the plans in 2020. At the same time, plan choices, benefits and Medicare Advantage enrollment have all increased.

There were 3,550 Medicare Advantage plans available in 2021 and because these vary based on location, the average Medicare beneficiary had access to 33 Medicare Advantage plans, the most ever according to the Kaiser Family Foundation.

For the most part, plans with cheaper premiums may offer far fewer benefits than those with more expensive premiums. Be sure to compare plans to get the coverage you want or need at a price you can afford.

New to Signing Up for Medicare?

Standard Medicare Costs Include Monthly Premiums Deductibles And Co

Medicare health insurance costs, like costs associated with any type of insurance, vary widely. Like other insurance plans, Medicare plans use out-of-pocket fees like annual deductibles, copays, and coinsurance fees, in addition to monthly premiums. Some of these costs will be more regular than others, and some may only arise once in a while. Understanding the scheduling is also important, as Part A and Part B dont use the same type of benefit period, meaning that out-of-pocket costs come at different frequencies.

Well go over all of the types of costs associated with every type of Medicare, so you can know what you can expect to pay. Monthly costs can vary from person to person even on the same plan, as some people may have to pay a coinsurance one month when another didnt require any care. However, these costs should help you understand what to expect if you know the details of your situation.

Recommended Reading: How Many Medicare Plans Are There

What Part B Doesnt Cover

There are a number of services Medicare Part B doesnt cover. Youd be responsible for paying for these services out of pocket unless you have other insurance that covers them.

Here are a few examples of services not covered by Medicare Part B:

Medicare Part B has premiums, a deductible and coinsurance

-

You need to pay the premiums each month, regardless of what care or services you get.

-

You need to pay your deductible out of pocket before Part B will start paying for most covered services.

-

You pay a 20% coinsurance for most medically necessary services covered by Part B, but theres no coinsurance for most preventive care.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: How To Lower Medicare Premiums

What Is The Best Medicare Supplement

As mentioned above, your best Medicare Supplement plan will be the plan that balances costs and coverage. In general, policies with more comprehensive coverage for deductibles and care will have higher monthly premiums.

For instance, Plan G is good for people who want very few medical bills and are willing to pay about $190 each month. This can give you peace of mind so that you wont be surprised by unexpected medical costs. However, if you expect your out-of-pocket medical costs to be less than the plans annual cost of about $2,280, then a cheaper Supplement plan may be more cost-effective.

Note that because of a recent legislation change, Plans C and F are not available for new enrollees. Below you can find a chart of the level of coverage and 2022 monthly premium ranges for all of the Medicare Supplement plans. The Medigap plan names are along the top, and on the left are the coverage categories.

| Plan A |

|---|

Find A $0 Premium Medicare Advantage Plan Today

1 MedicareAdvantage.com’s The Best States for Medicare report.

2 10-minute claim is based solely on the time to complete the e-application if you have your Medicare card and other pertinent information available when you apply. The time to shop for plans, compare rates, and estimate drug costs is not factored into the claim. Application time could be longer. Actual time to enroll will depend on the consumer and their plan comparison needs.

3 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

About the author

Christian Worstell is a senior Medicare and health insurance writer with MedicareAdvantage.com. He is also a licensed health insurance agent. Christian is well-known in the insurance industry for the thousands of educational articles hes written, helping Americans better understand their health insurance and Medicare coverage.

Christians work as a Medicare expert has appeared in several top-tier and trade news outlets including Forbes, MarketWatch, WebMD and Yahoo! Finance.

Christians passion for his role stems from his desire to make a difference in the senior community. He strongly believes that the more beneficiaries know about their Medicare coverage, the better their overall health and wellness is as a result.

You May Like: Does Medicare Cover Dental Root Canals

What Is The Average Cost Of Medicare Part D In 2022 By State

The chart below lists the average monthly premiums for Medicare Part D prescription drug plans by state.1

- The lowest average Part D premiums were for plans in Mississippi, Kentucky, Indiana and Oklahoma, with average premiums around $41 or less per month.

- California, Florida, Pennsylvania and West Virginia had Part D plans with the highest average premiums, around $52 or more per month.

| State |

|---|

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online when you visit MyRxPlans.com.

How Much Does Medicare Part B Cost

Medicare consists of several different parts, including Part B. Medicare Part B is medical insurance and covers medically necessary outpatient care and some preventative care. Together with Medicare Part A , it makes up whats called original Medicare.

If youre enrolled in Part B, youll pay a monthly premium as well as other costs like deductibles and coinsurance. Continue reading to take a deeper dive into Part B, its costs, and more.

Don’t Miss: Does Medicare Cover The Cost Of An Ambulance

Covered Services In Medicare Advantage Plans

With a Medicare Advantage Plan, you may have coverage for things Original Medicare doesn’t cover, like fitness programs and some vision, hearing, and dental services . Plans can also choose to cover even more benefits. For example, some plans may offer coverage for services like transportation to doctor visits, over-the-counter drugs, and services that promote your health and wellness. Plans can also tailor their benefit packages to offer these benefits to certain chronically-ill enrollees. These packages will provide benefits customized to treat specific conditions. Check with the plan before you enroll to see what benefits it offers, if you might qualify, and if there are any limitations. Learn more about what Medicare Advantage Plans cover.

Medicare Part A Deductible

Most Part A costs come from the inpatientInpatient refers to medical care that requires admission to the hospital, usually overnight. hospital deductible. Inpatient care provided at a hospital or skilled nursing facilitySkilled nursing facilities provide in-patient extended care with trained medical professionals to recover from injury or illness and activities of daily living. These facilities provide physical and occupational therapists, speech pathologists and medical professionals assist with medications, tube feedings and wound care. Skilled nursing stays are usually covered under Medicare Part A. will require you to pay the annual deductible.

For the year 2022, the Plan A deductible increased from 2022:

- Medicare Part A deductible 2021: $1,484

- Medicare Part A deductible 2022: $1,556

Also Check: Does Mutual Of Omaha Medicare Supplement Have Silver Sneakers

Enrolling In Medicare Part B

Some people are automatically enrolled in Part A and Part B. These people include:

- those who are going to turn 65 and are already receiving Social Security or RRB retirement benefits

- people who have a disability and have been receiving disability benefits from Social Security or the RRB for 24 months

Some people will have to sign up with the SSA to enroll in parts A and B. These people include those not already collecting Social Security or RRB retirement benefits at age 65 or those with ESRD or ALS.

For people who are automatically enrolled, Part B coverage is voluntary. That means that you can choose not to have it. Some people may wish to delay enrollment in Part B because they already have health coverage. Whether or not you choose to delay enrolling in Part B can depend on the specific health insurance plan that you have.

How Much Will Medicare Cost Me Per Month In 2022

Do you know how much Medicare will cost you each month in 2022?

Planning for retirement is really important, and if youâre going to be living off of a fixed income, you need to be aware of your expected insurance costs.

So, how much will Medicare cost you in 2022?

Don’t Miss: How Much Do You Pay For Medicare Part A

When Are Medicare Premiums Due

All Medicare bills are due on the 25th of the month. In most cases, your premium is due the same month that you get the bill. Example of billing timeline

For your payment to be on time, we must get your payment by the due date on your bill. Submit your payment at least 5 business days before the due date, so we can get it on time.

Medicare Part B Premium Discounts And Regulations

You can save some money on your monthly costs by electing to have your Part B premium payments deducted directly from your Social Security checks.

You’ll have to pay the standard premium if you are enrolling in Medicare Part B for the first time. Other reasons you might have to pay the standard Part B premium amount include:

- You do not receive Social Security Benefits

- Medicaid pays your monthly Part B coverage

- You choose to be billed directly for your Part B premiums

In most cases, you will pay a late enrollment penalty if you do not sign up for Medicare Part B when you are first eligible. This penalty will be enforced for the rest of the time that you receive Part B coverage, and could increase by up to 10 percent for each 12-month period that you didn’t enroll in Part B once you became eligible.

Recommended Reading: Do You Have To Pay A Premium For Medicare

What If I Can’t Afford Part B

If youre at least 65 and cant afford your Medicare Part B premium or deductible, there may be help. Medicare Savings ProgramsMedicare Savings Programs help those with low incomes pay premiums and sometimes coinsurance for Medicare expenses. are designed for low-income individuals who have trouble affording healthcare. To help you get started, here are the four types of MSPs, and their most-recent eligibility requirements from 2021:

- Qualified Medicare Beneficiary Program : helps pay premiums, copays, deductibles and coinsurance for Parts A and B.

- Whos eligible: individuals with income up to $1,094 per month couples making up to $1,472

If you need help finding an affordable Medicare plan, contact GoHealth. Our licensed insurance agents can help you navigate the different options and see what makes the most sense for you.

How Much Does Medicare Part C Cost

What it helps cover:

- Medicare Advantage plans are required by law to provideat minimumthe same coverage, benefits and rights provided by Original Medicare Part A and Part B, with the exception of hospice care.

- Many Medicare Advantage plans also choose to offer prescription drug coverage, as well as coverage for routine dental, vision and hearing benefits.

What it costs:

- Medicare Advantage plans are offered by private insurance companies contracted by the federal government, so they vary in cost, coverage, deductibles and copays.

- Many Medicare Advantage plans offer affordable or plus a variety of coverages and benefits not offered by Original Medicare .

Read Also: Is Medicare Advantage Part Of Medicare

What Medicare Part B Covers

First, lets take a look at what Medicare Part B actually covers. Medicare Part B covers medical treatments and services under two classifications: medically necessary services and preventive services. What qualifies something as medically necessary? In general, medically necessary services must be medical treatments that are required to treat a recognized medical condition or illness. Necessary services and items might include the following:

- Diagnostic equipment

- Supplies, such as walkers or wheelchairs

For example, diabetics need regular doctor visits to ensure appropriate blood levels, as well as appropriate diagnostic coverage to ensure accurate readings.

Medicare Part B beneficiaries also gain access to preventive services, like yearly screenings for the flu or certain cancers. In addition, Part B may cover other medical procedures and treatments that fall within the necessary or preventive range. Ambulance services, clinical research, mental health counseling and some prescription drugs for outpatient treatment may all be covered under Medicare Part B.

As of the 2019 plan year, the Centers for Medicare and Medicaid Services has lifted coverage caps on critical services covered under Medicare Part B. These include physical therapy, speech language pathology and occupational therapy.

But original Medicare doesnt cover everything. You may need to obtain supplemental insurance, such as Medigap, if you need coverage for the following:

D Coinsurance And Copays

Part D plans, as you may have guessed, will also vary. However, you can expect Part D plans to use a copay where you pay a fixed fee every time you have your prescription filled. Part D plans will also have a formulary or drug list, which tells you which copay you have to pay depending on which prescription you have filled. Before you choose a Part D plan, make sure to take a look at the formulary to double-check that the drugs you need are affordable for your budget.

Read Also: Does Costco Pharmacy Accept Medicare

Is Medicare Free At 65

Though you are eligible for premium-free Part A if you are over the age of 65 and if you or your spouse has been paying Medicare taxes for the past 10 years, Medicare is not free. Additionally, there is a late enrollment fee of 10% of the premium for each part of Medicare for those who enroll after age 65.

Read Also: Does Aetna Follow Medicare Guidelines

What Is The Average Cost Of Medicare Part D Prescription Drug Plans

In 2022, the average monthly premium for a Medicare Part D plan is $47.59 per month.1

Medicare Part D plan provide coverage solely for prescription medications. Part D plan costs may vary based on your plan and your location.

Learn about the average cost of Part D plans in your state.

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.2

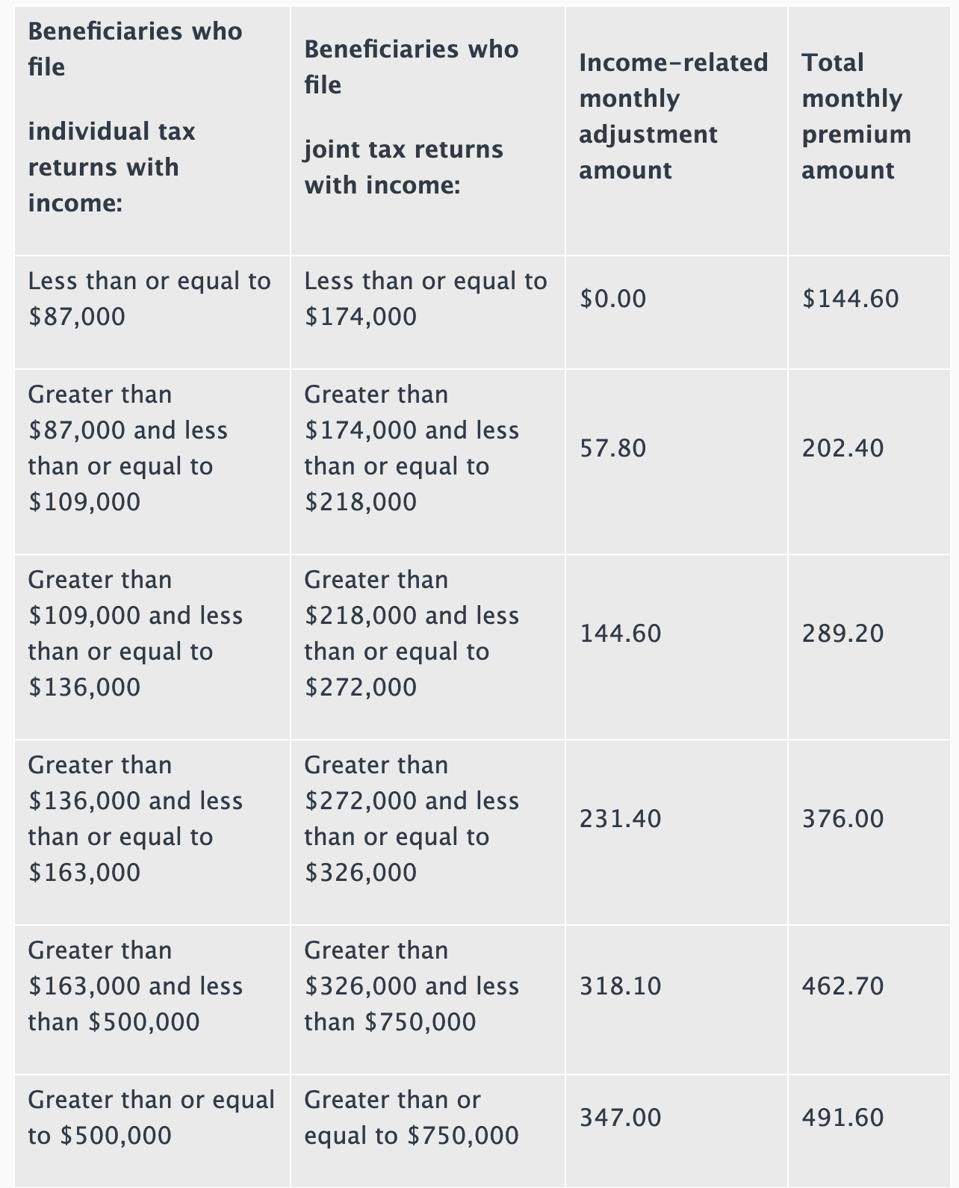

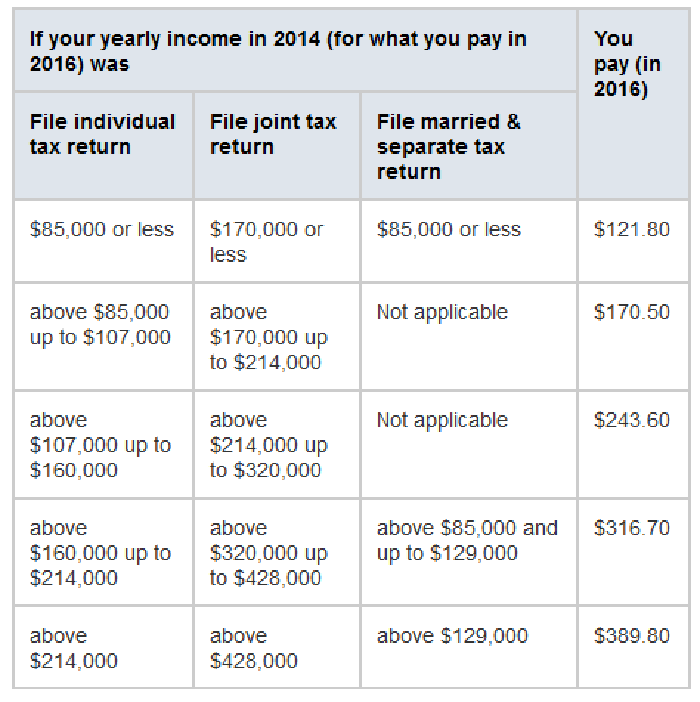

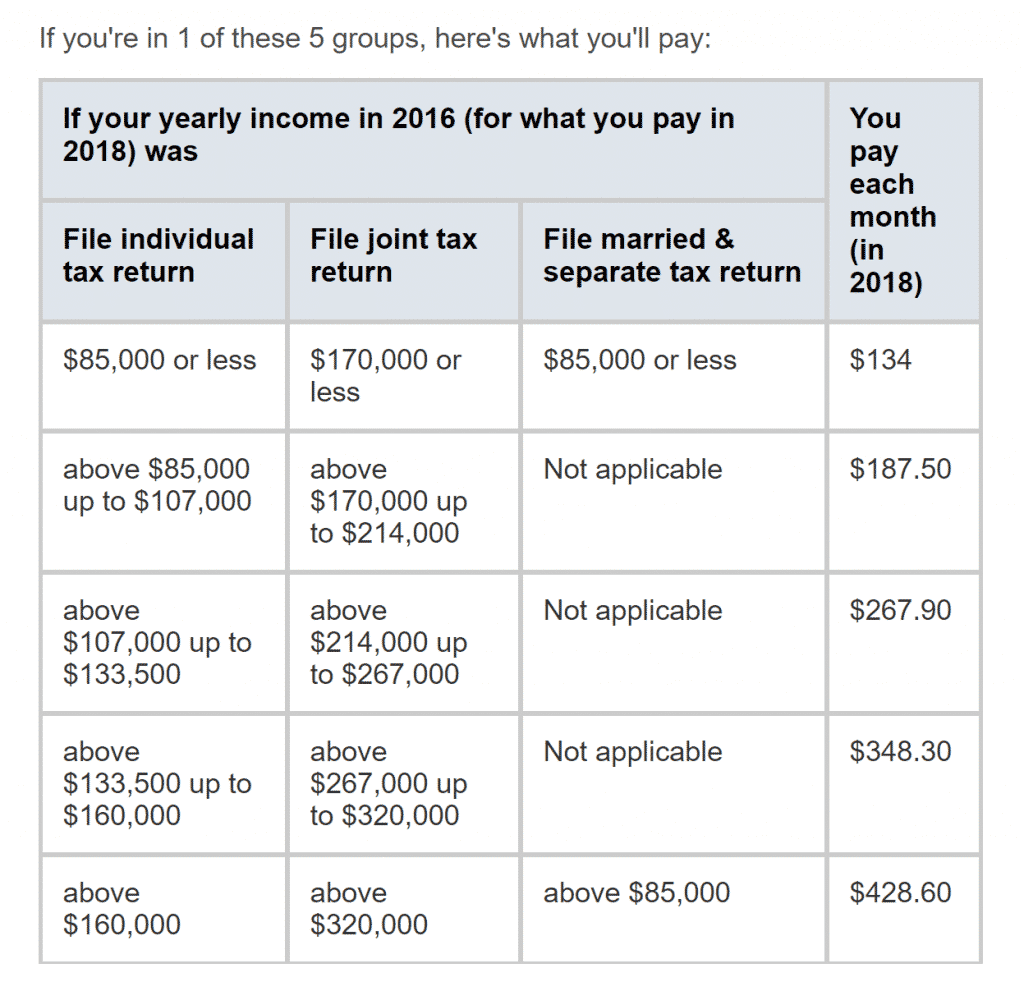

Depending on your income, you may be required to pay a higher Part D premium. As with Medicare Part B premiums, this adjusted amount is called the IRMAA .

If you are required to pay a higher Part D premium, it will be based on your reported income from two years ago .

Medicare Part D IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$77.90 + your plan premium |

You May Like: How To Decide Between Medicare Advantage And Medigap